Registering a computer (laptop) has its own characteristics. This consultation addresses the issue of how to capitalize (register) a computer.

Also see:

- Furniture in organizational accounting

- Is the computer the main tool

Computer accounting options

There are two options for computer accounting:

- Reflection as a single object.

- Reflection by components.

A more detailed answer to the question of whether a computer can be considered a primary tool can be found in our article at the link above.

On practice:

- if the computer was purchased assembled and in the receipt documents it is indicated by one name , such an object is registered according to the first option;

- if in the sales documents the computer is indicated in separate positions (for example, monitor, mouse, block) and its components have different useful lives, in this case the second option is used.

Let's take a closer look at these PC accounting options.

Computer depreciation and upgrading

Based on the results of modernization, the useful life of the computer can be increased. However, this can only be done within the 2nd depreciation group to which the PC belongs. SPI for it is from 2 to 3 years (Article 258 of the Tax Code of the Russian Federation, clause 1). The company is not obliged to increase SPI, but has the right to do so.

On a note! Restrictions on the period of use apply only to tax accounting. The BU does not provide for such restrictions. However, it is advisable in both cases to establish the same depreciation rules in order to simplify accounting.

Modernization costs are included in the calculation of depreciation charges. “New” depreciation is accrued from the month in which the modernization was completed.

Depreciation is reflected by posting Dt 26 (44) Kt 02.

Linear method

Let a company have a computer that is depreciated at the calculated rate. After a certain period of operation of the PC, it was decided to depreciate, but not increase the SPI. In this case:

- the cost of the PC will increase by the amount of modernization;

- the depreciation rate as a percentage will remain the same;

- before the modernization, a certain amount of depreciation will already be accumulated;

- after modernization, the calculation will be based on the new cost and the established norm;

- depreciation continues to accrue until the expiration of the fixed income investment period;

- the difference between the total amount accrued during the SPI amount of depreciation and the cost of the upgraded PC is written off as the balance of depreciation, using standard transactions.

Nonlinear method

The depreciation rate is determined by the formula from Article 259 of the Tax Code of the Russian Federation. The residual value of the PC is multiplied by the depreciation rate. The residual value calculated after modernization will increase by the amount of modernization. From the moment the modernization is completed, the new residual value is taken as the basis for calculations. If the SPI is decided not to increase, then the norm will remain the same.

This calculation will be valid until the residual value is equal to 20% of the original and is not fixed as the basis for calculations. Then the amount of depreciation for the month is calculated by dividing the base amount by the remaining SPI.

The computer is completely depreciated

In such cases, the original cost already written off through depreciation is added to the costs of modernization. Before the initially established SPI, another period is “added” within the depreciation group PC (Article 258-1 of the Tax Code of the Russian Federation). Based on the total, newly calculated useful life, the depreciation rate is calculated.

Reflection of a PC in accounting as a single object

Let's look at an example of how to capitalize a computer worth more than 40,000 rubles.

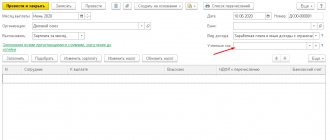

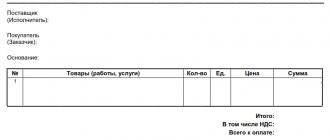

Sistema LLC purchased a computer for an accountant:

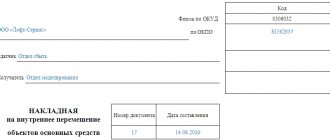

By order of the General Director, the useful life of the computer is set at 3 years. All parts arrived on one delivery note and were assembled on site by the seller's representative.

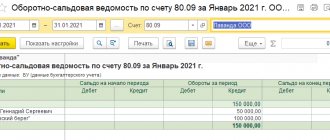

This computer was registered on the basis of the OS-1 act:

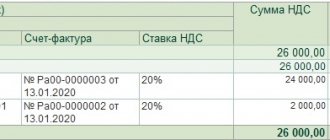

- Debit 08 Credit 60 – 50,750.00 rubles – for the purchase amount excluding VAT;

- Debit 19 Credit 60 – 10,150.00 rubles – VAT allocated;

- Debit 01 Credit 08 – 50,750.00 rubles – the computer is put into operation.

How to take into account low valuations before applying the new FSBU for OS

Thus, on the one hand, on January 1, 2022, you can take into account low-value fixed assets and special clothing (special equipment) with a service life of more than 12 months as part of the fixed assets and charge depreciation on them (clause 3 of FSBU 5/2019). This needs to be stated in the accounting policy.

On the other hand, all accounting regulations in force in 2022 allow such assets to be immediately taken into account in expenses (when organizing their off-balance sheet accounting) (clause 5 of PBU 6/01, PBU 1/2008, clause 5 of FSBU 6/2020).

Therefore, the Ministry of Finance issued a very useful letter, which allows us to overcome the inconsistency with the low price that arose in 2022.

Officials allowed assets with a useful life of more than 12 months and a value within the limit established by the organization (but not more than 40,000 rubles) to be reflected in accounting as part of the inventory in the same way as before, before FSB 5/2019 came into force.

This conclusion was made by the Ministry of Finance in letter No. 07-01-09/14384 based on paragraph 4 of clause 4 of PBU 6/01.

Organizations that have been applying FAS 6/2020 since 2022 cannot take advantage of this recommendation from the Ministry of Finance, officials indicated. There are two accounting options for them:

- account for such assets as part of fixed assets;

- the costs of acquiring such assets are recognized as expenses for the period in which they are incurred (clause 5 of FAS 6/2020).

Reflection of PC in accounting by component parts

A computer can also be registered in its component parts if:

- components have different useful lives;

- it is possible to use them in parts.

For example, when the mouse is used when working with a desktop PC and on a business trip on a laptop. Or several monitors will be connected to one computer, etc.

Let's look at how to capitalize a computer if it was purchased for spare parts.

In the conditions of the previous example, we will add information that the components were purchased at different times and from different sellers. The company plans to use the monitor, camera and keyboard to connect to stationary system units and, if necessary, move them to a duty station.

Based on this, the commissioning order establishes different useful life periods for the parts.

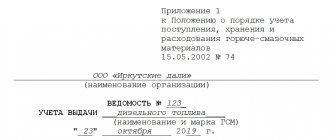

Therefore, the system unit itself is registered as an OS. And the posting of computer parts worth less than 40,000.00 rubles is carried out through account 10:

- Debit 10 Credit 60 – 15,000.00 rubles – monitor registered;

- Debit 10 Credit 60 – 1,000.00 rubles – the keyboard is registered;

- Debit 10 Credit 60 – 700.00 rubles – the mouse is registered;

- Debit 10 Credit 60 – 1,200.00 rubles – the video camera is registered.

When put into operation, from account 10 you can write off the entire cost of objects as expenses, without charging depreciation.

Computer in whole and in parts: we come to accounting

Question: An organization purchases personal computers. In the invoice they are indicated in one line (PC). In addition, individual components are purchased: mice, keyboards, monitors, system units. Some of them go towards repairing and upgrading existing computers, and some go towards assembling new ones. How will incoming computers and components arrive in this case?

Answer: Complete computers are registered as fixed assets (OS). When purchasing all the components to assemble a new computer, their cost also forms the cost of the OS (computer). Components purchased for repairs or simultaneously for different purposes are included as materials.

Rationale: Personal computers acquired by an organization for use in its own activities for longer than 12 months are OS (in this case, all conditions for recognition of OS assets are met). Moreover, a computer may include one or more monitors, one or more system units, a mouse, keyboard, mat and other components <*>.

This means that purchased assembled PCs , originally intended for long-term use, are credited to account 08 “Investments in long-term assets”. Then transfers their value to account 01 “Fixed assets”, while drawing up an act of acceptance and transfer of fixed assets. Please note that from October 1, 2022, you can draw up one act for several computers, but only if they have the same cost and characteristics <*>.

When purchasing computer components separately, the procedure for accepting them for accounting may have variations.

So, if an organization initially purchases components for assembling a new computer immediately after purchase, it reflects the cost of components on account 08 as expenses for the purchase of the OS. And then the generated initial cost of the computer is transferred from account 08 to account 01, while drawing up an act of acceptance and transfer of fixed assets <*>.

