Do I need a stamp on the 2-NDFL certificate?

Important! According to Law 82-FZ, companies currently have the right to operate without a seal. The 2-NDFL certificate form itself also now does not contain such details as “M.P.” (place of printing). This field is no longer provided.

If the company decides not to refuse to use the seal, then it must, as before, put it in the completed 2-NDFL certificate. That is, if the company has retained the seal and applies it, then it puts the seal on the certificate and no fine will be charged for this. However, even without a stamp, the certificate will be considered valid.

Is it possible for an employee to be given a 2-NDFL certificate without a stamp to submit to the bank?

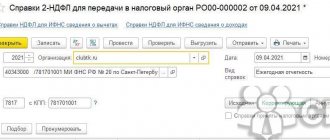

Quote (Stamp on 2-NDFL): Current as of: February 25, 2022 2-NDFL certificates for all individuals to whom income was paid are submitted to the Federal Tax Service at the end of the reporting year no later than April 1 of the following year (clause 2 of Article 230 of the Tax Code RF). And when filling out certificates, accountants ask themselves: is a stamp required for 2-NDFL? This issue is also related to the fact that starting from 2022, a certificate in a new form will be submitted to the tax office (Order of the Federal Tax Service dated October 30, 2021 No. ММВ-7-11/ [email protected] ). And there is no space for printing. So is there a stamp on the 2-NDFL certificate?

There is no need to put a stamp on 2-NDFL in 2022. After all, it really no longer contains such props as “M.P.” In addition, the Procedure for filling out a certificate (approved by Order of the Federal Tax Service dated October 30, 2021 No. ММВ-7-11 / [email protected] ) does not say anything about the need to put a stamp on the certificate.

Requirement of this Order: fill out the certificate and sign on each page if it does not fit on one page.

The Tax Code also does not require that the certificate be certified with the organization’s seal. Therefore, you can easily submit a 2-NDFL certificate to the Federal Tax Service without a stamp. At the same time, your organization can put a stamp in the new 2-NDFL at its own discretion.

When is a 2-NDFL stamp required?

If an employee submits a corresponding application addressed to his manager, then in accordance with, he must be provided with a 2-NDFL certificate. Since the employer withholding personal income tax from his employees acts as a tax agent. All documents directly related to work must be issued to employees within three days from the date of application, as well as on the day of dismissal.

Often an employee asks to provide him with a 2-NDFL certificate to apply for a loan from a bank. However, this does not mean that the company is obliged to put a stamp on this certificate. The law does not oblige companies to do this. Only the signature of the manager will be sufficient. But, the presence of a seal in such a document will serve as additional confirmation that the certificate is genuine. Therefore, if there is such a possibility, then it would be useful to put a stamp (

Is it necessary to put a stamp on 2NDFL for an employee at a bank?

Intellectual property

Is there a stamp on the new 2-NDFL certificate form?

It is not surprising that many people have problems and questions when filling it out. After all, in order for it to be valid, no problems arise, you need to fill it out correctly. In particular, many do not know whether it is necessary to put a stamp, who should sign, etc. The rules have changed a little, but there is nothing complicated.

Filling out the certificate does not require much time and effort. Do they now put a stamp on the 2-NDFL certificate?

This is no longer necessary. There is not even space for printing in the new form of the 2-NDFL form. Since now organizations operating as LLC or JSC are not necessarily

Do I need a stamp on the 2-NDFL certificate in 2022?

That is, if the company has retained the seal and applies it, then it puts the seal on the certificate and no fine will be charged for this. However, even without a stamp, the certificate will be considered valid.

If an employee submits a corresponding application addressed to his manager, then in accordance with, he must be provided with a 2-NDFL certificate.

Since the employer withholding personal income tax from his employees acts as a tax agent. All documents directly related to work must be issued to employees within three days from the date of application, as well as on the day of dismissal. Often an employee asks to provide him with a 2-NDFL certificate to apply for a loan from a bank.

However, this does not mean that the company is obliged to put a stamp on this certificate. The law does not oblige companies to do this.

Only the signature of the manager will be sufficient.

But, the presence of a seal in such a document will serve as additional confirmation that the certificate is genuine.

Do you need a stamp for 2-NDFL in 2022?

After which one copy of the certificate is given to the employee.

But if necessary, an employee can request such a certificate an unlimited number of times during the year. A certificate is also issued upon dismissal of an employee.

