In 2022, the New Year holidays will last from January 1 to January 8, 2020; on January 9 you will need to go to work. In accordance with the Labor Code, employers must pay employees wages for January in the same amount as for other months, despite such long holidays. Deputy head of Rostrud Ivan Shklovets told Rossiyskaya Gazeta about this .

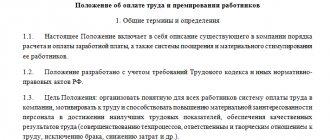

As Shklovets explained, according to Art. 112 of the Labor Code of the Russian Federation, employees receiving a salary must receive it for January 2022 in the same amount as in other calendar months. Employees with piecework wages are provided with additional remuneration for non-working holidays on which they were not involved in work. The amount and procedure for its payment are determined by the collective agreement, agreements, local regulations, and employment contracts. Thus, Article 112 of the Labor Code of the Russian Federation contains guarantees that do not allow employers to underestimate payments to employees due to holidays.

How are New Year holidays paid in 2022?

Article 112 of the Labor Code of the Russian Federation specifies how Christmas holidays are paid in Russia: piece workers and employees receiving wages at tariff rates are paid additional remuneration for the New Year holidays. The amount and procedure for payment of remuneration is determined by the employment contract or regulations on remuneration.

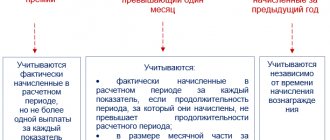

In such organizations, local regulations, an employment contract or a collective agreement establish the procedure for calculating the average salary in months that fall on non-working holidays. These are increased rates and surcharges. The Ministry of Labor reminds whether the employer pays for holidays and New Year's holidays with hourly wages - yes, at the average rate for working time standards. All employees receiving a salary must be paid for January 2022 in the same amount as in other calendar months. For workers on a piecework basis, the salary for January does not differ from other calendar months due to the recalculation of the cost of the shift.

Article 112. Non-working holidays.

§ 1. Except for parts 1 and 2 of Art. 112 has been radically changed. Its new edition provides details regarding remuneration for work on non-working holidays, the procedure for determining its size, attributing these payments to labor costs, and the procedure for transferring days off if they coincide with non-working holidays.

§ 2. The coincidence of a non-working holiday with a day off entails the transfer of the day off to the next working day after the holiday. Resolutions of the Government of the Russian Federation, which, as a rule, are adopted for the next calendar year, contribute to a uniform solution to the issue of postponing holidays. Article 112 provides that the transfer of days off to other days due to the coincidence of non-working holidays is carried out for the purpose of rational use of these days by employees. The commented article now provides that the regulatory legal act of the Government of the Russian Federation on the transfer of days off to other days in the next calendar year is subject to official publication no later than a month before the start of the corresponding calendar year. The adoption of regulations on the transfer of days off to other days during the calendar year is not excluded. It is permitted subject to the official publication of these acts no later than two months before the calendar date of the established day off. This rule will allow employees, members of their families and other citizens to plan and organize the use of free time on such days in advance.

§ 3. The above rule for transferring days off is applied in organizations where work is not carried out on these days. If the work and rest regime in an organization provides for work on holidays (in continuously operating industries, in organizations associated with daily services to the population, etc.), then weekends are not transferred (see Explanation of the Ministry of Labor of the Russian Federation dated December 29, 1992 N 5 // Bulletin of the Ministry of Labor of the Russian Federation. 1993. N 3).

§ 4. In continuously operating organizations, as well as in the case of cumulative accounting of working time, work on holidays is included in the monthly standard of working time (see paragraph 1 of the Explanation of the State Committee for Labor of the USSR and the All-Russian Central Council of Trade Unions of August 8, 1966 N 13/P-21 // Bulletin of the State Committee for Labor of the USSR 1966. N 10) (in accordance with Part 1 of Article 423 of the Labor Code, legal acts of the USSR are applied insofar as they do not contradict the Labor Code).

§ 5. In accordance with Art. 113 of the Labor Code, work on non-working holidays is, as a rule, prohibited. Exceptions to this rule are contained in the same article. Due to the need to serve the population, they establish, for example, store opening hours on holidays.

