What are active and passive accounting accounts?

Simply put, active financial accounting accounts are those accounts that specialize in accounting for all of a company's assets. While passive type accounts are accounting accounts that are designed to account for the organization’s liabilities, that is, its own funds: capital, reserves and other liabilities.

Based on a more significant difference, it can be noted that active accounting is created to account for the following items:

- Tangible and intangible property of the organization. This includes the company's fixed assets, its inventories and intangible assets.

- Cash in all forms, that is, in paper cash and in current accounts and bank deposits;

- costs associated with the production of the product, work in progress, semi-finished products;

- Various financial investments: short-term and long-term.

Due to the fact that active accounts involve accounting for the property and finances of the enterprise, the balances on such accounts can be exclusively in debit, that is, have a positive value.

The sources of creation of a company's assets reflect the liability side of the financial balance sheet. So, passive accounts are:

- capital of an economic entity;

- obligations assumed by the enterprise to be fulfilled;

- loan, credit and loans received;

- additional expenses, for example, depreciation;

- reserve funds for unfavorable debts.

Accordingly, the passive account has an exclusively credit balance at the end of the reporting period, and the debit balance on the passive account informs about errors in accounting. An increase in the coefficients on a passive account, as a rule, is formalized using credit turnover, and a reduction in the number of liabilities, capital or writing off necessary expenses is considered an operation to debit the passive account.

In the financial balance sheet, passive accounts respectively determine the section - liability. The generated balances at the end of the reporting period are distributed along certain lines of the liability side of the financial balance sheet, in accordance with the current rules for the formation of financial statements.

Active-passive accounts are also used when working with various invoices. In addition, they can highlight settlements with participants in business relationships.

It happens that some financial accounts contain credit or debit balances. Such accounts are also called active-passive. This may include accounting accounts that are capable of reflecting information about settlements with consumers or suppliers. It follows from this that during the shipment of any goods to the consumer, a receivable is created in the accounting account, and when the supplier receives a certain advance payment from the same buyer, an account payable is created in the accounting account.

It is worth considering that some financial accounts cannot be categorically classified as active or passive. For example, account 60, which is aimed at settlements with persons involved in supplies and contractors. The debit of such an account indicates a reduction in credit debt, that is, a liability, as well as an increase in receivables, in other words, an asset. In the same way, using the credit of accounting account 62, aimed at settlements with buyers and customers, it is possible to trace financial transactions that create not only an asset, but also a liability.

For example, if an enterprise bought products, but did not have time to pay for them, this means that on credit 60 of the account, the buyer has a payable debt to pay for goods or services. However, if the company gave an advance to the person supplying the products, then before the goods and materials are delivered on the debit of account 60, a receivable will appear. First we are talking about the passive accounting account, and then about the active one. Based on the fact that account 60 is directly related to certain economic aspects, this account is considered active-passive.

As a rule, it is customary to distinguish two main types of active-passive accounting accounts, namely:

- with one-sided balance;

- with a bilateral balance.

An active-passive accounting account with a one-sided balance implies a debit or credit balance. A striking example is account 99, which implies the company's profits and losses. So, if an organization’s total income significantly exceeds the amount of production and other expenses, then the difference between these amounts gives net profit; accordingly, the balance is considered a credit balance, because the credit turnover exceeds the debit one. Income is the main source of creation of tangible and intangible property of the company, which is visible in the liability side of the balance sheet. However, if losses occur in the organization, then the balance of the accounting account is considered debit, because the debit turnover is greater than the credit turnover.

An active-passive accounting account with a two-way expanded balance indicates simultaneously both a debit and a credit balance. An example is account 76, indicating settlements with various debtors and creditors. In this case, the debit balance refers to the debts of the company's counterparties to it, in other words, accounts receivable, while the credit balance refers to accounts payable. Thus, debit entries in such an account mean an increase in accounts receivable or, conversely, a decrease in the organization’s debt, which it must repay.