The employer has no right to refuse to issue an income certificate.

- When applying for a new job, the employee must submit form 2-NDFL from the previous place of work when applying for a new one and in other situations.

- Bank - when preparing documents for a consumer loan, car loan, mortgage.

- Tax office - when processing a refund of paid tax, for example, when buying an apartment, paying interest on a mortgage, paying for school fees, etc.

Certificate 2-NDFL can be downloaded. Let's look at the basic rules for filling out the certificate.

Do I need a stamp on personal income tax certificate 2?

The main difference is that indirect ones are included in the cost of the goods. In addition to determining the tax and its payer, for the functioning of the tax system the following must be determined:

- privileges;

- other elements.

- payment period;

- object of taxation;

In addition, basic principles must be observed, which include:

- integrity;

- obligation, etc.

- unity;

- equality;

- justice;

The taxation procedure is regulated by:

- Government regulations;

- Decrees of the President;

- the Constitution;

- Local legal acts.

- Tax Code;

- Orders of the Ministry of Finance and the Federal Tax Service;

Thus, the tax system is a complex component of the basic elements.

Stamp on the 2-NDFL certificate: is it necessary or not necessary to put it

The main difference is that indirect ones are included in the cost of the goods.

In addition to determining the tax and its payer, for the functioning of the tax system the following must be determined:

- other elements.

- payment period,

- privileges,

- object of taxation,

In addition, basic principles must be observed, which include:

- equality,

- unity,

- obligation, etc.

- justice,

- integrity,

The taxation procedure is regulated by:

- the Constitution,

- Local legal acts.

- By orders of the Ministry of Finance and the Federal Tax Service,

- By presidential decrees,

- Government regulations

- Tax Code,

Thus, the tax system is a complex component of the basic elements.

- This certificate is an official document indicating the amount of income paid to individuals from the employer company.

Is it necessary to put a stamp on an order, confirmation of the type of activity of the organization, or a personal income tax certificate?

The application must be accompanied by a certificate confirming the main type of economic activity. This document can be sent in one of two ways:

- On paper.

- Electronic.

In both cases, a seal is not affixed - the document is certified by a live or electronic signature of the head of the organization (or his deputy).

Is it possible to put a stamp on the personal income tax certificate 2 or is it mandatory to put a general stamp 2020

If the organization operates as usual, it must leave these fields of the certificate empty. In addition to the usual codes for residents, non-residents and highly qualified specialists, codes have now been added for migrants living outside the Russian Federation (code 4), refugees (5) and foreigners who came to Russia with their patent and work here.

A line has appeared for social deductions. You can’t figure it out right away whether you need to put a stamp on the 2-NDFL certificate in 2022? There have been many changes in this area, so from time to time accountants and personnel officers have questions about the rules for drawing up this document.

Look for the correct answer in the article. Starting from 2022, the country has two forms of certificates of individual income and tax amounts. Everything new raises questions, so it is not surprising that from time to time specialists are faced with questions about filling out new documents.

For example,

Availability of TIN in certificate 2-NDFL

Sometimes employees, after getting a job, do not provide their TIN to the accounting department. But indicating it in the 2-NDFL certificate is not mandatory today. In 2022, a 2-NDFL certificate can be submitted to the tax office without the employee’s TIN. This explanation can be found in the letter of the Federal Tax Service No. BS-4-11/1-68 dated January 27, 2016, which states that the TIN is not a mandatory detail. If the employee has not provided his TIN, then this field in Section 2 of the certificate is simply not filled in and there are no penalties for this.

When a company sends 2-NDFL electronically, the tax office responds by sending a protocol with the following content: “Warning. The TIN for a citizen of the Russian Federation has not been filled in.” Even if such a protocol is received, this does not mean that the certificate was not accepted by the tax authorities. 2-NDFL will be accepted as usual.

Important! Companies should be very careful about providing the correct TIN. If a fictitious TIN number is indicated on the certificate, this will be regarded as providing deliberately false information, for which the organization faces a fine of 500 rubles.

Previously, it was impossible to provide a 2-NDFL tax certificate that did not contain an INN. Therefore, employers independently found out the TIN number through the tax website - nalog.ru. If there was no TIN number in the tax database, then employees had to be sent to obtain this certificate.

