The practice of issuing sick leave is well known to employees and employers. Sick leave is needed to pay temporary disability benefits. It confirms that the employee was absent from work for a valid reason.

However, there are conflicts in calculations. One of the possibilities is calculation from the minimum wage. In what cases is this practice resorted to? What features must be observed when filling out a sick leave certificate?

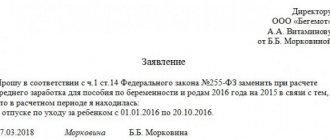

Filling out sick leave from the minimum wage: sample

Important aspects

The minimum wage (minimum wage) is an important factor in many areas: social, economic and even political. In digital terms, this is the minimum monthly salary threshold. The value is approved by the government of the Russian Federation, and in the regions by local authorities together with trade unions. It is important that the regional minimum wage cannot be less than the federal one.

The indicator influences the regulation of labor relations. The employer has no right to pay wages below this figure. Such cases are punishable by administrative liability. In this case, the form of ownership of the organization does not matter.

The minimum wage is used when calculating social benefits and taxes. This is one of the state-level guarantees that ensures wages for employees who have entered into an agreement.

The salary cannot be less than the established minimum wage

This rule does not apply to partners in a civil contract. In such cases, calculations of wages and minimum wage benefits are not carried out. The same rule applies to payment for newsletters.

Important ! Compensation is provided only for employees who have signed an employment contract.

Using the minimum wage to calculate the amount of sick leave payments

Let's consider the cases provided for by the regulations of the Russian Federation, in which the cash benefit on the ballot is calculated on the basis of the minimum wage:

- employment for a negotiated period not recorded in the work book;

- entries in the employee’s work book are less than 6 months;

- the reason for issuing sick leave was alcohol intoxication;

- the amount of wages is below the minimum wage;

- during treatment, the employee violated the prescribed rules;

- the employee for whom the certificate of incapacity for work was issued violated the schedule of visiting a medical specialist;

- the citizen’s work experience was interrupted in the previous two years.

In certain cases, sick leave benefits are calculated based on the minimum wage

Important ! Here you can download the sick leave form

Rules for filling out electronic sick leave certificates

Paper certificates of incapacity for work are issued less and less often, since now the patient has the right to choose an electronic document. This is convenient if the employee is in quarantine, working remotely, gets sick on a business trip, or is undergoing treatment in another city.

Data on all electronic certificates of incapacity for work are entered into a special register. To work with it, a unified information system was developed, the operator of which is the FSS. The employer can obtain information at any time; to do this, you will need to log into your personal account. This requires a qualified electronic signature. The FSS register stores information about all sick leave issued to employees of this company.

To gain access to the system, you need computer equipment that meets the minimum requirements. If the employer does not have such equipment (there is no technical ability to obtain data), then the sick leave is duplicated on paper.

How to fill out the register for an electronic sick leave for the Social Insurance Fund if there is no 2-personal income tax for the employee for previous years? In this case, the employer requests a certificate from the employee in format 182n. This document is the basis for calculating benefits if the employee worked elsewhere in the previous two years. The 2-NDFL certificate is not needed, since it does not contain the information necessary for the calculation and assignment of VNiM benefits.

How to fill out documents in case of temporary disability?

In order to correctly draw up a certificate of incapacity for work, you need to have some quantities on hand. This list includes the following:

- employment records of the sick employee;

- average daily earnings of an employee;

- how much earnings the employee received during the two years before settlement;

- final calculation figure.

A significant point is that in this case the role of the minimum wage is played by the size of the monthly salary.

The rules require filling out the form with a black ink pen (ballpoint pens are not permitted) if the document is written by hand. When using a computer, only black printer ink is selected.

Important ! The text is typed in capital letters, starting from the first cell. All columns must be filled out carefully, including spaces.

It is important that all columns on the sick leave sheet are filled out clearly and accurately.

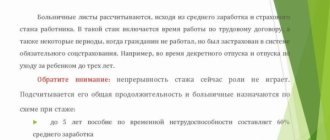

There are subtleties in calculating work experience. To do this, the period of work of the employee in this organization, during which the employer transferred insurance premiums, is calculated (the days before the start of sick leave are taken into account). Inaccuracies in calculations are unacceptable. Otherwise, the employee will remain without full compensation for sickness benefits and will suffer from a violation of his personal rights.

The next parameter is average earnings. The calculation is made on the basis of all payments that were transferred to the employee for the entire period under review.

The accuracy and correctness of the calculations is due to the fact that part of these payments is intended for making contributions to the funds.

When calculating sick leave payments, the employee’s average daily earnings are taken into account

If there is no salary or its small amount, the accrual amount will be 24 times the minimum wage for the time in question.

The sickness benefit includes two amounts. Part of the amount is provided by the employer. The second part is payment from the social insurance fund. Therefore, the numbers on the certificate of incapacity for work are written in two different columns.

Important ! The total value of the sick leave benefit is also recorded (in a separate field).

There are cases of exceptions. An example would be a case where documents were issued to an employee, but the cause was a child’s illness. This case is provided for by law - the payment amounts will come from the Social Insurance Fund in full. The column intended for entering amounts from the employer will remain empty.

If an employee takes sick leave in case of illness of his child, the benefit is fully paid by the Social Insurance Fund

If the fact of illness relates to a working employee, both columns are filled in with numbers that in total are equal to the payment for sick leave. It is important to know that the employer provides an invoice for the first three days. The employee will receive the rest from the Fund.

Step-by-step instructions: how to apply for sick leave in 2021

If the employer makes a mistake when drawing up a document, then the inaccuracies will have to be corrected according to the established rules. To avoid mistakes, we fill out the sick leave certificate correctly in the section for the employer.

Step No. 1. Indicate the name of the employer

In the provided cells, in capital block letters, enter the abbreviated name of the organization. If there is no abbreviated name, enter the full name. Abort when the field cells run out. There is no need to put quotation marks. The space between words is one empty cell.

Step No. 2. Specify the type of employment

We determine what place of work the employee is employed in: primary or part-time. Check the appropriate box on the completed sick leave form.

Specialists who work part-time in several companies at once have the right to provide a certificate of incapacity for work to each of their employers. In this case, the medical institution issues several certificates of incapacity for work at once - one for each organization.

Step No. 3. Specify the registration code in the Social Insurance Fund and the code of subordination

In this field you must indicate the code assigned to the company upon registration with the territorial branch of the Social Insurance Fund. Let us remind you that FSS representatives register policyholders independently. The procedure for entering an organization into the Social Insurance information database is carried out on the basis of information sent by the Federal Tax Service when registering a taxpayer.

The subordination code identifies the FSS branch to which the employer is attached. We indicate the four-digit branch code. If the company is attached to the fund's head office (not to a branch), then the code consists of 5 characters.

Step No. 4. Specify the employee’s INN and SNILS

We indicate the number of the sick employee’s insurance certificate issued by the Pension Fund of Russia. The TIN is indicated only if it is available. If the employee does not have a TIN or there is no information about the code, then leave the field blank.

Step No. 5. Determine special conditions for calculating benefits

In some cases, the calculation of sickness benefits differs from generally accepted norms. Each exception has a unique code. All types of special calculation conditions are listed on the back of the form (codes 43 to 51).

Step No. 6. Provide information about the work injury

If a certificate of incapacity for work is issued due to the fact that the employee was injured at work, then it is necessary to fill out a special field in the form. This is the date when the act was drawn up in form N-1. If the employee’s illness is not related to work-related injuries (see example of an employer’s sick leave form), this field is not filled out.

Step No. 7. Specify the start date of work

In most cases, the employer leaves this field on the sick leave blank. It will have to be filled out if the employee violated the deadlines within which he was supposed to start work. Such a violation becomes grounds for cancellation of the employment contract. If the contract was terminated, then in the “Date of start of work” column on the sick leave, what should I put in 2022? In this field, indicate the start date of work under the employment agreement.

Step No. 8. Determine insurance and non-insurance periods

The insurance period is all periods of an employee’s work activity during which he was insured, and the employer paid VNiM insurance premiums for him. Usually these are periods of work under employment contracts, but the total insurance period will also have to include periods of service in internal affairs bodies, periods of military and civil service.

In non-insurance periods, include periods of military service starting from 01/01/2007. If the service began before the specified date, then indicate in the column the period from 01/01/2007 to the actual end date.

IMPORTANT!

The employer enters the duration of the periods in years and full months on the certificate of incapacity for work. Non-insurance periods are necessarily included in the total insurance period.

Step No. 9. Specify the periods for calculating benefits

These columns of the certificate of incapacity for work are filled in with the dates of the beginning and end of the illness. Format for entering information: DD.MM.YYYY.

IMPORTANT!

Important information about the duration of illnesses: “Maximum duration of sick leave in 2022.”

Step No. 10. Calculate average earnings

To calculate sickness benefits, you will need to calculate several calculations. Average earnings for calculating benefits is one of them. It is determined in total for the two calendar years preceding the year of illness. Include only those amounts from which VNIM contributions were calculated.

Step No. 11. Calculate earnings per day

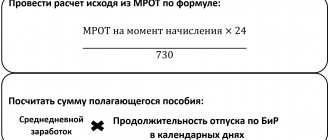

To calculate the average daily earnings, the amount of average earnings is divided by the number of days worked. We divide two fully worked years into 730 days. Please note that this algorithm is not applicable to the calculation of maternity benefits. The procedure for calculating and registering sick leave for pregnancy and childbirth in 2021 is in the article “How to calculate sick leave for pregnancy and childbirth.”

Step No. 12. Calculate benefit amounts

As a general rule, sickness benefits are paid from two sources:

- The first three days are paid by the employer.

- Remaining sick days - Social Insurance Fund.

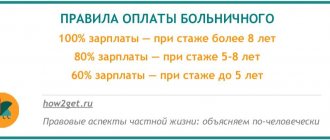

The calculation is made taking into account the length of service coefficient. For work experience from 6 months to 5 years, pay a benefit in the amount of 60% of average earnings, from 5 to 8 years - 80%, over 8 years - 100%.

If the total insurance period is less than six months, the benefit is calculated based on the minimum wage.

For more information on how to fill out a sick leave from the minimum wage in 2022, see the article “Why do you need a minimum wage for a sick leave?”

Enter the information on the sick leave form in the following order: in the columns, fill in the appropriate amounts at the expense of the employer and at the expense of the Social Insurance Fund. Then add up the total (the total amount of payments from both sources).

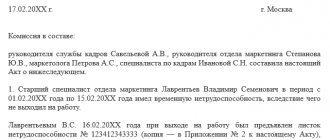

Step No. 13. Indicate the responsible persons

The rules for issuing sick leave by an employer in 2022 provide that the form is signed by the employer and the chief accountant of the enterprise. Please note that the initials of the manager and chief accountant are indicated without dots.

IMPORTANT!

If the organization does not have a chief accountant position, the manager signs the calculation twice. That is, full name. and the signature of the boss on the sick leave form filled out by the employer are duplicated.

IMPORTANT!

The completed calculation on the sick leave certificate should be certified with a round seal, but only if the employer has one. Make sure that the print does not fall on the filled cells. Otherwise, reading problems will occur.

Current example of filling out sick leave by an employer in 2021

How are calculations made if the average earnings are less than the minimum wage?

If during the period under review there were no salary accruals or its size was below the minimum wage level, then calculations are carried out taking the level of monthly income equal to the minimum wage level.

Entries on the sick leave sheet made by the employer will differ only in the calculation of sick leave benefits. The average earnings will be equal to 24 minimum wages.

The column “average daily earnings” is filled in with the value “minimum amount” for one day, which will be 311.97 rubles. The calculation is based on the fact that the minimum wage is 9,489 rubles. This amount increased by 367 rubles from May 1, as the minimum wage increased to 11,163 rubles.

If the employee’s earnings were below the minimum wage, sick leave payments are calculated taking into account the minimum wage

In the column “At the expense of the employer” there will be an amount equal to payments for three days. It is calculated by multiplying the minimum amount by the percentage of payment for the certificate of incapacity for work.

In numbers it looks like this: 311.97 * 3 *% payment for sick leave.

This means that in the column “At the expense of the fund” there will be the product of the minimum amount by the remaining days on sick leave and the percentage of payment.

Substituting the numbers, we get: 311.97*remaining days on sick leave*% of payment.

The “Total” column indicates the sum of the two figures obtained from the calculations given above.

The first three days of illness are paid by the employer, the rest - from the Social Insurance Fund

Operations with numbers are carried out by human resources specialists or accounting employees.

Important ! The employer is responsible for the employee's salary level.

If the regional coefficient is set

Labor in areas with different climatic conditions is paid more. The coefficients are usually used in the Far North, Western Siberia, Kazakhstan, and the Urals.

In relation to sick leave benefits, the regional coefficient is taken into account only when calculating from the minimum wage, in all other cases not.

Learn more about using a multiplying factor when calculating benefits.

In entities where a regional coefficient exists, the employer must perform the following actions:

- Calculate daily earnings based on total work activity.

- Calculate a similar indicator based on the minimum wage.

- Compare average daily earnings and actual income and minimum wage.

- Select a larger value and use it to calculate sick leave benefits.

- Multiply the received benefit amount by the regional coefficient.

If the choice is made in favor of calculation based on the minimum wage, then the following is filled out on the certificate of incapacity for work:

Formula:

Average earnings = 24*minimum wage;

Average daily = minimum wage*24/730;

The benefit amounts are already indicated taking into account multiplication by the regional coefficient (average daily earnings * Sick days * % of payment * Regional coefficient).

The size of the disability payment may be reduced in some cases. These include:

- violation by the employee of the regime prescribed by the attending doctor;

- absence of an employee from a mandatory medical examination.

The reasons for violating the regime can be very different. The main thing is the absence of valid reasons. Therefore, first of all, when an organization’s accounting department receives a certificate of incapacity for work, the employer should find out whether the reasons for violating the regime were valid.

Example

Example conditions:

The employee’s income for 2016 is 50,000, for 2022 – 90,000.

Sick leave is open in May 2022 for 7 days.

Regional coefficient = 1.2

Employee experience 3 years.

It is necessary to calculate the disability payment and fill out the form.

Calculation:

Daily earnings by income = (50000+90000) / 730 = 191.78 - this is less than the minimum 311.97, so calculations are made from the minimum wage.

Benefit at the expense of the employer = 311.97*3*60%*1.2 = 673.86.

Benefit from the Social Insurance Fund = 311.97*4*60%*1.2 = 898.47.

Total payout = 673.86 + 898.47 = 1572.33.

Sample of filling out a sick leave certificate from the minimum wage, taking into account the regional coefficient:

Calculations performed in special cases. Areas with increased odds

The amount of remuneration may vary depending on various parameters. One such example is an increase in wages for workers working in unfavorable climatic conditions. Such geographical areas in our country include the territories of Western Siberia, the Far North, and the Urals.

Important ! When calculating the earnings of workers in the above-mentioned areas, specialists take into account the minimum wage.

Calculation scheme

To calculate temporary disability benefits for workers in the above-mentioned areas, an accountant or human resources specialist must make the following calculations:

- based on entries in the labor record, the average daily earnings are calculated;

- the same indicator is calculated based on the minimum wage;

- compare (compare with the standard) the actual number with the one obtained from the minimum wage;

- choose the number that is larger and make payment based on it;

- the final number is multiplied by the size of the regional coefficient.

When calculating sick leave payments for employees working at compressor stations or in other similar regions, the regional coefficient is taken into account

There are options when the amount of benefits on a certificate of incapacity for work may be underestimated. This is permitted in the following cases:

- the patient violates the treatment regimen prescribed by the doctor;

- the employee misses a visit to a medical organization prescribed by a doctor or other specialist.

What violations of the regime do not affect the reduction of payments on the certificate of incapacity for work? The reasons must be valid.

Important ! To avoid mistakes, the specialist issuing sick leave must find out whether there have been any violations of the treatment regimen.

If the patient violated a certain regime, sick leave payments for him will be less

Calculation of sick leave based on the minimum wage

Every accountant should know in what cases insurance coverage for compulsory social insurance in case of temporary disability is determined based on the minimum wage (minimum wage), as well as the procedure for applying this indicator in calculations. This issue is of interest to employees of budgetary, non-profit organizations and commercial structures.

In accordance with Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ), benefits are calculated on the basis of average daily earnings multiplied by the coefficient taking into account the insurance period, and the number of calendar days of illness.

The coefficient taking into account the insurance period is determined by clause 1 of Art. 7 of Law No. 255-FZ in the following order:

- for an insured person with 8 or more years of insurance experience - 100% of average earnings;

- for an insured person with an insurance period of 5 to 8 years - 80% of average earnings;

- for an insured person with up to 5 years of insurance coverage - 60% of average earnings.

The calculation period for determining the average daily earnings is 2 calendar years preceding the year of the onset of temporary disability (Clause 1, Article 14 of Law No. 255-FZ). Average daily earnings are determined by dividing the amount of accrued earnings for the billing period by 730 (Clause 3, Article 14 of Law No. 255-FZ). If the earnings received are below the minimum wage on the day of the occurrence of the insured event or there were no payments at all to determine it, then the average earnings, on the basis of which temporary disability benefits are calculated, are taken equal to the minimum wage established by federal law on the day of the occurrence of the insured event (clause 1.1 of Art. 14 Law No. 255-FZ).

There are quite a lot of cases when the calculated average daily earnings may be less than the minimum, for example, among young people who have just started their working career, or among people who have a solid work history, but for some reason did not work completely or partially during the calculation period , and therefore the amount of accruals gives a low level of average daily earnings.

It should be noted that the minimum wage from 01/01/2009 to 05/31/2011 was 4330 rubles. per month, and from 06/01/2011 it was increased to 4611 rubles. per month (Article 1 of the Federal Law of June 19, 2000 N 82-FZ “On the minimum wage”). Since the minimum level of monthly wages is determined by law, for comparability we will calculate the minimum average daily earnings: for the period from 06/01/2011 - 4611 rubles. x 24 months / 730 days = 151.60 rubles, and for the period until 05/31/2011 - 4330 rubles. x 24 months / 730 days = 142.36 rub.

Example 1. In the accounting department of a bakery, technologist I.I. Ivanova provided a certificate of incapacity for work for the period from 02/08/2011 to 02/16/2011 for calculation. Insurance experience I.I. Ivanova is 6 years old. In 2009 it did not work, and there are no accruals for calculation. In 2010, she started working on June 1 and the amount of payments taken into account for calculating sick leave amounted to 98,000 rubles.

Let's calculate the amount of the benefit.

Average daily earnings are: 98,000 rubles. / 730 days = 134.25 rub.

The resulting value is less than the minimum wage in effect at the time of illness (RUB 142.36); therefore, temporary disability benefits are calculated based on the minimum wage.

The total amount of benefit I.I. Ivanova, taking into account the insurance period, will be: 142.36 rubles. x 0.8 x 9 days = 1024.99 rub. (0.8 is a coefficient taking into account the insurance period).

When comparing actual and minimum earnings, the described method is not always used. If the insured person, at the time of the occurrence of the insured event, works part-time (part-time, part-time), the average earnings, on the basis of which benefits are calculated in these cases, are determined in proportion to the working hours of the insured person (clause 1.1, article 14 Law N 255-FZ).

Example 2. Lawyer V.V. Petrova works in the organization on a part-time basis - 10 hours per week (working week - 40 hours). To the accounting department of the organization V.V. Petrova submitted a certificate of incapacity for work for the period from 07/06/2011 to 07/14/2011 for calculation. Insurance experience V.V. Petrova is 4 years old. In 2009

How to calculate the amount of sick leave payments based on the minimum wage?

Example No. 1. How is the calculation carried out when the average salary is below the minimum wage?

Limited Liability Company "Progress" paid employee S. for the previous two years the amounts of 117,350.00 and 120,080.00 rubles.

This year, employee S. went on sick leave for 5 days in January. From the initial data, we take into account the total length of service, which is 10 years (as of the current year).

To get the amount of actual earnings, add up the numbers for the selected time: 117,350 + 120,080 = 237,430 rubles.

When calculating sick leave payments, the employee’s income for the previous two years is taken into account.

We calculate the average daily earnings: 237,430 / 730 days = 325.25 rubles.

The same value calculated from the minimum wage is: 11,280 x 24 months / 730 days = 370.85 rubles.

When comparing two calculated values, we choose the larger one. In this case it is 370.85. Therefore, payments will be assigned from the minimum wage.

Employee S. was temporarily disabled for 5 days.

Accruals for this time: 370.85 x 5 days = 1854.25 rubles.

The employer will pay 1112.55 rubles, the employee will receive the remaining amount from the Social Insurance Fund. Based on the calculation - 741.70 rubles (370.85 x 2 days).

If the actual average daily earnings are lower than what is calculated from the minimum wage, sick leave payments will be calculated from the minimum wage

Example No. 2. How to calculate the amount for temporary disability in case of violation of the regime?

Employee K. Techservice LLC was paid a salary for 2022 in the amount of 299,450.00 rubles, and for 2022, 318,300.00 rubles were actually accrued. Employee K. was undergoing treatment from January 14, 2019 to January 22, 2019. The sick leave certificate contains a record of violation of the regime during treatment: code 23 is indicated. In this case, it is assumed that the patient will leave the hospital without the permission of medical specialists. The note was made on January 17th.

By the way! The example shows only one code; the full list can be found in order number 624n, approved in 2011.

If the employee not only ignored the sick leave, but also did not go to the clinic to see the doctor at all and did not bother to fill out the sick leave in full, the result will be unfavorable for him. Days of absence will be counted as an unexcused reason.

The patient could not provide a valid reason. The employee’s length of service at the time of sick leave was 15 years.

If an employee violates the regime, payments will be assigned to him taking into account the minimum wage

Actual (299,450+318,300) / 730 = 846.23 rubles.

According to the calculation from the minimum wage:

11280 / 31 days = 363.87 rubles. We divide by 31, since there are 31 days in the month when the violation was registered.

In this case, we divide the days of treatment into two parts: before the violation, four days (14.01 - 17.01), after the violation - five days (18.01 - 22.01). Total 9.

For the first four days, payment is based on actual average earnings: 846.23 x 4 days = 3384.92 rubles.

For the 5 days following the violation of the regime, the payment is calculated on the basis of the minimum wage: 363.87 x 5 = 1819.35 rubles.

The total amount will be 3384.92 + 1819.35 = 5204.27 rubles.

There are several types of regime violation

Existing violation codes.

| Code | Description |

| 25 | Returning to work without being discharged. |

| 26 | Refusal to refer for medical and social examination. |

| 27 | Late attendance at a medical and social examination. |

| 28 | Other violations. |

Example No. 3. Calculation of payments for an employee with less than six months of work experience

Employee M. came to work at Soyuzprom LLC on January 23, 2019. There are no entries in the work book before this date. It so happened that on January 30 she went on sick leave, which lasted 6 days.

Average daily earnings are calculated from the minimum wage and are equal to 370.85 rubles.

If the employee’s work experience is less than six months, the calculation is also based on the minimum wage

According to the law, if the work experience is less than six months, the benefit payment will be 60% of the calculated one.

370.85 x 60% x 6 days = 1335.06 rubles. This will be the total amount. At the expense of the employer - 3 days, which will amount to 667.53 rubles. From the Social Insurance Fund - the remaining 3 days, and you will get the same amount - 667.53 rubles.

When the work experience is less than 6 months and the disability payment is more than the monthly minimum wage, the following formula is used for calculation: minimum wage / K*.

*K - how many days does the month contain during which the disability occurred.

If the length of service is less than six months, the payment according to the newsletter is 60% of the employee’s salary

Minimum minimum for sick leave in 2022

As a general rule, sick leave benefits are calculated based on the employee’s salary for the two years preceding the illness. But in some cases, sick leave is calculated from the minimum wage. In our material today we will find out what these cases are, what the minimum wage is for these purposes and how to calculate sick leave from the minimum wage in 2022.

The amount of sick leave benefits is calculated from the minimum wage in the following situations:

- the average daily wage of an employee is below the minimum wage;

- the employee's insurance period is less than six months;

- the employee did not work and had no earnings for two years preceding the sick leave;

- the employee violated the hospital regime and/or did not appear for the next medical examination without good reason;

- the cause of incapacity for work was a state of alcohol or drug intoxication.

The minimum wage for 2022 used to calculate sick leave benefits is set at 12,130 rubles. At the same time, in certain regions of the Russian Federation, the legislation of local authorities may provide for regional coefficients that increase the amount of hospital benefits. Read below for information on how to calculate sick leave benefits.

Calculation of sick leave from the minimum wage in 2022

Calculation of sick leave from the minimum wage in 2022 is carried out using the following formula:

Minimum wage X 24 / 730 X Percentage depending on length of service X Number of days of incapacity for work X Regional deflator coefficient

Let's decipher the values included in this formula:

Minimum wage - the formula uses the minimum wage in effect on the date of the onset of the employee’s illness. Those.

if an employee falls ill on any day in 2022, it is necessary to calculate sick leave benefits based on the minimum wage established for 2022 - 12,130 rubles.

Despite the fact that the formula for determining average daily earnings includes multiplication by 24 months, it does not matter what minimum wage was in effect in previous periods.

24 - number of months; 730 is the number of days. That. multiplying the minimum wage by 24 months and dividing by 730 days allows us to determine the minimum average daily earnings of an employee for the last two years.

Considering that all the values for determining the average daily earnings when calculating sick leave from the minimum wage in 2022 are known, the average earnings for two years, as well as the average daily earnings of all workers who went on sick leave in 2022, are the same:

- Average earnings for two years = 12,130 X 24 = 291,120 rubles.

- Average daily earnings = 291,120 / 730 = 398.79 rubles.

Percentage depending on length of service. According to the Labor Code of the Russian Federation, depending on the employee’s length of service, the following percentage is included in the product of this formula:

- 100% for more than 8 years of experience;

- 80% with experience from 5 to 8 years;

- 60% for less than 5 years of experience.

Number of days of incapacity. Having calculated the employee’s average daily earnings and multiplied it by the percentage of length of service, then you need to multiply the resulting value by the number of days for which the employee is entitled to benefits.

Please note that the first three days of sick leave are paid by the employer. The remaining days are paid by the FSS of the Russian Federation

If the sick leave was related to caring for a sick relative, the Social Insurance Fund pays benefits starting from the first day.

Regional deflator coefficient. In some regions, increasing coefficients apply. For example, in the Kemerovo region the regional coefficient for 2022 is 1.3.

Accordingly, the amount of benefits for an employee in the Kemerovo region, other things being equal, will be higher than for an employee from a region where increasing coefficients do not apply.

If such a coefficient does not apply in your region, use it as its value in formula 1.

Part time

If an employee works part-time, then another coefficient is added to the above formula - the proportion of hours actually worked during the entire working time.

Results

Before calculating sick leave from the minimum wage in 2022, you must make sure that the employee belongs to the category to which this calculation is applicable.

Then it is necessary to calculate the sick leave benefit using a formula using the minimum wage in effect on the date of the onset of the employee’s illness.

Don’t forget to add a coefficient depending on length of service to the calculation formula, and also study regional legislation regarding the effect of the increasing coefficient.

This might also be useful:

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Accrual of sick leave during the transition period

There is such a thing as rolling sick leave. This is a situation where maintenance on temporary disability forms is calculated for the period of transition from one year to another. For example, the disease was recorded in the doctor’s documents at the end of 2018, but was closed at the beginning of this year 2022. What requires attention is the fact that the minimum wage has changed, and currently stands at 11,280 rubles.

Important ! According to the norms, the calculation will be based on the amount of the minimum payment on the day the disease began.

The instructions for calculating the salary will be different if the employee’s employment records show less than 6 months of service. This provision contains clause of the Government Resolution No. 375, approved in 2007, article six of the Federal Law No. 255. We are talking about the days that fell on the new payment indicators. More precisely, from January 1 of this year.

For an employee with more than 6 months of experience, maintenance based on the minimum wage for days starting from January of the current year is not revised.

There is such a thing as rolling sick leave.

For example, an employee got a job for the first time and her work experience is 4 months. At the same time, she received a salary of 275,000 rubles. According to the bulletin, the entry on the onset of the disease was made on December 28 of last year, and the closing date is January 6 of this year.

Important ! The standard for calculating a subsidy for employee illness is 60% of the original amount.

Payment for the previous year is calculated over 4 days.

At that time, the minimum wage was 11,163 rubles. To get an average one-day income, we carry out the following operations with numbers: (11,163 x 24 months) / 730 = 367.00 rubles.

In case of transferable sick leave, payments are calculated separately for the previous and current year.

We reduce the amount by 40%: (367.00 x 4 days) x 60% = 880.80 rubles.

In total, for December the employee will receive 880.80 rubles.

In January of this year we calculate 6 days.

The minimum wage was 11,280 rubles. We find the one-day average payment: (11,280 x 24 months) / 730 = 370.85 rubles. We manipulate the percentages and get the final number: (370.85 x 6 days) x 60% = 1335.06 rubles.

Let’s sum it up and state that the allowance for temporary disability for this employee will be 2215.86 rubles.

Important ! The amount of this benefit is also subject to personal income tax. The exception is cases of sick leave payments for pregnancy and childbirth.

Sick leave payments are subject to personal income tax

Sick leave from the minimum wage in 2022 during the transition period

If an employee fell ill in 2022 and closed his sick leave in 2022, the calculation of benefits from the minimum wage is based on the amount of the “minimum wage” valid on the date of opening of the sick leave. That is, for sick leave opened in 2022, the minimum wage in the calculations is used in the amount of 11,280 rubles.

The only exceptional case specified in paragraph of Government Decree No. 375 of June 15, 2007 is if the employee has a total length of service of less than 6 months on the date the doctor opens a sick leave certificate. Then the benefit falling on the days from 01/01/2020 will have to be recalculated taking into account the new minimum wage - 12,130 rubles.

In 2022, the same rules for payment and accrual at the expense of company funds and the Social Insurance Fund apply as before.

When accruing sick leave with codes “01” and “02”, that is, when the employee himself is ill, the first 3 days of sick leave are paid by the employing company, and the subsequent days by the Social Insurance Fund. In case of illness of a child or family member, all payments are made only at the expense of the Social Insurance Fund. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting entries for sick leave

Labor payments are carried out in the accounting department under account 70, which is called “Settlements with personnel for wages”. In particular, it appears when recording operations for temporary disability. The main thing that matters is whether the region takes part in the FSS pilot project or not.

To accrue maintenance for the first 3 days (at the expense of the employer) - debit account 20 “Main production” - credit account 70 “Settlements with personnel for wages”.

If the employee for whom the certificate of incapacity for work has been issued is not listed in the main production, the invoice is accepted in accordance with employment. For example:

- 23 – “Auxiliary production”;

- 25 – “General production expenses”;

- 26 – “General business expenses.”

Accountants are required to indicate such payments in reports

The component of benefits from social insurance funds is the debit of account 69 “Calculations for social insurance and security” - the credit of account 70 “Settlements with personnel for wages”.

Important ! This posting will include compensation from day 4.

Tax withholding: debit to account 70 “Settlements with personnel for wages” - credit to account 68 “Calculations for taxes and fees”.

After listing the contents: debit account 70 “Settlements with personnel for wages” - credit account 51 “Settlement accounts” (to a card account) or Credit account 50 “Cash” (in cash). Temporary disability benefits were paid to the employee.

Important ! Examples of postings and articles are given for regions that do not participate in the project.

The accountant must indicate all payments and taxes in the reporting

Situations for applying the minimum wage for sick leave

Let us analyze in theory and practical diagrams the filling out of sick leave in 2022 by the employer and a sample from the minimum wage.

Cases of application of the “minimum wage” are strictly stipulated by the Law of December 29, 2006 No. 255-FZ. The calculation of the minimum wage for sick leave is taken as a basis in the following circumstances:

- For 2017–2018 there is no income or its average value is less than or equal to the minimum payment limit. In this version, the minimum wage replaces earnings when calculating.

- Less than 6 months of experience. The amount is calculated in an amount not exceeding the “minimum wage”, taking into account the application of the regional coefficient.

- Without justified reasons, the patient violated the treatment regimen or failed to show up for an appointment on time.

- Illness and injury are caused by the use of alcohol, drugs, or toxic intoxication.

According to point 3, sick leave from the minimum wage is filled out from the day of the violation, and according to points 1, 2, 4 - for the entire period.

How to fill out a sick leave certificate from the minimum wage in 2022: sample filling and specific examples:

- Vaskov was sick for 8 days. With an experience of less than 5 years, but more than 6 months, this is Vaskov’s first place of work since January 10, 2022. When calculating, it is necessary to proceed from the “minimum wage” of 11,280 rubles, calculated per day, that is, 370.85 rubles. The amount due is 1,780.08 rubles. = 370.85 × 8 × 60%, of which 667.53 rub. The administration of the organization pays, and the Social Insurance Fund pays 1112.55 rubles.

- Lukin was sick for 5 days in March. Less than six months of experience. The area does not have a regional (climatic) coefficient. It is necessary to fill out a sick leave certificate from the employer in 2022 from the minimum wage if the salary is above the “minimum wage”. Pays out 1819.35 = 11,280: 31 x 5.

We invite you to familiarize yourself with the Donation Agreement - example, form, sample

Important: the number of days in this case is taken for a specific month! If Lukin’s salary is less than the minimum wage, then the amount is calculated based on actual income (clause 6

Art. 7 255-FZ).

Gladkova was ill for 11 days from 02/05/2019 to 02/15/2019, of which 4 days she violated the regime by not showing up for an appointment on February 12. 12 years of experience. The average daily salary for 2017–2018 is 2023.81 = (663,370,814,012): 730 and based on the minimum wage 402.86 = 11,280: 28 (the number of days in this case is taken for a specific month!).

To be paid 15,778.11 = (2023.81 × 7) (402.86 × 4), of which the organization pays 4303.12 = 15,778.11: 11 × 3 days.

A common question is how to fill out a sick leave sheet based on the minimum wage if the sheet has “carried over” from the end of the year. The new “minimum wage” is accepted when calculating in two versions:

- accumulated experience of up to six months;

- the treatment regimen is violated already next year when the leaf is opened in the previous period.

The days that fell during the period of approval of a different minimum wage are recalculated.

https://youtube.com/watch?v=QOc1OErshu0

What to check on the sick leave form before filling it out?

Sick leave is a document confirming the legal reason for an employee’s absence from work. Violations in its registration can lead to monetary losses. This is a mutual responsibility on the part of the administration and the employee. Therefore, when receiving a completed copy, it is important to read it carefully. You should follow the filling rules:

- Blots, corrections, deletions, unclear letters and symbols in the doctor’s notes are strictly prohibited;

- the design meets the requirements: the letters are in a separate cell, written in black ink, in capital case;

- The patient’s full place of employment and the nature of his employment must be indicated: main job or part-time job;

- in the case of employment at two enterprises, the patient can issue two certificates of incapacity for work to provide them at the place of main work and in combination;

- in part of the table, data is entered on the length of stay and the reason why the temporary disability developed;

- the same rules apply to the preparation of documents for sick leave to care for a child or other family member;

- The document is valid only with the signature of the attending physician and the seal of the medical organization.

If there are blots or corrections on the sick leave certificate, there may be no payments for it

The topic is always relevant, as changes are possible that the FSS makes. To protect the employer and employee from mistakes, the fund authorities constantly update the list of invalid sick leave. According to specialists accredited by the fund, fake papers are being circulated when preparing illness documents. The best way to avoid problems is to have a template provided by an official organization to fill out.

Important ! This will help anticipate potential problems with recalculations and conflicts with inspection organizations.

Below is such a sample, valid for 2022, with comments suitable for each line (data taken from the “Procedure for issuing certificates of incapacity for work”, paragraphs 56-63).

Sick leave certificates are often faked

The sample must contain the following parameters:

- place of work (you can enter punctuation marks - dashes, quotation marks, acceptable abbreviations);

- indication “Primary/Part-time”;

- the number that the Social Insurance Fund assigns to the enterprise after registration with a tax organization (registration);

- subordination code, territorial FSS number;

- if the patient has a TIN;

- if provided by the employee - taxpayer identification number, SNILS.

A two-digit code is written in the “Accrual conditions” column. For example, if an employee has less than 6 months of experience - 48.

The certificate of incapacity for work contains a special code indicating the reason for opening the ballot, length of service, etc.

The column “Act Form N-1” will be filled in if we are talking about an industrial accident. Numbers are written in date/month/year format.

The document is endorsed. The employer's stamp is placed in the specially designated field.

Next is a record of work experience indicating the months (the period when contributions to the Social Insurance Fund were deducted). Non-insurance periods are also indicated. For example, the document notes periods of military or other service, if any.

Important ! The period of validity of the certificate of incapacity for work is written down in numbers.

The document indicates the total length of service, non-insurance periods

To work with accruals, the document must contain the following information:

- average earnings;

- average earnings for the previous 2 years;

- average daily earnings, including length of service;

- the amount of funds of the employer;

- share of FSS funds;

- final value.

Finally, the surname and initials of the manager are indicated. The document must also contain a corresponding signature and transcript.

The surname and initials of the chief accountant, the corresponding signature, transcript (if by proxy - the data of the designated person) are also indicated.

The certificate of incapacity for work indicates the details of the manager, accountant

Important ! Here you can download a sample for filling out a sick leave certificate for an employee with less than 8 years of experience

The procedure for issuing and processing certificates of incapacity for work

Regulations:

- Ikaz No. 347n dated April 26, 2011 - sick leave form

- Order No. 925N dated 09/01/2020 - the procedure for issuing and processing sick leave, including electronic ones.

Letters from the Social Insurance Fund, which provide explanations for filling out sick leave:

- Letter from the FSS dated December 23, 2011 N 14-03-11/15-16055.

- Letter from the FSS dated October 28, 2011 N 14-03-18/15-12956.

A certificate of incapacity for work is issued to the insured persons:

- citizens of the Russian Federation;

- foreigners and stateless persons who permanently or temporarily reside in the territory of the Russian Federation;

- foreign citizens and stateless persons who are temporarily staying in the Russian Federation.

Only legal entities and individual entrepreneurs who have a medical license, including services for the examination of temporary disability, can issue sick leave. The sheet is compiled by medical workers of medical organizations, including attending physicians, paramedics, and dentists. Ambulance workers, emergency departments, medical prevention centers, etc. cannot issue sick leave.

The Order clearly states when and how many sick leaves should be issued in a medical institution (clause 6 - clause 8).

When and how many sick leaves are issued?

Option 1. At the time of the insured event, the insured person is employed by the same insurers as in the previous two years (average earnings, as is known, are calculated based on the two previous calendar years).

In this case, several paper certificates of incapacity for work are issued for each place of work or one certificate is generated in the form of an electronic document to represent its number for each place of work. The benefit is received for all places of work, with the exception of childcare benefits for children under 1.5 years of age.

When calculating average earnings, we take into account the earnings only from the place of work where we receive benefits.

Option 2. At the time of the insured event, the insured person is employed by some policyholders, and in the previous two years was employed by others (different).

In this case, the employee can receive benefits only for one of the places of work. At the same time, when calculating average earnings, earnings from all places of work, including previous ones, are taken into account. To do this, you need to provide relevant certificates, including that benefits were not paid at other places of work.

Option 2 corresponds to clause 7 of the procedure for issuing sick leave. It says that sick leave should be issued only to one organization.

Option 3. Mixed. At the time of the onset of the insured event, the insured person was employed by some policyholders, but in the previous two years he was employed not only by these, but also by others.

In such a situation, the law gives the employee the right to decide for himself which of the two previous options to count. Or count for each organization in which he works at the beginning of the case. Or you can choose one single organization from which he will receive benefits, but at the same time the employee can take into account the earnings of all other organizations.

Let's consider other important provisions

1. The order states on what day the sick leave must be discharged and closed. Details on this point are more interesting to doctors than to accountants. The Order states that sick leave can be issued on the day of closure, that is, when a person is already discharged, his sick leave is closed on that day. This was done in order to reduce the number of situations when an employee comes to you with an open sick leave certificate.

2. The procedure is described when a doctor alone can issue and extend sick leave. Now a doctor can unilaterally extend sick leave only for up to 15 days, for a longer period - only through a medical commission.

3. If the insured person is undergoing long-term treatment, the medical institution may close the sick leave before the person recovers, issue a new one, and give the closed old sick leave to the employee so that he can provide it for payment to the organization.

4. The restriction on the number of days per year for which a certificate of incapacity for work can be issued to care for sick children has been abolished: a child under 7 years of age, a disabled child under 18 years of age.

5. Now the Order clearly states that in continuation of a paper sick leave, an electronic one can be issued and vice versa.

6. Electronic sick leave for caring for several sick family members is issued in a single copy. For each patient, the periods of care for him, the conditions for the provision of medical care, full name, date of birth, code of the cause of disability, related (family) connection, SNILS are indicated. With paper sheets, everything is the same: if more than two children are sick at the same time, they issue a sick leave for each pair of children.

Simple and fast calculation of sick leave

In Kontur.Accounting, all calculations comply with current legislation

Try it

How to properly make corrections to a ballot?

Situations arise in which data on the form must be corrected. What to do in this case so that FSS employees do not protest the document?

The Procedure for issuing sick leave indicates what to do:

- corrections should be made only with a black gel pen;

- The incorrect entries must be crossed out and correct entries must be made on the back of the form, certified with the inscription “Believe the corrected one”, the signature, and the seal of the enterprise.

The law does not limit corrections to specific numbers per document. Even if there is more than one, it is worth correcting the shortcomings. If gross violations of the document's execution are detected, Fund employees may refuse to accept it for payment.

It is possible to make some corrections on the sick leave certificate, but it is not recommended

In addition to manual forms, an employee can bring sick leave in electronic form.

Please note that an employee has the right to submit a payment slip within 6 months after illness.

Correct completion of documents is one of the main indicators of an organization’s performance. Compliance with recommendations and legal requirements allows you to effectively interact with employees and higher supervisory organizations. The relevance of the issue involves making changes that must be studied in a timely manner. The introduction of new data into the minimum wage calculation system became the reason for new payment calculations. Upon careful consideration, they do not present any difficulties and consist in correctly indicating the average salary and daily earnings.

Is it possible to make adjustments to the completed ballot if the “minimum wage” has changed?

According to paragraph 65 of the Regulations, approved. By Order No. 624n, you can correct the error by carefully crossing it out, indicating on the reverse side of the LN the correct information and the inscription “believe the corrected”, signing and certifying with the seal of the organization (if any). Read more about the requirements for stamps on sick leave here.

Filling out the form is the responsibility of the employer . At the enterprise, this is done by an accountant or the head of the human resources department. The employer must carefully follow all the advice and rules for drawing up this document in order to eliminate possible consequences and unnecessary paperwork.