A pre-trial claim under a loan agreement or otherwise is now the first stage in a dispute with the debtor. Legislators introduced the institution of mandatory pre-trial procedure in the Arbitration Procedure Code of the Russian Federation, concerning the settlement of many civil disputes.

ATTENTION : our lawyer in disputes between the borrower and the lender will not only advise you, but will also take the task of drawing up a pre-trial claim; the proposal can be found at the link Drawing up a claim with us.

In what form are loan agreements concluded with the participation of legal entities and individual entrepreneurs?

Let's start with a change that concerns the form of the contract.

From June 1, 2018, a loan agreement between citizens must be drawn up in writing if its amount exceeds 10 thousand rubles (and not 10 minimum wages, as was previously the case). At the same time, as before, the amount threshold does not apply if the lender is a legal entity - in this case, a loan agreement even for 1 ruble must be drawn up in writing. These are the requirements of paragraph 1 of Article 808 of the Civil Code of the Russian Federation. Unfortunately, the legislator did not directly indicate whether a written form of agreement is needed if a legal entity acts as a borrower. On the one hand, transactions of legal entities between themselves and with citizens must be formalized in writing, regardless of the amount of the transaction (subclause 1, clause 1, article 161 of the Civil Code of the Russian Federation). On the other hand, paragraph 2 of Article 161 of the Civil Code of the Russian Federation states that compliance with a simple written form is not required for transactions that, in accordance with Article 159 of the Civil Code of the Russian Federation, can be concluded orally. At the same time, paragraph 2 of Article 159 of the Civil Code of the Russian Federation states that all transactions that are executed upon their very completion can be concluded orally, with the exception of transactions for which a notarial form has been established, and transactions for which failure to comply with a simple written form entails their invalidity.

It turns out that a loan agreement, in which both parties are legal entities, must be concluded in writing, as this is required by paragraph 1 of Article 808 of the Civil Code of the Russian Federation. And if a legal entity borrows money from an individual who is not an individual entrepreneur, and the money is transferred directly upon concluding an agreement, then an oral form of the transaction is formally acceptable. However, we would not recommend an oral agreement even for small borrowing, since for tax purposes (for example, to record income and expenses) it is still necessary to have a document (Article 252 of the Tax Code of the Russian Federation).

Keep records, prepare and submit income tax and VAT reports

Let us separately dwell on transactions in which individual entrepreneurs participate. Here it must be taken into account that for the purposes of the Civil Code of the Russian Federation, although entrepreneurs are citizens, due to the direct indication of paragraph 3 of Article of the Civil Code of the Russian Federation, the rules that regulate the activities of commercial legal entities are applied to their business activities. Exceptions may be established by legal acts.

In relation to the form of a loan agreement, this means the following. If a loan is taken from an individual entrepreneur, then, on the basis of paragraph 1 of Article 808 of the Civil Code of the Russian Federation, the agreement must be concluded in writing, since the individual entrepreneur-lender is equated in this case to a legal entity. In this case, the amount of the transaction and the status of the borrower (another individual entrepreneur, individual or legal entity) do not matter (resolution of the Federal Antimonopoly Service of the East Siberian District dated June 19, 2006 No. A58-4192/05-Ф02-2826/06-С2 in case No. A58-4192/ 05).

If an entrepreneur receives money in debt from a legal entity or another individual entrepreneur, then based on paragraph 1 of Article 808 of the Civil Code of the Russian Federation, the agreement must be drawn up in writing. But if the lender is an “ordinary” individual, and the money is transferred immediately upon completion of the transaction, then an oral form of the agreement is also acceptable (but we would recommend that in this case, too, formalize the relationship of the parties in writing).

Keep records and prepare reports according to the simplified tax system for free

Experienced lawyers of Alfagroup:

- They will participate in negotiations with the debtor, draw up the text of the claim for debt repayment (if the borrower is a legal entity);

- They will draw up and send a statement of claim to the court, determining the jurisdiction of the claim. The claim must be drawn up in a legally competent manner, otherwise the court will send it for revision or refuse to initiate legal proceedings;

- Collect and prepare all documents attached to the statement of claim or necessary at the trial;

- They will prepare an evidence base confirming your requirements;

- They will calculate the amount of penalties and damages that you can demand from the debtor;

- They will represent your interests at the trial, help you decide on your tactics in court and adequately respond to the defendant’s objections;

- They will undertake all procedural actions, such as filing petitions, challenges, objections, etc.;

- They will monitor the enforcement proceedings in the case and the proper work of the bailiffs.

Alfagroup lawyers are familiar with all the intricacies of the legislation regulating the area of debt collection, so they will be able to use all legal methods in order to achieve a successful completion of the case. It is better to seek legal assistance at the time of concluding a loan agreement, so that a specialist can correctly draft its text, as well as analyze possible risks when concluding an agreement.

Written form of the contract: is it possible to limit it to a receipt?

As we can see, in most cases, loan agreements in which a legal entity and an individual entrepreneur participate are concluded in writing. At the same time, violation of the rule on the written form of an agreement will not make it invalid or unconcluded (for more details, see “When an agreement is considered concluded: correspondence and an invoice by e-mail, analogues of an electronic signature, drawing up a letter with an agreement”). However, in the event of a dispute, the parties will not be able to refer to witness testimony to confirm both the very fact of concluding a loan agreement and its terms (clause 1 of article 160 of the Civil Code of the Russian Federation, clause 1 of section I of the Review of judicial practice of the Supreme Court of the Russian Federation No. 1 (2016 ), approved by the Presidium of the RF Armed Forces on April 13, 2016).

What does the term “written form” mean? Is it necessary to have a single document called an “agreement” signed by both parties? It follows from paragraph 2 of Article 808 of the Civil Code of the Russian Federation that the written form of the loan agreement will be observed even if there is a receipt from the borrower or another document certifying the transfer by the lender of a certain amount of money to the borrower. At the same time, this receipt (other document) must confirm both the very fact of concluding the loan agreement and its terms - this directly follows from the wording of the norm in question. This means that the text of the receipt (other document) must contain an indication that the money was received on loan, that is, the borrower undertakes to return it to the lender within the prescribed period or at the request of the lender (determination of the Supreme Arbitration Court of the Russian Federation dated March 31, 2011 No. VAS-1827/11 on case No. A28-3935/2010-102/25). Also, the receipt (other document) must indicate the loan amount and make a note that the borrower has received this amount. If the listed provisions are not stated in the receipt (other document), then it will be almost impossible to prove that the money was transferred and transferred specifically under the loan agreement. This conclusion is confirmed by extensive judicial practice.

