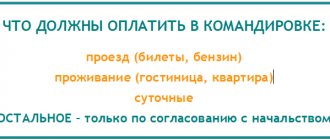

What is included in the daily allowance

The composition of daily expenses, in order to cover which the employee is entitled to daily payments, is not regulated by law, although they are separated in regulatory regulation from the costs of transport and accommodation (clause 11 of the Regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as the Regulations) ).

The employer determines the amount of daily allowance in internal corporate regulations. Payments of up to 700 rubles for business trips in Russia and up to 2,500 rubles for employees traveling abroad are not subject to tax and social contributions (clause 3 of Article 217 of the Tax Code of the Russian Federation).

Per diems are usually spent on food. But the traveler can spend it on anything at his own discretion; he is not required to report on the content of such expenses.

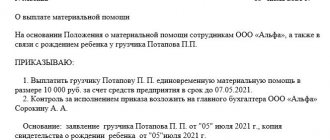

The amount of daily allowance can be set by order

The amount of daily allowance can be established in a collective (labor) agreement or an order can be issued to establish daily allowance (Part 4 of Article 168 of the Labor Code of the Russian Federation). Since the legislation does not establish a unified form for such an order, it can be drawn up in any form. Our specialists have prepared a sample of such an order especially for our readers.

You can also find a free sample order for establishing daily allowance.

When preparing an order, you need to remember that this is a primary document. This means that you cannot do without the mandatory details provided for by law (Article 9 of the Federal Law dated December 6, 2011 No. 402-FZ, letter of Rostrud dated February 14, 2013 No. PG/1487-6-1). If for some reason any of them is missing, then the document drawn up is not valid (for more details, see “Primary document: indicate the required details”).

Alimony from daily allowances paid to an employee is not withheld. The fact is that daily allowances relate to compensation payments related to business trips (Article 168 of the Labor Code of the Russian Federation, subparagraph “a”, paragraph 8, part 1, article 101 of the Federal Law of October 2, 2007 No. 229-FZ, subparagraph “p” "Clause 2 of the List, approved by Decree of the Government of the Russian Federation dated July 18, 1996 No. 841). Moreover, the amount of daily allowance does not matter (for more details, see “Alimony cannot be deducted from daily allowance”).

How to calculate daily allowance for a business trip in Russia and abroad

Both when traveling around Russia and when traveling abroad, the amount of daily allowance is determined by the formula:

RS = SD × D,

Where:

RS - estimated daily allowance;

SD - the amount of daily allowance per day established by local regulations;

D — duration of the business trip in days (including travel days).

IMPORTANT! If the business traveler’s daily allowance has not been spent in full, then the unspent balance does not need to be returned to the employer’s cash desk - unlike the part of the advance that is used to cover housing and transportation expenses.

If the employee’s daily allowance was not enough, then he can spend his money on current expenses, provided that these expenses are agreed upon with the employer (Article 168 of the Labor Code of the Russian Federation). These costs are subsequently reimbursed.

Daily allowance for business trips abroad

When calculating daily allowances for foreign business trips, the following should be taken into account:

- The day of crossing the border of the Russian Federation when sent to another country is considered the day of a foreign business trip. The amount of daily allowance is determined based on the stay abroad.

- The day of crossing the border of the Russian Federation upon return is considered as a day of internal business trip . The amount of daily allowance is determined as for business trips in Russia.

On days of border crossing, daily allowances are calculated based on the border guards’ marks in the international passport, or in travel documents (if the employee is sent to CIS countries, where marks are not placed in the international passport).

Example : An employee from the administrative and management staff of Alpha LLC is sent on a business trip to Prague, Czech Republic. The duration of the business trip is from September 4, 2022 to September 14, 2022. The employee travels to Prague by plane and back by train. Tickets purchased in advance.

On September 4, 2022, the employee crosses the border of the Russian Federation, which means he is entitled to a daily allowance in the amount of 3,500 rubles per day.

From September 5 to September 12 (8 days) he is in Prague, during this period he is entitled to the following daily allowance - 3,500 * 8 = 28,000 rubles,

On September 13, he boards the train and crosses the Russian border on September 14. During this period, he was accrued daily allowance - 3,500 rubles. (for September 13 - time on the train outside the Russian Federation) + 1,000 rubles. (for the day on which the border crossing occurred) = 4,500 rubles.

