General accounting rules for account 08

The main documents that an accountant needs to follow when working with the 08th account:

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting of financial and economic activities of organizations and instructions for its application” (hereinafter referred to as Order No. 94n);

- “Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations”, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n (hereinafter referred to as Instruction 94n);

- PBU 6/01;

- PBU 17/02.

Accounting account 08 is designed to accumulate data on enterprise investments in tangible and intangible non-current assets, which in the future can be recorded in accounts 01, 03, 04 as fixed assets, intangible assets or profitable investments, respectively. Today, order No. 94n established eight subaccounts to account 08.

IMPORTANT! In the working chart of accounts, an enterprise can clarify the contents of the list of second-order accounts (sub-accounts), excluding or merging them. If necessary, additional subaccounts can be introduced if this is required by the specifics of the activity or such introduction is dictated by the need to deepen its control and analysis. In this regard, the register of subaccounts for account 08 in the standard chart of accounts is advisory and methodological in nature. It is this circumstance that explains the need to approve a working chart of accounts for the enterprise (clause 5 of PBU 1/98).

According to Order No. 94n, subaccounts 1, 2, 4, 5 and 7 to account 08 are intended to account for investments in finished non-current assets. Account 08-1 is intended for synthesizing data on capital investments of an enterprise for the acquisition of land plots. Investments in environmental management facilities are accounted for in subaccount 08-2. The 4th subaccount takes into account the costs of purchasing individual OS objects that do not require installation. The 5th subaccount accumulates data on investments in intangible assets; in this case, these objects must also be completed. Subaccount 7 synthesizes the costs of purchasing adult animals.

Subaccount 3 is intended to accumulate information on the construction of environmental facilities, and subaccount 6 takes into account the costs of raising young animals before transferring them to the main herd. The 8th subaccount takes into account expenses associated with research, design work, and the development of new technological and management processes.

Analytical accounting for accounts 08-1, 08-2, 08-3, 08-4, 08-5 is maintained for each fixed asset (purchased or constructed). According to accounts 08-6 and 08-7 - for each species (group) of animals. According to account 08-8 - for each type of work (service) or R&D.

You can clarify the procedure for reflecting the balance of account 08 in the balance sheet in the material “On which line should the balance of account 08 be reflected in the balance sheet?”

Intangible assets and 08th account

Intangible assets (IMA) are assets that have a certain value, are capable of generating income for an enterprise, but do not have a clear tangible form. The rules for accounting for intangible assets are established by PBU 14/2000. PBU 17/2 establishes the rules for accounting for expenses on research, experimental, design and technological developments.

On the 08th account there are two sub-accounts in which information about intangible assets is accumulated. These are subaccounts 08-5 “Purchase of intangible assets” and 08-8 “Performance of research, development and technological work.”

Moreover, if the results of scientific research, experiments, design documentation and developed technologies find their application in the production process of products (works, services) or in the management activities of the enterprise, then the costs of their implementation upon completion of the work are written off from credit 08-8 to debit 04 -th account “Intangible assets”.

If, as a result of research, experiments, design developments or testing of technologies, positive results are not obtained, or if these results are not implemented in the production of products (works, services) or do not influence management processes in the organization, then such expenses are written off from credit 08-8 in debit 91 “Other income and expenses”.

Subaccount 08-5 “Acquisition of intangible assets” relates to those intangible assets that are acquired in several stages and have associated costs. All these expenses until the completion of the process of obtaining rights to intangible assets are collected in subaccount 08-5. Upon completion of the acquisition process, upon receipt of documents confirming the rights to own intangible assets or the right to use them, expenses from credit 08-5 are written off to the debit of account 04.

The question often arises: is intangible design documentation for the construction of fixed assets? For an organization that develops design documentation, these intellectual property objects are intangible assets and the costs of their creation are collected in subaccount 08-8, if such an asset does not have the characteristics of a “good” for such an organization and is not intended for sale/resale.

For organizations that receive this documentation as a result of contractual relations, and along with it the rights to use it and transfer it to third parties, such documentation must also be included in the intangible assets. But if the contract for the creation of design documentation does not indicate that, along with the documents, the rights to dispose of this intellectual property are transferred from the contractor to the customer, then the costs of creating the project and developing design documentation must be attributed to the costs of creating (constructing) that object The OS for which such documentation was created.

The procedure for conducting an inventory of goods and displaying the results

An integral part of inventories is finished products and goods.

To summarize information about the availability and movement of inventory items purchased as goods for sale, account 41 “Goods” is used in accounting. This account is used mainly by organizations engaged in trading activities, as well as organizations providing public catering services.

Goods accepted for safekeeping are accounted for in off-balance sheet account 002 “Inventory assets accepted for safekeeping.” Goods accepted for commission are accounted for in off-balance sheet account 004 “Goods accepted for commission.”

Sub-accounts can be opened for account 41

41-1 “Goods in warehouses” - this subaccount takes into account the presence and movement of inventory located in wholesale and distribution bases, warehouses, storerooms of organizations providing catering services, vegetable storehouses, refrigerators, etc.

41-2 “Goods in retail trade” - this subaccount takes into account the availability and movement of goods located in organizations engaged in retail trade (in shops, tents, stalls, kiosks, etc.) and in buffets of organizations engaged in public catering.

41-3 “Containers under goods and empty” - this subaccount takes into account the presence and movement of containers under goods and empty containers (except for glassware in organizations engaged in retail trade and in buffets of organizations providing catering services).

41-4 “Purchased Products” - in this subaccount, organizations engaged in industrial and other production activities using account 41 “Goods” take into account the availability and movement of goods (in relation to the procedure provided for accounting for inventories).

When accepting goods, the following standardized forms of documents are used:

TORG-1 “Act of acceptance of goods” - is used to formalize the acceptance of goods in terms of quality, quantity, weight and completeness in accordance with the rules for acceptance of goods and the terms of the contract. The act is drawn up by members of the selection committee authorized to do so by the head of the organization. The composition of the selection committee is approved by order of the head of the organization.

TORG-2 “Act on the established discrepancy in quantity and quality when accepting inventory items” and TORG-3 “Act on the established discrepancy in quantity and quality when accepting imported goods” These acts are the basis for making claims against the supplier of goods, etc. d.

Before starting the inventory of goods, members of the inventory commission seal all premises where the goods are stored.

If at the time of the inventory it is possible to suspend operations for the receipt and disposal of goods without causing damage to the trading enterprise, then this must be done. If this is not possible, it is allowed to accept and sell goods in the usual manner for the enterprise, subject to the presence of the financially responsible person and members of the commission, as well as subject to the presence of an order from the manager.

During the inventory of goods, it is necessary, firstly, to compare their quantity in kind with the data of analytical and synthetic accounting for account 41 “Goods” and off-balance sheet accounts, and secondly, to confirm the correctness of the valuation of goods. Just as when conducting an inventory of fixed assets and materials, the actual availability of goods is determined by recalculation, weighing, measuring, etc. The management of a trade organization, in order to obtain correct information on the quantitative and cost assessment of goods, provides members of the inventory commission with technically serviceable weighing instruments and tools, measuring containers, etc.

For some groups of inventory items, it is permissible to use simplified inspection methods, for example, for goods in undamaged packaging.

Inventory of goods is essentially no different from inventory of materials. It can also be carried out at storage locations and at materially responsible persons.

During the inventory of goods, it is necessary to use regulations that reflect the characteristics of the trade sector.

During the inventory process, an inventory list of the actual availability of valuables is compiled in the INV-3 form, which is used to reflect data on the actual availability of inventory assets (inventory, finished products, goods, other inventories, etc.) in storage locations and at all stages of their movements in the organization. The inventory list is drawn up in two copies and signed by the responsible persons of the commission on the basis of recalculation, weighing, re-measuring of inventory items separately for each location and the financially responsible person or group of persons in whose custody the values are located.

One copy is transferred to the accounting department for drawing up a matching statement, the second remains with the financially responsible person.

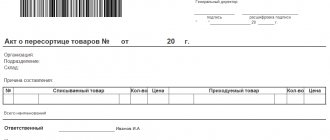

Discrepancies (surpluses or shortages) identified during the inventory are documented by drawing up comparison statements in the INV-19 form , which is used to reflect the results of the inventory of inventory items, finished products and other material assets for which deviations from accounting data are identified.

