Types of coupons

Coupons for fuel and lubricants can be:

- cash (issued for a certain limit on the cost of fuel and lubricants);

- liter (issued for a certain limit on the volume of fuel and lubricants).

To purchase fuel and lubricants using coupons, you need to enter into an agreement with the supplier. The supplier provides fuel and lubricants through a specific network of gas stations. The list of gas stations that dispense fuel and lubricants using coupons from a particular supplier is usually given in the contract (an appendix to it) with addresses indicated.

Attention: coupons for fuel and lubricants have a limited validity period (for example, a month or a quarter). If the agreement with the supplier does not provide for a refund for coupons not used on time, then untimely receipt of fuel and lubricants may result in financial losses for the organization.

Features of working with fuel cards

The procedure for obtaining and using fuel plastic cards is established by the fuel supplier. The conditions should be specified in the fuel supply contract. There are several options:

- The card is transferred to the ownership of the organization. The costs of purchase, maintenance and re-production are borne entirely by the buyer of fuels and lubricants (organization).

- The card is the property of the supplier. The purchasing organization receives the TC for temporary use. In this case, the technical documentation is returned to the supplier at the end of the contract.

- Another option. For example, a company purchases a one-time card, which is not replenished, but is canceled after the balance (money or liters) is completely used up. But this method is used extremely rarely and is not profitable for the buyer, since fuel prices with this calculation option are inflated.

For the organization of a TC - a strict reporting form that is subject to special accounting. The organization is obliged to prescribe the procedure for accounting for gasoline using fuel cards in the accounting department in its accounting policies.

Purchase of fuels and lubricants

Typically, the scheme for purchasing fuel and lubricants using coupons looks like this.

- The organization enters into a purchase and sale agreement with a fuel and lubricants supplier.

- The fuel and lubricants supplier issues an invoice to the organization for payment of coupons.

- The organization pays the bill and issues a power of attorney to its representative to receive coupons.

- A representative of the organization receives coupons and hands them over to the employee responsible for recording coupons and issuing them to drivers. Typically, on the day the coupons are issued, the supplier issues a consignment note (transfer and acceptance certificate) and an invoice for fuel and lubricants.

- The driver who has received the coupons presents them at the gas station and refuels the car. The volume of fuel supplied must correspond to the nominal value of the coupon. The driver is given a tear-off coupon for a redeemed ticket with a gas station stamp.

Situation: is it possible to capitalize fuels and lubricants purchased with coupons on the basis of tear-off coupons attached to the coupons?

Answer: yes, it is possible, provided that the amount of fuel received corresponds to the value of the coupon.

If less fuel is dispensed according to the coupon, its actual amount can only be confirmed by a cash receipt issued by the gas station.

Purchased fuel and lubricants can be capitalized on the basis of primary documents that contain the mandatory details specified in paragraph 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. If the tear-off coupon for the coupon meets these requirements, then it can be accepted for accounting as a primary document. However, this should only be done if the driver has filled the tank with the same amount of fuel as indicated on the ticket. If less fuel is dispensed according to the coupon, its actual quantity can only be confirmed by a cash receipt issued by the gas station (letter from the Ministry of Finance of Russia dated April 3, 2007 No. 03-03-06/1/209 and the Federal Tax Service of Russia for Moscow dated June 26, 2006 No. 20-12/56636). Moreover, when dispensing fuel and lubricants using coupons, gas stations have the right to issue cash receipts, which record only the volume of fuel without indicating the price and total cost (see, for example, letters from the Federal Tax Service of Russia for the Moscow Region dated August 4, 2005 No. 22-19/0156, UMNS Russia in Moscow dated April 30, 2004 No. 29-12/29514).

Advice: if the coupons are about to expire and the car’s gas tanks are fully filled, drain the gasoline into empty fireproof containers. For example, in metal cans. By choosing fully paid for fuel, the organization will avoid financial losses.

In practice, it is better to avoid situations in which the organization receives fuel in quantities less than the nominal value of the coupon. The fact is that, regardless of the actual volume of fuel supplied, the gas station coupon presented will pay off in full. In this case, the unselected amount of gasoline cannot be reflected either in accounting or tax accounting.

