The role of incentive provisions in salary calculation

The Regulations on Incentive Payments is a document, the presence of which is necessary to include in the employee’s salary that part of it that is defined as incentive in the Labor Code of the Russian Federation.

According to Art. 129 and 135 of the Labor Code of the Russian Federation, wages consist of:

- from the salary itself (salary or rate), determined by the qualifications of the employee and the characteristics of the work he performs;

- compensatory additional payments for special working conditions;

- incentive additional payments aimed at encouraging employees to work more efficiently;

- social benefits, in certain situations compensating for loss of income.

Stimulating in accordance with Art. 129 of the Labor Code of the Russian Federation can become:

- additional payments;

- allowances;

- bonuses;

- other payments.

They are divided into established ones:

- legislatively - for title, degree, category;

- independently - annual bonus, additional payments for length of service, quality, intensity of work or specific achievements.

For information about what payments form the composition of labor costs for the purposes of calculating income tax, read the article “Labor costs according to the norms of Article 255 of the Tax Code of the Russian Federation.”

Each employer bases its incentive mechanisms on its own methodology, outlining both the main criteria for which the employee should be rewarded and formulas for determining the amount of remuneration depending on the quantitative or qualitative characteristics of this criterion. A document such as the regulation on incentives is devoted to defining these criteria and the methodology for their application.

How to draw up and approve regulations on wages and bonuses in an organization? The answer to this question was explained by the state. inspector of the labor department of the Nizhny Novgorod region V.I. Neklyudov. Get free trial access to the ConsultantPlus system and follow the official’s recommendations.

Options for processing incentive payments

- How is overtime paid under the Labor Code?

If you need to legally formalize additional payments to the main part of your earnings, you will need to understand the forms of incentive payments and their correct purpose.

- Surcharge. They are associated with the direct performance of duties according to the job description and additional obligations. Overtime, schedules with night shifts and other work options that require increased pay are not considered additional pay.

- Allowances. For the purpose of incentives, sometimes management, in addition to the salary or tariff rate, adds its own payment system, under which employees have the right to count on an increase in labor income. The nature of the surcharges and the period of their application are determined by the enterprise independently, in accordance with the adopted regulatory act

- Awards. Bonuses are used most often. Management, intending to reward distinguished employees, more often resorts to a bonus system, independently determining the parameters of merit for which bonuses can be awarded. Similar options include bonuses in kind, but according to the law, the amount of such bonuses should not exceed a fifth of the salary.

Different enterprises have their own specific activities, and the administration has the right to develop its own incentive mechanisms for employees, stimulating staff to continue working and achieve high results, since there is no direct ban on the development of individual bonus systems by law.

Principles for creating incentive provisions

When creating incentive provisions, it is necessary to be guided by labor law norms, in particular Art. 135 Labor Code of the Russian Federation. The employer should consider:

- opinion of the workforce;

- the inadmissibility of deterioration of the conditions included in the collective agreement (or other internal regulatory act) in comparison with the norms of labor legislation;

- the inadmissibility of deterioration of the conditions included in the employment contract with the employee in comparison with the norms of labor legislation and the terms of the collective agreement (or other internal regulations).

NOTE! All types of payments that make up a salary form a remuneration system. It is formed individually for each employer and is enshrined in internal regulations. In this case, the specifics of a particular employee’s salary are fixed in his employment/collective agreement, which either reflects the entire system of entitlements, or indicates a reference to the internal regulation according to which labor will be paid. Such a document could be a salary regulation, which includes a section on incentive payments to employees. Or the employer stipulates wages in an employment/collective agreement with employees, and documents incentive payments in a separate provision.

Payments for work intensity and high performance results

Any employees whose work is rewarded for intensity and high results will continue to strive for similar successes. Such employees endure difficult working conditions more easily, complain less and conflict with management, since they receive a very noticeable increase in their salary.

