VAT on balance

VAT in the balance sheet is displayed in 3 lines:

- 1220 “VAT on acquired values”;

- 1230 “Accounts receivable”;

- 1520 “Accounts payable”.

Lines 1220 and 1230 are in the “current assets” section, since these are current assets with increased liquidity - their turnover occurs during the year or during the normal operating cycle for the organization. Based on the same reasoning (calculations occur during the year), line 1520 is located in the “Short-term liabilities” section of the balance sheet liability.

There are certain features of reflecting tax for each of these lines.

ConsultantPlus experts explained how to correctly reflect VAT in accounting. Get trial access to the system and upgrade to the Ready Solution for free.

Balance sheet structure

The assets and rights belonging to the organization are presented in a grouped form on the balance sheet.

In the liability, we see the sources through which this property and rights were acquired. Schematically, assets and liabilities can be represented as follows:

For enterprises using conventional accounting and reporting methods, the balance sheet (balance sheet assets and liabilities) (table) looks like this:

For enterprises using simplified accounting and reporting methods, the balance sheet looks different:

Input VAT

Line 1220 “VAT on purchased assets”

Line 1220 reflects the amount of tax that the company will be able to deduct in the future. The remaining value (debit balance) for account 19 is transferred to this balance line.

To exercise the right to deduction, a number of conditions must be simultaneously met:

- the acquired assets are intended for the type of activity that is subject to VAT;

- the cost of acquired assets is reflected in accounting;

- there is a correctly issued invoice from the supplier.

You can see how to fill out line 1220 using an example in the Guide from ConsultantPlus. Trial access to the K+ system is provided free of charge.

For many organizations, account 19 is reset to zero at the end of the year, and in this case a dash is added to line 1220 of the balance sheet. The balance on account 19 may arise in such cases (all of them follow from the text of Articles 171 and 172 of the Tax Code of the Russian Federation):

- when exporting raw materials (the delay in accepting VAT for deduction is due to the fact that it is necessary to go through the procedure of confirming the fact of export);

- if the acquired assets are used by a company with a long production cycle (VAT is deductible only after the finished product is shipped to the buyer);

- if the supplier did not provide an invoice or the invoice was issued with significant violations;

- when the taxpayer decides to deduct it at a later period (before the expiration of 3 years from the date of registration of the acquired property).

NOTE! For organizations with large balances on account 19, it is better to detail the value of line 1220. This right is provided for in clause 6 of PBU 4/99 “Accounting statements of an organization” (approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n). This can be done by adding lines 12201, 12202, etc. Detailing is possible in the context of operations (purchase) by fixed assets, inventories, intangible assets and others.

Standardized expenses

A debit balance on account 19 can also be formed when paying expenses, which are normalized when calculating income tax. Thus, there are expenses that cannot be fully taken into account in the tax base when calculating income tax.

Read about what expenses are regulated and what the limits for rationing are in the material “Standards provided for by the Tax Code of the Russian Federation” .

Hand in hand, taking into account standardized expenses, comes the problem of deducting value added tax. That is, if these expenses are normalized, then the right to deduct VAT on them is also curtailed.

In this case, usually the final value of the indicator for calculating the standard becomes known only at the end of the year, and the expenses themselves can be collected throughout the year, and the accountant has the obligation to quarterly adjust the VAT amount as the base from which the standard is determined increases.

At the end of the year, some amounts of undeductible VAT may accumulate. Their last day of the year should be written off as other expenses, since tax amounts exceeding the amount corresponding to the calculated value of the standard will no longer be accepted for deduction.

Common VAT entries for purchased assets

VAT on purchased assets is reflected in the balance sheet using special entries. Frequent are Dt 19 Kt 60 - this is how the input fee for acquired fixed assets, intangible assets, etc. is reflected.

If the lines on the balance sheet indicate the entry Dt 20 Kt 19, this means writing off tax on assets and services used in transactions that are not subject to tax. Posting Dt 91 Kt 19 means writing off the fee for other expenses if there is no invoice or the document was filled out incorrectly.

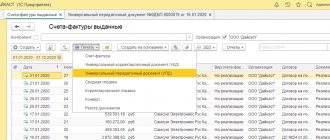

Score 46

The invoice reflects the completed stages of work in progress. It is designed to display information about completed stages of work. It is used by companies that perform long-term work, with the beginning and end of the work occurring in different reporting periods.

Score 19

The invoice reflects VAT on purchased assets. It is needed to summarize information about the collection amounts contributed by the company for valuables, works, and services. The account includes sub-accounts 19-1, 19-2, 19-3.

Advances listed

Line 1230 “Accounts receivable”

This line reflects the full amounts of buyer (debtor) debts remaining at the end of the year, including VAT. Here we summarize the data corresponding to the balances (debit) of accounts 60, 62, 76, as well as the total values for the debit of the “Settlements with ...” accounts: 68, 69, 70, 71, 73 and 75, reduced by the balance (credit) of the account 63.

Starting from 2011, organizations are required to form a reserve for doubtful debts (account 63, the balance of which is subtracted from the value accumulated in line 1230 of the balance sheet). This includes those debts of debtors for which they no longer hope to receive payment.

The organization independently determines such debts by assessing the likelihood of full or partial non-repayment (letter of the Ministry of Finance of Russia dated January 27, 2012 No. 07-02-18/01).

According to the explanations of the Ministry of Finance of Russia, when the buyer transfers an advance to the supplier, receivables are reflected in the balance sheet minus VAT, subject to deduction or accepted for deduction (attachment to the letter of the Ministry of Finance of Russia dated 01/09/2013 No. 07-02-18/01).

This means that in line 1230, in addition to existing accounts receivable with VAT, the amount of advances transferred to suppliers against a future transaction (shipment of goods, provision of work (services), transfer of property rights) is reflected minus VAT.

