How to fire a deceased employee

When a member of a work team dies, the employment agreement under which he was signed must be terminated, regardless of whether it is fixed-term or indefinite.

In order to properly formalize the termination of the contract, the following documentation is required:

- Death certificate issued by relatives at the registry office.

- An order or order that an employee is dismissed due to his death.

- Record of dismissal in the labor record.

Important! The date on which the agreement with a deceased employee is terminated is the date indicated in the document indicating his death.

| ★ Best-selling book “Calculating sick leave and insurance premiums in 2018” for dummies (understand how to calculate insurance premiums in 72 hours) 3000+ books purchased |

Details of the sick leave certificate for a deceased employee

Attention

Thus, work books that were not received by employees upon dismissal or were not claimed by relatives in the event of their death are stored in the personnel service for two years, and then transferred to the organization’s archives. The storage period for such documents is 50 years. Violation of the legislation on maintaining and storing work books refers to a violation of the legislation on labor and labor protection (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). Should I accept sick leave from relatives? It happens that an employee dies while on sick leave.

In such a situation, there are the following features of issuing a certificate of incapacity for work. According to paragraphs 60 - 61 of the Procedure for issuing certificates of incapacity for work Sick leave for a deceased employee: calculation

Temporary disability benefits are not assigned to the insured person for the following periods: 1) during the period of release of the employee from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation, with the exception of cases of loss of ability by the employee due to illness or injury during the period of annual paid vacation;2) for the period of suspension from work in accordance with the legislation of the Russian Federation, if wages are not accrued for this period;3) for the period of detention or administrative arrest;4) for the period of the forensic medical examination;5) for the period of downtime , except for the cases provided for in Part 7 of Art.

Sick leave for a deceased employee: how is the death of an employee on sick leave indicated?

When a person dies during an illness, the hospital or clinic worker must note the following information on the sick leave certificate:

- In the corresponding section, in the line “Other”, the code “34” is entered, indicating “died”.

- Next comes the day of death.

- There are no marks in the “Get Started” line.

Important! Filling out sick leave in the organization where the deceased worked will be similar to filling out sick leave for an employee who has started work. The exception is that the last day for which payment is due will be the day on which the employee died.

How can an employer close personal income tax after the death of an employee?

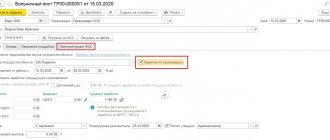

It is important for an employer to understand how sick leave should be closed in connection with the death of an employee. When registering an ELN, the attending physician enters code 34 in the “Other” column, which means closing the ELN due to the death of the insured person, and indicates the date of death. Filling out a certificate of incapacity for work by an organization upon receipt of such a document does not differ from the usual procedure, as does the calculation of benefits and the transfer of data to the Social Insurance Fund. The benefit is calculated by the employer for the period from the date of opening the personal insurance policy to the day of death of the employee, indicated by the doctor in the form of the certificate of incapacity for work.

Documentation required from family members

Who is entitled to receive money and what documentation is required for this is indicated in the table:

Important! The company has the opportunity to provide family members and dependents with funds due to the deceased person.

| Applicant status | Document type |

| All | Application Death certificate Applicant's identity card |

| Son, daughter, mother, father | Birth certificate Document on joint residence from the housing office or passport office |

| Dependents | Court decision Certificate of cohabitation * |

| Husband wife | Marriage certificate |

*If the husband or wife of the deceased had marks in their passport indicating registration at different addresses, this is not a basis for recognizing their residence as incompatible.

Important! In the case where no one from the family of the deceased lived with him, and he did not have any persons supported, the unclaimed amounts should be sent by the accounting department to the depositor, as they are subject to inclusion in the inheritance estate.

| ★ Best-selling book “Calculating sick leave and insurance premiums in 2018” for dummies (understand how to calculate insurance premiums in 72 hours) 3000+ books purchased |

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Pravo-info » Articles from magazines » PAYING SICK AWAY AFTER THE DEATH OF AN EMPLOYEE (How to pay and take into account benefits for sick leave closed due to the death of an employee)

Based on materials from the magazine "Glavnaya Ledger"

E. Shapoval

The employer is obliged to pay <1> the amounts of social insurance benefits not received in connection with the death of the employee:

- family members who lived together with the deceased - spouse, parents, children, adopted children, adoptive parents <2>;

- disabled dependents, regardless of cohabitation with the deceased.

At the same time, recently some branches of the Social Insurance Fund have not accepted expenses for the payment of benefits to family members of the deceased on sick leave closed due to the death of an employee. The fund proceeded from the fact that he himself did not present sick leave to the employer and no benefits were accrued to him during his lifetime. And the deceased is no longer insured. This means that such a certificate of incapacity for work is not subject to payment. Therefore, family members of the employee do not have the right to demand payment of benefits after his death.

However, this approach has not found support in judicial practice <3>.

The courts indicate that the death of an employee does not terminate the employer’s obligation to pay income not received during his lifetime, including temporary disability benefits. And if the employee, until the moment of death, was in an employment relationship with the employer, that is, was an insured person, then he had the right to receive temporary disability benefits, but was unable to realize it. After all, the right to receive benefits arises from the date of the insured event, that is, from the moment the illness began and loss of earnings for this reason, and not from the moment the benefit was accrued. All further actions, including applying for benefits, their accrual and payment, are only the implementation of a right that has already arisen. Therefore, in the event of the death of an employee, the calculation and payment of benefits must be made by the employer to family members of the insured person upon presentation of a certificate of incapacity for work for the entire period of incapacity, including the day of death of the insured <4>.

FSS also recently issued a Letter of similar position to guide field offices. The Foundation indicated that in the event of temporary incapacity for work, the medical organization must draw up and issue a certificate of incapacity for work. When closing the sheet due to the death of a sick person, code 34 is indicated in the “Other” line; after the code, the date of death of the employee <5> is entered in the cells. On the basis of this sheet, the employer must assign and pay temporary disability benefits to the family members who presented it, who lived together with the deceased insured person, as well as to disabled dependents, regardless of joint residence <6>. In addition to the sick leave certificate, family members must submit to the accounting department a document confirming their relationship with the deceased and the fact of cohabitation.

* * *

A claim for payment of benefits must be made by family members, as well as dependents at the place of work of the deceased, within 4 months from the date of death.

If such persons are absent or they have not made any claims to receive benefits within 4 months from the date of death of the employee, then the unreceived benefit is inherited on a general basis <7>. That is, the employer needs to deposit the accrued benefit amount and wait until it is applied for.

——————————-

<1> Part 5 Art. 15 of the Law of December 29, 2006 N 255-FZ; clause 1 art. 1183 Civil Code of the Russian Federation

<2> art. 2 IC RF

<3> Determination of the Supreme Court dated May 25, 2015 N 309-KG15-4768

<4> Art. 183 Labor Code of the Russian Federation; clause 1 art. 1183 Civil Code of the Russian Federation

<5> clause 61 of the Procedure, approved. By Order of the Ministry of Health and Social Development dated June 29, 2011 N 624n

<6> Letter from the FSS dated 07/08/2015 N 02-09-11/15-11127

<7> art. 1114, para. 2, 3 tbsp. 1183 Civil Code of the Russian Federation

First published in the journal "Glavnaya Kniga" 2015, N 22

How to calculate and pay correctly

After the death of a person, the following may remain unpaid:

- Sick leave amounts.

- Unreceived salary.

- Compensation payments for vacation that the employee did not have time to take off.

- Other amounts specified in the employment agreement and local regulations.

Example of accrual and payment

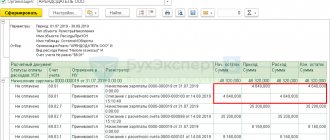

Deputy Head of Department Kirilenko N.A. I got sick on September 15, 2016. While on sick leave, she died on September 25, 2016.

