A soft inventory accounting card is a special form of document that is needed to record acquired property that is used many times, but does not change its characteristics and functional purpose.

The card records inventory whose period of use is at least 12 months, and its price does not exceed the amount established by the document regulating the procedure for maintaining accounting and tax records in an organization for assets with a similar characteristic.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Soft goods: what is it?

Soft goods are the general name for textile products that are used for a long time and also have close contact with the human body.

In an organization, soft equipment is considered to be:

- Underwear - undershirts, pajama pants, long johns and other products made from textile materials.

- Woven products that are widely used to furnish a bed - pillowcases, duvet covers, sheets, mattress covers and other similar products.

- Items that are placed on a mattress or bed - blankets, pillows, sleeping bags, etc.

- Sewing products worn on the body - specialized clothing, special everyday uniforms, etc.

- Products to be worn on feet: all types of work shoes.

What is not soft equipment

Often, the person filling out the document may mistakenly classify the following as soft inventory assets:

- Tablecloths, curtains, curtains and other similar products - although these are sewn products, they are not listed in the legal regulations of Russian legislation, therefore, they do not belong to any group represented there.

- Raw materials for soft equipment - fabric, insulation, sewing materials used for making clothing linings and various auxiliary parts and components necessary for the manufacture of textile products.

- Small personal items whose service life is less than 12 months - handkerchiefs, hair ties, etc.

- Old rags used to wipe or dry something.

- Separate “soft” objects that do not provide individual protection to a person.

The most well-known type of error today is the failure to include in this type of assets conventionally called “hard” things, which are actually considered soft inventory. This:

- headgear that protects the owner from mechanical damage - a helmet;

- protective helmet to protect the head of military personnel, firefighters - helmet;

- a means of protecting the respiratory system, vision and facial skin - a gas mask.

Soft inventory accounting card 2022 sample download

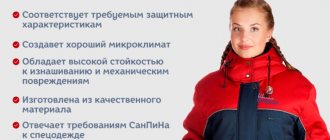

Special clothing and personal protective equipment include: overalls, jackets, gloves, respirators, goggles, headphones, gas masks, etc.

Article 221 of the Labor Code of the Russian Federation obliges heads of organizations to provide employees with uniforms and PPE free of charge if they work: in hazardous production (for example, in chemical production in order to protect against the influence of harmful substances, etc.

); if contamination is possible during work (uniforms are needed so as not to stain the employee’s personal clothing); if the employee’s work involves exposure to unusual temperatures (high or low).

Specialized forms of primary accounting documentation of the agro-industrial complex (AIC)

The procedure for classifying low-value means of labor as fixed assets, their composition and write-off are regulated by internal regulations, depending on the adopted accounting policy of the organization.

For this purpose, it is recommended to combine them into the following homogeneous types (groups): - general purpose tools and devices (cutting, plumbing, universal measuring instruments and devices, etc.); — special tools and devices (tools, molds, etc.

); — production equipment (desks, workbenches, racks, cabinets, bedside tables, etc.); - household supplies (office furniture - tables, chairs, cabinets, etc.)

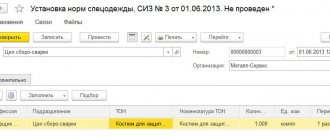

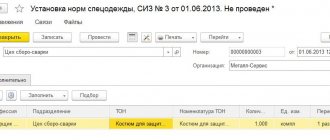

Formation of form 0504206 “Card (book) for recording the issuance of property for use”

According to paragraphs 24, 25 of the Instructions for the application of the Chart of Accounts for Budget Accounting (approved.

"24. Reflection in the accounting of operations for the movement of material reserves within the institution is carried out in the registers of analytical accounting of material reserves by changing the materially responsible person on the basis of the following primary documents:

- Statement for the issuance of feed and fodder (f. 0504203);

- Statement of issuance of material assets for the needs of the institution (f. 0504210).

- Request-invoice (f. 0315006);

- Menu - requirement for issuing food products (f. 0504202);

25.

The write-off of materials and food products is carried out on the basis of: By Order of the Ministry of Finance of Russia dated August 17, 2015 No. 127n, changes were made to Instruction No. 162n, however, the list of documents justifying the transfer of material reserves into operation and their write-off from account 05 “Material reserves” has not changed.

Form 423-APK

The procedure for classifying low-value means of labor as fixed assets, their composition and write-off are regulated by internal regulations, depending on the adopted accounting policy of the organization.

For this purpose, it is recommended to combine them into the following homogeneous types (groups): general purpose tools and devices (cutting, plumbing, universal measuring instruments and devices, etc.

); special tools and devices (tools, molds, etc.); production equipment (desks, workbenches, racks, cabinets, bedside tables, etc.

); household supplies (office furniture - tables, chairs, cabinets, etc.)

Form MB-2

The formation of an accounting card for low-value and wearable items is necessary to control the movement of this type of property within the enterprise. Organizations, as a rule, have quite a lot of property and not all property, objects and products fall into this category.

But there are signs by which this group of goods can be distinguished from the rest: Like any other property, low-value and wearable items are used in work by employees of the enterprise. The period for their use is quite often limited in time, and they must be issued only against receipt.

Most often, the MB-2 form is issued for such things as bags, gloves, stationery, hygiene products, etc. Thus, property is accounted for in current activities

Accounting for soft inventory in budgetary institutions (Repin A

Article posted date: 10/04/2015 How to accept soft inventory for accounting?

In accordance with paragraph 31 of Instruction No. 174n, the receipt of soft equipment in budgetary institutions is reflected in the following accounts: - 0 105 25 000

“Soft inventory is particularly valuable movable property of an institution”

; - 0 105 35 000 “Soft inventory - other movable property of the institution.”

Instructions for the use of the Chart of Accounts of budgetary institutions, approved.

Source: https://152-zakon.ru/kartochka-ucheta-mjagkogo-inventarja-2021-obrazec-skachat-12444/

Sample of keeping a ledger for soft inventory

Similar materials Information from the Central Bank of the Russian Federation 03/15/2021 USD: 56. Property accounting is carried out by the names of materials (products, equipment, etc.), their quantity, and types.

To do this, fill out separate pages for each item.

Rules for registering books of warehouse records of materials Get free legal advice by phone right now: The information contained in it must fully correspond to the actual availability of property in the organization. Property accounting is carried out by the names of materials (products, equipment, etc.), their quantity, and types.

Join our VKontakte community. Similar materials Information from the Central Bank of the Russian Federation 03/15/2021 USD: 56.

rubles per unit.

You can get a free small business consultation from one of our experienced experts. Join our VKontakte community.

- 09/01/2021

- Palladium: RUB 1,955.59

- Dynamics of exchange rates

- Inflation: 2.5%

- EUR: 68.87 rub.

- Platinum: 1716.7 rub.

- Gold: RUB 2,400.97

- Key rate: 7.75%

- USD: 57.6 rub.

- Silver: 31 rub.

© 2008-2010 BizGuru.ru - small business in detail: small business ideas, business plans, business programs, business news.

Reproduction of materials is permitted only with the permission of the project administration. for free. Form No. 9-ON.

Card for accounting of sanitary clothing, tools and equipment in use

- special tools and devices (tools, molds, etc.)

- Business name

- Personnel number and full name

- Item name

- Date of issue and for how long

- Amount and % of wear

- Refund Information

Tool registration card

The form contains the following required fields:

The title page of the tool accounting card looks like the figure below.

Additionally, a personal record card for issuing the instrument is maintained. Its required fields are:

- Full name of the responsible employee

- Employee personnel number

- Profession and structural unit of registration

- Date of entry into office

- Table with issuance and return by piece

This is what a personal instrument issue card looks like, sample. It turns out that it is the instrument issue card that serves as a document that reflects all movements of the asset.

At any point in time, say, during a scheduled or unscheduled inventory, you can determine where and who has this or that sample. You can download your personal instrument registration card from us.

For the convenience of site users, we place all forms on our resource. IMPORTANT: earlier, when this card was approved, the limit was 2000 rubles.

, you no longer need to rely on it, since now the limit is fixed by the enterprise itself with a special company document.

PLEASE NOTE: for accounting, you can use one of the proposed forms of unified accounting, or develop your own form with all the required details and secure its form with an order.

Source: https://credit-helper.ru/kartochka-ucheta-mjagkogo-inventarja-2021-obrazec-skachat-25741/

What information should be contained in the document

To enter data into the card, inventory and accessories should be combined according to the same type of use or the same price category.

On the front side of the document you must indicate:

- Title of the document;

- registration number;

- Name of the organization;

- structural unit (place of document preparation).

