Almost all of them have employees whose job responsibilities involve traveling around the city. Most often these are couriers and managers, however, they can also be lawyers and accountants.

Such employees purchase a travel ticket in advance or are reimbursed for travel expenses based on the documents submitted by the employees. However, employees often lose documents or forget to bring them on time. Even if all the documents are available, accounting and calculation of compensation for accounting is a rather labor-intensive process.

How to make it easier for employees to pay for travel

It is more convenient and profitable to buy travel tickets centrally and distribute them to employees.

Legal entities and individual entrepreneurs can buy travel passes for employees via the Internet by bank transfer through the Troika Business service (ORC LLC, agent of Mosgortrans). There will be no commission for this.

If you suddenly don’t know what “Troika” is. This is an electronic refillable plastic transport card of Moscow, which can be used to pay for travel on all public transport.

Do I need to collect Troika cards from employees in order to use the service?

No, it is enough to know the card number.

You can add tickets to your card immediately after paying the bill:

- through the Troika Business mobile application,

- in the terminals of the Moscow Credit Bank.

If employees do not have cards, they can be purchased through the service with delivery. For orders over 30,000 rubles, card delivery is free..

In general, you don’t need to travel anywhere; you can arrange everything through the website.

Travel surcharges

An allowance or additional payment for traveling work is not required . But the employer can set it at his own discretion. Only the reimbursement of expenses mentioned above is required.

Thus, in labor legislation there is no direct prohibition on establishing a fixed additional payment for travel to an employee as compensation for expenses incurred by him. Moreover, these payments are in no way related to the employee’s achievement of work results. The company must take into account that such an additional payment must fully compensate the employee’s possible expenses for travel, renting accommodation and other agreed expenses.

But with this type of compensation for travel, inspectors may have questions. Especially if there are no documents that confirm the expenses incurred by the employee. In this case, the amounts of additional payments made cannot be considered compensatory. This is what the Russian Ministry of Labor thinks. This position is set out in letter dated September 30, 2014 No. 17-4/B-462).

In the case of fixed compensation for the traveling nature of the work, the employment contract must make reference to the Regulations, which stipulate the amounts and conditions for receiving such allowances. Or you need to indicate the amount of additional payment in the employment contract itself.

You can study in more detail the issue of drawing up an employment contract for traveling work in our material “What should be an employment contract regarding the traveling nature of work.”

What documents will the accounting department receive when purchasing a travel pass through Troika Business?

1. Agreement (on request).

2. For delivery service, collateral value of cards and wallet service 1 rub.: invoices and waybill TORG 12.

The first copy of the invoice (the “ORC” copy) will be sent to the buyer’s email address at the time the order is transferred to the courier service. At the time of receiving the cards, you must hand over a copy of the invoice with a signature and seal to the courier.

The 2nd copy of the invoice (Buyer’s copy) with the signature and seal of ORC LLC is placed in the envelope with the cards.

3. To pay for travel tickets:

- Report on accepted payments,

- Register for the report on accepted payments.

Documents are generated after recording all travel tickets on Troika cards, paid for on one invoice.

You will be able to receive the originals both in paper and electronic form. To do this, you will need to send an email using the “Complete reporting documents” link, indicating your postal or email address. In addition, documents can be sent via EDF.

simplified tax system

The tax base of organizations that apply the simplification and pay a single tax on income does not reduce the cost of paying for travel tickets (clause 1 of Article 346.14, clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, accounting for expenses for travel tickets depends on:

- whether the employee whose travel is paid has a traveling nature of work;

- Is travel payment for the employee provided for in the employment (collective) agreement.

If an organization pays travel for employees whose work is not required to travel, the cost of travel tickets is:

- take into account when calculating the single tax as part of labor costs - if the organization’s obligation to pay for travel is provided for in the labor (collective) agreement (subclause 6, clause 1, clause 2, article 346.16, article 255 of the Tax Code of the Russian Federation). Please take into account the costs at the time of payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation);

- do not take into account when calculating the single tax - if the organization’s obligation to pay for travel is not provided for in the labor (collective) agreement (subclause 6, clause 1, clause 2, article 346.16, article 252 of the Tax Code of the Russian Federation).

