Preparation

Before drawing up the program, it is imperative to decide on the period that the inspection should cover. It is also necessary to highlight the topic of the audit. The preparatory stage also includes the study by audit participants of the necessary documentation. This includes:

- Local regulations of the organization.

- Legislative acts of the specific district (or other territorial unit) to which the company belongs.

- Other normative and legal acts regulating issues related to this topic.

- Statistical data. This applies, first of all, to physical indicators that organizations can indicate in their documentation.

- Reporting information on the conduct and regulation of the financial and economic activities of the inspected institution.

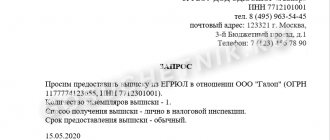

The initiator can be either the organization itself or external controlling organizations. These include the Chamber of Control and Accounts, the Tax Chamber, etc.

Audits are also carried out at the request of law enforcement agencies. The audit program is drawn up by the employee and certified by the head of the control and audit body. Drawing up an act is a mandatory and one of the most important stages in the entire program.

The audit must be regulated and mentioned in the accounting policies of the organization. Without this, all actions taken will not be considered legal.

The procedure for recording the inspection results, what are the features

All information that was obtained during the audit must be reflected in a special form, which has the name - audit act. Correction of errors is possible only on the basis of an audit report.

The legislation does not provide for a unified form of the internal audit report, therefore the enterprise must independently develop the form and approve it in its accounting policies. It can be edited for different purposes.

The audit report must contain information such as: (click to expand)

- Full name of the enterprise;

- The day of drawing up the audit report;

- The reason for the audit and the issuance of the act itself is indicated;

- List of ongoing events;

- Name of operations;

- During what period was the audit carried out?

- Full name, positions of responsible persons, as well as their signatures.

It is also not prohibited to draw up additional annexes to the act. After the audit, a list of identified errors and violations is compiled, and the auditor makes a number of recommendations for their elimination. Those responsible must report within three days. This must also be recorded in the act. If the audit report is missing at least one of the required details, then the submitted act will lose legal force. And if a deficiency is identified under this act, it will not be possible to recover the deficiency from the financially responsible person.

Elements of the act

The document is quite long. Usually it is located on several sheets. It should detail all areas subject to audit in which the organization is subject to control.

When drawing up the act, the following must be reflected:

- Audit object.

- Verification methods. How were the checks carried out?

- The result obtained, conclusions.

The beginning of the document, like all its contents, must comply, in terms of the information present, with Article 9 of the Law “On Accounting”. It implies that the act must contain:

- Name of the locality.

- Document's name.

- Number.

- Revision period.

- Date of preparation of the document.

After this header comes the body of the act. It begins with the stating part of the document. The latter includes:

- A link to the Regulations on the procedure for conducting inspections and audits of the Finance Department of the administration of a particular district. For each document, it will depend on the territorial location of the organization.

- Information about the auditor (last name, initials, as well as the number and date of issue of the certificate that gives him the right to carry out this type of activity).

- If the inspection is carried out on the initiative of the regulatory authorities, then the number and date of the corresponding order of the head of administration or a similar administrative document is also given here.

- The period for which the audit was carried out. Usually this is several years.

- A link to the control and audit work plan developed by the structure.

It is separately stated when the study of the documentation began and when the audit was completed.

Further, the act should list the main points that were established by the audit. For convenience, they are divided into points:

- General provisions.

- Estimated values.

- The preparation of cost estimates is being considered.

- If this is a budgetary organization, then it is considered how the expenditure of the provided funds corresponds to their intended purpose.

- Checking the organization's settlements with debtors and creditors.

- Spending funds on employee salaries.

- Bank operations.

- If available, cash transactions. This also includes operations with cash registers, available cash, etc.

- Calculations with accountable persons.

- Registration of expenditure of funds for the maintenance of official transport.

- Operations with fixed assets and inventories of the organization.

- State of accounting.

At the end of each item, a record is made of whether violations were identified or not.

About the audit

For the purpose of periodic, both scheduled and unscheduled inspection of the financial, office work, archival and other activities of enterprises and organizations, audits are carried out.

On the basis of an enterprise or organization, for the purpose of conducting audits, both permanent audit commissions and those created by special order are created. You can learn about drawing up an order to create a commission from the material at the link.

The right to conduct audits at enterprises and organizations also has:

- tax authorities;

- government bodies in relation to subordinate organizations;

- parent companies in relation to branches, etc.

At the same time, the audits themselves can be divided according to the object of inspection and according to organizational characteristics.

Thus, according to the object of inspection, audits are divided into:

- documentary, which are carried out according to available reporting documents;

- factual, which involve checking both documents and certain material objects, for example, goods in a warehouse;

- continuous, which cover the entire scope of activity of an enterprise or organization;

- selective, which are carried out in relation to certain areas of activity of an enterprise or organization.

