Transport tax rates in the Kirov region

For a year

| Name of taxable object | Rate (RUB) for 2022 |

| Passenger cars | |

| up to 45 hp (up to 33.1 kW) inclusive | 15 |

| over 45 hp up to 85 hp (over 33.1 kW to 62.5 kW) inclusive | 18 |

| over 85 hp up to 110 hp (over 62.5 kW to 80.91 kW) inclusive | 20 |

| over 110 hp up to 150 hp (over 80.91 kW to 110.33 kW) inclusive | 30 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 75 |

| over 250 hp (over 183.9 kW) | 150 |

| Motorcycles and scooters | |

| up to 20 hp (up to 14.7 kW) inclusive | 6 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 12 |

| over 35 hp up to 45 hp (over 25.74 kW to 33.1 kW) inclusive | 15 |

| over 45 hp up to 100 hp (over 33.1 kW to 73.55 kW) inclusive | 30 |

| over 100 hp (over 73.55 kW) | 50 |

| Buses | |

| up to 200 hp (up to 147.1 kW) inclusive | 50 |

| over 200 hp (over 147.1 kW) | 100 |

| Trucks | |

| up to 100 hp (up to 73.55 kW) inclusive | 25 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 40 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 65 |

| over 250 hp (over 183.9 kW) | 85 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms | 25 |

| Snowmobiles, motor sleighs | |

| up to 50 hp (up to 36.77 kW) inclusive | 25 |

| over 50 hp (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles | |

| up to 100 hp (up to 73.55 kW) inclusive | 50 |

| over 100 hp (over 73.55 kW) | 100 |

| Yachts and other motor-sailing vessels | |

| up to 100 hp (up to 73.55 kW) inclusive | 100 |

| over 100 hp (over 73.55 kW) | 200 |

| Jet skis | |

| up to 100 hp (up to 73.55 kW) inclusive | 125 |

| over 100 hp (over 73.55 kW) | 250 |

| Non-self-propelled (towed) ships for which gross tonnage is determined (from each registered ton of gross tonnage) | 100 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 125 |

| Airplanes with jet engines (per kilogram of thrust) | 100 |

| Other water and air vehicles without engines (per vehicle unit) | 1000 |

FILES

Note to the table: the values are given in the Kirov region for 2016, 2022, 2022, 2022, 2022, 2022, 2022. To select rates for a specific year, use the selector. These rates are applied in the cities: Kirov, Kirovo-Chepetsk, Slobodskoy, Vyatskie Polyany, Kotelnich, Omutninsk, Yaransk, Sovetsk, Sosnovka and other settlements of the Kirov region.

More than 330 thousand citizens and legal entities in the Kirov region pay transport tax. The procedure for settlements under it is regulated by Law No. 114-ZO of November 28, 2002.

Calculator for calculating transport tax

Using the calculator presented below, owners of vehicles that are registered in the Kirov region can calculate the tax required to be paid.

Data for calculating tax payment on a vehicle

What information do you need to know to correctly calculate the amount of your tax payment:

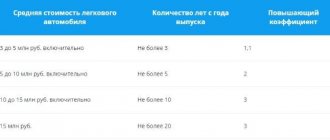

- Release date and cost of the vehicle - if its market value is above 3 million rubles, an increasing factor based on these parameters will be included in the calculation of the final tax amount.

- Time of purchase of transport - if a car or other equipment was purchased a year or more ago, then in this case the tax is paid in full. If the tenure period is several months, the payment is made in an amount directly proportional to this period.

- The power of the engine in the vehicle is the tax base of the future payment and one of the main multipliers. Typically, this indicator is measured in horsepower; in cases where the engine is electric, kilowatts are converted to horsepower. If the vehicle does not have an engine or is towed, the indicator is calculated based on the technical characteristics of the object - load capacity, for example.

- The transport tax rate, which is approved by local authorities. You should check these metrics for updates as they may change from time to time. For now:

- For passenger cars, the rate varies from 18 to 120 rubles.

- For scooters and motorcycles – from 6 to 25 rubles.

- For buses – 50-100 rubles.

- Trucks – 25-85 rubles.

- Motor sleighs and snowmobiles – 25-50 rubles.

- Boats and motor boats - 50-100 rubles.

- Yachts and sailing ships - 100-200 rubles.