Kirilenko N.A. amounts were accrued for sick leave from September 15 to September 25 inclusive.

The employer's accruals were made from the first to the third day of illness - September 15, 16, 17.

The remaining days - from September 18 to 25 - are subject to payment at the expense of the Social Insurance Fund.

Funds accrued for sick leave were received by B.V. Kirilenko’s husband.

Important! Amounts of sick leave benefits due to a deceased employee are assigned within a period not exceeding four months from the date of death.

How to get sick leave for a deceased person: direct payments from the Social Insurance Fund

In 2022, all regions of Russia, including those that did not participate in the “pilot project,” switched to direct payments of benefits from the Social Insurance Fund. The procedure for assigning such payments is regulated by Government Decree No. 2375 of December 30, 2020. The traditional offset system, in which the employer himself paid the entire amount of sick leave and then reimbursed part of the benefit from the Social Insurance Fund, has ceased to exist. Now, the first three days of illness, as before, are paid for by the employer from its own funds, and for the remaining days of sick leave, the Social Insurance Fund transfers payment independently - directly to the employee.

What documents and where should family members or dependents of the deceased submit in order to receive unpaid benefits?

All necessary documents are provided to the employer, since it is he who is given sick leave for a deceased relative, and he will also submit the necessary information for calculating benefits to the Social Insurance Fund.

The package of documents includes:

- sick leave certificate of the deceased (original);

- application from a relative for payment of the due benefit (in the form of Appendix No. 1 to FSS order No. 578 dated November 24, 2017);

- a copy of the applicant’s passport (or other identification document);

- a copy of the employee's death certificate;

- if other relatives of the deceased live with the applicant, they will be required to provide a written refusal in favor of the applicant to receive the amount of sick pay for the deceased employee;

- documents confirming the fact of relationship with the deceased applicant and other family members living with him (birth certificates, marriage certificates, court decisions, etc.);

- a document confirming that members of his family lived together with the deceased or were dependent on him on the date of death.

Please note that if an application is submitted, for example, by a spouse who is registered at an address different from the address of the deceased (even if they actually lived together in the same living space), the FSS may not recognize his right to receive benefits, and then he will have to apply for payment already after entering into inheritance, i.e. six months after the death of a person.

The employer fills out his part of the sick leave and, along with it, transfers to the Social Insurance Fund all documents received from relatives for the payment of sick leave for the deceased employee, attaching to them:

- a copy of the work book of the deceased employee;

- benefit calculation;

- inventory of documents (according to the form of Appendix No. 2 to FSS Order No. 578).

Based on the information posted on the websites of the territorial offices of the FSS, all specified documents must be submitted exclusively on paper. All copies of submitted documents are certified by the signature and seal (if any) of the employer.

When personal income tax and social security contributions are not calculated

Personal income tax may not be charged to the deceased and his relatives in a number of certain cases. It is also important to note that the employer may, on his own initiative, pay financial assistance to the relatives of the deceased or a funeral benefit. Read also the article: → “The procedure for dismissal due to the death of an employee, a sample of a dismissal order”

Amounts and taxes of the deceased person

Other amounts indicated in the table along with taxes that the heirs must pay are also not subject to taxation.

Important! Funds due to the deceased on sick leave are not subject to personal income tax and contributions to the Social Insurance Fund.

| No personal income tax or fees | To be paid by heirs |

| Sick leave benefit Salary due Vacation pay compensation Other charges specified in the employment agreement and local acts | Transport Land Property taxes |

Amounts and taxes of relatives

In most cases, these amounts are not subject to income tax.

