How are working hours determined?

In accordance with Articles 100 and 189 of the Labor Code of the Russian Federation, the working hours are established by the employer in agreement with the employee. The length of the working day is necessarily fixed in the employment contract.

At the same time, the normal working hours per week cannot exceed 40 hours (Article 91 of the Labor Code of the Russian Federation).

This number of hours is the most common standard for most positions. It turns out that the employee works 5 days a week for 8 hours.

For certain categories of citizens, as well as for some labor positions, a smaller number of working hours per week is established. For example, in hazardous industries they work on average 20-25 hours a week. The duration of one working day is not regulated by current labor legislation: in fact, it can be anything.

Standard calculation method

In accordance with Art. 152 of the Labor Code of the Russian Federation, overtime hours worked are paid according to the scheme outlined below:

- the first two hours of overtime work - at a coefficient of not less than 1.5;

- third and further hours of overtime work - at a factor of 2 or more.

The procedure for calculating payment is established at the local level through a collective agreement, individual employment contracts and relevant orders of the head of the enterprise or organization. At the same time, the procedure established at the local level should not worsen the employee’s position in comparison with the amount of payment established by the Labor Code of the Russian Federation.

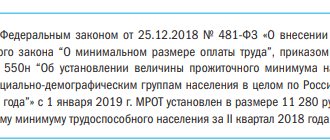

The formula for calculating overtime hours is not regulated; however, Letter No. 16-4/2059436 of the Ministry of Health of the Russian Federation contains a completely workable calculation formula.

So, in accordance with the Letter of the Ministry of Health, overtime can be calculated by performing the arithmetic operation O / (GN / 12) = PO, where:

- O is the salary size;

- GN – annual norm according to the production calendar;

- 12 – months of the calendar year;

- PO – hourly salary.

For example, take the following hypothetical conditions.

Loader A. worked 3 hours overtime. The salary of a loader is 15,000 rubles. Taking into account a 40-hour work week, loader A. worked 1970 hours during the billing period. We calculate payment for overtime work:

15,000 / (1970/12) = 91 rubles 40 kopecks cost of one standard hour. Next, we calculate the hours taking into account the coefficient:

- 91.40 × 2 × 1.5 (one and a half coefficient) = 274 rubles 20 kopecks payment for the first two overtime hours;

- 91.40 × 1 × 2 = 182 rubles 80 kopecks for the third overtime hour;

- 272.20 + 182.80 = 455 rubles payable for 3 overtime hours.

Legislative regulation of shift work schedules

Shift work schedule is a form of employment permitted by law. This is a non-standard regime that requires the employer to maintain summarized records of working time. Every year in Russia a new production calendar is introduced (approved by the Government of the Russian Federation).

This regulation specifies the maximum number of hours that an employee can work in a year.

For each category of workers, a separate number of working hours is established.

If an employee is engaged in seasonal production or works on a shift schedule, the employer must use a summarized scheme for calculating working hours. That is, if it is not possible to accurately calculate the number of hours worked per week, they can be added up during one reporting period.

A special type of working time recording – summarized

Summarized accounting is, in fact, a special operating mode based on compliance with certain schedules (as a rule, these are “sliding” or shift schedules).

The basis for establishing such schedules is the reason “by contradiction” - when it is not possible to plan the regime in such a way that the working week is the fixed number of hours provided for by the norms of Art. 91-92 Labor Code of the Russian Federation:

- 24 – for youth under 16 years of age;

- 35 – for those with a disability group;

- 36 – for teachers and workers in hazardous industries;

- 39 – for doctors

- 40 hours is the standard duration.

A working week cannot include more than 40 hours.

With RMS, shortcomings during one period can be compensated by processing in other time intervals, which in total reaches the result required by the standard.

Number of hours with a shift schedule of 2 every 2

In most cases, with such a work schedule, an employee has 7-8 shifts in one calendar month. With a 40-hour work week, the total number of hours per month is about 160 hours. This is the normal figure, from which one hour should be subtracted for each Friday shortened day.

If we start from the most common cooperation schemes, then with a 2/2 shift schedule the duration of one shift is 10-12 hours. At the same time, we would like to remind you that the legislation does not regulate the duration of one work shift. It is established by the employer independently, based on normal, generally accepted standards.

As an example, you can take a 12-hour work schedule. Hence:

- If an employee works 15 days on average (7-8 shifts), then the total working hours in one month will be 180 hours (12*15).

- The normal working hours for a 40-hour workweek is 160 hours.

- It turns out that with a shift schedule, an employee overworks the norm by an average of 20 hours.

