Modern electronic document management technologies can significantly reduce the burden on business, significantly reducing the time and money spent on document exchange. The market offers not only a choice of EDI software solutions, but also operators.

An EDF operator is an organization that has sufficient technological, personnel and legal capabilities to provide EDF using UKEP (clause 1.2 of the order of the Federal Tax Service of Russia dated April 20, 2012 No. ММВ-7-6/ [ email protected] “On approval of the Temporary Regulations on Network of Trusted Operators of Electronic Document Management and the Temporary Regulations on the Procedure for Joining the Network of Trusted Operators of Electronic Document Management”).

Interaction with the EDF operator begins with the fact that he connects to the software that your company uses for document management and reporting. In Russian realities, 99% of companies need integration with 1C

Looking ahead, we note that without choosing an operator, you can use the WA:EDO technology built into 1C, which ensures the exchange of legally significant documents, electronic invoices and other electronic documents directly from the accounting system, without using other programs through one or more electronic document management operators .

We will implement EDI with quick setup of roaming with various operators

Next, we will consider the criteria by which you should choose an electronic document management provider, as well as the rating of the best EDI providers.

Fig. 1 Electronic document flow through an operator

What is an electronic document management system?

EDI is a system of processes for processing documents in electronic form. The majority of personnel and accounting programs are able to generate documents in accordance with established requirements. In order for a document to acquire legal force, it must be certified with an electronic signature.

The entire EDI system can be divided into two types:

- exchange of documents within the company;

- transfer of documents between different companies via the Internet.

To use EDI within a company, you need to purchase a special software package and network equipment to activate its operation. To exchange documents with third-party companies, you will additionally need an electronic document management operator. With its help, the necessary information will be transmitted and its format will be controlled.

How you can implement EDI: methods of implementation

So, in general there are two options:

1. Exchange of electronic documents directly with counterparties.

You can do without intermediaries, for example, simply send all documents by e-mail to suppliers and clients. However, this method of interaction requires a lot of self-organization.

You will need to organize an electronic archive, provide enough space for virtual storage, independently systematize, check, and save documents. In general, there is no talk of complete automation of the process.

In addition, if you are going to transfer documents signed with a non-qualified signature in this way, then you need to sign an agreement with each of the participants regulating the procedure and conditions of EDF.

2. Exchange through an electronic document management operator.

The operator completely undertakes all functions of electronic document management with counterparties, interaction with government agencies (EGAIS, Chestny ZNAK), and storage of a large volume of documents. Such services already have all the capabilities (legal, technical, personnel) to ensure the exchange of EDI of any type.

To work with 1C-EDO you don’t need to pay anything - connecting to the service is free, and you can also receive incoming documents for free. Outgoing documents are paid based on the number of packages sent.

For ITS subscribers and users of the PROF version, 100 packages of outgoing documents per month are available free of charge, and for TECHNO users - 50 packages.

What documents can I send?

The EDI system allows companies to exchange the following documents:

- UPD and invoices. The rules for their transfer are established by the Ministry of Finance and the Federal Tax Service.

- Torg-12 and acts. Their formats are recommended by the tax service and are suitable for transmission to control authorities.

- Other documents certified by an electronic signature for which there is no established Federal Tax Service format.

The most popular documents that clients work with are:

- agreement

- invoices

- acts

- source documents

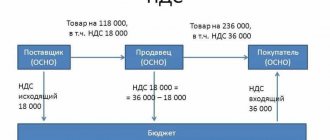

As a rule, organizations first transfer all primary documents and invoices to EDI. The latter are associated with tax deductions, so special attention is paid to them. Organizations must prepare these documents in accordance with statutory requirements. If invoices do not comply with the format approved by Order of the Federal Tax Service dated December 19, 2018 No. ММВ-7-15/820, they will not have legal force.

Reporting Schemes

The legislation provides for the possibility of submitting reports in three ways:

- personally or through a representative;

- by mail in a valuable letter with an inventory of the contents;

- in electronic form via the Internet.

