What is KOSGU

In the budget, KOSGU is a classification of operations of the general government sector. A specific codifier allows you to group operations that are similar in content. Assignment to KOSGU significantly simplifies accounting and reporting of the public sector.

IMPORTANT!

The rules for the formation and assignment of KOSGU codes are enshrined in Order of the Ministry of Finance No. 209n dated November 29, 2017. Instruction 209n also approves the new procedure for applying KOSGU for budgetary institutions in 2022: a number of changes for the next year have been adopted, but Order of the Ministry of Finance No. 133n dated September 24, 2021 has not yet entered into force.

Back in 2022 (after registration of Order No. 133n), public sector employees will have to take into account in subarticle 273 of the KOSGU “Extraordinary expenses on transactions with assets” the outflow of money in the event of shortages, theft, or revocation of a license from a credit institution. Carry out the accounting transaction on the day the claim for damages is recognized or on the day the money is received to repay the debt.

From 01/01/2022, changes to KOSGU 250 “Gratuitous transfers to budgets” come into force. This code should be used to separate operations of a current and capital nature. Current operations are accounted for under sub-articles of KOSGU 251, 252, 253. Capital transactions are reflected under sub-articles of KOSGU:

- 254 — transfers to other budgets;

- 255 - transfers to supranational organizations, foreign governments;

- 256 - transfers to international states.

The KOSGU code consists of three characters in the format “ХХХ”. The first digit of the codifier indicates membership in a specific group of operations, the second and third characters of the code detail the subgroup and content of the operation. We present the current codes in the KOSGU table for 2022 (by group):

| 100 | Revenues, including profits of public sector institutions |

| 110 - tax revenues | |

| 111 - taxes | |

| 112 — state duties and other fees | |

| 130 — income from the provision of paid services | |

| 180 - other income | |

| 200 | Expenses, the group of which includes all categories of institution expenses |

| 211 - salary | |

| 212 - other cash payments to staff | |

| 213 - taxes | |

| 221 - communication services | |

| 222 - transport services | |

| 223 - utilities | |

| 225 - works and services for building maintenance | |

| 226: decoding of KOSGU 226 in 2022 for budgetary institutions - other works and services | |

| 228 - work for capital investment purposes | |

| 290 — other expenses | |

| 300 | Receipt of non-financial assets |

| 310 - increase in the cost of fixed assets | |

| 320 - increase in intangible inventories | |

| 330 - increase in non-productive assets | |

| 340 - increase in inventories | |

| 341 - increase in medications | |

| 342 - increase in food costs | |

| 343 - increase in fuels and lubricants | |

| 344 - increase in building materials | |

| 345 — increase in soft inventory | |

| 346: decoding of KOSGU 346 in 2022 for budgetary institutions - increase in the cost of other material reserves | |

| 347 - increase in the cost of inventories for capital investments | |

| 349: decoding of KOSGU 349 in 2022 for budgetary institutions - increase in the cost of other disposable inventories | |

| 400 | Disposal of non-financial assets (transactions on disposal of non-financial assets are reflected) |

| 410 - decrease in the value of fixed assets | |

| 411 - depreciation of fixed assets | |

| 420 - decrease in the value of intangible assets | |

| 421 - amortization of intangible assets | |

| 440 - decrease in the cost of inventories | |

| 500 | Receipt of financial assets (operations to increase cash balances on current accounts and at the institution’s cash desk) |

| 510 - receipt of cash and cash equivalents | |

| 520 — increase in the value of securities | |

| 530 - increase in share price | |

| 600 | Disposal of financial assets, that is, expenditure of cash and other financial instruments |

| 610 - disposal of cash and cash equivalents | |

| 620 — decrease in the value of securities | |

| 630 - decrease in share price | |

| 700 | Increased obligations. Reflects the amounts of obligations accepted for execution |

| 710 — increase in debt on internal borrowings | |

| 720 — increase in debt on external borrowings | |

| 730 — increase in other accounts payable | |

| 800 | Reducing obligations. Fixes the amounts of fulfilled obligations |

| 810 — reduction of debt on internal borrowed liabilities | |

| 820 — reduction of debt on external liabilities attracted | |

| 830 - reduction of other accounts payable |

Back in 2015, all costly operations in the budget were classified according to KOSGU. The codifier was an integral part of the budget classification code. The 20-digit KBK of each expense transaction ended with three characters - KOSGU. But since January 2016, the rules have changed, and the budget classification according to KOSGU is not formed. Instead of classifying operations of the general government sector, the BCC indicates the type of expenditure code, or CVR.

ConsultantPlus experts discussed how to apply CVR without errors and violations. Use these instructions for free.

Fixed assets in accounting

Fixed assets are material assets that are planned to be used to carry out the activities of the institution for at least 12 months.

