As you know, from January 1, 2022, the powers of the Federal Tax Service have expanded, and now it administers insurance premiums. In this regard, many details in the contribution payment have changed - KBK, recipient, etc. For the most part, incorrectly filling out a document does not result in any sanctions for the paying company. Well, one more thing - the Federal Tax Service will distribute the funds correctly, because... The automatic accounting system itself will forward erroneous columns. So why should an accountant suffer and learn new filling rules?

Answer. The fact is that not everyone uses automated programs; some send a payment order manually. And the payer’s banks may reject such a document due to the fact that the fields are filled in incorrectly. Basically, the standardization of bank software is carried out on the initiative of the Central Bank. And he implements the instructions of the Ministry of Finance.

The introduction of new blocks into the system is slow. Accordingly, in order to avoid getting into trouble and make the payment on time, you need to know exactly how the Ministry of Finance recommends filling out the fields of the payment order for social contributions.

Many fields have not changed, but we will look at them all so that you do not have to look for information about filling out payment orders for social contributions somewhere else.

By tradition, we first suggest downloading the sample of filling out a payment order:

- Form and sample

- Online viewing

- Free download

- Safely

FILES

It is necessary to check payment orders in 2022

It is necessary to indicate new details of the Federal Treasury. Although I didn't notice any changes in the details.

You need to fill out detail “15” of the payment order - the account number of the recipient’s bank, which is part of the single treasury account (STA).

The details can be checked using the service of the Federal Tax Service website.

Attention! Starting from 2022, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Even contributions for December must be transferred according to the new BCC to the Federal Tax Service (except for contributions to the Social Insurance Fund for injuries). Here you can find out the details of your Federal Tax Service.

Starting from 2022, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

From February 6, 2022, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2019-2020, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

What do the fields mean in the payment order for insurance premiums?

The payment form in the Social Insurance Fund and the field data have not changed since 2016. In this article, we will consider only the payment terms for contributions to the Federal Tax Service and describe what to enter and where. The rules for filling out payment orders, as well as forms for “manual” delivery, are contained in Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013 “On approval of the rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

Let's go through all the fields:

| About the recipient | ||

| 16 | Recipient | UFK for the subject of the Russian Federation, Federal Tax Service for registration |

| 61 | Recipient's TIN | You can find information on the Federal Tax Service portal |

| 103 | Recipient's checkpoint | |

| 13 – 15, 17 | Recipient's bank details | |

| About the payer | ||

| 8 | Payer's name | |

| 9, 10 – 12 | Payer's bank details | |

| 43 | The payer's stamp is optional if the organization does not have a stamp | If the payment is submitted electronically through the client bank, filling in these fields is optional |

| 44 | Signatures of the persons indicated on the bank signature card (director, chief accountant) | |

| 60 | Payer's TIN | |

| 101 | Payer status | 01 - legal entity, 09 - individual entrepreneur |

| 102 | Payer checkpoint | parent organization or standalone, depending on who pays |

| 105 | OKTMO payer | It is a mistaken opinion that when the contribution is “moved” from the Fund to the Federal Tax Service, OKTMO will change. No, it remains the same, because... this is the identifier of the payer, not the recipient. |

| About payment | ||

| 3 | Payment number assigned by the payer | Numbering begins either every day or continues throughout the month. |

| 4, 62, 71 | Dates, preparation of clauses, receipts at the bank, execution | Usually done in one day |

| 5 | Type/form of payment - urgently, by mail, etc. | You don’t have to enter it if the payment is made through the client bank |

| 6, 7 | Transfer amount in words and in digital format | |

| 18 | Type of operation | Transfer of funds by order - code 01 |

| 19, 20 and 23 | Without a bank requirement, fields must be left blank | |

| 21 | Payment order | |

| 22 | Intended to indicate the UIN code | is set to “0”, except in cases where the Federal Tax Service indicates a specific UIN in the payment request |

| 24 | Detailed purpose of payment - what, where, how much, for what period | |

| 104 | KBK payment | New BCCs for contributions are contained in the order of the Ministry of Finance of Russia dated December 7, 2016 No. 230n |

| 106 | Basis (period) of payment | TP – current payments for this year, ZD – debt payment |

| 107 | The period for which contributions are transferred is indicated - month, quarter, year. | |

| 108 | For social contributions sent on time, enter “0” | |

| 109, 110 | Field values for contributions = "0" | |

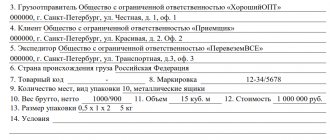

Pension Fund FFOMS and FSS (except NSiPZ)

Purpose of payment: Insurance contributions to the Pension Fund for compulsory pension insurance for March 2022 Reg. No. 071-058-000000

Purpose of payment: Insurance premiums for compulsory health insurance, credited to the FFOMS budget March 2022 Reg. No. 071-058-000000

Purpose of payment: Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity to the budget of the Social Insurance Fund of the Russian Federation for March 2022 Reg. No. 6100000000

Purpose of payment: Insurance contributions for compulsory social insurance against accidents at work and occupational diseases to the budget of the Federal Social Insurance Fund of the Russian Federation for March 2022. Registration number - 7712355456

Payer status: 01 - for organizations / 09 - for individual entrepreneurs (If payment of insurance premiums for employees) (letter of the Federal Tax Service dated 02/03/2017 No. ZN-4-1 / [email protected] ) (Order of the Ministry of Finance dated April 5, 2022 No. 58n) .

TIN, KPP and OKTMO should not start from scratch. OKTMO must be 8-digit.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

Attention! Starting from 2022, the new KBK and the new recipient of contributions are not the Pension Fund of Russia but the Federal Tax Service. Here you can find out the details of your Federal Tax Service.

Also, starting from 2022, it is necessary to indicate the period for which contributions are paid - for example MS.12.2018.

Rice. .

Fig. Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Business Pack.

Recipient details in the payment order for insurance premiums

From 2022, contributions must be transferred to:

| WHERE | Who for what | What - what types of compulsory insurance? |

| To the Tax Inspectorate at the place of registration of the entrepreneur or company | Individual entrepreneurs without employees - “for themselves” from their own income |

|

| For legal entities and individual entrepreneurs who have hired employees - from the salary accrued to them |

| |

| In the FSS | Individual entrepreneurs and legal entities - from employee salaries |

|

FSS NSiPZ

Purpose of payment: Insurance contributions for compulsory social insurance against accidents at work and occupational diseases to the budget of the Federal Social Insurance Fund of the Russian Federation for March 2022. Registration number - 7712355456

Payer status: 08 (only here 08, because this is the only contribution that we pay not to the Federal Tax Service).

TIN, KPP and OKTMO should not start from scratch.

Rice. Sample of filling out a payment order (FSS NSiPZ) in Excel (download).

How long should payments be kept?

Within 6 years after the end of the year in which the document was last used for calculating contributions and reporting (Clause 6 of Part 2 of Article 28 of the Federal Law dated July 24, 2009 No. 212-FZ) or 5 years (clause 459 Order of the Ministry of Culture of Russia dated August 25 .2010 N 558)

Fig. Sample of filling out a payment order (FSS NSiPZ) in Business Pack.

Features of filling out fields in a payment order

Recipient of contributions - field 16

The Tax Service explained how to correctly register the recipient of contributions in letter No. ZN-4-1/ [email protected] back on 12/01/2016. This information is included in the fields:

- 16 - “Recipient”,

- 61 – “TIN”,

- 103 – “Checkpoint”.

In field 16, the recipient of contributions should be “your” tax office, the one with which the organization is registered. But the funds are transferred not to the Federal Tax Service itself, but to the Federal Treasury. For the convenience of “separating them”, after indicating a specific body of the Federal Criminal Code, it is necessary to briefly name the inspection in brackets.

If you pay in the capital of the Russian Federation, then the entry will be as follows: “UFK for Moscow (Inspectorate of the Federal Tax Service of Russia No. 16 for Moscow).”

Fields 61 and 103 are your identifiers in the inspection, i.e., it is from this data that the tax office will understand that it is you who pay the contributions. The TIN and KPP can be seen either in the certificate of registration with the Federal Tax Service. Or in an extract from the Federal Tax Service portal.

Payer status – field 101

The rules for selecting a code are contained in Order of the Ministry of Finance No. 107n of 2013. However, they are not unambiguous, because legislators did not expect that contributions to the Federal Tax Service would be paid for them. And no changes were made to it that year.

