Is maternity leave considered maternity leave?

Parental leave must be distinguished from maternity leave, which is leave granted in connection with pregnancy and childbirth (Article 255 of the Labor Code of the Russian Federation) and issued with sick leave. Its name goes back to the decree “On Maternity Benefits” issued in 1917 in Russia.

Maternity leave is mandatory and is given only to the mother. Leave to care for a child up to 1.5 years old (Article 256 of the Labor Code of the Russian Federation) is taken at will, can be used in parts, be provided not only to the mother, but also to other persons actually caring for the child, and allows for the possibility of continuing (resuming) work during it on a part-time basis.

Expert advice will help you arrange parental leave wisely. Get free trial access to ConsultantPlus and go to the material.

Caring for a baby: vacation and allowance

Upon the birth of a child, the state provides the mother or another person with the opportunity to care for the new citizen by providing appropriate leave. While on this leave, which can last up to 3 years, for the first year and a half, the caregiver has the right to receive social financial support guaranteed by the state - a child care allowance for up to 1.5 years. It is provided through the finances of the Citizens Social Insurance Fund, which consists of transferred insurance contributions.

NOTE ! Even if the vacation after your child turns 1.5 years old lasts up to 3 years, the payment of state benefits will be stopped, instead only monthly compensation from the employer is due (50 rubles)

Can going on maternity leave without authorization lead to dismissal?

Obtaining parental leave depends only on the desire of the child’s mother to take it, expressed in the application. The employer does not have the opportunity not to provide such leave. So, having written the necessary application, a woman can go on vacation without waiting for the employer’s decision. Even if the latter is not satisfied with this situation, he will not be able to fire the employee for absenteeism (decision of the Moscow City Court dated November 12, 2012 in case No. 11-6805).

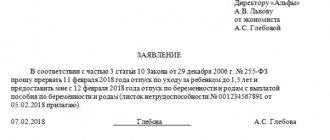

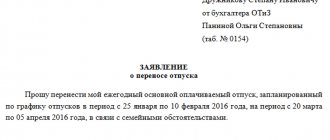

For more information on how to fill out an application for parental leave, read the article “Application for parental leave - form and sample” .

If the corresponding leave is taken not by the mother, but by the father or another person, simultaneously with the application, the employer must submit a document confirming that the child’s mother (or both parents, if it is not the parent who takes the leave) is either working (and such leave has not been issued at work), or is unemployed. A person who has taken out such leave is fully covered by all the guarantees provided by Article 256 of the Labor Code of the Russian Federation:

- maintaining his job;

- the ability to use vacation in parts;

- receiving care benefits;

- the opportunity to resume work on a part-time basis while maintaining benefits;

Read about how the working day must be reduced in order for benefits to be maintained here.

- accounting for vacation time in the length of service.

Allowance for caring for a disabled child

A monthly allowance for caring for a disabled child is provided in case of caring for him under the age of 18 years. To receive this benefit, the parent or adoptive parent must be able to work, but not work. Only in this case will a benefit be assigned.

The amount of this benefit in 2022 for parents depends on the region and on the type of family relationship between the disabled person and the caregiver. For example, in Moscow, the parent or adoptive parent of a disabled child is paid 10,000 rubles, and another relative or non-family member is paid 1,200 rubles.

These benefits are paid not by the Social Insurance Fund, but by the Pension Fund. Therefore, you should apply for them in 2022 directly to the Pension Fund.

What benefits are paid during parental leave in 2020–2021?

For a person who has taken leave to care for a child, Article 256 of the Labor Code of the Russian Federation secures the right to receive benefits at work related to this leave. Including benefits are paid in case of part-time work. Moreover, it does not matter where the employee continues to work under such conditions: where he is paid benefits, or in another place.

The types and amounts of benefits provided for in Article 256 of the Labor Code of the Russian Federation (with comments for 2020–2021) are as follows:

- Monthly allowance for child care up to 1.5 years (Article 14 of the Law “On State Benefits for Citizens with Children” dated May 19, 1995 No. 81-FZ). It is estimated as 40% of the employee’s average earnings determined for the 2 years preceding the vacation. However, there is an upper limit to its size, defined as the sum of the maximum values from which contributions to the Social Insurance Fund were paid in each accounting year, divided by 730 (clause 3.3 of Article 14 of the Law “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity " dated December 29, 2006 No. 255-FZ), as well as the minimum benefit amount.

What are the maximum and minimum benefits in 2022, see ConsultantPlus. Trial access to this and other system materials can be obtained free of charge.

