What is the regional coefficient?

The regional coefficient is a special type of cash surcharge that exists in the Russian Federation. Basic rules for such payment:

- Rule one. The regional coefficient is not widespread, but only in some parts of the country. These include regions where a harsh climate prevails and there are environmental problems (for example, regions of the Far North and those nearby). Since these factors negatively affect human health and complicate his work life, the government introduced a regional coefficient.

- Rule two. It is legally established that the regional coefficient is not affected by the total length of service and regional wages.

This coefficient is accrued to employees in addition to their basic labor earnings, which includes the following monetary privileges:

- Pay for work that depends entirely on the employee's specialty, the amount of work performed and the environment in which it was performed.

- Monetary compensation. These include incentives that compensate for the employee’s labor expended in places where environmental indicators deviate greatly from climate standards (for example, they are constantly in severe frost), or they work at radioactively contaminated sites.

- Bonuses, allowances and other incentive cash rewards.

Each region independently regulates this coefficient, that is, it increases it depending on the individual climatic indicators of the area. In this case, payments already come not only from the government budget, but from the budget of the constituent entity of the Russian Federation and municipal spheres.

The overestimated indicator applies to the following entities:

- government bodies of the Russian Federation, which includes the Ministry of Internal Affairs, administrations, etc.;

- government institutions of the Russian Federation;

- local government bodies;

- municipal institutions.

At the legal level, a subject of the Russian Federation may be assigned a maximum amount of regional surcharge. It is standardly established by municipalities located in the region of the Russian Federation.

Ural coefficient

For residents of the Urals, a regional Ural coefficient has been established since November 1987. It applies to the wages of residents of the Urals. The Labor Code establishes that the Government of the Russian Federation approves the coefficients, but today there is no such law that would provide for the regions in which the coefficient is established, as well as the size of the coefficient. Therefore, those regulations that were adopted by government agencies of the constituent entities of the Russian Federation on the basis of the legislation of the USSR are in force to this day.

Thus, as of 2022, the obligation to accrue the Ural coefficient on employee salaries remained with employers in the cities of the Urals (

In what cases is the regional coefficient calculated on sick leave?

The district coefficient is added to the employee by multiplying it by the basic salary. If we talk about the coefficient for sick leave, then in this case it is not added.

This is due to the fact that sick pay is calculated according to the actual salary, which has already been multiplied by the coefficient established by law and issued to the employee.

However, this rule has relaxations. Temporarily disabled workers receive this increase in sick leave even in the following cases:

- A citizen has insurance that is valid for about six months, no more.

- For the previous two working years, the employee had income less than the minimum subsistence level. For example, if a sick leave is issued in 2022, then the years 2022 and 2017 are taken into account, respectively.

- The employee applying for sick leave did not perform labor activities in accordance with the Labor Code of the Russian Federation for the previous two years and did not receive official wages or other monetary privileges.

- Treatment or rehabilitation was disrupted by the employee.

- The cause of injury or illness was alcohol or drug intoxication.

Payments indexed by the Republic of Kazakhstan

The law provides a list of financial income that is subject to the obligation to apply the district allowance:

- the minimum amount of labor remuneration and, accordingly, all payments “tied” to the minimum wage;

- salary, tariff rate, wages themselves - the entire amount received by the employee;

- all additional payments to labor remuneration - compensation, bonuses, allowances for length of service, for qualifications, for military or commercial secrets, etc.;

- surcharge “for harmfulness”;

- compensation for temporary disability;

- remuneration for seasonal workers, part-time workers, flexible or part-time workers;

- pension accruals;

- other funds paid on the basis of an employment or collective agreement.

NOTE! Pensioners will receive increased amounts only as long as they live in “special” territories; moving will necessarily remove the regional indexation of pensions.

How is sick leave with the regional coefficient calculated?

This procedure is purely individual for each subordinate, as it takes into account many nuances. If an illness, injury of any severity or quarantine has caused the need to undergo sanatorium-resort, inpatient rehabilitation or rehabilitation after prosthetics, the size of the coefficient is affected by work experience:

- If the experience is 8 years or more, then the additional payment is 100%, that is, it is identical to the salary.

- If an employee has 5 to 8 years of experience, the coefficient is slightly lower - 80% of the salary.

- And if an employee has worked for only 5 years, then the additional payment for sick leave is only 60% of the standard salary.

In addition to information about percentages, when calculating sickness benefits, the average salary per day and how many days the temporary disability lasted are taken into account.