Important! The employer may, on its own initiative, pay the relatives of the deceased financial assistance, as well as a funeral benefit at the expense of social insurance funds.

| Status in relation to the deceased employee | No personal income tax |

| Husband | Financial assistance in any amount Funeral benefit Funeral services |

| Wife | |

| Children | |

| Father | |

| Mother | |

| Adoptive parent and adopted child | |

| Dependent on the day of death | |

| Other relatives and persons who paid for the funeral with supporting documents | Funeral benefit Funeral services |

Last salary

At the time of the employee's death, the employer may have a debt to him.

Payments that have not been transferred are:

- wage;

- compensation for missed vacation;

- unpaid disability benefits.

Based on Article 141 of the Labor Code of the Russian Federation, family members or dependents of the deceased may receive unpaid wages. In this case, the dependent person does not necessarily have to be part of the employee’s circle of relatives.

Article 141. Issuance of wages not received by the day of the employee’s death

The right to receive funds is stated in paragraph 1 of Article 1183 of the Civil Code of the Russian Federation.

Article 1183. Inheritance of unpaid amounts provided to a citizen as a means of subsistence

It says that relatives can apply for:

- wages;

- pensions;

- scholarships;

- social benefits;

- compensation payments;

- alimony.

The main requirement for a relative to receive a payment is (in accordance with Article 141 of the Labor Code of the Russian Federation) cohabitation of the applied citizen with the deceased person.

Accountants should pay special attention to the method of transferring funds. When paying wages to a bank card and reporting information about the death of an employee, it is necessary to exclude the possibility of salary transfer.

After all, if the money is deposited into the account, but the relatives cannot withdraw it, they may file claims against the institution. This is due to a violation of their rights to receive the salary of a deceased relative.

Personal income tax and other contributions

It is important to remember that personal income tax is not withheld from the salary of a deceased employee. This is due to legal requirements.

When inheriting, relatives pay off the debts of the deceased in relation to tax on:

- transport;

- land;

- property.

This norm is reflected in subparagraph 3 of paragraph 3 of Article 44 of the Tax Code of the Russian Federation. However, the law does not provide for the repayment of debts on the income of individuals.

Article 44. Emergence, change and termination of the obligation to pay taxes, fees, insurance contributions

Income that the employee should have received, but did not receive due to death, is transferred to relatives. However, they should not be counted as their income. Therefore, they are not subject to taxation.

When inheriting, personal income tax is not charged on the property received. Therefore, the tax agent does not have the right to withhold tax from wages paid to relatives.

A separate category that often raises questions from accountants are contributions to the Social Insurance Fund, the Compulsory Medical Insurance Fund and the Pension Fund. It is worth remembering that mandatory insurance contributions paid to individuals are received only by employees associated with the institution through labor relations.

If an employee has died, but his wages have been accrued, it is legal to deduct a certain amount to the funds. This is where disagreements arise.

By letter of the Ministry of Labor of the Russian Federation dated February 20, 2013 N 17-3/292, it was explained that it is not required to calculate and pay contributions from the last salary of a deceased person. After the death of an employee, the employment relationship ends. Therefore, the deductions are illegal. There is no need to contribute funds to the Pension Fund, the Mandatory Medical Insurance Fund and the Social Insurance Fund.

Many believe that the Letter of the Ministry of Labor of the Russian Federation is not a legislative act, and therefore has no right to be accepted as an explanatory one. However, when checking the activities of an institution, it can be referred to.

Controlling organizations often noted that personal income tax is paid by the employee himself, and contributions to the funds are made by the employer. Therefore, even after the death of a person, the employer's responsibilities remain the same.

The above calculation procedure is also used if a contractor who was bound by a civil contract with the employer dies. After all, the legislative regulation of such relations is identical to labor relations.

Accounting entries for settlements with relatives

Settlements with family members are entered into account 76 “Miscellaneous D&C”. The salary balance moves from 70 to 76 accounts.

Accruals to a deceased team member are reflected as follows.

D 20 (26, 44) K 70 – salary, vacation pay, financial assistance are calculated;

D 20 (26, 44) K 70 – accrual of sick leave at the expense of the company;

D 69 K 70 – accrual of sick leave at the expense of social insurance;

D 70 K 76 – debt to the deceased turns into debt to relatives;

D 76 K 50 – payment to a relative.

Are there any deductions for advances?

There are cases when an employee is on sick leave for more than a month, and accountants have doubts: should they pay him part of the sick leave in the form of an advance? Of course, it is impossible to do this, since the Social Insurance Fund pays benefits only for sick leave. Moreover, this situation will worsen if the employee died while on sick leave.

There are also cases when an employee died while on sick leave, and before that he took a vacation in advance.

Important! Article 137 of the Labor Code of the Russian Federation does not say anything about deductions from the wages of a deceased employee.

Based on the instructions in this article, we can conclude that the erroneously paid advance and vacation pay relate to salary and are not subject to deduction from the deceased employee.

Registration procedure

Registration of a sheet of temporary incapacity for work, during which the employee did not work, is carried out in a similar manner. But the sick leave of a deceased employee contains some special items.

The medical worker creating the document writes code number 34 in the “Other” line. It reflects the consequence of the disease, namely the death of the employee. The date of death must be indicated, which is recorded on the death certificate. An important point is the absence of data in the “Get Started With” field.

The rest of the information is processed in the same way as a regular sick leave.

You must enter on the sheet:

- name of the institution;

- type of cooperation (permanent, temporary);

- taxpayer identification number;

- SNILS;

- the period the person was on sick leave;

- amount of payment;

- surname, name, patronymic of the head of the institution;

- last name, first name, patronymic of the chief accountant who will make the calculations.

The date of death is indicated in the column about the day of receipt of sick leave benefits.

How to receive a payment for the sick leave of a deceased person

Sick leave does not always end in recovery, and therefore at such moments you have to think about what payments are due to the relatives of the deceased.

This question has different sides depending on whose death occurred.

Therefore, it is necessary to understand the intricacies of the process of calculating payments to various categories of people. Sick leave is always issued from the first day of a person’s visit to a medical institution until the moment of recovery.

In the event of the death of a patient, the sick leave is closed on the day the death occurred.

Receiving payments during this period is the legal right of every person. Therefore, death in this case does not cancel the occurrence of the insured event. And accordingly, payments according to the law must be accrued from the moment the sick leave is opened until the day the person died, inclusive.

This applies to any employee. With regard to pregnant women, everything is not so clear. In many ways, the period will depend on the period when the child’s death occurred.

According to order No. 624n of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011:

- If a pregnancy is terminated before 21 weeks, not maternity leave is given, but regular sick leave.

- At 22-30 weeks it is already considered maternity leave. Therefore, payments will be allocated accordingly. Moreover, depending on the duration of sick leave, the employer is obliged to pay for the entire recovery period.

Also, many are interested in the issue of parental leave and lump sum birth payment.

If death occurs after payment, then it does not need to be returned. But if before that, the woman is obliged to submit the appropriate documents, since she no longer has rights to these funds. Leave also ends from the moment the child dies, although it is paid up to and including the day of the baby’s death.

A sick leave certificate is issued in the event of the death of an employee in the same way as during recovery.

Payment of sick leave on the salary card of a deceased employee

Employees may temporarily lose their ability to work during their working career. In this case, they are entitled to sick leave, paid in accordance with the procedure established by law from the Social Insurance Fund.

After restoration of working capacity, the employee provides a sick leave certificate to the accounting department. However, not in all cases the disease ends in recovery.

If an employee dies, then it is necessary to follow some procedure for calculating and paying benefits. Sick leave for a deceased employee is provided in any case. Based on this, payment is made to the relatives of the deceased. To avoid controversial issues, it is important to follow the rules for calculation and payment. Registration procedure Registration of a sheet of temporary incapacity for work, during which the employee did not work, is carried out in a similar manner. But the sick leave of a deceased employee contains some special items.