In case of interruption of vacation and return to work full-time, payment of benefits is terminated (letter of the Ministry of Labor of the Russian Federation dated May 16, 2013 No. 13-7/3030623-2831).

- Monthly compensation in the amount of 50 rubles. (Decree of the President of the Russian Federation dated May 30, 1994 No. 1110), paid until the child reaches 3 years of age and calculated taking into account the regional coefficient (Decree of the Government of the Russian Federation dated November 3, 1994 No. 1206).

Important! From 2022, compensation is 50 rubles. for child care under 3 years old has been cancelled. It must continue to be paid only for children born before 12/31/2019 inclusive (Presidential Decree No. 570 dated 11/25/2019).

- Additional payments established by regional laws, made at least once a quarter (Article 16 of Law No. 81-FZ).

Thus, parental leave provided for in Art. 256 of the Labor Code of the Russian Federation, taking into account comments regarding the timing of payment of benefits during it, is divided into 2 parts:

- up to 1.5 years, for which payment of all types of established benefits is mandatory, including monthly care allowance;

- from 1.5 to 3 years, during which care allowance is not paid, but compensation established by Decree No. 1110 continues to be paid (for children born before 2022), as well as additional payments established in the region (if the corresponding regional legislative act).

An exception is the care allowance paid to citizens affected by radiation during the Chernobyl disaster. For them, it is set at double the amount and is paid until the child turns 3 years old (Decree of the Government of the Russian Federation dated July 16, 2005 No. 439, order of the Ministry of Health and Social Development of the Russian Federation dated December 1, 2008 No. 692n).

Read more about how child benefits are assigned here .

Calculation of child care benefits in 1C: ZUP 8

We will consider the procedure for calculating monthly child care benefits until the child reaches the age of 1.5 years in the 1C: Salaries and Personnel Management 8 program, edition 3, using the following example.

Example

Employee of LLC "Style" E.S. Zybina from 06/18/2020 to 04/30/2023 is granted leave to care for her first child until she reaches the age of 3 years. A childcare benefit for children up to 1.5 years old is also accrued from 06/18/2020 to 10/30/2021. Child care benefits for children under 3 years of age are not accrued (child born on April 30, 2020). The employee has been working at Stil LLC since 06/03/2019. The amount of earnings for 2022 was 420,000 rubles. The employee also provided a certificate from another employer about the amount of earnings for 2022, which amounted to 100,00 rubles, for 2022 - 377,570 rubles.

In the program “1C: Salaries and Personnel Management 8” (rev. 3) the following actions are performed:

- Registration of parental leave.

- Calculation and accrual of benefits for child care up to 1.5 years.

Registration of parental leave

Providing parental leave for a child up to 1.5 years and assigning benefits are made in the program using the Child Care Leave document (section Salary - Parental Leave and Returns from Leave - button Create - Child Care Leave).

In the Month field, select the month in which the employee is granted parental leave for up to 1.5 years (Fig. 1).

Rice. 1

The Organization field is filled in by default. If more than one organization is registered in the information base, then you must select the organization in which the employee is registered.

The Date field indicates the date the document was registered in the infobase. In the Employee field, select an employee who is granted parental leave for up to 1.5 years. The Start Date and End Date fields indicate the period of parental leave. In our Example - from 06/18/2020 to 04/30/2023 (parental leave period up to 3 years). The estimated end date of the vacation is indicated for informational purposes and is used to print the order.

An employee's return from vacation is registered with the document Return from Care Leave, which indicates the actual end date of the vacation. It is convenient to enter a document on the basis of a discontinued vacation. Starting from the specified return date, the benefits assigned to the employee will be terminated and his previously existing planned accruals will be resumed. If necessary, they can be changed in this document.

The Free up salary for the vacation period flag is set if it is necessary to free up the employee's salary at his place of work in the organization for the vacation period. Then, according to the start date specified in the document, the release of rates for all places of work of the employee in the organization is registered, and on the end date of the vacation, rates are taken up again. The flag appears in the document if the ability to maintain a staffing table is enabled in the personnel records settings (section Settings - Personnel records - link Setting up staffing). In our Example, the flag does not need to be set.

Next, fill out the Benefits tab in the Benefits section for up to 1.5 years (at the expense of the Social Insurance Fund). The Pay by flag is set and the date on which child care benefits up to 1.5 years of age will be paid, inclusive, is indicated. In our Example - until 10/30/2021. If leave is granted to care for two or more children, then the date of achievement of the age of 1.5 years for the eldest (eldest) of the children for whom care is provided during the leave period is indicated.