But such a scheme is not considered a violation on the part of the employer, since it is permissible to sum up the total number of hours during the reporting period. Such a reporting period can be a month, a quarter, or a year. It all depends on what type of work the employee performs and for how long the employment contract is concluded.

Rules for summarized working time recording

Let's summarize the requirements for RMS: the employer, when planning such an operating mode, must take into account the following important points.

- RMS is mandatory introduced in organizations that cannot ensure constant compliance with working hours throughout the working day (shift) or week.

- The amount of time worked during RMS during the accounting period should not exceed that provided for by law.

- The RMS schedule is mandatory when organizing shift work and is desirable in all other modes.

- The accounting period under the RMS regime is set arbitrarily, except for those types of activities where it is provided for by law, and it is unlawful to set it longer than 1 year.

- The following items must be regulated in the RMS schedule:

- the beginning and end of the labor process;

- duration of the shift (working day) in hours;

- frequency of work shifts and days off;

- rest time between shifts.

- It is forbidden to include significant rework in the schedule (this is fraught with administrative liability), and shortcomings are also undesirable. If this or that actually happened, this must be compensated by the employer in the manner prescribed by law.

- Overtime hours are calculated and paid after the end of the accounting period.

- Work on public holidays according to the schedule is included in the general standard of hours, although it is additionally paid or compensated, without being overtime.

- For an employee who does not begin his duties at the beginning of the accounting period, the total hourly rate is reduced.

- The absence of an employee for a valid reason, in particular due to sick leave or vacation, excludes the missed hours from his norm for the accounting period.

Maximum number of hours according to the 2020 production calendar

The 2022 production calendar has already been approved by the Government of the Russian Federation, and its text is available for free review. The total number of working hours is 1,979 per year. Anything that exceeds this figure is considered processing, which must be paid separately.

Each quarter has its own working hours. Current figures:

- 1st quarter - 456.

- 2nd quarter - 477.

- 3rd quarter - 528.

- 4th quarter - 518.

If the reporting period established by the employer is one quarter (3 months), then the maximum number of hours can be specified in the list above. To clarify the duration of one exit, it is enough to divide the maximum number of working hours by the number of employee exits. In this way, you can clarify whether there is a fact of processing or not.

At the same time, most employers, in order to avoid violations of the Labor Code, establish a reporting period of one year (for long-term contracts). This way they can compensate for overwork in one month with underwork in another.

4 / 5 ( 7 votes)

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Calculation of overtime when working in shifts

How to calculate overtime for a salary, we wrote here

With the weekly accounting method, identifying hours worked in excess of the norm is quite simple. You just need to know the maximum standard for the duration of a working week for a particular employee, established by law. All hours worked above this limit will be overtime. In order to calculate the amount of additional payment for overtime during a shift change, you first need to determine the number of hours worked in excess of the norm.

If the company uses cumulative accounting of work time, then in order to determine the duration of overtime it will be necessary to calculate the time worked cumulatively for the entire accounting period. This point is fundamentally important, since excessively worked hours that go beyond the norm established by law are considered overtime only at the end of the reporting period.

For example, if in a company, for employees working in shifts, time worked is calculated using the cumulative accounting method using a quarterly reporting period, with a standard 40-hour work week, the normal length of work time in the 3rd quarter of 2022 will be as follows:

- July - 184 hours;

- August - 168 hours;

- September - 176 hours;

- total - 528 hours.

Let's say an employee worked:

- in July - 186 hours;

- August - 160 hours;

- September - 186 hours;

- in total for the 3rd quarter - 532 hours.

Thus, the overtime duration for the 3rd quarter of 2022 for this employee is: 532 − 528 = 4 hours. It is these 4 hours that should be compensated to the employee as overtime worked.

Comments: 377

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Anatoly

03/02/2022 at 22:23 Hello! Is it possible to work 14 hours on a 2/2 schedule?

Reply ↓ Anna Popovich

03/03/2022 at 00:25Dear Anatoly, labor legislation regulates the normal length of the working week - no more than 40 hours in the general case. But for employers practicing a shift component of no more than 40 hours. This is due to the specifics of the production process. In this case, Art. 94 of the Labor Code of the Russian Federation allows the employer to use summarized recording of working time. Consequently, when using summarized working time tracking, 1 individual shift may differ in duration both up and down. But in general, the number of hours worked for the period of time accepted as an accounting period should not be more than established for this period, provided that the work hours are normal.

Reply ↓

02/26/2022 at 12:04

I work as a video surveillance operator at a school. Shift schedule for two people. Five-day work week. six hours a day (7 a.m. to 1 p.m. and from 1 p.m. to 7 p.m.) The director offers two options. Salary 0.8 of the rate or change the work schedule to work 8 hours a day. What kind of schedule could there be for two workers?

Reply ↓

- Anna Popovich

02/28/2022 at 16:45

Dear Sergey, you need to contact the school’s personnel service. A schedule of 8 hours per shift is standard.

Reply ↓

02/20/2022 at 17:41

Hello, is a 13-hour working day the norm with a 3/3 shift schedule, and how many hours are deviations from the norm?

Reply ↓

- Anna Popovich

02/20/2022 at 18:23

Dear Olga, this is legal. But the duration of weekly continuous rest cannot be less than 42 hours, and during the working day (shift), the employee must be given a break for rest and food lasting no more than two hours and no less than 30 minutes, which is not included in working hours. You also need to remember that normal working hours cannot exceed 40 hours per week. However, when working according to a schedule, this norm may not be observed, then a summarized recording of working time is introduced so that the duration of working time for the accounting period (month, quarter and other periods) does not exceed the normal number of working hours.

Reply ↓

02/10/2022 at 22:27

Good afternoon. I work under a contract on a 2/2 schedule and on a salary. In January there was 7 days of sick leave, of which 3 days were supposed to be working days. 154 working hours, 33 of them on sick leave. How is the amount of time worked calculated taking into account sick leave? Are you not paid only for non-working hours or the entire week? And another question. Do you have to pay double for holidays when officially registering?

Reply ↓

- Anna Popovich

02/20/2022 at 01:28

Dear Alexey, non-working time is not paid in accordance with the sick leave.

Reply ↓

02/10/2022 at 21:16

Good afternoon My colleague and I have a shift work schedule, but it is not clearly fixed. On average there are 13-14 shifts of 12 hours each. There are employees with a 2/2 shift schedule, and there are several people on 5/2 shifts. During the January holidays, my colleague and I were not assigned a single shift, citing a lack of tasks, and were told that we would receive our salary. In January we have 132 hours, 2/2 - 165 hours, 5/2 - 128 hours. As a result, we received less salary for about another 12 hours. How correct was the employer? Can we request a recalculation, or additional shifts to equalize the hours for the year?

Reply ↓

- Anna Popovich

02/20/2022 at 01:35

Dear Kira, a deficiency due to the fault of the employer occurs when during the accounting period all scheduled hours have been worked, but this is less than the norm. For hours not completed to standard, the average hourly wage is paid (Articles 102, 155 of the Labor Code of the Russian Federation).

Reply ↓

02/09/2022 at 22:29

Alex. I have a 12 hour work shift. At lunch I went to the store and left the enterprise for 20 minutes. And my employer fined me 40 minutes of working time. Who is right here or did I violate something?

Reply ↓

- Anna Popovich

02/09/2022 at 23:45

Dear Alexander, during your lunch break you have the right to leave your workplace.

Reply ↓

02/19/2022 at 15:00

Fines are a gross violation of labor laws by the employer ☝️

Reply ↓

02/07/2022 at 04:29

Good day. It turns out that on 01/03/22 I came to work part-time from 9 am to 1 pm, the next day on 01/04/22, more from 9 am to 5 pm, on 01/05/22 they gave me a day off, and from 01/06/22 they started setting official 2/2 shifts (from 9 am and until 21 pm), this continued until 02/04/22, and later they wrote 02/07/22 I will work 5 hours a day at half rate... why did this happen?

Reply ↓

02/02/2022 at 20:51

Good afternoon, I work with a schedule of 2/2 for 11 hours a day, they pay per month according to the schedule of 2/2, when someone goes on vacation the schedule changes to 3/1 and overtime is not paid. But the employer says that there are not enough hours to work. It is legal? And what kind of output is my employer asking me to pay if shifts are paid only according to the white schedule 2/2?

Reply ↓

- Anna Popovich

02/03/2022 at 01:10

Dear Christina, we recommend that you contact the relevant department with this question on the website Onlineinspektsiya.rf. Upon self-checking the legality of the situation, you will be provided with links to labor legislation if violations occur.

Reply ↓

02/02/2022 at 17:36

Hello! I am a personnel officer, in one department the schedule is 12 hours. , schedule 2/2. We take the period to be a year. Those. At the end of the year, should I somehow remove the extra hours (for example, send me on vacation at my own expense for 211 hours)? A time sheet with a norm of 40 hours per week = 1973 hours/year, and a time sheet with a 2/2 schedule turned out to be 2184 hours/year. They just write everywhere that we will decide on the period and eventually bring it to normal. So what should my norm be under such conditions? It seems to me that I somehow misunderstood this, it turned out to be 211 nonsense. …..And further…. It turns out that if BEFORE the end of the year, then in the last month you need to go on vacation WITHOUT PAY (TIME OFF) for 211 hours (211 hours / 12 hours shift = 17 days). SO THAT THERE IS NO RECYCLING. Or if he does not want to take these days off, but works, then these 211 hours must be paid as overtime. ? Or maybe I completely misunderstood everything.

