The employer reflects entries for “incapacity for work” only in relation to the benefits that are covered from its funds. With the system of direct insurance payments, the benefit transferred by the Social Insurance Fund is not reflected in the policyholder's records. Since 2022, all regions of the Russian Federation have switched to this mechanism for paying sick leave - the employer continues to pay from its own funds the first three days of the period of incapacity for work. The amounts of benefits for the remaining days of incapacity, as well as benefits that are fully paid from the funds of the Social Insurance Fund, are directly transferred to insured individuals by Social Insurance, i.e. the employer does not accrue these amounts, does not withhold tax from them, therefore, he does not have any grounds for reflecting such funds in accounting.

Procedure for obtaining sick leave

Entries on sick leave are made in Russian in printed capital letters in black ink or using printing devices.

You can use a gel, capillary or fountain pen. The use of a ballpoint pen is not allowed.

Entries on sick leave should not go beyond the boundaries of the cells provided for making relevant entries.

The doctor of the medical organization fills out:

— the counterfoil of the sick leave form;

— section “To be completed by a doctor of a medical organization.”

This section also contains the table “Exemption from work”, where in the column “From what date” the date (day, month and year) from which the citizen is released from work is indicated, and in the column “On what date” the date is indicated ( date, month and year) (inclusive) for which the citizen is released from work.

If a citizen seeks medical help after the end of working hours (shift), at his request, the date of release from work on the certificate of incapacity for work can be indicated from the next calendar day.

For outpatient treatment, sick leave is extended from the day following the day the citizen is examined by a doctor. Each extension of sick leave is recorded in separate rows of the table column.

When registering a duplicate sick leave, in the “From what date” and “To what date” columns of the “Exemption from work” table, the entire period of incapacity for work is indicated in one line.

When registering sick leave by decision of the medical commission, including for the past time, in the columns “Physician’s position” and “Last name and initials of the doctor or identification number” the surname, initials and position of the attending physician are indicated, as well as the surname and initials of the chairman of the medical commission after each case considered by a medical commission.

The employer's region does not participate in the FSS pilot project

If the region in which the employer operates does not participate in the Social Insurance Fund pilot project, then the entire amount of benefits due to the employee on the basis of a certificate of incapacity for work is transferred to the employee by the employer. In this case, the accrual and payment of sick leave is documented using the following entries:

| Operation | Wiring |

| Temporary disability benefits accrued at the expense of the employer (for the first 3 days of illness) | Debit account 20 “Main production” - Credit account 70 “Settlements with personnel for wages” If the sick employee is not engaged in the main production, then the account corresponding to the employment of this employee is used (i.e. debit account 23 “Auxiliary production”, 25 “General production expenses”, 26 General business expenses”, 44 “Sales expenses” or others) |

| Temporary disability benefits accrued at the expense of the Social Insurance Fund (for the remaining days of illness) | Debit of account 69 “Settlements for social insurance and security” - Credit of account 70 “Settlements with personnel for wages” |

| Personal income tax withheld from temporary disability benefits | Debit of account 70 “Settlements with personnel for wages” - Credit of account 68 “Calculations for taxes and fees” |

| Temporary disability benefits paid to the employee | Debit of account 70 “Settlements with personnel for wages” - Credit of account 51 “Cash accounts” or Credit of account 50 “Cash” |

Postings for accrual of sick leave in 2018

There have been no changes in the accounting treatment of transactions for calculating temporary disability benefits. Those. Sick leave entries in 2022 are the same as in 2022.

But you need to keep in mind that in 2022 the list of regions participating in the FSS pilot project has been expanded. Thus, from July 1, 2018, the Kabardino-Balkarian Republic, the Republic of Karelia, the Republic of North Ossetia-Alania, the Republic of Tyva, the Kostroma and Kursk regions joined the project (Government Decree No. 619 of May 30, 2018). Consequently, employers in this region have one less entry when recording sick leave transactions.

Accounting support and preparation of entries within the framework of accrual and payment of temporary disability benefits (sick leave) to employees at the expense of the Social Insurance Fund is carried out in the following sequence:

- Receiving a certificate of incapacity for work from the employee and checking that it is filled out correctly.

- Calculation of average daily earnings, reconciliation with the minimum values for the current year.

- Determination of benefits per day, calculation of the total amount of benefits.

- Withholding personal income tax.

- Payment to the employee.

- Reimbursement of part of expenses to the Social Insurance Fund.

Any employer is obliged to pay temporary disability benefits to insured employees, while in accordance with Federal Law No. 255 of December 29, 2006, the organization pays for the first 3 days of sick leave at its own expense, and starting from the 4th day - with funds from the Social Insurance Fund. Benefits for temporary disability for reasons not related to illnesses and injuries (for example, child care, maternity leave, etc.) are paid by the Social Insurance Fund starting from the first day.

Something to keep in mind! In 2022, an employee has the right to take sick leave to care for a child under 7 years of age for any time, but the accountant must calculate payment only for 60 days (90 in some cases).

Calculation of temporary disability benefits based on sick leave

As a rule, the policyholder calculates the full temporary disability benefit and pays it to the employee, and then reimburses the costs by contacting the territorial social insurance funds. The organization is obliged to accrue benefits within 10 days after presentation of sick leave and pay funds on the nearest date of payment of wages:

- To calculate the payment, you must first determine the employee’s average daily earnings using the formula: employee’s income for previous illnesses 2 calendar years / 730.

- After calculation, you need to check the resulting figure with the minimum average daily earnings for the current year.

Note from the author! To determine the minimum value of average daily earnings, it is necessary to calculate it based on the minimum wage established for the current year: 9489 * 24 / 730 = 311.97 - the minimum for 2022.If the employee’s average daily earnings are below the minimum, further calculations are made based on the minimum established for the current year.

- After the calculation, it is necessary to determine the amount of temporary disability benefits for the employee per day, which will depend on the length of service:

with work experience of more than 8 years, the benefit is paid 100%;5-8 years – 80% is taken into account;

up to 5 years of work experience – 60%.

- The daily allowance is multiplied by the number of calendar days of illness registered on the sick leave.

Author's addition! For employees who have had no income in the previous 2 years (for example, those returning from maternity leave), sick leave is paid based on the minimum wage, based on their total length of service.

Temporary disability

The processing of benefits in the Pilot Project differs from the credit system. The Sick Leave document is still created

, the benefit amount is calculated, and from this amount the employer pays for the first three days, and the balance at the expense of the Social Insurance Fund will not appear in the reports, since

Direct payments

.

Figure 5 - Sick leave

Figure 6 - Distribution of amounts

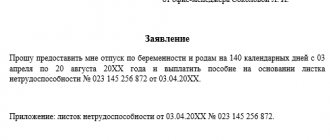

In addition to the Sick Leave, you need to fill out the information for the Register of Information, fill out an Application for Payment of Benefits and the Register of Information itself. Data for the Registry

must be entered in the document

Sick leave

.

Follow the highlighted hyperlink Fill in the data

for the register of information submitted to the FSS.

Figure 7 - Sick leave

The certificate of incapacity for work can be paper or electronic. If the program is configured to receive sick leave data, it will be downloaded automatically. Enter in the appropriate fields: employee’s full name, certificate of incapacity for work and click the Receive from the Social Insurance Fund

.

You can also download the ELN file from the State Services website and click Download from file

. The data will be automatically pulled from the downloaded file.

Figure 8 — ELN sick leave

Sick leave with code 03 Quarantine

usually issued as electronic certificates of incapacity for work.

The employee brings a printed coupon issued to him at the medical institution. Due to the pandemic in 2022, sick leave certificates for coronavirus were also issued as quarantine sick leave. For such sick leave in the program, in the Reason

there should be code 03. Sick leave for quarantine is paid entirely at the expense of the Social Insurance Fund.

Figure 9 - Coupon issued to an employee in a hospital

If the employee brought a paper sick leave, the data must be entered independently. The hyperlink will open the form. Required fields are highlighted in red.

Figure 9 — Entering sick leave certificate data

When creating a medical organization, it is important to correctly enter the OGRN and fill in the address of the medical institution. Fill out the reason for disability in accordance with the sick leave, pay attention to the additional codes indicated on the sick leave.

Figure 10 — Medical organization

If your employee has brought more than one sick leave, and the second is a continuation of the first, in the form for filling out the certificate of incapacity for work, you need to set code 31 and enter the number of the next sick leave.