Accounting

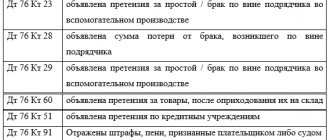

The accounting procedure for coupons for fuel and lubricants depends on the terms of the contract with the supplier, as well as on the type of coupons. Fuel (coupons for fuel and lubricants) should be taken into account at the actual cost (excluding VAT) (clauses 5, 6 of PBU 5/01). The VAT allocated in the invoice should be taken into account separately on account 19 “VAT on purchased values”.

If the contract does not indicate the moment of transfer of ownership of fuel and lubricants, come to them at the time of receipt of coupons. This follows from the provisions of Articles 223 and 458 of the Civil Code of the Russian Federation.

On the date of receipt of coupons, make the following entry:

Debit 10 subaccount “Coupons for fuel and lubricants received” Credit 60

– gasoline coupons have been capitalized (based on the invoice (transfer and acceptance certificate)).

After the coupons are issued to the drivers, make the following entries in the accounting:

Debit 10 sub-account “Coupons for fuel and lubricants issued” Credit 10 sub-account “Coupons for fuel and lubricants received”

– coupons for fuel and lubricants were issued to drivers (based on the book of registration of the movement of coupons).

The amount of gasoline actually received at the gas station is reflected by wiring:

Debit 10 subaccount “Fuels and lubricants in gas tanks of cars” Credit 10 subaccount “Coupons for fuels and lubricants issued”

– gasoline filled into the tank of the car is credited (based on the tear-off coupon for the coupon and the gas station receipt).

If the contract states that ownership of fuel and lubricants passes to the organization at the time the car is refueled, then the accounting procedure depends on the type of coupons.

Take liter coupons into account in the balance on account 006 “Strict reporting forms”. Changes in prices that may occur after payment of coupons will not in any way affect the assessment of fuel and lubricants in accounting: they will be reflected at the purchase price.

When you receive the coupons, make the following entry in your accounting:

Debit 006 subaccount “Coupons for fuel and lubricants”

– gasoline coupons have been capitalized (based on the invoice (transfer and acceptance certificate)).

Reflect the issuance of coupons to drivers in accounting as follows:

Credit 006 subaccount “Coupons for fuel and lubricants”

– coupons were issued to the driver (based on the logbook for the receipt and issuance of gasoline coupons).

When registering fuel (refueling a car at a gas station), make the following entries:

Debit 10-3 Credit 60

– the fuel actually received was capitalized (based on gas station receipts, tear-off coupons for coupons).

If you purchased cash coupons, take them into account at the cash register as part of your cash documents. In accounting, reflect the receipt of coupons by posting:

Debit 50-3 Credit 60

– gasoline coupons were received (based on the invoice (acceptance certificate)).

Issue tickets to drivers upon reporting:

Debit 71 Credit 50-3

– coupons were issued to the employee (based on the book of registration of the movement of coupons).

Capitalize fuel received using coupons using the following entries:

Debit 10-3 Credit 71

– fuels and lubricants purchased using coupons are capitalized (based on a gas station receipt, tear-off coupons for coupons).

Issuing fuel cards to employees: how to apply

The issuance of electronic media to employees must be formalized. To do this, the organization itself can develop a document form. You can call it, for example, the act of acceptance of transfer.

Sample transfer and acceptance certificate

The return of electronic media from the responsible employee who will no longer use it is processed in a similar way. Give the same smart card to another employee.

If there is a large number of carriers and responsible employees, it is inconvenient to register issuance and return with a separate document each time - to record the movement of smart cards, you can use the issuance and return log.

The choice of documentation procedure is left to the organization. Its procedure and forms of documents must be fixed in a local regulatory act.

Typically, electronic media have a shelf life. After its completion, smart cards that are no longer usable must be written off off-balance sheet. To document the write-off, a write-off act is drawn up.

Fuel card write-off act: sample

Fuel quantity calculation

Based on the waybill data, calculate the amount of fuel that is written off as expenses. To do this, use the formula:

| Amount of fuel to be written off as expenses (l) | = | Fuel remaining when leaving the car (l) | + | Amount of fuel filled into the vehicle tank (l) | – | Fuel remaining at the end of the day (l) |

Fuel write-off

The cost of fuel, which is written off as expenses, depends on the method of assessing fuel oil (FIFO, at average cost) (clause 16 of PBU 5/01).