Reply ↓

- Anna Popovich

02/03/2022 at 01:20

Dear Svetlana, for detailed advice we recommend contacting the duty inspector of the Onlineinspektsiya.rf portal using this link.

Reply ↓

01/27/2022 at 11:46

Good afternoon I have a question, in our organization we have 2 watchmen working from 20.00 to 08.00 in the morning (12 hours) and 2 assistant teachers for night duty from 22.00 to 08.00. (10h) can these people work 2 in 2? at the moment they are working 1/1, that is, they started their shift today, they worked, they went home, the guard starts their shift again after 12 hours, the assistant teacher after 14 hours? is this legal? and is it possible for these people to work with such a 2/2 schedule? the employer refers to Article 103 of the Labor Code of the Russian Federation; working two shifts in a row is prohibited.

Reply ↓

- Anna Popovich

01/31/2022 at 19:09

Dear Olga, in accordance with Part 5 of Art. 103 of the Labor Code of the Russian Federation, working for two shifts in a row is prohibited, even when the employee agrees with this or it is his initiative.

Reply ↓

02/03/2022 at 17:58

Hello, two shifts in a row means that the employee worked from 20.00 to 08.00 and immediately started work from 08.00 to 20.00 without leaving home - this means he worked two shifts in a row, this is prohibited. The 2/2 work schedule is not a work schedule, it is a work mode with floating days off. Work 2/2 with a work schedule started today at 8 am finished at 8 pm and started tomorrow at 8 am and finished work at 8 pm is legal.

Reply ↓

01/27/2022 at 07:15

Hello, can you tell me if an employer can consider a woman’s overtime to be based on the male norm, and not on the female norm?

Reply ↓

- Anna Popovich

01/28/2022 at 23:51

Dear Ekaterina, the Labor Code of the Russian Federation guarantees the employee that he will work the full working time for the accounting period, which is established according to the PC for the current calendar year, including depending on gender.

Reply ↓

01/20/2022 at 21:02

Shift work schedule of 12 hours (day, night, rest, weekend) per month, approximately 15 shifts! The employer calculates the standard hours for the month based on the number of shifts per month, arguing that the calculation of a 40-hour week does not fit the shift schedule! How legitimate are his statements and if not, what and what articles should be used to guide him when proving the opposite! Thank you in advance!!!

Reply ↓

- Anna Popovich

01/21/2022 at 01:48

Dear Alexander, calculating the standard hours for a shift schedule is done as follows: the number of working hours daily is multiplied by the number of days for the corresponding period (the number of working hours in a 5-day week is taken as a basis). This figure may not be equal to 40 hours, but it is within the norm for the accounting period.

Reply ↓

Maria

02/07/2022 at 16:06

Hello. We work on a 2/2 shift schedule from 8:00 to 23. We fill in timesheets as from 11 to 23. Is this even normal?!

Reply ↓

Anna Popovich

02/09/2022 at 01:33

Dear Maria, no, this is a violation of workers’ rights. For detailed advice, we recommend contacting the duty inspector of the Onlineinspektsiya.rf portal using this link.

Reply ↓

01/20/2022 at 15:28

Hello! Tell me how to correctly calculate the norm for an employee on a shift schedule a day after yours to calculate the summarized accounting of working hours if he was on vacation, on sick leave or on a business trip? For example, an employee was on vacation from March 1 to March 28, 2022, and his shift falls on March 30. He actually works 20 hours. What will be his norm? how to calculate it?

Reply ↓

01/19/2022 at 04:37

Hello! I work on a 2/2/3 shift schedule for 12 hours, the pay is piecework, there are 2 people per shift, if one of the employees goes on vacation, they are transferred to a 4/2 schedule without any additional payments. In February, 16 workers were installed shifts, also 12 hours. Is this legal on the part of the employer? Thank you!

Reply ↓

- Anna Popovich

01/22/2022 at 04:31

Dear Anastasia, no, we recommend that you seek advice from Onlineinspektsiya.rf using this link.

Reply ↓

01/18/2022 at 22:22

2 nights at 12 o'clock. (from 20:00 to 8:00) a day at home, 2 days for 12 hours. three days at home, repeat on the 4th day. 4 such cycles, December 2022, 176 hours. norm, 196 in fact. All year round, the schedule shifts by a day every month, 4 cycles are not always, there is a lot of processing! They put you on paid time off, is it possible to refuse them to pay for overtime?

Reply ↓

- Anna Popovich

01/20/2022 at 01:06

Dear Alexander, your employer is violating your right, you can receive either monetary compensation or time off for overtime. Contact your employer in writing with a request for compensation in monetary terms for overtime.

Reply ↓

01/17/2022 at 16:49

Good afternoon. I am a personnel officer, and I have a question: With a 2/2 schedule of 11 hours and a day (12 months), the schedule results in 40 extra hours per year compared to the norm. How to reduce these hours correctly? Should I just schedule extra days off, or reduce the number of hours on some days? This is my first time encountering this, so I don’t quite understand what I have the right to and what I don’t.

Reply ↓

- Anna Popovich

01/20/2022 at 00:57

Dear Maria, the total number of working hours may exceed the standard working hours for the accounting period. This means that the employee will be entitled to additional payment for overtime work on the basis of Article 152 of the Labor Code. When an employee is on vacation or sick leave, reduce the working hours by the number of hours during which he was absent.

Reply ↓

01/16/2022 at 23:47

Good afternoon. I work a 2/2 schedule in the store from opening to closing. This turns out to be not 12, but 15 hours. Does the employer have the right to force people to work so many hours or should there be some kind of revolving schedule?

Reply ↓

- Anna Popovich

01/20/2022 at 00:36

Dear Svetlana, no, performance of labor duties beyond the established working hours must be paid.

Reply ↓

01/16/2022 at 17:58

work 2/2 a day for 11 hours, for example in December I got 165 hours at a rate of 176 minimum salary 12792 respectively and the salary turned out to be lower than the minimum wage is this true

Reply ↓

- Anna Popovich

01/20/2022 at 03:18

Dear Svetlana, no, if at the end of the accounting period the employee works fewer hours than the norm established by law for this period, then there will be a shortfall due to the fault of the employer, since he did not provide the employee with work.

Reply ↓

01/12/2022 at 04:09

Work 2/2 a day for 11 hours, there is no overtime, not even some overtime, like in December, I ended up with 165 hours on schedule, and the standard hours are 176, and they ask me to work these hours on my days off! What should I do?

Reply ↓

- Anna Popovich

01/12/2022 at 15:51

Dear Vitaly, this is a gross violation of the law. A shortfall due to the fault of the employer occurs when during the accounting period all scheduled hours have been worked, but this is less than the norm. For hours not worked to standard, the employer is obliged to pay the average hourly wage (Articles 102, 155 of the Labor Code of the Russian Federation).

Reply ↓

01/11/2022 at 19:14

I work 2/2 days a night, 12 hours a day. Overtime is 20 hours per month. In order to save money, the employer introduces unpaid time off, while wages are reduced by 2,000 rubles. Can I refuse time off and work all hours so as not to lose money?

Reply ↓

- Anna Popovich

01/12/2022 at 01:15

Dear Elena, employers do not have the right to send an employee on unpaid leave or time off on their own initiative.

Reply ↓

Julia

01/13/2022 at 14:07

And if he prescribed these days off in the collective agreement, then he can do anything?

Reply ↓

Anna Popovich

01/18/2022 at 02:17

Dear Yulia, what is commonly called time off is legally formalized as leave without pay, an additional day off or a day off on account of vacation. None of the three options can be forced, infringing on the rights of the employee.

Reply ↓

4

Additional shifts: overtime or weekend work?

author of the answer,

Question

The organization has a 2/2 shift schedule, 11 hours a day. An employee, due to production needs, works additional shifts and has 18 work shifts per month. How to calculate this? Like overtime or something else?

Answer

Whether such work is considered overtime or otherwise will depend on the manner in which the employee is assigned to work those additional shifts.

Option 1. If you engage an employee to work on his day off according to his work schedule, such work is not overtime work. In this case, these additional shifts were not originally planned in the work schedule. This work must be documented as employment on a day off. For more details, see Rationale.

Option 2. If you engage an employee to work after the end of his shift (i.e., on his working day (shift), the employee remains after the shift), then such work will be considered engaging in overtime work.

Rationale

Rationale:

According to the general rule established by Part 1 of Art. 113 of the Labor Code of the Russian Federation (the link allows you to view the local version of Consultant Plus), work on weekends and non-working holidays is prohibited, with the exception of cases of attracting workers to work on such days as provided for in this article ( with or without the consent of the workers).

Option 1.

Recruitment to work on days off.

Involvement of employees to work on weekends and non-working holidays is carried out with their written consent, if it is necessary to perform unforeseen work, the urgent implementation of which subsequently determines the normal work of the organization or its individual structural divisions, an individual entrepreneur (Part 2 of Article 113 of the Labor Code of the Russian Federation) .

