Is a day trip a business trip?

A business trip is a trip by an employee in accordance with the order of the employer for any period of time for the purpose of performing an official assignment outside the permanent place of work (166 Labor Code of the Russian Federation). Business trips of employees are also regulated by the Regulation on Business Travel No. 749, hereinafter referred to as the Regulation. Both the Labor Code and the Regulations do not contain a minimum period for which an employer must send an employee on a business trip. From this we can conclude that if an employee goes on a trip in accordance with the order of the manager, carries out his instructions while on the trip, and this happens outside the place of work, then such a trip can be considered a business trip. It does not matter how many days it lasts, one or several (

Payment of expenses incurred

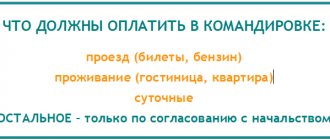

If an employee is sent on a business trip, the employer is obliged to compensate him for:

- travel expenses;

- costs of renting residential premises;

- additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses made by the employee with the permission or knowledge of the employer (Article 168 of the Labor Code of the Russian Federation).

Tax legislation, in addition to the listed expenses, allows the income tax base to include amounts spent on the registration and issuance of visas, passports, vouchers, invitations and other similar documents; consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees (subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation).

In order to include such expenses in the income tax base, the employee must submit tickets, checks, and receipts for expenses incurred.

Yu.L. Ternovka, expert editor

Daily allowance for a business trip for one day

When an employee is sent on a business trip for two days or longer, he must pay not only for travel to and from his destination, but also for accommodation. In addition, the employee is paid a daily allowance, depending on the number of days of travel (168 Labor Code of the Russian Federation). As for daily allowances for one-day business trips, everything will depend on where exactly the employer sent the employee. There are business trips in Russia and abroad.

If an employee is sent across Russia on a business trip for one day, then the payment of daily allowances is not provided (Regulation). At the same time, the company itself has the right to decide whether to pay compensation to the employee instead of daily allowance or not (168 Labor Code of the Russian Federation). In this case, the employer should provide for such compensation in the organization’s local document. Such a document can be an employment or collective agreement. You can also arrange it in another way. For example, issue an order to pay the employee compensation for travel expenses instead of daily allowance. Both in the order and in the employment or collective agreement, the employer must specify the amount of such payments.

Business trip: daily allowance and other payments to employees

author of the answer,

Question

1. If an employee is paid per diem (additional expenses associated with living away from the place of residence), should the company reimburse him for food expenses on a check (in addition to the per diem received)?

2. What expenses associated with living away from home are covered by the per diem?

3. If the company pays daily allowances for a one-day business trip (according to internal regulations), should the company additionally compensate the employee for food expenses, etc. by checks?

Answer

1. When sending an employee on a business trip, the organization is obliged to pay him daily allowance. The employer is not required to pay for meals on a business trip.

2. Daily allowances are issued to compensate for those expenses that cannot be taken into account in advance or that cannot be documented.

3. Daily allowances for a one-day business trip are not paid. Consequently, those payments that are made to employees on one-day business trips are not daily allowances. As stated above, the organization is not obliged to compensate employees for the cost of food while on a business trip, regardless of its duration.

Rationale

1. When sent on a business trip, the company is legally required to compensate the employee for travel expenses, rental housing, daily allowance or field allowance, as well as other expenses agreed upon by the employer (Article 168 of the Labor Code of the Russian Federation). Accordingly, payment for food for a business trip employee is not included in the list of expenses required to be reimbursed. At the same time, the Labor Code allows compensation for any other costs, subject to their agreement with the employer. To do this, the organization must establish a list of costs and the procedure for compensating them in the relevant local regulations. Therefore, compensation for food costs is a right, but not an obligation.

If the employer compensates for the actual cost of meals during a business trip, he must charge insurance premiums on these amounts.