Figure 11 — Continuation of sick leave

On the Special Causes of Disability

special conditions of sick leave are indicated: sanatorium treatment, hospital stay, caring for a sick family member, disability status, regime violations.

Figure 12 - Special causes of disability

In the document Sick leave

You can generate

an Application for payment of benefits

. If the document already contains all the data, it will automatically be included in the Application.

Figure 13 — Employee statement

In the second tab, the payment method is pulled from the employee’s card. If the transfer is to a bank account, indicate the personal account number and bank. If the card is MIR, please indicate its number. The employee's address is automatically inserted into the postal order.

Figure 14 — Payment method

On the Attached Documents

the number of the certificate of incapacity for work is written down.

In the Calculation of Benefits

, the average earnings and earnings for two years are recorded.

If necessary, the reason for recalculating sick leave is also indicated here. This setting is used if the ledger needs to be resent due to a recalculation. In the Information tab for the register,

the date of submission of documents to the Social Insurance Fund and the terms of the fixed-term contract with the employee are specified.

Figure 15 - Benefit calculation

Now go to the Salaries and Personnel section - Transferring information about benefits to the Social Insurance Fund

.

By clicking the Create

, a list will appear in which you need to select

Information Register

.

Figure 16 — Register of information

On the form that opens, click the Fill

All sick leaves are pulled up according to this type of register.

The data in the register is filled in automatically from the Sick Leave

and employee card. If fields marked in red appear, you can edit them manually in the Information Register.

Figure 17 — Register of information

The employer must provide the Register of Information or a set of documents with an inventory of benefits that are not provided electronically to the regional body of the Social Insurance Fund within 5 days from the date the employee signs the application. The Social Insurance Fund pays sick leave within 10 days from the date of receipt of the Register of Disability Benefits.

Accounting entries for payment of sick leave at the expense of the Social Insurance Fund

Since compensation for temporary disability is the employee’s social insurance, accounting for accrued payments from the Social Insurance Fund is recorded in the accounting records on the account. 69: account credit – summary of information about all accrued benefits, debit – actual payments. Settlements with the employee are directly displayed within the framework of the labor relationship and are recorded separately for each employee on the account. 70:

- Accrual of part of the temporary disability benefit after checking the correctness of filling out the sick leave, paid with funds from the Social Insurance Fund

Dt 69.01 Kt 70 - Withholding personal income tax

Dt 70 Kt 68Something to keep in mind! According to current legislation, temporary disability benefits due to pregnancy and childbirth are paid in full without withholding personal income tax.

- Issuance of benefits to the employee

Dt 70 Kt 50 – when paying cash from the organization’s cash desk;Dt 70 Kt 51 – non-cash transfer of funds to an employee’s bank account.

- Reimbursement of expenses to the organization's current account

Dt 51 Kt 69.01

Accounting entries for sick leave when calculating benefits at the expense of the Social Insurance Fund

The accountant should take into account the fact that the reflection in the accounting records of the operation for calculating temporary disability benefits will depend on the reason for being on sick leave (general illness, domestic injury, pregnancy and childbirth, work injury).

| ★ Best-selling book “Calculating sick leave and insurance premiums in 2018” for dummies (understand how to calculate insurance premiums in 72 hours) 3000+ books purchased |

Important! To reflect the accrual of sick leave benefits from the Social Insurance Fund for sick leave in the event of an industrial injury, maternity and disability, separate sub-accounts must be opened to account 69.

| DEBIT | CREDIT | Operation, comment |

| 69 | 70 |

|

| Debit of the subaccount (for calculating social insurance against industrial accidents) to account 69 | 70 | When accruing sick leave benefits in the event of an employee being injured at work (all days are paid from the Social Insurance Fund). |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Common mistakes

Error:

An accountant of a company from the region that is participating in the FSS pilot project displays in the accounting records the accrual of benefits at the expense of the FSS.

A comment:

Employers of firms from regions participating in the FSS pilot project should not display benefits at the expense of the FSS in their accounting records, since the FSS directly transfers the benefit to the employee’s account, without transferring funds to the employer.

Error:

The accountant reflected in the accounting records the payment of sick leave benefits for an industrial injury at the expense of the employer (for the first 3 days).

A comment:

When an employee receives a work-related injury, sick leave benefits for the entire period of sick leave are paid from the Social Insurance Fund.