To attract employees to work on weekends and non-working holidays in other cases (not established by the Labor Code of the Russian Federation), the employer must not only obtain the written consent of the employees, but also take into account the opinion of the elected body of the primary trade union organization (part 5 of article 113 of the Labor Code of the Russian Federation, section 4 Recommendations of Rostrud on issues of compliance with labor laws governing the procedure for providing employees with non-working holidays (approved at a meeting of the working group on informing and consulting workers and employers on compliance with labor laws and regulations containing labor law norms, protocol No. 1 dated 06/02/2014 (hereinafter referred to as the Rostrud Recommendations). If the employer does not have a trade union, then their written consent is sufficient to attract employees to work in this situation (Section 4 of the Rostrud Recommendations).

The employee’s written consent or refusal to work on a day off or a non-working holiday can be recorded, for example, in a notice in which the employee is invited to go to work and the reasons for this need are indicated.

This notification can be addressed to the team as a whole, listing the last names, first names, patronymics and positions of all employees, or to each specific employee (personal notification). The legislator does not require the preparation of such a document in two copies. The notice should record the fact of familiarization with the notice and agreement or refusal to work on a weekend or non-working holiday. This document can also indicate the form of compensation in the form of payment or another day of rest.

Some categories of employees must be familiar with the right to refuse to work on weekends and non-working holidays against a signature, even if it is related to the cases listed in Part 3 of Art. 113 of the Labor Code of the Russian Federation, the norms of which make it possible to attract workers without their consent. In other words, despite the provisions of Art. 113 of the Labor Code of the Russian Federation, the employer is obliged to familiarize the relevant categories of employees with their right to refuse such work and in these cases does not have the right to involve in it those for whom this work is prohibited or contraindicated for health reasons. For more information on this, see clauses 2 and 5 of this material.

Please note that it is necessary to request the employee’s consent each time before engaging him or her to work on weekends and non-working holidays. Employees’ refusal to do this work is not a disciplinary violation and does not entail any consequences for them.

The involvement of workers in work is formalized by order.

There is no unified form of order for inviting employees to work on weekends and non-working holidays. The employer has the right to develop it independently. The order should reflect:

— last names, first names and patronymics of employees;

— positions of employees;

— date (or dates) of hiring;

— reasons that necessitated the need to go to work on a weekend or holiday.

The “Bases” column indicates the details of the document in accordance with which the employee’s consent to such work was obtained. If an employee is involved in work without his consent, the corresponding basis is reflected (Part 3 of Article 113 of the Labor Code of the Russian Federation).

In addition, the order may indicate the type of compensation for work on a weekend or non-working holiday (payment or provision of another day of rest). If the method of compensation is not determined in advance, then after completion of the work an order (instruction) is issued either to pay at least double the amount or to provide another day of rest.

If an employee who has agreed to work on a day off or a non-working holiday refuses to familiarize himself with the order, then this fact is recorded in the act.

If the necessary procedures for recruitment to work were followed in relation to the employee, but he did not start work, then the employee may be subject to disciplinary action.

The working time of employees of an organization (enterprise) is kept in accordance with unified forms N T-12 or N T-13 (approved by Resolution of the State Statistics Committee of Russia dated 01/05/2004 N 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment”). For example, when filling out Form N T-13 using the method of continuous registration of appearances and absences from work, working hours on non-working holidays are reflected as follows: in the top line of column 4 opposite the employee’s last name, an alphabetic (РВ) or numeric (03) code should be indicated, and in the bottom line is the duration of work.

The Labor Code of the Russian Federation establishes the employer’s obligation to compensate for work on days off and non-working holidays: pay for the time worked at least double the amount or provide another day of rest (Article 153 of the Labor Code of the Russian Federation).

Work on weekends and non-working holidays is paid (Part 1 of Article 153 of the Labor Code of the Russian Federation):

- piece workers - no less than double piece rates;

- employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

- for employees receiving a salary - in the amount of no less than a single daily or hourly rate in excess of the salary, if work on a weekend or non-working holiday was carried out within the monthly standard working time, and in an amount of not less than double the daily or hourly rate (part of the salary per day or an hour of work) in addition to the salary, if the work was performed in excess of the monthly working time standard.

The specific amount of payment for work on a day off or a non-working holiday can be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract (Part 2 of Article 153 of the Labor Code of the Russian Federation).

Increased payment is made to all employees for hours actually worked on a weekend or non-working holiday. If part of the working day (shift) falls on a weekend or non-working holiday, the hours actually worked on such a day (from 0 to 24 hours) are paid at an increased rate (Part 3 of Article 153 of the Labor Code of the Russian Federation).