What documents to prepare to justify the need to pay for travel?

The condition regarding the traveling nature of the work is mandatory for inclusion in the employment contract (Part 2 of Article 57 of the Labor Code of the Russian Federation). But the procedure for paying for travel or compensation for it can be determined by a collective agreement or other local regulatory act, for example, a regulation on the traveling nature of work. These documents can be used to establish that the organization itself buys travel tickets and issues them to employees.

The list of employees for whom tickets are purchased is approved by order. For example, like this:

sample order in Word format.

The Ministry of Finance clarified whether it is necessary to impose personal income tax and contributions on compensation for employee travel to their place of work

The Ministry of Finance of Russia in Letter dated January 18, 2019 N 03-03-06/1/2093 once again reminded employers of the procedure for taxing and compensating employees for the cost of travel to and from work. The position of officials is clear - travel compensation is subject to personal income tax and insurance contributions.

Rules for calculating personal income tax:

- the cost of travel to the place of work and back ─ this is the employee’s income in kind (clause 1 of Article 210 of the Tax Code of the Russian Federation, clause 1 of clause 2 of Article 211 of the Tax Code of the Russian Federation);

- the tax base is defined as the market price of services provided to the employee (clause 1 of Article 211 of the Tax Code of the Russian Federation);

- the date of actual receipt of income in kind is the date of its transfer to the employee (clause 2, clause 1, article 223 of the Tax Code of the Russian Federation, clause 3, article 226 of the Tax Code of the Russian Federation);

- personal income tax must be calculated on the last day of the calendar month in which such services are provided;

- Personal income tax can be withheld at the expense of any monetary income of the employee (for example, from salary), and transferred no later than the day following the day of payment of the monetary income at the expense of which this personal income tax was withheld (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Payment for the cost of travel for employees to and from work is not included in the list of non-taxable payments (Article 422 of the Tax Code of the Russian Federation) and is subject to insurance contributions on a general basis.

The Ministry of Finance expressed this position earlier (Letter of the Ministry of Finance of the Russian Federation dated March 16, 2017 N 03-04-06/15198). The Ministry of Labor agrees with this (Letter of the Ministry of Labor of the Russian Federation dated September 10, 2014 N 17-3/OOG-759).

The taxable profit of reimbursement amounts for employee travel to and from work may be reduced if such compensation is provided for in an employment or collective agreement.

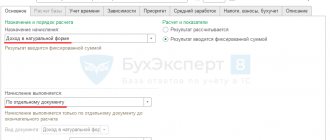

For an example of settings for income in kind, see the video Income in kind using the example of daily allowances above the norm

See also:

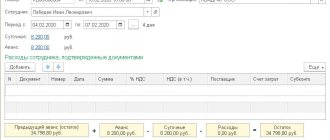

- Withholding of personal income tax from natural income received on the nearest date of payment of other employee income

- Type of income for insurance premiums

- Personal income tax code

- Type of expense for income tax

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- The Ministry of Finance explained how to assess personal income tax and contributions for compensation of expenses for a one-day business trip...

- The Ministry of Finance and the Federal Tax Service explained how to levy contributions on the travel of northerners to a vacation destination abroad. Persons working in organizations of the Far North and equivalent...

- Taxation of the cost of vouchers and payment for travel to the place of treatment with personal income tax and insurance premiums The Ministry of Finance of Russia in Letter dated 04/12/2018 N 03-15-06/24316 explained the nuances...

- The Supreme Court declared invalid the explanations of the Ministry of Finance on the imposition of insurance premiums on the cost of travel of family members of northerners to the place of vacation and back. Thanks to the Decision of the Armed Forces of the Russian Federation of June 14, 2018 N AKPI18-393, the end has been put...