- Other water and aircraft - from 100-1000 rubles.

You can calculate the tax amount using our calculator or yourself using the formula: rate * base. If the cost of the vehicle is above 3 million, and the ownership period is less than a year, these indicators are substituted into the calculation formula.

For example, on an inexpensive car with a capacity of 150 horsepower, which has been in the owner’s possession for more than a year, the tax will be charged in the amount of 44 * 150 = 6600 rubles. In this calculation, 44 rubles is the transport tax rate in force in the Kirov region in 2020.

Tax calculation and payment deadlines for organizations

Tax for legal entities is charged on properly registered vehicles classified by the Tax Code of the Russian Federation as objects of taxation. If the legal entity owns any, it is necessary to make an advance payment based on the results of each quarter, calculated as 25% of the total expected amount. You are given 15 days to transfer funds after the end of the reporting period, equal to a quarter.

At the end of the year, no later than March 1, the remaining amount is transferred.

Deadline for payment of transport tax for legal entities in 2022:

- for 2022 - no later than 15 calendar days from the date of filing the tax return (deadline for filing a tax return - no later than March 1, 2022)

- for the 1st quarter of 2022 - no later than May 2, 2022

- for the 2nd quarter of 2022 (6 months) - no later than August 1, 2022

- for the 3rd quarter of 2022 (9 months) - no later than October 31, 2022

- for the 4th quarter and the entire year 2022 - no later than 15 calendar days from the date of filing the tax return (the deadline for filing a tax return is no later than March 1, 2023)

Deadlines for paying road tax

| Document Number | Document date | Payment deadline for individuals persons | Payment deadline for legal entities persons |

| 114-ZO | 28.11.2002 | no later than 12/02/2022 | Tax calculated based on the results of the tax period - no later than 02/18/2022; taxpayers who calculated the amount of tax for the past tax period in the amount of 5 thousand rubles or more, at the end of each reporting period, pay advance tax payments no later than May 15, 2022, August 15, 2022, November 15, 2022 |

Rules and deadlines for paying taxes for individuals

For citizens, calculations are made by employees of the Federal Tax Service division in which the individual is registered. The calculation takes into account the ownership period (the number of months during the year), the rate and the tax base (most often the engine power in hp).

This information is received by payers in the form of a notification sent to residential addresses after the end of the tax year. The payment deadline is December 1. In case of delay, penalties are charged on the entire amount of the debt.

Deadline for payment of transport tax for individuals in 2022:

- for 2022 - no later than December 1, 2022

- for 2022 - no later than December 1, 2023

Please take into account: in accordance with paragraph 7 of Art. 6.1. Tax Code of the Russian Federation, if the last day of the period falls on a weekend, then the day of expiration of the period is considered to be the next working day following it.

Benefits for large families

Transport tax benefit of 50%

is provided to one of the parents (adoptive parents) of a large family that at the end of the tax period includes three or more children under the age of 18 and an average per capita income below the subsistence level per capita established in the Kirov region (11 171 ₽

(2022)), not enjoying benefits on other grounds,

per vehicle

:

- a passenger car or truck with an engine power of up to 150 hp. (up to 110.33 kW) inclusive;

- or a bus with an engine power of up to 200 hp. (up to 147.1 kW) inclusive;

- or a motorcycle (motor scooter) with an engine power of up to 45 hp. (up to 33.1 kW) inclusive.

Benefits for individuals

Citizens belonging to the following categories have the right to apply for exemption from the need to pay tax, or for a reduction in the applicable rate:

- Heroes of Labor, USSR, Russian Federation, holders of the Order of Glory (3 degrees);

- citizens with confirmed disabilities of groups 1, 2, 3;

- Individuals using tractors and combines for farming;

- disabled combat veterans;

- citizens who have reached retirement age;

- parents (or adoptive parents) in large families;

- guardians of disabled children;

- veterans.

FILESOpen the table of transport tax benefits in the Kirov region

Tax rates and benefits

Agricultural producers in relation to their vehicles belonging to the category of cargo vehicles. Agricultural producers are organizations and peasant (farm) enterprises engaged in the production of agricultural products, their primary and subsequent (industrial) processing in accordance with the list approved by the Government of the Russian Federation, and the sale of these products, provided that in the total income from the sale of products ( works, services) the share of income from the sale of agricultural products produced by them, including products of their primary processing, produced by them from agricultural raw materials of their own production, is at least 70 percent for the tax period.Condition

The share of income from the sale of agricultural products is determined based on the results of work for the past tax period: if for the past tax period the share of income was 70 percent or more, then no tax is paid in the current tax period, but if, based on the results of work for the current tax period, this share is less 70 percent, tax payment for the current tax period is made within ten days from the day established for the submission of the accounting report and balance sheet for the year; in the event that during the last tax period the tax was paid, but based on the results of work for this tax period the share of income was 70 percent or more, the taxpayer, upon his application, is refunded the amounts of tax paid or offset against future payments in the prescribed manner; if for the past tax period the share of income was less than 70 percent, then in the current tax period the tax is paid in accordance with the generally established procedure. For agricultural producers engaged in trading activities, the total income takes into account the difference between the sales and purchase prices of goods.

Base

for organizations and peasant (farm) enterprises registered as legal entities, data from annual reports on the financial and economic condition of commodity producers in the agro-industrial complex are provided in the form approved by the Ministry of Agriculture of the Russian Federation.

According to

Article 5, paragraph 1, paragraph 6

Individual

Legal entity

IP

Benefits for other categories of citizens

Exempt from paying tax

- Heroes of the Soviet Union, Heroes of the Russian Federation, Heroes of Socialist Labor and full holders of the Order of Glory, disabled people of group I - for one passenger car with an engine power of up to 150 hp.

With. (up to 110.33 kW) inclusive OR one motorcycle/motor scooter with engine power up to 45 hp. With. (up to 33.1 kW) inclusive ; - individuals in relation to tractors and self-propelled combines of all brands

, running personal subsidiary farming, classified as such in accordance with Federal Law N 112-FZ “On personal subsidiary farming” (06/28/2021), on land plots provided for rent; - organizations in relation to vehicles equipped to use natural gas as a motor fuel

; - organizations whose main type of economic activity relates to public postal services;

- agricultural producers in relation to their vehicles belonging to the category of cargo vehicles.

Have a benefit of 70% of the tax amount

For one passenger car with an engine power of up to 150 hp. With. (up to 110.33 kW) inclusive OR one motorcycle (motor scooter) with engine power up to 45 hp. With. (up to 33.1 kW) inclusive:

- categories of citizens exposed to radiation as a result of the Chernobyl disaster;

- disabled people of groups II and III;

- disabled combatants specified in subparagraphs 2, 3, 6 of Article 4 of Federal Law No. 5-FZ “On Veterans” (02/16/2022).

Have a benefit of 50% of the tax amount

- men who have reached the age of 60 years, and women who have reached the age of 55 years, who do not benefit from benefits on other grounds, for one passenger car with an engine power of up to 150 hp.

With. (up to 110.33 kW) inclusive OR one motorcycle/motor scooter with engine power up to 45 hp. With. (up to 33.1 kW) inclusive ; - individuals in relation to one boat, motor boat or other water vehicle with an engine power of up to 100 hp.

(up to 73.55 kW) inclusive ; - veterans specified in paragraph 1 of Article 3 of Federal Law No. 5-FZ “On Veterans” (02/16/2022), as well as military personnel, private and commanding personnel of internal affairs bodies, bodies and institutions of the penal system, transferred to the reserve (retirement ), who took part in hostilities in the performance of official duties during armed conflicts of a non-international nature, counter-terrorism operations, in zones of emergency on the territory of the Russian Federation and the territories of the republics of the former USSR, not included in section III of the List of states, cities, territories and periods of combat actions involving citizens of the Russian Federation - annexes to the Federal Law “On Veterans”, in relation to one of the following vehicles

:- a passenger car with an engine power of up to 150 hp. With. (up to 110.33 kW) inclusive;

- motorcycle (motor scooter) with engine power up to 45 hp. With. (up to 33.1 kW) inclusive.

- individuals - one of the parents (adoptive parents, guardians, trustees) with a disabled child (disabled children) under the age of 18 years, in relation to one of the following vehicles

:- a passenger car with an engine power of up to 150 hp. With. (up to 110.33 kW) inclusive;

- motorcycle (motor scooter) with engine power up to 45 hp. With. (up to 33.1 kW) inclusive.