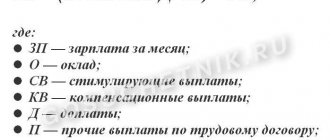

Before calculating the amount of the benefit with the regional coefficient, it is necessary to calculate the employee’s earnings per day. To do this, use the following formula: SDZ = Zp2/730 .

The designations are deciphered as follows:

- SDZ is the average wage per day;

- Zp2 is the employee’s salary for the two previous years.

Calculation example. For an employee applying for sick leave in 2022, the salary for the two previous years was, for example, 1,385,000 rubles, that is, in 2022 - 732,000 rubles, and in 2022 - 653,000 rubles.

We apply the formula: 1385,000/730 = 1897.26. It turns out that average wage per day is 1897.26 rubles.

After this calculation is completed, they begin to calculate the regional coefficient. The formula used is: PVN = (SDZ × KD) × RV + RK.

Let's understand the notation:

- PVN is sickness benefit;

- SDZ – a person’s salary for the previous two years;

- CD – the sum of days during which the employee was temporarily disabled;

- РВ – payment of benefits based on length of service;

- RK is the regional coefficient.

An example of calculating PVN. Let's take the following information. The employee was sick for 14 days – this is a sickness period. We take 60% for RV, and 15% for RK. SDZ is known from the previous calculation. Further:

- Calculate (SDZ × CD) – 1897.26 × 14 = 26561.64.

- We make the final calculation: (SDZ × KD) × RV + RK – 26561.64 × 0.6 + 0.15 = 15937.134.

As a result, it turns out that the benefit for temporary unemployment due to illness is equal to 15,937.134 rubles for two weeks for this prospective employee.

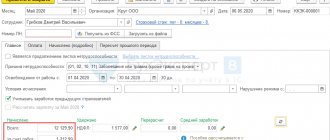

An example of calculating sick leave in 2022, taking into account the coefficient

Petr Semenovich Ivanov works at Aspect LLC. From January 24, 2022 to February 2, 2022, he is forced to take sick leave due to COVID-19. The employee’s insurance experience is more than 8 years, that is, he is entitled to a benefit of 100% of his salary. The region also has a regional coefficient of 50%. Ivanov’s income over the last 2 years is 350,000 rubles, which is more than 24 minimum wages (13890*24 = 333,360).

- We calculate the average earnings: 350,000 rubles. / 730 days = 479.45 rubles.

- We calculate the minimum amount of average daily earnings based on the minimum wage: 24 months. * RUB 13,890 * 1.5 (regional coefficient) / 730 days = 684.98 rub.

- We compare the actual average earnings with the minimum: 479.45 rubles.

The minimum wage with the coefficient turned out to be higher, even though the actual income was more than 24 minimum wages.

- We calculate the total benefit amount: 689.98 rubles. * 10 days = 6,899.8 rub.

Who calculates the amount of benefits and pays the funds to the employee?

The benefits are paid either by the manager himself or by the Social Insurance Fund of the Russian Federation.

If the employer pays:

- The employer pays for three sick days. At the same time, he uses company funds.

- After four days of illness, sick leave is also paid by the manager, but in this case the Social Insurance Fund of the Russian Federation compensates for losses.

- If sick leave is issued due to injury, then the employer pays for the entire period of incapacity for work.

The benefit is paid by the Social Insurance Fund of the Russian Federation after four days of illness of the employee. The fund compensates for the employer's losses. After four days from the moment of illness and from the first day after the injury of the employee, the FSS of the Russian Federation pays benefits in the following cases:

- if at the time the employee went on sick leave the company dissolved and ceased to exist;

- if the employer does not have excess funds to pay benefits, that is, the funds for such expenses are simply not available in the company’s account;

- if the manager is unable to pay the required amount because the company is facing bankruptcy in the near future.

Remember that at the legislative level there are deadlines for when benefits with a regional coefficient for sick leave are received:

- The manager assigns benefits and pays them in one of two options. Option one – after ten days after the payment is assigned. Option two - on payday.

- The Social Insurance Fund of the Russian Federation pays benefits ten days after the request.

How to determine the insurance period for calculating temporary disability benefits

In accordance with the law, the insurance period is determined on the day the insured event occurs. To correctly calculate the length of service, it is necessary to use the “Rules for calculating and confirming the insurance period for determining the amount of benefits for temporary disability, pregnancy and childbirth,” which are approved by Order of the Ministry of Health and Social Development No. 91 of 02/06/2007, as amended on 11/09/2022. According to these rules, length of service is calculated based on full months (30 days are taken per month) and a full year (12 months are taken per year), that is, every 30 days will be counted as 1 month, and every 12 months will be counted as a year. This rule applies if the employee has not worked in full for a month or a year.

When calculating temporary disability benefits, it is important to determine the length of insurance coverage. The insurance period is the time when the employee worked and insurance contributions were paid to the Social Insurance Fund for him. However, there are periods when the employee did not work. But this time is still included in the calculation of insurance soot. These periods include:

- If the employee is on maternity leave for up to 1.5 years or on maternity leave;

- If the employee is on leave to care for a disabled family member;

- If an employee is on leave to care for an elderly relative (elderly relatives include people over 80 years of age;

- If the employee is undergoing military service;

- If the employee is in public or civil service;

- In other cases listed in Law No. 4468-I dated 02.12.93

The legislative framework

The following legislative framework regulates the regional coefficient:

- “Labor Code of the Russian Federation”, Article No. 129 and Article No. 316;

- Federal Law No. 255 of December 29, 2006;

- Decree of the Government of the Russian Federation No. 512 of May 29, 1992;

- Order of the Government of the Russian Federation No. 176 of January 29, 1992.

You can also learn about the basic rules for paying the regional coefficient in the following video:

The regional coefficient is an excellent monetary compensation for citizens of the Russian Federation working in regions with a harsh climate and poor ecology. This coefficient is usually not calculated on sick leave, but there are exceptions to the rules that allow employees to receive involuntary unemployment benefits due to illness.

Changes for part-time employees

For employees who work part-time, legislative innovations are also applicable. To compare actual and minimum earnings, you also need to take into account the regional coefficient .

However, the average earnings of such employees must be determined in proportion to the length of their working hours. For example, if an employee works part-time, we add a coefficient of 0.5. The formula for this calculation is as follows:

24 months * minimum wage * regional coefficient * employment coefficient / 730 days

Questions and answers

- I work on a rotational basis in the regions of the Far North. Will the regional coefficient be calculated when calculating sick leave benefits?

Answer: In accordance with Art. 302 of the Labor Code of the Russian Federation, workers who travel to perform work on a rotational basis in areas in which regional coefficients for wages are applied, these coefficients are calculated in accordance with labor legislation and other regulatory legal acts containing labor law norms. Thus, taking into account the fact that in your case the regional coefficient will be calculated on wages, it will also be taken into account in calculating the amount of temporary disability benefits.

- I was told that sick leave benefits would be calculated based on the minimum wage. Will the regional coefficient be calculated in this case?

Answer: Yes, in this case the regional coefficient is calculated.

Who should calculate and pay sick leave benefits?

Payment of temporary disability benefits is carried out as follows:

| Payer | Terms of payment | A comment |

| Employer | First 3 days of illness | At my own expense |

| From the 4th day of illness | At your own expense, but with subsequent reimbursement of expenses from the Social Insurance Fund | |

| Work injury | At your own expense for all days of illness | |

| FSS | From the 4th day of illness | Reimburses expenses to the employer |

| From day 4 of illness and work injury (from day 1) |

|

If the Ural coefficient is not calculated

Not all employees decide about the Ural coefficient for their employer. Some due to not having full information, and many due to fear of losing their job. The employer is not always interested in additional personnel costs and often ignores its obligation to calculate such a coefficient. In addition, many citizens are convinced that this coefficient applies only to those employees who work in government organizations, and commercial organizations can charge it at their discretion. However, workers in the Ural District must not only know their rights, but also demand that they be respected.

Important! The Ural coefficient should be calculated not only on the salary, but on the employee’s bonus.

Often, the employer indicates in the labor contract with a note that the salary includes the Ural coefficient. An employment contract concluded with employees working in areas in which regional coefficients are established (including the Ural) must separately highlight the salary and the coefficient separately. This requirement is due to the fact that the coefficient is applied to employee bonuses and additional payments, and not just to salary. And in case of an entry that will contain a salary that includes a coefficient, its accrual, for example, for a bonus is not provided.

If an organization made such a mistake and introduced a clause on the amount of wages, which also includes Ural wages, then it is no longer possible to correct it retroactively. For all components of wages that were paid to employees, the regional coefficient must be calculated and paid.

Important! In the employment contract, the salary and the Ural coefficient must be indicated separately. Otherwise, the employee has the right to demand that a coefficient be calculated on the specified salary.