Accounting for current account transactions

- home

- Postings

On the territory of the Russian Federation, non-cash payments are carried out through credit organizations - banks on current accounts opened on the basis of a banking service agreement (how to open a current account). Operations on the current account are carried out using settlement documents. The most common are settlement transactions by payment orders.

Payment documents are accepted by the bank regardless of the availability of funds in the payer's account. If there are insufficient funds in the organization's current account, the bank proceeds as follows: a card file is created on the organization's current account - recording settlement documents for debiting funds from the account. To pay for settlement documents found in the card index, the legislation (Article 855 of the Civil Code of the Russian Federation) establishes the following order of execution:

- carrying out operations under executive documents providing for the transfer or issuance of funds from the account to satisfy claims for compensation for harm caused to life and health, as well as claims for the collection of alimony;

- carrying out operations under executive documents providing for the transfer or issuance of funds for settlements for the payment of severance pay and wages;

- carrying out operations on payment documents providing for the transfer or issuance of funds for settlements of wages, as well as contributions to the Pension Fund of the Russian Federation;

- carrying out operations on payment documents providing for payments to the budget and extra-budgetary funds;

- carrying out operations under executive documents providing for the satisfaction of other monetary claims;

- Carrying out operations on other payment documents in calendar order.

Debiting funds from the account for claims related to one queue is carried out in the calendar order of receipt of documents. In case of partial payment of a payment document, the bank issues a payment order and one of its copies is attached to the bank account statement.

The procedure for filling out, submitting, recalling and returning payment documents can be found in Chapter 2 of the Regulations on Non-Cash Payments of the Russian Federation.

Accounting for transactions on a current account in the currency of the Russian Federation is kept on account 51 “Current accounts” of the accounting chart of accounts. The debit of this account reflects the receipt of funds, and the credit reflects the debit of funds from the current account. If an organization has several current accounts, it is necessary to organize analytical accounting in the context of current accounts.

Transactions on current accounts are reflected on the basis of statements from credit institutions (banks) and settlement documents attached to them. After receiving the statement, the accountant must compare the balance of funds in the current account at the end of the day of the previous (last) statement with the balance of funds at the beginning of the day of the current statement, and also check the completeness of the information in the statement in accordance with the primary settlement documents. All discrepancies discovered during the audit are reflected in the subaccount “Settlements for claims” of account 76 “Settlements with various debtors and creditors”. Disputed amounts can be protested within 10 days from the date of receipt of the statement.

Checking of settlement documents and recording of transactions on settlement accounts must be carried out on the day the statements are received. Let's consider accounting for typical transactions on current accounts:

- accounting for the receipt of funds into the current account;

- accounting for the transfer of funds from a current account;

- accounting for the return of funds to the current account.

Separately, we can highlight the accounting of transactions on current accounts in foreign currency. On the territory of the Russian Federation, transactions with foreign currency are regulated by Federal Law No. 173-FZ “On Currency Regulation and Currency Control”.

Active accounting accounts

First of all, it is necessary to determine the types of active accounting accounts. They are generally divided into the following four categories:

- Inventory accounts that take into account all the property of the organization, namely:

– fixed assets of the enterprise;

– intangible assets of the company, this also includes investments in research and development work;

– materials that are used to account for the quantity of materials, raw materials, semi-finished products, and so on;

- Cash accounts, which reflect the company's funds in both cash and non-cash form;

- Collection and distribution accounts, which serve for various expenses of the enterprise. They are not directly related to the production process, however, they are included in the calculation due to the distribution in proportion to any attribute;

- Cost or costing accounts, which are created to form the cost of finished goods and services.