Moreover, in the process of recognizing fixed assets in accounting, its value does not play any role. In 2022, public sector employees are required to maintain asset accounting according to the new federal standard. We talked about the key changes that are regulated by this regulatory legal act in the article “Understanding the new accounting standards.”

Synthetic and analytical accounting of fixed assets in a budgetary institution is carried out on account 0 101 00 000. Accounting objects are included in the balance sheet of the organization at their original cost:

- if the cost of fixed assets is up to 10,000 rubles - it is considered to be of low value and is recorded on off-balance sheet accounts;

- when assessed up to 100,000 rubles, but more than 10,000 rubles. — the object is accounted for in the corresponding account 101, while the original cost (posting below) is written off to the corresponding depreciation account 0 104 00 000 in the amount of 100%;

- objects costing more than 100,000 rubles are subject to accounting on balance sheet account 101 with periodic depreciation accrual, according to the chosen method.

Let's look at the key transactions for fixed assets in accounting 2022 for budgetary institutions using specific examples.

Application of KOSGU in practice

After the exclusion of KOSGU from the structure of expenditure codes of the budget classification, the codifier did not lose its relevance. State employees are required to classify operations according to KOSGU. For example, government institutions and the management sector work only according to the codifier. They use KOSGU in the following cases:

- in planning budget income and expenses, drawing up schedules, cash plans;

- when drawing up budget estimates for a government organization;

- when drawing up justifications for expenses to the budget and budget estimates;

- limits and allocations are communicated to recipients of budget funds in the context of the KOSGU codifier;

- when drawing up a procurement plan and schedule;

- when calculating with the budget;

- when drawing up some reporting forms;

- when accepting obligations (budgetary, monetary);

- in other cases provided for by the Budget Code of the Russian Federation and Order No. 209n.

Don't forget about budget reporting. Some forms provide for the structuring of information in the context of KOSGU: a statement of financial performance and a statement of cash flows.

Code linkages for 2022

The Ministry of Finance has published a new compliance table for 2022. Below is presented only the KVR 200 group, which is most often used in procurement activities. The full version with all codes is attached in the file.

| Type of KVR | KOSGU | Note | ||

| Code | Name | Code | Name | |

| 210 Development, purchase and repair of weapons, military and special equipment, industrial and technical products and property | The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area | |||

| 211 | Supply of weapons, military and special equipment and military-technical property within the framework of the state defense order in order to support the state weapons program | 226 | Other works, services | |

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 212 | Supply of weapons, military and special equipment and military-technical property within the framework of the state defense order outside the state armament program | 226 | Other works, services | |

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 213 | Supply of goods, works and services to meet government needs in the field of geodesy and cartography within the framework of the state defense order | 220 | Payment for work and services | |

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 214 | Repair of weapons, military and special equipment and military-technical property within the framework of the state defense order in order to support the state weapons program | 225 | Works and services for property maintenance | |

| 226 | Other works, services | |||

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 215 | Repair of weapons, military and special equipment and military-technical property within the framework of the state defense order outside the state armament program | 225 | Works and services for property maintenance | |

| 226 | Other works, services | |||

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 216 | Fundamental research in the interests of ensuring the defense and national security of the Russian Federation within the framework of the state defense order in order to support the state weapons program | 226 | Other works, services | |

| 320 | Increase in the value of intangible assets | |||

| 217 | Research in the field of development of weapons, military and special equipment and military-technical property within the framework of the state defense order in order to support the state weapons program | 226 | Other works, services | |

| 320 | Increase in the value of intangible assets | |||

| 218 | Research in the field of development of weapons, military and special equipment and military-technical property within the framework of the state defense order outside the state weapons program | 226 | Other works, services | |

| 320 | Increase in the value of intangible assets | |||

| 219 | Supply of products (works, services) in order to ensure the assignments of the state defense order | 220 | Payment for work and services | |

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 220 Purchase of goods, works and services to provide special fuel and fuels and lubricants, food and clothing supplies to bodies in the field of national security, law enforcement and defense | ||||

| 221 | Providing fuel and lubricants within the framework of the state defense order | 222 | Transport services | The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area |

| 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |||

| 226 | Other works, services | |||

| 229 | Rent for the use of land plots and other isolated natural objects | |||

| 310 | Increase in the value of fixed assets | |||

| 343 | Increase in the cost of fuels and lubricants | |||

| 223 | Food supply within the framework of the state defense order | 214 | Other non-social payments to staff in kind | |

| 226 | Other works, services | The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area | ||

| 342 | Increased food costs | |||

| 346 | Increase in the cost of other working inventories (materials) | Regarding the cost of paying for animal feed | ||

| 224 | Food supply outside the framework of the state defense order | 226 | Other works, services | |

| 225 | Clothing provision within the framework of the state defense order | 226 | Other works, services | The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area |

| 310 | Increase in the value of fixed assets | |||

| 345 | Increasing the cost of soft inventory | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 230 Purchase of goods, works, services for the purpose of forming a state material reserve | ||||