When writing off fuel and lubricants in accounting, make the following entry:

Debit 20 (23, 26, 44...) Credit 10-3 (10 subaccount “Coupons in gas tanks of cars”)

– the cost of consumed fuel is written off (based on the waybill).

An example of how fuel and lubricants purchased using coupons are reflected in accounting. Ownership of fuel and lubricants passes to the organization upon receipt of coupons

On June 1, Alpha LLC purchased a cash voucher for gasoline worth 510 rubles. (including VAT - 78 rubles). The supplier issued an invoice and issued an invoice to Alpha.

On June 4, a ticket was issued to the driver of the company car, Yu.I. Kolesov. A corresponding note about this is made in the book for registering the movement of coupons. On the same day, the driver purchased 30 liters of AI-92 gasoline using a coupon at a price of 17 rubles. per liter (including VAT - 2.59 rubles). To evaluate materials in accounting, the organization's accounting policy provides for the average cost method.

According to the organization's accounting policy, waybills are prepared monthly. On June 30, Kolesov submitted his waybill to the accounting department. According to the waybill, all the gasoline received with the coupon (30 liters) was consumed within a month. Actual consumption corresponds to the standards approved by the head of the organization.

The following entries were made in the organization's records.

June 1st:

Debit 60 Credit 51 – 510 rub. – paid for a gas ticket;

Debit 10 subaccount “Coupons received for fuel and lubricants” Credit 60 – 432 rub. (510 rubles – 78 rubles) – a petrol coupon has been capitalized;

Debit 19 Credit 60 – 78 rub. – VAT is reflected on the purchased coupon.

June 4:

Debit 10 sub-account “Coupons for fuel and lubricants issued” Credit 10 sub-account “Coupons for fuel and lubricants received” – 432 rubles. – a ticket was issued to the driver (based on the ticket book);

Debit 10 subaccount “Fuels and lubricants in gas tanks of cars” Credit 10 subaccount “Coupons for fuels and lubricants issued” – 432 rubles. – gasoline filled into the tank of the car is credited (based on the gas station receipt and the tear-off coupon attached to the coupon);

Debit 68 “Calculations for VAT” Credit 19 – 78 rub. – submitted for VAT deduction.

On June 30, Alpha's accountant calculated the average cost of 1 liter of fuel. Based on the calculation, the average cost of 1 liter of gasoline turned out to be equal to its purchase price.

Based on the waybill, the cost of fuel and lubricants was written off as expenses in accounting:

Debit 26 Credit 10 subaccount “Fuels and lubricants in gas tanks of cars” – 432 rubles. – actually consumed gasoline is written off.

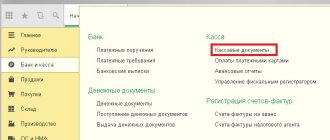

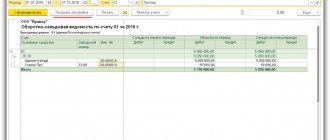

Simplification of accounting for fuel costs in 1C: Accounting 8

Starting from version 3.0.74 in “1C: Accounting 8” you can keep track of fuel using waybills. In order for the new feature to become available to the user, you will need to enable the corresponding functionality (section Main - Settings - Functionality). On the Inventory tab, you must set the Waybills flag (see Fig. 1). After enabling this setting, a new document appears in the program - Waybill.

Rice. 1. Setting up the program functionality

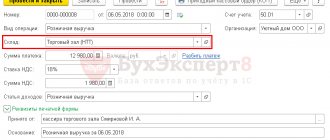

A waybill is issued for each vehicle. This document is used to substantiate fuel expenses for income tax purposes. The Waybill also indicates the amount of fuel that was purchased and consumed during the flight. In the full interface, the document is available in the Purchases section. In a simple interface - in the Documents section. Let's take a closer look at the new document.

