What is registration under a GPC agreement and how does it differ from an employment contract?

A civil law agreement (abbreviated as GPC) is a document that is regulated by the norms of the Civil Code of the Russian Federation. Its essence is that the parties specify in it the result of the work that the customer should receive, property relations and other issues, without entering into an employment relationship

.

Simply put, under a GPC agreement, an individual undertakes to perform certain work for an organization or individual entrepreneur with a certain result. In this case, the performer will not be an employee of the company or individual entrepreneur.

Types of civil contracts:

- contract agreements,

- contracts for paid services,

- copyright agreements, for example, to write a book for a publishing house or an article for a magazine. Such agreements can be concluded with freelancers.

The norms of the Labor Code do not apply to GPC agreements . Relations between the parties are regulated by Part 2 of the Civil Code of the Russian Federation (chapters 37-41). The document should not use labor law terms.

Several more important features of GPCs that distinguish them from employment contracts:

- According to a civil contract, the main thing is the result, not the process. A deadline must be set and the result of the work must be determined. Under an employment contract, an employee is assigned to a specific position, which involves the performance of certain job duties.

- A civil law agreement must have expiration dates for the agreement (Article 708 and Article 783 of the Civil Code of the Russian Federation). Employment contracts in most cases do not have specific validity periods.

- A separate chapter is devoted to each type of agreement, which may be of a civil nature. The Civil Code of the Russian Federation gives precise definitions to the basic concepts - work and service - in Article 703 and Article 779, respectively.

Is it necessary to draw up an act under a civil contract for the performance of work (provision of services)?

Drawing up an act on the provision of services (performance of work) is mandatory only if such a requirement is provided for by civil legislation or a concluded contract. This is the opinion of the Russian Ministry of Finance (letter dated November 13, 2009 No. 03-03-06/1/750). In turn, the Civil Code of the Russian Federation directly prescribes the drawing up of an act on the provision of services (performance of work) only when performing work under a construction contract (clause 4 of Article 753 of the Civil Code of the Russian Federation). The drawing up of an act is also mentioned in Article 720 of the Civil Code of the Russian Federation, which applies to all types of work contracts. However, it says that along with the act, the parties can draw up another document certifying acceptance.

Acts under a civil contract can be drawn up as follows:

- act of acceptance and transfer of completed work;

- the act of providing services.

In other cases, it is not necessary to draw up an act. Therefore, the fact of performance of work (provision of services) for accounting and taxation purposes can be confirmed by another document (Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ, Clause 1 of Article 252 of the Tax Code of the Russian Federation). For example, for a transportation contract, the fact of provision of services is confirmed by the third copy of the consignment note. If the transportation of cargo by truck is paid by the customer at a time-based rate, then the document confirming the completion of transportation services, in addition to the consignment note, is a tear-off coupon for the waybill. The fact of provision of services under a commission agreement is confirmed by the commission agent’s report (Article 999 of the Civil Code of the Russian Federation). Under an agency agreement - a report from the agent (Article 1008 of the Civil Code of the Russian Federation). For agency agreements (if provided for by the agreement itself) - a report from the attorney (paragraph 5 of Article 974 of the Civil Code of the Russian Federation).

At the same time, in order to recognize expenses under a contract for tax purposes, an act may be required in cases not provided for in civil legislation. The Tax Code of the Russian Federation states that the act is needed by organizations using the accrual method to recognize material expenses under contracts for the performance of work (rendering services) of a production nature (sub-clause 6, clause 1, article 254, clause 2, art. 272 of the Tax Code of the Russian Federation). Similar explanations are contained in the letter of the Federal Tax Service of Russia dated December 29, 2009 No. 3-2-09/279.

Advice: in cases where drawing up an act is not mandatory, work (services, rights) can be taken into account in accounting and taxation on the basis of an agreement (or other documents confirming the fact of completion of work, provision of services, alienation of rights) (Part 1 of Art. 9 of the Law of December 6, 2011 No. 402-FZ, paragraph 1 of Article 252 of the Tax Code of the Russian Federation).

To do this, for example, write down the following condition in the contract. If the customer, upon the provision of services specified in the contract, does not make any claims against the contractor, the service is considered provided (work completed). In this case, the documents confirming the provision of services may, in particular, be:

- contract;

- an invoice for payment;

- payment documents.

This approach is confirmed by the Ministry of Finance of Russia in letters dated May 4, 2012 No. 03-03-06/1/226 and dated November 17, 2006 No. 03-03-04/1/778.

However, this does not apply to works (services), for which acceptance must be documented in a separate document. For example, for a construction contract, for which the act is mandatory (clause 4 of Article 753 of the Civil Code of the Russian Federation).