Here are the main active accounting accounts:

- 01 “Fixed assets”;

- 03 “Profitable investments in material assets”;

- 04 “Intangible assets”;

- 07 “Equipment for installation”;

- 08 “Investments in non-current assets”;

- 09 “Deferred tax assets”;

- 10 "Materials";

- 11 “Animals in cultivation and fattening”;

- 15 “Procurement and acquisition of material assets”;

- 16 “Deviation in the cost of material assets”;

- 19 “Value added tax on acquired assets”;

- 20 “Main production”;

- 21 “Semi-finished products of own production”;

- 23 “Auxiliary production”;

- 25 “General production expenses”;

- 26 “General business expenses”;

- 28 “Defects in production”;

- 29 “Service industries and farms”;

- 40 “Product release”;

- 41 "Products";

- 43 “Finished products”;

- 44 “Sales expenses”;

- 45 “Goods shipped”;

- 46 “Completed stages of work in progress”;

- 50 "Cashier";

- 51 “Current accounts”;

- 52 “Currency accounts”;

- 55 “Special bank accounts”;

- 57 “Translations on the way”;

- 58 “Financial investments”;

- 81 “Own shares”;

- 94 “Shortages and losses from damage to valuables”;

- 97 “Deferred expenses”.

Classification and types

| Classification of accounting accounts | |||

By economic content:

| By type of reflected objects:

| According to the depth of clarification:

| Upon inclusion in the balance sheet:

|

Active, passive and active-passive

Depending on what type of property or liabilities is subject to accounting, accounts are divided into active, passive and active-passive.

Active - records of assets (property values) are kept by composition and location.

Data from active accounts is reflected on the left side of the balance sheet in the “Assets” section.

Features:

- the opening balance is always debit;

- the debit of the account shows the increase in property;

- for a loan - reduction of property;

- The ending balance is always a debit.

Examples of active accounting accounts:

- to reflect funds - 50 “Cash”, 51 “Currency accounts”, 52 “Currency accounts”, 55 “Special accounts in banks”;

- to reflect property - 01 “Fixed assets”, 02 “Intangible assets”, 10 “Materials”, 41 “Goods”, etc.;

- to reflect costs - 20 “Main production”, 25 “General production costs”, 44 “Sales expenses”, etc.

Passive - records are kept of liabilities (sources of assets) with distribution depending on the intended purpose.

Data from passive accounts is included on the right side of the balance sheet in the “Liabilities” section.

Features:

- the opening balance is always a credit balance;

- the debit of the account shows a decrease in liabilities;

- for a loan - increase in liability;

- The ending balance is always a credit balance.

Examples of passive accounts:

- to reflect capital - 80 “Authorized capital”, 83 “Additional capital”, 82 “Reserve capital”;

- to reflect loans - 66 “Calculations for short-term loans and borrowings”, 67 “Calculations for long-term loans and borrowings”;

- to reflect depreciation - 02 “Depreciation of fixed assets”, 04 “Depreciation of intangible assets”.

Active-passive - both assets and liabilities can be taken into account.

Indicators in these accounts can be included in both assets and liabilities of the balance sheet. Main characteristics:

- The opening balance can be either debit or credit

- When accounting for assets, such accounts behave as active ones,

- when accounting for liabilities - as passive;

- The ending balance can be either a debit or a credit.

Examples of active-passive accounts:

- to reflect settlements with various persons - 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 70 “Settlements with personnel for wages”, etc.;

- to reflect income/expenses - 90 “Sales”, 91 “Other income and expenses”, etc.

On-balance sheet and off-balance sheet

In relation to the balance sheet, accounts can be divided into on-balance sheet and off-balance sheet accounts.

All accounts from the 8 sections of the Accounting Plan with numbers from 01 to 99 are balance sheet. These are the main accounts for accounting, their indicators are included in the final financial statements of the enterprise and, above all, in the balance sheet and income statement.

Examples of balance sheet accounts:

- 01 “Fixed assets”;

- 02 “Depreciation of fixed assets”;

- 04 “Intangible assets”;

- …

- 99 “Profits and losses.

Off-balance sheet accounts are not included in the main 8 sections of the Accounting Plan and are reflected separately in the last section. Unlike balance sheets, they have a three-digit digital code rather than a two-digit one.

These are auxiliary accounts that reflect data on:

- the property that is in temporary use or disposal;

- rights and obligations received and issued;

- individual operations - accounting for BSO, wear and tear of fixed assets, written off receivables.

Examples of off-balance sheet accounts:

- 001 “Leased fixed assets”;

- 002 “Inventory materials accepted for response. storage”;

- …

- 011 “Fixed assets leased out.”

Synthetic and analytical, subaccounts

Based on the detail of accounting, accounts can be divided into synthetic and analytical.

All accounts from the Accounting Plan are synthetic (first order). Their purpose is to keep records of transactions in a generalized monetary form without excessive detail.

Example:

Synthetic account 10 “Material” is intended to reflect material assets in the form of amounts.

By debit, you can see how much the company has materials in stock, but it is impossible to determine what types of materials are available and in what quantities.

Using the loan, you can see the amount of materials left from the warehouse, but it is possible to say which MCs were released and in what quantities.

subaccounts are opened for synthetic accounts , where assets and liabilities are divided according to individual types, types, and purposes. Accounting for sub-accounts is carried out in Russian rubles.

The Accounting Plan contains recommendations for each synthetic account about which subaccounts can be opened and what to account for in them. Subaccounts have a number consisting of a two-digit account number and the serial number of the subaccount is added through a dot.

Example:

Synthetic account 41 “Goods” is used to record inventory items intended for sale. The debit reflects the total amount of goods arriving at the warehouse, as well as those available, while the credit reflects the total amount of goods sent for sale without detailing by type of value.

According to the Plan, you can open the following for synthetic account 41 “Goods”:

- 41.1 “Goods in warehouses, depots and vegetable stores”;

- 41.2 “Goods in retail trade”, etc.

For greater detail, additional analytical accounts are opened in addition to synthetic accounts and sub-accounts, where accounting can be kept both in rubles and in physical terms (pieces, meters, grams, liters, boxes, etc.).

You can open any number of analytical accounts, since they serve only for the convenience of accounting. The accountant can assign them any numbers or names.

An enterprise must maintain synthetic accounting, but is not required to maintain analytical accounting; as a rule, it is necessary in large enterprises with a large number of transactions and numerous cash flows.

Example:

The company sells goods - household chemicals (washing powders, dishwashing detergents, glass cleaners, floor cleaners, sanitary ware).

Accounting for goods in rubles will be kept on synthetic account 41 “Goods”, to which the accountant, for convenience and clarity, has the right to open analytical accounts:

- "Washing powders";

- “Dishwashing detergents”;

- “Glass cleaning products”;

- “Floor cleaning products”, etc.

It is possible to maintain analytical records for manufacturers of household chemicals.

Analytics can be carried out in rubles or in boxes or pieces.

Rules for maintaining accounts

It should be understood that the report on financial accounts is submitted based on a certain procedure.

The main characteristic of an active-passive account is that it can be heterogeneous. So, on an active-passive account, the balance can be expressed as a credit or a debit, depending on the situation. Therefore, the balance on synthetic accounts can be determined solely by the final accounting on second-order accounts, as well as on accounts intended for detailed and specific information about the presence, condition and movement of funds and their sources in synthetic accounts, in other words, on analytical accounts.

It is necessary to understand that it is impossible to expand the balance on analytical accounts, however, it can change, that is, for one period it can be debit, and for another – credit. In case of full repayment of obligations, such an account may already be successfully closed. It follows that the sequence of calculations may change based on the instructions for using charts of accounts.

The balance can be expanded on a synthetic active-liability account, provided that there is a balance on both sides of the chart of accounts. Similarly, if a particular form has debts to suppliers or customers, they are reflected in the credit of this account, which is open for accounting, and such debt can be repaid by debiting the corresponding account. But when a receivable is detected, the entire process of repayment occurs on the credit of a specific account.

Course 2: Creating your first accounting account

Now a little about the terms related to the accounting account.

Debit is the name of the left side of the accounting account . Credit is the name of the right side of the accounting account. The turnover on the debit of an account is the sum of all movements on the debit, i.e. on the left side of the accounting account. The account credit turnover is the sum of all movements on the credit, i.e. on the right side of the accounting account. Account balance is the balance either at the beginning or at the end of the accounting account .

In our case: beginning balance 0 rubles, ending balance 5,000 rubles, debit turnover 12,000 rubles, credit turnover 7,000 rubles.

As you will see below, any accounting system consists of a set of accounting accounts.

What a terrible word - subconto

Everything is translated simply: sub from subject - from English “dependent”, conto - from Italian “account”, comes from the Italian mathematician and progenitor of accounting - Pocioli Luca. In Russian it will be: dependent on the account. This is what is usually called in accounting for additional columns that are included in the table (accounting account). These columns are needed for:

- so that when filling out the table, we immediately record in it the information for which this column was created at the time of entry into the table (for accounting purposes). — to quickly select information on an accounting account using this column.

For example: I want that when recording “information” on the “Cashier” account, it should be indicated for which cash register the entry is being made, then I will add an additional column “Cashier” to the accounting account (table), and after the information has accumulated in my table ( accounting account), I will be able to select all records that are associated specifically with a specific cash register, for example, “Cashier-Production”.

You can create the required number of such sub-accounts according to the accounting account in the 1C database. You can see which subaccounts have been entered for a specific accounting account in 1C in the Chart of Accounts (menu.Operations-Charts of Accounts...)

Next, you will see that the correct subcontos established for an accounting account allow you to build informative reports and quickly understand in numbers what happened with a particular accounting object (money, receivables, goods) in the context of a specific object (a specific cash register, a specific client, a specific product), and not in general. Those. the structure of the account (accounting table), supplemented with the correct sub-contos (columns), allows you to significantly increase the amount of information that can be obtained from the accounting account and speeds up the receipt of such information.

at how to squeeze (receive) all the information from the accounting account and from the accounting system using standard 1C tools in the final lesson of the course .

Course 3: Creating the structure of our accounting system >>>

What is synthetic accounting?

Synthetic accounting is the recording of all information on types of property, business transactions, debts, taking into account their economic characteristics. Such accounting is carried out on synthetic accounts in accordance with the Accounting Law.

Synthetic accounts are of both first order and second, that is, subaccounts. The balance is grouped in Form No. 1 of the accounting report.

Such accounts are used to work with various types of information about large accounting objects, but exclusively in monetary terms. Synthetic accounting can only be carried out in national currency.

Account Definition

Let's try a popular science explanation of what accounting accounts are for dummies.

Accounts are a method of cumulative interconnected reflection and grouping of property by location and composition, by sources of its formation, as well as a method of business transactions according to qualitatively homogeneous characteristics, expressed in natural, labor and monetary measures.

This is an official and very complex definition. Let's put it in simpler words: these are tables of 2 columns: left (debit) and right (credit). This table allows you to see all the operations of the enterprise that occurred during the month.

Receipts to the enterprise account are reflected on the left, and disposals are taken into account on the right. The numbers displayed in the table are equated to monetary terms.

Accounting accounts are displayed in the table

Within the enterprise, many different business transactions are carried out every day: the receipt of funds and their disposal, salary payments, payment of taxes and much more. All these operations are usually grouped according to common characteristics. Each group belongs to a specific account.

For example, any operations to record material assets belong to account 10 (materials). Any cash transactions relate to account 50 (cash), etc.

On a note!

In total, 99 accounts are allocated in accounting, each of which can be viewed in the “Chart of Accounts” document.

What is analytical accounting?

Analytical accounting is carried out both in material and in other accounting accounts. It must group certain information about the property, business transactions and debts of all synthetic accounts.