What is labor intensity and high performance results? Obviously, this is a stressful job that provides more productivity than usual. The criteria for establishing such payments should be formed taking into account the specifics of the employer’s activities and can be very diverse.

Let's see how this is fixed in the by-laws. For example, in paragraph 34 of the section “Payments for intensity and high performance results” of the Regulations on the remuneration system for civilian personnel of military units and organizations of the Armed Forces of the Russian Federation, approved by Order of the Minister of Defense of the Russian Federation dated April 23, 2014 N 255, it is stated that the monthly incentive payment for complexity, intensity and special mode of work is established for civilian personnel in the amount of up to 100% of the official salary when the indicators and criteria for assessing performance are met.

Often similar payments are due for special work modes. In clause 4.2 of the Model Regulations on the remuneration of employees of federal budgetary institutions for the type of economic activity “Agriculture, hunting and forestry”, approved by Order of the Ministry of Agriculture of Russia dated September 23, 2008 N 441, it is said that when making payments for intensity and high results of work may be taken into account:

- intensity and intensity of work;

— special operating mode (related to ensuring trouble-free, trouble-free and uninterrupted operation of the institution’s engineering and economic and operational life support systems);

— organizing and conducting events aimed at increasing the authority and image of the institution among the population;

— direct participation in the implementation of national projects, federal and regional target programs.

Naturally, if such payments are established, the employer’s local regulations should stipulate not only the very fact of their appointment, but also determine under what conditions the work will be considered intensive and stressful or what falls under the concept of “special mode of work.”

To document the introduction of this payment, we recommend including the appropriate conditions in the internal regulations on remuneration (example 3).

Example 3. Fragment of the wage provision.

<�…>

3. Additional payments for work intensity and high performance results.

3.1. Additional payment for intensity and high results of work, carried out in accordance with these Regulations, is a type of incentive.

3.2. The basis for establishing additional payment for intensity and high results of work is the performance of work that meets the criteria provided in Table 4.

3.3. An employee may be given an additional payment for the intensity and high results of work on one or more grounds.

3.4. The decision to assign an additional payment is made by a commission (hereinafter referred to as the Commission on Incentive Payments), the composition of which is approved by order of the Company and which acts on the basis of the Regulations for the work of the Commission on Incentive Payments approved by the General Director of the Company.

3.5. An employee applying for an additional payment for intensity and high performance results in accordance with Table 4 submits an application (in the form according to Appendix No. 2 to these Regulations) to the Commission on Incentive Payments.

3.6. The minutes of the meeting of the Commission on Incentive Payments justify the decision to establish an additional payment for intensity and high performance results for each employee or to refuse to establish it, indicate the number of points received, as well as the voting results when making the decision.

3.7. Indicators that influence the change in size, removal of additional payment for intensity and high performance results are provided in Table 5. Changes and removal of additional payment for intensity and high performance results are allowed upon the recommendation of the employee’s immediate supervisor. The corresponding submission is sent for a decision by the Incentive Payments Commission.

3.8. Appointment, change in size, removal of additional payment for intensity and high performance results are formalized by order of the Company.

<�…>

Contents of the incentive provision

The text of the incentive provision usually contains:

- links to documents justifying its creation;

- goals and objectives set for the team as a whole;

- principles of organizing assessment of the contribution of each employee to the common cause;

- methodology for documenting the assessment process;

- determination of reporting periods and deadlines for data generation;

- point limits for each position;

- a list of evaluation criteria indicating the limits of their numerical values and accounting algorithms for remuneration;

- the procedure in which an employee can challenge the results of the assessment.

The set of criteria may vary depending on the characteristics of the employer’s activities. But at the same time, for all of them there must be the possibility of converting into a digital assessment (points).

The results of assessing the work of each ordinary employee must be formed taking into account the opinions of himself, the trade union body, managers and the employer. They are reflected in the evaluation sheet drawn up for a certain period for each employee.