In the small sign below:

- Date of preparation;

- structural subdivision;

- personnel number, number according to OKUD and OKPO.

All other cells are filled in as needed.

The full name and position of the person filling out the card is entered under a small sign, after which the main table is filled in:

- "Item":

- names of soft equipment;

- inventory (nomenclature) number.

- "Issued":

- when the inventory was issued;

- to whom issued;

- quantity of issued inventory;

- signature of the employee who issued the soft equipment.

- "Returned":

- date of return of inventory;

- quantity;

- signature of the employee who returned the equipment.

- "Act of disposal":

- item number of soft equipment;

- date of disposal;

- inventory service life.

Important! The disposed inventory is documented in an act based on the decision of the special commission.

As for the reverse side, the main thing here is not to forget about the signature of the responsible person filling out the card and its decoding.

How many copies should be issued?

The card is issued in one copy.

Soft inventory accounting book free download

If your company has a warehouse, you are required to take into account all received inventory items. For this purpose, a register of material assets is used, a sample of which we have placed in this material.

Logbook for issuing material assets, sample Previously, to record the receipt and storage of inventory items at the warehouse, the MX-5 form was used, in which a separate section was allocated for each type of inventory item. Journal form Article 9 of the Federal Law dated 06.12.

11 No. 402-FZ “On Accounting” the requirement to use established document forms has been canceled.

However, the forms of papers used as primary accounting documents, established by authorized bodies in accordance with and on the basis of other regulations, continue to be applied. An example is the inventory log used by storekeepers in military units.

Form 423-apk: household supplies inventory cards

Therefore, the card can take into account those low-value fixed assets whose value does not exceed the value limit established by the accounting policy for such assets.

In accounting, an organization can use a unified document form or an independently developed one, which must contain mandatory details.

Find out what details the primary document should contain in the article “Primary accounting documents - list”.

Explanations for filling out the card To enter data into the card, inventory and accessories should be grouped according to the same type of application or the same cost. The card indicates the name of the property group and its purpose. The card is issued in one copy for each financially responsible person.

Data on the receipt and disposal of inventory is entered into the card on the basis of primary documents.

Book of accounting of material assets (okud 0504042)

In case of destruction of inventory items, approved documents must be attached. Responsible persons are members of the commission for the receipt and disposal of assets. They are appointed by order of the head of the institution.

Let's give a sample act of writing off material assets that have fallen into disrepair, using the example of a children's institution canteen. Step 1.

We fill in the number and date, name of the organization, structural unit, OKPO code, INN and KPP of the institution, financially responsible person, members of the commission for the receipt and disposal of assets, details of the order on the basis of which the commission operates. Step 2.

The commission, in the presence (in our case) of the canteen manager, checks whether the valuables have really become unusable, which they certify with signatures. Decides on the need to exclude from the valuables items that do not meet the requirements for them. Step 3.

Card for inventory and household supplies

Using form 423-APK - household supplies inventory card, acquired property is taken into account as part of the enterprise's fixed assets with a useful life of more than 1 year and a cost of no more than 2 thousand rubles per unit.

Maintaining a household supplies inventory card is shown only for property items of the same type with the same economic and production characteristics, as well as with identical value.

When filling out form 423-APK, the “name” column must be filled in, as well as “location” and “object numbers”. Among the mandatory data recorded on the card, it is also necessary to note the cost of the object at the time of transfer for use, as well as the maximum service life.

These data are indicated on the front side of the card. On the back side of the card form, data on the write-off of objects, as well as those received during liquidation in the accounting accounts, is indicated.

Sample inventory book

Attention, the Act on the write-off of soft and household equipment (form 0504143) is used for the write-off of soft equipment, dishes and items of household equipment. The act is drawn up by a commission and approved by the head of the enterprise.

The form is filled out in two copies (the first is sent to the accounting department, the second remains with the financially responsible person).

The form can be filled out by hand or in a machine-readable manner. This is determined by the accounting policy of the enterprise.

When registering, the date and number of the document, the name of the organization (institution) and department, the composition of the commission (positions and names), and the details of the legal document (order, regulation) are indicated. The form consists of two tables and eight columns each.

Book of accounting of material assets

The form of the book of accounting of material assets according to OKUD 0504042 corresponds to the Order of the Ministry of Finance of the Russian Federation (Ministry of Finance of Russia) dated March 30.

2015 N 52n Moscow “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions and Guidelines for their application » The book of accounting of material assets (f. 0504042) is used to record in places of storage of material assets by persons responsible for their safety. Accounting in the Book (f.

Sample act of writing off material assets

- The date of recording is entered in the second column. The entry must be made on the day the material is received or issued;

- the third column indicates the date and number of the document on the basis of which the goods and materials are accepted (for example, a limit card, if unused balances are returned to the warehouse) or the goods and materials are issued (for example, a statement for the issuance of material assets for the needs of the institution);

- the fourth column reflects the source of arrival of inventory items (for example, supplier) or the structural unit to which the inventory items are issued and the responsible person;

- depending on the type of operation—reception or issue of inventory items—the fifth column “Incoming” or the sixth column “Expense” is filled in;

- the seventh column shows the balance of inventory items in the warehouse after the transaction;

- the last column is used for control marks.

Blanker.ru

Important Sheets are numbered and stitched, sealed with the organization's seal. Accounting for inventory items at an enterprise Accounting for inventory items at an enterprise is carried out in order to monitor the safety and appropriateness of use of property.

Information about the property of the enterprise is entered into the warehouse journal. Keeping records of material assets, as well as the obligation to make entries in the document, falls on the specialist appointed by the director - the storekeeper.

All types of material assets that arrived at the enterprise’s warehouse are subject to accounting.

Filling out the inventory log

After filling in all the required fields, the last sheet is filled out with the signature of the chairman and members of the commission. They can be the administrative staff of the organization, accounting employees, and other specialists. Issued in two copies.

One of them is transferred to the appropriate service in order to reflect the data in accounting. The second remains with the financially responsible person as a document confirming the disposal of the material. How long to store The document is stored in the archives of the institution for at least five years.

Responsibility The commission is responsible for drawing up documents, checking materials, and establishing complete wear and tear or unsuitability of valuables.

Items used for work, like any equipment, become unusable. To exclude them from the organization’s property, it is necessary to carry out a write-off procedure.

For government institutions, Order No. 52n of the Ministry of Finance of Russia dated March 30, 2015 applies, which regulates, among other things, the forms of documents required for disposal.

The sample act for writing off materials for production depends on the type of property being written off. So, there are:

- act on write-off of inventories;

- act on the disposal of soft and household equipment.

The sample act for writing off inventory differs not only in the type of asset, but also in the form of the form. A sample of the OKUD form 0504143 You can download a free form of an act for writing off material assets using the link below.

Source: https://abm-a.ru/kniga-ucheta-myagkogo-inventarya-skachat-besplatno/

Requirements that must be observed when drawing up a document

When drawing up a card, you must adhere to the following series of requirements:

- Maintain a distance between the text and the edges of the page that is strictly established by Russian legislation.

- The card must be issued on high-quality white A4 paper (state symbols of the Russian Federation on the sheet are not acceptable).

- Enter data into the card by typewriting or print it using a computer.

- The text of the document must contain clear, not blurred lines, letters, numbers and other characters.

- Sections and subsections must have headings.

- The calendar date is written in numbers only.

- Each signature must be decrypted.

Mistakes that are often made when drafting

Often, when drawing up a document, even an experienced specialist makes mistakes when creating a document:

- there is no title in the card;

- the date is entered incorrectly or is missing;

- no inventory number;

- the service life is not written;

- details are missing or incorrectly written in the document for receipt of soft inventory;

- there is no information about issuance;

- many amendments were made to the document;

- the main text is written in poor handwriting and is therefore difficult to read;

- The full name of the person drawing up the document is written incorrectly;

- a lot of spelling errors;

- the main text is difficult to see due to the document being heavily worn out;

- The form is artificially aged.

Accounting for inventory and household supplies in a budgetary institution

In a budgetary institution, inventory and household supplies are recorded both as fixed assets and as inventories. The institution independently decides how to account for received property, relying on regulations or the conclusion of the commission on the receipt and disposal of assets.

Inventory and household supplies mean:

- furniture;

- means of communication (telephone, fax machine, etc.);

- cleaning equipment;

- household, lighting devices;

- fire-fighting equipment;

- tool;

- hygiene products;

- stationery;

- kitchen equipment.

The method of writing off property is necessarily reflected in the accounting policy of the institution, but, in general, accounting for inventory and household supplies is no different from accounting for MH and OS.