When components are purchased simultaneously for different purposes (both for repair and for assembling new computers) or different parts are purchased in different batches and (or) in different quantities, their cost is reflected in account 10 “Materials”. And from this account it is transferred according to the directions of spending <*>:

- when on leave for repairs - shown on expense accounts (D-t 23, 25, 26, 29, 44 - K-t 10);

- when used to modernize existing computers - is included in the costs of modernization (D-t 08 - K-t 10). Upon completion of the modernization, all costs for its implementation are written off to account 01, i.e. increase the cost of the computer;

- in the case of assembling a computer from various components available in stock - forms the cost of the computer (D-t 08 - K-t 10). On the date of assembly, an act of acceptance and transfer of fixed assets is drawn up and the generated value of the computer is reflected in the corresponding entry (D-t 01 - K-t 08).

Classification of work: repair or modernization

Replacement of components in a computer can occur during its repair or modernization.

Since repair and modernization operations are reflected differently in accounting and taxation, it is important to classify them correctly. This can be done based on the purpose of repair and modernization. The main purpose of repair work is to eliminate faults that make it impossible to operate the main asset. Unlike repairs, modernization is carried out in order to improve the characteristics and change the purpose of the fixed asset (paragraph 2, paragraph 2, article 257 of the Tax Code of the Russian Federation). Therefore, replacing a failed computer element is considered a repair. If the replacement is associated not with the physical wear and tear of components, but with moral wear and tear, this is modernization. For example, if instead of outdated components, more modern ones with better characteristics were installed. A similar point of view is reflected in letters of the Ministry of Finance of Russia dated November 6, 2009 No. 03-03-06/4/95, dated May 27, 2005 No. 03-03-01-04/4/67 and dated December 1, 2004. No. 03-03-01-04/1/166.

Situation: can the replacement of failed components in a computer with more modern ones with better characteristics be considered as repairs?

Yes, you can, provided that after replacing the components, the functionality of the computer has not changed.

One of the main conditions for classifying the replacement of components as repair is a computer malfunction. However, if the computer's performance has improved, then replacing components can be considered an upgrade. In this case, when distinguishing between modernization and repair, it is necessary to determine whether the improvement in characteristics has led to a change in the functional purpose of the computer. For example, before replacing components, which led to improved performance, the computer was used as a workstation, and after replacement, it was used as a server to maintain normal network operation. In this case, the replacement of components during a tax audit can be recognized as modernization (paragraph 2, paragraph 2, article 257 of the Tax Code of the Russian Federation). If the functionality of the computer has not changed, then the replacement of components is considered a repair. A similar point of view is reflected in letters of the Ministry of Finance of Russia dated October 9, 2006 No. 03-03-04/4/156 and dated May 27, 2005 No. 03-03-01-04/4/67.

Arbitration courts share this position. In their opinion, replacing faulty parts of a fixed asset with more powerful (advanced) ones is not modernization. If, as a result of such a replacement, the technological or production purpose of the facility has not changed, then, despite the improvement in its operational characteristics, the costs of replacing faulty components (assemblies) should be qualified as the cost of repairing a fixed asset (see, for example, resolutions of the Federal Antimonopoly Service of the Moscow District dated 23 July 2008 No. KA-A40/6654-08, dated August 14, 2006 No. KA-A40/7489-06, Ural District dated June 17, 2008 No. F09-4293/08-S3, dated June 7, 2006 No. Ф09-4680/06-С7, North-Western District dated August 21, 2007 No. A56-20587/2006).

Account for the computer correctly

Alina DOMKINA

The company bought a computer. The accountant was faced with the question: how to account for it correctly? For example, a separate monitor, system unit, keyboard and other parts. Or in general, as a complex. The company's accountant will have to choose.

What PBU says

The accounting regulation “Accounting for fixed assets” PBU 6/01 (approved by Order of the Ministry of Finance dated March 30, 2001 No. 26n) lists the signs by which one can determine whether an asset belongs to fixed assets or not. Property can be considered a fixed asset if:

- the company plans to use it in its activities;

- the company plans to use the property for more than twelve months;

- the company does not intend to subsequently resell the property;

- property can generate income for the company.

The computer purchased by the company theoretically fits the criteria of a fixed asset according to PBU 6/01.

The accounting unit for fixed assets is an inventory item. Moreover, the inventory object that the company’s accountant takes into account can be either “an object with all the fixtures and accessories, a separate structurally isolated object intended to perform certain independent functions, or a separate complex of structurally articulated objects representing a single whole and intended to perform a certain work" (clause 6 of PBU 6/01). Further, PBU defines the concept of “a complex of structurally articulated objects” - this is one or several objects of one or different purposes, having common devices and accessories, common control, mounted on the same foundation, as a result of which each object included in the complex can perform its functions only in as part of the complex, and not independently.

Accounting

In order for a company to use a computer, it needs not only a system unit, but also a monitor, keyboard and mouse. All of them are connected to the system unit. And most importantly: indeed, you cannot use the processor, monitor, keyboard and mouse separately. Same as the printer. Therefore, most likely, a computer and its accessories can be considered as “a complex of structurally articulated objects.” Accordingly, the computer must be accounted for as one inventory item.

True, there is one “but”. The same PBU 6/01 states that if an inventory object consists of several parts, and these parts, in turn, have a significant difference in their useful life, each part of the object must be taken into account separately. The accountant is given the right to independently determine the useful life of an object based on the expected period of its use, expected physical wear and tear, regulatory and other restrictions on the use of this object (clause 20 of PBU 6/01).

An accountant can simplify his task and take into account the computer as a complex. As a basis, we can take the Government Decree “On the classification of fixed assets included in depreciation groups” dated January 1, 2002 No. 1. For example, computers and printing devices for them are included in the third group with a useful life of three to five years.

Please note that the Decree states that this classification “may be used for accounting purposes” (clause 1 of the Decree). That is, a company can be guided by the classifier for accounting, but is not obliged to. It is still necessary to establish the useful life of an object based on the criteria of paragraph 20 of PBU 6/01.

And one more important point. If the accountant has established different useful lives for the components of the computer and the price of an individual object (for example, a mouse or keyboard) is no more than 20,000 rubles, it can be included in inventories (clause 5 of PBU 6/01). And for those objects that the accountant classifies as fixed assets, the company is obliged to charge corporate property tax (clause 1 of Article 374 of the Tax Code).

Court practice does not provide an answer

There is court practice that has taken the side of the taxpayer. For example, the resolution of the Federal Arbitration Court of the Volga District dated July 23, 2004 No. A65-21021/2003-SA2-11. In it, the court considered this: if objects have different useful lives, then they can be taken into account separately. True, the practice of courts is based on the “old” edition of PBU 6/01. In the new edition, “different” useful lives are not enough.

To count the components of a computer as different objects, their useful lives must be “materially” different. True, PBU 6/01 does not provide the concept of a “significant” difference in useful life. It would be possible to use the already mentioned classifier, but, unfortunately, it does not separate the monitor, printer, keyboard and mouse into separate shock-absorbing groups. On the contrary, they are included in one group. So, the use of this classifier will not lead to the division of objects into parts. The company can independently determine what useful life is “significant”. And reflect it in the accounting policies.

Let’s say the useful life of a monitor is five years, and that of a system unit is one year. After a year, the system unit will no longer be used, and therefore the monitor will be connected to another system unit. Accordingly, the complex in the form in which it existed at the beginning will no longer exist, since the system unit will have to be excluded from it.

Do not confuse with tax accounting

In tax accounting there is a different definition of a fixed asset. This is property that a company uses as means of labor to produce and sell goods, perform work, provide services, or to manage an organization (Clause 1 of Article 257 of the Tax Code). The company charges depreciation on fixed assets based on depreciation groups (clause 1 of Article 258 of the Tax Code). Moreover, the classification of fixed assets included in depreciation groups must be approved by Government Resolution (clause 4 of Article 258 of the Tax Code).

That is, the Resolution “On the classification of fixed assets included in depreciation groups” dated January 1, 2002 No. 1, which was already mentioned above, was approved specifically for tax accounting. And, as we have already said, according to this classification, computers are included in the third group No. 4 3020000 “Electronic computing equipment” with a useful life of three to five years.

The Tax Service, in a letter dated August 5, 2004 No. 02-5-11/ [email protected] “On the procedure for calculating depreciation on fixed assets”, considers that “all devices and accessories of the standard configuration of a personal computer (monitor, system unit, keyboard , mouse), which are a complex of structurally articulated objects and capable of performing their functions only as part of the complex, are counted as a separate inventory object.” Therefore, in tax accounting, it is better for companies not to divide the computer into its component parts.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up