Pros and cons of a civil contract for the performer

| Pros of GPC | Cons of GPC |

| The customer cannot interfere with the work of the contractor. The exception is the acceptance of intermediate results. | The employee is not registered as a member of the company. |

| Possibility to work on a flexible schedule. The main thing is to do the work on time and of the required quality. | The customer is not obliged to provide the employee with materials, tools, or provide a workplace. All this must be purchased at your own expense. |

| You can involve third parties to perform work, or combine work in several places. | There are no social guarantees. Vacation pay, sick leave, and maternity pay are not paid. There are no additional payments for overtime work. The customer is not obliged to provide leave to the contractor. |

| The time spent performing work under a civil contract is included in the length of service. Accordingly, the performer can accumulate the necessary length of service to receive an insurance pension, rather than a social one. | The customer does not insure the performer with the FSS (Social Insurance Fund) and is not responsible for work-related injuries that the performer may receive (unless he voluntarily agrees to this). |

| A GPC agreement may provide for insurance in the event of a work injury if the customer agrees to voluntarily pay contributions to the Social Insurance Fund. | Payment is based on results, and not just being at the workplace, time spent, etc. The customer can pay less than the minimum wage (minimum wage in labor law). |

| Ease of applying for a job. | The period of activity under the civil contract (civil contract) is not taken into account when calculating unemployment benefits. |

How does DHPC differ from labor

To legally formalize the relationship for the performance of work or provision of services, an individual enters into a contract - DHPC.

The choice of executor depends on the purpose of concluding a civil contract and is not limited by the legislator:

- for the provision of services (legal, accounting, cleaning, etc.);

- to carry out work (repair, manufacture of products, etc.).

There are two design options:

- hiring an employee and concluding an employment contract;

- registration of GPC.

The main differences are in the table:

| Base | Labor | GPC |

| Legal regulation | Labor Code of the Russian Federation | Civil Code of the Russian Federation |

| Item | Personal performance of duties by the employee | The final result of the provision of services (performance of work) with the right to involve third parties in the work |

| Operating mode | Established by local act and agreed with the employer | Not installed |

| Term | As a rule, indefinitely. The law establishes grounds for establishing a period | Provided by contract |

| Payment order | At least once every two weeks | The parties will agree on their own |

| Taxes and fees | The employer withholds personal income tax, pays contributions to the Social Insurance Fund, Pension Fund, and Compulsory Medical Insurance Fund | The customer withholds personal income tax, pays contributions to the Pension Fund and the Compulsory Medical Insurance Fund |

| Termination | Regulated by law: the employee has the right to refuse the agreement by notifying the employer two weeks in advance, the employer has the right to terminate the contract in cases specified by law | The procedure for termination and unilateral refusal is established in the contract |

Pros and cons of a civil contract for the customer

| Pros of GPC | Cons of GPC |

| No social burden. No need to pay vacation pay, sick leave, etc. | The customer has no right to interfere with the process, with the exception of intermediate acceptance of the results. |

| The customer does not pay insurance premiums to the Social Insurance Fund (unless otherwise specified in the GPC agreement). | An employee cannot be held accountable for violating internal rules, for example, for being late. |

| There is no need to spend money on workplace equipment. | There is a risk of re-qualifying the GPC agreement into an employment contract with additional assessment of contributions to the Social Insurance Fund and penalties. |

| It is not necessary to make payments to employees twice a month, as is the case with an employment contract. You can register the payment once after the completion of the work. | It is necessary to accrue and pay taxes in case of payments under a GPC agreement to an individual. Accordingly, this is some burden on the customer’s accounting department. |

| No need to conduct personnel records. | If the company has a strict framework for hiring employees based on level of education, qualifications, and work experience, then under a GPC agreement it is possible to hire a contractor who does not meet these requirements. |

Documents for accrual and payment of amounts under GPC agreements

Calculation of amounts under GPC agreements in 1C 8.3 ZUP can be made using the following documents:

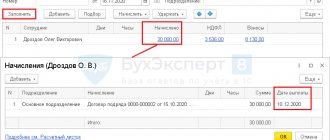

- If it is necessary to make payments during the inter-settlement period, then a document is used for these purposes Accrual under contracts (Salary – Accruals under contracts (including copyright) – Accruals under contracts). Amounts in the document Accrual under contracts can be calculated automatically using the button Fill. Moreover, for Contracts (works, services), in which Payment method specified – according to certificates of completed work, you will first need to deposit Acceptance certificate for completed work. Another option for filling out the document is by clicking the button Selection. After accrual of amounts under the GPC agreement paid during the intersettlement period, it is necessary to create Statement..., in which in the field Pay select value - Accruals under contracts and follow the link Not selected indicate the document Accruals under contracts:

See also:

- Separate accruals and payments under GPC agreements (ZUP 3.1.2)

- If payments under the GPC agreement are made within the payment deadlines, then the document Calculation of salaries and contributions .