Exchange legally significant “primary data” with counterparties via the Internet. Free inbox.

For example, courts do not recognize the debtor’s accounting documents (including transcripts of the relevant balance sheet lines) as evidence of the conclusion of a loan agreement. Justification - such documents do not contain an indication of the borrowed nature of the relationship between specific persons (resolutions of the Federal Antimonopoly Service of the North-Western District dated 10.21.09 in case No. A13-1829/2009 and the FAS Central District dated 02.12.13 in case No. A35-11432/2010) . You also cannot use a reconciliation report. According to the courts, this document does not confirm the existence of a loan relationship between the parties, despite the fact that it contains their signatures (resolution of the Federal Antimonopoly Service of the Moscow District dated December 28, 2009 No. KG-A40/13537-09 in case No. A40-43264/09-47 -267, ruling of the Supreme Arbitration Court of the Russian Federation dated 02.02.12 No. VAS-214/12 in case No. A41-45367/10).

But even with the correct execution of the receipt (other document), there may still be problems with confirming the loan. For example, this can happen if the loan amount is large and there is no information confirming that the lender actually has this amount (for example, information that he withdrew funds from a bank account or indicated the loan amount in a tax return). In such a situation, even a correctly drawn up receipt will not be one hundred percent confirmation of the conclusion of a loan agreement (decision of the Supreme Court of the Russian Federation dated October 2, 2009 No. 50-B09-7). At the same time, we note that it is the lender who is obliged to prove the possibility of issuing a loan in such an amount, otherwise he will not be able to get his money back (resolution of the Arbitration Court of the Far Eastern District dated 06/09/18 No. F03-2065/2018 in case No. A51-3905/2017). We also note that there are no criteria for the “largeness” of the loan amount. Therefore, the court decides this issue each time taking into account the specific circumstances of the case. In particular, in the above court decisions, loans of 10 million rubles and 700 thousand rubles were recognized as large.

As we can see, to confirm the borrowing relationship, it is quite dangerous not to conclude a loan agreement in the form of a single document signed by the parties, but to limit it to only a receipt. Moreover, the risk arises not only from the lender, who may encounter difficulties in repaying the loan amount. Problems may also arise for the borrower. As is known, in tax accounting, amounts received under a loan agreement are not included in income (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation). However, if the court, when considering the dispute that has arisen, indicates that there are no grounds for recognizing the relationship between the parties as borrowed, then the received loan amount will have to be included in income.

Check the counterparty for signs of a shell company

How to repay a debt without a receipt

Close relatives and friends often do not formalize the borrowed money in any way. Some people are simply uncomfortable making such demands, while others don’t even think about possible deception. Sometimes it's hard to say no to a request, but if you want to learn how to say NO, read here.

The absence of an agreement is a big problem in case of voluntary refusal of a refund. But this does not mean that the borrowing party does not have any evidence of the transfer of money. Sometimes it is possible to return what you borrow, but you have to work hard.

Conversation with the debtor

Before starting a full-scale fight, you should have a heart-to-heart talk with the other side. A sincere and polite conversation can solve the problem. If a person does not refuse to give back what he took, but simply does not have the opportunity, it is advisable to discuss new conditions for return. Ideally, it is necessary to take a receipt from him confirming the announced agreement.

Important! I do not recommend writing a document retroactively; they can conduct an examination (Article 67 of the Code of Civil Procedure of the Russian Federation) and prove the fact that it was written “retroactively.” But I had a blast.

Therefore, write the dates as they are, for example: the date of issue of money is 03/21/2019, the date of the document is 08/15/2019. Remember exactly the date of transfer of money, since during the showdown it may turn out that your debtor was not in the city (he will provide train or plane tickets and the case is lost), and the court will refuse compensation.

Collecting evidence

The debtor's refusal to comply requires the use of more serious measures. It is necessary to collect the maximum package of evidence that will confirm that the fact of lending was:

- video or audio recording of a conversation;

- correspondence printed from mail, instant messengers and social networks;

- SMS messages printed and certified by a notary.

If there is no receipt, the witnesses will not help.

You can use a trick known since the times of ancient Babylon. Write a question to the borrower by email or SMS:

— (YOU): Hello! Do you remember, on March 21, 2019, I lent you 220,000 rubles. You swore to repay the debt by June 1, 2019, but you never did. I need my 220,000 very urgently, can you transfer it before the end of the month?

- (D.): Stop! I owe 200k, but not 220,000.

— (YOU): Sorry, I mixed something up. So, will you determine it by timing?

— (D.): Sorry, but while I’m in a financial hole, I’ll try to find the amount before the end of the month.

Having received an SMS or e-mail, we run to the notary and notarize them, paying a little money (compared to the debt) for the service. This is not a 100% guarantee, but the chances of a successful resolution of the situation increase.

Contact the police

The lender has the right to contact the police. The department needs to outline in detail all the nuances of the situation that has arisen. Based on the above, a statement of fraud is drawn up. As a result, you will have a notification coupon in your hands.

An accepted statement is processed by calling the accused party for a conversation. At the department, the situation and its seriousness are described to the debtor, and a statement is taken from him. Afterwards, the police decide whether to initiate a criminal case or not. You are given 3 days to make a decision, sometimes the period is extended to 30 days.

Lawyers say that this can work on a psychological level: it happens that the debtor immediately comes running and pays the entire amount.

We receive a resolution

The categorical refusal of the accused to have a financial relationship with the applicant leads to a refusal to initiate a criminal case. However, the hope of returning the funds is not lost. The applicant receives a refusal order from the police department and applies to the court with it.

Making an application to the court

To go to court, you will need to file a statement of claim. Its content should be concise, but maximally revealing the essence of the conflict. It is quite difficult to draw up such a document on your own, so I tried to describe all the stages here. When you contact a professional lawyer, your chance of winning your case increases. The specialist will draw up a claim based on legislative norms and supporting each phrase with a reference to the law. Samples are just below the text.