For work on weekends and non-working holidays, another day of rest can be provided only at the request of the employee (Article 153 of the Labor Code of the Russian Federation). In other words, the employer does not have the right to independently determine the type of compensation.

When filling out Form N T-13 using the method of continuous registration of appearances and absences from work, another day of rest provided for work on a weekend or non-working holiday is reflected as follows: in the top lines of column 4, opposite the employee’s last name, you should enter an alphabetic (NV) or numeric ( 28) code, and leave the bottom line blank.

Option 2.

Involvement in overtime work.

Overtime work is work performed by an employee at the initiative of the employer outside the working hours established for the employee (daily work (shift)) , and in the case of cumulative accounting of working hours - in excess of the normal number of working hours for the accounting period (Article 99 of the Labor Code of the Russian Federation).

In cases where summarized recording of working time is established, the employer must determine the accounting period (month, quarter or other period up to a year) in the internal labor regulations (hereinafter referred to as IWTR). This is necessary for the correct calculation of hours worked overtime by an employee (Article 104 of the Labor Code of the Russian Federation).

In this case, the standard working time for the accounting period must be equal to the standard established for the corresponding category of workers, but not exceed 40 hours per week.

Involvement in overtime work should not be systematic; it can occur sporadically in certain cases (letter of Rostrud dated 06/07/2008 N 1316-6-1). In accordance with Part 6 of Art. 99 of the Labor Code of the Russian Federation for two days in a row, the duration of overtime work cannot exceed four hours.

The employer, as the person responsible for the organization of work, should not allow situations where employees, due to the volume of duties assigned to them, constantly remain at the workplace after the end of the working day. In turn, employees are required to comply with the labor regulations, including the rules on working hours (Article 21 of the Labor Code of the Russian Federation). Compliance with these two conditions will allow you to avoid controversial situations regarding the payment of overtime work to an employee who remained at work on his own initiative.

According to the Russian Ministry of Labor, if an employee, on his own initiative, performs work after the end of the working day (shift), then such work is not overtime (Letter dated 03/05/2018 N 14-2/B-149).

The duration of overtime work should not exceed four hours for each employee for two days in a row and 120 hours per year (Part 6 of Article 99 of the Labor Code of the Russian Federation). The employer is obliged to keep records of time worked overtime (Part 7, Article 99 of the Labor Code of the Russian Federation). The time worked overtime by an employee must be reflected in the working time sheet (for example, in form N T-12 or N T-13, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1).

If the procedure for involving an employee in overtime work is violated, administrative liability is possible under Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, and if a similar violation is committed again - under Part 2 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

The following categories of workers are not allowed to work overtime:

a) pregnant women (Part 5 of Article 99 of the Labor Code of the Russian Federation);

b) persons under 18 years of age, with the exception of:

— certain categories of creative workers (Article 268 of the Labor Code of the Russian Federation). Their List was approved by Decree of the Government of the Russian Federation of April 28, 2007 N 252;

- athletes, if a collective or labor agreement, agreements, or local regulations establish the cases and procedure for involving in overtime work (Part 3 of Article 348.8 of the Labor Code of the Russian Federation);

c) employees during the period of validity of the apprenticeship contract (Part 3 of Article 203 of the Labor Code of the Russian Federation);

d) other employees (as a rule, restrictions are established due to medical contraindications, for example, for persons with an active form of tuberculosis - Resolution of the Council of People's Commissars of the USSR of 01/05/1943 N 15; drivers allowed to drive a vehicle as an exception due to a special condition health, - Sanitary rules for occupational hygiene of car drivers, approved by the USSR Ministry of Health on May 05, 1988 N 4616-88).

When involving certain categories of employees in overtime work, the employer must (Part 5 of Article 99 of the Labor Code of the Russian Federation):

— obtain the employee’s written consent;

— make sure there are no medical contraindications;

— familiarize employees with the right to refuse overtime work, upon signature.

Such employees include (part 5 of article 99, article 259, 264 of the Labor Code of the Russian Federation):

— disabled people;

- women with children under three years of age;

- mothers and fathers raising children under the age of five without a spouse;

— employees with disabled children;

— workers caring for sick family members in accordance with a medical report;

- guardians (trustees) of minors.

An employee, with his written consent, can be involved in overtime work in the following cases ( Part 2 of Article 99 ):

- if it is necessary to perform (finish) work that has begun, which, due to an unforeseen delay due to technical production conditions, could not be performed (finished) within the working hours established for the employee, if failure to complete this work may result in damage or destruction of the employer’s property or create a threat life and health of people;

- during temporary work on the repair and restoration of mechanisms or structures in cases where their malfunction can cause the cessation of work for many workers;

- to continue work if the replacement employee does not show up, if the work does not allow a break.