Accounting

Travel tickets are monetary documents and must be accounted for in account 50 subaccount 3 .

| Operation | Debit | Credit | Source documents |

| Payment for travel tickets has been transferred | 60 (76) | 51 | Bank statement, payment order |

| Travel tickets have been received and posted (only security deposit value) | 50.3 | 60 (76) | Universal transfer document |

| Cards issued to employees (deposit value) | 71 | 50.3 | Log book, card issuance sheet |

| Travel expenses | 60 (76) | 20 (44,26) | Report on accepted payments and register |

| Return of the card by an employee (for example, in case of dismissal) | 50.3 | 71 | Accounting journal, accounting certificate |

ACCOUNTING FOR TRANSPORT COSTS

Transport costs are an integral part of the total costs of organizations. They include costs associated with transporting cargo or employees. Russian legislation does not have individual rules for accounting for these expenses, so each organization independently develops its own version of accounting for transportation costs.

Accounting of transport expenses

General requirements for the composition of costs recognized as expenses in accounting are contained in PBU 10/99 “Organizational expenses” [1]. The following accounts are used to account for them:

20 “Main production”;

26 “General business expenses”;

44 “Sales expenses”.

During the month, transportation costs can be reflected in whole or in part in the following accounts:

23 “Auxiliary production”;

25 “General production expenses”

with subsequent debiting to account 20 “Main production”.

For your information

The organization has the right to approve the procedure for distributing transportation costs in such a situation independently, enshrining it in its accounting policies.

For example, transportation costs can be distributed in proportion to the cost of purchased goods, their quantity, weight, or other characteristics suitable for a particular type of product.

When delivering materials or goods, it is necessary to take into account clause 11 of FSBU 5/2019 “Inventories”[2], which requires that transport costs be taken into account in the cost of goods and materials received. This procedure is used if, from the documents, it is possible to establish the amount of transportation costs incurred for the delivery of specific goods and materials.

Transport costs can be reflected in the cost of the goods or in the current expenses of the organization. Let's look at examples of reflecting transportation costs in accounting.

Reflection of transport costs in the cost of goods

A trade organization purchased goods from a supplier on a self-pickup basis. The organization does not have its own vehicles, and it has entered into an agreement with a transport organization for the delivery of this product from the supplier’s warehouse to its warehouse.

Since in this case transportation costs are associated with the delivery of the goods, they are taken into account in the cost of the delivered goods.

Reflection in accounting:

1. The goods are received and delivered to the warehouse of a trading organization (VAT is not assessed):

Debit of account 41 “Goods” sub-account “Central Warehouse” Credit of account 60 “Settlements with suppliers and contractors” - 500,000 rubles.

2. The services of a transport organization for the delivery of goods (excluding VAT) are reflected in the cost of the delivered goods:

Debit of account 41 “Goods” sub-account “Central Warehouse” Credit of account 76 “Settlements with various debtors and creditors” - 10,000 rubles.

3. The amount of VAT on the cost of services of the transport organization is reflected:

Debit of account 19 “VAT on purchased valuables” Credit of account 76 “Settlements with various debtors and creditors” - 2000 rubles.

4. The goods are transferred to the store for sale at actual cost:

Debit of account 41 “Goods” sub-account “Warehouse store” Credit of account 41 “Goods” sub-account “Central warehouse” - 510,000 rubles. (500,000 + 10,000).

Reflection of transport costs in the current expenses of the organization

A manufacturing enterprise bought lumber for 200,000 rubles. and transported them from the supplier’s warehouse using our own vehicles.

The company's vehicles regularly make trips to deliver purchased materials from suppliers and manufactured products to customers.

Based on the accounting policy, transportation costs are taken into account according to actual expenses - 35,000 rubles. - under account 26 “General business expenses”.

Reflection in accounting:

1. Material received from supplier:

Debit of account 10 “Materials” Credit of account 60 “Settlements with suppliers and contractors” - 200,000 rubles. (NDS is not appearing).

2. Transport costs reflected:

Debit of account 26 “General business expenses” sub-account “Transportation expenses” Credit of account 02 “Depreciation of fixed assets”; account 10 “Materials” sub-account “Fuels and lubricants” - 35,000 rubles.