When this child turns 1.5 years old, the program must register a change in the conditions for calculating the amount of benefits (date of payment of benefits, number of children) using the document Change in terms of payment for parental leave, which can be entered based on the document Parental leave .

The Number of children field indicates the number of children being cared for up to 1.5 years. For example, if you are caring for your first child, you must specify the quantity “1” and set the flag This is the first child. The first child of a mother is understood as a child (one of the children) born in the first successful birth or adopted chronologically first.

If an employee has one child (for example, 5 years old), and then a second one is born, “1” is indicated in the field, and the flag This is the first child does not need to be set (since care is provided for the second child born in the second successful birth) .

If the employee’s first child was born, then it is indicated in field “2” and the flag Among the children has a first child is set.

If an employee has one child (for example, 5 years old), and then two more are born, then “2” is indicated in the field, and the Among children there is a first child flag does not need to be set. Setting the flag affects the minimum benefit amount. In our Example, “1” is indicated and the This is the first child flag is set, because the care is being taken for the first child.

The Take into account the earnings of previous policyholders is set by default, so that when calculating benefits, the earnings that the employee received from other policyholders (employers) for the two previous calendar years (in our Example, 2022 and 2022) are taken into account. The amount of earnings received from other employers is registered in the document Certificate for calculating benefits (incoming) (section Salary - Certificates for calculating benefits). If the Take into account the earnings of previous policyholders is reset, then when creating the next parental leave for the same employee, the flag will remain reset (i.e., the setting of the flag from the last document is remembered).

The Apply benefits when calculating benefits flag is inactive (even if the employee’s card indicates that he is entitled to a benefit). Benefits assigned from July 1, 2016 to employees exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant are paid at the expense of the Federal Social Insurance Fund of the Russian Federation in a single amount in accordance with Federal Law dated December 29, 2015 No. 388-FZ (previously, benefits were paid in double amount and before until the child reaches three years of age).

If an employee is employed on a part-time basis, then when calculating benefits in the case where the employee’s earnings for the billing years are absent or below the minimum wage, in accordance with the law, the share of part-time work must be taken into account (the average earnings on the basis of which benefits are calculated in these cases are determined proportional to the working hours of the insured person). If the work is performed full time, then by default the value of 1.000 is indicated in the Percentage of part-time field. If necessary, the share can be changed manually in the document.

The Regional coefficient field indicates the value of the regional coefficient that is applied in the organization or separate division.

This field is filled in automatically in accordance with the value specified in the organization or separate division card (Settings section - Organizations - Basic information tab and Settings section - Divisions - Main tab) as a federal coefficient.

In the Average daily earnings field, the amount of average daily earnings is automatically calculated according to the information base, based on information for the previous two calendar years. Data for calculating average earnings can be viewed/edited using the pencil button (Fig. 1). When you click the button, the Data Entry form for calculating average earnings opens. If the information base contains data taken into account when calculating average earnings, then in the automatic calculation mode this data is automatically entered into a table summarized by calendar year of the billing period (Fig. 1). The number of calendar days for each year that fall on days of illness, maternity leave, parental leave and the period of release of an employee from work with full or partial retention of wages in accordance with the legislation of the Russian Federation, if the wages are maintained, is also automatically calculated. During this period, insurance contributions to the Social Insurance Fund of the Russian Federation were not accrued. In this form, click the Add help from previous button. place of work, you can fill out a certificate to calculate benefits indicating the amount of earnings received from other employers, which will automatically be reflected in the form. You can also set the switch to the Manually set position and select the desired years for calculating benefits. You can also manually edit data in the form for months in which salaries have already been calculated in the program. Corrected data is highlighted in bold. Please note that changes made in such months are not taken into account in subsequent calculations of average earnings (unlike months for which salaries have not yet been accrued in the program). These corrections affect only the calculation of average earnings and only in the specific copy of the document in which they are made.

The Calculate wages for flag is set if it is necessary to make wage calculations for the time before the start of parental leave. When you check the flag, new bookmarks appear - Remuneration; Deductions, personal income tax; Repayment of loans; Contributions and Payment Adjustments. The Planned payment date field is filled in automatically.