Important! In addition to obtaining written consent from employees to perform overtime work, the employer is obliged to familiarize certain categories of employees with the right to refuse such work by signature.

An employee may be involved in overtime work without his consent in the following cases ( Part 3 of Article 99 of the Labor Code of the Russian Federation):

— when carrying out work necessary to prevent a catastrophe, industrial accident or eliminate the consequences of a catastrophe, industrial accident or natural disaster;

— when performing socially necessary work to eliminate unforeseen circumstances that disrupt the normal functioning of centralized hot water supply, cold water supply and (or) sewerage systems, gas supply systems, heat supply, lighting, transport, communications;

- when carrying out work the need for which is due to the introduction of a state of emergency or martial law, as well as urgent work under emergency circumstances, i.e. in the event of a disaster or threat of disaster (fires, floods, famine, earthquakes, epidemics or epizootics) and in other cases threatening the life or normal living conditions of the entire population or part of it.

To engage in work on the specified grounds, taking into account the opinion of the elected body of the primary trade union organization and the consent of workers is not required, since these circumstances are extraordinary and not the norm.

Important! To attract certain categories of workers to work in these situations, it is necessary to obtain their written consent and familiarize them with the right to refuse such work.

In other cases, when the employer needs to involve employees in overtime work, involvement is allowed only with the written consent of the employee and taking into account the opinion of the trade union (if there is one).

Preparation of documents for involvement in overtime work

The employee’s consent to engage in overtime work must be obtained in writing (except for the cases specified in Part 3 of Article 99 of the Labor Code of the Russian Federation).

An employee can express his consent or refusal to such work, for example, in a notice of the employee’s involvement in overtime work, which is drawn up by the employer.

Important! When notifying disabled people, women with children under three years of age, as well as mothers, fathers raising children under five years of age without a spouse, workers with disabled children or caring for sick family members, fathers raising Children without a mother and guardians (trustees) of minors must be informed in the document about the right to refuse to perform overtime work.

To formalize the involvement of an employee in overtime work, it is necessary to issue an order. The unified form of such an order has not been approved, so the employer has the right to develop it independently. The order must indicate the reason for involving the employee in overtime work, the start date of work, the surname, first name, patronymic of the employee, his position and details of the document in which the employee agreed to be involved in such work.

If a collective agreement or other local regulation establishes the amount of additional surcharge, then it is possible to indicate this amount in the order. The amount may also be determined by agreement of the parties. If the employee has decided on the form of compensation (increased pay or additional rest time), this item is also included in the order. The employee must be familiarized with the order and signed.

If an employee agreed to work overtime and read the relevant order, but did not start working without a good reason, he can be subject to disciplinary action, taking into account the requirements for carrying out this procedure.

Working hours during overtime work are recorded using unified forms N T-12 or N T-13 (approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1).

For example, form N T-13 is filled out according to the following rules: in the upper lines of column 4, an alphabetic (C) or numeric (04) code is entered opposite the employee’s last name, and in the lower lines the duration of working hours is indicated.

Overtime work can be compensated by increased pay or the provision of additional rest time at the request of the employee (Part 1 of Article 152 of the Labor Code of the Russian Federation).

The first two hours of overtime work are paid at least one and a half times, and all subsequent hours at least double (Part 1 of Article 152 of the Labor Code of the Russian Federation). Specific payment amounts can be established:

— local regulations;

- collective or labor agreement.

Please note that work beyond normal working hours on weekends and non-working holidays, paid (compensated by the provision of another day of rest) in accordance with Art. 153 of the Labor Code of the Russian Federation, when determining the duration of overtime work for payment in the manner established by Part 1 of Art. 152 of the Labor Code of the Russian Federation, is not taken into account. This is provided for in Part 3 of Art. 152 Labor Code of the Russian Federation.

At the employee's request, payment for overtime work can be replaced with additional rest time. Rest time cannot be shorter in duration than time worked overtime. Thus, if an employee has worked four hours overtime, then the additional rest time provided to him as compensation must be at least four hours.

The issue of choosing compensation (payment or rest) can be decided when drawing up an order to involve the employee in overtime work or after he has completed such work. In this case, an additional compensation order is issued.

Thus, if an employee was involved in additional shifts on the employee’s days off, then we are talking about involvement in work on a day off. In your question you write about additional shifts, i.e. shifts that were not initially planned in the schedule , then your option is 1, hiring you to work on weekends.

| She answered the question: O.Ya. Reshetova, Consultant at IPC "Consultant+Askon" |