How to indicate the TIN in 2-NDFL

If a company makes payments to individuals, then they are required to submit 2-NDFL tax certificates annually (230 Tax Code of the Russian Federation). This document indicates the certificate attribute: “1” or “2”. A certificate with attribute “1” is submitted for individuals to whom payments were made throughout the year. A certificate with attribute “2” is submitted if tax was not withheld from any income by the tax agent. The deadlines for submitting certificates vary depending on what feature it contains.

The second section of the 2-NDFL certificate contains the following fields:

- “TIN in the Russian Federation”;

- "TIN in the country of citizenship."

If the certificate is drawn up for a citizen of the Russian Federation, then the TIN in the Russian Federation is written in the field. If a foreigner is employed in an organization, then the employer should find out information about the availability of a number that is similar to the TIN. If this number is available, then it is entered in the “TIN in the country of citizenship” field.

If an employee has a TIN, but does not know it, the employer can determine it himself. To do this, you can use the special “Find out TIN” service on the website nalog.ru . The service will request the following data: full name of the individual, date of birth and passport details. If this person really has a TIN, it will be indicated on the computer. Otherwise, the employer will have only one option - to submit a certificate without this number. And we repeat once again, this will not be a violation.

Important! If a company submits 2-NDFL certificates electronically, it has the right to submit it without a TIN. If the taxpayer does not have this number, then the “TIN in the Russian Federation” field simply remains blank.

In what situations is printing needed?

If your company uses a seal in its activities, then in 2020 you can affix it to the 2-NDFL certificate at your own request. The tax authorities will definitely not issue a fine for its presence or absence, since this process is not regulated by law.

This certificate can be used for various purposes. One of your employees may, for example, go to the bank to apply for a loan. In this case, no stamp is required. But in order for the employees of the credit institution to have no doubts about issuing money, it is better to leave an imprint on the document.

If the organization’s seal is not affixed, then the bank, in its own interests, can make calls to the employer to clarify the information and confirm its accuracy. To avoid such inconveniences and not do unnecessary work, you should immediately issue a 2-NDFL certificate with a stamp. This simple action will help you avoid unnecessary questions and intrusive calls.

The absence of a seal is not a violation, but for your own peace of mind you can affix it. The imprint will make your life much easier, as it increases the confidence of third parties in the authenticity of the document.

Which documents need to be stamped with a stamp, and which ones need a seal for documents?

In accordance with this procedure, the bodies on whose seals the State Emblem of the Russian Federation is placed approve acts that determine which documents are affixed with the state emblem.

1) licenses issued to commercial banks and credit institutions for the right to carry out banking activities, amendments and additions to them, charters of commercial banks and credit institutions, amendments to them;

We recommend reading: Is it possible to buy a house from mother-in-law with the same last name using maternity capital in 2-19 years

How to properly stamp a new form

A new sample certificate is certified only by the signature of the tax agent, as well as his legal representative by power of attorney.

At your own request, you can add a round seal to the document. If an organization uses a print in its activities, then it must be used in reporting in accordance with established standards.

Since there is no space for a stamp on the 2-NDFL certificate in the updated format, the stamp is placed in different ways.

It will be considered correct to use it in the following places in the document:

- On the signature of the responsible person;

- The signatures below.

Putting a stamp in this way is an unspoken generally accepted norm. It is used by analogy with the previous sample certificate, in which the letters “M. P." pointed to the place of printing.

How to understand that personal income tax certificate 2 is real

Forging a personal income tax certificate is a popular service from dubious persons. Users of the document are able to distinguish a real form from a fake one. As mentioned, inspections, including territorial tax authorities, receive most of the TKS certificates, and in the case of personal submission, directly from the agent or his representative.

For reference! The representative must have a power of attorney from the manager, a passport and a document indicating the heads of the company (for example, an extract from the Unified State Register of Legal Entities).

Other users check the personal income tax document using their own resources. The most thorough check is carried out by banks - a lending specialist visually examines the certificate, correlates the data with other submitted documents (year of the certificate, data on the agent and payer, amounts), requests data from available sources and uses other information resources. For example:

- in the registers of the Federal Tax Service - Unified State Register of Individual Entrepreneurs, Unified State Register of Legal Entities; you can request free information on the Tax Service website or order a general statement, which is paid by state duty (the registration period is 5 working days, an urgent one is prepared within 24 hours, but costs 2 times more);

- comparative analysis of salaries by industry, region and municipal territory, in similar companies; if the salaries indicated in the certificate differ greatly from the average industry and territorial values, the bank will have questions and suspicions;

- use of information from paid services and databases;

- checking the client's credit history;

- and other methods.