In the section Benefits up to 3 years (at the expense of the employer), the Pay by flag is set and the date on which, inclusive, monetary compensation will be paid for the period of parental leave up to 3 years is indicated (Fig. 1). In our Example, there is no need to set the flag, since the child was born in 2022. Please note that starting from version 3.1.3.120 “1C: Salaries and HR Management 8”, when creating a new information base, this section is not in the document, since from 01/01/2020, by Presidential Decree of November 25, 2019 No. 570, the monthly compensation payment in the amount of 50 rub. certain categories of persons on parental leave to care for a child under 3 years of age. The right to receive compensation payments after 01/01/2020 is reserved for certain categories of persons (clause 2 of Decree No. 570).

But employers continue to be required (i.e. after 01/01/2020) to pay compensation to employees who are currently on parental leave or whose child was born before 01/01/2020.

Rice. 2

On the Accruals tab, by default, the Do not accrue salaries and do not pay advance payments during vacation flag is selected (Fig. 2). When the flag is set, the employee’s planned accruals that were in effect at the time of granting parental leave are terminated. Starting from the start date of the vacation, the automatic calculation of the employee’s salary stops, and the employee will not be taken into account when filling out statements for the payment of a planned advance if the advance payment was assigned in the amount or percentage of the tariff. If, along with the benefits, the employee must also receive a salary, for example, if they work part-time, then the flag should be removed. At the same time, its current planned accruals will remain. If necessary, they can be changed directly in this document by checking the Change accruals flag. Moreover, if a person has several jobs in the organization, work with accruals for each of his jobs will be available.

From 01/01/2021, all regions will switch to direct payments of benefits from the Social Insurance Fund of the Russian Federation. After setting the date on which child care benefits up to 1.5 years will be paid, starting from 01/01/2021, the FSS Pilot Project tab appears (in our Example, parental leave for a child up to 1.5 years ends on 10/30/2021). On the FSS Pilot Project tab, information about the children being cared for is indicated (Fig. 2).

| 1C:ITS For information about the FSS RF pilot project and about filling out the “FSS Pilot Project” tab, see the reference book “Personnel accounting and settlements with personnel in 1C programs” section “Instructions for accounting in 1C programs”. |

The Manager field is automatically filled in with the last name, first name, patronymic, and position of the head of the organization from the Organization directory (section Settings - Organizations - Accounting policies and other settings tab - Responsible persons link) based on information about the responsible persons of the organization and is used to decipher the signature in the printed form of the order granting leave (button Print - Order for granting leave (T-6)). Next, click the Submit button.

In order to analyze the results of the accrual, you can generate a printed form for calculating average earnings by clicking the Print - Calculation of average earnings button.

The child care benefit for children under 1.5 years of age is calculated based on the average earnings of the insured person, calculated for the 2 calendar years preceding the year of parental leave. Average earnings are taken into account for each calendar year in an amount not exceeding the maximum base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for the corresponding calendar year (for 2022 - 815,000 rubles and for 2019 - 865,000 rub.).

In our Example, the employee’s earnings for 2022 are RUB 377,570, which does not exceed the base limit for 2022, and earnings for 2022 are RUB 520,000, which also does not exceed the base limit for 2022.

1. Earnings for the accounting years:

RUB 377,570 + 520,000 rub. = 897,570 rub.

The number of calendar days in the billing period was 730, of which:

- in 2022 - 365 calendar days;

- in 2022 - 365 calendar days.

2. Average daily earnings

:

RUB 897,570 / 730 days = 1,229.55 rubles.

This is less than the maximum average daily earnings for maternity benefits in 2022:

815,000 rub. + 865,000 rub. / 730 = 2,301.37 rubles.

In accordance with Federal Law No. 463-FZ dated December 27, 2019, on the day the insured event occurs, the minimum wage is 12,130 rubles.

3. Minimum average daily earnings, calculated from the minimum wage:

RUB 12,130 x 24 / 730 days = 398.79 rub.

This is less than the employee's actual average daily earnings. To calculate the benefit, the employee’s average daily earnings of 1,229.55 rubles are taken, since it is more than the minimum average daily earnings calculated from the minimum wage.

With what comments and reservations is Art. 256 of the Labor Code of the Russian Federation (Part 3) in 2020–2021?

Art. 256 of the Labor Code of the Russian Federation allows a person who has taken out parental leave to work part-time during the leave if there is a desire. The employer must provide such an opportunity (letter of Rostrud dated September 12, 2013 No. 697-6-1) and cannot force the employee to refuse this job.

At the same time, there are often situations when an employee cannot cope with the amount of work, makes mistakes or violates the work schedule established for him (is late or absent), that is, commits disciplinary offenses. Can disciplinary action be taken against him?