| 231 | Purchase of goods, works, services for the purpose of forming a state material reserve within the framework of the state defense order | 220 | Payment for work and services | |

| 300 | Receipt of non-financial assets | |||

| 232 | Purchase of goods, works, services in order to ensure the formation of the state material reserve, reserves of material resources | 220 | Payment for work and services | |

| 300 | Receipt of non-financial assets | |||

| 240 Other purchases of goods, works and services to meet state (municipal) needs | ||||

| 241 | Research and development work | 226 | Other works, services | |

| 320 | Increase in the value of intangible assets | |||

| 242 | Procurement of goods, works, services in the field of information and communication technologies | 221 | Communication services | |

| 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |||

| 225 | Works and services for property maintenance | |||

| 226 | Other works, services | |||

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 347 | Increasing the value of inventories for capital investment purposes | |||

| 349 | Increase in the cost of other disposable inventories | Regarding strict reporting forms | ||

| 243 | Purchase of goods, works, services for the purpose of major repairs of state (municipal) property | 222 | Transport services | |

| 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |||

| 225 | Works and services for property maintenance | |||

| 226 | Other works, services | |||

| 228 | Services, work for capital investment purposes | |||

| 229 | Rent for the use of land plots and other isolated natural objects | |||

| 296 | Other current payments to individuals | Reimbursement (compensation) provided for by the consolidated estimate of the cost of major repairs | ||

| 297 | Other current payments to organizations | Regarding the fee for compensatory landscaping in case of destruction of green spaces | ||

| 299 | Other capital payments to organizations | |||

| 310 | Increase in the value of fixed assets | |||

| 344 | Increased cost of building materials | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 347 | Increasing the value of inventories for capital investment purposes | |||

| 244 | Other procurement of goods, works and services | 214 | Other non-social payments to staff in kind | In terms of recording transactions for the purchase of milk or other equivalent food products for free distribution to employees engaged in work with hazardous working conditions |

| 220 | Payment for work and services | Including costs for the delivery (shipment) of pensions, benefits and other social payments to the population | ||

| 267 | Social compensation to staff in kind | |||

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 340 | Increase in the cost of inventories | |||

| 530 | Increase in the value of shares and other financial instruments | |||

| 245 | Purchase of goods, works and services to meet state (municipal) needs in the field of geodesy and cartography outside the framework of the state defense order | 220 | Payment for work and services | |

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 246 | Purchase of goods, works, services for the purpose of creation, development, operation and decommissioning of state information systems | 221 | Communication services | |

| 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |||

| 225 | Works and services for property maintenance | |||

| 226 | Other works, services | |||

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 340 | Increase in the cost of inventories | |||

| 247 | Procurement of energy resources | 223 | Public utilities | In terms of payment at tariffs for the supply of electricity, gas supply, heat supply, as well as payment for the transportation of gas, electricity through gas distribution and electrical networks (with the exception of similar expenses of foreign apparatus of government bodies (expenditure line 90039 “Expenses for ensuring the functions of foreign apparatus of government bodies”) , for the provision of whose activities type of expenses 247 is not applied) |

| for 2022 |

IMPORTANT!

To transfer money for special purposes, use code 853: decoding of CVR 853 in 2022 for budgetary institutions - “Payment of other payments.” It is used with connections KOSGU 233, 252, 290 and 530.

KOSGU in procurement activities

Conducting procurement in public sector organizations is impossible without allocating costs according to existing codifiers. When drawing up an institution's schedule, it is necessary to be guided by the budget estimate, which includes KOSGU and is compiled by cost items.

For example, Order No. 209n provides a breakdown of what is included in KOSGU 346 - an increase in the cost of other inventories:

- spare parts for repair of machinery and equipment;

- special equipment for R&D;

- seeds, fertilizers, planting materials;

- reagents, chemical glassware, radio components;

- special purpose materials, etc.

The customer does not have the right to plan purchases more than the limits and allocations reached. The distribution of funds in the procurement documentation is made in strict accordance with the PFHD or estimate, that is, in the context of KOSGU and KVR codes.

Adjustments to the structure of the KBK changed the principles of reflecting codes in procurement documentation. Now operations are classified only by CVR. But don’t forget about KOSGU: excluding the code from the KBK structure did not cancel its significance. This is due to the fact that the KVR and KOSGU codes are inextricably linked.

It is impossible to determine the correct expense type code for an operation without setting the correct KOSGU. If you make a mistake and incorrectly determine the codifiers, the institution will not be able to purchase the necessary equipment, work or services. Administrative liability is provided for violation of the rules for drawing up procurement and planning documentation.

Transcript 340 KOSGU

In the new Instruction 209n, Article 340 has been detailed; read more about it in a separate article. Now the increase in the cost of inventory should be attributed to the following sub-items:

- 341 – medicines and used for medical purposes by the Ministry of Health;

- 342 – food products;

- 343 – fuels and lubricants;

- 344 – building materials;

- 345 – soft equipment;

- 346 – other working inventories (materials);

- 347 – Ministry of Health for capital investment purposes;

- 349 – other single-use inventories.