An analytical accounting account is formed in the process of creating a synthetic account for all its components. It includes detailed and complete financial data about the enterprise values and all the activity found inside all synthetic accounts.

Each organization creates such accounts independently, taking into account all the features of its focus. This is how the accounting policy of a particular enterprise appears.

The analytical account provides the receipt of all accounting characteristics, including concluded contracts with the borrower or party to the contract in civil law relations. Such accounting is also carried out in any foreign currency or even together with the national one at the same time.

- Active;

- Passive;

- Active-Passive.

Active accounts are accounts in which the assets of the enterprise are recorded.

Their opening and closing balances are always debit, the debit reflects an increase in the asset of the enterprise, and the credit a decrease. The main active accounts include:

- 01 Fixed assets;

- 04 Intangible assets;

- 10 Materials;

- 20 Main production;

- 43 Finished products;

- 50 Cashier;

- 51 Current accounts;

- 52 Currency accounts;

- 58 Financial investments;

Passive - accounts that take into account the liabilities of the enterprise, that is, the sources of formation of assets. The opening and closing balances of passive accounts are always in credit. Their distinctive feature is that an increase in liabilities is reflected as a credit, and a decrease as a debit.

The main passive accounts include:

- 60 Settlements with suppliers and contractors;

- 66 Calculations for short-term loans and borrowings;

- 67 Calculations for long-term loans and borrowings;

- 68 Calculations for taxes and fees;

- 69 Calculations for social insurance and security;

- 70 Settlements with personnel for wages;

- 80 Authorized capital;

- 82 Reserve capital;

- 83 Additional capital;

- 99 Profits and losses.

Active-passive - accounts that take into account both the assets of the enterprise and liabilities. They usually have both a debit balance and a credit balance.

The main active-passive accounts include:

- 71 Settlements with accountable persons;

- 75 Settlements with founders;

- 76 Settlements with various debtors and creditors;

- 99 Profits and losses.

HOW TO DISTINGUISH ACTIVE OR PASSIVE ACCOUNT IN ACCOUNTING?

Let’s carry out an analysis and find out how you can determine whether an account is active or passive.

Is count 62 active or passive?

This account reflects relationships with customers. When a product is sold to a buyer, the latter incurs a debt to the organization, which we will reflect in debit 62. Accounts receivable is an asset of the enterprise, that is, an increase in the asset is reflected in the debit.

When paying for goods, the debt decreases; we will reflect the decrease in the asset on credit 62. At first glance, 62 is an active account, since it is characterized by the characteristics of active accounts.

However, a situation is possible when the buyer transfers an advance payment (prepayment), in this case the organization accounts payable to the buyer (liability), it will be reflected on loan 62. After the goods are shipped to the buyer to offset this advance, the accounts payable decreases, we will reflect the decrease in liabilities as debit 62. We see that in this case the account. 62 fits the definition of passive accounts.

From all of the above, we can draw the following conclusion: count. 62 corresponds to the characteristics of both active and passive accounts, that is, it is active-passive.

You can also take 60 “Settlements with suppliers”. Is 60 account active or passive? Having analyzed it similarly, we conclude that the count. 60 is also active-passive. Accounts can also be divided into synthetic and analytical.

Accounting also uses synthetic and analytical accounting

Synthetic accounting is the recording of generalized accounting data on types of property, liabilities and business transactions according to certain economic characteristics, which is maintained on synthetic accounting accounts.

Analytical accounting is accounting that is maintained in personal and other analytical accounting accounts, grouping detailed information about property, liabilities and business transactions within each synthetic account.

Relationship between synthetic and analytical accounts

- The opening balance for all analytical accounts opened according to the synthetic account data is equal to the opening balance of the synthetic account to which they are opened;

- The turnover of all analytical accounts opened using the synthetic account data must be equal to the turnover of the synthetic account;

- The final balance for all analytical accounts opened for this synthetic account is equal to the final balance of the synthetic account.

