What is a payslip

A payslip is a special internal document of an enterprise in which complete information about an employee’s salary is entered. It is formed individually for each employee and includes information about payments due, including salary, various allowances, bonuses, rewards, compensation, as well as deductions made (taxes and contributions to extra-budgetary funds) and the final salary amount. The payslip is drawn up monthly and handed over to the employee of the enterprise for whom it was paid.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

It should be noted that according to the Labor Code of the Russian Federation, the employer is obliged to inform the subordinate about all components of his salary. This allows the employee to make sure that the salary accrued to him complies with the terms of the employment contract and legal norms.

The payslip is drawn up in any form and handed over to the employee of the enterprise immediately at the time of payment of wages. It does not matter whether the employee receives payment for his work in cash or through a transfer to a bank card.

The procedure for issuing pay slips is determined in each specific case individually. It must be reflected in the company’s local regulatory documents. Among other things, they specify the form of the pay slip, the day it is handed over to the employee (as mentioned above, it must coincide with the day of payment of the second part of the salary), the obligation of the responsible person to issue the slip to employees against signature. The latter’s autograph will indicate that the employer has fulfilled its obligations before the law to inform the subordinate about the salary in full.

Deadline for issuing salary slips

According to Part 1 of Article 136 of the Labor Code of the Russian Federation, the employer must notify the employee about the components of wages when paying them. And part 6 of Article 136 of the Labor Code of the Russian Federation requires paying wages every half month. This means that payslips must be sent to employees twice a month. Recently, this opinion was expressed by Rostrud specialists (see “Rostrud: pay slips should be issued twice a month”).

However, the Ministry of Labor, in letter dated 05.24.18 No. 14-1/OOG-4375, explained the following: when using remuneration systems in which salaries or monthly tariff rates are established for employees, it is permissible to draw up payslips indicating the accrued monthly wages. In other words, such employees can be issued a receipt with a breakdown of accruals and deductions once a month. A similar conclusion is contained in the letter of Rostrud dated September 17, 21 No. PG/26944-6-1.

With other remuneration systems, when the salary for the first half of the month depends on actual output, a payslip is issued with each payment. If any amounts are withheld from the employee’s “advance” payment, this is also the basis for issuing a receipt for the payment of the first part of the salary.

When dismissing an employee, the payslip must be sent on the day of dismissal. This follows from the provisions of Article 140 of the Labor Code of the Russian Federation. It states that upon termination of an employment contract, the employer is obliged to make a final settlement with the employee in the form of wages and other amounts due on the day of dismissal.

Attention!

Transferring salaries to employee cards is not grounds for non-issuance of payslips (letter of the Ministry of Labor dated October 23, 2018 No. 14-1/OOG-8459; see “Salaries are transferred to a card: is it necessary to issue a payslip?”)

But when paying vacation pay, you do not need to prepare payslips. This is due to the fact that vacations are paid based on average earnings. This means that such payment is not a salary payment. Therefore, there is no reason to issue receipts with a breakdown of salaries when transferring vacation pay (letter of Rostrud dated December 24, 2007 No. 5277-6-1).

Calculate your salary and vacation pay for free in the web service

How to draw up a document

Both in terms of the format of the statement and in terms of its design, everything is left to the compiler. The document can be generated on a simple ordinary piece of paper or on a form with company details and the company logo. The statement can also be drawn by hand or printed on a computer (in the vast majority of cases, the second option is used).

The statement is always made in one original copy. Its volume may vary, but if it contains several sheets, they must be numbered in order and fastened with thick, harsh thread. On the last page, a piece of paper is pasted onto the bundle, indicating the number of pages, the date and the signature of the responsible employee.

Is it necessary for payroll sheets?

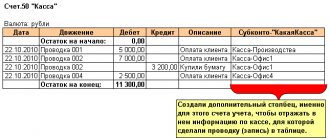

Article 136 of the Labor Code of the Russian Federation obliges the employer to issue a payslip. Any employee should know and understand how the employer calculates remuneration for work done. How to understand the payslip?

When checking the documentation of a legal entity, the labor inspectorate may require confirmation of the issuance of pay slips to subordinates.

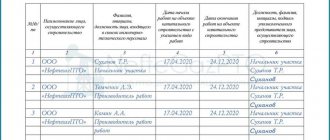

Often, employers keep a special book that records the receipt of a pay slip by an employee.

Such a summary document may be called a statement.

Maintaining a sheet record sheet is not a requirement, but filling it out will help resolve legal disputes and also avoid fines.

The sheet can be replaced with a sheet issuance log.

Sample statement

If you need to create a payslip issuance sheet that you have never done before, use the recommendations below and look at its example - based on it, you can easily create what you need.

- First of all, indicate the name of the company on the form (abbreviated or full, it makes no difference).

- Then write the name of the document, assign it a number (if necessary), enter the month for which it is being compiled.

- It would not be amiss to enter the structural unit for which the document is being drawn up.

- It is better to do the further part in the form of a table. The number of rows and columns is determined depending on the needs of the organization. But these must include the date of issue of the pay slip, the position and full name of the employee who received it. Employees of the enterprise must sign their autographs in a separate column. After filling out the form, the responsible employee must also sign the form.

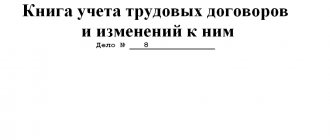

Journal for issuing pay slips: sample

Due to the fact that failure to issue “settlements” is quite harshly punished by law, managers and accountants try to protect themselves from possible legal consequences. In particular, logs of the issuance of pay slips are kept, designed to record the fact of issuing this document.

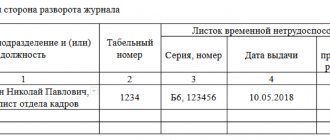

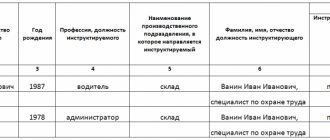

Existing legislation does not oblige the issuance of salary notices against the signature of the employee; accordingly, a unified form of the journal does not currently exist. At the same time, there is a structure developed in practice. In accordance with it, the journal should include the following information, organized in table form:

- employee serial number;

- FULL NAME;

- date of issue of the payslip;

- employee's position;

- signature.

In addition, the title of the journal must indicate the name of the organization or entrepreneur, as well as the period for which the documents are issued. Below it is certified by the signature of the employee responsible for issuing them. You can see a sample and download the logbook for issuing pay slips below.

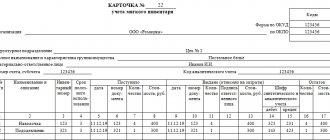

Some employers take the T-49 form as the basis for the journal, in which they enter the missing columns - the date of issue of the “calculation” and the signature. In addition to the described options for confirming the fact of receipt of the sheet, employers often use forms with a tear-off spine for this document. On it, employees indicate the date of receipt and sign. These roots are then filed and stored at the enterprise.

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2022 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Why do they buy gold? Selling gold competently is a process that will require you to spend some free time. It will be necessary to find out...

Journal of registration of pay slips for employees' salaries 2020

And, nevertheless, it is still advisable to prepare a journal for recording the issuance of slips in order to avoid difficulties during the next inspection by the same Labor Inspectorate or tax inspectorate.

It is quite difficult to prove that the employee was notified on time about the amount of his salary, as well as its amount, without written confirmation.

Moreover, none of the employees will definitely keep the sheets for five years, and on the copy of the specified document, which is stored in the accounting department, the signature of the workers, as a rule, is missing, as well as the date of delivery.

Document form

Considering that keeping a journal is not mandatory by law, its form is formed in any order, based on the rules adopted for maintaining documentation of this type.

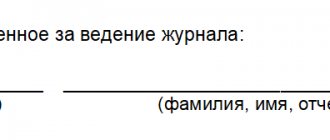

In particular, the journal must:

- contain a title page with the name, terms of establishment and storage;

- be stitched in the manner prescribed by law, with a seal on the last page and an indication of the number of sheets.

Also, the journal should include data about the person who is charged with the responsibility for its registration and maintenance in tabular form, in which it is most convenient to record all the necessary information.

By the way, making retroactive entries is unacceptable. But the procedure for correcting errors can be fixed in the same Regulations on Journal Keeping.

After all, you can even edit work books, of course, in the manner prescribed by law, so why not use the same method when maintaining a journal for issuing pay slips.

What sections should it contain?

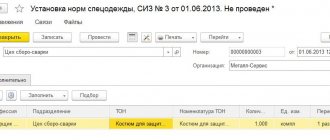

In order to correctly reflect all the necessary data to confirm receipt of the slip, the journal must contain the following columns:

- serial number;

- Full name of the employee;

- his personnel number;

- Job title;

- date of issue of the certificate;

- employee signature.

There is no need to include other information, given that the amount received relates to personal data, the processing of which requires permission from employees.

And there is no need for additional columns, although you can also provide a note where it is possible to reflect the same going on maternity leave, which will explain during a routine check the lack of data about an employee who was previously included on the list monthly.

Sample, form and completed example

An approximate sample of the log, as well as the procedure for filling it out, can be found below.

The form can be downloaded here:

Logbook for issuing pay slips

Who forms and fills it out?

As a rule, the finance department is responsible for maintaining all payroll documentation.

Consequently, the responsibilities for drawing up the sheet, as well as issuing it, are assigned to one of the ordinary accountants, who, in addition to the above obligations, is more appropriately charged with maintaining a journal, given that it will be much easier to obtain signatures from the very employee who hands the sheets.

Approval order (sample)

By virtue of Article 60 of the Labor Code of the Russian Federation, the employer does not have the right to demand the fulfillment of duties that are not specified in the employment contract.

Therefore, in order to assign the obligation to keep a log of the delivery of leaflets to one or another employee, it is necessary to issue an order, on the basis of which the employee will perform the task assigned to him.

At the same time, taking into account that the journal from the moment of its registration will relate to the documentation of the enterprise, it is advisable to issue another order, which will approve the Regulations on maintaining the journal and its form, not to mention other nuances, such as storage periods.

How much and where is it stored?

By virtue of Order No. 558, salary slips are stored in the company for at least 5 years and can be destroyed only after an audit.

In order to confirm the fact that leaflets were issued for a specified period, the journal must be kept for the same period in the company’s archives or in the accounting department.

Do I need an order to approve the payslip form? How is financial assistance paid for vacation? Find out here.

What is the fine for non-payment of wages? Read here.

conclusions

Drawing up a record of the issuance of pay slips is not a strict action of the employer, but is evidence in the event of claims from the labor inspectorate.

This document will also be able to prevent legal proceedings for violation of workers’ labor rights.

For refusal to inform employees about the amount of their salary, administrative liability may be applied to a legal entity (Article 5.27 of the Code of Administrative Offenses of the Russian Federation): for officials a fine of 1 thousand rubles, for legal entities - 50 thousand rubles.