§ 6. In Russia, where the population adheres to various religions, the establishment of an Orthodox holiday - the Nativity of Christ - led to the need to secure the right of adherents of other religions to also have their own holidays. Moreover, Art. 28 of the Constitution of the Russian Federation guarantees freedom of religion, including the right to profess, individually or together with others, any religion. The legislation does not and cannot have any obstacles to the exercise of this right: corresponding non-working days can be established by the constituent entities of the Russian Federation in connection with holidays characteristic of other religions. At the same time, it seems that the issue of non-working holidays introduced for religious reasons should be resolved at the level of federal law.

§ 7. In addition to holidays, non-working days, Russia also has holidays that are not associated with the mandatory release of workers from work. These are, first of all, numerous professional holidays. The list of holidays, professional holidays and memorable days celebrated in the Russian Federation in 2004 was published in the Bulletin of the Ministry of Labor of the Russian Federation (see Bulletin of the Ministry of Labor of the Russian Federation. 2003. N 10. P. 52; 2005. N 7. Art. 560). The procedure for considering proposals from federal executive authorities to establish professional holidays and memorable days was approved by Decree of the Government of the Russian Federation of March 16, 2000 N 225 (SZ RF. 2000. N 12. Art. 1299; 2005. N 7. Art. 560). In accordance with it, proposals to establish professional holidays are submitted to the Government of the Russian Federation, taking into account consultations with all-Russian associations of employers, all-Russian associations of trade unions (Part 4 of Article 3 of the said Resolution). Exemption from work on such days is often provided for in industry agreements and collective agreements.

§ 8. Part 3 of Art. 112 for the first time provides for payment for non-working holidays not only for employees receiving wages on the basis of a fixed salary (official salary), the amount of which non-working days falling within the paid period did not and do not affect, but also for those whose wages are based on the actual output, labor costs. The inability to work on statutory non-working holidays (and work on these days is usually prohibited - see Article 113) reduces their wages. Which is unfair in comparison with those whose work is paid on the basis of salaries (official salaries) and for whom the presence of non-working holidays in a calendar month is not grounds for a reduction in wages (see Part 4 of Article 112). New edition of Part 3 of Art. 112 provides that employees, with the exception of employees receiving a salary (official salary), are paid additional remuneration for non-working holidays on which they were not involved in work. The amount and procedure for its payment are determined by the collective agreement or agreement. These issues can be resolved by a local normative act adopted taking into account the opinion of the elected body of the primary trade union organization (see Article 372). These issues can also be resolved in the employment contract. Apparently, with the help of an employment contract (i.e., individually), these issues can be resolved in the absence of corresponding norms in a collective agreement, agreement, or local regulatory act.

Holiday salaries for state employees

In state and municipal institutions, the rules established by the Labor Code of the Russian Federation apply. It follows from this whether New Year holidays should be paid for in 2022 for budgetary institutions - yes, in the same order as in commercial organizations. In full, depending on the salary or tariff rate.

For those state employees who have a special shift regime (medics, emergency services employees, police, military personnel, emergency services employees, rescuers and others) and are required to work on January 1st by law, shifts are paid double or, at the employee’s choice, time off is provided to another convenient location. time.

General rules for paying for weekends and holidays

The procedure in which payment for New Year holidays in 2022 is calculated depends on whether the citizen works on a salary or in shifts. The current labor legislation stipulates that work on weekends or holidays is subject to increased remuneration. According to Article 153 of the Labor Code of the Russian Federation, the employer is obliged to pay for work on holidays an amount of no less than double the person’s basic pay.

It is not prohibited to establish additional payments to employees in a larger volume. If the financial capabilities of the enterprise allow it, then its multiplicity, which differs from the norms of the Labor Code of the Russian Federation, should be fixed in local regulations for the organization: in a collective agreement or regulations on remuneration. It is impossible to establish an additional payment less than that stipulated in Article 153 of the Labor Code of the Russian Federation.

Instead of double pay, the employee has the right to demand additional time for rest and work on holidays and receive time off. If time off is provided, double payment is not made. As a result, the employee receives payment for work on a day off as for a regular working day (in a single amount), and also gets an extra day off.

IMPORTANT!

Personal income tax will be withheld from wages for working during the New Year holidays. The accountant will also have to calculate insurance premiums.

Are holidays grounds for reducing wages?

Article 112 of the Labor Code of the Russian Federation enshrines guarantees that do not allow employers to reduce wages to employees due to vacations. It has been established how New Year's holidays are paid under the Labor Code: the employer is obliged to pay the full amount due to employees within the time limits established in accordance with the collective agreement, internal regulations, salary regulations and employment contracts.

If the management of an organization refuses to pay wages during the New Year holidays in accordance with the law, employees should file a complaint with the state labor inspectorate, the prosecutor's office or the court. Are New Year holidays paid if you don’t work? No, only if you are registered with the employment service. In this case, unemployment benefits will be paid in full.

General rule

The fact is that non-working holidays are not shortened or increased - they are established by Article 112 of the Labor Code of the Russian Federation. And the decree of the Russian Government annually approves only the postponement of days off that coincide with non-working holidays.

It is important to understand that the number of both non-working and working days per year does not change.

REFERENCE

Non-working holidays in Russia:

- January 1, 2, 3, 4, 5, 6 and 8 – New Year holidays;

- January 7 – Christmas;

- February 23 – Defender of the Fatherland Day;

- March 8 – International Women's Day;

- May 1 – Spring and Labor Day;

- May 9 – Victory Day;

- June 12 – Russia Day;

- November 4 is National Unity Day.

How are New Year holidays paid for those who work during the holidays?

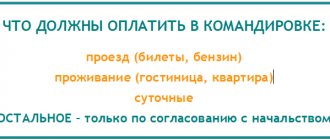

According to Art. 153 of the Labor Code of the Russian Federation, work on a weekend or a non-working holiday (and in 2022 this is the period from January 1 to January 9) is paid at least double the amount. How to pay for days in January at a double rate is established in the Labor Code of the Russian Federation. Payment is carried out according to the rules:

- for piece workers - no less than double piece rates;

- persons whose work is paid at tariff rates - in the amount of at least double the tariff rate;

- for persons receiving a salary - in the amount of not less than a single rate, if work on a weekend or non-working holiday was carried out within the monthly working time standard;

- persons receiving a salary - in the amount of at least double the daily or hourly rate for a day or hour of work in excess of the salary, if the work was performed in excess of the monthly working time standard.

However, an employee who worked on weekends has the right to take time off. In this case, work on days off is paid at a single rate. But the employee communicates his choice (to take time off or not) in writing, then there will be no disagreements in the future.

If he refuses to take time off, the additional payment is calculated as follows:

salary / number of working hours in January 2022 × number of hours worked × 2.

For information: in accordance with the production calendar for 2022, working hours in January for a five-day week will be:

- with a 40-hour work week - 136 working hours;

- at 36 hours - 122.4;

- at 24 hours - 81.6.

How we work in January 2022

New Year holidays are just around the corner. And the question of the duration of rest at this fabulous time of year is relevant again.

The duration of vacations is different for all workers. It all depends on the work schedule.

- Five days and six days. Workers on the five-day and six-day periods this time rest for the same length of time: ten full days from 12/31/2021 to 01/09/2022 inclusive;

- Shift work. Those working on a shift schedule are less fortunate. For them, the duration of the vacation is determined in accordance with the approved work schedule. You should familiarize yourself with this at the company where you work.

We have decided on the duration of the vacation, now we will figure out how holidays are paid in January 2022 in Russia and what nuances to take into account about salaries in January.

Payment December 31

In 2022, the last day of the year is a holiday. There are no explanations on how to pay on December 31, 2022, if a person is called upon to perform official duties, but, according to the Labor Code, this must be done in double amount. If employees are on vacation, pay them wages as for a regular working day, but in advance. December salaries are paid ahead of schedule, since the scheduled payment falls on holidays.

ConsultantPlus experts analyzed what threatens the employer if he does not pay the December salary on time. Use these instructions for free.

Payment for a shift work schedule

Finally, we’ll figure out how New Year’s holidays are paid for on a shift schedule in 2022.

For shift workers, payment for New Year holidays according to the law of the Russian Federation depends on what day the shift falls on. There are several options:

- The entire work shift or only part of it fell on a Saturday or Sunday, which are not holidays, therefore earnings per shift are calculated in a single amount (Article 111 of the Labor Code of the Russian Federation).

- If the scheduled shift falls on a holiday, then calculations are made at least double the amount. Moreover, the shift worker is not entitled to time off. This day is included in the employee’s normal working hours.

- If you have to work on a day that is scheduled to be a day off, then the person has the opportunity to take time off. If he takes time off, then work not according to schedule is paid in a single amount. And if you refuse additional rest, you must pay at least twice as much.

Separately, we note how New Year's Eve is paid - double the amount. If an employee’s scheduled shift falls on that night, then he has no right to demand time off.

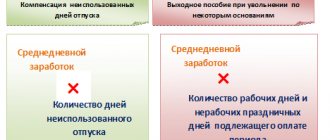

If vacation is in January

The Labor Code does not contain a ban on granting leave during the holidays - from January 1 to January 9, 2022, but it must be taken into account that it is extended by the number of non-working days falling on it. According to Art. 120 of the Labor Code of the Russian Federation, non-working holidays falling during the period of annual main or annual additional paid rest are not included in the number of calendar days of vacation. Let's say an employee takes vacation from January 1 to January 14, 2022 and does not indicate the date of return to work and the number of days of vacation. In this case, his vacation is automatically extended by the number of non-working holidays - by eight days. That is, according to the Labor Code, the employee’s rest will last until January 22, and he must appear at work on January 23, 2022. To avoid conflict situations and misunderstandings, we recommend specifying the number of days and date of return to work in the application.

Which days are considered holidays in January 2022?

In 2022, the New Year holidays will last 10 days - from January 1 to January 10. These days are considered non-working holidays (Article 112 of the Labor Code of the Russian Federation):

Non-working holidays are established by law and are the same for all employees, regardless of their work schedule (Article 112 of the Labor Code of the Russian Federation).

When inviting employees to work on a holiday, the employer should obtain written consent from them. And also do not forget about the ban on such work for certain categories of employees (Article 113, Part 1, Article 259, Article 268 of the Labor Code of the Russian Federation, etc.).

Involving an employee to work on a holiday should be formalized by order (Article 113 of the Labor Code of the Russian Federation) and such work should be reflected in the working time sheet by entering the letter code “РВ” or the digital code “03” in the column under the corresponding date at the top of the cell, and at the bottom of the cell, indicate the exact number of hours worked by the employee on the holiday.

Labor legislation in matters of remuneration on holidays contains not only general rules, but also provides for specific features for various circumstances, which we will discuss below.

Payment for working days according to the usual schedule

In January, with a five-day workday, Russians will have to work only 15 days. Therefore, the question often arises of how January holidays will be paid in 2022 with a salary, given that the number of working days has been reduced. Despite the fact that most work less than usual, wages are accrued in full. If a salaried employee has worked all the required days, then payment is made in full. This follows from the same article 112 of the Labor Code of the Russian Federation. It makes no sense to separately consider the question of whether holidays in January are paid in government agencies or municipal structures, since the law states: the presence of non-working holidays in a calendar month is not grounds for reducing wages for salaried employees.

As for the remaining employees (piece workers, hourly workers, etc.) who were not involved in work during the New Year holidays, for non-working holidays they are paid additional remuneration, the amount of which is determined by the internal LNA.

Read more: How to calculate salary based on salary

IMPORTANT!

If an employee is on sick leave, he will be paid benefits after the certificate of incapacity for work is closed. If an employee is on vacation, he already receives money for the New Year holidays 3 days before it starts, plus the vacation is extended due to official holidays. But there are situations when they won’t pay anything. The first is that the employment contract is valid, but the employee took unpaid leave at his own expense. The second is that a person is registered in the organization, but is not currently fulfilling his duties (applies to employees suspended from work, women on maternity leave).

Piece-rate employee

Piece workers who work on weekends and holidays are paid at least at double piece rates. The calculation for this category of employees is performed using the formula:

Payment for a non-working holiday = Piece rate × Quantity of products produced × 2

Calculation example for an employee on piecework payment

. The potter receives 150 rubles for each product. In January 2022, he produced 100 products, 10 of them on January 1. This means that for work on January 1 he will receive 3,000 rubles (150 rubles × 2 × 10).

How to pay overtime during winter break

If an employee has to perform official duties overtime during the New Year holidays, the rules for how to pay on December 31, 2022 are specified in Article 153 of the Labor Code of the Russian Federation: a minimum of double the tariff rate. The payment is not taken into account when determining the duration of overtime work, subject to payment at an increased rate, in accordance with Art. 152 Labor Code of the Russian Federation.

ConsultantPlus experts have figured out how to pay for holidays in January. Use these instructions for free.

To correctly pay for holidays in January, correctly formalize the recruitment of employees to work. To do this, you must first obtain the consent of the staff, issue an order from the manager, and familiarize it with the signature of all subordinates to whom this order concerns. The order must provide the reasons for the need to work on New Year's holidays and a list of persons who will have to work on the holiday. If an employee who has agreed to work on holidays does not come to work, disciplinary action will be taken against him.

Read more: We issue an order for overtime work