This position is supported by the Ministry of Labor, citing the following arguments. Compensation for meals to employees is not directly established by labor legislation. Accordingly, these monetary compensations, which reimburse employees for their food costs, are payments within the framework of labor relations and therefore should be subject to insurance premiums in the general manner (Letter of the Ministry of Labor of Russia dated March 11, 2014 No. 17-3/B-100).

There are different points of view on the issue of taxation of personal income tax on compensation for meals on a business trip. According to the Ministry of Finance of Russia, compensation for meals on a business trip is subject to personal income tax, since it is not included in the list of payments exempt from tax in connection with a business trip established in the Tax Code of the Russian Federation (Letter dated October 14, 2009 No. 03-04-06-01/ 263). The Federal Tax Service takes a similar position: reimbursement of expenses for an employee’s meals in public catering establishments during a business trip is his income and is subject to personal income tax (Letter of the Federal Tax Service of Russia for Moscow dated July 14, 2006 No. 28-11/62271).

However, judicial practice in this area is contradictory; at the moment, arbitrators do not have a clear opinion. Some resolutions indicate that the organization is obliged to withhold personal income tax from the cost of compensation for meals to a posted employee (Resolution of the Federal Antimonopoly Service of the Moscow District dated April 4, 2013 No. A40-51503/12-90-279). The courts point out that compensation for meals for a posted employee is not mentioned in paragraph 3 of Article 217 of the Tax Code of the Russian Federation, therefore it is unlawful to exempt these payments from personal income tax.

There are also opposing court rulings, reasoned as follows: since the employee performed official tasks during a business trip, these costs were incurred in the interests of his employer. Accordingly, compensation for his food expenses is not subject to personal income tax (Resolution of the Federal Antimonopoly Service of the North-Western District dated March 23, 2009 No. A05-8942/2008). Thus, due to the ambiguity of judicial practice, there is a risk that the tax authorities will demand that personal income tax be withheld from the amount of actual compensation for an employee’s expenses for food on a business trip, and this point of view will be supported by the court. The optimal solution for employers is to impose personal income tax on this type of compensation; otherwise, you need to be prepared to defend your opinion in court.

2. Daily allowance and meal allowance are different types of payments that are not related to each other. Payment of daily allowance to an employee when sent on a business trip does not depend in any way on whether he is compensated for food costs, since this is the direct responsibility of the employer. In some court decisions, arbitrators emphasize that the purpose of the daily allowance is to cover additional expenses of an employee during a business trip related to living outside his place of permanent residence (Appeal ruling of the Moscow Regional Court dated September 28, 2016 in case No. 33-26804/2016). This is compensation for the inconvenience that an employee may experience when performing his duties in another city.

Considering the legal nature of daily allowances, the Supreme Arbitration Court of the Russian Federation, in Decision No. 16141/04 dated January 26, 2005, noted that daily allowances are a compensation payment for reimbursement of employee expenses caused by the need to perform labor functions outside the place of permanent work.

The Supreme Court of the Russian Federation in its Decision dated March 4, 2005 No. GKPI05-147 also indicated: from the contents of Art. Art. 167, 168 of the Labor Code of the Russian Federation it follows that daily allowances are intended to cover the employee’s personal expenses for the duration of the business trip. The legislator made the payment of daily allowance to an employee conditional on the employee’s residence outside his place of permanent residence for more than 24 hours (see also Resolution of the Federal Antimonopoly Service of the Ural District dated June 29, 2009 No. F09-4274/09-S2).

3. When traveling on business to an area from where the employee, based on the conditions of transport communication and the nature of the work performed on the business trip, has the opportunity to return daily to his place of permanent residence, daily allowances are not paid (clause 11 of the Regulations on the specifics of sending employees on business trips, approved by the Decree of the Government of the Russian Federation dated 13.10.2008 No. 749).

If an organization decides to pay so-called “daily allowances” for a one-day business trip, then it should be taken into account that these payments are subject to personal income tax and insurance contributions.