Features of the new document “Waybill”

Using the Waybill document (Fig. 2) of the program, the user can:

- take into account information about the route of a passenger car that is used for business purposes. Moreover, this can be either the organization’s own car or a rented one, as well as personal transport belonging to an employee of the organization;

- reflect the purchase of fuel in cash or using a fuel card;

- take into account fuel consumption in the vehicle tank;

- take into account fuel costs in accounting and tax accounting (for profit tax purposes, when applying the simplified tax system with the object “income reduced by the amount of expenses”, as well as for the professional deduction of an individual entrepreneur when paying personal income tax).

- print the waybill according to the standard intersectoral form No. 3 (approved by Resolution No. 78) or in a simplified form;

- print an advance report in form AO-1 (approved by Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55) - when purchasing fuel for cash.

Rice. 2. Document “Waybill”. Purchasing fuel using a cash receipt

Please note that the Waybill document has limitations: it can only be used by enterprises that are not transport companies and for which transportation is not their main activity. In addition, the Waybill does not support fuel accounting using coupons for fuel and lubricants. If the organization’s activities do not use passenger cars, refueling “in a can” is practiced, coupons for fuels and lubricants are used, and the fuel is stored in different warehouses, then accounting for fuels and lubricants should be carried out according to the previous (“traditional”) scenario. The methodology for accounting for fuel using waybills required changes to the program.

Changes in 1C:Accounting 8 to automate cost accounting for waybills

As part of the automation of accounting for fuel costs using waybills in 1C: Accounting 8, starting from version 3.0.74, the following changes have occurred:

- Third order subaccounts have been added to account 10.03 “Fuel”:

- 10.03.1 “Fuel in warehouse”;

- 10.03.2 “Fuel in the tank.”

Subaccount 10.03.1 takes into account the availability and movement of petroleum products and lubricants intended for the operation of vehicles, technological needs of production, energy generation and heating, solid and gaseous fuels. Analytical accounting is maintained by item, storage location and batch (receipt document). Each name is an element of the Nomenclature directory. Each storage location is an element of the Warehouses directory. To maintain analytical accounting for warehouses and batches, you must make the appropriate settings for accounting parameters (section Main - Chart of Accounts - Setting up a chart of accounts - Inventory accounting). Subaccount 10.03.1 is the “successor” of account 10.03, used in previous versions of the program, and is used in “traditional” scenarios for working with fuels and lubricants. Subaccount 10.03.2 takes into account the presence and movement of petroleum products in the vehicle tank. Analytical accounting is carried out by fuel types and vehicles. Each name is an element of the Nomenclature directory. Each car is an element of the Vehicles directory.

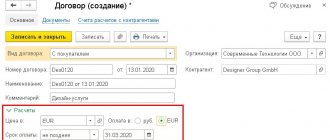

- A new subaccount 76.15 “Purchases using fuel cards” has been added to account 76 “Settlements with various debtors and creditors”. This sub-account is intended for quantitative accounting of payments for fuel purchased by an organization using fuel cards in the currency of the Russian Federation. Analytical accounting is carried out for individual types of fuel (subconto Nomenclature) and cars (subconto Vehicles).

- A new program object has appeared - Vehicle (an element of the Vehicles directory), which can be accessed from the Directories - OS and Intangible Materials section. If a car is accounted for in an organization as a fixed asset (FPE), then the Vehicle (Fig. 3) is created automatically when the vehicle is registered with the Federal Tax Service (fixed asset card - link Register), since the Register entry of a vehicle contains all necessary information. Rented cars and personal vehicles of employees used for business purposes should be entered manually in the Vehicles directory;

- For the document Receipt (act, invoice), a new type of operation Fuel has appeared.

Rice. 3. Vehicle card

BASIC

Depending on the nature of the use of transport, costs for fuel and lubricants should be included in:

- material expenses (when providing motor transport services) (subclause 5, clause 1, article 254 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia for Moscow dated November 14, 2006 No. 20-12/100253);

- other expenses associated with production and sales (when using vehicles for the needs of the organization) (subclauses 11 and 12, clause 1, article 264 of the Tax Code of the Russian Federation).