An example of drawing up a regulation on incentive payments in an organization was prepared by ConsultantPlus experts. To do everything correctly, get trial access to the system and proceed to the sample. It's free.

Who gets the incentive bonus? What is an integrated incentive bonus?

Employees of the enterprise who meet the requirements established by internal regulations have the right to receive such monetary payments. The list of persons to whom bonuses are paid is determined during the adoption of a local act (in accordance with Article 8 of the Labor Code of the Russian Federation) or when concluding a collective agreement (in accordance with Article 40 of the Labor Code of the Russian Federation).

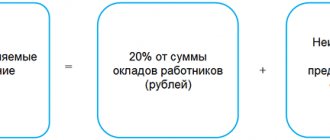

An integrated incentive bonus (ISI) is a tool that allows you to differentiate the amount of an employee’s remuneration depending on his professional qualities and performance results in the reporting period. As a rule, the ISN represents a certain percentage of the employee’s basic earnings.

IMPORTANT! ISN is not a guaranteed payment and is assigned only if the employee’s activities meet certain requirements. An employee’s professionalism and performance are assessed on the basis of a system of corporate criteria developed by the personnel service in collaboration with the immediate management of the unit in which the employee works.

Based on the results of the procedure for assessing the employee’s performance, a protocol is drawn up, which reflects the final size of the ISN. The employee must be familiarized with this document upon signature.

So, incentive bonuses and additional payments are an integral part of the worker’s earnings. The exact list of grounds for their accrual is established by the provisions of local regulations in force at the enterprise. Public sector employees receive incentive bonuses both in accordance with federal legislation and in accordance with local regulations of specific departments.

Features of creating a situation in state unitary enterprises and municipal unitary enterprises

Most employers have a fairly large degree of freedom in determining the rules for stimulating employees. However, along with them, there are organizations in Russia in which wages are regulated at the state level. These are budgetary institutions (SUE and MUP).

In relation to them, the text of Art. 135 of the Labor Code of the Russian Federation contains a reference to unified recommendations for establishing wages. Such recommendations are developed annually by a tripartite (Government of the Russian Federation - trade unions - employers) commission and establish a unified approach to remuneration of employees of these legal entities at all levels of the budget system (from federal to local). Based on this document, the volumes of budget funding for the next year are established for the maintenance of state unitary enterprises and municipal unitary enterprises, including those working in the fields of education and healthcare. If the tripartite commission has not developed such a document, then it is approved by the Government of the Russian Federation, bringing the commission’s opinion to the constituent entities of the Russian Federation.

In addition, the number of regulations that define the system of remuneration for public sector employees includes Decree of the Government of the Russian Federation dated 05.08.2008 No. 583. According to paragraph 5 of this resolution, each budgetary organization develops and approves an individual regulation on incentive payments.

Types of payments of an incentive nature for budgetary institutions are established by order of the Ministry of Health and Social Development of the Russian Federation dated December 29, 2007 No. 818. Among them, additional payments are highlighted:

- for the intensity of work and achieving high results in work;

- high-quality performance of work;

- continuous experience and long service;

- based on the results of work activity.

To implement the mechanism of incentive additional payments in a state unitary enterprise or municipal unitary enterprise, a system of criteria must be created that will allow assessing the effectiveness and quality of the work of each employee individually and can become a factor encouraging the improvement of the quality level of functioning of the budgetary institution as a whole.

The general recommended approach to the criteria is as follows:

- The employee must have a clear understanding of his job responsibilities, the rules for assessing the effectiveness of their implementation and their impact on the final amount of remuneration.

- The amount of remuneration for a specific employee should be determined taking into account the impact of his activities on the final result of the institution as a whole.

- The conditions that serve as the basis for calculating the final amount of remuneration must be sufficiently transparent to be clearly understood by both the employer and the employee.

