Step-by-step instruction

On June 01, the Organization transferred a loan in the amount of 100,000 rubles to the counterparty. According to the terms of the agreement:

- loan term - 1 month;

- rate - 10% per annum;

- interest payment - at the end of the term.

On June 30, the loan amount and interest were credited to the current account.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C |

| KUDiR | ||||||

| Issuing a loan to a counterparty | ||||||

| June 1st | 58.03 | 51 | 100 000 | Issuing a loan to a counterparty | Debiting from the current account - Issuing a loan to a counterparty | |

| Reflection in accounting of accrued interest on a loan | ||||||

| 30 June | 76.09 | 91.01 | 794,60 | Interest accrual | Manual entry - Operation | |

| Receipt of loan principal | ||||||

| 30 June | 51 | 58.03 | 100 000 | Receipt of principal | Receipt to the current account - Repayment of the loan by the counterparty | |

| Receipt of interest on the loan | ||||||

| 30 June | 51 | 76.09 | 794,60 | Payment of principal and interest included therein | Receipt to current account - Other settlements with counterparties | |

| — | — | — | 794,60 | Income. Interest | Report Book of Income and Expenses of the simplified tax system | |

Loan received by an LLC using the simplified tax system

First, let's look at the situation with an organization receiving a loan. Is the loan received considered income under the simplified tax system “income” and “income minus expenses”?

Let’s say right away that income and expenses are determined uniformly for both the “income” and “income-expenditure” simplified tax systems, therefore, we consider the loan received under the simplified tax system - income and simplified tax system - income minus expenses in one block and everything said is suitable for both options calculation of simplified tax. In addition, for accounting in LLC income, it does not matter whether an interest-bearing or interest-free loan was received, since the concept of material benefit from saving on interest does not appear in this case.

The list of income that a taxpayer must take into account using the simplification is specified in Art. 346.15 Tax Code of the Russian Federation. It contains references to paragraphs. 1 and 2 tbsp. 248 of the Tax Code of the Russian Federation, which specifies income related to such when calculating the simplified tax. In addition, in the same article there is a reference to Art. 251 of the Tax Code of the Russian Federation, which indicates income that is not taken into account for the purposes of calculating the simplified tax. In paragraph 10 of Art. 251 of the Tax Code of the Russian Federation states that accounted income does not include amounts of cash and other property, provided they are received under loan agreements.

Simply put, the Tax Code clearly states that a loan received is not recognized as income and does not increase the tax base when calculating the simplified tax.

Issuing a loan to a counterparty

Regulatory regulation

Under a loan agreement, one party transfers money (or other material assets) to the other party, and the second party undertakes to return them (or the equivalent) after a certain period of time (Article 807 of the Civil Code of the Russian Federation).

The lender, a legal entity, enters into written loan agreement (Article 808 of the Civil Code of the Russian Federation), in which it indicates (Articles 807, 809 of the Civil Code of the Russian Federation):

- the amount and duration of the contract;

- the amount of interest, the procedure for their calculation and payment;

- other conditions - at the request of one of the parties (clause 1 of Article 432 of the Civil Code of the Russian Federation).

If the agreement does not specify the amount of interest, they are calculated at the key rate of the Bank of Russia in effect during the periods of interest accrual (clause 1 of Article 809 of the Civil Code of the Russian Federation).

Interest is calculated from the day following the day of provision of the loan (Article 191 of the Civil Code of the Russian Federation) until the day of its repayment (inclusive).

BOO. Interest-bearing loans provided to other organizations are classified as financial investments (clause 3 of PBU 19/02).

Loan interest:

- relate to other income of the organization (clause 35 of PBU 19/02, clause 7 of PBU 9/99);

- are accrued for each expired month in accordance with the terms of the agreement and are recognized as income during the term of the agreement at the end of each reporting period and on the date of repayment of the loan - regardless of the actual receipt to the current account (clause 16 of PBU 9/99).

Interest-free loans do not meet the definition of financial investments, since they do not bring economic benefits (clause 2 of PBU 19/02) and are reflected in accounts receivable on account 76 “Settlements with various debtors and creditors.” Account 58 “Loans provided” is not applicable in this case.

USN. Interest received on a loan is recognized as income on the date of actual receipt (clause 6, article 250, clause 1, article 346.17 of the Tax Code of the Russian Federation).

Read more Loans issued: general accounting issues

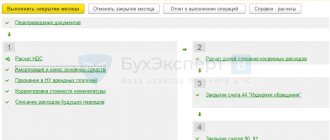

Accounting in 1C

Reflect the transfer of a loan to a counterparty in the document Write-off from the current account transaction type Issue of a loan to a counterparty in the Bank and cash department - Bank statements - Write-off button.

Please indicate:

- Debit account - 58.03 “Loans provided”;

- The recipient is the borrower under the agreement, selected from the Counterparties directory;

- Agreement - an agreement with the borrower on which interest is accrued, selected from the Agreements directory: Type of agreement - Other;

- Type of movement - Acquisition of debt securities, provision of loans to other persons .

Postings according to the document

The document generates the posting:

- Dt 58.03 Kt - loan transfer.

Results

Funds transferred into debt are not taken into account either in income or expenses, or when issuing (receiving) or when returning.