The Labor Code of the Russian Federation does not contain a ban on this. However, there are 2 opposing points of view regarding the use of dismissal as a disciplinary measure:

- it is acceptable (letter of the Ministry of Labor of the Russian Federation dated September 10, 2013 No. 14-2/3045-623-4334);

- it is illegal, because work is carried out during vacation, and it is impossible to dismiss an employee during this period (Article 81 of the Labor Code of the Russian Federation) (decision of the Primorsky Regional Court dated 05/03/2012 in case No. 33-4035).

Thus, disciplinary action in the form of dismissal during parental leave will most likely be considered illegal. Safe disciplinary measures against such employees should be considered:

- comment;

- rebuke.

It is also possible to influence labor results through deduction of bonuses in connection with the employee’s disciplinary offenses, if it is provided for by the employer’s bonus regulations.

For more information about the cases in which deduction of bonuses is associated with a disciplinary offense, read the material “What are the grounds in the Labor Code of the Russian Federation for depriving an employee of a bonus?” .

Registration of parental leave in ZUP 3.1

Child care leave is provided to both the mother, grandmother, grandfather, father, or other person actually caring for the child. At the same time, an employee, while on parental leave, can go to work on a part-time basis while maintaining benefits.

Entering the “Parental Leave” document

Parental leave is issued in 1C ZUP 8.3 with the document Child Care Leave , which is located in the Personnel section - Parental Leave and Returns from Leave.

- In the Month , indicate the month in which the vacation begins.

- The Date and Number fields are used as details of the vacation order in printed forms T-6 and T-2.

- In the Start Date and End Date , you must indicate the period of parental leave, according to the employee’s application. The end date is usually the date the child turns 3 years old.

For example, employee Orlova E.N. applied to the employer for parental leave from August 6, 2022 until the child reaches the age of 3 years. The child will be born on May 28, 2022. This is the employee's second child.

Create a document Parental leave , and fill out its header as follows:

- Month —month of vacation start—August 2021;

- Date - date of order - 08/04/2021;

- start date — 06.08.2021;

- End date - the date when the child turns 3 years old - 05/28/2024.

You can print out an order for granting leave using the unified form T-6.

Assignment of benefits for the period of parental leave

Assignment of child care benefits up to 1.5 years

In order for an employee to receive monthly benefits from the Social Insurance Fund for up to 1.5 years, in the Child Care Leave , select the Pay by and indicate the date when the child turns 1.5 years old.

You must also indicate the number of children being cared for. You should indicate exactly the number of children under 1.5 years of age for whom benefits are calculated, and not the total number of the employee’s children.

Select the This is the first child check box if this is the employee's first child. The first child is understood as the child born in the first birth or adopted chronologically first. This information is needed to correctly determine the amount of the minimum child care benefit, as well as to correctly fill out reports.

In the example under consideration, 1.5 years will turn on November 28, 2022, we will indicate this in the document. Since this is the employee’s second child, uncheck the This is the first child checkbox.

Average earnings are calculated in the program in accordance with the law.

Average daily earnings are calculated based on earnings for the two previous calendar years.

Average daily earnings are calculated using the formula:

- (Income for the 1st calendar year + Income for the 2nd calendar year) / (Number of calendar days in two calculation years - excluded days).

Excluded days are days on sick leave, maternity leave, parental leave, as well as in other cases of release from work with full or partial retention of wages, if insurance premiums are not charged on the retained wages.

The monthly benefit amount is calculated using the formula:

- Average daily earnings * 30.4 * 0.4.

The benefit for an incomplete month is calculated as:

- Benefit for a full month / Calendar days of the month * Number of days of parental leave in a month.

Average daily earnings field displays the amount of average earnings used to calculate the monthly child care benefit for children up to 1.5 years old. The program calculates it automatically based on earnings for the previous two years.

By clicking the button with the image of a green pencil, you can open a form for details of calculating average earnings.

If in one or two previous calendar years the employee was on maternity leave or child care leave, then this year (year), at the request of the employee, can be replaced by previous years (year), provided that the amount of the benefit it will increase.

To reflect such a replacement in the program, the calculation period should be adjusted in the form of calculating the average. Set the switch to the Set manually and specify the years in accordance with the employee’s application.

Employee Gromova N.P. applied to the employer for parental leave from August 18, 2021 until the child reaches the age of 3 years. The employee also wrote an application to change the years in the billing period when calculating benefits for 2017 and 2022, due to the fact that in 2022 she was on maternity leave, and in 2022 on leave to care for her first child.

Average earnings for the billing period 2022 and 2022 amounted to 1,934.32 rubles.

