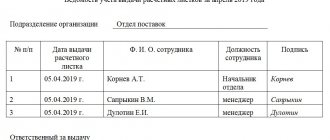

What is a payslip? A payslip is a special internal document of an enterprise in which

What is an inventory procedure Inventory is a procedure for checking the quantitative and qualitative characteristics of property

The law does not prohibit taking cash from individual clients. But just put the money in your pocket

Consignment note, purpose Consignment note Consignment note by proxy Consignment note – documentation for

Features of the annual DAM Calculation form for insurance premiums approved by order of the Federal Tax Service dated October 15, 2020 No.

Any citizen has the right to work part-time, that is, to combine his main job with additional work. He

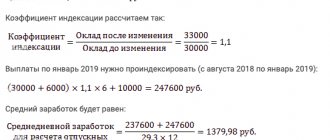

What the legislation says The terms of remuneration for each employee are determined in labor or civil law

HomeCustoms paymentsCustoms excise duty Material updated: 01/17/2022 Customs excise duty is one of the types

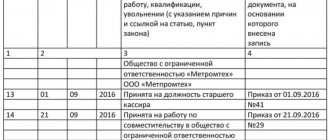

Account 60 This account is used to summarize all data on such transactions between the organization

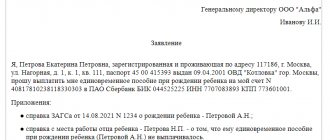

Who is entitled to receive maternity benefits in 2022 Maternity benefits