In this case, income under GPC agreements is calculated on a separate tab - Agreements :

In Vedomosti... when paying amounts under GPC agreements accrued by the document Accrual of salaries and contributions , in the Pay the following methods of salary payment are selected:

- Remuneration to employees under GPC agreements - the document includes amounts only for “pure” agreements, or if an employee is also hired into the organization under an employment contract and at the same time, for each type of agreement, its own element of the Employees directory has been created , then only the amounts under the agreement will be loaded the Sheet... GPC. The amount under the employment contract for the same employee will appear when choosing the payment method - Salaries of workers and employees .

- Monthly salary – all debts due to the employee will be covered

See also:

- Filling out statements by type of contract (ZUP 3.1.3.157)

When and with whom can a GPC agreement be concluded?

It is important to understand that GPC is not an employment relationship: the subject of regulation is the result, not the process of activity.

If the conclusion of such an agreement with a legal entity or individual entrepreneur does not raise any doubts, then with an individual the situation is more complicated. It does not matter what services it provides. Article 15 of the Labor Code of the Russian Federation establishes the inadmissibility of disguising labor relations as civil law .

There is a risk of reclassification of a GPC agreement with an individual into an employment contract if the inspectors consider that the customer and the contractor are actually in an employment relationship. It is extremely important what wording will be in the civil contract and in the acts drawn up based on the results of the work. In any case, when concluding a GPC agreement with an individual, it is better for the customer to consult with lawyers about the risks and check all the wording in the documents.

There are no strict criteria for the validity period of GPC agreements. The time frame is determined during the discussion, mutually.

This agreement can also be extended (extended). In this case, an additional agreement must be drawn up to change the timing of the work.

How to conclude a DHPC

The law does not establish any special procedure for concluding a civil contract; general rules of office work apply:

- Agreement of conditions.

- Familiarization with the draft contract and adjustments.

- Signing of the deal by the parties.

The legislative grounds for concluding a civil contract depend on the type of transaction: contract, paid provision of services or a mixed contract. Depending on the legal regulation, the relevant norms of the Civil Code of the Russian Federation are applied.

Here are the documents needed to register the GPC:

- for an organization - charter, order appointing a manager, certificate of registration and bank details;

- for citizens - passport, INN and SNILS.

The answer to the question of whether it is necessary to issue an order to conclude a GPC is negative: for a GPC, unlike a labor agreement, an order is not needed.

In what cases can a GPC agreement be recognized as a labor agreement?

Recharacterization of a GPC agreement is at least unpleasant, because a civil transaction with an employee has a number of big advantages. Such personnel are freelance. This means less personnel work, no obligation to pay for sick leave and vacations, including maternity and children's leave. You don't even need to provide a workplace.

If the agreements are transferred to the category of labor agreements, you will have to pay additional contributions to the Social Insurance Fund and pay penalties. They may be required to assign saved social benefits.

The main criteria for recognizing a relationship as an employment relationship:

- The GPC agreement specifies the labor function, and not specific work and results. For example, it is stated that the performer writes texts in general, but specific texts must be specified (for example, a copywriter undertakes to prepare a text about the company and descriptions for 50 product cards).

- The contractor receives the same payment every month. This looks strange because... under a GPC agreement, the scope of work usually varies and cannot be the same every month.

- The performer systematically performs the same work. The range of his tasks does not change. iThe contractor works on the customer’s premises and has an equipped workplace there.

- The agreement does not contain mandatory clauses, for example, on the timing of the work.

- The contract specifies internal rules.

- The contractor is provided with vacation, paid sick leave or given a bonus, which can only be received by a full-time employee registered in accordance with the Labor Code of the Russian Federation.

- There is a mention of subordination to full-time employees of the customer company.

- The contractor under the GPC agreement is sent on a business trip and is paid travel allowances.

What taxes does the employer pay under the GPC agreement?

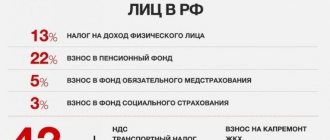

If the payment is made to an individual, then personal income tax in the amount of 13% must be withheld and paid from the fee. If the customer is an organization, then this tax is calculated and transferred to the budget by the customer, since in this case he is the tax agent.

For example, the remuneration under the GPC agreement is 10,000 rubles. In fact, the customer will transfer 13% less to the employee, that is, 8,700 rubles. The amount of personal income tax in the amount of 1300 rubles. the customer will transfer it to the budget.

An exception is a GPC agreement concluded with an individual entrepreneur. In this case, taxes on payments under a civil law agreement are paid by the individual entrepreneur.