Other working inventories include:

- special equipment for R&D;

- spare parts for cars, computers, information and computing systems;

- kitchen tools;

- young animals;

- blank products;

- other MH.

Almost all articles of KOSGU correspond to synthetic accounts for accounting for materials, except for 347 and 349. 347 should reflect the receipt of materials, including construction materials, for major repairs. In this case, purchases must be made according to KVR 243. Code 349 takes into account materials previously classified as KOSGU:

- 226 – strict reporting forms;

- 223 – bottled water, if the organization does not have a central water supply, or the results of the study revealed that the water does not comply with sanitary standards;

- souvenir and gift products not intended for resale.

Materials based on Instruction 157n include the following assets, the useful life of which exceeds 12 months:

- equipment intended for installation;

- precious metals for prosthetics;

- disabled equipment intended for transfer to the population;

- building structures for installation;

- young animals;

- perennial plantings;

- container;

- bed sheets;

- rental items;

- fishing gear;

- forest roads subject to reclamation.

Service to determine KVR and KOSGU in the State Finance System. Service for KVR and KOSGU will select codes for your situation. Enter your request and get a quick response. Also see how to apply the new KOSGU codes in 2022 with comments, case studies, and how to compare the 2022 and 2022 budget classification codes.

We work with KVR correctly

The expense type code is a three-digit code used to group similar transactions for the expenditure of budget funds. Moreover, the classification of operations is carried out directly according to their content in order to effectively manage the budget process and control over legal execution. This specific codifier is used when compiling the budget classification code. This means that the code is used in almost all areas of financial activity.

IMPORTANT!

State employees work with the CVR according to Order of the Ministry of Finance No. 85n dated 06/06/2019 (as amended on 07/29/2021). And the list of budget classification codes for 2022 was approved by Order No. 75n dated 06/08/2021.

The KVR classifier has a grouping:

How to use the new code 247

The Ministry of Finance introduced a new CVR 247 “Purchase of energy resources” (Order of the Ministry of Finance No. 85n dated 06/06/2019). The Ministry of Finance explained the procedure for applying the new expense code in letter No. 02-05-10/10752 dated 02/17/2021. The code is used regardless of the date of conclusion of the contract or reflection of accounts payable.

The table shows cases of application of codes 244 and 247 according to the rules of the Ministry of Finance.

| 244 “Other procurement of goods, works, | |

|

|

IMPORTANT!

The Ministry of Finance explained how to carry out combined contracts for the supply of heat and hot water in 2022 - only under KVR 247 (Letter of the Ministry of Finance No. 02-05-11/77361 dated 09.22.2021). Previously, mixed agreements were concluded under two articles - 244 (hot water supply) and 247 (heat energy). In 2022, KVR 244 for combined government contracts is used only in exceptional cases.

KOSGU 343 transcript in 2022

KOSGU 343 in 2022 states - “Increasing the cost of fuels and lubricants” - in terms of payment for contracts for the supply (purchase) of all types of fuel, fuels and lubricants used to ensure the functioning of fuel systems.

Example: Which KOSGU should include the purchase of coal: 343 or 223. The institution enters into employment contracts with stokers (i.e. independently without the involvement of a third-party organization).

Transactions for payment of utilities for the provision of solid fuel in the presence of stove heating and payment for contracts for the supply of solid fuel:

- KOSGU 223 “Utilities” - in terms of payment for contracts for the provision of utility services, including services for the provision of solid fuel in the presence of stove heating;

- KOSGU 343 “Increasing the cost of fuels and lubricants” - in terms of payment for contracts for the supply (purchase) of all types of fuel, fuels and lubricants used to ensure the functioning of fuel systems.

Based on this, in the case of our example, we need to use KOSGU 343, because Coal is purchased independently as a solid fuel, rather than purchased as a utility service from a third party.

The procedure for determining KVR and KOSGU

With the change in the structure of the KBK, the order of interaction between the KVR and KOSGU was also adjusted. To determine the correct budget classification code, you must:

- Select the correct KOSGU for the operation being performed.

- Determine the KVR, which corresponds to KOSGU.

- Check the data linking KVR and KOSGU using the current correspondence table.

- Include the verified CWR in the planning and reporting documentation.

The correspondence table between KVR and KOSGU was put into effect back in 2016, but the positions of the document are systematically updated. Officials approved a new compliance table for the job.

Transcript 310 KOSGU

This item includes expenses under contracts for the acquisition, construction or production of fixed assets, as well as modernization (with or without additional equipment), reconstruction and expansion.

If expenses are incurred that increase the cost of a building leased or used for free, they should also be attributed to code 310. Guidelines for the application of 209n (Letter of the Ministry of Finance dated June 29, 2018 No. 02-05-10/45153) clarify that for this The article also applies to the acquisition of dilapidated housing in houses subject to demolition, purchased from the owners. The recommendations indicate that when choosing an article, you can be guided by the OK 034-2014 classifier (CPES 2008), put into effect on February 1, 2014. You should take into account Instruction 157n, which states that OS does not include:

- Items whose service life is less than 12 months.

- Finished products.

- Assets, in accordance with 157n related to the Ministry of Health.

- Assets in transit.

- NFA included in unfinished capital investments.

The criteria by which an asset can be accepted for accounting as fixed assets are set out in the federal standard “Fixed Assets”. The most significant of them:

- useful life is more than 12 months;

- performing an independent function;

- the possibility of future economic benefits or service potential.

Download the cheat sheet with the latest changes in KOSGU:

Note! It is important to use the correct KOSGU codes to avoid errors in accounting and reporting.

How to work with KVR and KOSGU codes and the correspondence table

Example No. 1.

Let’s say a government agency plans to repair equipment. Repair work, in accordance with Order No. 209n, should be attributed to expense item 225 of KOSGU “Works, services for property maintenance.”

Now we analyze the type of planned equipment repair and the type of equipment itself. For example, equipment does not belong to information and communication areas. Then you should select KVR 244. If ICT equipment, then the code is 242 (BU and AU are not used). The type of repair also affects the type of costs. For example, current repairs are classified into groups 244 or 242, and if major repairs are carried out, then KVR - 243.

IMPORTANT!

KVR 242 is not used by budgetary and autonomous institutions. For such government agencies, all types of expenses are sent to code 244 or 243, regardless of their connection to ICT.

Example No. 2.

The budgetary institution entered into an agreement to conduct periodic medical examinations of drivers. Such costs are attributed to subarticle 226 of KOSGU. This category should include all types of work and services that are not included in subarticles 221-225, 227-229 of KOSGU.

Reflect the costs of paying for the medical examination of drivers under subarticle 226 of KOSGU in connection with expense type code 244 “Other purchase of goods, works and services” (clause 10.2.6 of Procedure No. 209n, section III of Procedure No. 85n).

Example No. 3.

The institution orders design and estimate documentation for the reconstruction of the building. Let's analyze the operation. Preparation of design and estimate documentation is not a direct expense for capital construction or repairs. Consequently, services and work for the purpose of capital investments are attributed to subarticle KOSGU 228 in conjunction with KVR 243 “Purchase of goods, work, services for the purpose of major repairs of state (municipal) property.”

Example No. 4.

Accountants often get confused in KOSGU codes when reflecting expenses for the acquisition of fixed assets and inventories. Before determining the exact sub-item of KOSGU and KVR, it is necessary to understand which group of non-financial assets the acquired objects belong to.

How to correctly determine the codifier:

| If an institution acquires an asset that meets the characteristics of an operating system and is used as an independent object | If an institution purchases an asset for replacement, installation, installation, provided that the asset is not used as an independent object and meets the criteria of MH |

| Reflect expenses on subsection 310 and CVR 244. | Reflect expenses in subgroup 340 according to KVR 244 (or according to KVR 243, if expenses are related to capital investments). |

| In subarticle 310 “Increase in the cost of fixed assets” reflect the costs of construction, acquisition (manufacturing), reconstruction, technical re-equipment, expansion, modernization (modernization with additional equipment) of fixed assets and operations for their receipt (acceptance for accounting). | Article 340 “Increase in the cost of inventories” of KOSGU is detailed in subarticles 341-347, 349 of KOSGU. For these sub-items, reflect the costs of acquiring (manufacturing) objects recognized as inventories, and operations for their receipt (acceptance for accounting). Article 344 “Increase in the cost of building materials.” |

Budget institutions. Accounting for the modernization of fixed assets

On the application of the budget classification of the Russian Federation when reflecting cash expenses for the modernization of fixed assets

Letter of the Ministry of Finance of the Russian Federation, Federal Treasury of the Russian Federation dated June 27, 2006 No. 42-7.1-15/2.2-265

Work on modernization of fixed assets includes

work caused by a change in the technological or service purpose of equipment or another object of depreciable fixed assets, increased loads and (or) new qualities (

clause 2 of Article 257 of the Tax Code of the Russian Federation

).

In accordance with clause 13 of the Instructions for Budget Accounting

, approved by order of the Ministry of Finance of the Russian Federation dated February 10, 2006 No. 25n, changes in the initial cost of fixed assets are allowed in cases of their modernization.

Replacement of devices and accessories

(for example, a monitor, a system unit, a computer DVD-recording drive, etc.) that perform their functions only

as part of a complex

and not independently,

cannot be considered as a modernization

of fixed assets on which the specified replacement is carried out.

Operations to replace components and components of fixed assets should be considered as the use of other materials when carrying out current (overhaul)

repairs of fixed assets

.

Consequently, the costs of their acquisition are subject to planning and reflection under Article 340

“Increase in the cost of inventories” of the economic classification of budget expenditures of the Russian Federation.

Expenses for purchasing printers

, which are reflected as fixed assets in budget accounting, are planned and implemented

according to Article 310

“Increase in the cost of fixed assets” of the economic classification of budget expenditures of the Russian Federation.

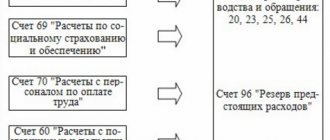

In the accounting of a budgetary institution, operations to replace components and components of fixed assets are reflected in the following entries in the budget accounting accounts

:

DEBIT 120622560 CREDIT 130405340

– advance payment for the supply of spare parts for the repair of fixed assets;

DEBIT 110506340 CREDIT 130222730

– posting of spare parts;

DEBIT 130222830 CREDIT 120622660

– crediting prepayment as part of settlements with the supplier;

DEBIT 130222830 CREDIT 130405340

– final settlement with the supplier;

DEBIT 140101272 CREDIT 110506440

– reflection of the write-off of spare parts used for repairs.

Linking CWR and KOSGU for 2022 in procurement

For reference: the table includes only the grouping by KVR 200, which is most often used in procurement activities. You will find other types of KOSGU expenses for 209n in a single table.

| KVR | KOSGU | Note | ||

| Code | Budget expense items with explanation | Code | Name | |

| 210 Development, purchase and repair of weapons, military and special equipment, industrial and technical products and property | The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area | |||

| 211 | Supply of weapons, military and special equipment and military-technical property within the framework of the state defense order in order to support the state weapons program | 226 | Other works, services | |

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 212 | Supply of weapons, military and special equipment and military-technical property within the framework of the state defense order outside the state armament program | 226 | Other works, services | |

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 213 | Supply of goods, works and services to meet government needs in the field of geodesy and cartography within the framework of the state defense order | 220 | Payment for work and services | |

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 214 | Repair of weapons, military and special equipment and military-technical property within the framework of the state defense order in order to support the state weapons program | 225 | Works and services for property maintenance | |

| 226 | Other works, services | |||

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 215 | Repair of weapons, military and special equipment and military-technical property within the framework of the state defense order outside the state armament program | 225 | Works and services for property maintenance | |

| 226 | Other works, services | |||

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 216 | Fundamental research in the interests of ensuring the defense and national security of the Russian Federation within the framework of the state defense order in order to support the state weapons program | 226 | Other works, services | |

| 320 | Increase in the value of intangible assets | |||

| 217 | Research in the field of development of weapons, military and special equipment and military-technical property within the framework of the state defense order in order to support the state weapons program | 226 | Other works, services | |

| 320 | Increase in the value of intangible assets | |||

| 218 | Research in the field of development of weapons, military and special equipment and military-technical property within the framework of the state defense order outside the state weapons program | 226 | Other works, services | |

| 320 | Increase in the value of intangible assets | |||

| 219 | Supply of products (works, services) in order to ensure the assignments of the state defense order | 220 | Payment for work and services | |

| 310 | Increase in the value of fixed assets | |||

| 340 | Increase in the cost of inventories | |||

| 220 Purchase of goods, works and services to provide special fuel and fuels and lubricants, food and clothing supplies to bodies in the field of national security, law enforcement and defense | ||||

| 221 | Providing fuel and lubricants within the framework of the state defense order | 222 | Transport services | The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area |

| 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |||

| 226 | Other works, services | |||

| 229 | Rent for the use of land plots and other isolated natural objects | |||

| 310 | Increase in the value of fixed assets | |||

| 343 | Increase in the cost of fuels and lubricants | |||

| 223 | Food supply within the framework of the state defense order | 214 | Other non-social payments to staff in kind | |

| 226 | Other works, services | The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area | ||

| 342 | Increased food costs | |||

| 346 | Increase in the cost of other working inventories (materials) | Regarding the cost of paying for animal feed | ||

| 224 | Food supply outside the framework of the state defense order | 226 | Other works, services | |

| 225 | Clothing provision within the framework of the state defense order | 226 | Other works, services | The classification of expenses as procurement is carried out on the basis of the provisions of regulatory legal acts governing relations in this area |

| 310 | Increase in the value of fixed assets | |||

| 345 | Increasing the cost of soft inventory | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 230 Purchase of goods, works, services for the purpose of forming a state material reserve | ||||

| 231 | Purchase of goods, works, services for the purpose of forming a state material reserve within the framework of the state defense order | 220 | Payment for work and services | |

| 300 | Receipt of non-financial assets | |||

| 232 | Purchase of goods, works, services in order to ensure the formation of the state material reserve, reserves of material resources | 220 | Payment for work and services | |

| 300 | Receipt of non-financial assets | |||

| 240 Other purchases of goods, works and services to meet state (municipal) needs | ||||

| 241 | Research and development work | 226 | Other works, services | |

| 320 | Increase in the value of intangible assets | |||

| 242 | Procurement of goods, works, services in the field of information and communication technologies | 221 | Communication services | |

| 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |||

| 225 | Works and services for property maintenance | |||

| 226 | Other works, services | |||

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 347 | Increasing the value of inventories for capital investment purposes | |||

| 349 | Increase in the cost of other disposable inventories | Regarding strict reporting forms | ||

| 243 | Purchase of goods, works, services for the purpose of major repairs of state (municipal) property | 222 | Transport services | |

| 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |||

| 225 | Works and services for property maintenance | |||

| 226 | Other works, services | |||

| 228 | Services, work for capital investment purposes | |||

| 229 | Rent for the use of land plots and other isolated natural objects | |||

| 296 | Other current payments to individuals | Reimbursement (compensations) provided for by the consolidated estimate of the cost of major repairs | ||

| 297 | Other current payments to organizations | Regarding the fee for compensatory landscaping in case of destruction of green spaces | ||

| 299 | Other capital payments to organizations | |||

| 310 | Increase in the value of fixed assets | |||

| 344 | Increased cost of building materials | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 347 | Increasing the value of inventories for capital investment purposes | |||

| 244 | Other procurement of goods, works and services | 214 | Other non-social payments to staff in kind | In terms of recording transactions for the purchase of milk or other equivalent food products for free distribution to employees engaged in work with hazardous working conditions |

| 220 | Payment for work and services | Including costs for the delivery (shipment) of pensions, benefits and other social payments to the population | ||

| 267 | Social compensation to staff in kind | |||

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 340 | Increase in the cost of inventories | |||

| 530 | Increase in the value of shares and other financial instruments | |||

| 245 | Purchase of goods, works and services to meet state (municipal) needs in the field of geodesy and cartography outside the framework of the state defense order | 220 | Payment for work and services | |

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 346 | Increase in the cost of other working inventories (materials) | |||

| 246 | Purchase of goods, works, services for the purpose of creation, development, operation and decommissioning of state information systems | 224 | Rent for the use of property (except for land plots and other isolated natural objects) | |

| 225 | Works and services for property maintenance | |||

| 226 | Other works, services | |||

| 228 | Services, work for capital investment purposes | |||

| 310 | Increase in the value of fixed assets | |||

| 320 | Increase in the value of intangible assets | |||

| 340 | Increase in the cost of inventories | |||

| 247 | Procurement of energy resources | 223 | Public utilities | In terms of payment at tariffs for the supply of electricity, gas supply, for heat supply, as well as payment for the transportation of gas, electricity through gas distribution and electrical networks (with the exception of similar expenses of foreign apparatus of government bodies (expenditure line 90039 “Expenses for ensuring the functions of foreign apparatus of government bodies" ), for the provision of activities of which type of expenses 247 does not apply) |

IMPORTANT!

Since 2022, new CWR for procurement have been applied - 246 and 247. Code 246 is not intended for all institutions - government agencies, federal government agencies and bodies managing extra-budgetary funds (clause 48.2.4.6 of Order 85n). Code 247 will have to be used by almost all public sector employees and autonomous institutions when purchasing energy resources.

| for 2022 |

Repair and modernization of fixed assets “1C:BGU 8” ed. 1.0

For both accounting and tax accounting, the concepts of repair and modernization have fundamental differences. Sometimes the line between these concepts is very difficult to determine. And still…

As a rule, repair work is the restoration and maintenance of fixed assets in good condition, maintaining operability and original technical and economic characteristics. But, if during the repair process the original characteristics of the fixed asset object are improved, then the repair can be transformed into modernization.

In other words, work on completion, additional equipment, and modernization will include work caused by a change in technological or service purpose, as well as the possibility of increasing the load on equipment and increasing its technical and economic indicators.

The reflection of these transactions in the accounting and tax accounts will differ significantly from each other:

- in the case of repairs, expenses for current or major repairs will be taken into account in the reporting period and will not increase the value of the fixed asset;

- in the case of modernization and reconstruction, costs will increase the cost of the fixed asset and will be included in expenses as depreciation is calculated.

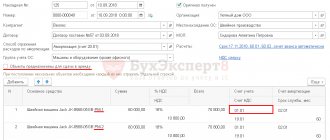

Using a test example, we will reflect these operations in accounting.

The Institution's balance sheet includes a TX 300S7F Server, the book value of which is 120 thousand rubles. As of February 1, 2013, depreciation was accrued in the amount of RUB 43,333.33. During the inspection of the technical condition of the equipment, it was determined that it was necessary to replace one of the failed hard drives with a similar one. Also, due to the need to increase data storage capacity, it was decided to add another identical hard drive.

It was decided to carry out the repair and modernization of the Server by a contractor, and purchase the necessary parts from them.

We will pay for spare parts. The costs of paying for contracts for the purchase of spare parts for computer equipment will be attributed to Art. 340 “Increase in the cost of inventories.”

We will reflect the receipt of spare parts for repairs and modernization with the document “Purchase of Materials”.

We will reflect the write-off of spare parts using the document write-off of materials.

To write off spare parts for repairs (replacing a failed Hard Drive), we select write-off in correspondence with the account. 401.20 “Costs of the current financial year” or 109.00 “Costs of manufacturing finished products, performing work, services” (depending on the accounting option you choose).

To write off spare parts for modernization (installation of an additional hard drive), we select write-off in correspondence with the account. 106.00 “Investments in non-financial assets.”

We will reflect the services for replacing and installing an additional Hard Drive in the document “Third Party Services”.

Expenses for payment of contracts for the performance of work, provision of services related to the maintenance, repair of non-financial assets will be attributed to Art. 225 “Works, services for property maintenance.”

The costs of paying for the modernization contract will be reflected in Art. 310 “Increase in the value of fixed assets.”

We will pay for the services of the contractor.

To formulate the cost of the Server obtained as a result of modernization, we will use the document “Overhaul, modernization”.

As a result of modernization, the cost of the facility increased by 18 thousand rubles. (16,500 rubles for the cost of an additional hard drive and 1,500 rubles for the cost of upgrade services.)

The facility's inventory card will reflect the modernization.

Responsibility for errors of KVR and KOSGU

Administrative liability is provided for errors made in determining codifiers.

| Error | Fine | How to avoid punishment: actions of an accountant |

| The used linkage of the KVR-KOSGU codifier is not provided for by current legislation | Art. 15.14 Code of Administrative Offenses of the Russian Federation:

| If a government agency is planning a transaction that is not included in the new Order of the Ministry of Finance No. 85n, prepare a request to the Ministry of Finance requesting clarification. It is not recommended to use a non-existent link until official clarification is received. |

| The BP code is determined by an inaccurate, that is, by the intended description (purpose) of the product | Planning and/or implementation of purchases using codes that do not correspond to the documentary description (purpose) of goods, works or services is not allowed. This is a violation of the requirements of the BC RF and 44-FZ. Before making a transaction, read the technical or other documentation for the product being purchased or check the technical characteristics of similar product items | |

| The KVR 200 codifier group includes costs not related to procurement | Violations often involve accountable expenses of government employees. To avoid mistakes, it is necessary to clearly differentiate the purpose of the costs: purchases for the needs of the organization or other types of costs | |

| A CVR has been applied that does not correspond to the type of institution (state-owned, autonomous or budgetary) | Before conducting a “problematic” transaction, double-check yourself. Compare the selected CVR with the approved codes from Order of the Ministry of Finance No. 85n |

About the author of this article

Natalya Evdokimova Since 2022 - author and scientific editor of electronic journals on accounting and taxation. But until that time, she kept accounting and tax records in the public sector, including as the chief accountant.

Other publications by the author

- 2022.02.16ProvisionInstructions for filling out payment forms for participation in government procurement

- 2021.11.10 Procurement control Is it mandatory to plan purchases under 44-FZ based on the FCD plan

- 2021.11.09 Customer documents Table of CVR and KOSGU for public procurement

- 2021.10.11 Procurement controlLimits on budgetary obligations: how to accept and distribute for public procurement

Accounting

A change in the initial cost of fixed assets, in which they are accepted for accounting, is allowed in cases of completion, additional equipment, reconstruction, modernization, partial liquidation (clause 14 of PBU “Accounting for fixed assets 6/01”, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, hereinafter referred to as PBU 6/01).

Upon completion of work on the completion, additional equipment, reconstruction, modernization of a fixed asset item, the costs recorded in the account for investments in non-current assets either increase the initial cost of this fixed asset item and are written off as a debit to the fixed asset account, or are recorded separately in the fixed asset account , and in this case, a separate inventory card is opened for the amount of expenses incurred (clause 42 of the “Methodological guidelines for accounting of fixed assets”, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, hereinafter referred to as the Guidelines).

The costs of such work are recorded on account “08” “Investments in non-current assets”. Upon completion of the work performed, they must be written off from the credit of account “08” “Investments in non-current assets” to the debit of account “01” “Fixed assets” (clause 42 of the Methodological Instructions, Instructions for using the chart of accounts). In connection with the modernization, reconstruction, completion or additional equipment, the useful life of the facility may be changed (clause 20 of PBU 6/01).

Depreciation for the reconstructed facility will be accrued from the first day of the month following the month of completion of all reconstruction work (clause 21 of PBU 6/01, clause 4 of Article 259 of the Tax Code of the Russian Federation).

note

When carrying out repairs, you need to draw up a defect report.