We provide materials on the case

Evidence of the case must be attached to the statement of claim. The more thorough they are, the higher the chance of a positive outcome. Ideally, what is stated in the claim should be confirmed not only by video, audio recordings and printouts, but also by witness testimony.

Lack of evidence can lead to loss in court.

We receive a court decision

If a positive court decision is received, debt collection can also take a lot of time. To begin with, the defendant is given 10 days to appeal. Only after the end of the period can you receive a court decision in your hands.

You can collect funds in two ways:

- Agree with the defendant on voluntary transfer.

- Contact the bailiff service.

The FSSP will repay debt obligations using methods available to them - withholding partly from official income, seizing accounts, confiscating property, and so on.

Attracting collectors

The work of bailiffs often takes quite a lot of time, so the lender can choose a more “bloody” path - turn to collectors.

Collection companies buy out debt obligations and return them in every possible way. It must be said that their methods often achieve their goals, but have a lot of disadvantages. Firstly, only a small part of the funds will be returned to the lender (up to 70%). Secondly, the life of the debtor turns into hell, but this is still a relative or friend, even an ex-friend.

Claim for unjust enrichment

It can only work if a non-cash transfer was made to a card or account.

You can try to go from this end, to recover funds as unjust enrichment.

To do this, we explain how this situation came about:

- Sent by mistake to the wrong person

- I sent it on account of a future loan agreement, hoping for decency.

According to the law, physical a person is obliged to return someone else's property received without a contract. The debtor can dodge and claim that it is a gift, but the court will require evidence (clause 4 of Article 1109 of the Civil Code of the Russian Federation).

in PDF and Docx formats:

We draw up a loan agreement: transfer and return of money, accrual of interest

Let's move on to consider other rules that need to be taken into account when drawing up a loan agreement. In particular, these include rules governing the transfer and return of money. And here too there have been changes.

Thus, according to the new edition of paragraph 3 of Article 810 of the Civil Code of the Russian Federation, unless otherwise provided by the agreement, the loan is considered repaid at the moment the money is received by the bank in which the lender’s account is opened, and not to the lender’s account itself, as was the case before June 1. Accordingly, if the lender is not confident in his bank and wants to transfer to the borrower the risks associated with the possible bankruptcy of the credit institution, then the agreement must indicate that the loan is considered repaid only after the money is credited to the lender’s account. Note that the Civil Code of the Russian Federation does not contain a similar rule regarding the moment the borrower receives money. Therefore, the corresponding condition should be agreed upon in the text of the contract.

The date of transfer and repayment of the loan is closely related to the procedure for calculating interest. According to the new edition of paragraph 3 of Article 809 of the Civil Code of the Russian Federation, interest is paid up to and including the day the loan is repaid. But legislators again ignored the start date for interest accrual. Therefore, in order to avoid disputes, the condition about whether interest is accrued on the day the money is transferred (or whether it begins to “drip” only from the next day) must be reflected in the contract.

Let us dwell on the norm that regulates the obligation to pay interest itself. The general rule is this: if there is no interest clause in a loan agreement, this does not mean that it is interest-free. An exception is the situation when two conditions are simultaneously met: the agreement is concluded between individuals (including individual entrepreneurs), and the loan amount does not exceed 100 thousand rubles. In this case, an agreement that does not contain an interest clause is recognized as interest-free (new edition of clause 4 of Article 809 of the Civil Code of the Russian Federation).

In all other cases, you will need to pay for a cash loan, unless the contract specifically states that it is interest-free. Moreover, if the parties have not agreed on the amount of interest in the contract, then they are calculated based on the key rate of the Central Bank of the Russian Federation in force during the loan period (new edition of clause 1 of Article 809 of the Civil Code of the Russian Federation).

Select a bank guarantee for free under 44‑FZ and 223‑FZ online

Loan repayment guarantees under the agreement

We, as professionals, cannot give a 100% guarantee that your money can be returned. After all, each specific situation has its own characteristics that need to be taken into account.

But we can always guarantee:

- High quality legal services and service by qualified specialists who know their business;

- Using all possible legal methods of debt repayment, including the use of non-standard approaches to the matter;

- Individual approach taking into account the characteristics of a particular client and actual circumstances;

- A detailed explanation of all the nuances of your situation, so that you can reasonably choose tactics for further action.

Is it possible to refuse a loan?

Due to the fact that the Civil Code of the Russian Federation now allows for the drawing up of a loan agreement, which comes into force even before the transfer of money, the question of the possibility of each of the parties to refuse such an agreement becomes relevant.

The new version of paragraph 3 of Article 807 of the Civil Code of the Russian Federation states: the lender may refuse to transfer money if, after signing the agreement, circumstances arise that clearly indicate that the loan will not be repaid on time. However, a list of such circumstances is not given in the Civil Code of the Russian Federation. In our opinion, these may be the following events concerning the borrower: the appearance in the Unified State Register of Legal Entities of an entry about the upcoming liquidation of the company or the exclusion of the company from the register as inactive; commencement of bankruptcy proceedings; entry into force of the decision on a tax audit with additional assessments; losing a lawsuit for a significant amount, etc.

Please note that the mentioned paragraph 3 of Article 807 of the Civil Code of the Russian Federation speaks of the impossibility of repaying the loan on time (as a condition for the lender’s unilateral refusal to fulfill the agreement). But at the same time, the loan term is not a mandatory condition of the agreement: if this period is not established, then the loan amount must be repaid by the borrower within 30 days from the date the lender submits a request for this, unless otherwise provided by the agreement (clause 1 of Article 810 Civil Code of the Russian Federation). The same procedure applies when, under the terms of the agreement, the loan must be repaid at the request of the borrower, which he can present at any time.

However, these rules for “perpetual” loans are included by the legislator in the same norm (clause 1 of Article 810 of the Civil Code of the Russian Federation), which regulates the return of funds under fixed-term loan agreements. This means that the lender can also refuse a loan agreement that does not set a deadline for repaying the money, if, before the money is transferred, circumstances arise indicating that the loan will not be repaid within thirty days after the relevant demand is presented. That is, in our opinion, the lender’s right to withdraw from the agreement does not depend on whether it establishes a period for which the loan is provided. But in order to avoid disputes, it is also better to directly agree on this point in the text of the contract.