Table 1. Taxes that must be paid on payments under a civil contract.

| Type of tax | Accrued or not | Tax amount |

| Personal income tax (personal income tax) | Accrued | 13% |

| Contributions to the RF Pension Fund (Russian Pension Fund) | Accrued | 22% |

| Contributions to the Federal Compulsory Medical Insurance Fund (for medicine) | Accrued | 5,1% |

| Contributions to the Social Insurance Fund (for insurance in case of temporary disability and in connection with maternity) | Not credited | — |

| Contributions to the Social Insurance Fund (for insurance against accidents at work and occupational diseases) | Accrued if provided for in the contract. | — |

Important nuances regarding the taxation of payments under GPC agreements:

- An individual, receiving payments under GPC agreements, has the right to use standard tax deductions . For example, deductions for the purchase of real estate, payment for education or medical services, including dental services, deductions for the presence of dependent minor children. In this way, you can reduce the amount of income tax that is transferred to the state, or return previously paid taxes from the budget.

- To take advantage of tax deductions, an individual must provide receipts for all expenses.

- The deduction and transfer of insurance premiums under the GPC agreement by customers is carried out not in favor of various funds, but strictly to the tax office.

- Any fees are paid only if the agreement between the contractor and the customer involves the provision of copyright services or the performance of contract work. When executing agreements regarding a lease or a cash loan, social payments are not transferred to the local education budget.

- When concluding a transaction, the purpose of which is not only to perform work, but also to transfer rights to property, the income lines of the second party must be divided into taxable remuneration and non-taxable financial receipts. Contributions will be deducted only from the first part.

Document for registration of conditions under the GPC agreement

In order for it to be possible to take into account income under a civil law agreement in 1C 8.3 ZUP, you should first of all set the checkbox in the salary calculation settings (Settings - Payroll calculation) Register payments under civil law contracts :

a special journal will appear in the Salary Agreements (including author’s) , where using the document Agreement (works, services) you can register the conditions under the GPC agreement:

There are three payment methods :

- once at the end of the term

- according to certificates of completed work

- at the end of the term with monthly advance payments

If you select the Payment Method - according to certificates of work performed , then it is necessary, based on the document Contract (work, services), to enter the document Acceptance Certificate of Work Completed (Salary - Agreements (including author's) - Acceptance Certificate of Work Completed):

The documents Contract (work, services) and Acceptance Certificate for completed work do not accrue anything. The contract (work, services) serves to register the terms of the contract, and the Acceptance Certificate for completed work serves to register the amount that should then be accrued on the basis of the signed report.

The procedure for accepting work under a civil contract

Completed work (services) is accepted according to the acceptance certificate for completed work (services).

For violation of deadlines for completing work, a penalty in the form of a fine or penalties may be collected from the contractor . In case of damage to the customer's property, the contractor must compensate for the losses in full.

In addition, unlike an employment contract, under contract or paid services, the contractor bears the risk of accidental death or accidental damage to the result of the work performed before its acceptance by the customer.

Civil contract

Organizations enter into a civil law agreement (CLA) with individuals to provide specific work or services, for example: cleaning of premises, legal, accounting services, etc. At the same time, the enterprise is relieved of the need to maintain personnel records in relation to citizens engaged under civil-processing agreements, is exempt from paying some mandatory contributions when concluding an employment contract, for example to the Social Insurance Fund, and is paid for the results of work performed or services provided under the contract, and not for the time of presence on the job. work.

Features of the GPC agreement:

- The conclusion and execution of a GPC agreement is subject to the provisions of the Civil Code of the Russian Federation, and not labor legislation.

- A citizen performing work or providing services under a civil law contract receives payment for the work actually performed (services provided), and not for the time spent at work

- In a civil contract, it is permissible to prescribe penalties (fines, penalties) for untimely or poor-quality performance of work or provision of services.

- A citizen performing his duties under a civil contract is (in accordance with civil law) liable for losses caused to the organization by poor-quality work (services) or delay and is obliged to compensate them in full

- Services or work under a GPC agreement are performed by a citizen using his own materials and equipment, the cost of their use is included in the cost of the work (services)

- A civil law contract is concluded for the performance of a certain amount of work (services), the result of the work (services) under the civil process agreement is subject to subsequent acceptance by the customer. Upon execution, the contract terminates, that is, it does not bind the parties to permanent obligations.

- Under a civil law contract, the contractor is not bound by the obligation to fulfill the requirements and comply with internal local acts of the organization (working hours, mandatory presence at the workplace, etc.), he is not provided with a separate workplace

The procedure for terminating the GPC agreement

In this part of the article, we will tell you how to correctly terminate a GPC agreement and what nuances there are in this process.

- The contract for the provision of services can be terminated unilaterally by both the customer and the contractor if one pays the other for the expenses incurred. Only the customer has the right to terminate the contract unilaterally if he pays the contractor’s expenses.

- How to terminate a GPC agreement if both parties decide to terminate cooperation? In this case, a written termination agreement is drawn up. The procedure for termination may be specified in the GPC agreement. Then the parties act according to the described rules.

- It is possible to terminate a GPC agreement through the court only if the other party is against or does not respond to the notice of termination within the period established by the agreement or within 30 days if no period is established.