The comparison statements reflect the results of the inventory, that is, the discrepancies between the indicators according to accounting data and the data of inventory records.

For goods that are not owned, but are listed in accounting records (those in custody or rented, received for processing), separate matching statements are compiled.

The matching statement is drawn up in two copies by the accountant, one of which is kept in the accounting department, the second is transferred to the financially responsible person(s).

Based on the inventory results, the following accounting entries are made:

Debit 41 “Goods” - Credit 91-1 “Other expenses” - goods recognized as surplus based on inventory results are accepted for accounting.

The capitalization of such surpluses is carried out at market value, despite the accounting valuation of materials in the accounting documentation.

If a shortage is identified during the inventory and the culprit is not found, the following entries are made:

Debit 94 “Shortages and losses from damage to valuables” - Credit 41 “Goods” - reflects the cost of the missing goods;

Debit 94 “Shortages and losses from damage to valuables” Credit 68 subaccount “VAT” - the VAT amount has been restored;

Debit 91 subaccount “Other expenses” - Credit 94 “Shortages and losses from damage to valuables” - the amount of the shortfall is reflected as part of other expenses.

If the culprit is found, and the shortages will be written off at his expense, the following entries are made in accounting:

Debit 94 “Shortages and losses from damage to valuables” - Credit 41 “Goods” - writing off the cost of missing goods;

Debit 73 subaccount “Calculations for compensation of material damage” Credit 94 “Shortages and losses from damage to valuables” - compensation for identified shortfalls at the expense of the guilty party.

If an organization, on the basis of concluded contracts, ships goods only after payment, then the shipped goods are displayed on account 45 “Goods shipped”. The purpose of conducting an inventory of such goods will be to confirm the validity of the amounts reflected in the debit of account 45 for each customer.

In practice, when conducting an inventory of goods, enterprise employees carrying out inventory often have to deal with such a concept as “re-grading”.

Re-grading should be understood as identifying a surplus of one type of goods and a shortage of another, with the same name.

As a rule, the reasons for the occurrence of misgrading are the human factor due to neglect by materially responsible persons of their official duties, or an insufficient degree of control over the movement of goods, violation by responsible persons of the rules for receiving and storing goods, etc.

The current legislation, neither tax nor accounting, does not provide a definition of such a concept as “name”. As a result, when offsetting the identified surplus of one type of product against another, with the same name, a number of difficulties arise. The Ministry of Finance of the Russian Federation recommended to use the All-Russian Product Classifier (OKP) to ensure reliability, comparability and automated processing of information and products in such areas as standardization, statistics, economics and others. At the same time, it is recommended to use the Classifier to solve problems of product cataloging, including the development of catalogs and systematization of products in them according to the most important technical and economic characteristics; when certifying products in accordance with groups of homogeneous products built on the basis of OKP groupings; for statistical analysis of production, sales and use of products at the macroeconomic, regional and industry levels; for structuring industrial and economic information by types of products manufactured by enterprises for the purpose of conducting marketing research and carrying out supply and sales operations.

In accordance with the Methodological Guidelines for Inventorying Property and Financial Obligations, it is allowed to offset surpluses and shortages resulting from regrading, subject to the following conditions:

— surplus and shortage of goods as a result of misgrading relate to the same audited period;

— formed by one person being checked;

- goods have the same name and identical quantity.

If the cost of missing goods exceeds the cost of goods identified as surplus during offset, the difference in cost is attributed to the guilty parties. If the perpetrators cannot be identified, the resulting amount difference should be considered as a shortfall in excess of loss norms and written off against profit or reserve funds. At the same time, the protocols of the inventory commission must provide comprehensive explanations of the reasons for the absence of the perpetrators.

Mutual offset of surpluses and shortages as a result of regrading can be allowed only as an exception. The result of such an offset can be either an excess of the value of the missing values over the value of the values identified as a surplus (in this case, the legally established norms of natural loss must be applied to the name of the values for which a shortage has been established), and an excess of the value identified as a surplus. surplus of valuables over the value of valuables identified as a shortage.

In the event that, based on the results of the offset of shortages with surpluses according to the misgrading revealed by the results of the inventory, using the norms of natural loss approved by law, a shortage is still identified, in accordance with the Methodological Guidelines for the Inventory of Property and Liabilities, regulation of discrepancies in the actual availability of values identified during the inventory and accounting data are submitted for consideration to the head of the organization, a decision is made on the sources of covering such losses. Covering losses can be carried out through compensation of the amounts of identified shortfalls, established in accordance with current legislation, by the guilty parties.

If there are no guilty persons, the amount of the identified shortfall should be considered as a shortfall in excess of the norms of natural loss and debited to account 91 “Other income and expenses”, subaccount “Other expenses”.

If the value of the assets identified as a surplus by the results exceeds the value of similar assets identified as a shortage, the difference resulting from the offset is reflected in the credit of account 91 “Other income and expenses”, subaccount “Other income”.

It is impossible to count completely different goods if, based on the results of an inventory, a surplus of one type and a shortage of another is identified.

The financially responsible person is obliged to provide a detailed report on the misgrading he committed, identified as a result of the inventory.

An integral part of inventories is finished products and goods.

To summarize information about the availability and movement of inventory items purchased as goods for sale, account 41 “Goods” is used in accounting. This account is used mainly by organizations engaged in trading activities, as well as organizations providing public catering services.

Goods accepted for safekeeping are accounted for in off-balance sheet account 002 “Inventory assets accepted for safekeeping.” Goods accepted for commission are accounted for in off-balance sheet account 004 “Goods accepted for commission.”

Sub-accounts can be opened for account 41

41-1 “Goods in warehouses” - this subaccount takes into account the presence and movement of inventory located in wholesale and distribution bases, warehouses, storerooms of organizations providing catering services, vegetable storehouses, refrigerators, etc.

41-2 “Goods in retail trade” - this subaccount takes into account the availability and movement of goods located in organizations engaged in retail trade (in shops, tents, stalls, kiosks, etc.) and in buffets of organizations engaged in public catering.

41-3 “Containers under goods and empty” - this subaccount takes into account the presence and movement of containers under goods and empty containers (except for glassware in organizations engaged in retail trade and in buffets of organizations providing catering services).

41-4 “Purchased Products” - in this subaccount, organizations engaged in industrial and other production activities using account 41 “Goods” take into account the availability and movement of goods (in relation to the procedure provided for accounting for inventories).

When accepting goods, the following standardized forms of documents are used:

TORG-1 “Act of acceptance of goods” - is used to formalize the acceptance of goods in terms of quality, quantity, weight and completeness in accordance with the rules for acceptance of goods and the terms of the contract. The act is drawn up by members of the selection committee authorized to do so by the head of the organization. The composition of the selection committee is approved by order of the head of the organization.

TORG-2 “Act on the established discrepancy in quantity and quality when accepting inventory items” and TORG-3 “Act on the established discrepancy in quantity and quality when accepting imported goods” These acts are the basis for making claims against the supplier of goods, etc. d.

Before starting the inventory of goods, members of the inventory commission seal all premises where the goods are stored.

If at the time of the inventory it is possible to suspend operations for the receipt and disposal of goods without causing damage to the trading enterprise, then this must be done. If this is not possible, it is allowed to accept and sell goods in the usual manner for the enterprise, subject to the presence of the financially responsible person and members of the commission, as well as subject to the presence of an order from the manager.

During the inventory of goods, it is necessary, firstly, to compare their quantity in kind with the data of analytical and synthetic accounting for account 41 “Goods” and off-balance sheet accounts, and secondly, to confirm the correctness of the valuation of goods. Just as when conducting an inventory of fixed assets and materials, the actual availability of goods is determined by recalculation, weighing, measuring, etc. The management of a trade organization, in order to obtain correct information on the quantitative and cost assessment of goods, provides members of the inventory commission with technically serviceable weighing instruments and tools, measuring containers, etc.

For some groups of inventory items, it is permissible to use simplified inspection methods, for example, for goods in undamaged packaging.

Inventory of goods is essentially no different from inventory of materials. It can also be carried out at storage locations and at materially responsible persons.

During the inventory of goods, it is necessary to use regulations that reflect the characteristics of the trade sector.

During the inventory process, an inventory list of the actual availability of valuables is compiled in the INV-3 form, which is used to reflect data on the actual availability of inventory assets (inventory, finished products, goods, other inventories, etc.) in storage locations and at all stages of their movements in the organization. The inventory list is drawn up in two copies and signed by the responsible persons of the commission on the basis of recalculation, weighing, re-measuring of inventory items separately for each location and the financially responsible person or group of persons in whose custody the values are located.

One copy is transferred to the accounting department for drawing up a matching statement, the second remains with the financially responsible person.

Discrepancies (surpluses or shortages) identified during the inventory are documented by drawing up comparison statements in the INV-19 form , which is used to reflect the results of the inventory of inventory items, finished products and other material assets for which deviations from accounting data are identified.

The comparison statements reflect the results of the inventory, that is, the discrepancies between the indicators according to accounting data and the data of inventory records.

For goods that are not owned, but are listed in accounting records (those in custody or rented, received for processing), separate matching statements are compiled.

The matching statement is drawn up in two copies by the accountant, one of which is kept in the accounting department, the second is transferred to the financially responsible person(s).

Based on the inventory results, the following accounting entries are made:

Debit 41 “Goods” - Credit 91-1 “Other expenses” - goods recognized as surplus based on inventory results are accepted for accounting.

The capitalization of such surpluses is carried out at market value, despite the accounting valuation of materials in the accounting documentation.

If a shortage is identified during the inventory and the culprit is not found, the following entries are made:

Debit 94 “Shortages and losses from damage to valuables” - Credit 41 “Goods” - reflects the cost of the missing goods;

Debit 94 “Shortages and losses from damage to valuables” Credit 68 subaccount “VAT” - the VAT amount has been restored;

Debit 91 subaccount “Other expenses” - Credit 94 “Shortages and losses from damage to valuables” - the amount of the shortfall is reflected as part of other expenses.

If the culprit is found, and the shortages will be written off at his expense, the following entries are made in accounting:

Debit 94 “Shortages and losses from damage to valuables” - Credit 41 “Goods” - writing off the cost of missing goods;

Debit 73 subaccount “Calculations for compensation of material damage” Credit 94 “Shortages and losses from damage to valuables” - compensation for identified shortfalls at the expense of the guilty party.

If an organization, on the basis of concluded contracts, ships goods only after payment, then the shipped goods are displayed on account 45 “Goods shipped”. The purpose of conducting an inventory of such goods will be to confirm the validity of the amounts reflected in the debit of account 45 for each customer.

In practice, when conducting an inventory of goods, enterprise employees carrying out inventory often have to deal with such a concept as “re-grading”.

Re-grading should be understood as identifying a surplus of one type of goods and a shortage of another, with the same name.

As a rule, the reasons for the occurrence of misgrading are the human factor due to neglect by materially responsible persons of their official duties, or an insufficient degree of control over the movement of goods, violation by responsible persons of the rules for receiving and storing goods, etc.

The current legislation, neither tax nor accounting, does not provide a definition of such a concept as “name”. As a result, when offsetting the identified surplus of one type of product against another, with the same name, a number of difficulties arise. The Ministry of Finance of the Russian Federation recommended to use the All-Russian Product Classifier (OKP) to ensure reliability, comparability and automated processing of information and products in such areas as standardization, statistics, economics and others. At the same time, it is recommended to use the Classifier to solve problems of product cataloging, including the development of catalogs and systematization of products in them according to the most important technical and economic characteristics; when certifying products in accordance with groups of homogeneous products built on the basis of OKP groupings; for statistical analysis of production, sales and use of products at the macroeconomic, regional and industry levels; for structuring industrial and economic information by types of products manufactured by enterprises for the purpose of conducting marketing research and carrying out supply and sales operations.

In accordance with the Methodological Guidelines for Inventorying Property and Financial Obligations, it is allowed to offset surpluses and shortages resulting from regrading, subject to the following conditions:

— surplus and shortage of goods as a result of misgrading relate to the same audited period;

— formed by one person being checked;

- goods have the same name and identical quantity.

If the cost of missing goods exceeds the cost of goods identified as surplus during offset, the difference in cost is attributed to the guilty parties. If the perpetrators cannot be identified, the resulting amount difference should be considered as a shortfall in excess of loss norms and written off against profit or reserve funds. At the same time, the protocols of the inventory commission must provide comprehensive explanations of the reasons for the absence of the perpetrators.

Mutual offset of surpluses and shortages as a result of regrading can be allowed only as an exception. The result of such an offset can be either an excess of the value of the missing values over the value of the values identified as a surplus (in this case, the legally established norms of natural loss must be applied to the name of the values for which a shortage has been established), and an excess of the value identified as a surplus. surplus of valuables over the value of valuables identified as a shortage.

In the event that, based on the results of the offset of shortages with surpluses according to the misgrading revealed by the results of the inventory, using the norms of natural loss approved by law, a shortage is still identified, in accordance with the Methodological Guidelines for the Inventory of Property and Liabilities, regulation of discrepancies in the actual availability of values identified during the inventory and accounting data are submitted for consideration to the head of the organization, a decision is made on the sources of covering such losses. Covering losses can be carried out through compensation of the amounts of identified shortfalls, established in accordance with current legislation, by the guilty parties.

If there are no guilty persons, the amount of the identified shortfall should be considered as a shortfall in excess of the norms of natural loss and debited to account 91 “Other income and expenses”, subaccount “Other expenses”.

If the value of the assets identified as a surplus by the results exceeds the value of similar assets identified as a shortage, the difference resulting from the offset is reflected in the credit of account 91 “Other income and expenses”, subaccount “Other income”.

It is impossible to count completely different goods if, based on the results of an inventory, a surplus of one type and a shortage of another is identified.

The financially responsible person is obliged to provide a detailed report on the misgrading he committed, identified as a result of the inventory.

Nuances of accounting for the costs of construction of fixed assets

The construction of fixed assets begins with planning and design. Projects for buildings, structures, and technical objects, as we have already found out, can be either an intangible asset (and then the costs of design estimates are taken into account in subaccount 08-5) and part of the costs of creating a fixed asset.

The process of constructing an OS can be carried out by involving contractors or carried out by a special division of the enterprise. In the first case, contracts are concluded with contractors, and they are responsible for ensuring that the object in its finished form must comply with the project. In the second, the document flow process is regulated by the internal rules of the enterprise. In both cases, expenses are accumulated in subaccount 08-3.

Important! ConsultantPlus warns that real estate properties (residential buildings, apartments, garages, etc.), the costs of which are recorded on account 08, are subject to property tax at the cadastral value, if such conditions are simultaneously met... For more details, see K+. Trial access is available for free.

Even if the OS is constructed by contractors, it can be made from customer materials. Accounting for materials used in construction is a labor-intensive process. Write-off of materials for construction is carried out on the basis of primary documents. Here it is necessary to recommend the development and use of such primary documents that will help carry out the process of monitoring the use of materials within the framework of estimate calculations. An example of such a primary document is a limit-fence card.

We recommend that you learn more about the procedure for warehouse accounting and the release of materials from the warehouse, as well as about the forms of warehouse documents from the following materials:

- “Maintaining document flow for warehouse accounting of materials”;

- “Procedure for filling out form M-11 requirement-invoice”;

- “Material warehouse card - form and sample.”

The enterprise has the right to develop its own form of the primary document, convenient for monitoring and analyzing the construction process.

Initially, expenses for the purchase of materials for construction are reflected in the debit of the 10th account. As required, within the framework of standards, materials are delivered to the construction site. The accounting department writes them off for construction by correspondence Dt 08.3 Kt 10. Thus, material costs for the construction of a specific object are accumulated in the debit of subaccount 08.3 until the OS object is put into operation. The commissioning of an OS facility upon completion of construction is reflected by posting Dt 01 Kt 08.3.

You will find detailed instructions for registering real estate in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Briefly about BPO inventory

To keep records of BPO, account 97 is used. It can reflect expenses such as:

- construction;

- contributions to SRO;

- purchase of licensed software;

- purchasing licenses or certificates;

- for health insurance.