The costs of paying benefits for the period of Ivanova’s illness until the day of her death - from August 27 to 29, 2016 - are reimbursed by the FSS of Russia. The organization paid the benefit to Ivanova’s husband. LETTER OF THE FSS OF RUSSIA DATED 07/08/2015 No. 02-09-11/15-11127 [On sending information on the issue of payment of temporary disability benefits not received by the insured person during his lifetime] Social Insurance Fund of the Russian Federation (hereinafter referred to as the Fund) by letter dated 07/08. 2015 No. 2-09-11/15-11127 in connection with incoming requests from the territorial bodies of the Fund, organizations and citizens on the issue of payment of temporary disability benefits not received by the insured person during his lifetime in connection with his death, to members of his family living with him , as well as disabled dependents, regardless of whether they lived with the deceased or not, sends the following information.

- When 731 days are used to calculate benefits, No. 15

- When to pay monthly child care allowance, No. 13

- How to calculate sick leave supplement before salary, No. 11

- Social insurance benefits: to whom, when, how much, No. 11

- ABC of social insurance benefits, No. 10

- How to get your money from the FSS, No. 10

- We send the employee for benefits to the Social Insurance Fund, No. 8

- Benefit based on a PFR certificate: can it be trusted, No. 6

- Will the Social Insurance Fund reimburse sick leave benefits if the medical institution does not have a license, No. 6

- Do you know everything about calculating sick leave?, No. 2

- We issue a certificate of excluded periods for “children’s” benefits, No. 2

- Adjustment of social insurance benefits - 2013, No. 2

- Children's benefits - 2013, No. 1

- Temporary disability benefits, No. 1

2012

Do I need to calculate and transfer benefits?

If an employee dies while on sick leave, the employing company does not lose the obligation to calculate and transfer the due temporary disability benefits. According to current legislation, recipients of funds may be:

- relatives of the deceased who lived with him in the same apartment (husband, wife);

- disabled dependents, regardless of their place of actual residence.

Before issuing funds due, the accountant is obliged to request documents from the relatives of the deceased confirming the right to receive benefits.

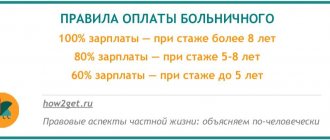

Sick leave for a deceased employee. The average salary of a specialist is multiplied by the number of days on the certificate of incapacity for work. A percentage of the amount received is paid according to the employee’s insurance length (from 60 to 100%). Funds are transferred in any case, whatever the reasons for the death of the citizen.

The law gives the relatives of the deceased four months to come and claim the benefits they are entitled to. If they do not report to the company within this period, the amount is subject to deposit and inclusion in the total amount of the inheritance.

If the deceased specialist lived in a constituent entity of the Russian Federation included in the Social Insurance Fund pilot project, the employer pays sick leave benefits only for the first three days of illness. The remaining period of incapacity for work is “repaid” by the Fund after an application from the relatives of the deceased.

Regulatory framework and documents confirming death

Legal relations between employees and their employers are in most cases terminated at the initiative of one of the parties or by mutual agreement.

However, there are circumstances in which the contract must be terminated for reasons beyond the control of the parties. The death of an employee is one such reason. Moreover, labor relations have such specificity that even if an employee is declared missing by the court, he must be dismissed as deceased. However, to confirm the fact of death, documents are required, such as:

- Death certificate. It is received from the civil registry office, the document is drawn up in accordance with the norms of the Law “On Acts of Civil Status” dated November 15, 1997 No. 143-FZ.

- Judgment. The verdict must contain one of two wordings: to declare the citizen dead (Article 45 of the Civil Code of the Russian Federation) or to recognize him as missing (Article 42 of the Civil Code of the Russian Federation). An interested person must submit an application to the court, and the consideration of the application is carried out in a special proceeding.

Did an employee die on the job? Sign up for a free trial access to ConsultantPlus and find out the full algorithm of the employer’s actions if an employee dies at work.