Meal reimbursement is a right, not an obligation of the organization.

| She answered the question: Lyudmila Mikhailovna Zolina, Consultant at IPC "Consultant+Askon" |

Procedure for paying for a business trip for one day

When traveling for one day, the employee is entitled to the same types of payment as for multi-day trips. With the exception of daily allowances, as we have already discussed above, they are only valid for one-day trips abroad. When traveling for one day in Russia, daily allowances are not paid.

For one-day business trips, the employee is reimbursed for the following expenses:

- For travel;

- Other expenses that the employee incurred with the permission of the employer.

Such payments, as well as their amount and procedure for compensation, are determined in the collective agreement or local regulations of the company. Moreover, the amount of payments can be differentiated depending on what position the employee occupies. In other words, a one-day trip for an employee with a higher position may be paid higher than the same trip for an ordinary employee.

Important! In addition to these payments, the employee is paid the average salary for this day of travel (167 Labor Code of the Russian Federation).

Let's sum it up

- The duration of the business trip is determined by the composition, volume and complexity of the assignment given to the business traveler, as well as the time required to travel to the place of business and back. Its minimum duration is 1 day.

- The amount of payments for work performed during a business trip is calculated based on the employee’s average earnings. But such payments are accrued only for days that are working days in accordance with the work schedule established for the employee.

- If a one-day business trip coincides with a day off for the employee, then labor on such a day will have to be paid according to the rules of Art. 153 Labor Code of the Russian Federation. The parameters underlying these rules correspond to the indicators characterizing the wage system. Therefore, the result of the calculation for them will be wages, and not average earnings.

Does an employee need to return home from a business trip every day?

Whether or not to return home every day from a business trip, even if there is such an opportunity, is decided by the manager. Each specific case is considered separately, taking into account:

- Travel range;

- What are the transport conditions?

- Nature of the job assignment;

- Does the employee need rest?

If an employee, after completing a working day on a trip, decides to remain in the place of business trip, he must agree with the employer. If the manager agrees, then the employee will need to reimburse the costs of renting housing within the amounts determined by the collective agreement. However, such a business trip will no longer be considered a one-day trip.

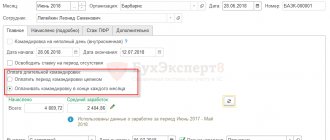

Arranging a business trip for one day

The registration procedure for one-day tickets is the same as for multi-day tickets. Before the employee leaves, he must complete a work assignment. After this, an order is issued. If the company’s internal documents provide for the issuance of a travel certificate, the employee must issue it.

Important! For one-day business trips, a travel certificate is not required.

In the time sheet, the employer records the fact of the employee’s trip. Upon return, the employee provides a report on the work he has done in the official assignment, and also fills out an advance report. Documents confirming expenses are attached to the advance report. These can be checks, receipts, contracts, transport documents, etc.

Personal income tax and insurance premiums on daily allowances

If an employee sent on a one-day business trip confirms all his expenses, then personal income tax does not need to be withheld from the funds that were paid to him. If the employee is unable to confirm his expenses, then the payment is exempt from taxation only up to 700 rubles for business trips in Russia and 2,500 rubles for business trips abroad (Letter of the Ministry of Finance of Russia No. 03-04-07/6189 dated March 26, 2013).

As the Ministry of Finance explains, those funds that are paid for a one-day business trip are not per diem. They represent other expenses associated with business travel. They are also included in expenses subject to exemption from personal income tax, due to the fact that these payments are directly related to the employee’s performance of his official duties.

However, if the employee cannot provide documentary evidence of the costs of such payments, then they are recognized as income. In this case, personal income tax is assessed only on the amount paid in excess of 700 rubles when traveling within the Russian Federation and in excess of 2,500 rubles when traveling abroad. As for insurance premiums, the logic is the same. Those payments that the employee can confirm are not subject to contributions, since they represent compensation for expenses incurred by the employee.