For a sample of filling out the balance sheet for 2022, see here.

Accounting accounts to display VAT on purchases

VAT is a complex tax and an accountant needs to be very careful when working with it. If a company operates on a common system, then it buys mainly from counterparties that work with VAT. Therefore, the tax on all company purchases in the total amount is the amount of the “input” tax, which usually reduces the amount of VAT transferred to the budget.

Take our proprietary course on choosing stocks on the stock market → training course

It doesn’t matter at all what is purchased for the organization’s activities - stationery or expensive equipment, or maybe a service. If the purchase and sale transaction is completed in accordance with all the rules and you have a full set of original documents, including accounting documents, then VAT can be safely taken into account. The accumulation of tax amounts on purchases is shown in account 19 .

The entire amount of value added tax that comes to the organization along with the purchase of goods, services or other valuables must be very clearly reflected in the accounting accounts. There are three main entries that relate to the “input” tax.

| Contents of operation | Wiring | Explanation |

| The amount of tax billed by the seller | D19 K60 | When purchasing a product, service, or value, the buyer pays VAT along with the cost. Its amount is taken into account in account 19 |

| Tax accepted for deduction | D68 K19 | Tax that is subject to deduction from the budget is reflected in credit 19 of account |

| Write-off of VAT amount | D91 K19 | In the event that you have to write off the tax amount, the amount falls to 91 accounts |

Every accountant makes such entries when accounting for VAT on purchases.

It must be remembered that goods can be purchased for their further sale, property related to fixed assets, materials, intangible assets, as well as services. If you have an invoice, VAT from such transactions will be “input” and will ultimately reduce the accrued tax at the end of the quarter.

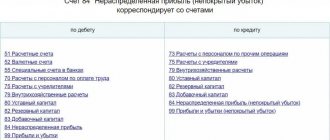

Advances received

Line 1520 “Debt to creditors”

The line “Debt to creditors” (balance sheet liability) summarizes the balances (credit) on the following accounts: 60, 62, 68, 69, 70, 71, 73, 75 and 76, including VAT. These are all the debts of the enterprise that it is obliged to repay within a year, or during the production cycle if it exceeds a calendar year.

IMPORTANT! The amounts of debts to the budget must be verified with the fiscal authorities. It is strictly prohibited to arbitrarily calculate unsettled debts to the budget (clause 74 of the PBU on accounting and accounting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

When forming line 1520 of the balance sheet, you should take into account a certain nuance with the reflection of advances received. Here there is a situation similar to that of the advances listed. The Russian Ministry of Finance also recommends that advances received be reflected in the balance sheet minus VAT (attachment to the letter of the Russian Ministry of Finance dated January 9, 2013 No. 07-02-18/01).

So on line 1520 you should include:

- accounts payable including VAT,

- advances received minus VAT.

You can see how to fill out line 1520 using an example in the Guide from ConsultantPlus. Trial access to the K+ system is provided free of charge.

Read about the nuances of working with advances received in the material “What is the general procedure for accounting for VAT on advances received .

How to transfer a deduction to another period

You can transfer a deduction on an invoice:

- the full amount;

- part of the amount.

If a large deduction, which “pulls” the calculations on the declaration towards reimbursement from the budget, needs to be postponed completely, an invoice from the supplier is entered into the purchase book of the quarter in which the amount should be paid. It will be reflected in the NU registers of the corresponding period and in the tax return for it.

If the company intends to carry out the transfer in parts, to divide it by periods, the invoice must be registered in the purchase book, declarations for all these periods, but not the full amount, but the part that should be included in the declaration. The total tax amount must match the invoice amount.

All tax settlements must be completed before the 3-year deadline. For example, if an invoice was issued on March 28, 2018, then the period expires on March 28, 2022. This means that the last amount on the document (full or partial) can be deducted no later than the 1st quarter of 2022.

However, there is a legal trap for taxpayers here. Literal interpretation of Art. 172-1.1 of the Tax Code allows the fiscal authorities to question the deduction presented in the last quarter. After all, the declaration for the period is submitted after its completion, before the 25th of the next month, “falling out” of the three-year period under the Tax Code of the Russian Federation. To date, judicial practice on this issue is not in favor of the taxpayer (opinion BC 308-KG18-12631 in case No. A32-32030/2017 dated 04/09/18). In order not to be refused, it is better to carry out the transfer without waiting for the deadlines specified in the law.

At the same time, there is a letter from the Ministry of Finance No. 03-07-11/27161 dated 05/12/15, which asserts the taxpayer’s right to deduct VAT no later than the tax period in which the 3-year period expires.

Results

VAT is reflected in the balance sheet as follows:

- in the asset - in two lines (1220 and 1230),

- in the passive - in one line (1520).

The Russian Ministry of Finance advises including in lines 1230 and 1520 receivables and payables for advances minus VAT. Note that the taxpayer has the right to act differently and not deduct the amount of tax from the debt. However, in this case you need to be prepared to argue your position.

Sources:

- Tax Code of the Russian Federation

- PBU 4/99, approved. by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 N 43n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Other current assets

Other current assets include:

- the cost of missing or damaged material assets, in respect of which a decision has not been made to write them off as production costs (sales costs) or to the guilty parties;

- VAT amounts calculated on advances and prepayments (partial payments);

- amounts of excise taxes subject to subsequent deductions;

- amounts of overpaid (collected) taxes and fees, penalties and fines, contributions for compulsory insurance, for which no decision has been made on offset (refund from the budget);

- amounts of VAT accrued upon shipment of goods (products, other valuables), the proceeds from the sale of which cannot be recognized in accounting for a certain time;

- own shares (shares) purchased from shareholders (participants) for the purpose of resale.