Inventory is a reconciliation of information, debit and credit turnover, on account 97 with what is indicated in the primary documentation. Typically, the procedure is carried out once a year, at the end, before the formation of annual reporting. The purpose of the inventory is to reconcile the data and find out whether there were errors when writing off funds.

First of all, the manager must issue an order to conduct an inventory in the INV-22 form. In it, he must indicate the composition of the commission that will carry out the procedure (usually accountants, clerks, economists, representatives of the organization’s management), and the period for its implementation. During the inventory process, the RBP fill out the report form.

Reference! Deferred expenses are those expenses that the company incurred in previous or current periods, but they must be included in the cost of goods, work or services in subsequent periods.

Nuances of accounting for investments in non-current assets in agriculture

For agricultural enterprises or organizations with livestock divisions, two special sub-accounts are allocated on account 08:

- 08-6 “Transfer of young animals to the main herd”;

- 08-7 “Acquisition of adult animals.”

The acquisition of mature animals, as a rule, does not cause any problems in accounting. The formation of the actual cost of purchasing an adult animal is carried out by synthesizing the cost of acquiring the asset itself, the costs of its delivery, the examination or evaluation, and other expenses associated with the fact of purchasing the animal. After putting the animal into operation, its value is transferred from account 08 to account 01 using standard posting.

The moment the animal is put into service can be the date:

- its entry into the main herd (including breeding);

- its receipt in the unit where its further maintenance is planned (zoos, laboratories, departments of service dog breeding).

If an animal is received by an enterprise free of charge, then its acceptance is based on the market value of animals with similar characteristics (breed, age, constitution, color). Then the initial cost of such an asset is equal to the market value of the asset, increased by the costs of its delivery, examination, etc.

A large number of questions arise in accounting for the costs of raising young animals. In the chart of accounts there is account 11 “Animals for growing and fattening”. Accountants often ask the question, why do we need subaccount 08-6?

Firstly, instruction 94n does not imply direct wiring of Dt 01 Kt 11.

Secondly, through account 08.6 the planned cost of young animals transferred to the main herd is written off from the cost of all animals being fattened and raised.

If an organization transfers young animals to the main herd, typical postings look like this:

Dt 08.6 Kt 11 - write-off of the cost of young animals;

Dt 01 Kt 08.6 - increase in the cost of animals in the main herd due to the arrival of young animals.

During the year, young animals can be transferred to the herd several times. Its transfer is carried out at the planned cost. At the end of the year, the farm is obliged to adjust the planned cost of the transferred young animals to the actual one. In this case, the reversal or increase in amounts is carried out similarly to the entries shown above.

We reflect the completed inventory

Go to the “Warehouse” section, “Goods Inventory” item:

We create a new document, indicating the main warehouse and the materially responsible person at this warehouse.

Let’s move on to the “Products” tabular section. To fill it out, click the “Fill” button -> “Fill according to stock balances”:

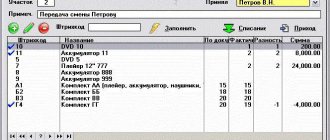

The tabular part is filled with all balances in the selected warehouse for accounts 10 and 41:

By default, the “Actual Quantity” column is equal to the “Accounting Quantity” column. Their equality means the absence of deviations, but in our case, actual shortages of flour (100 kg) and excess sugar (50 kg) and coffee makers (1 pc) were identified.

Let’s reflect this fact by adjusting the “Quantity of fact” column:

Go to the “Carrying out inventory” tab and indicate here the period of conduct, the reason and the document approving the inventory:

Go to the “Inventory Commission” tab:

We indicate its participants by checking the chairman of the commission.

We navigate through the document and see printed forms that can be printed:

Here is part of the matching sheet from the printed form INV-19:

Now our task is to write off the identified shortage in accounting and capitalize the surplus.

The easiest way to do this is by entering documents for the receipt and write-off of goods based on the inventory document:

Results

Account 08 in accounting is used to synthesize information about the cost of fixed assets purchased (or produced independently) by an enterprise, intangible assets and profitable investments in tangible assets.

The nuances of accounting for such investments are regulated by accounting legislation - PBU 6/01, PBU 17/02 and the chart of accounts. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.