Tax accounting of transport expenses

For tax accounting of transportation expenses, it is necessary to determine in the accounting policy whether they will be reflected as direct or indirect expenses.

For your information

An organization has the right to take into account transportation costs in current tax expenses if the requirements of Art. 252 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) - expenses are economically justified, justified and documented by primary documents.

Trade organizations reflect transportation costs in accordance with Art. 320 of the Tax Code of the Russian Federation: the taxpayer has the right to determine the cost of purchasing goods, taking into account the costs associated with their acquisition. This cost is taken into account when selling goods (subclause 3, clause 1, article 268 of the Tax Code of the Russian Federation). Thus, expenses associated with the purchase of goods may:

• included in the cost of purchased goods

• or taken into account as distribution costs and not included in the cost of purchased goods.

The taxpayer has the right to choose one of the proposed methods of accounting for the costs of delivering purchased goods to the warehouse. The procedure for forming the cost of purchasing goods is determined by the taxpayer in the accounting policy for tax purposes and is applied for at least two tax periods.

If transport costs are paid in excess of the price of the goods under the contract or delivery is carried out by a third-party organization, then for tax accounting purposes transport costs associated with the purchase of goods are always included in sales costs (Article 320 of the Tax Code of the Russian Federation).

If transportation costs are highlighted in the contract as a separate line, they must be taken into account separately from the price of the goods.

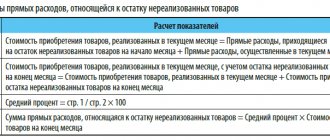

When taking into account transport costs related to the balances of unsold goods, their tax expense is determined by the average percentage for the current month, taking into account the carryover balance at the beginning of the month in the following order (see table).

In this case, the amount of transportation costs is distributed not to the actual balances of goods in the warehouse, but rather to the balances of goods, the ownership of which has not yet transferred to the buyer.

Calculation of the balance of transportation costs at the end of the reporting period

The company's tax records include:

800,000 rub. — total cost of goods sold in October;

150,000 rub. — cost of unsold goods at the end of October;

100,000 rub. — the amount of transportation costs for October;

30,000 rub. (account balance 44) - the amount of direct transport costs attributable to the balance of goods at the beginning of October.

Calculation of tax expenses:

• the amount of direct transportation costs to be written off in October:

100,000 rub. + 30,000 rub. = 130,000 rub.;

• the amount of goods sold in October, plus the amount of goods not sold at the end of the same month:

800,000 rub. + 150,000 rub. = 950,000 rub.

Let's define the average percentage as the ratio of the amount of direct costs to the cost of goods:

130,000 rub. / 950,000 rub. × 100% = 13.68%.

To determine the amount of direct expenses related to the balance of unsold goods, we multiply the average percentage by the cost of the balance of goods at the end of October:

150,000 rub. × 13.68% = 20,520 rub. This amount is not taken into account in tax expenses for October.

Let's calculate the amount of transportation costs that will be taken into account as part of direct tax expenses for October:

130,000 rub. – 20,520 rub. = 109,480 rub.

If a company sells several types of goods, then the amount of transportation costs that relate to unsold goods is determined by the total balance of goods. The Tax Code of the Russian Federation does not require the distribution of transport costs by type of goods.

Conditions for recording transportation costs

So, the procedure for accounting for transportation costs depends on the type of activity of the organization, the adopted accounting policy, as well as the delivery conditions for each transaction. But it is also important to find out whether the organization has the right to reflect the transportation costs incurred in its accounting.

The purchase and sale agreement stipulates which party bears the costs of delivering the goods to the buyer's warehouse. The same condition must be reflected in the invoice offer or public offer agreement.

The contract may stipulate that the costs of transporting goods are borne by the seller of goods, who delivers the goods to the organization’s warehouse. In this case, the buyer has no reason to record transportation costs associated with the delivery of goods.

Delivery of goods can be carried out by the buyer if the ownership of the goods is transferred to him not on his territory, but, for example, in the seller’s warehouse. The buyer can use his own vehicles or the services of a specialized transport organization, but in any case, transport costs will be reflected on his balance sheet and as part of his expenses.