Groups of analytical accounting accounts are called subaccounts. A subaccount is an intermediate accounting link between synthetic and analytical accounting accounts.

For example, our company purchases materials in the form of products: flour and sugar, and we want to keep separate records for each type of material.

In accounting, we open a synthetic account. 10 “Materials” and to it two analytical ones “Flour” and “Sugar”. Moreover, on a synthetic account. 10 flour and sugar will be accounted for in rubles, and in analytical ones they can also be calculated in other quantities (pieces, kilograms, tons), as will be convenient for the accountant.

Features of active and passive accounts

Active and passive accounting accounts form the basis of accounting accounts. However, they differ greatly in appearance.

Thus, active accounts imply objects in which the organization invests its funds. They create entries in ascending order of assets and record the current balance in the debit side. If assets are reduced, it is assigned to credit accounting.

The main difference is that the primary balance and the final balance are always debit. To calculate the value of the final balance, use the following formula: Sk = Sn + Add – Kob Sk.

- Sk – initial balance;

- DOB – debit turnover;

- KOB – loan turnover.

At the same time, passive accounts determine all movements of the organization; they are classified as sources of funds.

Its difference is that the initial and final balances are always credit. Therefore, to calculate the closing balance, use the following formula:

Sk = Sn + ObK – ObD.

- Сн – initial balance;

- DOB – debit turnover;

- KOB – loan turnover.

Standard Chart of Accounts

An accountant does not need to come up with his own accounts for bookkeeping. The Ministry of Finance of the Russian Federation, by its order No. 94n dated October 31, 2000, approved a standard accounting plan, which presents a list of accounting accounts that can be used for accounting.

The plan contains:

- 8 sections with a list of balance sheet accounts with numbers from 01 to 99 - the main ones where transactions are recorded.

- 1 section with a list of off-balance sheet accounts with numbers from 001 to 011 - auxiliary, where records are kept of assets and liabilities that are not owned by the company (leased, in temporary storage, for commissions, guarantees issued and received).

Balance sheet data shows the amounts of a business's assets and liabilities and is used to prepare a balance sheet. They have numbers from 01 to 99, but now only 62 are used, the remaining numbers are spare and can be used by the company for its own purposes in accordance with the specifics of its activity if there are not enough available accounts.

Data from off-balance sheet accounts are not shown in the balance sheet and are necessary to reflect property and liabilities that do not belong to the company - assets under lease, under storage, commissions accepted for installation, strict reporting forms, guarantees, non-recoverable receivables.

Structure of a standard Plan:

Work plan

An enterprise is not obliged to apply all accounting accounts included in the standard accounting plan.

The company has the right to select the necessary accounts - the Work Plan, and prescribe this list in the Order on accounting policies.

.

Determining the final balance on an active-liability account

In order to identify the final balance on an active-passive account, it is recommended to add up all debit amounts and find out the final credit amount. Thus, the final balance will be on the side where the amount will be greater and, nevertheless, will be equal to the difference between the credit and debit amounts.

The main thing to understand is that receivables arise when an organization is required to return funds after an agreed period of time, but if receivables arise during a loan.

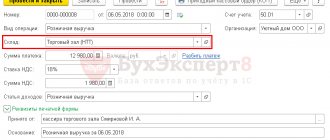

1C: Accounting 8

“1C: Accounting 8” is the most popular accounting program that can take accounting automation to a whole new level. A convenient product and services connected to it will allow you to effectively solve the problems of the accounting department of any business!

- Support of different tax systems, maintaining accounting and tax records, submitting reports;

- Inventory accounting, batch accounting, settlements with counterparties, extracting primary documents;

- Payroll calculation, accounting of cash transactions;

- Integration with other 1C programs and websites;

- Working with electronic certificates of incapacity for work (ELS).

Try 30 days free Order

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter