Business trip by personal transport. The legislative framework

Chapter 24 of the Labor Code is devoted to business trips, which in its articles defines such a business trip and also establishes:

- guarantees for an employee when he is sent on a business trip;

- procedure for reimbursement of travel expenses in various conditions of business trips.

The general norms of the Labor Code of the Russian Federation are specified in the Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749) - the main document establishing the procedure for sending employees to another location to perform tasks.

ATTENTION! The employer must prescribe the procedure for processing and paying for a business trip in a local regulatory act, for example, in the regulations on business trips. Read about the nuances of document preparation in the material “How to draw up a business trip regulation.”

What to do with any reimbursement option

An employee should first discuss going on a business trip by car with his manager. If the issue is agreed upon, the accountant issues a business trip order, waybill and memo.

Business trip order

We draw up the document according to the T-9 form (paragraph 2, clause 7 of the Decree of the Government of the Russian Federation of October 13, 2008 No. 749, hereinafter referred to as the Regulations on Business Travel). In the order we add the field “Transit to the place of business trip”.

Waybill

This document will confirm that the personal car is used for official purposes (clause 7 of the Business Travel Regulations). You can develop the form of the waybill yourself or use a unified one. If we are talking about a passenger car, fill out the sheet according to form No. 3, if a truck - according to form No. 4-C or No. 4-P.

Service memo

It is used to determine how long the employee stayed where he was sent.

Upon returning from a business trip, the employee gives the employer a memo and supporting documents: waybills, invoices, receipts, checks (clause 7 of the Business Travel Regulations).

And the employer is obliged to reimburse the employee for all business trip expenses, including the cost of consumed gasoline. This is done on the basis of cash receipts.

If an employee wants to go on a business trip in a personal car, this can be done in two ways. The size and procedure for compensation for gasoline and the taxation of this payment depend on which option you choose.

Arrange a business trip and calculate taxes online for free

Do I need to enter into a car rental agreement?

There are 2 answers to the question “Should I enter into an agreement with an employee to rent a personal car?”

- It is safer to conclude an agreement and specify the amount of compensation. The amount of compensation for fuel and lubricants can be any, but only standard indicators can be taken into account in expenses:

- 1,200 rub. per month - if the engine volume is less than 2000 cm 3;

- 1,500 rub. per month - in case of exceeding 2,000 cm3.

IMPORTANT! Be sure to take a copy of the car registration certificate (Letter of the Ministry of Finance dated January 23, 2018 N 03-04-05/3235).

2. If an agreement is not concluded, then the employee is paid the entire amount for gasoline according to the advance report. The same amount is taken into account in tax expenses. In this case, disputes with tax authorities are possible, because They recommend paying for fuel and lubricants in accordance with the standards in this case as well.

In any case, issue a waybill. The document will serve as proof of real gasoline costs, because it indicates mileage, route, etc.

Accounting for expenses for tax purposes for a company

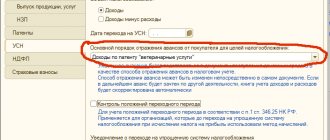

But as for accounting for expenses for tax purposes for a company that uses both a general and a simplified taxation system with the object “Income reduced by the amount of expenses,” then compensation can be taken into account in expenses only within the established standards.

This is indicated by specialists from the Ministry of Finance in a letter dated 08/02/2019 No. 03-11-11/58296. They refer to the norms of expenses of organizations for the payment of compensation for the use of personal cars for business trips, established by Decree of the Government of the Russian Federation dated 02/08/2002 No. 92 “On establishing norms of expenses of organizations for the payment of compensation for the use of personal cars and motorcycles for business trips, within which, when determining the tax base for corporate income tax, such expenses are included in other expenses associated with production and sales.” According to paragraph 1 of this Resolution, the norms for organizations' expenses for paying compensation for the use of personal cars and motorcycles for business trips for tax purposes are set at 1,200 rubles. for passenger cars with engine capacity up to 2000 cc. see inclusive and 1500 rub. for passenger cars with engine capacity over 2000 cc. cm.

Companies using the simplified tax system also need to pay attention to the fact that only compensation for the use of cars and motorcycles for business purposes can be taken into account in expenses that reduce the taxable base (clause 12, clause 1, article 346.16 of the Tax Code of the Russian Federation). Compensation for the use of an employee’s personal truck is not included in the closed list of expenses under the simplified tax system and therefore does not reduce the taxable base under the simplified tax system. If an employee’s freight transport is used for business purposes, it is best for companies using the simplified tax system to enter into a vehicle lease agreement with the employee, in which case rental payments can reduce the tax base of the tenant organization.

If a company applies a simplified taxation system with the taxation object “Income,” then compensation payments cannot be taken into account for tax purposes.

To receive compensation, an employee must submit an application indicating the frequency of use of personal transport for business purposes, attaching to the application a copy of the vehicle registration certificate and documents (receipts, cash receipts, etc.) confirming the expenses incurred by the employee for fuel and lubricants.

Accounting entries when calculating compensation to an employee are similar to accruals under lease agreements:

Debit 20, 26, 44 ... Credit 73 - compensation has been accrued for the use of the employee’s car.

Features of preparing a waybill for a business trip in your car

If an employee goes on a business trip in his own car, it is strongly recommended to issue a waybill. Despite the fact that the tax service does not require the submission of such a document when checking an organization’s expenses, with a completed waybill it will be much easier to confirm both the fact of using the car for business purposes and the given calculation of gasoline consumption.

The waybill is drawn up in a form approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78, or independently developed by the organization. The use of the waybill form developed at the enterprise is permitted by the Ministry of Finance of Russia (letter of the Ministry of Finance of the Russian Federation dated August 25, 2009 No. 03-03-06/2/161) provided that the document contains the mandatory details established by the order of the Ministry of Transport of Russia dated September 11, 2022. No. 368 (recall that until 2022 Order No. 152 dated September 18, 2008 was in force).

Such details include (Section 1 of Order No. 368 of the Ministry of Transport of the Russian Federation):

- name and number of the waybill;

- information about the validity period of the document;

- information about the car owner;

- vehicle information;

- driver information;

- transportation information.

How to issue a waybill for a passenger car, see here.

How do you go on a business trip?

As of January 1, 2016, some documents previously issued for business trips were canceled. So, now there is no need to formalize:

- official assignment;

- travel certificate;

- trip report.

In addition, the obligation to keep a log of posted workers has been abolished. To be fair, it is worth noting that some employers remained faithful to the previous procedure for documenting business trips and established the obligation to draw up the listed documents by internal orders of the organizations. However, even in such cases, the main document for sending on a business trip from the point of view of legislation is an order.

The specific form of the order is not approved by law. In this case, enterprises prefer to use unified forms of order No. T9 (on sending an employee on a business trip) or No. T9a (on sending a group of employees on a business trip), approved. Resolution of the State Statistics Committee of the Russian Federation dated 01/05/2004 No. 1, although from 01/01/2013 the use of forms of primary accounting documents is not mandatory.

The T-9 form can be downloaded from the link below.

In any case, the order must indicate the following information (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- name of company;

- date of preparation and number of the administrative document;

- employee details, name of his position;

- information about the place where the employee is sent to complete the task;

- duration of the business trip (dates of departure and arrival);

- purpose of the trip;

- details of the use of transport (personal, business, public, etc.);

- information about the organization that will reimburse the employee for travel expenses.

The order is signed by the head of the organization or an authorized employee. The posted worker must also sign the order, thus confirming the fact of familiarization with it.

A sample of filling out an order on form T-9 can be downloaded from the link below.

Reimbursement of travel expenses

According to Art. 168 of the Labor Code of the Russian Federation and clause 11 of Decree of the Government of the Russian Federation No. 749, the posted employee is reimbursed for the following expenses:

- for travel in both directions;

- for renting housing;

- daily allowance;

- other expenses determined by the employer.

Each organization sets the daily allowance amount independently (with the exception of government agencies). At the same time, it is important to remember that in accordance with the Tax Code of the Russian Federation (clause 3 of Article 217), only amounts in the amount of 700 rubles for business trips in Russia and 2,500 rubles for business trips abroad are not subject to tax on the income of individuals. Amounts above these standards are subject to taxation.

Upon returning from a business trip, the employee must submit an advance report to the accounting department, which is drawn up according to form No. AO-1, approved. Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 No. 55. The following must be attached to the report:

- documents confirming housing expenses (receipts from the hotel or receipts for receiving money if the housing was rented from an individual);

- receipts for fuel and lubricants;

- waybill;

- memo.

The memo is intended to confirm the duration of the business trip. Such a document is drawn up in any form, however, in order to avoid misunderstandings during tax audits, it is recommended to establish the form of an internal memo in the internal documents of the organization.

An example of a service design:

If several employees were sent on a business trip in a personal car, then the waybill is issued only for the driver. Accordingly, if only the driver paid for gasoline, other business travelers should not submit receipts for payment for fuel and lubricants. If repairs to a personal vehicle are required during a business trip, maintenance costs will be reimbursed by the employer as part of the vehicle use agreement concluded between the employer and employee. Also, by agreement, the employee may be compensated for expenses associated with an accident that occurred while on a business trip (of course, if it was not the fault of the posted employee).

Agreement on compensation (Article 188 of the Labor Code of the Russian Federation)

Another option for registering the use of personal transport is the conclusion of an additional agreement to the employment contract on compensation for the use of personal vehicles for business purposes.

In this case, as in rental with crew, only the owner of the vehicle will be able to use the car. The amount of compensation for the use of a personal car for business purposes is not provided for by labor legislation; accordingly, the organization establishes the methodology for calculating compensation independently, either by setting a fixed fixed monthly payment price, or by monthly calculating compensation depending on the intensity of use of the car.

The basis for payment of compensation when using personal vehicles is an order from the head of the company to pay compensation, which stipulates the amount of such compensation.

Please note that compensation is not subject to personal income tax and insurance contributions in the full amount that was agreed upon between the employer and employee, based on the provisions of clause 3 of Art. 217, para. 10 pp. 2 p. 1 art. 422 of the Tax Code of the Russian Federation.