Total: 3,500 rub. + 28,000 rub. + 4,500 rub. = 36,000 rub.

Is daily allowance paid for one day?

If a business traveler solves his production problems on the territory of Russia, then he is not entitled to daily allowance. When traveling abroad - they are assigned in the amount of 50% of those established by internal corporate regulations for foreign business trips lasting more than 1 day (clause 20 of the Regulations). That is, “foreign” daily allowances for a one-day business trip will be subject to personal income tax for amounts exceeding 1,250 rubles.

IMPORTANT! The employer has the right to issue a local standard according to which, even during one-day business trips within the Russian Federation, the employee is guaranteed payments for current expenses instead of daily allowances. Provided that these expenses are documented, personal income tax may not be charged on them (letter of the Ministry of Finance of the Russian Federation dated May 26, 2014 No. 03-03-06/1/24916).

ConsultantPlus experts explained in detail whether daily allowances are subject to insurance premiums. If you do not have access to the K+ system, get a trial online access for free.

When - before or after a business trip - are daily allowances paid?

Daily allowances, like other funds included in the advance payment, are issued to the business traveler before the trip.

The timing and method of transferring the advance (in cash, to a bank card) can be fixed in internal regulations, for example in the regulations on business trips.

You can learn more about the application of the business travel regulations in the article “Regulations on official business trips - sample 2021”.

However, a scenario is possible in which the daily allowance may be paid additionally after the trip. If an employee was forced to spend part of the issued daily allowance on transport or accommodation (which must be paid 100% by the employer), then upon returning to work the accounting department will return the amount spent to him.

What is the procedure for paying daily allowance on weekends?

If an employee is on a business trip on weekends, then the daily allowance is paid for each day off in the usual amount (unless otherwise established by local regulations). This is one of the differences between the daily allowance calculation scheme and the salary calculation scheme for a business traveler on weekends, which:

- is paid double if the employee works on weekends (and this is reflected in Timesheet No. T-13);

- is not paid if the traveler does not work on weekends.

It is worth noting that salary and daily allowance are fundamentally different payments both from the point of view of taxation and in terms of calculation principles. And the fact that the rule of doubling the employee’s income does not apply to daily allowances must be remembered.

Types of daily allowances

Classification

The daily allowance will be received by the employee before the upcoming assignment on a business trip. The Labor Code obliges the employer to make daily allowance payments.

Daily allowances are paid:

- when sending your employees on a local or foreign business trip

- when constantly working on the road, during constant field trips, when equipping for an expedition or geological exploration

- when an employee is attending advanced training classes

Procedure for calculating and paying daily allowances

The exact amount of daily allowance is not reflected in the Labor Code and is calculated each time on an individual basis. The daily allowance varies on each business trip. All expenses of an employee who goes on a business trip are agreed upon in advance.

The law does not provide for a limit on establishing the maximum amount of daily allowance payments.

However:

- In Russia, the maximum daily allowance from which tax will not be collected is 700 rubles.

- For business trips abroad – 2500 rubles.

The amount of daily allowance will depend on the calculation of other expected expenses during the business trip. While the employee has not yet gone on a business trip, the number of days it will take to complete the business trip is calculated. The start of a business trip will be considered the departure from the place of work. The time spent on the way to the train station, airport, bus station is included in the travel allowance.

Per diem and accounting

The duration of any business trip will be confirmed by travel documents, which are presented to accountants when the employee completes the trip and returns to his permanent place of work. In addition, the employee provides a report on the advance payment. The employee will not receive daily allowance until the employer issues an order for the employee to travel on a business trip.

Daily allowance accounting

Since 2015, the previous package of documents is no longer needed to confirm the business purpose of a future business trip. Now daily allowance payments are declared according to the company’s internal procedures and are prescribed only in the order to send an employee on a business trip.

All expenses incurred from the daily allowances issued to employees are recorded in an advance report, which is filled out by an employee who has returned from a business trip. Before the trip, the employee fills out an application in which he requests funds for personal needs. Once completed, the application is submitted to the accounting department. The application must be signed by the chief accountant, the head of the organization and the employee being sent.

Daily allowance for trips abroad

The currency in which daily allowances are issued for a foreign travel assignment is determined by the employer himself. Daily allowances received in foreign currency are converted into the ruble equivalent of the Central Bank exchange rate (based on the last day of the month), in which the advance report is approved.

Upon returning, the employee (no later than ten days after arrival) must present an advance report. The report must indicate the following:

Business trip abroad

- all documents that record the spending of issued money (checks, receipts, etc.)

- a report detailing all the activities involved in completing a travel assignment

- scanned page of a foreign passport with customs marks

The daily allowance is issued to the employee in the form of an advance, which is calculated according to the travel estimate. The amount of daily allowance issued by a commercial organization is determined by it itself, but in any case it will not be lower than the legally established minimum.

Daily allowances are accrued according to foreign standards immediately after departure from Russia. This formality also works in the opposite direction. The day the amount of money given as daily allowance changes is determined by the stamp in the passport at the border.

Unspent funds must be returned to the company's cash desk.

Daily allowance for one-day business trips

The issuance of daily allowances for trips of a day or less has not yet been fully regulated. An employer can give employees money for one-day business trips if this is confirmed and secured by a collective agreement. Then the daily allowance will be considered other expenses that the employer himself allowed.

Payment of daily allowances

If an employee, while on a one-day business trip, has the opportunity to come to his place of residence every day, the employer has a legal basis not to pay the daily allowance. This nuance is regulated by Regulation No. 749. But if the employee and the employer agree, the daily allowance can be paid in a smaller amount or even replaced with a one-time salary increase.

The employer may consider the amount of the daily allowance payment to be insignificant and retroactively include it in other travel expenses. In the event of a controversial situation, the employer may justify non-payment of daily allowances for business trips of less than 24 hours by the fact that the employee does not need to pay for housing.

For one-day business trips or work trips to another country, the employee will receive a daily allowance in the amount of 50% of the amount reflected in the internal regulations of the organization. The payment is made in the currency of the country where the employee is sent.

Per diems for day trips are still controversial. An employer often tries to withhold daily allowances and deprive employees of them, motivating this in different ways. Employees' knowledge of the relevant chapters of the Labor Code will help them solve this problem to their advantage.

Daily allowances on weekends and non-working days

Daily allowances are also accrued for weekends that fall during a business trip. The employee will receive them in any case, even if he does not work on a business trip. Although such payments are regulated by labor legislation, the size and timing of accrual can be regulated within the enterprise, in accordance with its internal regulations.

Weekend work

Payment will apply not only to work and leisure during the weekend spent on a business trip. An employee receives benefits when going on a business trip on weekends, including non-working days:

- daily allowance payments are made at double rate

- For each day off or non-working day spent without accrual of daily allowance, the employee deserves an extraordinary day off paid by the employer

Daily allowances for weekends can also provoke a conflict situation with management. But here the situation is resolved more simply, because the law will be on the employee’s side. An exception may be the payment of daily allowances on non-working days designated by the company’s internal regulations. This could be a day off due to a holiday for one of the employees, the head of the company, the anniversary of the founding of the company and other similar occasions. If the issuance of daily allowances on such days is not agreed upon by the company’s regulations, then an arbitration court will help resolve the situation.

Results

Resolution 749 and the Labor Code of the Russian Federation explain in sufficient detail what daily expenses are on business trips. For a business trip that lasts 1 day, such payments are not due in the Russian Federation; for trips abroad, they are assigned in the amount of 50% of the “foreign” daily allowance.

You can learn more about calculating various payments for business trips in the following articles:

- “We arrange and pay for business trips”;

- “Are travel allowances subject to insurance premiums?”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is daily allowance in 2020?

Daily allowances for business travelers represent payment for expenses incurred by a person on a trip. Their payment is carried out taking into account the main requirements: Formed amount. Money for each day of a business trip, including daily allowances for the weekend spent on the trip.

When the required daily allowance is paid, both the employee of the accounting department and the business traveler himself must know how to calculate the days correctly. It is worth knowing that the fixed period of a business trip includes the days of departure and return, as well as possible downtime.

The departure date is the number of departure of the vehicle from the populated area, and the return date is the date of official arrival back, corresponding to the tickets. If the transport used is until 0-00 o'clock and inclusive at this time, the current day will be taken into account. If a person arrives after 0-00 hours, the person will be paid an additional full day.

The transfer of daily expenses required by law when traveling from the enterprise in 2022 is carried out strictly one day before the departure of the specialist.

There is another important requirement for calculating daily allowances. This amount is due if the trip takes more than a day. If a specialist leaves in the morning and returns back on the same date in the evening, according to the law he will not be entitled to daily allowance, but only travel passes.