How to spend sick leave

During illness a person does not work. Therefore, instead of a salary, the employee receives social benefits. The right to a paid ballot is enshrined in Article 183 of the Labor Code of the Russian Federation. Employees are paid from two sources:

- The employer pays for the first three calendar days

- The remaining days of incapacity for work are paid for by the Social Insurance Fund.

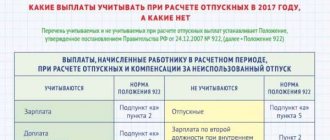

The employer's accounting department calculates and accrues the amount payable to the employee. Accruing sick leave means making accounting entries. Postings on sick leave are affected by two circumstances:

- The department in which the sick person works

- Subject of the Russian Federation in which the company is registered.

Disability benefits are included in labor costs. Payment for the newsletter is reflected in the credit of account 70 “Settlements with personnel for wages”. The debit of the account depends on the department in which the employee works, or the type of work that the mercenary performs. Payments are recorded as a debit to the accounts of production costs, commercial or other expenses:

Let's give an example. Payment for a ballot to a trade employee is reflected in the following entry:

Debit account 44 - credit account 70.

The second circumstance that determines the composition of accounting records is the location of the organization or individual entrepreneur - the employer. A number of constituent entities of the Russian Federation are participating in the FSS pilot project.

Accounting for benefits if the employee has not returned them

The benefit amount cannot be forcibly returned if the failure is a consequence of a violation of laws by the accountant. Collection of funds is a right, not an obligation of the employer. That is, he may not collect benefits, even if there are grounds for this (the grounds are Article 240 of the Labor Code of the Russian Federation).

If the employee has not returned the benefit, the following entries are made:

- DT69 KT70. Reversal of accrued benefit.

- DT91/2 KT70. Attribution of expenses to other expenses.

- DT91/2 KT69. Calculation of insurance premiums for the amount.

- DT70 KT68. Withholding personal income tax from payments. The exception is disability benefits.

- DT91/2 KT69 (special account “Penies, fines”). Penalties for contributions paid late due to a deficiency.

- DT91/2 KT68 (special account “Fees and Fines”). Penalty for personal income tax paid late.

- DT69/68 KT51. Transfer of insurance premiums and personal income tax to the state treasury.

Personal income tax will be withheld from the employee. If an employee quits, the Federal Tax Service must be informed about the impossibility of withholding tax.

What are the rules for accruing sick leave - 2018-2019

Calculation and accrual of temporary disability benefits in 2018-2019 are carried out according to the following algorithm:

Stage 1. The accountant calculates the average daily wage for the work of the sick employee - for this he determines the billing period and the employee’s total earnings for the billing period.

The calculation period for sick leave is 2 calendar years preceding the year of the employee’s illness.

Example 1

Accountant Ignatieva came to work at Stigma LLC in April 2003. This is her first job. Ignatieva was on sick leave from 07/01/2018 to 07/10/2018, then the billing period was 2016–2017. (but if Ignatieva was on maternity leave in 2016 or 2022 or was caring for a baby and had no income, then in accordance with the letter of the Ministry of Labor of the Russian Federation dated 08/03/2015 No. 171/OOG-1105, the accountant will take for the billing period, upon application from the employee, those preceding the billing period years, that is, 2014–2015, but not later).

No matter how many days there are in the years of the billing period, its duration is always 730 days. Vacation days and sick days cannot be excluded (Article 14 of the Law “On Compulsory Social Insurance...” dated December 29, 2006 No. 255-FZ).

Earnings for the billing period are wages, bonuses and other payments from the employer, for which social security contributions were calculated. State benefits and compensation from the employer are not included in this amount.

The accountant will find the average daily earnings (ADE) by dividing earnings for the billing period by 730 days.

Example 1 (continued)

Ignatieva earned 683,455 rubles in 2022, and 657,320 rubles in 2016.

SDZ Ignatieva: (657,320 + 683,455) / 730 = 1,836.68 rubles.

Stage 2. The accountant must compare the received SDZ amount with the maximum and minimum amounts. The maximum size of SDZ is calculated in accordance with the amounts of contribution limits to the Social Insurance Fund in the previous (calculated) 2 years; in 2022 it is equal to 2,017.81 rubles. ((755,000 + 718,000) / 730 days). In 2022, the period that should be taken into account for 2017-2018 will change. In 2022, the limit for social contributions is 865,000 rubles. Therefore, the maximum SDZ will be equal to RUB 2,219.18. ((755,000 + 865,000) / 730 days).

