Inventory procedure

The procedure by which the inventory is carried out is established in the Methodological Instructions (approved by Order of the Ministry of Finance of Russia No. 49 of June 13, 1995). It is presented in three stages:

- At the first stage, the company issues an order to conduct an inventory (form INV-22), after which it is registered in the control log for the implementation of the relevant orders (INV-23). In addition, at the first stage, an inventory commission is formed;

- At the second stage, the calculations are directly verified. To do this, account balances are opened for individual employees. After this, they consider documents confirming how legitimate the debt is in settlements for each employee;

- At the third stage, an act is drawn up (form INV-17), which reflects the balance of debts in settlements with employees that have not been documented. After this, the inventory results are entered into the INV-23 form.

Checking calculations for personnel remuneration

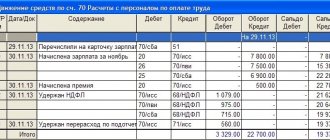

All operations for accrual, payment of wages, vacation pay and benefits are reflected in account 70 “Settlements with personnel for wages”. To confirm the balance of this account, the turnover on it is checked. If there is an error, the incorrect balance will be reflected.

Credit 70 of the account reflects the accrual of payments to employees, including wages, vacation pay and benefits. The created commission checks orders for the payment of bonuses, compensation, sick leave, as well as time sheets, employment contracts and additional agreements to them. The salary calculation is reflected in one of two statements: in T-51, if the salary is transferred to the card, or T-49 (T-53), if the salary is issued from the cash register.

Debit 70 of the account reflects deductions from accrued payments (alimony, personal income tax, etc.), as well as direct payments (salaries, vacation pay, benefits, etc.).

In order for the inventory calculation to be correct, it is necessary to check the availability of documents for:

- Personal income tax, including applications for deductions, as well as copies of birth certificates;

- Other deductions, for example, writs of execution, orders to withhold amounts from wages, etc.;

- Payment documents for salary payments (vacation pay or benefits).

Answer

Deductions under enforcement documents are reflected in accounting as a decrease in accounts payable to the employee and the occurrence of accounts payable to the collector. Consequently, the confirmed debt to the claimant will be the amount withheld from the employee in accordance with the writs of execution available to the employer. An unacknowledged debt is an incorrect amount of withholding. For example, an error in the amount of deduction or deduction after the expiration of the writ of execution.

Deductions on writs of execution are reflected in accounting entries Dt 70 - Kt 76. Consequently, according to the accounting data when inventorying calculations for wages of account 70 and according to the inventory of account 76 for settlements with the claimant without comparing with writs of execution, unreliable data should be reflected in the inventory act impossible.

In addition to reflecting the identified unconfirmed debts in the act, it is also necessary to issue an accounting certificate confirming the correct calculations based on the existing writs of execution.

Salary arrears

If accounts payable are shown on account 70, this means that employees have been accrued wages (vacation pay, benefits), but have not yet been paid. If there is a debit balance on account 70, this indicates that there is a debt due to personnel. In this case, the created commission identifies the reasons that contributed to its occurrence, and also evaluates the possibility of its repayment. After this, a decision is made whether it is possible to create a reserve for doubtful debt, or whether to write off the debt as other expenses (Read also the article ⇒ Cash compensation for salary delays in 2022).

Features of accounting for settlements with employees

Loan 70 reflects the accrual of payments to the employee within the framework of the employment relationship:

- wages;

- bonuses;

- benefits and other social payments;

- dividends to shareholders (participants of the company) who are employees of the organization.

So what does account credit 70 mean - this is the organization’s obligation to pay employees the amounts due to them. The balance is the organization's debt to employees for wages as of a certain date.

Let's move on to what it means to debit account 70 reflected over a period of time:

- payments of accrued wages (or dividends) made;

- deductions (personal income tax, alimony, other payments under writs of execution and other deductions).

Checking settlements with accountable persons

All settlements with reporting employees are reflected in 71 accounts. To carry out the verification, a turnover is generated for this account. If there are accounts receivable at the end of the year, this means that the employee has not fully accounted for the amounts he received. Moreover, such debt can be either normal or overdue. It is normal if the period during which the employee had to account for the amounts given to him has not yet expired. This period is 3 days from the end of the period for which the money was issued. That is, if the period for which the employee was given the money expires on February 10, then no later than February 13, the employee must provide an advance report on it, or return the unspent funds. If the employee does not do this on time, an overdue debt arises from the accountable person. When checking, the inventory commission identifies the reasons for the occurrence of receivables. This may be an advance report that was not submitted on time, or the employee did not provide documents confirming his expenses (

Checking settlements with employees for other transactions

To reflect other settlements with employees, account 73 is used, for example, loans issued to the employee, or compensation for damage associated with cash shortages or manufacturing defects. If there is a receivable on this account, it means that the employee has an outstanding loan or loss. The amount of damage and the procedure for its repayment is established according to one of the documents: an order, a court decision, a PKO or a payroll statement. To reconcile loan balances, the commission will consider documents on the employee’s repayment of the debt, as well as the loan agreement itself. Documents confirming the fact of debt repayment are: PKO, an employee’s statement in which he asks to make a deduction from wages, a payroll statement, as well as an extract from the company’s account if the debt is not repaid in cash.

The debt of employees is verified with the data of accounting certificates and receipt documents. After this, the commission assesses the likelihood of repaying the debt.

The loan balance of account 73 shows that the company has debts to staff. For example, an employer pays an employee compensation for the use of his car. Such debt can also be normal or overdue. When checking, the commission checks the amount of debt with the amounts of compensation specified in the lease agreement or in the additional agreement to the employment contract.

Inventory of settlements with employees

The inventory of payments to employees is not regulated by law, so the inventory is usually carried out once a year. However, if you conduct an inventory quarterly, this will avoid debt to staff, and therefore the risks of labor inspection inspections, disputes with employees, and even company losses when the accountable person does not return the funds.

The procedure for inventorying settlements with personnel is not clearly defined, therefore, if there are specific features of settlements with personnel, then it is better to establish the inventory procedure in a local act. The general procedure for conducting an inventory is established in the order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 (as amended on November 8, 2010) “On approval of the Guidelines for the inventory of property and financial obligations.”

But in general, the algorithm for inventorying settlements with personnel is as follows:

| The number of inventories in the reporting year, the date of their conduct, the list of property and financial obligations verified during each of them are established by the head of the organization |

| The manager issues an order to conduct an inventory |

| The manager appoints members of the inventory commission |

| Analysis of invoices for specific employees |

| Analysis of documents regarding employees |

| Drawing up an act in form INV-17 and entering the results in form INV-23 |

The inventory commission includes representatives of the organization’s administration, accounting employees, and other specialists (engineers, economists, technicians, etc.).

Before checking the actual availability of property, the inventory commission must receive the latest receipts and expenditure documents or reports on the movement of material assets and cash at the time of inventory.

With regard to the inventory of settlements with employees, it is important that in debt to employees of the organization, unpaid amounts for wages are identified that are subject to transfer to the account of depositors, as well as the amounts and reasons for overpayments to employees. The reserve for the upcoming payment of regular (annual) and additional vacations provided for by law to employees, reflected in the annual balance sheet, must be clarified based on the number of days of unused vacation, the average daily amount of expenses for remuneration of employees (taking into account the established methodology for calculating average earnings) and mandatory deductions to the Social Insurance Fund of the Russian Federation, the Pension Fund of the Russian Federation, the State Employment Fund of the Russian Federation and for medical insurance.

Accordingly, the inventory results are documented in an act.

GOOD TO KNOW

All unified forms listed in the scheme are approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88. At the same time, any company can use independently developed forms.

Checking payroll calculations

The procedure for checking wage calculations and a specific list of documents are also established in each specific case.

It is better to carry out the inventory in three stages.

At the first stage, you need to check account transactions:

- 71 “Settlements with accountable persons” (amounts issued on account for which advance reports have not been received);

- 73 “Settlements with personnel for other operations” (debt of employees to repay loans, to compensate for material damage caused by an employee of the organization as a result of shortages and thefts, defects, etc.).

Credit balances on accounts are also checked:

- 70 “Settlements with personnel for wages” (debt to employees for wages, payment of benefits for temporary disability, maternity benefits, etc., payment of income from participation in the organization (dividends));

- 71 “Settlements with accountable persons” (amounts of overexpenditures on advance reports subject to reimbursement to accountable persons);

- 73 “Settlements with personnel for other operations” (debt to employees for payment of compensation for the use of personal vehicles (other property) for business purposes, etc.).

GOOD TO KNOW

When conducting an inventory of deposited amounts, the balance of account 76 of subaccount 4 “Calculations for deposited amounts” is checked for compliance with the amounts in the deposited salary book or in depositor cards, and, if necessary, with payroll statements.

Example 1.

Here is an example of an error identified during an inventory.

Accountant A.K. Ivanova accrued vacation pay to secretary S.S. Belova twice.

The accountant was supposed to accrue the amount of 18,000 rubles, but accrued 36,000 rubles.

The accountant agreed with S.S. Belova that she would return the amount to the cash desk.

In accounting, the amount overcharged to the employee is reversed:

| Debit | Credit | Sum | Description |

| 26 | 70 | 18 000 | The amount overcharged to the employee due to a counting error was reversed |

Negative consequences of not detecting an error in a timely manner could include:

- dismissal of an employee;

- refusal to return overcharged funds.

At the second stage, it is advisable to check the documents.

The accuracy of payroll calculation is regulated by:

- regulations, instructions and decisions of the employer regulating the remuneration system;

- staffing schedule;

- resolutions, orders, instructions, collective agreement, other decisions on the organization of work, payment of wages, bonuses, financial assistance or other remuneration;

- contracts that provide for the payment of wages or other remuneration, including civil contracts;

- other documents related to payments in favor of employees.

GOOD TO KNOW

An inventory of settlements with employees is a check of the validity of the amounts of debt in settlements with employees, which are listed on the company’s accounting accounts.

An example of a detected error.

The inventory commission revealed the presence of different amounts in the staffing table and the employment contract. In the employment contract, the salary amount is 30,000 rubles. In the staffing table - 26,000 rubles.

Based on the results of the inventory, it was revealed that the employee’s salary was increased, however, an error was made in the staffing table.

Negative consequences of not detecting an error in a timely manner could include:

- claims from tax authorities;

- claims of the Pension Fund and the Social Insurance Fund of the Russian Federation.

GOOD TO KNOW

Accruals on the credit of account 70 are reconciled with settlement and payroll statements. Turnovers in the debit of account 70 are compared with cash receipts or payment orders, if salaries are transferred by bank transfer, with the documents on the basis of which deductions were made.

The following documents are also subject to verification:

- The order of acceptance to work;

- time sheets and payroll records;

- contracts of a civil law nature, under the terms of which insurance premiums are charged on the remuneration paid;

- payslips;

- payrolls;

- personal accounts;

- bank and cash documents for payments in favor of employees (income) not related to the wage fund (material assistance; bonuses not related to the performance of work duties; other one-time incentives, including the cost of gifts; funds to reimburse employees’ expenses for housing; supplements to pensions for those working at the enterprise from the employer's funds; expenses for payment to health care institutions for services provided to employees at the expense of the enterprise; payment for vouchers for employees and members of their families on excursions, travel at the expense of the employer, etc.).

GOOD TO KNOW

Information on the payment of wages to employees is presented in payment (settlement and payment) statements and cash receipts.

If the company employs disabled people who have a reduced work week and benefits on insurance premiums, then you need to check:

- lists of working disabled people, certified by the seal of the organization and the signatures of its director and chief accountant, indicating the disability group, pension certificate number, number and date of issue of the certificate confirming the fact of disability for each disabled person;

- information on the amount of payments accrued in favor of working disabled people;

- certificates (copies of certificates) from medical and social examination institutions confirming the presence of disability among disabled workers;

- copies of settlement and payment documents confirming the amount of payments in favor of employees who are disabled people of groups I, II, III, organizations of any organizational and legal forms;

- documents confirming the existence of labor relations of the organization with disabled employees.

At the third stage , it is advisable to pay attention to individual cases (for example, if an accident occurred at work).

The assignment and payment of temporary disability benefits due to an industrial accident or occupational disease are made in the manner established by the legislation of the Russian Federation for the assignment and payment of temporary disability benefits under state social insurance (Clause 1, Article 15 of the Federal Law of July 24, 1998 No. 125-FZ).

Therefore, it is necessary to check:

- accounting accounts;

- documents;

- special situations related to remuneration.

GOOD TO KNOW

The credit balance of account 70 shows the company's debt to employees. This is accrued but not paid wages, vacation pay, etc.

We check settlements with personnel for other transactions

To inventory settlements with personnel for other transactions, you need to check transactions on account 73.

As part of checking account 73, you need to evaluate:

- the amount that must be issued for reporting;

- the period for which the money is issued;

- signature of the head of the organization (another person authorized to sign applications for the issuance of money under a power of attorney);

- date of signing the application.

You also need to check:

- expense cash orders (RKO) according to form No. KO-2;

- orders;

- employment contracts with employees;

- expense reports;

- purchase receipts.

Inventory of settlements with accountable persons consists of reconciling the balances for each accountable person in relation to advances issued (submitted reports), checking compliance by the accountable person with the deadlines for submitting the advance report and returning unspent amounts on it, the availability of primary documents confirming payments made, and the compliance of the report with its intended purpose. advance received (clause 3.47 of the Inventory Guidelines).

During the inventory, the amounts of receivables, payables, and depositor debts for which the statute of limitations have expired are established (clause “c”, clause 3.48 of the Inventory Guidelines).

GOOD TO KNOW

The credit balance on account 73 indicates that the company has a debt to employees.

The most common errors identified during inventory are:

- non-refund of funds;

- use of funds by the employee for personal purposes;

- issuance of funds on account in the absence of a report for previously issued funds.

Correction of errors based on inventory results. Postings

An inventory is carried out at the end of the reporting year, that is, on December 31 (No. 402-FZ dated December 6, 2011, letter of the Ministry of Finance of Russia No. 07-02-18/01 dated January 9, 2013). All errors identified during the inventory are recorded on December 31. The same number must be used to correct errors.

Correction of excessively accrued salary amounts is formalized by the following posting:

D20 K70 – excess accrued salary reversed

If it is necessary to accrue the missing amounts, the posting will be as follows:

D20 K70 – additional wages accrued.

What is this register and what is it used for?

According to the Federal Law “On Accounting” No. 402-FZ dated December 6, 2011, the chart of accounts and the procedure for its application are established by federal standards (clause 3 of Article 21 of Law 402-FZ).

This standard is the order of the Ministry of Finance of the Russian Federation dated October 3, 2000 No. 94n. It spells out everything about account 70 in section VI “Calculations”. The register is intended to reflect the accrual and payment of wages to employees and, in some cases, the accrual of dividends (other income from participation in the capital of the organization). It is active-passive, so the normal account balance is 70, both debit and credit. The balance at the end of the reporting period is reflected in the financial statements as follows:

- credit - in the liability side of the balance sheet as part of accounts payable;

- debit - in the balance sheet asset as part of accounts receivable.

Provision for doubtful debts

If the inventory reveals debit balances, this means that the employees owe the employer. Depending on the specific situation as a result of which the debt was formed, one or another rule for its repayment is applied. They are indicated in Article 811 of the Civil Code of the Russian Federation and the following articles of the Labor Code of the Russian Federation: 137, 138, 248, 392.

In some cases, debt is classified as doubtful. For example, if it is not secured by any guarantees, or if the debt is not repaid on time or will not be repaid on time with a high probability. Debt can be classified as doubtful debt for up to three years from the date of its occurrence. If the claim period has expired and the debt has not been repaid, it can be written off. A reserve for doubtful debts is created using the following entries:

D91 subaccount “Other expenses” K63

The amount of doubtful debt is determined for each such debt. If the employee nevertheless repays the debt, it is documented with the following entry:

D63 K91 subaccount “Other income”.

When the claim period has already passed, the receivable can be written off. In this case, the postings will depend on whether a reserve for doubtful debts has been created for this receivable. If yes, then the wiring will be as follows:

D63 K70 (71, 73)

If not, then the debt is written off against the company’s financial results, and the posting will be as follows:

D91.2 K70(71, 73)

In addition, the debt is reflected in account 007 “Debt of insolvent creditors written off at a loss”, where it is taken into account for 5 years. To write off the debt, an inventory act is drawn up, as well as an order from the director.