What does the 2-NDFL certificate contain?

Certificate 2-NDFL is considered an official document confirming the income received and the payment of taxes on it. It is used in various areas (for lending, refund of tax payments when purchasing real estate, etc.) and has several sections.

The latter includes the following data:

- Tax agent details;

- Information about the recipient of the earnings;

- Income for a certain period;

- Applicable deductions;

- The combination of income and tax amounts.

In addition to the above information, the document must include the date of preparation, the number in the organization’s reporting and the signature of the responsible person. Without this data, the certificate will not be considered valid and you will not be able to use it.

Reporting in Form 2-NDFL includes information about the recipient of income, which is compiled exclusively according to his passport. Even a minor mistake can make it impossible to use the document for its intended purpose. Initial care when entering data into the computer will help you avoid difficulties in the future.

How do they report on past years now?

Certificates of income for individuals often undergo changes. In 2015-2016, the old form was used, approved by the Order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11 / [email protected] But at the end of 2022, the Federal Tax Service initiated consideration of further changes to this Order in connection with the approval of the Order of the Federal Tax Service of Russia dated 17.01 .2018 No. ММВ-7-11/ [email protected] (registered with the Ministry of Justice and published on January 30, 2018). If you need to submit information for previous periods, the tax office requires you to use the forms that were in force during that period.

How are income certificates of individuals certified?

The current form of the income document does not provide a place for affixing the tax agent's seal.

IMPORTANT!

The existing procedure for filling out a certificate, approved by Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/753, does not require putting the organization’s seal on it.

This rule is the same for all organizations and individual entrepreneurs. It follows from this whether a stamp on the 2-NDFL certificate is required - no, it is not required. But if you wish, you can install it; this is not a violation.

Who is required to submit certificates?

A free sample of the new 2-NDFL certificate for 2022 is required for all tax agents who are required to report to the Federal Tax Service. They are organizations, individual entrepreneurs, other persons, in accordance with Article 226 of the Tax Code of the Russian Federation, who pay income to an individual who is a taxpayer, employees who are in labor relations with the organization, working under a contract, and other citizens. Such a person is obliged to calculate, withhold tax from the taxpayer and transfer it to the budget.

The form for submission to the Federal Tax Service is filled out for each individual.

Each tax agent is obliged to ensure accounting of income paid to individuals, deductions provided to them, and taxes calculated and withheld. For this purpose, a tax register is compiled. It opens immediately upon hiring an employee. The register is developed and approved independently by the tax agent and contains information:

- about an individual, his identification data (full name, date of birth, passport details, TIN);

- types and amounts of income;

- provided deductions;

- amounts of calculated, withheld and transferred taxes;

- dates of tax withholding and its transfer to the budget, details of payment documents.

It is the data from this tax register that will be used to fill out the forms. Please note that if the organization paid the employee only benefits that are not subject to personal income tax (for example, for caring for a child under 1.5 years old), then the certificate does not need to be submitted to the Federal Tax Service.

Delivery formats

When the company consists of several people, then 2-NFDL can be submitted to the tax office on paper. If the number of individuals who received income in the company exceeded 25 people, then the report will have to be submitted only in electronic form (clause 2 of Article 230 of the Tax Code of the Russian Federation) via telecommunication channels.

To prepare reports, the free software of the Federal Tax Service “Taxpayer Legal Entity” is used. To send an electronic report to the Federal Tax Service in electronic form, you must enter into an agreement with an authorized telecom operator, obtain an electronic digital signature and install software.

How to check a certificate before submitting it to the tax office electronically? To do this, just download the free Tester program from the official website of the Federal Tax Service. By installing it on your computer, you can check the file sent to the Federal Tax Service for compliance with the format for submitting the report in electronic form.

Report submission deadlines

Please note that you must fill out and submit 2-NDFL to the tax office no later than April 1 of the year following the reporting year. Since this is the last date when tax agents transmit information about an individual’s income, calculated, withheld and transferred taxes to the budget (clause 2 of Article 230 of the Tax Code of the Russian Federation). In this case, the number 1 is indicated in the “Sign” field. In 2022, April 1 fell on a Sunday, so the deadline was postponed to 04/02/2018. As for 2022, no transfers are envisaged.