The minimum SDZ is equal to:

Minimum wage on the date of opening of sick leave × 24 months / 730 days.

In the second half of 2022, the minimum wage is 11,163 rubles, therefore, the minimum SDZ is 367.01 rubles. From January 2022, the minimum wage will increase to 11,280 rubles. That is, the minimum SDZ will be 370.85 rubles. (11,280 × 24 months / 730 days).

Thus, the employer cannot take an SDZ amount of more than 2,017.81 rubles to calculate sick leave. and less than 367.01 rubles. in 2018, and more than 2,219.18 rubles. and less than 370.85 rubles. in 2019.

If the employee’s earnings are above the maximum, then the benefit is paid based on the maximum SDZ.

Example 1 (continued)

Since Ignatieva’s SDZ is equal to 1,836.68 rubles. and this is less than the maximum SDZ for 2022 (1,901.37 rubles), then sick leave should be calculated based on the SDZ in the amount of 1,836.68 rubles, calculated based on Ignatieva’s actual income.

If the SDZ calculated by the accountant is less than the minimum, then the accountant takes the daily earnings in the amount of 367.01 rubles to calculate the benefit. - for a full-time worker.

NOTE! If the sick person works part-time, and his SDZ is less than or equal to the minimum, then the minimum SDZ is subject to reduction in proportion to the duration of working hours. That is, for an employee at 0.5 times the wage rate with average daily earnings less than 367.01 rubles. you will have to compare your actual earnings for the day with earnings calculated based on the amount of 367.01 / 2 = 183.51 rubles. This rule does not apply to employees whose SDZ is higher than the minimum: even if an employee works at a quarter rate, then his average daily earnings do not need to be divided by 4 (clause 16 of the Government of the Russian Federation of July 15, 2007 No. 375).

Stage 3. The accountant must determine the total length of service of the employee for his entire career, since only an employee who has worked for more than 8 years has the right to receive 100% of the average daily wage. If the employee’s work experience is from 5 to 8 years, then they will pay him 80% of the average daily earnings, if less than 5 years (but more than six months) - 60%. For an employee with less than 6 months of work experience, sick leave is calculated based on the minimum wage (Article 7 of Law No. 255-FZ).

Read more about calculating length of service for calculating sick leave.

Example 1 (continued)

Since Ignatieva’s total work experience is 15 years 2 months (from April 2003 to June 2022 inclusive), she will receive 100% of the average daily earnings.

NOTE! For those who have received an injury or occupational disease at work, the earnings must be taken in full for calculation and a benefit paid in 100%, regardless of length of service (Article 9 of the Law “On Compulsory Social Insurance against Industrial Accidents and Occupational Diseases” dated July 24, 1998 No. 125-FZ).

Stage 4. The accountant multiplies the resulting SDZ amount by the number of sick days. The sick employee's certificate of incapacity for work is paid for by the Social Insurance Fund, but only from the fourth day of illness. The first 3 days must be paid by the employer.

But if a relative is sick and an employee is caring for him, then the rules for paying for such sick leave are different. Read about them in the material “Paying sick leave to care for a sick relative.”

How to make entries for accrual of sick leave

The accountant will reflect the accrual of sick leave in accounting as follows:

Dt 20 (and other cost accounting accounts - depending on how the patient works in which department) Kt 70 - sick leave accrued for the first 3 days of the employee’s illness;

Dt 69 (according to the subaccount of settlements with social insurance) Kt 70 - sick leave accrued at the expense of the Social Insurance Fund.

On the payment day, the accountant will make the following entries:

Dt 70 Kt 68 (subaccounts for income tax calculations) – income tax is withheld from sick leave;

Dt 70 Kt 50 (if from the cash register) or 51 (from the current account) - benefits were paid to the employee.

NOTE! For firms in the regions participating in the FSS pilot project, personal income tax must be withheld only from benefits for the first 3 days of incapacity for work (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Example 1 (continued)

The amount of Ignatieva’s benefit for 10 days of illness: 1,836.68 × 10 = 18,366.80 rubles. Minus personal income tax, Ignatieva will receive 15,978.80 rubles.