The borrower also has the opportunity to “reverse the move”. He may refuse the agreement and not receive borrowed funds, unless otherwise expressly stated in the agreement. The period for refusal can also be regulated by agreement. If this is not done, then the borrower has the right to refuse the obligations assumed at any time before the actual receipt of the money (new edition of clause 3 of Article 807 of the Civil Code of the Russian Federation).

Debt collection under a loan agreement. Step-by-step instruction.

Home » Debt collection lawyer

Author Kotkov Reading time 21 min. Views 34

- Determining the end of the limitation period. (Collect debt under contract - Step No. 2)

- Determination of jurisdiction and territorial jurisdiction of the case (Collection of debt under an agreement - Step No. 3)

- Preparing an application for a court order or a statement of claim (Collect a debt under an agreement - Step No. 4)

- Requirements for the content of an application for a court order and a statement of claim are contained in Art. 131 Code of Civil Procedure of the Russian Federation:

- Payment of state duty (Collection of debt under the contract - Step No. 5)

- Details for paying the fee are on the websites of the magistrate and district courts.

- Filing an application for an order for debt collection under an agreement in the magistrate’s court and a statement of claim in the district court (Debt collection under an agreement - Step No. 6)

- The procedure and timing of consideration of the application in court.

- In what case is a court decision made in absentia to collect a debt under a contract?

- What difficulties may arise during the trial of the case?

- Receiving a writ of execution and presenting it to the bailiff service (Collection of debt under an agreement - STEP No.

- Debt collection under contract. Enforcement of a court decision by bailiffs.

- DEBT COLLECTION UNDER THE AGREEMENT IN 1 STEP. ONE STEP = 8 STEPS.

- In conclusion.

- What should the loan agreement be? Sample loan agreement.

Debt collection under contract? Are you not being repaid under your loan agreement? What actions need to be taken? Should I entrust a lawyer with handling the debt collection case under the contract or should I collect the debt myself?

The article describes judicial methods of collecting money lent under a loan agreement.

Step-by-step instructions for independently resolving the issue of debt collection under a loan agreement.

ASSESSING THE JUDICIAL PERSPECTIVE OF YOUR SITUATION

Judicial review of debt disputes allows the creditor to obtain a writ of execution, which is necessary for official confirmation and legal repayment of the debt.

The received writ of execution for debt collection under a loan agreement allows the creditor to contact the bailiff service, debt collectors, or sell the debt to third parties.

The creditor has two options for filing a claim in court to collect the debt under the contract and obtaining a writ of execution:

OPTION 1 . Entrust the case of debt collection under a loan agreement to a lawyer specializing in resolving debt disputes. The lawyer will carry out all the necessary pre-trial preparation and conduct the case in court “turnkey” without the participation of the creditor.

IMPORTANT : Legal expenses incurred by the plaintiff (creditor) - payment to a lawyer, state fees, postal expenses, expenses for appointing an examination, etc.) are recovered from the debtor

A LAWYER

CONSULTATION WITH A LAWYER

Oral consultation , duration up to one hour - 1000 rubles .

CONDUCTING A CASE IN COURT

Full legal support of the case in court - from 30,000 rubles .

PREPARATION OF DOCUMENTS

Drawing up documents for self- application to court - from 5,000 rubles .

OPTION 2 . To independently collect the debt under the contract:

- analyze the loan agreement;

- form a legal position;

- carry out pre-trial preparation of documents for trial;

- submit documents to court;

- protect your interests in court;

- work with bailiffs (applications to prohibit the debtor from leaving, applications for seizure and sale of property, appealing against unlawful actions or inaction of bailiffs);

- prepare and conclude an agreement on the assignment of rights of claim under a writ of execution with third parties

Let us consider, step by step, the necessary actions that the creditor will have to take to collect the debt under the agreement.

Preparing to go to court. (Collection of debt under the contract - Step No. 1)

It is necessary to pay attention to the following nuances:

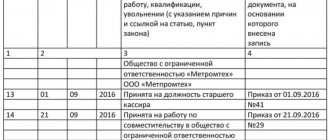

- Is the information correctly indicated in the contract to identify the debtor (last name, first name, patronymic, passport details, place of residence or registration). Are there any errors (misprints, corrections) in the information provided;

- Does the agreement contain the terms of the loan (loan size, repayment procedure, interest payable, penalties for violating the terms of the agreement);

- How was the transfer of money or other property under the agreement carried out (are there documents confirming the fact of the transfer);

- The period for repayment of borrowed funds (whether the contract has a period for repayment or the repayment is determined by the moment of demand);

- Does the contract have a provision on contractual jurisdiction?

Determining the end of the limitation period. (Collect debt under contract - Step No. 2)

The statute of limitations for disputes regarding the repayment of borrowed funds is three years. The limitation period begins on the date when the debtor is due to fulfill his obligation - to repay the debt under the contract. Appeal to the court after the expiration of the three-year limitation period leads to the court’s refusal to satisfy claims for debt collection under the loan agreement.

Option : The contract does not contain a date for fulfillment of the obligation (the date for the return of money is not specified or the return is made upon request).

In this case, it is necessary, first, to present to the debtor a written demand for repayment of the debt under the contract. After 30 days from the date of receipt by the debtor of the demand, in case of evasion of debt repayment, go to court.

Determination of jurisdiction and territorial jurisdiction of the case (Collection of debt under an agreement - Step No. 3)

Determining jurisdiction is the establishment of a court that will consider your claims for debt collection under the contract. Depending on the amount of the debt (principal amount + interest), the consideration will be handled by the magistrate court (debt less than 500 thousand rubles) or the district court (over 500 thousand rubles).

Territorial jurisdiction – determination of the territorial location of the court (magistrate or district), which will consider your claim to collect the debt under the contract. Territorial jurisdiction is established at the place of registration of the debtor. If his place of registration is not known (has changed), you must go to court at the last place of his registration or residence known to you.

Upon receipt of an application to the court, the judge will double-check the information you provided about the place of registration (residence) of the debtor and, if the debtor is registered in another place, will redirect the court case to the appropriate court.

Preparing an application for a court order or a statement of claim (Collect a debt under an agreement - Step No. 4)

Requirements for the content of an application for a court order and a statement of claim for the collection of a debt under a contract are contained in Art. 124 Code of Civil Procedure of the Russian Federation:

An application for a court order must be made in writing.

