Employers must pay wages twice a month, and traditionally the first payment is called an advance. However, in the Labor Code there is no such thing as an advance: wages must be paid for the first half of the month. How is the payment period for such salaries determined? What is the procedure for calculating it? Is it possible to pay it in a fixed amount in order to minimize the labor costs of settlement service employees? How to fill out section 2 forms 6-NDFL, if at the end of the month the employee received only an advance, from which personal income tax was not withheld? You will learn about what clarifications on these issues came from the Ministry of Labor, Rostrud, the Ministry of Finance and the Federal Tax Service from the presented article.

Labor Code of the Russian Federation on salary advance for newcomers

There is no mention of salary advances for newcomers in labor legislation. At the same time, in Art. 136 of the Labor Code of the Russian Federation establishes the following requirements:

- salary payment - at least every six months;

- the specific date of payment is established in internal local acts, but no later than 15 calendar days from the end of the period for which it was accrued.

Find out how to reflect salary accruals in accounting in our publication.

Labor Code:

- calls all salary payments “salaries”, the term “advance” is not used;

- determines the minimum number of salary payments per month, each of which is not of an advance nature, but is calculated based on the time actually worked;

- establishes the maximum permissible calendar gap between the first and second parts of the salary;

- reserves the right for companies and individual entrepreneurs to determine the dates for issuing money and calculation algorithms.

Learn about employer rights from the article.

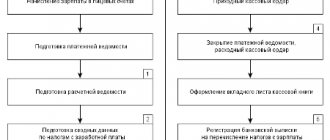

General rules for payment of wages

There are rules common to all employers that must be followed when paying wages:

- Salaries are paid every half month. The first payment for the current month will be an advance payment

- Specific payment days are established. Wages must be paid at least every 15 days. The enterprise selects a specific payment date and enshrines it in local regulations

- When calculating the advance, the time that the employee worked for half the month is taken into account

- Even if the employee wrote a statement that he does not want to receive an advance, the employer is obliged to issue wages at least every 15 days. Otherwise, it will be a violation of labor laws

The advance amount must be indicated on the pay slip, which is issued to each employee upon payment of the final payment . Thus, the employee can control all accruals for the month.

Also, one should not forget that there is liability for violations when paying an advance. She may be:

- Administrative. Includes fines for both organizations or individual entrepreneurs and individuals

- Disciplinary. Such liability may come in the form of a reprimand, reprimand, or even dismissal.

- Material. If there is a delay in payment, the employer is obliged to pay the amounts due with compensation. Such compensation will be a form of financial liability.

- Criminal. If payments are delayed for a long time, criminal liability arises. This may be the imposition of a fine, which will be many times higher than the fines provided for administrative liability. In addition, an official may be subject to forced labor, imprisonment, or deprived of the right to hold office for up to 3 years.

We fix “salary” deadlines

Determine the dates of the first and second salary payments yourself. For example, you can set the numbers 30 (31) and 15 (16) respectively - officials consider this option optimal (letter of the Ministry of Health and Social Development of Russia dated February 25, 2009 No. 22-2-709).

Download the salary slip form here.

Don’t forget about newcomers - it is also important for them to set the deadline for their first salary, and it may not coincide with the dates established by the company.

Make a description of salary aspects in a local intra-company act - this could be PVTR (internal labor regulations), regulations on remuneration, collective agreement, etc.

The following publications will introduce you to internal local acts that include “salary” aspects:

- “Internal labor regulations - sample 2022”;

- “Regulations on incentive payments with performance criteria.”

See below for specific wording on how to set wages.

The first salary has a separate deadline

When formulating the text of the salary part of internal local acts, be guided by the following rules:

- The salary payment deadline is a specific day, not a calendar period (not a “fork” of dates). Rostrud insists on this.

Find out more here .

- Distribute the days for issuing the first and second parts of the salary so that every half month workers receive payment for their work. This is a requirement of Art. 136 Labor Code of the Russian Federation.

Choose convenient dates based on the specifics of the company’s work. This could be, for example, the 10th day (final payment for the previous month) and the 25th day (advance payment for the current month).

It should be taken into account that with this formulation, newcomers find themselves in a special position - persons who started work on one of the days of the billing month. It turns out that with salary payments on the 5th (calculation for the previous month) and on the 20th (advance for the current month), an employee who started work on the 1st needs to pay only the advance on the 20th. That is, the gap between the start of work and the date of payment of the advance is more than ½ month, which is a violation of the law. We will tell you what to do in such a situation below.

Advance payment as part of salary

There are several ways to pay an advance for a new employee.

One of them is the payment of an advance as a certain part of the employee’s salary for the month.

Let's imagine that an employee got a job from the beginning of the month, on the 1st. The organization has two dates for payment of wages - the 20th and the 5th. Accordingly, the employee should receive the advance only on the 20th, but this will be a violation of Article 136 of the Labor Code of the Russian Federation.

In accordance with this, the employee may be paid a portion of the salary for the time worked. The employer must choose a specific date that will be earlier than the generally established advance date, but later than the date of payment of the final payment. For example, it could be the number 10.

Accordingly, such a payment for new employees must be fixed in the company’s internal documents. You can write down exactly what date money is paid when you start working in different periods of the month.

Advances to newly hired employees - what and where do we prescribe?

Include the deadlines for advance payments to newly hired employees in the PVTR (or other local act) in one section describing the salary deadlines common to the entire team.

The following example can be used as a sample.

Example

At Tekhnostroyprom LLC, all salary nuances are reflected in the Regulations on Remuneration. Based on the modern wording of labor legislation, the company decided not to use the term “advance” and determined that salaries would be paid twice a month.

At the same time, for newcomers in the first month of work, special terms for payment of wages are provided, allowing:

- comply with the requirements of the Labor Code of the Russian Federation to pay wages at least every half month (more often is possible, less often is not possible);

- gradually (without prejudice to newcomers and the employer) transfer newcomers to the regular payment schedule provided by the company, without violating the requirements of labor legislation.

Excerpt from the Regulations on remuneration of Tekhnostroyprom LLC:

3.1. Salaries at Tekhnostroyprom LLC are paid:

- 20th day of the current month - for the 1st half of the billing month;

- 5th day of the next month - for the 2nd half of the billing month.

3.2. Deadlines for issuing salaries in the first month of work for newly hired employees:

| Calendar dates for employment | Deadline for first salary payment |

| From 1st to 14th | 15th - exclusively for newly hired employees |

| From the 15th to the 19th | 20th - at the same time as all employees |

| From the 20th to the end of the month | 5th - on the general deadline for salary payments |

3.3. Subsequent wage payments are made within the deadlines established by Tekhnostroyprom LLC, specified in clause 3.1.”

You can see the full text of the Regulations on remuneration of Tekhnostroyprom LLC at the link below:

Find out about local acts that help in your work from the following materials:

- «Regulations on business trips - sample»;

- “Regulations on the occupational safety and health management system - sample”;

- “Regulations for working with accounts receivable - sample”.

In addition to the deadlines, the local act may also contain an indication of the algorithm for calculating the amount of each salary payment, including the advance payment for the first month of work.

Where are the conditions for issuance established and within what time frame is the advance issued?

Since issues related to the payment of wages are regulated by the state and are considered one of the most important, the enterprise must also create a coherent system in this area.

The procedure and terms for issuing wages must be fixed in the internal documents of the company. As the law states, this must be done in the internal regulations and in one of the agreements - either a collective agreement or a labor agreement. Currently, not many collective agreements are drawn up, so the majority of employers specify the conditions for issuance in employment contracts.

Article 136 of the Labor Code of the Russian Federation regulates the issue of wages and advance payments, among other things. It has been established that wages must be paid at least twice a month, that is, every half month. The advance is issued for the first 15 days of the month. The advance payment period is from the 16th to the 30th (or 31st). Each company sets a specific date independently and enshrines it in its internal documents .

Method for calculating advance payment when hiring

Establish in a local act the method for calculating the advance payment when hiring - it should not contradict the requirements of the law, which determines the calculation of the first and second salary payments based on the time actually worked.

Is it possible to set wages for the first half of the month at 40% of the salary and how to withhold personal income tax? You will find the answer to this question in ConsultantPlus. Get free access to the system and proceed to expert explanations.

It is impossible to establish an advance payment in a fixed amount for all employees - it is impossible to do without preliminary calculations.

In addition, you should take into account the requirements of legal acts and the opinion of officials regarding the minimum and maximum amounts of the advance:

| Advance amount | Opinion of officials and legislators | NPA |

| Minimum | The minimum amount of the advance must not be lower than the employee’s tariff rate for the time worked | Art. 129 Labor Code of the Russian Federation |

| Payment to an employee for half a month cannot be less than the tariff rate or salary for the time actually worked (the amount of work actually completed) | Letter of Rostrud dated 02/03/2016 No. 14-1/10/B-660 | |

| The advance is calculated on the basis of the salary (tariff rate) and bonuses to it (for part-time work, for work at night according to a schedule, etc.) Those payments that are determined based on the results of the completed month (bonus, overtime) should not be used when calculating the advance payment. | Letter of the Ministry of Labor of the Russian Federation dated August 10, 2017 No. 14-1/B-725 | |

| Maximum (not regulated by law) | It is necessary to calculate wages for every half month in approximately equal amounts (excluding bonus payments), since wages are paid at least twice a month | Letter of the Ministry of Health and Social Development of Russia dated February 25, 2009 No. 22-2-709 |

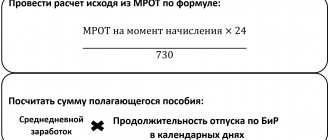

How much can an advance be given?

If you focus on the legislation, then you cannot find the exact amount of the advance in any regulatory act.

Typically, employers have two ways to calculate the amount of an advance to an employee: the amount is set as a fixed percentage or calculated in proportion to the time worked. The second option is more fair and accurate.

| Fixed interest advance | Advance based on actual time worked |

| This is a simplified method. The amount of expected charges for the month is taken, multiplied by a set percentage (usually 40%), the amount of the advance payment for the first half of the month is obtained | Recently, regulatory authorities have recommended using just this method of calculation. The calculation is made in the following way: personal income tax is deducted from the accrued salary amount, the resulting result is divided by the number of working days in a full month and multiplied by the number of days already worked. This method is recommended for all companies. |

The newcomer was not given an advance - what are the consequences?

There is no specific provision of law establishing liability for late payment of an advance to new employees or incorrect calculation of its amount.

However, an employer who deviates from legal requirements cannot avoid liability. In this situation, general rules apply, namely:

| Type of violation of labor laws | Type of responsibility | Punishment |

| Late payment (non-payment) of advance payment, wages | Administrative (Article 5.27 of the Administrative Code) | Primary violation - a fine for officials and individual entrepreneurs from 1,000 to 5,000 rubles, for a company - from 30,000 to 50,000 rubles; Repeated violation - a fine for officials and individual entrepreneurs from 10,000 to 20,000 rubles. or disqualification for a period of 1 to 3 years, per company - from 50,000 to 70,000 rubles. |

| Disciplinary (Article 192 of the Labor Code of the Russian Federation) | If the salary is not paid due to the fault of the manager (or other authorized person), this may be considered as improper performance of their official duties and lead to the imposition of one of the provisions provided for in Art. 192 of the Labor Code of the Russian Federation of disciplinary sanctions | |

| Material (Article 236 of the Labor Code of the Russian Federation) | The employer is obliged to pay (except for delayed wages) interest - not less than 1/150 of the key rate of the Central Bank of the Russian Federation in force at that time on amounts not paid on time for each day of delay, starting from the next day after the established payment deadline up to and including the day of actual settlement | |

| Criminal (Article 145.1 of the Criminal Code of the Russian Federation) | Partial non-payment of wages for more than 3 months, committed out of selfish or other personal interest by the head of an organization, an employer - an individual, the head of a branch, representative office or other separate structural unit of an organization, is punishable by a fine in the amount of up to 120,000 rubles, the salary or other income of the convicted person for the period up to 1 year, or deprivation of the right to hold certain positions or engage in certain activities for up to 1 year, or forced labor for up to 2 years, or imprisonment for up to 1 year. Complete non-payment of wages for more than 2 months (or payment of wages for more than 2 months in an amount below the minimum wage established by federal law, committed out of selfish or other personal interest by the head of the organization, the employer - an individual, the head of a branch, representative office or other separate structural unit of the organization - punishable by a fine in the amount of 100,000 rubles to 500,000 rubles or in the amount of wages or other income of the convicted person for a period of up to 3 years, or by forced labor for a period of up to 3 years with deprivation of the right to hold certain positions or engage in certain activities for a period of up to 3 years or without it, or imprisonment for up to 3 years with deprivation of the right to hold certain positions or engage in certain activities for up to 3 years or without it |

An employer cannot avoid punishment if an employee asks for a salary in one amount once a month and his request is not denied (letter of Rostrud dated November 30, 2009 No. 3528-6-1). You can see detailed explanations of this position from an official from the Ministry of Labor in K+, having received free trial access to the system.

If your employee asks to pay him an advance payment several months in advance, and you meet him halfway, arrange such payment in the form of a loan with a minimum interest rate. Otherwise, you may have all sorts of problems: the advance may be considered an interest-free loan (the need to withhold personal income tax from the amount of the benefit from saving on interest), and you will have to immediately pay insurance premiums, etc., on the entire amount.

An employer who has not paid an employee (new or long-time) for the first half of the month will not be punished only if this employee did not work in the first half of the month (appeal ruling of the Moscow Regional Court dated 08/07/2012 in case No. 33-15891 /2012).

Results

Newcomers must receive their first salary payment no later than 2 weeks after starting work. All subsequent payments are made within the time limits set by the company for issuing wages (every half month, taking into account the actual days worked).

In order to comply with the salary requirements of the law for newcomers, it is necessary in the local act of the company to provide for special deadlines for the payment of the first salary. Otherwise, the employer may be subject to disciplinary, material, administrative or criminal liability.

Sources:

- Labor Code of the Russian Federation

- Code of Administrative Offenses of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.