The accountant will make the following entries:

Dt 20 Kt 70 in the amount of RUB 5,510.04. – sick leave accrued at the expense of the employer;

Dt 69 Kt 70 in the amount of RUB 12,856.76. – sick leave was accrued at the expense of the Social Insurance Fund;

On the day of payment of wages to employees:

Dt 70 Kt 68 in the amount of RUB 2,388.00. – personal income tax is withheld from benefit amounts;

Dt 70 Kt 50 in the amount of RUB 15,978.80. – Ignatieva’s temporary disability benefit was issued under RKO.

NOTE! In accordance with paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, income tax on temporary disability benefits in 2022 must be transferred to the budget no later than the last day of the month in which the benefit was paid.

Accrual of sick leave in 2022: calculation examples

We will show you in more detail how to correctly calculate and accrue sick leave in 2022.

Example 2

From 07/01/2018 to 07/05/2018, the cleaning lady Govorunova was on sick leave. She brought a certificate of incapacity for work to Barter LLC on July 6, 2018 - the accountant has 10 calendar days to accrue benefits. Govorunova works at 0.5 rate; she also worked for the previous 2 years and was not on maternity leave. Govorunova’s work experience is 12 years. Calculation period – 2016–2017.

Govorunova got a job at Barter LLC in January 2022, before that she worked for individual entrepreneur I. F. Kuznetsov. Her earnings for 2022 are 68,505 rubles. The accountant will take the salary for 2016 from the certificate of salary amount given to Govorunova by IP Kuznetsov upon dismissal - 65,732 rubles. At the moment, Govorunova works only at Barter LLC. Average daily earnings of Govorunova:

(68,505 + 65,732) / 730 = 183.89 rubles.

This is less than the minimum size of SDZ in the second half of 2018 (RUB 367.01). But, since Govorunova works part-time, her average daily earnings should be compared with 0.5 minimum wage = 183.51 rubles. Since the employee’s actual SDZ is greater than the minimum, we take the actual earnings to calculate:

183.89 × 5 days of illness = 919.45 rubles, of which the employer will pay 551.67 rubles. (for the first 3 days of illness), and 367.78 rubles. - social insurance.

Example 3 (calculation of sickness benefit when changing years)

Engineer Mayseenko fell ill on July 1, 2018, and her sick leave was closed on July 10, 2018. Mayseenko’s work experience is 3 years and 7 months. She works part-time in 2 organizations: at Sopromat LLC she has been working at 0.5 rate since 2013, and she got a job with IP Stolyarov A.P. in December 2022, also at 0.5 rate.

Mayseenko decided to receive benefits from Sopromat LLC. Since in 2016–2017. She was first on maternity leave, and then cared for the child, then she wrote a statement asking her to change the years for the calculation. In this case, the calculation period is 2014–2015. At Sopromat LLC in 2014, Mayseenko earned 246,350 rubles, in 2015 - 275,034 rubles.

From IP Stolyarov A.P. Mayseenko will take a certificate stating that temporary disability benefits were not accrued or paid to her. SDZ Mayseenko's accountant will take only one place of work - Sopromat LLC, since IP Stolyarov A.P. Mayseenko had in 2014–2015. did not work:

(246,350 + 275,034) / 730 = 714.22 rub.

This amount fits within the boundaries between the upper ((624,000 + 670,000) / 730 = 1,772.60 rubles) and lower (367.01 × 0.5 = 183.51 rubles) SDZ size. Since Mayseenko’s experience is less than 5 years, she is entitled to only 60% of the SDZ:

714.22 × 60% = 428.53 rub.

Mayseenko's sick leave amount: 428.53 rubles. × 10 days of illness = 4,285.35 rubles. For the first 3 days, expenses will be borne by the policyholder - 1,285.59 rubles, social insurance will pay 2,999.76 rubles. Minus income tax, Mayseenko will receive 3,728.35 rubles.