The application must indicate:

- name of the court,

- name of the claimant, his place of residence or location;

- information about the debtor: for a citizen-debtor - last name, first name, patronymic (if available) and place of residence, as well as date and place of birth, place of work (if known),

- one of the identifiers (insurance number of an individual personal account, taxpayer identification number, series and number of an identity document, main state registration number of an individual entrepreneur, series and number of a driver’s license, series and number of a vehicle registration certificate) if they are known.

- the claim of the collector (collection of debt under the contract) and the circumstances of the transfer of money;

- documents confirming the requirements;

- list of attached documents.

- An application for a court order is signed by the claimant or his representative having the appropriate authority.

Receiving a writ of execution allows you to present it to the bailiffs for collection, present it to the debtor's credit institution, or sell the debt.

Requirements for the content of an application for a court order and a statement of claim are contained in Art. 131 Code of Civil Procedure of the Russian Federation:

A statement of claim for the collection of a debt under a contract from an individual is submitted in writing.

The statement of claim must indicate:

- name of the court;

- the name of the plaintiff, his place of residence, as well as the name of the representative and his address, if the application is submitted by a representative;

- information about the defendant: for a citizen - last name, first name, patronymic (if any) and place of residence, as well as date and place of birth, place of work (if known) and one of the identifiers (insurance number of an individual personal account, taxpayer identification number, series and the number of the identity document, the main state registration number of the individual entrepreneur, the series and number of the driver's license, the series and number of the vehicle registration certificate). In a citizen's statement of claim, one of the identifiers of the defendant citizen is indicated if it is known to the plaintiff;

- what is the violation of the plaintiff’s interests and his demand to collect the debt under the loan agreement;

- the circumstances on which the plaintiff bases his claims and evidence;

- cost of claim;

- calculation of the collected amounts;

- information about compliance with the pre-trial procedure for contacting the defendant,

- information about the actions taken by the party (parties) aimed at reconciliation, if such actions were taken;

- list of documents attached to the application.

The application may indicate telephone numbers, fax numbers, and email addresses of the plaintiff, his representative, and the defendant.

The statement may set out the plaintiff's requests.

The statement of claim is signed by the plaintiff or his representative if he has the authority to sign the statement and present it to the court.

In accordance with Part 6, Article 132 of the Code of Civil Procedure of the Russian Federation, it is necessary to attach to the statement of claim a notice of delivery or other documents confirming the sending to other persons participating in the case, copies of the statement of claim and documents attached to it, which other persons participating in the case have , are missing. In particular, in the case of filing a statement of claim and the documents attached to it by filling out a form posted on the official website of the relevant court on the Internet;

Payment of state duty (Collection of debt under the contract - Step No. 5)

Details for paying the fee are on the websites of the magistrate and district courts.

The amount of the state fee paid when filing an application for a court order in a magistrate's court or a statement of claim in a district court is determined in accordance with Part 1, Article 333.19 of the Tax Code of the Russian Federation.

In the case under consideration, claims for collection of debt under an agreement from an individual are of a property nature, since satisfaction of claims implies the receipt of funds or things.

When filing a claim of a property nature, the state duty will be, based on the cost of the claim:

- up to 20,000 rubles - 4 percent of the claim price, but not less than 400 rubles;

- from 20,001 rubles to 100,000 rubles - 800 rubles plus 3 percent of the amount exceeding 20,000 rubles;

- amount from 100,001 rubles to 200,000 rubles - 3,200 rubles plus 2 percent of the amount exceeding 100,000 rubles;

- from 200,001 rubles to 1,000,000 rubles - 5,200 rubles plus 1 percent of the amount exceeding 200,000 rubles;

- over 1,000,000 rubles - 13,200 rubles plus 0.5 percent of the amount exceeding 1,000,000 rubles, but not more than 60,000 rubles;

IMPORTANT : when applying for a court order to the magistrate's court, the fee is paid in the amount of 50% of the amount specified in Part 1 of Article 333.19 of the Tax Code of the Russian Federation.

Filing an application for an order for debt collection under an agreement in the magistrate’s court and a statement of claim in the district court (Debt collection under an agreement - Step No. 6)

An application to the magistrate's court can be submitted directly by the applicant to the office of the relevant judicial district, or sent to the magistrate's address by post (preferably by a valuable letter with a list of attachments).

A statement of claim to the district court can also be filed through the court office, or sent by mail, similar to sending to the magistrates' court.

In addition, a statement of claim can be filed by filling out a form posted on the official website of the court on the Internet.

IMPORTANT : a receipt for payment of the state fee is attached to the original application;

when submitting an application through the office of a magistrate or district court, be sure to receive an acceptance mark on your copy of the application;

receipts for sending the statement of claim and the documents attached to it to the debtor (defendant) are attached in the originals

Simultaneously with filing a claim in court, a petition may be filed for the court to take interim measures. Taking interim measures is necessary to create obstacles for the debtor to alienate existing property. The court has the right to seize property upon a submitted petition. Subsequently, bailiffs will sell the seized property to enforce the court decision if the debtor does not repay the existing debt.

SAMPLE APPLICATION FOR TAKEN PROVISIONAL MEASURES.

STATEMENT

on securing a claim

I am the Plaintiff in case No. _____ in the claim of _______________ to _____________ about _______________ (indicate the subject of the claim).

In accordance with Art. 139 of the Code of Civil Procedure of the Russian Federation, a court or judge, upon the application of persons participating in the case, may take measures to secure the claim. Securing a claim is allowed in any situation in the case if failure to take measures to secure the claim may complicate or make it impossible to enforce the court decision.

Currently, the following situation has developed in this case: ___________, in connection with which I believe that failure to take measures to secure the claim may complicate or make it impossible to enforce the court decision.

Based on the above and in accordance with Articles 35, 139, 140 of the Code of Civil Procedure of the Russian Federation

ASK:

- Take measures to secure the claim brought by the Plaintiff ______________ to _______________ about ____________ (Case No. ______) in the form of ______________.

Plaintiff (Plaintiff's representative) ___________________________

"___"______________ ____ G.

As stated above, if the magistrate’s court has doubts about the validity of the claims or the court sees a dispute about the law in the stated claims, the issuance of a court order to collect the debt under the contract will be refused.

If the debtor objects to the issuance of a court order, the previously issued court order will be canceled. The debtor has the right to file an objection to the cancellation of the court order within 10 days from the date of receipt of the court order to collect the debt from him under the contract.

If any of these events occurs, your only option to protect your interests is to appeal to the district court.

CONTACT A LAWYER

It is necessary to change the text of the application submitted to the magistrate's court, make corrections and turn it into a statement of claim to the district court. In addition, it is necessary to pay an additional 50% of the state fee paid when submitting the application to the magistrate’s court.

The procedure and timing of consideration of the application in court.

After accepting the statement of claim for debt collection under the contract, the judge, within five days, checks the documents and decides whether to accept the case for proceedings.

If the statement of claim is drawn up with errors or, in the opinion of the judge, no documents are attached, the statement of claim will be left without progress.

The judge will issue a ruling on leaving the statement of claim without progress, in which he will invite you to correct the existing shortcomings within a certain period.

If the deficiencies are eliminated within the specified period, the case will be assigned for consideration; if not, all documents will be returned to you.

Participation in the court's consideration of a debt collection case (Collection of debt under an agreement - Step No. 7)

When participating in the consideration of a case in a district court, it is necessary to submit in originals those documents that were attached in copies to the statement of claim.

According to the Code of Civil Procedure of the Russian Federation, 2 months are given to make a court decision, but the case can be postponed and suspended. The reasons for postponement may be either the failure of the parties to appear or the appointment of an expert examination to examine documents.

In what case is a court decision made in absentia to collect a debt under a contract?

If the debtor fails to appear in court on the stated demand for collection of the contract under the contract, a judgment in absentia may be made.

The default judgment is sent to the debtor by mail. After receiving a court decision by mail, the debtor can cancel the decision within 7 days. In this case, the consideration of the case is resumed.

If the plaintiff (creditor) fails to appear in court and there is no application to consider the case in his absence, the case may be left without consideration.

After the court makes a decision on the case, the debtor has a month to appeal the decision on appeal.

If the decision is appealed through the appellate procedure, the case is considered by the appellate authority. The decision comes into force either after a month from the date of rendering by the district court, or from the date of the ruling by the appellate court.

After the decision to collect a debt under an agreement from an individual comes into legal force, you can receive a writ of execution.

What difficulties may arise during the trial of the case?

Depending on the degree of legal “savvy” or participation in the legal process on the debtor’s side by a lawyer or lawyer, the debtor’s position may be as follows:

“I did not sign the agreement, the handwriting is not mine, I did not receive any money under the agreement . In this case, a forensic handwriting examination is ordered, and handwriting samples are taken from the debtor. The trial is suspended until the results of the examination are received.

In my practice, there have been cases when, when signing an agreement, debtors deliberately distorted the handwriting and signature in the agreement.

“I signed the agreement, but did not receive the money . In this situation, a lot depends on the form in which the money was transferred and how the transfer of funds or things is recorded in the contract.

“I signed the agreement due to difficult circumstances, under duress, in a state where I did not give an account of my actions, for another person, etc. ”

As we see, there are quite a lot of options. It is enough to approach the issue “creatively” and consult with a knowledgeable lawyer.

Receiving a writ of execution and presenting it to the bailiff service (Collection of debt under an agreement - STEP No.

Debt collection under contract. Enforcement of a court decision by bailiffs.

At this stage, constant monitoring of the actions of bailiffs is necessary. As long-term practice shows, the time frame for carrying out enforcement actions by bailiffs is often unjustifiably delayed.

In addition, it would not be superfluous to provide the bailiffs with information about the debtor’s property. It will speed up the repayment of debt and force bailiffs to be more active in preparing documents for the sale of the debtor’s property.

So, having completed the symbolic 8 steps, you are closer to receiving your money.

If for some reason this path seemed long or too troublesome to you and you would like to do your work, relax, and not waste your time and nerves on meetings and proceedings with the debtor, court hearings, visits to bailiffs - you have the opportunity to do There is only ONE step - contact a debt lawyer .

DEBT COLLECTION UNDER THE AGREEMENT IN 1 STEP. ONE STEP = 8 STEPS.

A debt lawyer will take all necessary actions to solve your problem:

- will analyze the situation;

- prepare documents for debt collection under the contract,

- will submit documents to the court;

- will protect your rights during legal proceedings in any instance;

- will receive a writ of execution and transfer it to the bailiff service;

- will control the execution of enforcement actions by bailiffs;

- will prepare the necessary documents if you decide to sell the debt

In conclusion.

What should the loan agreement be? Sample loan agreement.

The legislator imposes the following requirements for a loan agreement:

- Written form (if a loan is made between individuals and the loan amount exceeds 10,000 rubles, if the loan is from a legal entity - regardless of the loan amount);

- interest for using the loan can be established in the agreement;

- an agreement can be interest-free if it is concluded between citizens, including individual entrepreneurs, for an amount not exceeding one hundred thousand rubles;

- if the loan repayment period is not established by the agreement or is determined by the moment of demand, the loan amount must be repaid by the borrower within thirty days from the date the lender submits a request for this, unless the agreement contains other deadlines;

- a loan provided at interest to a citizen borrower for personal, family, home or other use not related to business activities may be repaid by the citizen borrower ahead of schedule in full or in parts. In this case, the lender is notified of this no less than thirty days before the day of such return;

- the loan agreement may provide for the return of the loan in installments (in installments), then if the borrower violates the deadline established for the return of the next part of the loan, the lender has the right to demand early repayment of the entire remaining loan amount along with interest;

- the loan can be provided for purposes specified in the agreement (targeted loan);

- the loan agreement may provide for loan security;

- the agreement may stipulate that the loan is provided in an amount equivalent to a certain amount in foreign currency or in conventional monetary units. In this case, the amount to be refunded is determined at the official exchange rate of the relevant currency to the ruble on the day of payment, unless a different rate is agreed upon by the parties.

Sample LOAN AGREEMENT

Cash loan agreement

____________________ ____ “___” ______________ 20_____

________________________________________ represented by ________________________________________, acting on the basis of _________________________________________, hereinafter referred to as the “ Lender ”, on the one hand, and citizen ________________________________________, passport (series, number, issued) _______ ______________ _____________________________________________ ______________, residing at the address _________________________________________, hereinafter referred to as the “ Borrower ”, on the other hand, hereinafter referred to as the “ Parties ”, have entered into this agreement, hereinafter the “Agreement”, as follows:

- Under the Agreement, the Lender provides the Borrower with an interest-bearing loan in the amount of ________________________________________ rubles, and the Borrower undertakes to repay the specified amount of money within the period specified in the Agreement.

- The interest rate on borrowed funds is _______% for each calendar day of use of borrowed funds. Interest is paid monthly, by the _______ day of each calendar month.

- Borrowed funds are provided to the Borrower for a period of up to “___”______________ _______ year. Upon expiration of the loan period, the Borrower undertakes to return the funds transferred into ownership under this Agreement, as well as pay all due interest. The proper deadline for final settlement is “___”______________ _______ year. Violation of the specified period by the Borrower provides the Lender with an unconditional right to demand payment of a fine in the amount of _______% of the total debt (loan amount and interest amount). At the same time, collection of a fine does not relieve the guilty Party from fulfilling its obligations.

- The parties allow for the possibility of early repayment of the loan. In this case, the Borrower must notify the Lender in writing of such intention, indicate the date of expected repayment, and also provide a calculation of the amount of interest payable for the actual use of the loan. The specified notice must be submitted to the Lender no later than _______ business days before the date of early repayment of the loan. Missing the specified deadline gives the Lender the right to set a new date for early repayment, taking into account the deadline agreed above.

- Borrowed funds are provided in cash. The transfer of funds is carried out at the time of signing this Agreement and is recorded by the corresponding primary document. Refunds are made in any way not prohibited by law.

- The parties have the right to agree on a different method of fulfillment of obligations, which is necessarily fixed in a separate written agreement, which is an integral part of this Agreement.

- The Parties are released from liability for partial or complete failure to fulfill obligations under this Agreement if this failure was the result of force majeure circumstances that arose after the conclusion of this Agreement, which the Parties could not foresee or prevent. By agreement of the Parties, the specified force majeure circumstances include exclusively natural acts (hurricanes, earthquakes, mudflows, floods).

- The essential terms of this Agreement specified in the text of the document, as well as in all appendices to it and all other documents executed by the Parties in connection with the execution of this Agreement, are confidential and not subject to disclosure.

- All disputes and disagreements that may arise during the execution of this Agreement will, if possible, be resolved through negotiations between the parties. If it is impossible to resolve disputes through negotiations, the parties have the right to apply to the courts for protection of the violated right.

- The Borrower grants the Lender the right to receive and process his personal data necessary to fulfill the terms of this Agreement. In this case, this information includes any personal data about the Borrower used within the framework of this transaction and in connection with it. This consent is valid for the entire duration of this Agreement.

- The Borrower represents and warrants that it has no prohibitions and/or restrictions for completing this transaction, and also has all the necessary consents and approvals to enter into this Agreement from the parties interested in this.

- This Agreement is drawn up in two identical copies, in Russian. Both copies have the same legal force. Each Party has one copy of this Agreement.

- Changing the terms of the Agreement is possible only with the written consent of both Parties.

- Any additions/changes to this Agreement will have legal force if they are drawn up in writing and signed by the Parties.

ADDRESSES AND PAYMENT DETAILS OF THE PARTIES

Lender

- Legal address: ______________________________

- Mailing address: ______________________________

- Phone fax: ______________________________

- INN/KPP: ______________________________

- Checking account: ______________________________

- Bank: ______________________________

- Correspondent account: ______________________________

- BIC: ______________________________

- Signature: ______________________________

Borrower

- Registration address: ______________________________

- Mailing address: ______________________________

- Phone fax: ______________________________

- Passport series, number: ______________________________

- Issued by: ______________________________

- When issued: ______________________________

- Signature: ______________________________

ARE THERE PROBLEMS WITH REFUNDING THE DEBT UNDER THE AGREEMENT?

DO YOU NEED TO COLLECT A DEBT UNDER A LOAN AGREEMENT?

HAVE A DISPUTE WITH A DEBTOR OR CREDITOR? DO YOU NEED THE HELP OF A DEBT LAWYER?

DO YOU HAVE DEMANDS FOR DEBT COLLECTION?

SIGN UP FOR A CONSULTATION BY TEL. 8 (812) 922-99-80.

TO CONTACT A LAWYER, FILL OUT THE FORM:

Transfer of loan amount to a third party

And in conclusion, we will talk about the amendments that completely legalized the issuance of a loan by transferring it not to the borrower’s account, but to third parties specified by the borrower. Previously, such loans were at risk, since from the provisions of Article 807 of the Civil Code of the Russian Federation it followed that, according to the loan agreement, the money must be transferred to the borrower. And if the lender met the counterparty halfway, transferring money at his request directly to the borrower’s creditors, then the latter had a chance to challenge such a loan and not return the money (see, for example, the resolution of the Arbitration Court of the Volga-Vyatka District dated March 26, 2018 No. F01-547/ 2018 in case No. A82-746/2017).

The new editions of Articles 807 and 812 of the Civil Code of the Russian Federation remove these risks, since they contain rules equating the transfer of money at the request of the borrower to a third party with its transfer directly to the borrower. Thus, now there is no need to fear such relationships. It is only sufficient to have a clear indication from the borrower that the loan amount under the agreement must be transferred to the account of a third party. This can be done either directly in the text of the agreement or in a corresponding letter from the borrower. In the latter case, make sure that the letter contains a link to the details of the loan agreement.

In what cases will it not be possible to repay the debt?

It is not always worth spending time and money on litigation to recover a debt. There are a number of circumstances that make receiving funds back impossible even with strong documentary evidence.

The statute of limitations has expired

The statute of limitations for debt collection is three years. If the lender does not go to court within three years, the right to resolve the issue in court is lost.

It is possible to extend the statute of limitations, but this requires very compelling reasons. In 99 cases out of a hundred, it is very difficult to prove that it was not possible to go to court before.

There is no financial opportunity to repay the debt

The defendant's lack of official work and valuable property makes recovery impossible. There is actually nothing to take from him, so there is no talk of repaying the debt.