Unlike an employment contract, the GPC regulates itself in terms of the procedure for termination by the parties. These conditions may be stated in one of the clauses or be part of the “rights of the parties”.

Typically, the contract provides certain guarantees for the parties in case the contractor begins work on the order and the client decides to abandon the project. The clauses of the agreement may provide for compensation or other sanctions against the party initiating the severance of the relationship. If there is no such clause, the party must write a notification letter with explanations on the basis of which the contract can be terminated.

The advance paid under the GPC agreement can be returned to the customer subject to failure to fulfill the agreement or failure to meet deadlines, if this is specified in the agreement itself, or in court.

What conditions are included in the document?

The contract is drawn up in writing in two copies.

When drawing up, the parties agree on the conditions for concluding a civil contract:

- name and volume of services provided, work performed;

- deadlines;

- payment order;

- rights and obligations of the parties;

- procedure for accepting works and services;

- procedure for termination and refusal of the transaction.

The law does not limit the parties in agreeing on conditions, but it is necessary to take into account the provisions of the Civil Code of the Russian Federation for certain types of transactions:

- paid provision of services - Ch. 39 Civil Code of the Russian Federation;

- in a row - ch. 37 Civil Code of the Russian Federation.

ConsultantPlus experts examined how a legal entity can protect itself from recognition of a civil law contract as an employment contract. Use these instructions for free.

to read.

Summary

A GPC agreement is not a simple document or formality. Before signing it, you must carefully read all the terms and conditions.

If you do not understand something or doubt that the document protects your interests, be sure to consult with lawyers. A civil law contract is not an employment agreement, where the employee is seriously protected by the norms of the Labor Code of the Russian Federation. Most often, GPC protects the interests of the customer and can have many nuances in relation to the contractor.

Author: Kadrof.ru (KadrofID: 79032) Added: 05/30/2019 at 13:14

To favorites

Comments (52)

Valentina (KadrofID: 100310)

Please tell me, when you work under a civil service agreement, the employer provides income certificates to apply for a subsidy

04/05/2020 at 14:25

Sergey Antropov (KadrofID: 5)

Valentina, if you are asking about a certificate of income in form 2-NDFL, then you can receive such a certificate when working under a GPC agreement. In it, the employer will reflect the income you received and taxes withheld. The issuance of such a certificate is regulated by Art. 230 of the Tax Code of the Russian Federation.

05/01/2020 at 17:37

Natalia (KadrofID: 111378)

Tell me, if a person is employed under a GPC agreement, can he register with the labor exchange?

08/05/2020 at 01:20

Sergey Antropov (KadrofID: 5)

Natalya, no. According to the Law of the Russian Federation of April 19, 1991 N 1032-1 Article 2, such citizens are considered employed, i.e. having income.

08/05/2020 at 22:21

Maxim (KadrofID: 111438)

Tell me, is the existence of a Civil Legal Agreement (CLA) without receiving income for a certain period of time equivalent to conducting business during this period? After all, in fact, since there is no income, then there is actually no activity! And the concluded GPC Agreement is only a formal necessity for the possible conduct of activities.

08/06/2020 at 10:29

Sergey Antropov (KadrofID: 5)

Maxim, the term conducting business is usually used for individual entrepreneurs or organizations. A GPC agreement is concluded with an individual to perform certain work. Therefore, please clarify your question.

08/07/2020 at 22:48

Olga (KadrofID: 112288)

If, as your article says, the main thing is the result, and not the process, is it then legal for the organization to require me to work according to the schedule they have determined (I am not satisfied with such a schedule)?

08/22/2020 at 15:47

Tatiana (KadrofID: 113091)

Can individuals be attracted? Is a person working under a GPC agreement liable for illegal conduct of business activities?

09.09.2020 at 11:34

Sergey Antropov (KadrofID: 5)

Olga, legally no, but in practice it is better to agree with the customer on working conditions acceptable to both parties. After all, the customer can initiate termination of the contract.

09.09.2020 at 22:29

Sergey Antropov (KadrofID: 5)

Tatyana, if you are not disguising your business activities under the guise of GPC, then I see no reason. You pay taxes, you do work.

09.09.2020 at 22:30

Enver (KadrofID: 114155)

Can the employment center check the number and date of the GPC agreement?

09.30.2020 at 21:47

Annushka24 (KadrofID: 114304)

Hello. She worked under a contract for the provision of paid services. During this time I received another education. To receive a tax deduction for training, I asked for a 2NDFL certificate. I was told that I was not entitled to such a certificate precisely because I worked under such an Agreement and did not pay taxes. I objected that, by law, the employer had to pay taxes. I was refused. What to do? Should I file with the Labor Inspectorate or court? Or will everything be useless? I read the contract carefully. The tax issue is not addressed in any way.

04.10.2020 at 01:31

Sergey Antropov (KadrofID: 5)

Enver, I’m not sure that CZ has such capabilities. They are most likely checking to see if any fees have been paid for the employee by the customer. After all, taxes are withheld from payments under civil contracts.

05.10.2020 at 13:48

Yulia Bocharova (KadrofID: 115423)

Tell me whether the amount of contributions should be included in the contract amount, or whether the amount should be included with personal income tax. Now there are disagreements in the institution on this issue. Previously, the amount with personal income tax was indicated, but a new chief accountant came in and now we are calculating all taxes.

10/24/2020 at 07:04

Juliana (KadrofID: 116010)

If I am registered with the Employment Center and receive unemployment benefits and I have registered for a job or part-time job under a GPC agreement, can I lose my benefit payment for the past month? Does the employment center have the right to suspend benefit payments?

02.11.2020 at 15:09

Roman (KadrofID: 116273)

The GPC agreement specifies the amount of 10,000 rubles, after signing the work acceptance certificate, I receive 8,700 rubles, that is, only personal income tax is withheld, and the article states that the employer must pay contributions to the Compulsory Medical Insurance Fund and the Pension Fund. Is this possible or have I misunderstood something? And also, how should my work be reflected on the tax website?

06.11.2020 at 02:01

Sergey Antropov (KadrofID: 5)

Yulia, as far as I know, the contract specifies the amount that includes personal income tax. Tax is withheld when paying money to individuals. face. I think that this can be stated in the documents as a separate paragraph.

07.11.2020 at 22:00

Sergey Antropov (KadrofID: 5)

Juliana, a citizen loses the right to receive benefits after employment. Because ceases to be unemployed. If I understand your question correctly, you have already received what was paid earlier and are not obligated to return it. But since you started working, you no longer have to receive benefits.

07.11.2020 at 22:01

Sergey Antropov (KadrofID: 5)

Hello, Annushka24! When paying money to individuals. For individuals, organizations act as a tax agent and must withhold and transfer taxes to the budget themselves. I assume that the organization for which you worked did not officially carry out the contract and did not pay taxes, and therefore does not want to issue you a certificate. If you worked somewhere else, try to get a certificate there to receive a personal income tax refund.

07.11.2020 at 22:20

Larisa (KadrofID: 116709)

Hello, how can I get Azerbaijani citizens to work for an individual entrepreneur on a patent if they do not have SNILS?

11/13/2020 at 18:41

Vladimir (KadrofID: 116906)

Hello, the employment center sent a letter demanding the return of the paid benefits due to the fact that I was working at that time under a civil service agreement. It turned out that since last year I have been accruing experience at Yandex LLC without payments. What can I do? Can I be sued or forced to return benefits?

16.11.2020 at 21:21

Tatiana (KadrofID: 118674)

I worked under a GPC contract and am a pensioner. I moved to another region and submitted documents to the Pension Fund to reimburse the relocation costs. The Pension Fund requires a certificate stating that I did not receive these payments from the organization with which the GPC agreement is concluded. Is it legal for the Pension Fund to require such certificates and is the organization obligated to issue them?

12/14/2020 at 11:17

Sergey Antropov (KadrofID: 5)

Hello, Vladimir! If you sent a letter, then this question will not be put on hold. It’s better to react, come to the employment center and figure everything out. If, according to the law, you were not entitled to benefits, because... worked, then unfortunately, the benefits will be required to be returned.

12/19/2020 at 12:58

Sergey Antropov (KadrofID: 5)

Hello Tatiana! The Pension Fund of the Russian Federation is a state structure and must act in accordance with the laws. If they ask for a certificate, it means they need it. Therefore, it is better to provide it. The organization must issue it, there are no obstacles to this.

12/19/2020 at 12:59

DMITRIY KOLESNIKOV (KadrofID: 119033)

Is it possible, while working under the GPC, to get another job officially using a work book?

12/20/2020 at 14:31

Annushka (KadrofID: 120205)

Hello. Can I get a job under the civil labor law without resigning from my previous job, where I worked under an employment contract (where I am on maternity leave)?

01/11/2021 at 15:33

Maria (KadrofID: 121179)

Good afternoon Please tell me, if a GPC agreement for the provision of services is concluded with an individual occasionally (2 times a year or once a year), will an employment relationship be considered in this case? The agreement is concluded of a purely civil nature; the frequency of concluding such agreements with the same person is simply not clear. The term for completing services is about 10 days.

01/25/2021 at 21:46

Maria (KadrofID: 121179)

Hello, DMITRIY KOLESNIKOV! Yes, you can, since according to the GPH agreement you perform certain work or services are provided, this is regulated by civil law, not labor law. You have the right to enter into labor relations and these relations, accordingly, will be regulated by the Labor Code of the Russian Federation.

01/25/2021 at 21:54

Maria (KadrofID: 121179)

Hello, Annushka! If you are not a civil servant, you can enter into a civil contract. State owners are increasingly strict in this regard, since a conflict of interest may be perceived, and most often there is a ban on engaging in other income-generating activities.