NOTE! If you are replacing an employee's years for calculating benefits, then there are mandatory conditions. First, the employee must write an application for a replacement. And second, the sick leave calculated with the replacement of years must be greater than that calculated in the usual manner, otherwise the employer pays benefits based on the standard calculation period.

from 07/01/2016, if the employee…

… average earnings for the previous two years are below the minimum wage

If the average employee’s earnings calculated for 2014 and 2015 (calculated for a full calendar month) are below the minimum wage, then the benefit is calculated based on the minimum wage. If the date of onset of the disease falls on the period from 01/01/2016 to 06/30/2016, then the minimum average daily earnings calculated from the minimum wage is 203 rubles. 97 kopecks (RUB 6,204 x 24) / 730 = RUB 203.97). For illnesses occurring starting from 07/01/2016, the minimum average daily earnings is 246 rubles. 58 kopecks (RUB 7,500 x 24) / 730 = RUB 246.58).

Example 4. Calculation of benefits from the minimum wage due to low earnings

| Employee N.I. Rostova presented to the accounting department a sick leave certificate for caring for a child under 7 years old on an outpatient basis for 1 day on 07/15/2016. The employee’s length of service on the day of illness was 2 years (less than 5 years, but more than six months). N.I. Rostova has been working part-time since November 2015. Her earnings for 2015 amounted to 50,000 rubles. Certificates from previous places of employment were not provided. The actual average daily earnings were: RUB 50,000.00. / 730 = 68.49 rub. The minimum average daily earnings from the minimum wage, taking into account part-time work, was: 246.58 rubles. x 0.5 = 123.29 rubles, which is more than actual. The benefit is calculated from the minimum wage of 123.29 rubles. taking into account experience. The experience is less than five years, so 60% is taken into account to calculate the benefit: 123.29 rubles. x 60% = 73.97 rub. |

Please note that the start date of the disability is important in this case. The disease occurred in July, so the minimum wage was 7,500 rubles. If the onset date of the illness was before July 1, 2016, and the illness continued in July, then a minimum wage of 6,204 rubles would be used.

... less than six months of experience

If the employee’s length of service is less than six months, then the disability and maternity benefits cannot exceed the minimum wage for each calendar month.

Example 5. Limitation of benefits to the minimum wage due to short work experience

| Employee D.V. Borovoy began working on 04/01/2016 full-time at an enterprise in an area without a regional coefficient (RK). A certificate of earnings from a previous employer in 2015 confirms the amount of 500,000 rubles. Sick leave was provided for 2 days: 06/30/2016–07/01/2017. On the day of the onset of illness, the length of service is less than six months and the amount of benefit is limited not by the maximum value of the base for calculating insurance premiums, but by the maximum amount of daily benefit calculated from the minimum wage. The actual average daily earnings were: RUB 500,000. / 730 = 684.93 rub. The experience is less than five years, so the average daily earnings are limited to 60% and equal to 684.93 rubles. x 60% = 410.96 rub. But since the length of service is less than six months, it is limited to the maximum daily benefit in June: 6,204 rubles. / 30 = 206.80 rubles, and in July 7,500 rubles. / 31 = 241.94 rub. Thus, for 2 days, a benefit of 206.80 rubles was accrued. + 241.94 rub. = 448.74 rub. (Fig. 4). |

Rice. 4. Sick leave accruals from the minimum wage

Please note that maternity benefits are accrued in advance even if the employee went on maternity leave before July 1 and before the new minimum wage was approved. Moreover, if the vacation continues after July 1, then the amount of the benefit must be recalculated taking into account the new minimum wage and the difference must be paid.

The need for recalculation arises if maternity benefits are limited to the maximum amount of daily benefits similar to Example 5 due to the fact that the employee’s length of service was less than six months. To perform recalculation in the program, you need to open the previously created and paid sick leave document. Click the Edit button to create a new document. In it, on the Recalculation of the previous period tab, previously accrued amounts are reversed, and on the Accrued (details) tab, new accruals are displayed. As a result, the new document shows the difference, in this case the amount of additional payment.

Results

The accrual of sick leave in 2022 has not undergone significant changes: the accountant needs, as before, to know the employee’s SDZ, length of service, and number of sick days. However, there are nuances in paying sick leave to an employee who was injured at work or to a woman who was recently on maternity leave.

For information on calculating sick leave after maternity leave, read the article “How to calculate sick leave after maternity leave?”

Sick leave is issued to an employee due to temporary loss of ability to work and is paid for by the employer or the Social Insurance Fund. ConsultantPlus FREE for 3 days Get access

Payments due for the period of incapacity for work are calculated based on average earnings for the last 2 years and the number of days for which a certificate of incapacity for work was issued.