When developing regulations on incentives in a state unitary enterprise or municipal unitary enterprise, one should be guided by industry recommendations for its formation, if they are established. For example, there are similar documents:

- for the healthcare system - order of the Ministry of Health of the Russian Federation dated June 28, 2013 No. 421;

- education systems - letter of the Ministry of Education and Science of the Russian Federation dated June 20, 2013 No. AP-1073/02;

- preschool educational institutions - letter of the Ministry of Education and Science of the Russian Federation dated March 31, 2008 No. 03-599;

- cultural institutions - letter of the Ministry of Culture of Russia dated 08/05/2014 No. 166-01-39/04-nm.

But at the same time, the incentive system in each specific institution can be individual. When developing it for itself, each state unitary enterprise or municipal unitary enterprise must be guided not only by uniform recommendations, but also by regional documents devoted to this issue, which should not contradict the uniform recommendations, but can complement and specify them.

Unlike other employers, in state unitary enterprises and municipal unitary enterprises the contribution of managers to the results of the institution’s work is also assessed. This assessment is carried out by a higher authority based on the overall performance of enterprises.

Who gets it?

All working citizens of both budgetary organizations and commercial ones have the right to receive incentive payments. Funds for accruals are taken from the enterprise's wage distribution fund.

How are executive compensation determined?

Like ordinary employees, the management of the enterprise has the opportunity to receive incentive payments to their salary. Their work and the reason for accrual of such additional payments are assessed according to appropriate criteria by the regulatory authorities of these enterprises. These criteria are reflected in the employment contract. Usually this:

- quality of work with employees, staffing levels;

- level of enterprise performance indicators and others.

Peculiarities of appointment to social workers

For teachers

To distribute the fund of incentive payments to employees of educational institutions, a point system is used.

There is a maximum number of points, based on which, taking into account the total volume of the fund, the value of one point is determined. Each employee has a score sheet with performance results and the amount of remuneration due. The procedure for calculating this system:

- The number of points earned is calculated for each teacher.

- The number of points of all employees is summed up.

- The value of one point is determined by dividing the fund's monetary value by the total number of points in a given institution.

- The additional payment is calculated individually - the points earned by the teacher are multiplied by the cost of one.

In the work of teachers, not only the performance of students is assessed. Extracurricular activities play a big role.

It is important whether the teacher takes part in special projects - excursions, hikes, socially significant events.

Participation in student achievement research is also considered and highly valued.

Dynamics of academic performance, participation in working with parents, in competitions, participation in the development of educational programs, working with children from disadvantaged families, design of the classroom - all these are criteria for assessing the work of a teacher.

The more he participates in these activities, the higher his points and incentive payment.

In preschool educational institutions, the incentive payment fund is divided between:

- educators and teachers. They receive 60% of the fund;

- other employees (nannies, cleaners, cooks, watchmen, auxiliary workers).

The criteria for evaluating their work is the success of clubs, electives, and educational programs.

The criteria for evaluating school directors and kindergarten managers are:

- active parenting;

- no complaints from parents;

- specialized training;

- attracting young specialists to work;

- performance indicators and USE results;

- availability of programs to work with children with special talents and gifted children.

The conditions of appointment and the amount of incentive payments are regulated by the Regulations, which are valid in each individual educational institution.

The adoption of such a provision is made only after discussing all the conditions with the labor collective at a meeting of the teachers' council.

The manager issues an order of appointment, the order is valid for a certain amount of time.

The Regulations also stipulate the conditions under which the amount of payments may be reduced or even withdrawn completely:

- violation of labor discipline, internal regulations or job descriptions;

- poor quality of performance of duties;

- violation of sanitary and safety regulations;

- presence of complaints;

- damage to property.

For health workers

For health workers, the procedure for incentive payments is regulated within the framework of a special program for the modernization of healthcare, which began in 2011.

Now not only doctors, but also middle and junior medical staff can count on them.

Since the program is being implemented throughout the Russian Federation, the process in each region is led by regional health authorities. They set criteria for evaluating the work of specialists and appointing them to positions.

The amount of payments is determined by the institution where the employee works. The criteria are usually established taking into account the population size, its density, gender composition, age composition, morbidity characteristics, and mortality of a particular territory.

The amount of incentive payments, taking into account all these criteria, depends on the number of services provided and varies depending on the location, the scale of the medical institution and its profile. Each institution also sets the following criteria:

- assessment of the work of a health worker. Compliance with standards and work deadlines;

- compliance with standards of medical care;

- time actually worked (full-time, part-time, part-time).

Cases when incentive payments are not awarded:

- managers who are not practicing doctors in the same medical institution;

- doctors receiving payments for participation in the national project “Health”;

- employees of medical institutions who receive additional payments for working with high-tech equipment.

Based on the order of the head physician, a health worker may be deprived of the assigned payment for failure to comply with the standards prescribed in the local act of work quality requirements.

For cultural workers

Cultural workers can also receive regular and one-time incentive payments. Regular ones are established by law, one-time ones are assigned in the form of incentives based on performance results.

These are payments for:

- quality of work;

- class, professional excellence;

- continuous work experience in cultural institutions

- presence of a degree, title “national”, “honored”;

- performing particularly important work.

Payments are established in accordance with the Regulations on Incentive Payments and distributed from the relevant institution fund.

How the 13th salary is calculated is a question that often interests employees of government agencies. When an organization is liquidated, employees are entitled to compensation. Which ones exactly - read about it in detail here.

Salaries for employees who work on a shift schedule are calculated according to a special scheme. Read more about this in our article.

Systems of evaluation criteria for state unitary enterprises and municipal unitary enterprises

Due to the uniform approach to remuneration in budgetary institutions, they are recommended to adhere to similar criteria for assessing the contribution of employees to the activities of institutions of the same profile. For example, evaluation criteria may include:

- for teaching staff of secondary educational institutions - the use of new information technologies in the learning process; preparation of students participating in Olympiads;

- for employees of medical institutions - the percentage of morbidity, reduction in treatment period, mortality rate or disability;

- for cultural institutions associated with artistic activities - the presence of independent creative developments, participation in festivals and competitions;

- for library workers - the results of work to replenish the book stock, register subscriptions or orders for books, and reader attendance.

Order of the Ministry of Labor of the Russian Federation dated April 26, 2013 No. 167n recommends indicating these criteria directly in employment contracts (effective contracts) or in additional agreements to them if a long-term employee is transferred to a new remuneration system.

Read about the form on which an employment contract can be drawn up in the material “Unified Form No. TD-1 - Employment Contract.”

Incentive payments to teaching staff

The formation of a system of incentive payments for teachers and educators of preschool institutions is carried out using methodological recommendations approved by letter of the Ministry of Education and Science of the Russian Federation dated June 20, 2013 No. AP-1073/02.

The set of evaluation criteria reflected in the regulations on incentive payments for teaching staff will vary depending on the purpose of the institution:

- in secondary educational institutions, the main indicators are: academic performance, activities outside the school curriculum and participation in external events, for which the level of training of students is important;

- for preschool educational institutions, the emphasis is on the level of development of children, the presence of progress in comparison with previous periods, a decrease in morbidity, and the absence of conflicts with parents.

For the heads of these institutions, the following indicators come to the fore:

- the quality of education provided, the attraction of new teachers, the creation of new training programs for secondary educational institutions;

- results of certification of the institution, level of health of children, participation in external events of a regional or broader scale - for preschool educational institutions.

You can read more about the criteria for incentive payments to teachers here.

Incentive payments: right or obligation of the employer?