Let's look at the details of the calculation.

Let's calculate the total amount of earnings for two years:

- 456,500.00 (income for 2022) + 0 (there was no income for 2022, since the employee was on leave to care for her first child all year) = RUB 456,500.00.

Let's calculate the number of days:

- 731 (total number of calendar days for 2 years) - 129 (number of excluded days in 2022) - 366 (number of excluded days in 2020) = 235 days

Let's determine the average earnings for calculating benefits:

- 456,500.00 (total income) / 235 (number of days taken into account) = 1934.32 rubles.

Let's open the form for calculating average earnings and change the calculation period to 2022 and 2022.

Let's consider the details of calculating average earnings for the billing period 2022 and 2022.

The employee's income for 2022 was 880,000.00. The income limit in 2022 is 755,000.00, so the amount taken into account for 2022 will be 755,000.00.

Income for 2022 amounted to 747,800.00, the size of the limit in 2022 was 815,000 rubles. This means that earnings for 2022 will be taken into account in full, in the amount of 747,800.00.

Let's calculate the total amount of earnings for two years:

- 755,000.00 (income for 2022) + 747,800.00 (income for 2022) = RUB 1,502,800.

Let's calculate the number of days:

- 730 (total number of calendar days for 2 years) – 16 (number of excluded days) = 714 days

Let's determine the average earnings for calculating benefits:

- 1,502,800 (total income) / 714 (number of days taken into account) = 2,104.76 rubles.

Thus, for the billing period 2022 and 2022, the average earnings will be 2,104.76 rubles. This amount is higher than that calculated for the 2022 and 2022 billing years. This means that the condition necessary to replace the years is satisfied.

Details of the calculation of the average can also be viewed in a printed form (Print - Calculation of average earnings).

Assignment of payment for child care up to 3 years of age

From January 1, 2020, by Decree of the President of the Russian Federation dated November 25, 2019 N 570, the accrual of compensation payments for child care under 3 years of age (50 rubles) was cancelled However, if the compensation payment is 50 rubles. was assigned to children born before 12/31/2019 (inclusive) , then it should be paid after 01/01/2020.

Also, LNA organizations may provide for the accrual of such payment at the expense of the organization even after 01/01/2020.

In order for an employee to receive a monthly compensation payment at the expense of the employer for a child under 3 years of age, in the Benefits up to 3 years of age (at the expense of the employer) , select the Pay by and indicate the date when the child turns 3 years old.

Child Care Leave document to display a block on the payment of benefits up to 3 years, the program must have an accrual set up with the assignment Child Care Benefit for up to 3 years .

Tab “Direct Social Security Payments” of the “Parental Leave” document

On the Direct Social Security Payments , information about the child and the documents provided is filled in.

This information is necessary for generating the documents Information for the register of direct payments to the Social Insurance Fund and the Register of information necessary for the assignment and payment of benefits (Reporting, certificates - Transfer of benefit information to the Social Insurance Fund).

The document Information for the register of direct payments to the Social Insurance Fund can be created using the link Application not entered .

“Accruals” tab of the “Parental Leave” document

Accruals tab contains information about the employee's current planned accruals.

By default, the Do not accrue salaries and do not pay advance payments during vacation is selected. This means that during the vacation period, the employee will only receive benefits for child care up to 1.5 years and compensation payment at the expense of the employer for child care up to 3 years.

If the employee, while on parental leave, will work part-time, then the Do not accrue wages or pay advance payments during leave checkbox should be unchecked. In this case, the employee will be accrued both benefits and his usual planned accruals ( Payment according to salary , Monthly bonus , etc.)

Working on parental leave on a part-time basis and returning from parental leave to ZUP 3.1.

If you plan to change planned accruals during the vacation period (for example, cancel some allowance or change its size), then you should check the Change accruals so that the table becomes available for editing and then make the necessary adjustments to accruals.

The ability to calculate salary for the time before the start of the vacation in the “Parental Leave” document

Parental Leave document allows you to calculate your salary for the time before the start of the leave.

If you need to make calculations for wages for the period from the beginning of the month to the start date of care leave, then you should check the Calculate wages for . The month is set by the month from the document header. After checking the box in the Parental Leave , additional tabs become available, similar to the tabs in the document Calculation of salaries and contributions .

Employee Nikanorov E.K. applied to the employer for parental leave from 08/10/2021 until the child reaches the age of 1.5 years (this will happen on 01/24/2022). It is necessary to send the employee on parental leave, assign benefits for up to 1.5 years, and also calculate the salary for the period from 08/01/2021 to 08/09/2021.

