Why is dismantling necessary?

The need to dismantle a fixed asset may arise as a result of the partial liquidation of an object or become an independent business operation, as a result of which several independent objects are formed that need to be formalized and registered.

Signs of dismantling of a fixed asset:

- the fixed asset was previously accepted for accounting (budget) accounting as one inventory item (inventory unit);

- there is a decision of the Commission on the receipt and disposal of assets operating in the institution (clause 34 of Instruction No. 157n);

- the fixed asset is disassembled (divided) into separate parts, which are taken into account as independent objects of fixed assets or are subject to dismantling and destruction.

The dismantling of a fixed asset must be properly documented and reflected in accounting (budget) and tax accounting if your fixed asset is depreciable.

It is not allowed to carry out measures to dismantle a fixed asset without a documentary basis, that is, until the Commission approves the relevant act.

Accounting for unbundling

Since neither the PBU nor the Methodological Instructions contain regulations on the procedure for accounting for disaggregated fixed assets, one has to be guided by expert opinions. The method of reflecting the unbundling and the procedure for this operation must be reflected in the accounting policies of the enterprise. There are two accepted accounting options for the division of fixed assets.

Breakdown postings as depreciation transfers

There are no economic consequences of unbundling, that is, income does not increase or decrease. Based on this, this procedure cannot be considered an operation for posting income or expenses (clause 2 of PBU 9/99 and 10/99). It is proposed to take into account changes in the cost of fixed assets by transferring depreciation amounts from the whole object to its parts. Postings and accounting entries:

- debit 01 “Fixed assets”, subaccount “Established object 1”, credit 01, subaccount “Initial object” - the initial cost of the newly formed object 1 has been formed;

- debit 02 “Depreciation of fixed assets”, subaccount “Initial object”, credit 02, subaccount “Newly formed object 1” - the amount of accrued depreciation related to the newly allocated object has been transferred.

Then the same transactions are made in relation to the remaining resulting objects (if they exist).

IMPORTANT! The initial cost of fixed assets and already accrued depreciation are divided between the resulting objects depending on the value of the new accounting objects.

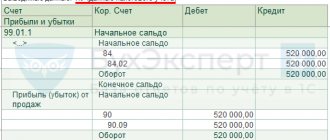

Postings of unbundling as the formation of new operating systems

If we assume that unbundling is the disposal of the original object and the emergence of others, although this is essentially a different business transaction, one should take into account the income and expenses from write-off and registration in a certain accounting period. The wiring will be more complicated:

- debit 01, sub-account “Disposal of fixed assets”, credit 01, sub-account “Initial object” - the initial cost of the original object of fixed assets is written off;

- debit 02, subaccount “Initial object”, credit 01, subaccount “Disposal of fixed assets” - the amount of accumulated depreciation on the original object of fixed assets is written off;

- debit 91 “Other income and expenses”, subaccount 2 “Other expenses”, credit 01, subaccount “Disposal of fixed assets” - the residual value of the old fixed asset item is written off.

At the same time, the following transactions are made:

- debit 08 “Investments in non-current assets”, subaccount “Established object 1”, credit 91, subaccount “Other income” - the emergence of a new object is reflected;

- debit 01, subaccount “Created object 1”, credit 08 – created object 1 is included in the fixed assets.

The same postings are made for each part of the disaggregated fixed asset.

FOR YOUR INFORMATION! With this approach, you need to re-evaluate the OS and set the useful life, but in a particular case it will simply coincide with the primary one.

How to arrange dismantling

When dismantling a fixed asset, it must be excluded from accounting. The basis for the accountant to reflect such a transaction will be the decision of the Commission on the receipt and disposal of assets, documented in the appropriate act depending on the type of fixed asset (clauses 34, 51 of Instruction No. 157n):

- act on the write-off of non-financial assets (except for vehicles) (f. 0504104);

- act on the write-off of soft and household equipment (f. 0504143);

- act on the write-off of excluded objects of the library collection (f. 0504144).

The tax consequences of “profitable” expenses depend on the correct qualification of fixed assets.

Thus, in one of the arbitration cases, a dispute with the tax inspectorate arose over the recording of a video surveillance system as a separate inventory item.

Moreover, each object included in the video surveillance system is suitable for installation in various configurations, is easily replaced and can function from each other at an arbitrary distance depending on the connection method, and their fixation as part of a separate set makes it difficult to correctly reflect their subsequent movements.

RESTORATION OF ACCOUNTING COST

According to the Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 “On the Classification of fixed assets included in depreciation groups”, the following useful life periods are established for video surveillance system objects:

- video camera – 5-7 years;

- cable for video systems – 20-25 years;

- installation kit – 3-5 years;

- Pentium-4 computer with monitor and 8-channel board – 2-3 years;

- Uninterruptible power supply – 3-5 years.

On this basis, the judges concluded that each of the above objects should be taken into account as an independent inventory object, since the useful life of individual objects of the video surveillance system deviates significantly from each other.

And since the cost of each object included in the video surveillance system separately (with the exception of the computer) was less than the established limit for accounting for fixed assets as part of depreciable property (in the disputed period - less than 10,000 rubles per unit), the company rightfully attributed their cost , as well as the cost of installation of equipment for one-time income tax expenses (Resolution of the Federal Antimonopoly Service of the Volga Region dated October 9, 2012 No. A65-30918/2011).

What entries should be included in accounting (budget) accounting?

Review correspondence for various types of institutions.

The first step is to write off the fixed asset. Let us remind you that all transactions with fixed assets are recorded at their original (book) cost.

Postings in the budget accounting of a government institution:

| Contents of operation | Debit | Credit | Rationale |

| Write-off of the book value of fixed assets | KDB 1.401.10.172 | KRB 1.101.ХХ.410 | clause 10 of Instruction No. 162n |

| Write-off of accrued depreciation and (or) impairment loss (if any) | KRB 1.104.ХХ.411 KRB 1.114.ХХ.412 | KDB 1.401.10.172 |

Postings in the accounting of a budgetary institution:

| Contents of operation | Debit | Credit | Rationale |

| Write-off of the book value of fixed assets | 0.401.10.172 | 0.101.ХХ.410 | clause 12 of Instruction No. 174n |

| Write-off of accrued depreciation and (or) impairment loss (if any) | 0.104.ХХ.411 0.114.ХХ.412 | 0.401.10.172 |

Postings in the accounting records of an autonomous institution:

| Contents of operation | Debit | Credit | Rationale |

| Write-off of the book value of fixed assets | 0.401.10.172 | 0.101.ХХ.410 | clause 12 of Instruction No. 183n |

| Write-off of accrued depreciation and (or) impairment loss (if any) | 0.104.ХХ.411 0.114.ХХ.412 | 0.401.10.172 |

In the correspondence accounts given in the table, in 24-26 digits of the account number, KOSGU codes are indicated (clause 3 of Instruction No. 183n). However, according to clause 21 of Instruction No. 157n, autonomous institutions in these categories account numbers of the working chart of accounts reflect the analytical code of receipts and disposals of accounting objects. We recommend that you formalize the applicable procedure for generating an account number in your accounting policy.

The second step is recognition (acceptance for accounting) of independent fixed assets formed as a result of dismantling. This operation must be documented with a supporting document (primary accounting document) (clause 34 of Instruction No. 157n). We propose to draw up an act on the acceptance and transfer of non-financial assets (f. 0504101).

The valuation of fixed assets accepted for accounting is carried out at the cost at which they were previously recorded before the merger (creation of a complex of fixed assets). Distribute accrued depreciation and losses from impairment of dismantled fixed assets among the received fixed assets based on their cost.

Postings in the budget accounting of a government institution:

| Contents of operation | Debit | Credit | Rationale |

| Accounting for fixed assets, as well as depreciation and impairment losses | KRB 1.101.ХХ.310 KDB 1.401.10.172 | KDB 1.401.10.172 KRB 1.104.ХХ.411 KRB 1.114.ХХ.412 | Clause 10 of Instruction No. 162n |

Postings in the accounting of a budgetary institution:

| Contents of operation | Debit | Credit | Rationale |

| Accounting for fixed assets, as well as depreciation and impairment losses | 0.101.ХХ.310 0.401.10.172 | 0.401.10.172 0.104.ХХ.411 0.114.ХХ.412 | Clause 12 of Instruction No. 174n |

Postings in the accounting records of an autonomous institution:

| Contents of operation | Debit | Credit | Rationale |

| Accounting for fixed assets, as well as depreciation and impairment losses | 0.101.ХХ.310 0.401.10.172 | 0.401.10.172 0.104.ХХ.411 0.114.ХХ.412 | Clause 12 of Instruction No. 183n |

In the correspondence accounts given in the table in 24 - 26 digits of the account number, KOSGU codes are indicated (clause 3 of Instruction No. 183n).

For fixed assets accepted for accounting, open new inventory cards (f. 0504031 or f. 0504032) (clause 54 of Instruction No. 157n, Guidelines for the use of forms of primary accounting documents and the formation of accounting registers).

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Pravo-info » Articles from magazines » HOW TO ACCOUNT FOR “COMPLEX” PROPERTY: AS ONE OS OBJECT OR SEVERAL

Polyanskaya V.A.

Many accountants, when taking into account property that has several components, thought about this issue. After all, it is not always possible to unambiguously determine whether assets are separate OS objects or whether they are one (single) object.

However, by unreasonably dividing one fixed asset into several inventory objects and writing off as expenses at a time the cost of those objects that cost no more than 40,000 rubles. <1>, you can underestimate income tax and property tax. In addition, when dividing an object into several parts, there is a possibility of incorrect determination of its original cost.

Let's see what you need to focus on.

Accounting and property tax

The main guideline is PBU 6/01 “Accounting for fixed assets”, which establishes that the unit of accounting for fixed assets is an inventory item, which can be <2>:

<or> object with all fixtures and accessories;

<or> a separate structurally isolated object intended to perform certain independent functions;

<or> a separate complex of structurally articulated objects, representing a single whole, intended to perform a specific job. Moreover, it may include one or more objects of the same or different purposes, which have common devices and accessories, common control, are mounted on the same foundation and can perform their functions only as part of the complex.

But, as we see, these are only general principles. But there is no specific definition in PBU 6/01. The only thing that the PBU talks about more specifically in relation to our question is that if there is a significant difference in useful life (SPI), the component parts must be taken into account as separate inventory items <3>. Although what is considered a significant difference in useful life is not specified. This remains at the discretion of the accountant himself.

You determine the useful life yourself, based on the following criteria <4>:

<or> the expected period of use of the facility in accordance with the expected productivity or capacity;

<or> expected physical wear and tear, depending on the operating mode, natural conditions and the influence of an aggressive environment, the repair system;

<or> regulatory and other restrictions on the use of this object.

Of course, it is usually easier for an accountant to split property. Especially if parts of a complex object cost less than 40,000 rubles. Then you can account for them as separate objects, so that the costs of their acquisition can be written off at a time and without having to create inventory cards for them.

Or, for example, if the SPI of objects differs significantly, then at the moment when a part of the OS with a short period of use breaks down, it will be possible to simply write it off. This is especially true if such a part has a significant value. Otherwise, if this particular part is replaced, you will either have to liquidate the entire object and create a new one, or reflect its reconstruction.

The Ministry of Finance in relation to the components of real estate objects believes that they can be taken into account as independent inventory objects if <5>:

— such property does not require installation;

— it can be used separately from the property complex;

— its purpose does not coincide with the functional purpose of the entire complex;

— its dismantling will not affect their purpose.

These criteria, in particular, include elevators, built-in ventilation systems, local networks, and other building communications.

As a result, you need to choose the option for accounting for a complex OS yourself based on your professional judgment and technical characteristics of the object.

The only risk you may face is an underestimation, according to tax authorities, of the property tax base. After all, the object of property tax is property recorded on the balance sheet as fixed assets according to accounting rules <6>. And, if you write off parts of a complex OS costing less than 40,000 rubles. at the same time, you may be accused of understating the tax base.

But the courts, as a rule, are on the side of organizations <7>. Therefore, it is important to prepare a justification for the chosen method. For example, if you decide to account for objects separately based on a significant difference in their PPI, then it is better that this is confirmed by technical documentation for the property.

Income tax

In the Tax Code of the Russian Federation there is no concept of “inventory object”, but there is the concept of “fixed asset” - property used as a means of labor <8>.

And the Ministry of Finance in its latest clarifications uses this very term, indicating that when identifying accounting units as separate objects of depreciable property, one must focus on the ability of each component of a complex object to perform its functions separately and the possibility of using each part as an independent means of labor <9> .

But most often accountants turn to the Classification of fixed assets included in depreciation groups <10>. If the property accepted for accounting is named there as a separate object, which has its own useful life, then for the purposes of calculating income tax it can be taken into account as an independent object of depreciable property.

And the courts support organizations that have taken into account property object by object, guided by their useful life according to Classification <11>.

Although, if you take into account a complex OS as one object, based on the unified integrity of all its parts, despite the deadlines, and the tax authorities make claims against you (after all, when such an OS begins to break down, replacement of even expensive parts is carried out as a repair <12>), then here too the court will still support you <13>.

* * *

You have the right to choose your own accounting option. In this case, it is better to take into account all factors: the specifics of the organization’s activities, the type of property, useful life, the possibility of using each component as an independent means of labor.

——————————-

<1> clause 1 art. 256 Tax Code of the Russian Federation; clause 5 PBU 6/01

<2> clause 6 PBU 6/01; clause 10 of the Guidelines, approved. By Order of the Ministry of Finance dated October 13, 2003 N 91n

<3> clause 6 PBU 6/01

<4> clause 20 PBU 6/01; clause 59 of the Methodological Instructions, approved. By Order of the Ministry of Finance dated October 13, 2003 N 91n

<5> Letters of the Ministry of Finance dated October 23, 2009 N 03-03-06/2/203, dated September 23, 2008 N 03-05-05-01/57, dated June 26, 2006 N 03-06-01-04/136

<6> art. 374 Tax Code of the Russian Federation

<7> Resolution of the Federal Antimonopoly Service of the Eastern Military District of August 25, 2010 N A29-12544/2009; FAS North Caucasus Region dated May 12, 2009 N A53-18043/2008-C5-34

<8> clause 1 art. 257 Tax Code of the Russian Federation

<9> Letters of the Ministry of Finance dated 02.06.2010 N 03-03-06/2/110, dated 06.11.2009 N 03-03-06/4/95, dated 04.09.2007 N 03-03-06/1/639

<10> approved Government Decree No. 1 of 01.01.2002

<11> Resolutions of the FAS MO dated September 16, 2011 N A40-130812/10-127-755, dated January 21, 2011 N KA-A40/16849-10, FAS UO dated February 17, 2010 N F09-564/10-S3; FAS PO dated January 26, 2010 N A65-8600/2009; FAS CO dated September 10, 2009 N A08-8752/2008-16

<12> clause 1 art. 260 Tax Code of the Russian Federation

<13> Resolution of the Federal Antimonopoly Service of the Eastern Military District of August 25, 2010 N A29-12544/2009; FAS DVO dated December 29, 2009 N A24-5934/2008

First published in the journal "Glavnaya Ledger" 2012, N 3

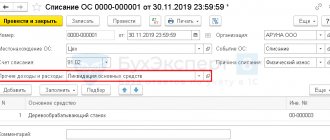

Disposal of an inventory item as a result of dismantling in 1C

The disposal of fixed assets as a result of dismantling is documented in the document “Write-off of assets of fixed assets, intangible assets, legal acts” (Section “Assets, intangible assets, legal acts” - command of the navigation panel “Write-off of objects of fixed assets, intangible assets, and legal acts”). When filling out the document on the line “Type of write-off”, you should select the value “Write-off of own fixed assets on the balance sheet (101, 102, 103)”. On the “Fixed Assets, Intangible Assets, Legal Entities” tab, we indicate the inventory item that is subject to dismantling and the reason for write-off. The remaining details will be filled in automatically.

On the “Accounting transaction” tab, to generate transactions in the “Typical transaction” attribute, select the operation “Disassembly of OS objects (401.10.172)”. Account 401.10.172 is automatically indicated as the write-off account. In the “Account” line, indicate the KPS and post the document.

When posting a document in the usual manner, depreciation is calculated for the current month (for objects with a linear depreciation method) and accounting records are generated for writing off the book value and depreciation in correspondence with account 401.10.172.

From the document you can generate an “Act on the write-off of non-financial assets (except vehicles) (form 0504104)” and/or an “Accounting certificate (form 0504833)”.

Property tax disputes

Tax disputes regarding the disaggregation of a fixed asset are associated, first of all, with the legality of applying tax benefits established by Article 381 of the Tax Code of the Russian Federation or reduced property tax rates. Thus, in terms of public railways, public federal highways, main pipelines, energy transmission lines, as well as structures that are an integral technological part of these facilities, tax rates established by the laws of the constituent entities of the Russian Federation should not exceed in 2016 - 1.3 %, in 2022 - 1.6%, in 2022 - 1.9%.

To apply the right to a benefit (after 2013 - a reduced rate), the property must comply with the notes of the List of property related to public railways, public federal highways, main pipelines, energy transmission lines, as well as structures that are an integral technological part of these objects , approved by Decree of the Government of the Russian Federation dated September 30, 2004 No. 504 “On the list of property related to public railways, public federal highways, main pipelines, power transmission lines, as well as structures that are an integral technological part of these objects, in relation to which organizations are exempt from corporate property tax" (hereinafter referred to as List No. 504) by its name and functional purpose, or the object must be an integral technological part of the object, the OKOF code of which is included in List No. 504.