Dismissal from work due to death while on sick leave

Free legal consultation: All of Russia To ensure the rights guaranteed by the Constitution of the country and legislative acts, when starting a job, the owner (or a person authorized to manage the activities of the organization) enters into an agreement with the future employee. The basic requirements for the terms of an employment contract, which should be in its content, are listed in Art.

57 Labor Code of the Russian Federation. In addition to information about opponents, it stipulates:

- other conditions provided for by the collective agreement, local legal acts, which do not worsen the rights of the employee in comparison with legislative norms in the field of labor.

- working hours, working conditions and validity periods (urgent, unlimited, temporary);

- the amount and methods of remuneration based on the results of the work done;

- time and place of action;

- rights and obligations of the parties;

- cases of compulsory insurance (for the possibility of receiving social benefits in old age or if there is sufficient insurance coverage, when working conditions are recognized as particularly dangerous, harmful to life and health, benefits for days of incapacity for work or the birth of a child);

An employment contract, despite its validity period, can be terminated at any time. The reasons when legal relations are terminated can be conditionally divided into three groups:

- at the request or forced personal circumstances of the employee himself;

- when the initiative to part with an employee who does not suit the employer is taken by the head of the enterprise (owner);

- the need to terminate the contract does not depend on the will of the parties.

Norms Art. 83 of the Labor Code of the Russian Federation provides a list of reasons when an employee is fired due to a coincidence, regardless of the fact that neither he nor the manager showed such initiative.

The sixth paragraph of this article provides for the termination of an employment contract if a person in an employment relationship with the enterprise dies or is declared missing or dead by a decision of the judicial authorities. When an employee is dismissed, in accordance with the provisions of Art.

Severance of labor relations between the parties

According to the Labor Code of the Russian Federation, the death of a person serves as a reason for termination of an employment contract with him. The documentary basis for starting the procedure is a copy of the death certificate. Until it is received, the relationship between the employee and the company cannot be terminated. During the period of “unknown”, the code “NN” is entered on the report card.

The previously signed agreement between the employee and the company is terminated by the date on which the specialist’s death occurred. A dismissal order is being prepared (on form T-8), which states the reason - the death of the employee (according to Article 83 of the Labor Code of the Russian Federation).

The order is signed on the date on which it was actually prepared. A specialist’s signature confirming the fact of familiarization with the personnel document is not required: it is clear that he is not able to sign it. A visa for the relatives of the deceased is also not required.

The personnel officer or accountant is required to fill out the employee’s work book. He must use the wording “termination of employment contract” rather than “dismissal” and refer to Art. 83 Labor Code of the Russian Federation. The date in the second column is the day of death of the specialist. The director's visa and stamp are placed on the page.

The shelf life of unclaimed labor is at least 75 years. Relatives of the deceased have the right to request the document to process social benefits. It is issued to applicants based on a written application.

When dismissing a specialist, the company is obliged to accrue wages for days worked, compensation for unpaid vacation and other payments due. The amount is given to family members of the deceased: husband or wife, children or parents (adoptive parents).

After three days from the date of dismissal, payments are deposited. If the specialist’s relatives apply for money, the organization is obliged to issue it within a week. The procedure is accompanied by documents: a written statement from the recipients of funds, a copy of the death certificate and papers confirming the relationship. If the deceased has no close relatives, the salary is included in the estate.

If you find an error, please select a piece of text and press Ctrl+Enter

.

According to the Labor Code of the Russian Federation, on the last working day a person must receive all amounts due to him. These include:

- wages for hours worked after the last payments;

- monetary compensation for unused days of paid leave;

- required incentive payments;

- remaining unpaid amounts of benefits during incapacity for work;

- severance pay (if provided for by law in connection with this reason for dismissal);

and others. Funds are paid through the organization's cash desk personally to the former employee, or transferred to the bank account of a financial institution specified by him.