We will create a document Parental leave , we will indicate the period of leave in accordance with the application.

In the Allowance up to 1.5 years , select the Pay by and indicate the date the child reaches the age of 1.5 years – 01/24/2022 and check the This is the first child .

And also check the Calculate salary for August 2022 checkbox.

After this, the document will calculate salaries, deductions, as well as taxes and contributions for the period before the start of the vacation.

In what cases can an employee be fired during parental leave?

Art. 256 of the Labor Code of the Russian Federation declares the obligation to maintain a workplace for the employee during parental leave. That is, it is impossible to fire him in a normal standard situation on the initiative of the employer.

However, there are situations when dismissal due to the employer’s initiative does occur during such leave or before the child reaches the age of 3 years. These include (Article 261 of the Labor Code of the Russian Federation):

- liquidation (termination of activities) of the employer;

- termination of an employment contract concluded for a certain period;

- dismissal of an employee who has left parental leave early due to gross violations of labor discipline (for example, absenteeism, theft, disclosure of secrets, immoral acts).

However, there are no restrictions on the dismissal of an employee during this period on his own initiative. It happens as usual.

For more information about disciplinary offenses considered gross, read the article “Labor discipline and responsibility for its violation .

Women who were fired or quit during the period when they have the right to receive child care benefits for up to 1.5 years may then be:

- Employed until the end of the benefit period. Then the new employer will continue to pay him according to his own calculations.

- Not employed. Then the benefit can be received from the social security authorities. But you will have to make a choice between 2 benefits: unemployment and care (clause 40 of the order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n).

In some situations, an employee may need to resign in order to care for a child under 14 years of age. ConsultantPlus experts explained in detail how to formalize dismissal for caring for a child under 14 years of age. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Five questions from accountants about parental leave for children up to one and a half years old

1. The employee works part-time and at the same time is on maternity leave until the child reaches age

If an employee works part-time while on maternity leave, she is entitled to annual paid leave.

Rationale. According to Art. 256 of the Labor Code of the Russian Federation, parental leave can be used in whole or in part by the child’s father, grandmother, grandfather, other relative or guardian who is actually caring for the child. In addition, at the request of a woman or one of the persons mentioned above, while on maternity leave, they can work part-time or at home while maintaining the right to receive state social insurance benefits. During the period of parental leave, the employee retains his place of work (position).

Parental leave is counted toward the total and continuous work experience, as well as into the length of service in the specialty (except for cases of early assignment of an old-age insurance pension).

Thus, an employee can receive both a monthly child care allowance until the child reaches the age of one and a half years, and wages (calculated in proportion to the time worked or depending on the amount of work performed), the amount of which is usually indicated in an additional agreement to the employment contract.

By virtue of Art. 121 of the Labor Code of the Russian Federation, the length of service that gives the right to annual basic paid leave includes, among other things, the time of actual work on a part-time basis or at home, but does not include parental leave. In addition, part-time work does not entail for employees any restrictions on the duration of annual paid leave, calculation of length of service and other labor rights (Article 93 of the Labor Code of the Russian Federation).

So, a person on parental leave and working part-time, along with other employees, has the right to annual paid leave, during which he retains his place of work (position) and average earnings (Article 114 of the Labor Code of the Russian Federation ).

2. The employee works part-time and at the same time is on maternity leave until the child reaches the age of one and a half years with the payment of appropriate benefits. She was given annual paid leave.

Is it necessary to pay child care benefits until the child reaches the age of one and a half years during the period of annual paid leave?

The insured person can either be on parental leave and receive the corresponding benefit, or interrupt parental leave to use the annual basic paid leave and, accordingly, receive vacation pay.

Rationale: In accordance with Parts 1 and 2 of Art. 11.1 of Federal Law No. 255-FZ, benefits are paid to insured persons from the date of provision of parental leave until the child reaches the age of one and a half years. However, the right to benefits is retained if the person on parental leave works part-time and continues to care for the child.

At the same time, according to the clarifications of the Plenum of the Armed Forces of the Russian Federation, annual paid leave is not provided to an employee who is on parental leave and at the same time receives child care benefits, since labor legislation does not provide for the use of two or more leaves at the same time (clause 20 of the Resolution dated 01/28/2014 No. 1 “On the application of legislation regulating the labor of women, persons with family responsibilities and minors”).

Thus, the insured person can either be on parental leave and receive the corresponding benefit, or interrupt parental leave to use the annual basic paid leave.

Interrupted vacation in accordance with Art. 256 of the Labor Code of the Russian Federation can subsequently be renewed, and the monthly child care allowance can be reassigned. Such clarifications are presented in letters of Rostrud dated October 15, 2012 No. PG/8139-6-1, FSS of the Russian Federation dated July 14, 2014 No. 17-03-14/06-7836. 3. The employee works part-time and at the same time is on maternity leave until the child reaches the age of one and a half years. She is paid an appropriate monthly child care allowance.

Should the employer pay such an employee a certificate of incapacity for child care?

If an employee works part-time while on maternity leave, during this period the employer routinely pays her sick leave to care for a sick child.

Rationale. Based on Art. 9 of Federal Law No. 255-FZ, temporary disability benefits are not assigned for the period of release of the employee from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation, with the exception of cases of loss of ability to work due to illness or injury during the period of annual paid leave.

At the same time, clause 40 of the Procedure for issuing certificates of incapacity for work, approved by Order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n, establishes that certificates of incapacity for work are not issued during the period of parental leave until the child reaches the age of three years, except for cases of performing work during the specified period for part-time or at home conditions.

In accordance with Art. 256 of the Labor Code of the Russian Federation, at the request of a woman or another person actually caring for a child, while on parental leave, they can work part-time or at home while maintaining the right to receive state social insurance benefits.

Thus, if an employee works part-time while on parental leave, during this period the employer routinely pays him a certificate of incapacity for caring for a sick child.

4. The employee works part-time and at the same time is on maternity leave until the child reaches the age of one and a half years. She is paid a monthly child care allowance.

Should the employer pay for sick leave when the woman herself falls ill?

If an employee works part-time while on maternity leave, during this period the employer routinely pays her sick leave in the event of her illness.

Rationale. In accordance with clauses 23, 40 of the Procedure for issuing certificates of incapacity for work, if an employee who is on parental leave before reaching the age of three years works part-time or at home, in the event of temporary disability, he is issued a sick leave certificate on a general basis.

In addition, a part-time employee, in the event of illness, has the right to receive temporary disability benefits, since he is an insured person (Clause 1, Part 1, Part 2, Article 2 of Federal Law No. 255-FZ, Part. 3, Article 93, Article 183 of the Labor Code of the Russian Federation).

So, the employer is obliged to pay this employee both temporary disability benefits and child care benefits.

Please note

According to clause 42 of the Procedure and conditions for the appointment and payment of state benefits to citizens with children, approved by Order of the Ministry of Health and Social Development of the Russian Federation dated December 23, 2009 No. 1012n, if the child’s mother, receiving a monthly child care allowance, cannot care for the child due to with his own illness, the right to receive a monthly child care benefit can be exercised by another family member who actually takes care of him during the specified period.In this case, the right to assign and pay child care benefits can be transferred from one family member to another, depending on which of them is actually providing care. This means that child care benefits are not paid only if a woman on maternity leave is actually unable to care for him (for example, during hospitalization).

5. The employee presented a certificate of incapacity for work to care for her grandson (child is three months old).

Should the organization pay her sick leave and what documents should be required from the employee in such a situation?

The organization is obliged to pay for a certificate of incapacity for child care issued to an employee (child’s grandmother) who is not on parental leave. However, there is no need to require her to submit additional documents.

Rationale. A certificate of incapacity for work is issued to the person who actually takes care of the sick family member. This could be the child's grandfather or grandmother. No restrictions are established by law. This conclusion follows from the Procedure for issuing certificates of incapacity for work.

According to clause 34 of this procedure, a certificate of incapacity for work for caring for a sick family member is issued by a medical worker to one of the family members (guardian, trustee, other relative) who is actually providing care. In the situation under consideration, the actual care of the child was provided by the grandmother, which means that it is she who the doctor issues a certificate of incapacity for work.

In addition, we note that the current Procedure does not contain grounds for refusing to issue a sick leave certificate to a grandmother if the child’s mother is on leave to care for him. A medical worker has the right to refuse to issue sick leave only to a person on parental leave (clause 40 of the Procedure for issuing certificates of incapacity for work), since the employee does not need to be released from work during this period.

Due to the fact that the employee, the child’s grandmother, did not apply for leave to care for him, the restriction on issuing a certificate of incapacity for caring for a sick child, established by paragraph 40 of the said procedure, does not apply to her.

Thus, the organization is obliged to pay for the certificate of incapacity for child care issued to the employee (the child’s grandmother).

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up