At the end of 2016 and the beginning of this year, in the general confusion with payments, the Federal Tax Service (in a joint letter with the Pension Fund of Russia and the Social Insurance Fund of January 26, 2017 No. BS-4–11/ [ email protected] /NP-30–26/947/02- 11-10/06–308-P) suggested that payers with employees in field 101 indicate code 14 - “taxpayer making payments to individuals.” However, banks refused to accept such clauses, citing inconsistency with the law. And, really:

- after amendments are made, the Tax Code separates the statuses of a tax payer and a payer of fees,

- status 14 depersonalizes the payer, combining both legal entities and individual entrepreneurs into a single mass.

In order for the processing program to begin to distinguish taxes from fees under status 14, the Central Bank needs to finalize it. This will happen no earlier than the summer of 2022.

The Federal Tax Service explained in letter No. ZN-4–1/1931 what to indicate in payments before on 02/03/17. So, in field 101 you must write the following payer statuses:

- if contributions are transferred by a legal entity, payer status 01 must be indicated;

- Individual entrepreneur for himself and for his employees – status 09

- tax agent – 02

- private notary – 10;

- lawyer – 11;

- head of a peasant farm - 12.

- an individual transferring contributions for employees – 13,

- payer's representative – 28.

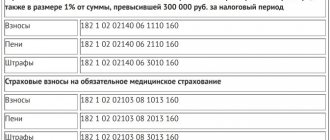

Budget classification code - field 104

Since the Federal Tax Service now accepts contributions, the code of the chief administrator of budget revenues has changed in the KBK accordingly. KGA - the first three digits in the KBK, for the tax office - 182. In a letter dated 12/01/16 No. ZN-4-1 / [email protected] tax officials explained that erroneous application of the 2016 KBK can lead to:

- to incorrect transfer of money;

- to the bank’s refusal to carry out the transaction under the p/p.

Changes to the legislation were made by order of the Ministry of Finance of Russia dated December 7, 2016 No. 230n. This document must be used as a guide when selecting and writing the BCC for contributions.

KBK contributions from the Pension Fund of the Russian Federation, Social Insurance Fund for employees

Current for 2019-2020.

| Payment type | BCC on contributions for December 2016 | BCC for contributions for the months of 2017-2019 |

| Contributions to compulsory pension insurance | ||

| Contributions of organizations for compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Additional pension contributions according to list 1, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Additional pension contributions according to list 1, if the tariff depends on the special assessment | 182 1 0220 160 | 182 1 0220 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Additional pension contributions according to list 2, if the tariff does not depend on the special assessment | 182 1 0210 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Additional pension contributions according to list 2, if the tariff depends on the special assessment | 182 1 0220 160 | 182 1 0220 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0200 160 |

| Individual entrepreneur contributions to compulsory pension insurance (26% of the minimum wage) | 182 1 0200 160 | 182 1 0210 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Individual entrepreneurs' contributions to compulsory pension insurance with income over 300 thousand rubles. | 182 1 0200 160 | 182 1 0200 160 |

| Penalties on contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions to compulsory pension insurance | 182 1 0200 160 | 182 1 0210 160 |

| Contributions for compulsory health insurance | ||

| Contributions of organizations for compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties on contributions for compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties for compulsory health insurance contributions | 182 1 0211 160 | 182 1 0213 160 |

| Individual entrepreneurs' contributions to compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties on contributions for compulsory health insurance | 182 1 0211 160 | 182 1 0213 160 |

| Penalties for compulsory health insurance contributions | 182 1 0211 160 | 182 1 0213 160 |

| Contributions to compulsory social insurance | ||

| Contributions for disability and maternity | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions in case of disability and maternity | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for contributions in case of disability and maternity | 182 1 0200 160 | 182 1 0210 160 |

| Contributions in case of industrial injuries and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

| Penalties on contributions in case of industrial injuries and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

| Penalties on contributions in case of industrial injuries and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

Payment period

Insurance payments must be transferred to legal entities before the 15th day of the month following the reporting month. If this day falls on a weekend or holiday, the payment date is postponed to the next business day. For example, in 2022, February 15 is Tuesday, therefore, there will be no postponements.

Other deadlines have been established for individual entrepreneurs:

- OPS from income up to 300,000 rubles. — until December 31, 2022;

- OPS for income above 300,000 rubles. - until July 1 of the year following the reporting year;

- Compulsory medical insurance - until December 31, 2022.

All payments

See the full list of payment orders:

- For a description of the fields and rules for payment orders, see here.

- Sample of filling out a payment order for payment of the simplified tax system in Excel and in Business Pack

- Sample of filling out a payment order (personal income tax for employees) in Excel and in Business Pack

- Sample of filling out a payment order for VAT payment in Excel and Business Pack

- Sample of filling out a payment order for payment of Property Tax in Excel and in Business Pack

- A sample of filling out a payment order for the payment of Income Tax in Excel and in Business Pack

- A sample of filling out a payment order for payment of the Fixed Contribution of Individual Entrepreneurs (PFR and FFOMS) in Excel and in Business Pack

- Sample of filling out a payment order (PFR, Social Insurance Fund contributions for employees) in Excel and in Business Pack

What to pay attention to when filling out payment orders

When filling out payment orders, you must follow some rules:

- regardless of what period the payments relate to, in 2022 funds for compulsory insurance are sent to the Federal Tax Service;

- the amount in payment orders for compulsory insurance is indicated in rubles and kopecks;

- It is important to indicate the period to which the payment relates! For legal entities, this is always a month; the format is presented in the example of a payment for insurance transfers. To avoid mistakes, do not copy the previous document. Create each time anew and thoughtfully fill out all the data, then carefully check in the printed form format, as otherwise you may miss, for example, an incorrect taxpayer status;

- incorrect indication of the Treasury current account where the funds are sent is a reason not to credit the money for its intended purpose;

- special attention should be paid to field 104, where the BCC is entered. These codes change frequently, so please ensure they are up to date.

Here is an example of a payment form for an individual entrepreneur for himself in pension and compulsory medical insurance in 2022 (you must make the payment before the end of the year so that there are no penalties and fines):

And this is a sample payment slip for legal entities for 01.2022:

This sample is an example of a payment order for fixed insurance contributions to the Pension Fund of the Russian Federation in 2022 for individual entrepreneurs for themselves for compulsory pension insurance (fixed payment):

Features of cost accounting under compulsory motor liability insurance

Regulatory regulation

Payment of the insurance premium to the accounting department should be taken into account as part of advances issued (clause 3, 16 of PBU 10/99). Costs for paying premiums are not recognized as deferred expenses, since this is a “continuing” service (clause 3, 16 of PBU 10/99). The organization has the right to terminate the contractual relationship early and return part of the funds paid in proportion to the remaining period of insurance.

In the 1C program, a special account 76.01.9 “Payments (contributions) for other types of insurance” is provided for calculations of insurance premiums. Despite the fact that the premium paid cannot be attributed to deferred expenses, account 76.01.9 has a sub-account Deferred Expenses PDF for automatic even recognition of expenses when performing the Month Closing procedure. Therefore, there is no need to create an additional cost accounting document, for example, a Receipt document (act, invoice) .

Insurance costs are recognized as expenses for ordinary activities evenly in the reporting period in cost accounts (clause 5 of PBU 10/99).

In NU, the costs of paying insurance premiums for compulsory insurance (including compulsory motor liability insurance) are included in indirect costs, like other costs associated with production and (or) sales (clause 5, clause 1, article 253 of the Tax Code of the Russian Federation, p. 2, paragraph 3 of Article 263 of the Tax Code of the Russian Federation).

Under insurance contracts valid for more than one reporting period, the insurance premium paid at a time is taken into account in expenses evenly during the term of the contract, in proportion to the number of calendar days (clause 6 of article 272 of the Tax Code of the Russian Federation, clause 1, clause 2 of article 263 Tax Code of the Russian Federation):

- within the limits of insurance rates, if they are provided for by law;

- in the amount of actual expenses, if limits on insurance rates are not provided.

Analytics for insurance premiums account

In the 1C program, you need to enter analytics for account 76.01.9 subconto Deferred Expenses - this is the name of the reference book for accounting for expenses subject to straight-line write-off. The procedure for filling it out for insurance premiums is as follows:

- Type for NU - Other types of insurance ;

- Type of asset in the balance sheet - Accounts receivable ;

- Amount - the paid amount of the insurance premium, written off evenly over the term of the contract;

- Recognition of expenses - By calendar days ;

- Write-off period —insurance period;

- Cost account - account for accounting costs for insurance;

- Cost item is a cost item for which the insurance premium is reflected in expenses.