When an employee works, he is paid a salary. When an employee goes on sick leave, he is paid compensation. It is accrued from the first day of sick leave. However, sometimes difficult situations arise. An employee, for example, can work half a day and then go on sick leave. What to charge in this case: sick leave or compensation? The problem also lies in which day is considered the date of sick leave. Let's take a closer look at all the controversial areas.

Changing the date on sick leave

The employee can bring the employer a sheet, the start date of the sick leave in which is the day worked. What to do in this case? There are two options:

- Acceptance of the document.

- Returning the sheet to the employee to correct the start date of sick leave.

Which of these options is considered correct? The necessary instructions are given in the order of the Ministry of Health and Social Development No. 624n dated June 29, 2011. Paragraph 15 of the order states that the date of sick leave can be postponed to the next day if the employee went to the clinic after work. Changing the date is precisely the right of the worker. But he may not exercise this right. That is, changing the date in the document is determined by the wishes of the employee. If he does not want to change the day, then the accountant is obliged to accept the sheet originally provided.

What to write on a time sheet

If the accountant accepts the sheet with the original date indicated, problems will arise with filling out the timesheet. In particular, the information from it and the data from the certificate of incapacity for work will not correspond to each other. In the timesheet, the date will be considered a working date, but based on the sheet, the same date is recognized as the beginning of sick leave.

Is it necessary to change information from the timesheet? In most cases, this is not necessary, since the employer must take into account the actual time worked. The basis is Article 91 of the Labor Code of the Russian Federation. The information on the report card must be true. That is, the day on which the employee worked should appear on the timesheet as a worker. Otherwise, the Labor Code of the Russian Federation will be violated.

Is it allowed to pay both salary and sick leave benefits?

We are considering a case in which the same date is both a day of work and a day of sick leave. It logically follows from this that both salary and benefits can be accrued on this day. However, double accrual is prohibited, since each receipt of funds must be supported by justification. And in the situation under consideration, the justifications are mutually exclusive.

What payment should I make?

The regulations do not provide guidance on what payment to make. This means that the appropriate decision must be made independently. But who should make this decision? There are two views on this question:

- The employer makes the decision.

- The choice is made by the employee himself.

Both options are not prohibited. If the second option is chosen, then it makes sense to request an application from the employee. An example of the content of the statement: “The first date of sick leave (February 2, 2022) was a full-time working day. Therefore, I ask you to recognize it as a working day and pay the salary for February 2.”

However, there is a position that it is the salary that needs to be paid. The corresponding conclusion can be drawn on the basis of Article 22 of the Labor Code of the Russian Federation. This is an article that contains the obligations of the employer. One of these obligations is the accrual of salary in full for the time worked. That is, if the employer does not provide salary for the day worked, he will break the law.

Is it possible to calculate both wages and benefits under the BL?

On the one hand, it seems that in this situation, a sick citizen has the right to two payments. The sick employee worked a whole working day, and the company must record it in the accounting sheet and pay wages in accordance with Article 56, Art. 132, art. 135 Labor Code of the Russian Federation.

At the same time, even though the employee took sick leave in the evening after working the whole day, on the basis of the received document he is released from performing his work duties for the same time, and in accordance with Federal Law No. 255-FZ of December 29, 2006 “On Mandatory Social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as the Law) has the right to receive benefits for the first day of illness.

In accordance with the Law, payment for the ballot is carried out within the framework of compulsory social insurance , aimed at reimbursing earnings lost due to illness. Thus, the two types of payments are mutually exclusive, have different grounds, and their simultaneous accrual is impossible. The employee must be paid either a benefit or a salary.

Which payout should I choose?

In most cases, each company independently decides what payment to accrue. In this case, the desire of the employee must be taken into account, who has the right to choose by analogy with the right to issue a ballot from the next day after applying.

An employee can write a statement addressed to the head of the organization indicating what type of payment he wants to receive for the first day of illness.

If we rely on the norms of labor legislation, on the basis of Art. 22 of the Labor Code of the Russian Federation, the employer is obliged to make all payments due to the employee in full . In the current situation, when the employee worked a full day and took sick leave in the evening, he fulfilled his job duties and should receive wages for the first day of sick leave.

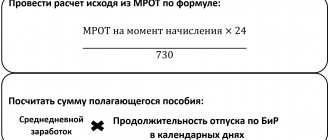

Features of accruing money for sick leave

Benefits can be accrued on a certificate of incapacity for work from the second day. For example, sick leave was received on the evening of February 2. This was a working day for the employee. The benefit is accrued from February 3. To prevent disagreements with regulatory authorities, you need to document your decision. An order or order can be used as confirmation. The paper must contain all the details of the case. As an additional measure of protection, you can request a statement from the worker. The subject of the application is the employee’s consent to the specified payment procedure.

There may be problems with the software when making payments.

In particular, the security may not miss the payment of wages accrued on the day the sick leave begins.

To eliminate this problem, you need to indicate in the program the day of onset of incapacity for work, the day following the last working day.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Labor disputes » About the case when an employee opened a sick leave on the day of dismissal

The chief accountant resigned on 04/19/19 and received the full payment on that day. In the evening of the same day, she took out a certificate of incapacity for work from April 19, 2019.

Question

How to reflect sick leave on a time sheet and how to pay for it?

Lawyer's answer

If an employee takes sick leave on the day of dismissal, your actions will depend on the grounds for dismissal. If the dismissal is not related to your initiative (for example, by agreement of the parties, of your own free will) or occurs in connection with the liquidation of the organization, formalize it on the specified day. But it is impossible to dismiss an employee on your initiative (except in the case of liquidation of the organization) on this day due to Part 6 of Art. 81 Labor Code of the Russian Federation. An exception when the court can recognize such dismissal as legal is the case if the employee abused his right and hid from you the fact that he took sick leave on the day of dismissal.

Ready-made solution: Is it possible to fire an employee who is on sick leave (ConsultantPlus, 2019) {ConsultantPlus}

Thus, formalize dismissal at your own request or by agreement of the parties as usual; the employee’s illness does not change the date of dismissal.

In your situation, the employee worked his last full day, received a work book with a notice of dismissal and payments in the final payment. At the end of the working day, he went to the doctor, and he was given a certificate of incapacity for work from the same day.

The last day of work (day of dismissal) will be indicated in the timesheet with the code “I” (“01”). Wages are accrued for this day.

In this case, it is considered that the illness occurred after termination of work under the employment contract (within the first 30 calendar days). Temporary disability benefits are assigned starting from the next day after dismissal and are calculated based on 60% of the average daily earnings (clause 2 of Article 7 of Law No. 255-FZ).

“Salaries in 2022” (21st edition, revised and expanded) (E.V. Vorobyova) (“IC Group”, 2018) {ConsultantPlus}

Selection of documents:

{Typical situation: How to pay for sick leave after dismissal (Glavnaya Kniga Publishing House, 2019) {ConsultantPlus}}

Situation: What to do if an employee gets sick after dismissal? (“Electronic magazine “ABC of Law”, 2019) {ConsultantPlus}

Typical situation: How to calculate sick leave (Glavnaya Kniga Publishing House, 2019) {ConsultantPlus}

The explanation was given by Igor Borisovich Makshakov, legal consultant of LLC NTVP Kedr-Consultant, April 2019.

When preparing the answer, SPS ConsultantPlus was used.

Various situations and procedures in them

Regulatory acts do not approve a clear sequence of actions when receiving sick leave after a working day. Therefore, the course of action depends on the specific situation.

A certificate of incapacity for work was issued at the end of the work shift

To prevent problems, the employer is recommended to have a conversation with employees regarding the procedure for obtaining a certificate of incapacity for work after a work shift. In particular, workers should be advised to ask the doctor to issue a certificate the next day. Employees have every right to do this.

What should I do if the sheet is issued on a date that is a working day? It makes sense to pay the employee not a benefit, but a salary. There is no direct indication of this in the laws, but there are indirect indications. Supporters of salary payments put forward this argument:

- Article 22 of the Labor Code of the Russian Federation states that the employer is obliged to pay wages for the time worked.

- The salary amount is usually greater than the benefit amount. It makes sense to choose a larger payment, since this cannot be interpreted as a violation of worker rights.

In this situation, the salary will be accrued from the next day of sick leave.

A certificate of incapacity for work was issued after a shift that was not fully worked

Let's look at an example. The employee felt unwell and took time off from work in the middle of the day. He went to the clinic and received a sheet for the same day. What to do in this case?

An employee can send an application to the employer requesting payment of salary for the day of sick leave. In this case, you need to accrue salary only for hours worked or work performed. Disability benefits are accrued from the following date.

An employee may submit an application to the employer requesting payment of benefits. In this case, the employer must provide the benefit. The legality of such a decision is confirmed by the worker’s statement. In this case, the salary does not need to be paid in order to avoid double accrual.

Certificate of incapacity for work issued upon completion of shift

Shift work is an additional factor that needs to be taken into account. Let's look at an example. The employee completed his shift. After her, he went to the clinic and received a certificate of incapacity for work. In this case, the employer must pay the salary for the shift worked. After this, benefits are calculated.

The sheet is issued upon completion of the night shift

Let's look at an example. The employee worked the night shift and then went on sick leave. Another shift falls on the sick leave date. That is, one day includes:

- worked night shift;

- sick leave;

- unworked day shift.

In this case, you need to pay in full for the night shift and record it on your time sheet. The benefit is paid for the day following the night. This means that the employee receives both salary and benefits for one day.

How to pay for sick leave opened after the end of the working day?

The institution had to go to court for an answer to this question. Disagreements with the FSS of Russia arose regarding the correctness of counting the first three days of the ballot, which must be paid by the employer (Resolution of the AS of the North-Western District of March 10, 2022 No. F07-17327/20).

On February 15, after working a full day, an employee of the institution went to the clinic, where she was given sick leave that same day. The period of incapacity for work lasted until February 27 inclusive. According to the employer, sick days should be paid as follows:

the first day – February 15 – is paid as time worked, i.e. a salary will be paid for him; for the second and third days – February 16 and 17 – the benefit is paid by the employer at his own expense; the fourth and subsequent days - from February 18 to 27 - must be paid by the FSS of Russia. But the Foundation did not agree with this approach. In his opinion, if an employee received wages for a day worked that coincided with the first day of the certificate of incapacity for work, this does not cancel the employer’s obligation to pay him benefits for the first three days of incapacity for work, when the employee needed to be released from work. In this case, these are the days from February 16 to 18, and for them, as the FSS of Russia believed, the institution should have paid benefits.

But judges at all levels of consideration of the case recognized the position of the FSS of Russia as erroneous. According to Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity,” the period of temporary disability and the countdown of the three-day period for which the benefit is paid at the expense of the employer begins on the date of the insurance case, and it is determined by the day the certificate of incapacity is issued. The first day of incapacity for work for which the employee was paid is deducted from the number of three days for which benefits are paid at the expense of the employer. The benefit at the expense of the Russian Social Insurance Fund is paid starting from the fourth day of temporary disability, and is not made dependent on other circumstances. The Fund did not have the right to apply a different procedure for calculating this period and offer the institution to pay benefits for the fourth day of incapacity at its own expense. Having paid the employee on February 15 as a working day, the institution legally paid sick leave benefits for the two subsequent days - February 16 and 17.

Let us note that this is not the first time that courts have come to such conclusions: in 2022, essentially similar decisions were made by judges of the Ural District Court, and in 2022 by cassators of the Volga-Vyatka District.

More on the topic: The employee returned from remote work. Is an unscheduled assessment of working conditions necessary?

Published 05/11/2021