1) We always fill out the roadmap according to the number of students! 2) General provision 1. This provision has been developed in order to strengthen the material interest of employees of the MBOU Children's Art School in the village of Ozerny (hereinafter referred to as the Institution) in improving the quality of educational and educational processes, developing creative activity and initiative in performing assigned tasks, successful and conscientious performance of official duties. 2. The regulation is a local regulatory act of the Institution, developed by the administration of the Institution, discussed, approved by the head of the Institution, taking into account the opinion of the representative body of employees. 3. The system of incentive payments to employees of the Institution includes additional payments, allowances and incentive payments based on work results (bonuses). Types of additional work and amounts of additional payments and allowances Incentive and compensatory payments include: • bonus for having an honorary title - up to 20% of the official salary; • bonus for the efficiency and quality of educational work - up to 20% of the official salary; • bonus for the complexity, intensity, intensity of the work performed - up to 50% of the official salary; • for performing the functions of a class teacher - up to 10% of the official salary; • for managing a specialized office (Choreography, Fine Arts, Theoretical disciplines, Instrumental) – 10% of the official salary; • for performing duties not included in the employee’s functional responsibilities - up to 20% of the official salary; • additional payment for working on office equipment – up to 10% of the official salary; • for combining professions (positions) and performing official duties of a temporarily absent employee without release from his main job - up to 15% of the official salary; • additional payment to teachers who are members of the Methodological Council of the Ozerno Children's School of Art - up to 20% of the official salary; • maintaining school records – up to 25% of the official salary; • technical and service personnel for the complexity and intensity of their work (cleaning toilets, working with bleach, landscaping the school, maintaining order and discipline in the school) - up to 30% of the official salary; • performance of work not included in job responsibilities (by agreement of the parties): teacher - duties of a secretary, clerk; carpenter - duties of a plumber, electrician; librarian - duties of a secretary, clerk - up to 30% of the official salary; Grounds and conditions for bonuses 1. Deputy directors for educational, methodological, extracurricular and extracurricular work are awarded bonuses for: • for drawing up and adjusting class schedules - up to 20% of the official salary; • for an increased amount of work on documentation – up to 30% of the official salary; • for organizing, conducting seminars, and the effectiveness of creative work - up to 30% of the official salary; • for the complexity and intensity of work associated with the activities of the educational process - up to 40% of the official salary. • introduction into the educational process of modern educational, methodological and didactic materials, software, training systems - up to 50% of the official salary; • development of the main directions of methodological work of an educational institution - up to 50% of the official salary; • formation and implementation of goals and objectives of the methodological work of an educational institution - up to 30% of the official salary; • providing organizational assistance in the development of educational and calendar plans in relevant areas of educational activities of the Children's Art School - up to 50% of the official salary; • providing organizational assistance in the development of work curricula for curriculum subjects - up to 50% of the official salary; • organization of innovative design and research activities of the Children's Art School - up to 40% of the official salary; • conducting methodological experiments to search for and test new technologies, forms and methods of teaching - up to 50% of the official salary; • personal contribution to ensuring the effectiveness of the educational process – 40% of the official salary; • introduction of innovative technologies, generalization and dissemination of best work experience - up to 50% of the official salary; • effective control over the progress of the educational process - up to 20% of the official salary; • high-quality and timely maintenance of reporting and other documentation – up to 20% of the official salary; • degree of participation in creating and maintaining a favorable climate in the team – up to 15% of the official salary; • compliance with personal discipline – up to 10% of the official salary; • state of affairs and results of activities of methodological associations of the Children's Art School - up to 20% of the official salary; • supervision of projects and educational programs - up to 30% of the official salary. 2. The deputy director for administrative and economic work is rewarded for: • the complexity and intensity of the work associated with ensuring the material and technical base of the school (sponsorship, work to attract extra-budgetary funds and material assets) - up to 40% of the official salary; • additional work on maintaining documentation on labor protection and fire safety - 20% of the official salary; • participation in repair work to maintain the school premises and improve the territory, to prepare the institution for the new academic year - up to 30% of the official salary; • performance of work not included in the official duties of the Deputy Director for administrative and economic work - up to 40% of the official salary. 3. Teaching staff are rewarded for: • high results in professional training and education of students based on the results of academic quarters and half-years - up to 50% of the official salary; • implementing an individual approach to students, organizing educational work with students, instilling in them a love for the profession, consciousness and activity, a culture of behavior, developing in students the ability to apply acquired knowledge in practice - up to 50% of the official salary; • conducting additional classes with gifted children, preparing them for participation in competitions, concerts, festivals at the zonal and regional levels - up to 50% of the official salary; • attracting students to participate in events in the village of Ozerny and Dukhovshchinsky district - up to 30% of the official salary; • conducting open lessons - up to 30% of the official salary; • continuous improvement of pedagogical skills, development of educational and methodological materials and manuals - up to 30% of the official salary; • pedagogical, lecture and educational, concert and organizational work with students in preparing and conducting extracurricular and extracurricular forms of the educational process - up to 30% of the official salary; • organizing and conducting events that increase the authority and image of the Institution among students, parents, and the public - up to 30% of the official salary; • training of concert artists (quantity, quality, variety) – up to 30% of the official salary; • work on preparing non-standard materials for teacher councils, summarizing best teaching experience, participation in innovative activities, development and implementation of proprietary programs - up to 40% of the official salary; • participation in seminars, conferences at the municipal, regional, all-Russian levels - up to 40% of the official salary; • maintaining the student population at the end of the academic year - up to 50% of the official salary; • employee participation in professional skills competitions (municipal, regional, all-Russian, international) – up to 50% of the official salary; • conducting master classes, presentations; speaking at conferences, forums, seminars – up to 40% of the official salary; • organization of extracurricular activities in the subject - up to 40% of the official salary; • participation of students in competitions, festivals, exhibitions - up to 30% of the official salary; • possession and use of pedagogical technologies in the educational process of the Children's School of Art - up to 30% of the official salary; • for the use of network opportunities in the implementation of the educational process (creation and use of electronic resources for lessons and homework for students) - up to 50% of the official salary; • organization of a “cultural event” (for example, a house, a literary lounge, a music lounge, a music box, etc.) – up to 40% of the official salary; • active participation in the life of the team, fulfilling public assignments - up to 20% of the official salary; • high level of executive discipline (preparing reports, filling out a journal, maintaining personal files, etc.) – up to 20% of the official salary; • exemplary classroom content (stands with information for students and parents, visual aids, photo exhibitions, etc.) – up to 30% of the official salary; • for preparing and holding an in-school concert - up to 50% of the official salary; • for preparing and holding a children's party - up to 50% of the official salary; • for preparing a student for a performance outside of school - up to 30% of the official salary; • for the design of school corridors and foyers - up to 50% of the official salary; • for career guidance work with parents and students of the Children's Art School - up to 50% of the official salary. 4. Service personnel are rewarded for: • accurate and conscientious performance of their duties - up to 50% of the official salary; • carrying out general cleaning – up to 50% of the official salary; • high quality of work – up to 30% of the official salary; • increase in the volume of work – up to 30% of the official salary; • prompt execution of requests to eliminate technical problems - up to 40% of the official salary; • compliance with safety rules and regulations – up to 30% of the official salary. Sources of bonuses and directions for their use The source of bonuses is the savings of the Institution's wages, which is formed through leaves without pay, temporary disability of employees, and combining positions. Directions for using funds: • current bonuses to employees for the main results of creative, production and economic activities; • one-time incentives for employees for their contribution to the implementation of particularly important creative and production tasks; • a one-time bonus to persons awarded Certificates of Honor from the Ministry of Culture and Mass Communications of the Russian Federation, the Administration of the Smolensk region, the Head of the Administration of the Dukhovshchinsky District municipality; • bonuses for school employees in connection with anniversaries (50, 55, 60, 65, 70 years) and national holidays: - Teacher’s Day - October - Defender of the Fatherland Day - February - International Women’s Day - March - Cultural Worker’s Day – March - other types of bonuses, incentive payments based on work results. Establishing bonus conditions that are not related to labor productivity is not permitted. Conditions and procedure for bonuses The distribution of the incentive part of the above-tariff fund is carried out by half-year by the school administration, the head of the Moscow Region, taking into account the opinion of the trade union. Conditions and procedure for canceling surcharges and allowances The types and amounts of surcharges and allowances can be revised before the start of a new academic year, a new financial year (increased or decreased), based on the amount of the super-tariff fund according to the new tariff, and are paid if funds are available on a monthly basis. The amount of additional payments may be changed depending on the employee’s performance. Employees may be deprived of additional payments and allowances partially or completely for: • failure to fulfill the employee's job duties; • employee refusal to perform certain work within the scope of job duties; • due to deterioration in the quality of work; • due to changes in working conditions in terms of intensity, complexity, tension; • persons who have committed absenteeism will lose 100% of their bonus; • refusal to participate in intra-school, municipal, regional, and all-Russian events; • for violation of labor discipline, as well as in the case of justified complaints from parents about the actions of a teacher or employee, a decrease in the quality of work, for which bonuses were determined. Validity period of this Regulation This Regulation is valid until 08/31/2016. and may be revised in connection with a change in the above-tariff wage fund for employees of the Institution, which is the source of additional payments and allowances, at the request of one of the parties that signed it, or extended until a new one is adopted.

