Article 262 of the Labor Code of the Russian Federation: essence with comments

In Art. 262 of the Labor Code of the Russian Federation provides that parents (or persons equivalent to them, for example legal guardians) of disabled children can receive monthly additional paid days off in order to fulfill their parental responsibilities in relation to such children.

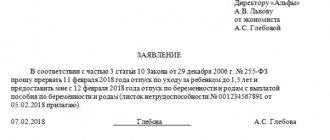

The procedure for implementing this norm has changed periodically. Today it is fixed in the Decree of the Government of the Russian Federation dated October 13, 2014 No. 1048. The main document for assigning a benefit will be a written application from the employee in the form from the order of the Ministry of Labor of Russia dated December 19, 2014 No. 1055n.

IMPORTANT! The main feature of paying for such days off is that these expenses of the employer are compensated by the Social Insurance Fund (after receiving the necessary documents).

The provisions of Part 2 of Art. 262 of the Labor Code of the Russian Federation on providing additional days off for women working in rural areas. However, analyzing Ch. 41 of the Labor Code of the Russian Federation, which regulates the work of women and family members, in general it can be assumed that this norm was also introduced to provide women with the opportunity to devote additional time to their family.

New rules for granting days off

From January 1, 2022, the taxation procedure for paying for additional days off provided to care for a disabled child will change. According to paragraphs. "k" clause 1 art. 1 of Federal Law No. 147-FZ of June 17, 2019, the amounts that the employee receives for these days are no longer subject to personal income tax. Until the law comes into force, the average earnings paid are included in the tax base.

As for insurance premiums, the new rules do not apply to them. They must be collected both now and after 01/01/2019.

What are the rules for providing additional paid days?

Days prescribed under Part 1 of Art. 262 of the Labor Code of the Russian Federation are not provided to a specific person during periods of his being on vacation:

- basically;

- additional;

- for child care up to 3 years old.

If the day off coincided with the period of temporary incapacity for work of the person to whom it was due, the day off can be rescheduled within the same month. To do this, the following conditions must be met:

- the disability must end before the end of the calendar month;

- The sick leave must also be presented to the employer before the end of the month.

Additional days off unused in the billing month are not transferred to other periods.

The right to additional days off begins in the month in which the child is diagnosed with a disability.

The right terminates from the month following the month when the disability was lifted or the child turned 18 years old.

How to apply for additional paid days off to care for a disabled child? The answer to the question is in ConsultantPlus. Get trial access to the system and upgrade to the Ready Solution for free.

Documenting

Decree of the Government of Russia dated October 13, 2014 No. 1048 established the procedure for providing additional paid days off to one of the parents (guardian, trustee) to care for disabled children.

It is provided that:

- the provision of additional vacation days is formalized by order (instruction) of the employer;

- the parent independently (in agreement with the employer) can determine the frequency of filing the application (monthly, once a quarter, once a year, as needed, etc.) as necessary;

- To provide days off, supporting documents are required;

- specifics have been established for the submission of individual documents in cases where one of the parents is unemployed, is engaged in business or private practice, and there are also circumstances confirming that the second parent cannot care for a disabled child;

- if one of the parents (guardian, trustee) partially uses additional paid days off in a calendar month, the other can use the remaining days in the same period;

- additional paid days off should not overlap with the days of the next annual paid leave, leave without pay, leave to care for a child until he reaches the age of three years.

The presence of more than one disabled child in a family does not entail an increase in the number of additional paid days off provided. There is also no provision for transferring additional paid days off unused during the month to another month. When recording working hours in aggregate, additional paid days off are provided based on the total number of working hours per day, increased by four times. Each additional paid day off is paid in the amount of the average earnings of the parent (guardian, trustee).

When and how is it confirmed that days off are not being used by the other parent?

If you receive additional days off under Part 1 of Art. 262 of the Labor Code of the Russian Federation, several family members with a disabled child can, the one who approaches the employer with such a request should confirm that the other parent (or an equivalent person) has not yet used the norm of days. To do this, a certificate is issued from the place of work of the other parent or a person equivalent to him.

This benefit is monthly, so you need to write a separate application for days off each time. A certificate of non-use is also presented monthly.

An exception is made for single (according to documents) parents, as well as if the second parent:

- limited in rights, declared missing or dead;

- is in prison;

- is on a long-term trip (for example, on a business trip for more than 1 month).

Of course, these facts will need to be confirmed by documents attached to the application for benefits under Art. 262 Labor Code of the Russian Federation.

NOTE! If the other parent is employed in private practice or is unemployed, documents confirming this must be attached to each application.

What instead of a certificate

What documents, instead of a certificate from the other parent’s place of work, must be provided to receive additional days off to care for a disabled child, if the other parent does not work or provides himself with work?

In this case, each time an employee applies for additional days off, he must submit documents (copies thereof) confirming that the other parent does not work or provides himself with work.

A document confirming that the second parent is not in an employment relationship can be his work book, if it does not contain a current record of employment.

If the second parent is registered as unemployed, then the supporting document may be a corresponding certificate issued by the employment service authority.

Persons who provide themselves with work include, in particular, individual entrepreneurs, lawyers, and private notaries. For example, a certificate of state registration of an individual as an individual entrepreneur can serve as a document confirming entrepreneurial activity.

The status of a lawyer can be confirmed by an appropriate certificate.

What other documents are needed to take advantage of the benefit?

In addition to a certificate of non-use of days off by another person (or documents allowing it not to be issued), the employee submits to the employer:

- ITU certificate about the child’s disability;

- document confirming the registration of the child at the place of residence;

- documents confirming parental rights (birth certificate, adoption certificate, guardianship certificate, etc.).

These documents are submitted once during their validity period. For example, if a certificate from the Bureau of Medical and Social Expertise is issued for 1 year, it is enough to present it once this year.

The employer's representative, after reviewing the original documents, must return them to the employee, making the necessary copies for himself.

Find out how the latest judicial practice develops in the event of an employer’s refusal to provide additional days off to the parent of a disabled child, from an analytical selection from ConsultantPlus. If you don't already have access to the system, get a free trial online.

Reasons for refusal of additional days off

An employer does not have the right to refuse to receive DV to employees who have children with disabilities. The exception is cases when the competence of persons is not confirmed or goes against the law:

- Lack of documents confirming the right to benefits.

- The presence of actual care in the absence of the required status, for example, if the person is a distant relative of a child with a disability or the spouse of the guardian.

- Absence of a certificate from the second parent’s place of employment.

- Applying for a benefit when it is fully used in the period.

A refusal to provide additional training without payment may occur in the case where production needs do not allow providing the employee with an unpaid rest period.

The main conditions for the provision of DO include contacting the employer, eligibility to submit an application and the manager’s agreement with a specific period of absence. By agreement with the employer, the period is postponed to a time convenient for the employee.

How are additional days off paid under Art. 262 of the Labor Code of the Russian Federation?

Only weekends provided in accordance with Part 1 of Art. 262 of the Labor Code of the Russian Federation, that is, for disabled children.

Payment is made based on the standard calculation of average daily earnings for the previous 12 months.

For more details, see the article “How to calculate the average monthly salary (formula)?”

IMPORTANT! If a business maintains aggregated time records, the calculation time is the sum of the hours worked per day multiplied by 4 (or the actual number of days used).

Whether additional days off are subject to insurance premiums was clarified by L.A. Kotova, an active state adviser of the Russian Federation, 3rd class. Get acquainted with the official's point of view by getting free trial access to the ConsultantPlus system.

Payment for additional days off

Additional days off are paid by the employer with subsequent coverage of expenses from social insurance funds. The payment amount is determined by average earnings. For the calculation, income received during the year preceding the event is taken into account. The payment is not compensation. An employee's average earnings are subject to personal income tax and contributions.

Example of calculation of payment for DV

An employee of the organization Kolos LLC is raising a child with a disability at home. Every month she is given 4 days for additional rest and care. Work is carried out on a five-day work week. In January 2022, M. received 4 additional days. The income of the previous year was 196,000 rubles. In the accounting of Kolos LLC, the accountant performs settlement transactions:

- Determines the billing period and the income received.

- Sets the number of working days in the billing period. In the period January-December 2016, M. worked 199 days.

- Calculates the amount of average earnings: Av = 196,000 / 199 = 984.92 rubles.

- Calculates the amount of payment for DV: D = 984.92 x 4 = 3,939.68 rubles.

The amount calculated based on average earnings is summed up with the wages due for January 2022.

Who is provided with additional unpaid days under Art. 262 of the Labor Code of the Russian Federation?

Women workers working in rural areas. Rural area criteria for the purposes of applying Art. 262 are not established in the Labor Code of the Russian Federation. Employers considering applications from female employees for additional leave under the Labor Code of the Russian Federation should take into account socio-geographical criteria and gradations established for their area (rural settlement, urban settlement, etc.).

Employees of the corresponding category can receive 1 additional day off per month without pay.

To whom

An employee who is a parent, guardian or trustee of a disabled child(ren) under the age of 18 is entitled to 4 additional paid days off during each calendar month.

Moreover, both one and both parents can use the weekend, but within the limits of the total number of additional days off per month. For example, if in October the mother of a disabled child received one additional day off, then the father has the right to only three days for this month.