Important: when calculating income tax, it is not necessary to take into account fuel costs within the norms. The fact is that the costs of maintaining vehicles, including fuel and lubricants, are not standardized (subclause 11, clause 1, article 264 of the Tax Code of the Russian Federation). And those standards that are given in the Methodological Recommendations (put into effect by Order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r) are advisory in nature. That is, when calculating profit tax, an organization has the right to take into account the costs of fuel and lubricants in full. Provided, of course, that they are economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation). Such clarifications are contained in letters of the Ministry of Finance of Russia dated June 3, 2013 No. 03-03-06/1/20097 and dated January 30, 2013 No. 03-03-06/2/12.

Advice: To economically justify the cost of fuel and lubricants, you can use the standards recommended by the Russian Ministry of Transport. Or, develop internal standards yourself, having the limits approved by order of the head of the organization.

But if gasoline costs exceed internal organizational standards, then this fact must be documented. Otherwise, above-limit expenses for fuel and lubricants will not be economically justified, and therefore it will not be possible to take them into account when calculating income tax (clause 1 of Article 252 of the Tax Code of the Russian Federation). This conclusion is contained in the resolution of the Federal Antimonopoly Service of the West Siberian District dated April 5, 2012 No. A27-8757/2011.

To calculate income tax, fuels and lubricants are taken into account at purchase prices (clause 2 of article 254 of the Tax Code of the Russian Federation). If VAT is included in the price and is highlighted in the payment documents as a separate line, then the amount of this tax should be excluded (clause 1 of Article 170 of the Tax Code of the Russian Federation). VAT on the basis of an invoice can be deducted (clause 1 of Article 172 of the Tax Code of the Russian Federation). The procedure for applying the tax deduction depends on when ownership of fuel and lubricants passes to the organization.

If ownership of fuel and lubricants passes to the organization at the time of shipment of coupons, then if there is a supplier invoice, input VAT on fuel can be deducted immediately in the full amount (clause 1 of Article 172 of the Tax Code of the Russian Federation).

Advice: deduct the amount of VAT on the cost of fuel and lubricants in coupons in proportion to the amount of fuel actually received. This will allow the organization to avoid claims from the tax inspectorate.

The amount of fuel actually received may be less than its nominal volume indicated in the coupons. This is possible due to untimely sampling of fuel at the gas station. Meanwhile, one of the conditions for applying a VAT deduction is the acceptance of goods (work, services) for accounting (paragraph 2, paragraph 1, article 172 of the Tax Code of the Russian Federation). If the amount of the deduction determined by the supplier's invoice exceeds the amount of the deduction from the cost of the fuel actually received, during the audit the tax office may require the restoration of input VAT on unreceived fuel and lubricants.

If ownership of fuels and lubricants passes to the organization at the time of refueling the car, then, if there is an invoice from the supplier, deduct VAT as the fuel received at the gas station is posted (paragraph 2, clause 1, article 172 of the Tax Code of the Russian Federation).

If the costs of purchasing fuel and lubricants are considered material costs, write them off taking into account the method of assessing materials that the organization uses (clause 8 of Article 254 of the Tax Code of the Russian Federation).

If the costs of purchasing fuel and lubricants are classified as other expenses, write them off at the actual cost of acquisition (excluding VAT) (subclause 11, clause 1, article 264, clause 1, article 170 of the Tax Code of the Russian Federation).

Situation: when can the cost of fuels and lubricants purchased using coupons be included in expenses for calculating income tax?

Include the cost of fuel and lubricants in expenses on the date of acceptance of the waybill for accounting. And if the costs of fuel and lubricants are recognized as direct - as the services are sold, in the cost of which they are included.

The dates for writing off fuel and lubricants in accounting and tax accounting are the same. This is explained by the fact that the basis for writing off fuel and lubricants is a correctly executed waybill. It is this document that confirms the validity of writing off fuel and lubricants (letter of the Ministry of Finance of Russia dated August 1, 2005 No. 03-03-04/1/117, clause 1 of Article 252 of the Tax Code of the Russian Federation). After the waybill has been registered, the cost of fuel and lubricants consumed on it can be included in expenses that reduce taxable profit. Attach gas station receipts to the waybill.

When using coupons, by the time the fuel is actually received, their cost has already been paid by the buyer. Therefore, this procedure for writing off fuel applies to both organizations that use the accrual method and organizations that calculate income tax on the cash basis. This conclusion can be made by the provisions of paragraph 2, subparagraph 3 of paragraph 7 of Article 272, paragraph 3 of Article 273 of the Tax Code of the Russian Federation.

However, there is one exception to this rule. If an organization uses the accrual method and expenses for fuel and lubricants are recognized as direct, fuel and lubricants can be taken into account only as services are sold in the cost of which they are included (paragraph 6, paragraph 1, paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation).

An example of how to reflect in accounting and taxation the acquisition and write-off of fuel and lubricants using coupons. Ownership of fuel passes to the organization at the time of filling the vehicle with fuel.

On June 25, Alpha LLC purchased a coupon for 10 liters of AI-92 gasoline and paid 170 rubles for it. (including VAT - 26 rubles). On the same day, the supplier issued an acceptance certificate and an invoice. According to the terms of the agreement, ownership of the fuel and lubricants passes to the buyer at the time the car is refueled at the gas station.

Alpha accrues income tax on a monthly basis. To evaluate materials in accounting, the organization's accounting policy provides for the average cost method.

On June 25, a ticket was issued to the driver of a company car. The waybill, which reflects the refueling of the car according to the coupon, was submitted to the accounting department on June 30. The waybill is accompanied by a tear-off coupon for the coupon and a gas station receipt.

The following entries were made in the organization's records.

June 25:

Debit 60 subaccount “Advances issued” Credit 51 – 170 rub. – prepayment for the coupon has been transferred;

Debit 006 subaccount “Coupons for fuel and lubricants” – 170 rubles. – a coupon for gasoline has been capitalized (based on the certificate of acceptance and transfer of coupons);

Credit 006 subaccount “Coupons for fuel and lubricants” – 170 rubles. – a ticket was issued to the driver (based on the ticket book).

30 June:

Debit 10-3 Credit 60 – 144 rub. – the gasoline actually received was capitalized (based on a gas station receipt, a tear-off coupon for the coupon);

Debit 19 Credit 60 – 26 rub. – VAT on purchased fuel is reflected;

Debit 60 Credit 60 subaccount “Advances issued” – 170 rubles. – prepayment is credited;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 26 rubles. – submitted for deduction of VAT on the gasoline actually received.

On June 30, Alpha's accountant calculated the average cost of 1 liter of fuel. Based on the calculation, the average cost of 1 liter of gasoline turned out to be equal to its purchase price.

Based on the waybill, the cost of fuel and lubricants was written off as expenses in accounting:

Debit 26 Credit 10-3 – 144 rub. (170 rubles – 26 rubles) – actually consumed gasoline is written off (based on the waybill).

Input VAT on purchased fuels and lubricants (26 rubles) was accepted for deduction in the second quarter. When calculating income tax in June, Alpha's accountant included in expenses the cost of actually consumed fuel (144 rubles).

Registration of SF supplier

Registration of the supplier's invoice is carried out automatically on the basis of the first Advance report , which will indicate the details of the received invoice.

To automatically reflect the VAT deduction amount in the Purchase Ledger , select the Reflect VAT deduction in the Purchase Ledger checkbox by the date of receipt in the Invoice received .

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.03 – acceptance of VAT for deduction.

VAT declaration

The VAT return reflects the amount of VAT deducted:

In Section 3 page 120 “Amount of VAT to be deducted”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- invoice received, transaction type code "".

simplified tax system

The tax base of simplified organizations that pay a single tax at a rate of 6 percent is not reduced by expenses for fuels and lubricants (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Simplified organizations that pay a single tax on the difference between income and expenses can include in the costs (other or material) documented and paid expenses for the purchase of fuels and lubricants (subclause 12, 5 clause 1, clause 2 of Article 346.16 of the Tax Code RF). The procedure for writing off such expenses when calculating a single tax is similar to the procedure that is applied in the general taxation system, taking into account the provisions of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation (Clause 2 of Article 346.16 of the Tax Code of the Russian Federation). This paragraph establishes a mandatory condition for the recognition of expenses during simplification - their payment. The VAT amounts on these expenses also reduce the tax base for the single tax (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).