01/25/2021 at 22:02

Sergey Antropov (KadrofID: 5)

Dmitry, it’s possible, because... work on GPC may not be the main one.

Annushka, I think so, because... You can work part-time. Just in case, I recommend checking your employment contract and checking to see if there are any clauses prohibiting you from working in other places.

01/25/2021 at 22:34

Sergey Antropov (KadrofID: 5)

Good afternoon, Maria! You need to look at the details, but since the services are provided periodically and not constantly, it seems to me that such a relationship is unlikely to be classified as an employment relationship. You can ask the contractor to register for self-employment and work with him in this status. In this case, I don’t see any risks at all, because... a self-employed person can work with a legal entity without any problems. persons and provide them with services at any frequency. You can read more about this mode in the article:

02/06/2021 at 15:00

Alexander (KadrofID: 124264)

I work under a GPC agreement. The customer pays for my services monthly after signing the Certificate of Work Completed. At the moment I am busy looking for another job where I want to get a job according to the Labor Code of the Russian Federation. Accordingly, I want to terminate the GPA, but the terms of termination are not specified in the contract. But there is a general term of the contract in the subject of the contract. The question is whether I have the right to terminate the contract without paying any compensation to the Customer BEFORE the expiration of our contract. I have a GPA until December 31, 2021, and for example, I will find a job in the summer of 2021. Will I be able to calmly terminate the GPA without losses for me? Thank you

03/15/2021 at 21:47

Sergey Antropov (KadrofID: 5)

Alexander, the GPC agreement can be terminated by agreement of the parties. If the customer agrees to terminate the relationship with you, then draw up a corresponding document. In it, write down that the parties have no claims against each other, and all other conditions that are important to you.

03/21/2021 at 19:06

Alexandra (KadrofID: 126088)

Good afternoon. Tell me, how can I conclude a GPC agreement with a citizen of another country (Kazakhstan, Belarus, Ukraine)? What taxes do you need to pay? What are the risks for the customer and the contractor? On the basis of such an agreement, can a citizen of another country stay on the territory of the Russian Federation for longer than 3 months, if a period for completing the work is prescribed (six months, a year)? Will the GPC agreement have the same force as the TD for migration? Is it possible to draw up such an agreement between relatives, one of whom has a Russian passport?

04/20/2021 at 09:22

Sergey Antropov (KadrofID: 5)

Good afternoon, Alexandra!

As far as I know, it is possible to draw up a GPC agreement with a citizen of a country that is part of the EAEU (Russia, Belarus, Armenia, Kazakhstan and Kyrgyzstan) without any problems. The performer is required to have a passport (if it is in a foreign language, then a notarized translation of the document), a migration card and a license (if the performer’s activities are licensed). At the same time, citizens of the EAEU member countries do not require a patent or work permit.

The Ministry of Internal Affairs must be notified of the conclusion and termination of a civil process agreement with a foreign citizen.

If the performer is a resident of Russia (that is, is on the territory of the Russian Federation for 183 days or more during the year), then the personal income tax rate will be 13%. If he is a non-resident, then 30%. Insurance premium rates, as far as I know, are the same as for Russian citizens.

04/24/2021 at 11:29

Irina (KadrofID: 126474)

Tell me, is the existence of a Civil Legal Agreement (CLA) without receiving income for a certain period of time equivalent to conducting business during this period? After all, in fact, since there is no income, then there is actually no activity! Having left my main job, the GPC agreement for joint activities (application of loans from the bank) remained unclosed. I closed it 2 weeks later. The employment center considered this to be my last place of work and prescribed a minimum allowance, although I provided all the income certificates from my main place of work. Is it possible to challenge the decision of the central office?

04/28/2021 at 11:43

Sergey Antropov (KadrofID: 5)

Good afternoon, Irina! Lawyers can give an exact answer to this question. I can assume that the actions of the Central Bank in this case are legal, since the presence of a GPC agreement means that the person works somewhere.

05/01/2021 at 16:10

Alex (KadrofID: 129916)

Hello. The spouse is temporarily unemployed, which is why her parents lose the right to a subsidy for housing and communal services. If a wife gets a temporary job under a civil contract, can the employer issue her a certificate of income and are such incomes taken into account in the average income of family members for six months to calculate the subsidy? Thank you!

07/22/2021 at 13:31

Sergey Antropov (KadrofID: 5)

Hello Alex! From the information that I was able to find, it follows that income from GPC agreements is taken into account when calculating subsidies.

07.27.2021 at 23:17

Meerim (KadrofID: 130258)

Hello! I am not a citizen of Russia and worked under a civil contract and now I am in a position. I wanted to register at the hospital. Is it possible to get a medical pole through GPC?