To calculate sick leave, it is necessary to establish the causes of disability and determine whether your region is participating in the pilot project of the Social Insurance Fund (see Decree of the Government of the Russian Federation of April 21, 2011 No. 294).

The listed factors have a direct impact on the accounting entries for the accrual of benefits.

Legislative regulation

| Art. 183 Labor Code of the Russian Federation | On the right of employees to receive sick leave benefits |

| clause 1 part 2 art. 3 of the Federal Law of December 29, 2006 No. 255-FZ | About sources of payment for sick leave |

| Clause 2 Decree of the Government of the Russian Federation dated April 21, 2011 No. 294 | On the dependence of accounting for the payment of sick leave benefits on the participation of the region where the company is located in the Social Insurance Fund pilot project |

| clause 3 of the Amendments, approved. Decree of the Government of the Russian Federation dated December 19, 2015 No. 1389 | On inclusion in the FSS pilot project. Republic of Mordovia, Bryansk, Kaliningrad, Kaluga, Lipetsk and Ulyanovsk regions |

| Art. 9 Federal Law of July 24, 1998 No. 125-FZ | On compulsory social insurance against accidents and occupational diseases |

| clause 1 art. 217 Tax Code of the Russian Federation | The fact that maternity benefits are not subject to personal income tax |

The procedure for calculating sick leave for different regions

From the point of view of calculating the amount due for days of incapacity, all regions of the country are divided into two categories: those participating in the FSS pilot project and those not.

If a region participates in a pilot project of the Social Insurance Fund, then the enterprise’s accounting department calculates and pays only part of the benefit paid by the employer, which is 3 days for illness. The rest will be considered by the Social Insurance Fund and paid directly to the account of the employee who provided the sick leave and the application for its payment.

If the region in which the company operates does not participate in the pilot project, then both parts of the sick leave are calculated and paid by the employer, and the Social Insurance Fund subsequently reimburses the amounts paid.

Let's look at the accounting entries for a certificate of incapacity for work using an example. The employee received compensation for 10 days of illness in the amount of 5,000 rubles. The employee received payments for the period of incapacity for work during pregnancy and childbirth in the amount of 145,000 rubles.

Postings on sick leave in regions not participating in the FSS pilot project:

| Debit | Credit | Amount, rub. | Primary document |

| The amount of payment for days of incapacity for work has been determined and personal income tax has been calculated. | Certificate of incapacity for work, certificate of accounting calculation | ||

| Amount due to employer | 20 (25, 26, 44) | Certificate of incapacity for work, certificate-calculation | |

| Amount due to the Social Insurance Fund | Certificate of incapacity for work, certificate-calculation | ||

| Sick leave benefits paid in cash from the cash register | Expense cash order, payroll | ||

| Reimbursement received from FSS | Bank statement | ||

| Maternity benefits accrued | 145 00 | Certificate of incapacity for work, certificate-calculation | |

| Financial assistance allowance was transferred from the current account | 145 000 | Payment order, bank statement | |

| Reimbursement of financial and economic benefits received from the Social Insurance Fund | 145 000 | Bank statement |

Accrual of sick leave - postings for 44 regions participating in the FSS pilot project:

| Debit | Credit | Sum. rub. | Primary document |

| Sickness benefits accrued at the expense of the employer | 20 (25, 26, 44) | Sick leave, certificate-calculation | |

| Personal income tax accrued on sick leave amount | Help for accounting calculations | ||

| Payment of sick leave benefits in cash from the cash register | Expense cash order, payroll | ||

| Payment of sick leave benefits from a current account | Payment order, payroll |

If the payment is made through a current account, then the posting will be D 70 K 51 in the amount of 1305 rubles.

Sick leave issued for pregnancy does not generate a statement, since it is fully paid at the expense of the Social Insurance Fund. The same applies to payments in connection with an accident at work.

Payment of sick leave in 1C

Create a document Payroll for February in the section Salaries and personnel - All accruals.

Check that the document reflects the amount of the benefit.

Form a statement for payment of benefits in the usual manner:

- Payment of wages through the cash register: in cash according to the statement

- Paying salaries through a bank using bank cards

We have successfully discussed how to calculate and manage sick leave in 1C 8.3 Accounting.

Test yourself! Take the test:

- Test No. 18. Salary settings in 1C

- Test No. 17. Settings for insurance premiums in 1C