The income of the party issuing the loan and the expense of the recipient will be the fee for the use of borrowed funds: interest stipulated by the loan agreement. In accounting, they are accrued, as a rule, monthly, and they can be taken into account in income or expenses for the purposes of calculating the simplified tax system only at the time of actual receipt or payment, respectively. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reflection in accounting of accrued interest on a loan

Calculate the amount of interest due for each month of the contract yourself.

The procedure for calculating interest is determined by the agreement. Interest calculation according to our example:

The amount of interest for June in our example will be:

100 000 * 10% / 365 * 29 = 794,52 rub.

Reflect the accrual of interest in the document Operation entered manually in the Operations section - Operations entered manually - Create button - Operation.

Features of filling out a document Operation entered manually according to our example:

- Debit - 76.09 “Other settlements with various debtors and creditors”;

- Subconto 1 - borrower under the agreement, selected from the Counterparties directory;

- Subconto 2 - agreement with the borrower, selected from the Agreements directory;

- Credit - 91.01 “Other income”;

- Subconto 1 - Interest receivable (payable) : Type of item - Interest receivable (payable) ;

How to reflect in accounting policies: then and now

To avoid difficulties in taking into account the deductible fee to the lender, previously documents on the enterprise’s accounting policy had to contain data on the method by which the maximum amount of interest is calculated on a loan issued on comparable terms. If the document did not contain these points, it was extremely difficult to prove comparability to the inspectors.

Attention! Today, there is no longer any need to prescribe these provisions in the accounting policy, since the entire amount of interest in fact is allowed to be included as expenses by default. Therefore, remove the relevant items from the accounting policy. Otherwise, tax authorities may find fault, pointing out that you do not comply with your main accounting document.

Receipt of loan principal

Receipt of the loan amount to the account is reflected in the document Receipt to the current account transaction type Repayment of loan by counterparty in the Bank and cash desk - Bank statements - Receipt button.

Please indicate:

- Payer - borrower under the agreement;

- Settlement account - 58.03 “Loans provided”;

- Income item - a predetermined item from the directory Cash Flow Items Receipts from the repayment of loans : Type of movement - Proceeds from the repayment of loans, from the sale of debt securities ;

Postings according to the document

The document generates the posting:

- Dt Kt 58.03 - return to the account of the loan amount.

Peculiarities

A loan agreement using the simplified tax system can be concluded between individuals and legal entities.

The amount of tax that each payer is obliged to contribute to the budget for conducting activities is, as a rule, determined by the assets he has. At the same time, borrowed assets received by a company or individual entrepreneur from various legal entities or individuals are not revenue. The simplified tax is not imposed on them.

Thus, money and other assets received temporarily are not income and are not subject to taxes. This regulation is valid for the general taxation regime and is relevant for the “simplified” tax regime.

When a person uses the simplified tax system and receives property, the return of which is associated only with the main amount received, there is no talk of its economic benefit. This concept does not exist for such situations.

Please keep in mind that cash advances are limited to certain amounts. Thus, for organizations and individual entrepreneurs, the loan limit is 100 thousand rubles per transaction. When you need to attract more finance, you need to draw up several contracts. If a party to the agreement is an individual, then there are no such restrictions.

Receipt of interest on the loan

Receipt to the interest account is reflected in the document Receipt to the current account type of operation Other settlements with counterparties in the Bank and cash department section - Bank statements - Receipt button.

Please indicate:

- Payer - borrower under the agreement;

- Amount - the amount of accrued interest under the agreement;

- Settlement account - 76.09 “Other settlements with various debtors and creditors”;

- Income item - an article from the directory Cash Flow Items: Type of movement - Receipts from dividends, interest on debt financial investments .

Postings according to the document

The document generates the posting:

- Dt Kt 76.09 - credit to the interest account.

Posts by KUDiR

The document Receipt to the current account forms movements according to the register Book of Income and Expenses (Section I) :

- registration entry for income of the simplified tax system for the amount of interest received.

KUDiR report

Expenses on interest received are reflected in the report Book of Income and Expenses (Reports - Book of Income and Expenses of the simplified tax system).

See also:

- Interest received on the bank account balance. Do I need to fill out Section 7 of the VAT return?

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Interest-bearing loan issued to an organization on OSNO Organizations often issue loans. They can be interest-bearing or interest-free...

- The company issued a loan: is a cash register needed? The Ministry of Finance and the Federal Tax Service in Letter dated September 18, 2018 N ED-4-20/ [email protected] told...

- Business trip: daily allowance in excess of the norm, payment through a corporate card, purchase of tickets by an organization. This article is devoted to accounting for settlements with a business trip employee who received an advance…

- Risks of working on accounts that have not previously been used by the organization. You do not have access to view. To gain access: Complete a commercial...

Interest payment and loan repayment under the simplified tax system “income minus expenses”

Let's look at the consequences of receiving a loan, namely, how interest payments and loan repayment are included in expenses. Since we are talking about expenses, these considerations do not concern the simplified tax system “income”.

Expenses under the simplified tax system are listed in a closed list in Art. 346.16 Tax Code of the Russian Federation. Subp. Clause 9, clause 1 states that interest paid under a loan agreement can be taken into account as expenses when calculating simplified tax. In this case, they are taken into account only after actual payment, since income and expenses under the simplified tax system are considered the cash method.

But the loan to be repaid is not mentioned in the closed list above, so repayment of the loan under the simplified tax system - income minus expenses cannot be taken into account in expenses for tax purposes under the simplified tax system.

All of the above is true for both legal entities and individual entrepreneurs.

Let's summarize the tax consequences of loan repayment: