It often happens at an enterprise that during the next inventory check, things that are listed in the documentation are missing. With every discrepancy, everyone starts to fuss - financially obligated, responsible people, management, and even subordinates, who are often asked. In the article we will talk about the shortage of goods and material assets (inventory) in the warehouse during inventory, and also describe how to document the posting.

Grounds for conducting an inventory of property

There is a misconception that maintaining a register and census is the prerogative of retail outlets, enterprises and factories that are also involved in sales. In fact, all organizations, even municipal or charitable, as well as private individual entrepreneurs, must regularly check all inventory for availability.

All material assets, which include furniture and household appliances, documents and even office supplies, are subject to recalculation. Depending on whether the organization has been prepared, the audit can be planned (on schedule, once a month) or unscheduled. To draw up a plan, write down a schedule according to which the responsible persons recalculate.

Reasons that may affect the conduct of an unscheduled inventory reconciliation:

- any natural disaster - fire, flood, destruction, as well as fire or flooding caused by workers;

- sale of a company or acquisition of a share, emergence of a new co-founder - any changes at the management level may lead to the need to find out the exact balance;

- theft, suspicion of theft, judicial or investigative proceedings.

Thus, an audit can be initiated for various reasons. But one thing remains mandatory - an order must be issued for the procedure, specifying the date and responsible persons.

Registration and accounting of shortages

Production and economic costs must be confirmed by primary documents, and reports of damage and shortages are drawn up. You can develop document forms yourself or use existing ones. For example, TORG - 6, 15, 16, 20 and others, depending on the detected problem. The book value of the missing property is written off to account 94 “shortages and damage from loss of valuables.” The posting is based on the matching sheet and the inventory accounting sheet.

Shortage within the limits of natural loss

If a shortage is found that does not exceed the limits of natural loss, it is written off as production costs or selling expenses. The norms for natural loss are determined by law. They differ for all types of goods. If the norms of natural loss are not provided for this property, then the shortage is considered as excess.

DT - 20 (44, etc.), CT - 94

Keep records, pay salaries, taxes and contributions, report via the Internet to Kontur.Accounting. The web service itself will calculate the amounts, select transactions, and generate reports. Get free access for 14 days

Shortage attributed to the financially responsible person

In other cases, check the documentation and reconcile account balances. After all, a shortage may be the result of errors in calculations, incorrect execution of reports, or lack of control on the part of the financially responsible person. If editing the documents did not help eliminate the deficiency, then responsibility for it falls on the MOL. The person responsible must draw up an explanatory note, which is attached to the results of the inspection. It will not be difficult to collect the amount of the deficiency from the financially responsible person. Damage from shortages is calculated at the purchase price, while lost profits in the form of trade margins are not taken into account. Formalize the decision to recover from the MOL by order. Withhold the amount of the shortfall from your salary partially or completely, but not more than 50%. The employer may also refuse to recover damages from the employee.

DT - 73, CT - 94

The perpetrators were not found or the court refused to recover damages

If there is no financially responsible person and the guilty person has not been identified or his guilt has not been proven, you will not be able to compensate for the loss from the loss of property. It will have to be written off as other expenses. In this case, it is necessary to confirm the validity of such a write-off:

- a court decision confirming the absence of the guilty person;

- a court decision refusing to recover damages from the perpetrator;

- conclusion about the fact of damage to valuables.

DT - 91.2, CT - 94

In addition to the organization’s employees themselves, your counterparty may also be responsible for the shortage. In this case, the amount of compensation is determined based on the terms of the contract and the norms of the Civil Code.

Registration and accounting of surplus

The surpluses identified during the inventory do not pose any problems for the accountant, but they must be taken into account. The basis for accepting the surplus for accounting will be a matching sheet or a sheet of accounting for inventory results. But there is no need to rush into accepting the surplus for accounting, because it may turn out to be the result of an error by an accountant or inventory commission. Then the error needs to be corrected.

Assets are taken into account at their current market value and in the same amount, the accountant recognizes other income. You can determine the market value of an asset yourself or invite an appraiser. Based on the assessment results, a certificate or appraiser's report is issued.

DT - 01, 08,10,41, etc., CT - 91.1

The inventory commission must determine the reasons for the surplus and obtain an explanation from the financially responsible person. In this case, no penalties are applied to the responsible person. However, management may reprimand him or deprive him of his bonus for disorder in the warehouse.

It is worth paying attention to the tax accounting procedure for surpluses. They are included in non-operating income and taken into account when calculating income tax. VAT-related consequences do not arise when surpluses are identified. When transferring them to production, VAT is also not required. However, in the event of further sale of discovered surpluses, VAT is charged in accordance with the general procedure.

Everything is at your fingertips in the program

Everything in Accounting is clear even to a beginner. Payments to employees, receipt and write-off of goods, reporting - an accessible interface, everything is at your fingertips. Previously, I worked in a popular accounting program: it was cumbersome, the database hung all the time, additional materials on legislation had to be searched on the Internet, and submission of reports took much more time.

Oksana Evteeva, accountant at IP Evteev (Bratsk)

What is an inventory shortage?

The accounting department of any company is usually afraid of this term because when there is a shortage, it is much more difficult to tie up accounting loose ends than when there is a surplus. But the discovery of a shortage of products or material resources almost always occurs during an inventory of property.

A shortage of goods and materials is the absence of the required amount of money, goods or furniture, items belonging to the organization and recorded in the register. To carry out an audit, everything must first be put on the balance sheet - listed in the accounting documents. Only after these procedures can an inventory be carried out and indicators be verified.

Another feature of this process is the indication of the value of the item. If a computer is lost in a department, then employees who are financially responsible will compensate for the costs of purchasing it. Therefore, in accounting, when making an inventory, cost is always taken into account.

The pharmacy also has its own rules. Despite the fact that medications are purchased at cost, the full retail price may be withheld from the pharmacist or other person responsible for the shortage in the pharmacy when taking inventory of a person. The situation is the same with stores. This is because a shortage is considered a loss—the owner loses not only the purchase price, but also the money he would have received upon sale.

Shortages include spoiled product, broken items, and broken dishes. Typically, this category is displayed in accounting and is posted as written off as expenses. Sometimes compensation is still required, for example, from waiters for broken glasses, since they are responsible for it. However, if the damaged goods were nevertheless sold, but at a reduced price, the shortage includes the difference between the full and final receipt.

Accounting Gaps: Identifying

A shortage is considered to be the discrepancy in values (quantitative or monetary) between their accounting and actual availability, when the accounting indicator exceeds the actual one. Shortages are identified during an inventory, the results of which are documented in matching statements. Regarding the reasons for the resulting shortage of assets, responsible persons are required to submit an explanatory note to the manager. Based on it, the manager decides how the established shortage will be repaid.

The reasons for its occurrence may be theft of inventory items, cash or finished products, accounting errors, natural loss, as well as emergency circumstances caused, for example, by natural disasters. The cost of damaged property is taken into account in the same way as shortages, since in accounting practice these phenomena are identical.

The category of shortages may include the cost of goods and materials under supply contracts, the quantity or weight of which is lower than stated in the contract within the limits of natural loss norms, if the agreement allows for a shortage within the agreed amounts. True, they should not be more than the norms established by legislation and regulations.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Reasons for the shortage

The manager should not have a negative and misunderstanding attitude towards inventory, because often people go into the red not because of poor performance of duties, but for reasons that are completely unrelated to the employees themselves. They should be taken into account. Why the balance doesn't work out:

- Theft. Proving it is often quite difficult, especially if there are no CCTV cameras.

- Emergencies - fires, floods, damaged engineering systems (electricity went out for a day, a lot of food in refrigerators spoiled).

- Costs of defects, as well as damage to goods. They don’t charge money for trying on clothes, but while putting them on, they can get dirty or torn. I have to write it off.

- Error during sale. Sometimes products, especially products without a barcode, get mixed up.

- The person who is responsible for the inventory shortage may make a mistake in the calculations and write down the wrong data.

Since all of the above reasons are presented in a different order, you should first analyze what caused the shortage. Usually all responsible persons write explanatory notes for each case.

The procedure for registering a deficit

First, you need to collect all the documents confirming the transactions, including the inventory report and sales receipts. Based on this, a write-off order is drawn up and signed.

Otherwise, if the costs turned out to be too high or a large batch of goods was damaged, an internal investigation is carried out for negligence or theft.

Not everything is taken into account so scrupulously. There are certain categories of goods and materials that are not considered special values due to their cost, so any quantity can be recorded as expenses.

There is another option for registering a deficit - withholding from the culprit. Usually the amount is deducted from his salary. This happens in cases where guilt is proven.

Registration of shortage

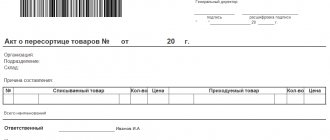

In clause 4.1 of the Methodological Instructions, approved. Order of the Ministry of Finance of the Russian Federation No. 49 of June 13, 1995 provides clear regulations for actions that must be performed by employees of the enterprise who notice a shortage of any goods, materials, parts or production facilities. According to government statements, the first operation carried out at such a moment is the preparation of a matching statement.

The paper is designed in accordance with the company's editorial and financial policy or printed in the form of a standardized form. Classic documents of this format are certificates No. INV-18 and No. INV-19. Aspects of their enforcement are prescribed, for example, in Resolution of the State Statistics Committee of the Russian Federation No. 88 of 1998.

How to write off shortages during inventory

Often, deterioration depends on customers, clients or natural wear and tear, time. In such cases, the registration procedure is as follows: you need to accurately calculate the loss expressed in monetary units, and then issue an order according to which this audit result should be included in the category of business expenses. In this case, you should carefully ensure that the monthly amounts do not exceed a certain norm, and also have confirmation in the form of cash receipts and explanatory notes, otherwise you may be charged with embezzlement.

There are predetermined standards, they are also called distribution costs. These include all shortages that were caused by the buyer. Let's take an example: in a grocery store, a customer accidentally broke an item; he is not obligated to pay for it. But if the amount of costs exceeds the norm, then you need to look for the culprit. For example, if the entire rack was hit, then perhaps the merchandiser is to blame for not arranging the products according to the rules.

And these requirements are most strictly imposed in government agencies. In a commercial company, managers often turn a blind eye, even when standards are clearly exceeded. But in the government structure, any value is part of the state budget, so the balance there is maintained very strictly. The shortage is seen as causing direct damage to the country. In Soviet times, this could have resulted in capital punishment. If the manager gives an order to write off the shortage based on the inventory results for a larger amount than required, then the fact will be considered as misuse of public funds and embezzlement. There is criminal liability for this.

Consequences for the financially responsible person

The person responsible for inventory items writes an explanatory note addressed to his immediate superiors. This document is provided by management within two days from the date of the relevant request, usually it arrives immediately after accounting.

Based on this paper, a decision is made, which consists of writing off the company’s expenses or deducting losses from the employee. The verdict is rendered in accordance with the admission of the share of guilt by the MOL.

Agreement on full financial responsibility

Full financial responsibility can be individual or collective (team). The last option is used when sellers work in shifts.

Please note: the lists of works and categories of workers with whom these contracts can be concluded, as well as standard forms of these contracts, are approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85, and this document is registered with the Ministry of Justice of Russia.

Thus, the List of positions and works replaced or performed by employees with whom the employer can enter into written agreements on full individual financial responsibility for shortages of entrusted property includes:

- positions of directors, managers, administrators, other heads of organizations and trade departments, their deputies, assistants, salespeople, commodity experts of all specializations;

- settlement work for the sale (sale) of goods, products and services (including not through the cash register, through the cash register, without a cash register through the seller).

A standard agreement on full financial liability can be supplemented with new conditions that do not contradict the Labor Code. However, the conditions provided for by the regulatory legal act of the Russian Ministry of Labor should not be excluded from it.

In accordance with the Standard Form of a Full Liability Agreement:

- the employee undertakes to participate in inventory, audits, and other verification of the safety and condition of the property entrusted to him (letter of the Ministry of Finance of Russia dated July 15, 2008 No. 07-05-12/16);

- determination of the amount of damage caused by the employee to the employer is made in accordance with current legislation.

How to recover the shortfall from the guilty parties

The consequences can be serious, including criminal penalties + compensation for costs. Most often, management positions and senior accountants are sanctioned. The level of financial responsibility is discussed during employment and specified in the contract. Sometimes the responsibility may be collective or partial. Then the shortage is removed from all employees.

The deficit is withheld from wages. First, the result of the inspection and a conclusion on it from management with a decision on penalties are provided. Then this amount is deducted from the next paycheck. If the culprit at this moment goes through the dismissal procedure, then the debt is deducted from the last salary. If an employee refuses to pay the funds, he can be held accountable through the court.

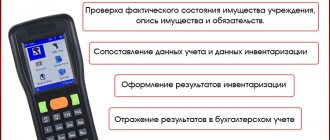

We document the inventory results in postings

The final stage of the inventory is the reconciliation of accounting data, and often there is a need to write off shortages or, on the contrary, to capitalize excess values.

How to reflect in postings the identified shortages during inventory

The shortage must be reflected on account 94 in correspondence with the account for the property being written off:

- Dt 94 K 10(41,43,01)

Next, we proceed in one of two ways:

1) The perpetrators have not been identified (not found).

You can write off the shortage within the approved norms of natural loss as expenses for the main activity. Shortage during wiring inventory:

- Dt 20 (23,25,26,44) Kt 94

If natural loss rates for certain types of property are not established or the shortage exceeds them, then it is charged to other expenses and reflected by posting:

- Dt 91.2 Kt 94

It is important to remember that in tax accounting it is impossible to recognize expenses in excess of the norms of natural loss (Article 254 of the Tax Code of the Russian Federation).

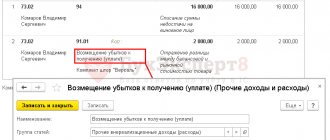

2) The perpetrators are identified, the damage is compensated at their expense.

In this situation, an important role is played by the presence and content of an agreement on financial liability, as well as the norms of the Labor Code of the Russian Federation, which contain instructions on the maximum amount and procedure for deducting amounts from employees’ wages. If the guilty person is not an employee of the organization and agrees to compensate for the damage (it is better to draw up an agreement on voluntary compensation for damage), then you can deposit the money into the cash register or into a current account. The accountant will reflect the shortage by posting:

- Dt 73 Kt 94 – the shortage is attributed to the guilty person;

- Dt 50 (51) Kt 73 – the guilty person compensated for the shortage.

If compensation for the shortfall is determined at a market value exceeding the book value, then the excess amount is reflected in the following entries:

- Dt 73 Kt 98 - the difference in the cost of the shortage is reflected;

- Dt 98 Kt 91 - the difference is attributed to other income.

If a person does not plead guilty and does not agree to compensate for the damage, then the shortfall is written off as other expenses (as in the case of an unidentified culprit) and awaits a court decision.

How to reflect in postings identified surpluses during inventory

As a rule, surpluses are detected less frequently during inventory. They are accounted for at market value, which must be confirmed in one of the following ways:

- A company certificate compiled on the basis of an analysis of prices for similar property (invoices from suppliers, advertisements for the sale of similar objects in the media, a certificate from statistical authorities, etc.);

- A certificate prepared by an independent appraiser (more preferable).

Excess valuables at market prices are included in other income and capitalized using the following entry:

- Dt 10 (41,01,50) Kt 91.1

Re-grading

If the audit reveals a shortage of one value and a surplus of another, this fact must also be reflected in accounting.

Situation: During an inventory of the spare parts warehouse, a shortage of three bushings costing 4,500 rubles per piece was revealed, and a surplus in the form of three injectors costing 6,700 rubles per piece.

Let's reflect in accounting:

| Dt | CT | Sum | Explanation | Document |

| 94 | 10.5 | 13 500,00 | A shortage of bushings was determined (writing off inventory items) | Inventory INV-3, statement INV-19 |

| 10.5 | 94 | 20 100,00 | Injectors are capitalized | Inventory INV-3, statement INV-19 |

| 94 | 91.1 | 6 600,00 | Other income recognized | Accounting certificate |

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Seller's shortage

The actual presence of inventory items is revealed during the inventory (Part 2 of Article 11 of the Federal Law “On Accounting”). We remind you that the inventory procedure is regulated by:

- Guidelines for inventory of property and financial obligations (approved by order of the Ministry of Finance of Russia dated June 13, 1995 No. 49);

- subsection IV “Inventory and inspection” of section I of the Methodological guidelines for accounting of inventories (approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n).

Inventories are carried out in a planned manner established by the head of the organization. However, an inventory is mandatory before drawing up annual financial statements (except for property, the inventory of which was carried out no earlier than October 1 of the reporting year), when financially responsible persons change, or when facts of property theft are revealed.

Verification of the actual availability of property is carried out with the obligatory participation of financially responsible persons.

EXAMPLE 1. CASE FROM PRACTICE

During the inventory process, the seller was informed about a sudden attack of illness in a disabled child. Having warned the administration about the impossibility of further participation in the inventory, the employee left the store. At the same time, she asked to postpone the inventory to the next day. Her request was not fulfilled and the inventory was completed without her participation. As a result of the inventory, a shortage was identified. However, under such circumstances, the employee’s financial liability is excluded. Firstly, her action was dictated by extreme necessity, and secondly, in the absence of a financially responsible person, the employer was obliged to suspend the inventory.

Based on Article 246 of the Labor Code, the amount of damage caused to the employer due to loss and damage to property is determined by actual losses, calculated on the basis of market prices prevailing in the area on the day the damage was caused, but not lower than the value of the property according to accounting data.

The actual cost of missing inventory items is reflected in the debit of account 94 “Shortages and losses from damage to assets”:

DEBIT 94 CREDIT 41

— reflects the amount of shortage of goods.

At the same time, VAT amounts on written-off goods that were previously lawfully accepted for deduction are not subject to restoration (decision of the Supreme Arbitration Court of the Russian Federation dated May 19, 2011 No. 3943/11).

Based on Article 247 of the Labor Code, requiring a written explanation from the employee to establish the cause of the damage is mandatory. In case of refusal or evasion of the employee from providing the specified explanation, a corresponding act is drawn up.

Shortage order

Based on the explanatory note, a decision must be made:

- the employee is guilty;

- innocent;

- it is necessary to assemble a commission to investigate.

As a result, a paper must be written to confirm one of the three intentions. It states:

- a brief description of the situation;

- persons involved;

- resolution.

Drafting sample

Shortage in stock

Warehouses have a constant flow of inventory items, so goods are often lost here. Let's figure out why this happens.

Causes

- Lost documents or filled them out incorrectly. The invoice arrived, they issued the commodity units according to it, but did not put it in the book.

- Lack of equipment, poor accounting conditions.

- Unforeseen factors that led to damage.

- Theft.

What to do

It is worth conducting an investigation according to the above standards, that is, start by obtaining explanatory notes, then issue an order. On its basis, make either a write-off as an expense or a recovery from the culprit. We also recommend installing CCTV cameras to monitor possible acts of theft.

How to avoid

We recommend keeping records using special devices and programs. Based on them, lists and documents are independently generated. This greatly simplifies all warehouse activities - deliveries and shipments. You can order such equipment and software at.

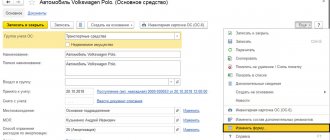

If your enterprise uses “1C: Accounting” in any delivery, “1C: UPP” or 1C for a construction organization, and you plan to carry out inventory only on barcodes (you will not use RFID), then a special driver for inventory is completely suitable for you from Cleverens, the delivery package of which includes all the programs and processing necessary both for printing labels and for working with the data collection terminal.

If you are using 1C, but you plan to implement RFID, then another program is suitable for you - Cleverence: Property Accounting. Also, there are software products for stores and warehouses that will help optimize and automate inventory accounting, as well as eliminate cases of shortages during inventory.

See how Magazin 15 helps automate the inventory process in a chain of building materials hypermarkets. As a result of implementation, the process became much simpler and made it possible to abandon the involvement of outsourcing companies.