The first two methods do not raise questions, but for some business entities such methods have become impossible. For example, in accordance with paragraph 3 of Art. 80 and paragraph 5 of Art. 174 of the Tax Code of the Russian Federation, all VAT payers, including tax agents, are required to submit VAT tax returns only in electronic form via telecommunication channels. Similar restrictions apply to personal income tax declarations, calculation of insurance premiums and others.

Before choosing a software product, you need to understand the technological side. There are three schemes for sending reports:

- straight;

- representative;

- portals.

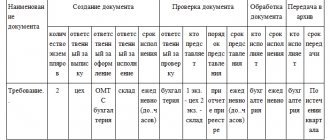

| Scheme name | The essence of the scheme | pros | Minuses |

| Straight | The client enters into an agreement with an electronic document management operator or intermediary. As a result, the subscriber is provided with a program for sending reports, and an electronic digital signature is issued to the manager or other authorized person. |

|

|

| Representative | Reporting is sent through an organization that has a software package that allows you to send reports to other organizations or individual entrepreneurs. |

|

|

| State portals | The organization buys a “key” to an electronic digital signature (EDS) from any accredited certification center and submits reports through the state. portals (https://www.nalog.ru/, https://fss.ru/, etc.). |

|

|

In what follows, only the direct scheme will be considered. The “representative” and “portals” schemes do not require analysis or commentary. When choosing to send reports using the “portals” scheme, you should read the section “Registration of an electronic digital signature certificate”.

How to choose a system?

Before switching to EDI, companies must choose an EDI operator based on their needs. The question of choice arises in the following cases:

- The company cooperates with many contractors who require a large number of documents. This is most often encountered by logistics companies.

- Employees regularly have to duplicate invoices because the originals are lost.

- Document flow is not transparent to management.

- Companies spend large sums on document exchange (purchase of stamps, costs of sending and receiving, storage and disposal of papers).

The list of EDF operators can be found on the Federal Tax Service website. When choosing a specific one, you need to be guided by the following criteria:

- possibilities;

- reliability;

- functionality;

- number of counterparties;

- roaming;

- experience;

- quality of service;

- product cost.

Summarize

To connect an enterprise to the electronic document management system you must:

- discuss this issue with your counterparties (are they ready for this format of work);

- choose a reliable EDF operator from the list recommended on the Federal Tax Service website, select a suitable software product for yourself;

- get CEP;

- conclude a service agreement with the operator and begin the exchange.

And then the responsibility for meeting the deadlines for sending documents, the safety of information, and the complete automation of the process rests with a specialized organization - the EDF operator.

Is it possible to exchange documents between the two systems?

If at least one counterparty uses another EDI system, both companies will need roaming. In this case, the concept of roaming is similar to that of mobile operators. Every company needs it to quickly transfer documents via 1C connected to different EDF operators.

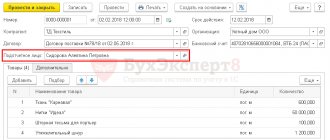

There are two ways to connect roaming between partner companies:

- Auto. In 1C, which works using EDI, in the settings you need to click the “Create” button. In the window that opens, fill in the “EDF Settings Profile”, “Counterparty”, “Counterparty Agreement” and click on “Send an invitation”. This action will send an invitation to EDF to the selected counterparty. The partner must also fill in the appropriate fields and send a counter invitation. After this, both companies will see their “Joined” status. From this moment they can begin to use electronic document management.

- On demand. 1C users connected to EDI request roaming from the operator in cases where automatic connection is not available. To do this, you need to leave a request in your “Personal Account”, send an email or call the support service. Having accepted the application, the operator will contact the counterparty and request his consent to exchange documents. Further roaming settings are made by company employees. EDF users can only update their statuses; they should change to “Joined”.

To go to the service, click on the title. The link is embedded in the title.

Connection to a specialized operator.

To exchange electronic documents (ED), a certified telecom operator is required (see .....). Currently, such services are provided by only two telecom operators (that are known to me, if there are others, I will gladly include them in the article) these are SKB Kontur and Taxcom.

Kontur implements this connection through its division Diadoc (https://www.diadoc.ru/), a service that was released to the market by SKB Kontur in early 2011, but only after the adoption of download formats did the Federal Tax Service begin to be actively promoted to users. But despite this, the popularity of this resource, as well as the method of working with it, among accountants, as the main users of EDI, as well as business development managers or IT specialists, is not high. Many users, when visiting the site for the first time, do not see the familiar Kontorov icon, which immediately arouses suspicion (although it is there, it is not very noticeable).

The EDI system from Taxcom was announced quite recently (mid-Q2), but immediately became known to both accountants and IT specialists. Taxcom has a significant advantage because it is integrated into 1C products, which is also reflected in support for its promotion. Firstly, letters are posted on the 1C website, which describe in detail the integration and terms of interaction: https://1c.ru/news/info.jsp?id=15101 and https://v8.1c.ru/edi/1c-taxcom / . Secondly, on the Internet on specialized accounting websites there are already Taxcom banners advertising EDI. Thirdly, 1C organizes seminars and lectures on EDI with the help of Taxcom. For example, in 1C:Lecture Hall there is a lecture “Organization of the exchange of electronic invoices and other documents in 1C:Enterprise 8.” According to the general impression, the array of advertising and information occasions for the Taxcom company is much larger than for the Kontur company.

To connect, you need to register with the operator, with Kontur you can leave a request through the website, with Taxcom you can register through the 1C website (where configurations are available for download).

"Contour Diadoc"

The EDI system "Kontur Diadok" allows you to work with documents remotely and resolve any work issue without leaving your office. All sent documents have legal force, as they are certified by an electronic signature. Papers signed in this way are equivalent to paper versions. The Kontur Diadoc system is used by more than a million companies.

The EDI system allows users to receive, send and sign analogues of paper documentation. It interacts not only with companies connected to Diadoc Circuit, but also with those that work in other programs. The service also sends reports to the tax authority.

To use the web version, you do not need to install additional software. Advantages of the “Contour Diadoc” system:

- Creation, transmission and receipt of electronic documents.

- Interaction with 1C. Users do not have to manually enter data; the necessary forms are generated independently and linked to the accounting program.

- Integration with various information systems: API, SAP, MS Dynamics, Oracle.

- To access advanced features, simply create an account.

- Documents can be exchanged not only with large companies, but also with government agencies of the Russian Federation.

- The system does not require duplication of information.

- You can make changes to electronic documents remotely.

- Users can easily monitor the process of sending and receiving data by monitoring the status changes.

- Using filters you can quickly find the document you need.

- You can enter the program not only from a personal computer, but also from any smartphone through the mobile application.

- Has its own data storage.

- You can build a transfer route for each paper.

- Easily interacts with similar services.

- Users of "Contour Diadoc" can track the actions of other counterparties. If any of them wants to access the documents, the system will notify you about this.

"Contour Diadoc" can be used for free if the program is needed only to receive incoming documents. To sign them, you will need to connect a paid subscription costing from 1000 to 3000 rubles. in year. The final price of the tariff depends on the number of outgoing documents.

Benefits of using operator services

Cooperation with intermediaries is beneficial for organizations. It saves a lot of time and money; there are other positive aspects that are worth dwelling on in more detail.

Seamless sending and receiving of ED

You can exchange electronic documents at any convenient time. At the same time, interacting legal entities and entrepreneurs must have compatible devices to fully work with data.

Solving a wide range of issues, including organizational ones

Considering what EDF programs are available, you can see that this is not just a service for sending letters. Counterparties can interact with each other through an intermediary without concluding additional agreements to confirm legality.

Offering ready-made options tailored to each client

Employees who have been accustomed to using a particular system for a long time will experience difficulties if they have to switch to others. Operators offer products that can be integrated with various software.

Storing information while ensuring its legal value

Where and how to store documentation is of interest to every user involved in electronic document management. Most offer archival services.

Subscriber technical support

It is especially required during the adaptation period, when employees are just getting used to the new functionality. No question should be left unanswered.

Safe cooperation with government authorities

Connection does not entail the transfer of data to tax and other authorities. For this purpose, there are separate specialists who provide reporting.

Flexible pricing

When deciding which EDF operator to choose, most potential users first of all pay attention to the price. Tariff packages are adjusted to the volume of outgoing and incoming traffic, as well as other criteria. Some companies offer a free trial period when there is no fee for shipping.

Development of technologies and maintaining high quality communications between counterparties

Companies that keep up with the times and improve technical equipment have no competitors and are always popular with entrepreneurs.

Prompt adaptation to the requirements of changing regulatory legal acts

Not all companies can quickly track changes in legislation. This is why there are providers who enter current data into the system, which is their direct responsibility under the agreement.

VLSI

Enterprises can use the VLSI platform simultaneously in several modes, each of which is adapted to interact with the other. The most popular mode among users is the use of electronic document management.

VLSI capabilities:

- verification of counterparties;

- preparing and sending reports to government agencies;

- search for tenders on different platforms and procurement analytics;

- collection of fiscal reports remotely;

- maintaining accounting, personnel and warehouse documentation;

- business process management;

- implementation of a CRM system for high-quality work of the sales department.

The SBIS EDI system has a free version that allows users to receive documents from counterparties, work with primary accounting documentation and create reports for government agencies. For ease of use, mobile applications have been developed that run on the iOS and Android operating systems.

The free version of VLSI does not allow users to send electronic documents. To do this, they need to activate a paid service package. The minimum tariff costs only 500 rubles. in year. For this money, companies will be able to receive: one electronic signature, the ability to send zero reporting, 50 outgoing packages per quarter, access to internal chat and video communication.

Transition to electronic document management

What steps need to be taken to connect EDI?

- It is necessary to inform your counterparties that you are introducing electronic document management in your company.

- You need to purchase an electronic signature from a special certification center that has been accredited by the Ministry of Communications of the Russian Federation. Each employee who will sign documents on behalf of the company must have his own electronic signature.

- If you are going to exchange documents through an EDF operator, you need to select an operator, enter into an agreement with it, and then register with the service.

- Now you will have the opportunity to upload ready-made electronic documents to your personal account, after which you will be able to sign them with an electronic signature and send them to the recipient selected from the list of available counterparties.

As you can see, the process of implementing EDI is not too complicated, but it allows you to optimize the document flow in the organization and save a lot of resources that you can direct to the development of your business.

ELMA

The ELMA system differs from others in its wide range of business solutions. It consists of a set of applications for managing an organization. They can be used both together and separately.

ELMA system line:

- Electronic document management. The application allows you to organize office work and conduct electronic document flow. Thanks to the WorkFlow mechanism, the system quickly adjusts to the needs of the organization.

- Business process management. ELMA builds flexible information systems. To create effective business processes, the program uses the international standard BPMN.

- Monitoring indicators. The application allows you to properly structure the management of your company. Its use will help improve performance indicators.

- CRM. This line does not need to be purchased separately; it comes as an addition to any standard package. CRM allows you to manage sales and track relationships with counterparties.

- Project management. ELMA easily organizes project activities in an organization. This makes it possible to monitor standard business processes and manage a budget project.

- Internal portal. All components of ELMA are based in a single internal portal. It is impossible to buy it separately, since it is additionally installed with any application. The portal includes: company structure, tasks, calendar, communication with users, data storage.

The cost of the ELMA system depends on the selected package. The price of a standard platform is 45,000 rubles. The price includes: 1 personal and 1 competitive license, ELMA server, ELMA Designer, Internal portal, ELMA CRM, and ELMA ECM+ application. You can add advanced features for an additional fee.

How to connect to electronic document management

Electronic document management is gradually replacing the exchange of paper documents. It's easier, more convenient and faster. And in some cases, this is the only possible exchange option established by law.

We tell you why electronic document management is needed and what its advantages are. And also, which ones can be sent and how to choose an EDF operator.

What is EDI

Electronic document management or EDI is the exchange of electronic documents between companies and government agencies using the Internet.

Why do you need EDI?

An electronic document is needed not only for the exchange of various acts, UPD, invoices and delivery notes. The second most important function is the transmission of marking codes via UTD in electronic form.

Also, thanks to EDI you can:

- To save time. You no longer need to wait for a courier or send documents by mail yourself. It is also faster to fill them out electronically than on paper.

- To save money. To send a document, you do not need to spend money on a courier or purchasing envelopes, as well as paper and cartridges. There is no need to spend money on maintaining the archive yet.

- Maintain confidentiality. When transferred between counterparties, securities will not be lost and will be available in a secure personal account at any time. They will not be duplicated and will not reach strangers.

- Send documents on time. The counterparty will receive the document immediately after the sender sends it.

- Exchange at any time. Documents can be signed and sent at any time from any device that has access to an electronic signature.

What can be sent via EDI

Only electronic documents can be sent via EDF.

Using EDI you can send formalized and non-formalized ones.

Formalized documents

Formalized - electronic documents in the form of a file with an xml extension, the format of which was approved by the Federal Tax Service. They have certain requirements for completion and transmission.

Formalized ones include:

- universal transfer document - UPD;

- corrective UPD;

- invoice;

- adjustment invoice;

- invoice in the form TORG-12;

- act of acceptance and delivery of work or services.

There is no strict format for acts and invoices, but there are mandatory details. Therefore, they can be created and transmitted:

- in the current format established by the order of the Federal Tax Service.

- in its own format developed by the organization or in another convenient form.

- in the no longer valid format of the Federal Tax Service according to Order of the Federal Tax Service of the Russian Federation dated March 21, 2012 No. ММВ-7-6/ [email protected]

If there is a CEP and all the required details, these documents are legally significant.

Unformalized documents

Unformalized - electronic documents, the format of which is not established by the Federal Tax Service.

Non-formalized documents include documents in the following formats: doc, xlsx, pdf, jpg and others. If an informal document is signed by the EPC, it is also considered legally significant. It does not need to be printed and additionally signed manually.

How does EDI work?

In order to exchange documents electronically, you need to connect to one of the EDF operators approved by the Federal Tax Service. This is what connecting to electronic document management looks like:

If you are sending a document

- Log in to your EDF personal account using a qualified electronic signature - CEP.

- Add the counterparty to the EDF. To do this, send him an invitation to exchange documents.

- Upload the file to your EDF personal account.

- Sign it electronically using the CEP.

- Send.

- Receive a notification that the document has been signed.

In your personal EDF account you can track all stages of document movement. There are statuses for this: “Sent”, “Received”, “Signed”, “Signature refused”.

When you want to send a file, the operator checks the authenticity of the electronic signature.

If you receive a document and a signature is required

- Log in to your EDF personal account.

- Select the desired file from your inbox.

- Sign the CEP document or request a correction if there is an error.

Once the sender and recipient have signed the document, it cannot be edited.

Also, to make working with electronic documents easier, EDO.POTOK has a free 1C connector. You can exchange documents in the 1C interface.

How to choose an EDF operator

To choose an EDF operator, consider the following features.

- Securely transfers documents. The operator must have an SLA - an agreement on the level of service quality. EDO.POTOK SLA is posted on the website.

- Integrated with the “Honest ZNAK” system (CRPT). Thanks to integration, the operator can transfer marking codes to the CRPT.

- Functional. The system must be able to:

- transmit and receive formatted and unformatted documents;

- view files in the interface;

- sign documents, refuse to sign;

- save the file to a computer or electronic archive;

- configure access for users;

- track document statuses.

- Has the ability to integrate with accounting systems. Some companies find it more convenient to work in their own accounting system. Ideally, EDF is integrated with popular accounting systems: 1C, SAP, Oracle, Docsvision, Directum, Parus.

- Roaming is configured. It is needed to exchange files with clients of other EDF operators.

- Demo access. This is important to check how the service works before concluding a contract.

What you need to know

- Using EDI, you can quickly exchange files with counterparties and partners and submit reports to government agencies.

- You can send any documents through EDI: invoices, UPD, images, invoices and acts.

- To choose an EDF operator, pay attention to: does the company have an SLA agreement, is it integrated with the CRPT, is it connected to the accounting system, does it have roaming and demo access.

Synerdocs

The electronic document management system Synerdocs has recently been gaining great popularity in Russia. Main features:

- Creation, editing, sending and receiving documents from contractors and government agencies.

- Integration with 1C, DIRECTUM, SAP.

- Drawing up acts of reconciliation of mutual settlements with counterparties.

The cost of connecting to the minimum Synerdocs package is RUB 2,500. in year. For this money, organizations get the opportunity to send 300 documents. If integration with the 1C program is necessary, it is recommended to choose tariffs that include 1000 or more documents, which will cost 6300 rubles. in year. Each document sent above the tariff will cost 7 rubles.

Electronic reporting market players

There are 127 electronic document management operators registered in Russia. Their list is posted on the website of the Federal Tax Service of the Russian Federation.

IMPORTANT!

Attention! Before you select an operator, make sure that it is included in the official list of electronic reporting operators.

Leaders in this market are constantly changing. The largest (by number of subscribers) are:

- Tensor (product - Sbis);

- Kaluga Astral (product - Astral Report and many so-called integration projects, where Kaluga Astral appears only as a special communications operator: 1C-Reporting, My Business, Sky and others);

- SKB Kontur (products: Kontur-Extern, Elba and Accounting.Kontur);

- Taxcom (products: Dockliner and 1C-Sprinter).

"Sberbank E-invoicing"

The EDI service from Sberbank allows you to significantly save time by eliminating the exchange of paper documents. Main advantages:

- The service works anywhere in the world and is not assigned to a specific computer.

- You can work with both formalized documents and arbitrary ones.

- Users have the opportunity to submit reports to government agencies; this function is included in the price of the service.

By connecting the Sberbank EDI, organizations will be able to work with any labeled products: medicines, shoes, perfumes, etc. Service:

- automatically transmits marking codes to Honest Sign;

- accepts mandatory invoices with marking codes from suppliers;

- generates closing documents with marking codes and sends them to partners.

There are two tariffs available for organizations to choose from:

- Basic. Includes the ability to receive documents from counterparties, exchange documents with Sberbank PJSC and receive documents with marking codes. This tariff is connected free of charge.

- Additional. In addition to the functions described above, users will also be able to send documents to counterparties and submit reports to government agencies. The cost of the tariff is 295 rubles. per month.

How to connect electronic document management in your enterprise

1. Determine your business needs.

Keep track of which documents the company uses most often, which routes internal (between employees) and external documents (with contractors) pass through, which processes should be automated, and in which areas of the document flow errors often occur. Typically, the need for EDI is revealed precisely in the primary accounting documents and other formalized acts.

2. Discuss the possibility of switching to EDI with your counterparties.

It is important that all participants in the turnover are connected to the system. But it is not necessary to work through one operator. As a rule, large services support and develop roaming technology.

3. Make changes to the company's accounting policies.

It must state that the organization has the right to draw up and use documents in electronic format that are signed with an electronic signature.

4. Select an EDF operator.

Above we recommended what criteria to pay attention to.

5. Select a product from your carrier.

Many modern companies offer several products for electronic document management, which differ in content, capabilities for different areas of business, cost, etc.

For example, Kaluga Astral offers its clients two products at once: 1C-EDO: a service for organizing electronic document management from 1C and Astral.EDO: an online service for the circulation of documentation with counterparties, which is used in various areas: from catering to the financial sector.

6. Conclude an agreement with the EDF operator and receive an electronic signature (ECS).

Let us remind you that a qualified electronic signature is issued only at Certification Centers that have been accredited by the Ministry of Telecom and Mass Communications of the Russian Federation. At this link you will find a list of UDCs operating in 2021-2022.

As a rule, EDF operators are also accredited to issue CEPs. Check this with the partner you are going to collaborate with.

7. Determine how to work with EDI.

There are two options: either the work will be organized through the interface of a separate service (as, for example, in Astral.EDO), or through a special software module built into 1C (1C-EDO). Decide for yourself which format is more convenient for your company.

"Contour.Extern"

The Kontur.Extern service is designed specifically for sending accounting and tax reports to the relevant government agency. If an organization does not need a full-fledged EDI system, this product is ideal for it.

"Konturn.Extern" is equipped with an interactive calendar that notifies you of the need to submit documents, and a function for checking reports for errors. Through the service you can also check VAT invoices. Additionally, you can enable the ability to connect to 1C.

The minimum connection cost is 1200 rubles. in year. This tariff only includes sending invoices to the pension fund and tax office. If you need to use the FSS and Rosstat, you need to purchase another tariff for 7680 rubles. in year. It includes additional options:

- verification of counterparties;

- drawing up reconciliation reports;

- the financial analysis;

- receiving statements;

- access to video lessons and legal framework.

If an organization works with a small number of reports, the free version will be enough for it.

Criteria for selecting a product for sending reports

"Free" or "not free"

Before you move on to choosing a program, you need to clarify your preferences. Technologically, there are two types of programs:

- offline - system on a computer (copy on an external hard drive or flash drive);

- online - cloud technologies, work from any computer on the Internet.

The first group includes such software products as VLSI++, 1C-Reporting, Astral Report and others.

With the second group everything is very difficult. Users think that online means the ability to work from any computer with Internet access. For example, the Kontur-Extern program. All reporting is created and uploaded on the Kontur portal, but at the same time, a cryptographic information protection tool (CIPF) must be installed on the workplace. It should be taken into account that if CIPF is installed on a computer, it is impossible to work from any machine. If CIPF is not installed on the computer, it is online. Such software products include Accounting.Kontur and Kaluga integration solutions: Bukhsoft, Moe Delo, Glavbukh and others.

What to look for when choosing a reporting program

What is expensive will not always justify its price. It may turn out that options that are not needed are provided for an additional fee. It is necessary to set priorities correctly and understand what we want to get from the program: just sending reports or an additional service.

Operators provide a varied list of additional services. Here are just a few of them:

- Carrying out the work of a professional accountant in automatic mode (the service itself prepares calculations for taxes and contributions, the client sends reports to all regulatory authorities with one click of a button).

- EDS registration.

- Service training.

- Providing accounting advice.

- Providing a regulatory framework.

- Data storage.

So, you asked for a program only for sending reports, but they additionally provided you with a complete package. For some, this will be a solution to all problems, while for others, it will be an unnecessary additional service. That is why, when choosing a program or sending service, it is necessary to clarify what exactly is included in the price. And if you don’t need these services, refuse them or look for another special communications operator.

The minimum requirements for the system (except for sending to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat) are letters, reconciliations, a system for preparing and checking reports, the ability to download report files from other programs. Many users need exactly this functionality, simple and basic, not hung with additional “bows”. It is also necessary to take into account how many subscribers you have: if there are many companies under your jurisdiction, you should definitely ask suppliers about the tariff for a group of companies. This is usually beneficial.

When choosing a software product, pay attention to the interface. A good interface is an intuitive interface, which means that no training is required to use the program.

DocSpace

The service is powered by MicrosoftSharePoint and offers users the following capabilities:

- track document flow;

- create internal administrative documents;

- keep records of all incoming and outgoing correspondence;

- perform stream scanning, which allows you to speed up the process of transition to electronic document management.

DocSpace is not purchased on a monthly or annual basis, but is installed on a specific computer. Connecting a system for 50 client accesses costs 450,000 rubles. Additional rights are purchased at the rate of 1200 rubles. for one workplace. Based on business needs, you can connect additional modules. The target audience of DocSpace is large businesses (large developers, energy companies, etc.)

What other functions does the EDF operator perform?

First, it checks every new subscriber that registers in its system. Thus, the operator ensures the reliability of information about all legal entities. persons connected to the EDI system, and each client can be sure that he is transferring invoices and other documents to a real organization.

Secondly, it saves the history of changes to all documents, recording both the actions of the buyer with the document and the actions of the seller. In case of controversial situations, for example, when the tax authorities have a question about a document or when a legal entity. the person files a lawsuit against the counterparty; the operator’s evidence is decisive.

Thirdly, the operator stores electronic documents in accordance with legal requirements. Thus, the invoice must be kept for 5 years.

Finally, the operator supports the user at all stages of his organization’s transition to EDI, starting with the selection of the optimal solution for integrating the EDI system into the company’s accounting systems. Diadoc offers several possibilities here. For example, an integration complex for SAP and for Oracle or an integration module for 1C - such solutions allow you to implement EDI painlessly for the organization. Legal the person will not have to change and rebuild internal processes.

In the future, the operator provides support to clients in the process of their work with the EDI system. For example, Diadoc’s contact center operates around the clock, all days of the week, so clients can quickly resolve their issues related to electronic document management.

"CASE"

Both large enterprises and small businesses work with the DELO system. Main advantages:

- the ability to track the movement of documents;

- ease of creating documentation projects;

- stable operation of the system.

The cost of the “DELO” system per workstation depends on the total number of connections - from 11,000 to 13,400 rubles. If an organization works with a Microsoft SQL Server DBMS, the price is reduced - from 7200 to 9500 rubles.

Connecting to EDF: step-by-step instructions

So, you are ready to give up paper in favor of electronic technologies. What needs to be done to switch to electronic document management?

Step one: make changes to the accounting policy. The fact that the organization works with documents compiled in electronic form and signed with an electronic signature must be reflected in the accounting policy. Also see “Accounting policies of the organization: samples for 2022, how to compile, examples.”

Get a sample accounting policy for a small LLC Get it for free

Step two: create a document flow diagram. If the company already has an established procedure for working with documents, there is no need to change it. Transactions that were previously completed on paper will be transferred to electronic form. If there are no regulations, they need to be established: determine who works with documents; which employees edit, approve and sign the documentation.

Step three: decide how to organize the work. Based on the approved electronic document management scheme, you need to choose the appropriate technical solution: web version or integration.

The web version is the easiest and most accessible way to switch to electronic document management, which does not affect the company’s information systems. Suitable for organizations with a small number of documents - about 100 outgoing monthly - and a small number of counterparties.

Integration with the company's accounting system allows you to work with electronic documents in the familiar interface of the program that the organization uses. This makes it possible to automate most actions.

Contour.Diadoc can be integrated in several ways:

- Through the module for 1C - a boxed integration solution for the most widespread accounting system in Russia. Universal - suitable for businesses of any size.

- Using a connector - suitable for those who do not want to interfere with the configuration of their accounting system, but need to automate a number of actions with electronic documents.

- Through a ready-made integration solution for your accounting system.

- Using API tools - an individual integration solution for a specific company.

The last three methods are suitable for companies with a large number of counterparties and intensive document flow.

Order an enhanced qualified electronic signature (CES) Receive in an hour

Step four: connect counterparties. If your clients and partners do not accept and sign electronic documents, all the results achieved through the previous steps will be useless. Therefore, it is necessary to agree with counterparties that they will receive documents from you only in electronic form.

Step five: purchase an electronic signature . For security reasons, Diadoc works only with a qualified electronic signature (CES). A qualified electronic signature certificate is issued by certification centers (CAs) that are accredited by the Ministry of Telecom and Mass Communications. CEP is required for all employees who sign documents. To view files, you do not need a signature: you can log into Diadoc using your login and password.

Step five: submit an application for connection to electronic document management. Small companies switch to EDI in one to two weeks. Corporations that have many branches will require more time: three months to a year.

"Logics"

Until 2012, the Logic program was called “Boss-Referent” and was very popular among organizations. The name change did not affect the quality of the product; as before, it allows you to effectively manage office work. Main advantages:

- high level of data protection;

- the ability to build complex document approval schemes;

- ease of use.

The cost of the license depends on the number of connected employees. 49 users - 5900 rub. per seat, from 50 to 199 - 5200. If access is opened for more than 200 employees, the license is sold at a minimum cost - 4900 rubles.

"EUPHRATES"

The EUFRAT system differs from others by the presence of unique software developments that no competitor has. Advantages:

- EUFRAT includes the Nika DBMS, which frees companies from purchasing additional software;

- nice interface;

- mechanism for managing access rights.

A standard license costs from 5200 to 7300 rubles. per workplace, the more users are connected, the lower the price will be.

Comparative table of the largest electronic document management systems

Using the table, companies can compare the largest EDI systems according to key parameters.

| Criterion/system | "Contour Diadoc" | VLSI | ELMA | Synerdocs | "Sberbank" |

| Minimum connection cost | 1000 rub. in year | 500 rub. in year | the cost of the platform is 45,000 rubles. | 2050 | 3540 |

| Possibility of remote reporting | There is | There is | There is | There is | There is |

| Free version | There is | There is | There is | There is | There is |

| Integration with 1C | There is | There is | There is | There is | There is |