If the tax agent was unable to withhold tax when paying income and during the entire tax period, then he is obliged to provide the tax report, indicating the number 2 in the “Sign” field. This must be done before March 1 of the next year (clause 5 of Article 226 of the Tax Code RF). Please note that the procedure for providing such information to the tax authorities is now presented in Appendix No. 4 to Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected]

For late submission of the report, a liability of 200 rubles is provided. for each certificate (clause 1 of Article 126 of the Tax Code of the Russian Federation), that is, for a form drawn up for an individual employee. Responsibility has also been introduced for providing certificates with false information. For each such report you will have to pay a fine of 500 rubles. (Article 126.1 of the Tax Code of the Russian Federation), and it can be avoided only if the tax agent identifies and corrects the error before it is discovered by the tax authority.

Should I put a stamp on Form 2 Personal Income Tax for the Bank?

Quote (A stamp on the 2-NDFL certificate is not required): Very soon, tax agents will have to submit to the tax inspectorate information on the income of individuals and the amount of tax calculated, withheld and transferred to the budget for 2015 in the 2-NDFL form.

Moreover, this year the 2-NDFL certificate will be submitted using a new form (Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] “On approval of the form of information on the income of an individual, the procedure for filling out and the format for its presentation in electronic form").

In this regard, organizations have more and more questions about filling out the certificate. Tax officials responded to another of them. Thus, they explained that the organization’s seal is not required to be affixed to the certificate (letter of the Federal Tax Service of Russia dated February 17, 2016 No.

No. BS-4-11/ [email protected] “On the absence of the obligation to affix the organization’s seal in the form of a certificate of income of an individual (form 2-NDFL)”).

Is it necessary to put a stamp on the 2-NDFL certificate in 2022?

If, when recalculating personal income tax for the entire reporting period, a state agent discovers a deficiency related to obligations to the state tax authority, then a special corrective column must be filled out in form 2-NDFL. When canceling form 2-NDFL, you must complete its title and first two sections. The following subparagraphs do not need to be filled out.

https://www.youtube.com/watch?v=T1V_k61HPWo

Before answering it, you should understand that all indicators entered in this form must be displayed in national currency. Therefore, according to the rules for filling out the certificate, it is approved by the signature of the governing body of the company, and it must bear the seal of the organization.

If your own seal has not yet been made or for some reason is not available in the company, it is not necessary to put it on. The absence of an imprint is not counted as a violation. It is worth clarifying that if the stamp is not affixed, many authorities will still not want to accept such a sample certificate.

Therefore, if possible, it is better not to ignore this requirement. In general, your imprint greatly simplifies doing business for individual entrepreneurs.

Bank of expert opinions

Placing a stamp on the certificate in Form 2-NDFL is not mandatory. In addition, the 2-NDFL form itself, approved by order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11 / [email protected] , does not contain such details as “MP”. Therefore, banks do not have the right to refuse to accept a certificate for granting a loan if it does not have a stamp.

We recommend reading: Partition Service Life

If you have questions in the field of accounting, taxation, law or personnel and you need an answer based on the legislative framework with links to primary sources, feel free to contact us. Experienced practitioners will prepare a response with justification and conclusions regarding your question.

Is it necessary to put a stamp on the new 2-NDFL certificate 2016

However, if the organization or entrepreneur still has a seal, then its imprint on the new form of the 2-NDFL certificate will not make it invalid (there are no legal restrictions in this regard).

Due to the fact that since 2015, companies have been exempted from the obligation to put a stamp on documents, many are interested in whether a stamp is needed on the 2NDFL certificate , which is submitted in 2016 for 2015.

Do I need a stamp on the 2-NDFL certificate?

The position regarding the abolition of the stamp is confirmed by the Federal Tax Service of the Russian Federation in letter No. BS-4-11/2577, therefore in 2022 a new certificate 2-NDFL will be submitted, whether it needs to be stamped can be seen from all of the above, the answer is no. The form is approved by the signature of the head of the organization or the signature of his deputy.

The rules for filling out the form are established by Federal Tax Service Order No. ММВ-7-11/19В dated January 17, 2018, where there are no instructions regarding affixing a stamp. Also on the form itself there is no line M.P. Therefore, the question of where to put a stamp on 2-NDFL becomes relevant for those companies that have a stamp.