07/30/2021 at 17:47

Sergey Antropov (KadrofID: 5)

Hello, Meerim! As far as I know, foreign citizens have the right to receive a compulsory medical insurance policy. I recommend that you contact insurance companies. They will tell you exactly what documents are needed to obtain the policy.

08/08/2021 at 12:23

[email protected] (KadrofID: 131830)

Good afternoon, can you tell me that I have an individual entrepreneur, but the employer wants to conclude a GPC agreement with me as an individual and not with an individual entrepreneur, is it possible to do this?

09/07/2021 at 05:23

Sergey Antropov (KadrofID: 5)

Hello! Yes, you can. In this case, you work as an individual. the person and taxes on payments will be paid for you by the customer. He will not be your employer, because... The GPC agreement is not an employment agreement. He will be the customer.

09.12.2021 at 23:06

Natalia (KadrofID: 134435)

I am officially employed, and I have a contract agreement (educational services) with another organization. Every month I read up to 50 hours in varying amounts. Yesterday they said that with this part-time job you can only work for 18 hours. Tell me, are there any restrictions?

07.11.2021 at 14:23

Sergey Antropov (KadrofID: 5)

Natalya, the length of the working day when working part-time is regulated by Art. 284 Labor Code of the Russian Federation. According to this article, you can work part-time for up to 4 hours a day. In this case, the total number of hours per month should not exceed half of the standard working time established for the employee at his main place. Usually this is 160 hours, i.e. You can work part-time for up to 80 hours. But there are categories of workers whose norm is less.

It is also better to check with personnel officers whether work under a GPC agreement is a part-time job. Because The Labor Code of the Russian Federation regulates only employment contracts. GPC is not one of them.

11/14/2021 at 2:17 pm

Olga (KadrofID: 135685)

Good afternoon. Is it possible to work as a salesperson in a grocery store? Is there a risk for the employer?

12/03/2021 at 14:13

Sergey Antropov (KadrofID: 5)

Hello Olga! I doubt that the seller can work under a GPC agreement. For the employer, there is a risk of reclassification of such a contract into an employment contract with additional assessment of the corresponding contributions:

12/11/2021 at 22:47

IGOR (KadrofID: 136296)

I work under the GPC and perform the duties of a janitor for the period of his suspension from work. services are provided temporarily. the start date for services is indicated, the cost of services per month is stated - constant, the organization is a budgetary one, they said the amount is constant, they will soon increase the minimum wage, can I legally demand an increase in payment for my services. And what are my risks when a former employee leaves.

12/17/2021 at 18:07

Sergey Antropov (KadrofID: 5)

Hello, Igor! The GPC agreement is not an employment agreement, therefore the increase in the minimum wage does not apply to it. The customer pays the amount specified in the contract. When a former employee returns to work, they may not renew the GPC, that is, they may refuse your services.

12/24/2021 at 21:53

Ekaterina (KadrofID: 138673)

The main criteria for recognizing a relationship as an employment relationship: The GPC agreement specifies the labor function, and not specific work and results. For example, it is stated that the performer writes texts in general, but specific texts must be specified (for example, a copywriter undertakes to prepare a text about the company and descriptions for 50 product cards).

The contractor receives the same payment every month. This looks strange because... under a GPC agreement, the scope of work usually varies and cannot be the same every month.

The performer systematically performs the same work. The range of his tasks does not change.

The contractor works on the customer’s premises and has an equipped workplace there.

QUESTION: If an organization requires a specialist who is hired for a year to perform the same set of works every month and, accordingly, with the same monthly payment, so that this GPC agreement is not recognized as an employment contract, would it be legal to write in it, for example, the total amount for the entire period, but with the acceptance of the result of the services provided in stages with monthly delivery and the preparation of intermediate Acceptance Certificates for the services provided or for the part of the service provided. Or will this wording already be the basis for recognizing such a GPC agreement as a labor agreement? Thank you.

02/09/2022 at 18:32

Sergey Antropov (KadrofID: 5)

Hello, Ekaterina! It is best to show the contract to lawyers, since there are many nuances in this issue. In my opinion, it is possible to specify in the contract a list of services that the contractor will provide, and a tariff (payment amount) per unit of service provided. For example, the cost of 1 banner for a website or something else (what a person will do). The acts indicate the volume of services provided per month and the corresponding cost.

02/12/2022 at 00:07

Anna (KadrofID: 139606)

Good afternoon I am officially employed by a state budgetary institution (I am not a state civil servant). At the moment I am on remote work for several months (I signed the papers). Can I enter into a GPC agreement with another organization (for example, for 2-3 months) Should I notify the employer at the place where I am employed according to the Labor Code of the Russian Federation? If the GPC agreement does not indicate the number of hours, but only the amount for completing the delivery of one order - and/or the average number of orders: how is the number of hours worked calculated, because part-time work has a limitation on the time worked!?

02/27/2022 at 00:22