Incentive criteria for health workers

Recommended lists of indicators with criteria for their implementation and assessment in points for different positions are indicated in Order of the Ministry of Health of the Russian Federation dated June 28, 2013 No. 421. Examples of such indicators:

- participation in disease prevention;

- reduction in morbidity and mortality rates;

- number of diseases detected in time;

- the fact of timely hospitalization;

- compliance with sanitary norms and medical standards;

- the presence of incorrect diagnoses or complications as a result of prescribed treatment;

- presence of patient complaints;

- the total amount of time worked for the period.

Order No. 421 also describes the features of the performance assessment procedure, the coefficients applied depending on the position, and the maximum amounts of points awarded.

Read more about incentive payments to healthcare workers here.

Results

The provision on incentive payments plays a very important role in the process of forming a remuneration system for any employer, influencing the employee’s direct interest in the results.

In relation to state unitary enterprises and municipal unitary enterprises, the creation of such a document is mandatory due to the existing legislative prerequisites for their application of a unified wage system, including additional incentive payments. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Incentive payments to preschool staff

According to the letter of the Ministry of Education and Science No. 03-599 dated March 31, 2008, the preschool education institution must, on its own, distribute money allocated from the budget for material, technical, educational needs and salaries. It is recommended to allocate 30 to 40% of the total wage fund (WF) for labor incentives. The institution has the right to set the specific value of the indicator independently.

The main criteria for stimulating the work of preschool employees include the following:

- Expanding the horizons of children;

- Identification of special abilities of wards;

- Contact with parents;

- Improving development programs;

- Carrying out health procedures;

- Help for children from disadvantaged families;

- Creation of visual elements: posters, panels, crafts, etc.

For the heads of preschool educational institutions, the fund for additional payments is formed centrally by the municipality. It is recommended to make contributions to it in the amount of 5% of the salary funds. The Department of Education assigns additional payments.

The conditions for bonuses for preschool educational institutions employees were proposed by the Ministry of Education and Science in the Regulations on the distribution of the incentive share of the payroll. Incentives are established and distributed by the head of the institution in agreement with the self-government body.

Example 1. Bonus for length of service

The agreement with the person accepted by the teacher includes a clause on an incentive bonus for length of service. After 3 years of continuous work in an institution, a person will receive a 20% increase in salary, and after 6 years - 30%. This measure encourages the employee to work in this place for as long as possible.