Stamping on the 2-NDFL certificate is not required

Very soon, tax agents will have to submit to the tax inspectorate information on the income of individuals and the amount of tax calculated, withheld and transferred to the budget for 2015 in form 2-NDFL.

Moreover, this year the 2-NDFL certificate will be submitted using a new form (Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] “On approval of the form of information on the income of an individual, the procedure for filling out and the format for its presentation in electronic form").

In this regard, organizations have more and more questions about filling out the certificate. Tax officials responded to another of them. Thus, they explained that the organization’s seal is not required to be affixed to the certificate (letter of the Federal Tax Service of Russia dated February 17, 2016 No.

No. BS-4-11/ [email protected] “On the absence of the obligation to affix the organization’s seal in the form of a certificate of income of an individual (form 2-NDFL)”).

The fact is that for organizations created in the form of LLC and JSC, the obligation to have a seal has been canceled, except in cases where such an obligation is provided for by federal law (Federal Law of April 6, 2015 No.

No. 82-FZ “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies”). Let us remind you that the presence of a seal became voluntary on April 6, 2015 1 .

Do I need a stamp on the new 2-NDFL certificate?

All indicators in the certificate are reflected in national currency. The completed certificate is approved by the signature of the head of the company and the seal. If the company does not have a seal, it is not necessary to affix an imprint, but its presence will not be considered a violation.

In addition, there are a huge number of reviews that personal income tax certificates without a stamp are not accepted by various authorities, despite the innovation. At the moment, it’s easier to just put it and not think about it. Personal income tax certificates 2 regarding withheld tax and income for 2015 must be submitted using the new form no later than April 1, 2016.

The form of the certificate as a whole has changed slightly.

Pechatimsk.ru specialists carry out urgent production of seals in less than 1 hour. Only high-quality materials are used for work. Products created by master craftsmen are distinguished by their reliability, durability, and compact size.

Depending on the wishes of the customer, specialists can make a primary seal according to the details, as well as recreate the cliche based on the impression on paper. The sketch can be sent by e-mail or brought to the company's office. If necessary, the product can be manufactured in just 1 hour.

In this case, the quality of the product will be as high as possible. Customers are guaranteed professional production of stamps in Moscow:

Do I need a stamp on the 2-NDFL certificate in 2022?

Currently, companies have the right to independently decide whether to use printing in their work or not. If companies do not refuse to use the seal, then when filling out the 2-NDFL certificate they have the following question: is a stamp required on the 2-NDFL certificate.

The issue is related to the fact that on the certificate form itself there is no such detail as “M.P.” (place of printing). In this article we will figure out whether it is necessary to put a stamp on the 2-NDFL certificate, as well as what an accountant should do if the employee has not provided his TIN and residential address.

Important! If a company submits 2-NDFL certificates electronically, it has the right to submit it without a TIN. If the taxpayer does not have this number, then the “TIN in the Russian Federation” field simply remains blank.

Do I need a stamp on the 2-NDFL certificate from 2022?

Tax agents are obligated to provide, at the request of an employee or individual. a person with whom a civil contract has been concluded, certificate 2-NDFL (clause 3 of Article 230 of the Tax Code of the Russian Federation). The deadline for its issuance is not established by the Tax Code.

The previous form 2-NDFL contained the field “M.P.”, so there were no questions regarding the seal; it was required. Currently, many accountants have doubts: is a stamp required on the 2-NDFL certificate from 2022? The answer to this question is in the article.

Stamp on 2-NDFL

There is no need to stamp the 2-NDFL certificate that the tax agent submits to the inspectorate. After all, the certificate form, indeed, does not even provide the details for affixing the “M.P.” stamp.

Federal Tax Service specialists do not argue with this. In the letter of the Federal Tax Service of Russia dated February 17, 2016 No. BS-4-11 / [email protected] it is directly explained that a stamp is not needed on the certificate.

Accordingly, the tax office does not have the right to refuse to accept the 2-NDFL certificate due to the lack of a stamp.

Composition of the document

Contains information about the income received by an individual. Including investments in the stock market.

It states the following:

- Tax agent information. Print its name. They also give his phone number. Inform about OKTMO, INN and checkpoint codes.

- Information about who receives income.

- List of taxable income.

- Tax rates.

- Various tax deductions.