The applicant may seek justice for years, but it will be easier to simply erase the situation from his life and write it off as charity.

The debtor is declared bankrupt in court

Legislative norms allow not only legal entities, but also individuals to declare bankruptcy. If a person has gone through the official bankruptcy procedure, then all his assets have already been transferred to pay off debt obligations. The remaining debts are simply written off. The bankrupt’s financial history is reset to zero, and it is no longer possible to collect the debt from him.

A person does not give back money taken against a receipt

When borrowing a certain amount against a receipt, the lender feels protected. Indeed, the presence of a document facilitates the return procedure, but does not guarantee a positive outcome of the case.

Pre-trial actions

Even if there is an agreement, before going to court, it is recommended to first go through a pre-trial conflict resolution procedure. It may look different, but it should not violate the law. Physical or mental pressure will result in a lawsuit being filed against the lender.

We find out the position of the debtor

The very first step of the pre-trial procedure will be a confidential conversation with the borrowing party. It is recommended to find out his position, ask for what reason he does not give away the funds, whether the current situation is his principled position or whether the circumstances just happened that way.

If the defendant sincerely wants the money back, a settlement agreement can be drawn up. The document specifies the agreed return procedure.

Record the conversation

Private conversations do not always go well. You can protect yourself and obtain additional evidence of your ex-friend’s dishonesty using audio or video recordings. It is unlikely that a citizen will be frank during open filming, but if the voice recorder is turned on in secret, then you can get truthful answers (but here again there is a risk that the court will not accept a confession recorded in secret). Subsequently, such a record can be attached to a lawsuit.

Anti-advertising

When conducting a conversation, it is important to correctly navigate and build your position depending on the mood of the debtor himself. If a person behaves rudely and declares that he will not give anything away, you can resort to anti-advertising.

This method implies that the lender takes an active and aggressive position - he tells mutual acquaintances, friends, and colleagues about the dishonest actions of the other party. Anti-advertising can be carried out both offline and online.

Heart to heart conversation

The lack of aggression on the part of the borrower suggests that it is better to rely on his sense of conscience. A heart-to-heart conversation will help you understand his motives and build an up-to-date model for future relationships. Quite often, people become habitual defaulters unintentionally and suffer from the fact that they have lost a friend.

Talk to relatives

The problem can be solved not only through the debtor himself, but also through his relatives. Few people want an unpleasant conflict to become public knowledge. Relatives may return the money out of pity for their loved one or out of fear of disgracing themselves.

It is recommended to contact your closest relatives – parents and family members. Longer-distance connections are unlikely to want to help.

Return before trial

The pre-trial return procedure implies the conclusion of a settlement agreement. This document is drawn up in accordance with current legislative norms and must be notarized. The settlement agreement is the documentary basis for applying to the bailiff service. You can resort to the help of the FSSP if at some stage the debtor stops fulfilling his obligations.

Drawing up a pre-trial claim

When going to court, it is necessary to have a pre-trial claim. This document is a written request to repay borrowed funds within a specified period. The lender draws up a document and delivers it to the other party against signature. If you refuse to sign, the document is sent by registered mail. A description of the sent attachment is required.

After 30 days after delivery of the notice, the obligations are considered unfulfilled and legal action can be taken.

Application to court

The court accepts citizens' appeals only in writing. The plaintiff must draw up a statement of claim in triplicate. Documents proving the above, as well as a receipt for payment of the state duty, are attached to the claim.

An incorrectly drafted claim will be returned for revision. If the application was drawn up correctly, it is accepted for consideration. After the date of the hearing is set, the plaintiff receives a notification about the time of the litigation.

Drawing up a statement of claim

The statement of claim is drawn up on a sheet of A4 paper. The document has a conditionally free form, but necessarily contains:

- Details of the plaintiff and defendant - full name, residence/registration addresses.

- Information about the essence of the conflict: loan size, date of transfer of funds.

- Information about the receipt and return period.

- A description of the reasons for the defendant’s refusal to voluntarily return the specified amount.

- Data on pre-trial dispute settlement.

- Demands to return the specified amount.

- List of documentary evidence attached to the application.

The claim is certified by the signature of the plaintiff and the date of its writing.

in PDF and Docx formats:

We pay the state fee for consideration of the case in court

When filing a claim, please note that you must pay a state fee for consideration. Its size is calculated from the amount of claims: the larger the debt, the higher the state duty.

Payment is made in advance before submitting the application. The plaintiff has the right to recover legal costs from the defendant. If the case is won, he will receive back not only the debt amounts, but also the state duty paid.

We send the necessary documents

The application to the court is submitted along with documents confirming what was said on paper. The list of documents includes:

- Two copies of the claim.

- Receipt for payment of state duty.

- IOU.

- Receipts for sending a pre-trial claim.

- Other forms revealing the essence of the matter.

If the amount claimed exceeds that stated in the promissory note, a written calculation of the amount required must be made and attached to the claim.

We are waiting for the court's decision

A court decision may be made by way of writ proceedings. This procedure takes no more than five days and does not require the presence of the parties. But most often, claims are considered in a standard manner, and one meeting is often not enough. The legal battle could drag on for several months. The plaintiff can only be patient and not despair.

We receive funds

A positive court decision does not at all guarantee that the money will be returned to the winning party instantly. Often you still have to run a lot for your money. The lender can choose a collection method convenient for him:

- Do everything yourself.

- Contact the bailiffs.

- Transfer debt to third parties.

Each option has its own nuances.

Contacting the borrower's bank

After receiving a court decision to collect debt obligations, the plaintiff may resort to official methods of obtaining his own funds. The simplest and most logical way would be to present a writ of execution to the debtor’s bank. Based on this, money will be withheld from accounts. But this method is only good if you have bank accounts with a positive balance.

Contacting the bailiff service

Bailiffs have a wider range of influence on the losing party. They can send a request to work demanding that money be withheld from the salary. If there is no official source of income, then they can describe the property, suspend the driver’s license, impose a ban on traveling abroad, and much more.

Assign rights of claim to third parties

If neither the first nor the second method is suitable, you can assign the rights to the borrowed amount to third parties. Collection organizations are happy to buy disputed debts. The plaintiff receives a small percentage of the claimed debt and washes his hands of it. And collectors take on the losing side and act in a variety of, sometimes very illegal, ways.