Document approval deadlines

There is an opinion that accounting policies must be approved at the end of each calendar year. But that's not true. If nothing has changed in the activities, accounting and taxation of the organization, then there is no need to “re-approve” the document. You should use the existing one. If changes occur, you will have to rework the document. It is permissible to approve adjustments by a separate order, defining only specific innovations. The organization also has the right to cancel the old rules for reflecting business transactions and generating reports and prepare a new order.

The deadlines for approval and amendments to accounting policies are determined at the legislative level:

| Event | Approval period for BU | Deadline for tax accounting |

| Creation of a new organization | Approve the accounting rules no later than 90 calendar days from the date of registration of the organization (clause 9 of PBU 1/2008) | Approve the new UE no later than the end of the first reporting tax period (clause 12 of article 167 of the Tax Code of the Russian Federation) |

| Alteration | According to generally accepted requirements, make changes in the current period, but apply the updated provisions from the new calendar year (clause 10 and clause 12 of PBU 1/2008) | If the company has changed its tax accounting methods or there have been significant changes in its activities, then the changes in the management system should be applied from the new tax period (Article 313 of the Tax Code of the Russian Federation). When legislative norms change, use the innovations from the date of their entry into force |

| Making additions | At the moment when clarifications and additions became necessary for further accounting (clause 10 of PBU 1/2008) | Approve the additions in the period in which these clarifications became necessary for tax accounting (Article 313 of the Tax Code of the Russian Federation) |

Please note that addition and modification are completely different things.

To quickly and correctly draw up a document, use the free online accounting policy designer for 2022 from ConsultantPlus experts.

Accounting policy

Accounting policy ( eng.

accounting policy

) - in accordance with the legislation of the Russian Federation on accounting, a set of accounting methods adopted by an organization - primary observation, cost measurement, current grouping and final generalization of the facts of economic activity. Accounting methods include methods of grouping and assessing facts of economic activity, paying off the value of assets, organizing document flow, inventory, methods of using accounting accounts, systems of accounting registers, processing information, and other methods and techniques. The accounting policy of the organization is formed by the chief accountant (accountant) of the organization on the basis of the Accounting Regulations “Accounting Policy of the Organization” PBU 1/2008, which also regulates the issues of disclosing and changing accounting policies.

According to Art. 8 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, the accounting policy adopted by the organization is approved by order or order of the person responsible for the organization and state of accounting.

In this case it is stated:

- a working chart of accounts containing synthetic and analytical accounts necessary for maintaining accounting records in accordance with the requirements of timeliness and completeness of accounting and reporting;

- forms of primary accounting documents used for registration of business transactions, for which standard forms of primary accounting documents are not provided, as well as forms of documents for internal accounting reporting;

- the procedure for conducting an inventory and methods for assessing types of property and liabilities;

- document flow rules and accounting information processing technology;

- the procedure for monitoring business transactions and other decisions necessary for organizing accounting.

The accounting policies adopted by the organization are applied consistently from year to year. Changes in accounting policies can be made in cases of changes in the legislation of the Russian Federation or regulations of bodies that regulate accounting, the organization develops new methods of accounting, or a significant change in the conditions of its activities. In order to ensure comparability of accounting data, changes in accounting policies must be introduced from the beginning of the financial year.

In accounting

Economic entities in their accounting policies for accounting purposes reflect provisions that disclose accounting methods and industry specifics.

Regardless of the type of activity, organizations claim:

- working chart of accounts and forms of primary documents;

- a method of controlling the procurement, acquisition and write-off of inventories;

- method of calculating depreciation;

- error correction procedure.

Trade organizations indicate the method of reflecting transportation and procurement costs - in the cost of the goods or as they are sold.

Retail trade organizations indicate the method of accounting for goods - at purchase prices without markup.

Organizations with a long production cycle indicate the method of recognizing income as work, services, and products are ready.

IMPORTANT!

From 2022, the mandatory application of the FSB begins:

- 25/2018 “Lease Accounting”;

- 6/2020 “Fixed assets”;

- 26/2020 “Capital investments”;

- 27/2021 “Documents and document flow in accounting.”

Be sure to specify the rules for their application in the accounting policy. Check the provisions related to the application of FSB 5/2019, the obligation to apply which began in 2021.

The role and basis for the formation of accounting policies in accounting

All organizations, both large and small, are required to have an Accounting Policy drawn up in accordance with the law. Due to various changes, this is especially important for any business in 2021

Determination of accounting policies

Therefore, we can say that accounting policy is one of the most important components of any enterprise.

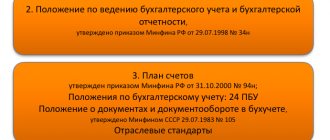

The procedure for developing the organization’s accounting policy for 2021 was approved by Order of the Ministry of Finance of Russia dated October 6, 2008 N 106n “On approval of accounting regulations”, the corresponding provision “Accounting Policy of the Organization” (PBU 1/2008).”

The general provisions have been significantly changed compared to 2022. As before, all organizations are required to formulate accounting policies. But if earlier this responsibility was the chief accountant's, now this can be assigned to any person in the enterprise who maintains accounting records.

IMPORTANT CHANGES:

In 2022, it is necessary to make significant changes to the accounting policy in the field of inventory accounting. In particular, the paragraph “Accounting for inventories” must be stated in the following form:

1. In accordance with clause 3. Part 1 of FSBU 5/2019 includes assets that are consumed or sold as part of the organization’s normal operating cycle, or used for a period of no more than 12 months.

2. Accounting for inventories in the organization is carried out in accordance with FAS 5/2019.

3. Evaluation upon recognition. The organization's inventories are recognized in accounting at actual cost.

Evaluation after recognition. An organization's inventories are measured at the reporting date at the lower of the following:

a) actual cost of inventories;

b) net realizable value of inventory.

4. When releasing inventories into production, shipping finished products, goods to the buyer, writing off inventories, the cost of inventories in the organization is calculated based on the cost of each unit.

Such regulation of the item “Accounting for inventories” will allow organizations to bring their accounting policies into compliance with current legislation.

In tax accounting

Depending on the applied tax regime, the accounting policy considers the following issues:

- income recognition method for calculating income tax: cash or accrual;

- method for determining the cost of write-off of materials and goods: by unit cost, weighted average or FIFO method - by the cost of the first purchases;

- method of calculating depreciation of fixed assets and intangible assets: linear or non-linear;

- the possibility of accruing reserves to regulate income tax: for doubtful debts for vacation pay, for warranty repairs and repairs of fixed assets;

- tax register form for calculating the taxable base: book of income and expenses, book of sales and book of purchases, independently developed registers.

Read more: about the formation of accounting policies for tax purposes

Explanatory note and accounting policies of the organization

Organizations that publish their reports, in accordance with PBU 1/2008, must indicate the methods of accounting in an explanatory note . This note should contain the following information:

— methods of calculating depreciation

— methods for assessing inventories, goods, finished products

— methods of recognizing revenue from various types of activities.

If the enterprise has made any amendments to its accounting policies, then in the explanatory note it is obliged to indicate the reason for these changes, their content and reflection of the consequences, as well as the application of new regulations.

Also, the explanatory note must indicate estimated values, which, according to PBU 21/2008, include:

- the amount of valuation reserves that the enterprise has created

- useful life.

It can be noted that changes in PBU are moving accounting and tax accounting further and further away from each other, since the Tax Code of the Russian Federation strictly determines the formation of a reserve for doubtful debts and prohibits changing the useful life.

For small businesses

Small businesses (SMBs) have the right to use simplified accounting registers and submit simplified financial statements.

If an organization wants to exercise this right, it must be written down in a document.

SMP has the right to refuse to apply 6 accounting standards, such as “Accounting for construction contracts” (PBU 2/2008), “Estimated liabilities, contingent liabilities and contingent assets” (PBU 8/2010) and others. There are also benefits for small businesses in applying the new federal accounting standards.

Read more: about the new FSBU

All accounting standards that are not applied by the entity should be listed in a special section “Application of accounting provisions.”

Basic provisions

The accounting policy is approved by the manager by order when creating a company no later than 90 days after its registration (Article 313 of the Tax Code of the Russian Federation, PBU 1/2008). Hypothetically, accounting policies can be applied for several years without changes. But while for accounting purposes this is still quite possible, for tax accounting it is unlikely. This is due to the fact that almost every year changes are made to the Tax Code, which force the taxpayer to rebuild the accounting procedure.

You need to approach the writing of accounting policies very carefully, because an inaccurate interpretation of any item can work against the company. This important document includes methods of accounting - both accounting and tax.

There is no point in describing in detail accounting methods for which the only option is legally established. For example, there is no need to describe the essence of the cash method, which is unconditionally applied under the simplified tax system. It is inappropriate to include in the accounting policies and postulates of the Tax Code.

The accounting policy must necessarily address those areas of accounting for which there is a choice. In particular, options for assessing materials, methods of depreciation of fixed assets, the procedure for forming reserves, etc. should be fixed in the document.

Important! The accounting policy should state only those accounting methods and methods that the organization intends to practically apply in the reporting year. There is no need to include all existing accounting methods in the document if their use is still in question. If necessary, any reasonable changes can be made to the accounting policies without hindrance.

Features for simplified taxation system

The accounting policy for organizations using the simplified tax system in the simplest version is limited to several points:

- tax accounting is maintained by the chief accountant (director, accounting firm);

- object of taxation - income minus targeted financing and income from the revaluation of foreign currency;

- The tax register is a book of income and expenses, entries in which are made on the basis of primary documents;

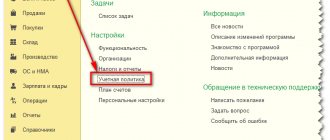

- accounting is maintained using the 1C:Accounting program;

- the amount of the simplified tax system is reduced by the insurance premiums paid.

Some accounting websites help develop accounting policies for a manufacturing commercial enterprise by offering an accounting policy designer. By sequentially selecting in the designer methods for assessing fixed assets, inventories, reserves, other income and expenses, a set of rules for reflecting transactions and generating reporting data for accounting or tax accounting purposes is created.

Why and how to make accounting policies publicly available

Since 2022, accounting and tax regulations have become publicly available and open. This applies not only to the founders in relation to their subordinate institutions, but also to all legal entities. Let us remind you that individual entrepreneurs are not required to keep accounting records and, therefore, to draw up accounting policies.

All representatives of the public sector are required to publish accounting regulations on their official websites. In some cases, a copy of the order approving the accounting policy along with the text and attachments will have to be provided to the founder.

The approach allows you to monitor the relevance of the provisions introduced by the relevant order. The founder checks:

- is accounting properly organized and maintained at the government agency;

- does it meet the stated requirements and standards;

- whether it meets the individual characteristics of the industry.

If inconsistencies are identified, the founder orders that the violations be eliminated as soon as possible.