- Total amounts of income and tax deductions.

The certificate also states:

- TIN issued in Russia and abroad, last name, first name, patronymic, code designation of an identity document, address and information about place of residence in the Russian Federation, code of a subject of the Federation or a foreign state. The series and number of the passport are also imprinted.

- The income table indicates the month of receipt, the designation of the types of income and their amounts for each type. This also applies to deductions.

- In the final part, print or enter the total amount of income and taxes that were withheld. The certificate also includes the amount of accrued and over-withheld taxes.

- In the appropriate columns indicate the total cost of the fixed advance payments made. Information is also provided on the amount of taxes that were not subject to withholding.

Here is a sample document:

Is it valid without it and in what cases?

The certificate will be valid even without a stamp.

In order for it to be used legally, it requires the following information already mentioned:

Information about the tax agent.

- Identification data of the individual who received the income.

- Amounts of income for the period specified in the certificate.

- Deductions made.

- Results of income and tax calculations.

Also, the document in question should always indicate the date of preparation. In addition, they write down his number, under which he is listed in the reporting. It is signed by responsible employees.

All information about the recipient should be taken only from the passport. The certificate should be drawn up very carefully, since it may be necessary both for the employee and for the institution, say, for a bank.

How and where to place

Actually, it doesn’t need to be placed. But many firms, financial and other institutions may ask for a document to be certified with a seal.

If it is used regularly or when desired, it can be placed in one of two places:

- on a signature made by an authorized person;

- under the above signature.

Usually they put stamps of any kind there.

What to do if a new employee brings a document without a stamp?

The optionality of the certificate indicates the possibility of accepting it without a stamp.

The absence of a stamp does not mean that it is invalid. If the certificate contains all the necessary information, then it should be considered complete.

An exception applies to organizations for which a seal is required.

This rule applies to non-profit organizations.

A seal is also required in circumstances specified by law.

Is there a stamp on the Bank Certificate 2022?

The fact is that for organizations created in the form of LLC and JSC, the obligation to have a seal has been canceled, except in cases where such an obligation is provided for by federal law (Federal Law of April 6, 2015 No. 82-FZ “On Amendments to Certain Legislative Acts Russian Federation regarding the abolition of the mandatory seal of business companies").

Let us remind you that the presence of a seal became voluntary on April 6, 2015 1 . Very soon, tax agents will have to submit to the tax inspectorate information on the income of individuals and the amount of tax calculated, withheld and transferred to the budget for 2015 in form 2-NDFL.

Moreover, this year the 2-NDFL certificate will be submitted using a new form (Order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] “On approval of the form of information on the income of an individual, the procedure for filling out and the format for its presentation in electronic form").

In this regard, organizations have more and more questions about filling out the certificate. Tax officials responded to another of them. Thus, they explained that the organization’s seal is not required to be affixed to the certificate (letter of the Federal Tax Service of Russia dated February 17, 2016 No.

No. BS-4-11/ [email protected] “On the absence of the obligation to affix the organization’s seal in the form of a certificate of income of an individual (form 2-NDFL)”).

Stamp on the 2-NDFL certificate

It was already indicated above that this seal is not needed for LLCs and JSCs. This is due to the fact that Federal Law No. 82-FZ of April 6, 2015 “On amendments to certain legislative acts regarding the abolition of the seal...” does not contain provisions on its mandatory use in these types of organizations.

- TIN issued in Russia and abroad, last name, first name, patronymic, code designation of an identity document, address and information about place of residence in the Russian Federation, code of a subject of the Federation or a foreign state. The series and number of the passport are also imprinted.

- The income table indicates the month of receipt, the designation of the types of income and their amounts for each type. This also applies to deductions.

- In the final part, print or enter the total amount of income and taxes that were withheld. The certificate also includes the amount of accrued and over-withheld taxes.

- In the appropriate columns indicate the total cost of the fixed advance payments made. Information is also provided on the amount of taxes that were not subject to withholding.

Do I need a stamp on the 2-NDFL certificate from 2022?

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

However, according to Articles 62 and 84.

1 of the Labor Code of the Russian Federation, work-related documents must be issued to the employee no later than three working days from the date the employee submits the relevant application, and in case of dismissal - on the same day.

If the company violates these deadlines for any reason, the employee can complain to the labor inspectorate. And she will face a fine of 30,000 to 50,000 rubles. (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Is a stamp required on the 2-NDFL certificate from 2022? The answer is no. The fact is that joint stock companies and limited liability companies may not use a seal in their work (Federal Law No. 82-FZ dated 04/06/2015). This innovation came into force in April 2015.

Stamp in 2-NDFL

The procedure for filling out the 2-NDFL certificate requires certification of the document only with the signature of the tax agent or his authorized representative. To do this, you need to enter the appropriate code: 1 - tax agent, 2 - his representative, and also indicate a document confirming the authority of the representative. The position, surname and initials of the person signing the certificate are indicated.

Starting from reporting for 2015, a certificate of income of individuals 2-NDFL is provided in a new form. Tax agents will soon have to report on accrued, withheld and transferred taxes on the income of their employees for 2016. Many will inevitably have questions about filling out the certificate, including the need to affix a stamp on the 2-NDFL.

Do I need a stamp on the 2-NDFL certificate? Is it necessary to put it or not?

This certificate can be used for various purposes. One of your employees may, for example, go to the bank to apply for a loan. In this case, no stamp is required. But in order for the employees of the credit institution to have no doubts about issuing money, it is better to leave an imprint on the document.

Reporting in Form 2-NDFL includes information about the recipient of income, which is compiled exclusively according to his passport. Even a minor mistake can make it impossible to use the document for its intended purpose. Initial care when entering data into the computer will help you avoid difficulties in the future.

Is there a stamp on the new form of the 2-NDFL certificate?

But, if you plan to put a stamp, but there is no space for it on the form, what should you do? Many people do not know how to solve this issue and what to do so as not to spoil the form. Since there is no space for a seal, it can be placed where it says: “Tax Agent” and a signature is placed.

This certificate may be required in different situations. It may be requested by the tax authorities themselves, for example, if an individual received income that for one reason or another could not be taxed. Also, such a certificate is often required if a person wants to get a loan from a bank, apply for a mortgage, and more.

Is it necessary to put a stamp on the 2-NDFL certificate in 2022?

The report is compiled based on the results of the past year and applies to all taxpayers without exception. To submit, you need to prepare information and indicate it in a certificate issued in the 2-NDFL format. The new form for filling out the 2-NDFL certificate was approved by order of the Federal Tax Service of the Russian Federation.

According to the current legislation of the country, any organization or company engaged in business activities is required to submit a report to the State Tax Service on the tax withheld from income intended for individuals.

New form of certificate 2-NDFL (form and sample for filling out 2020)

It is no secret that a new form of certificate 2-NDFL 2022 has been approved. The form and sample filling are what HR officers and accountants need. The administration encounters this document regularly.

The form not only needs to be submitted to the tax office, but also given to employees upon request. It is impossible to refuse an employee his legal request (clause 3 of Article 230 of the Tax Code of the Russian Federation).

What is the new form of certificate 2-NDFL 2022? We will tell you the details in the material.

Is it necessary to put the organization’s seal on the order?

Often, clerks and HR department specialists have doubts about whether it is necessary to put the organization’s seal on the order. There are two very clear rules here: 1. An order is an organizational and administrative document issued by the head of a company for its employees. It may contain the following content:

- about hiring;

- on granting regular, student or maternity leave;

- on the transfer of an employee to another position;

- on the payment of bonuses based on performance;

- about dismissal.

Since the order is an internal document created within the company itself, it is not stamped. 2. However, in the event that a copy of the order is requested by an employee of the company, another legal entity or government agencies, the document acquires the status of outgoing. In this case, it must be certified with the seal of the organization.

How many types of forms for 2-NDFL are there?

The report in form 2-NDFL is used in two cases:

That is, there are two grounds on which a 2-NDFL certificate is issued. This fact is taken into account starting with reporting for 2018, and therefore two different forms of personal income tax certificate have been introduced.

Forms of 2-NDFL certificates and the procedure for their execution are established by order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11/ [email protected]

Previously, the form for certificates to the tax office and the employee was uniform and contained the alphanumeric code “2-NDFL” in the title. Now this code remains only on certificates submitted to the regulatory authority.

Certificates issued to employees are called as follows:

That is, if you requested a 2-NDFL certificate from your employer, and they gave you a document that does not have any “2-NDFL” designation, do not be alarmed. That's how it should be. This is a new form of certificate that contains all the information necessary to verify your income.