Based on organizational characteristics, audits are divided into:

- planned;

- unscheduled;

- complex.

Regardless of the type of audit, its results are always documented in the form of an audit report.

General provisions

The general provisions of the audit report of financial and economic activities include:

- listing the company's powers;

- status of the organization (legal entity);

- on what basis does it carry out its activities;

- what legislative acts it is guided by;

- what details appear on its documentation;

- reason code for registration of the organization;

- when the previous audit of financial and economic activities was carried out;

- who has the right of first and second signature.

This part, at the discretion of the revisionist, may contain other fundamentally important points. For example, if this is a budgetary institution, then in this part of the document there will be a reference to whose funds finance the institution.

Audit rules and verification of cash and cash transactions of a credit organization

The purpose of checking cash discipline and auditing is to identify violations in the handling of cash and material assets, as well as to prevent concealment of shortages or surpluses of money. A special commission is created to audit and verify cash discipline. However, its composition is not defined by this act - it is only indicated that it is approved on the basis of the bank’s administrative document. It is important to know that the number of inspectors cannot include persons working with money or valuables, the handling of which is being checked.

Based on the results of audit and verification activities, various measures are taken to eliminate identified deficiencies. Their list is also not specified in the Regulations.

Materials for auditing and verifying the conduct of cash transactions must be stored in a credit institution. The procedure for storing them is not established by law, therefore it is also determined by the bank independently.

Characteristic features of the act

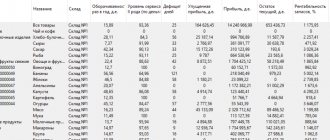

All other points of the act reveal the corresponding areas of the financial and economic life of the organization. A fundamentally important feature of this document is the listing of specific digital data point by point. Information is presented in a structured manner.

The document is also replete with references to existing legislation. This is not surprising, since the specialist conducting the audit must, first of all, know what documents the organization’s activities must comply with. He needs this in order to draw conclusions as to whether there are violations. And if so, in what area and why.

In general, we can say that the act of auditing the financial and economic activities of an organization is the main reflection of its results. Without it, the process would be meaningless.

Sample of drawing up an audit report

Report of the Audit Commission on the audit of the financial and economic activities of OJSC “Tsvetochek”: store No. 275

Krasnodar March 15, 2022

Purpose of the audit Checking cash discipline for the period 01/01/2016-31/12/2016

Grounds for the audit Director's Order No. 111 dated February 1, 2017

Objectives of the audit Determination of the status and compliance with legal requirements for the preparation of cash documents

Composition of the Audit Commission:

- Ivanov Ivan Ivanovich (chairman of the commission)

- Sidorova Maria Ivanovna

- Petrova Tatyana Alekseevna

in the presence:

- cashier Zimina Olga Vyacheslavovna

- accountant Elena Nikolaevna Voronova

operates on the basis of the Charter and the decision of the meeting of shareholders No. 123 dated December 25, 2015 The following were subject to inspection :

1) Cash book

2) Incoming and outgoing cash orders

3) Registration log of PKO and RKO

4)Advance reports

5) Statements for account 50 “Cashier”

Based on the results of the audit, it was established:

OJSC "Flower" in the matter of maintaining cash discipline is guided by the Bank of Russia Directive No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions”, the Bank of Russia Directive No. 3073-U dated October 7, 2013 “On cash payments”, the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n, etc.

When checking the cash book, violations were discovered, namely:

1) When compiling the cash book for 02/01/2016, an arithmetic error was made, which subsequently resulted in a negative balance in the cash register of store No. 275. So, as of 03/01/2016, the balance was -10,000 rubles. This circumstance indicates the lack of proper control over cash flow in this store.

2) During the period from 03/03/2016 to 07/01/2016, the cash book was not filled out. Information about cash flows can only be restored based on existing outgoing and incoming orders. This circumstance does not allow us to reliably establish the amount of funds received.

conclusions

Cash discipline in store No. 275 of Tsvetochek OJSC was practically not observed during the period under review; many violations were revealed.

Recommendations of the audit commission based on the results of the audit

1) Restore the cash book

2) Put in order PKO and RKO and the journal for their registration

3) Bring disciplinary action to cashier O.V. Zimina. and accountant Voronov E.N. on the basis of Art. 192 Labor Code of the Russian Federation

Chairman of the commission Ivanov I.I. Ivanov

(signature)

Members of the commission Sidorova Maria Ivanovna Sidorova

Petrova Tatyana Alekseevna Petrova

Cashier Zimina Olga Vyacheslavovna Zimina was familiarized with the act 03/15/2017

Accountant Voronova Elena Nikolaevna Voronova was familiarized with the act 03/15/2017