- Consignment note, purpose

- Packing list

- Consignment note by proxy

- Consignment note – documentation for inventory accounting

- Conclusion

For a long time, tax payers have been arguing with fiscal authorities regarding the rights to deduct value added tax, if the purchase of products was carried out with a TORG-12 consignment note, the consumer did not receive a TTN. There are also disputes over reducing the profit tax base.

Consignment note, purpose

The waybill (BW) is considered generally accepted documentation, approved by the State Committee on Statistics back in 1997. Upon approval, explanations were provided on the use and correct execution of the consignment note. The consignment note must be considered documentation of title for recording activities in road transport. The consignment note is divided into 2 sections:

- Transport.

- Commodity.

The goods section is required by the sender and the recipient of the cargo to write off inventory items from the sender's warehouse stocks, and to account for these stocks at the recipient. A TTN is issued if the delivery of the purchased goods to the recipient is made by the company transporting the goods. First of all, a consignment note must be drawn up in order to confirm the fact of concluding a contractual relationship for the transportation of goods. For a company selling a product, documentation in Form 1-T, in the product section, is considered the basis for writing off inventories, and for a company that purchased the product, this part of the TTN is considered the basis and is needed to account for these values. The transport part of the documentation is required by the company transporting the goods, as well as by the customer of the vehicle for making payments. The company transporting the goods, based on the transport part of the TTN, calculates the salary of the car driver.

For the driver, a TTN is needed for free movement on roads, since the TTN proves the validity of transporting goods to law enforcement organizations that carry out checks on roads. Consequently, the consignment note is considered documentation that defines the mutual relations of the shippers of the goods with the enterprise that owns the road transport and transports the goods, accompanying the consignment note. In particular, the TTN is intended to account for the operation of transport and settlements between senders or recipients of goods with an enterprise that owns motor transport for the service provided for transporting goods.

What needs to be indicated in the form

Each participant in a logistics operation must know how to fill out a consignment note - a completed sample of the correct execution of a cargo consignment note should always be at hand for employees responsible for document management.

For senders

The status of the party sending the cargo may include sellers, buyers and forwarders, whose responsibility is to enter most of the information about the conditions of transportation. In addition to the “header” of the technical document, which indicates the date, registration and serial number of the copy and application, the following sections are also required:

- 1. "Consignor". Details of an individual or legal entity, TIN, location address and contact information. As part of forwarding shipments, an additional mark is also placed and section 1a is filled out.

- 2. "Consignee". Identical to the previous paragraph, only this time about the second party involved in the process.

- 3. "Cargo". An expanded column that provides for entering the most detailed data about the transported object. The nomenclature name, the number of packages, dimensions and weight, the presence of potentially hazardous substances, as well as the declared value, which can be taken from the TN or UPD (universal transfer document), are indicated. If there is no information on individual items, a dash is added.

- 4. “Accompanying documentation.” A complete list of details of invoices, certificates, passports, certificates, etc. The more detailed, the better from the point of view of potential tax audits.

- 5. "Shipper's instructions." A list of requirements determined by the specifics and characteristics of the products being moved, and mandatory compliance for logistics. Indication of information about the entity dispensing the goods, as well as the address of the warehouse, date and time of shipment. During the transfer process, the actual dates of arrival, the condition of the batch, the weight and number of seats are noted. Certified by the transferor, the driver of the car, and also, if necessary, the sender of the delivery.

- 7. “Surrender.” Similar to the previous point, but this time information about the process of unloading products is entered.

- 15. “Signatures of the parties.” In accordance with the rules and examples of registration of waybills for the transportation of goods, given in the samples for filling out the TTN and TN forms, the signatories are the responsible authorized persons; It is mandatory to indicate personal data and position held. It is worth noting that this section is completed by all participants in the logistics operation.

For carriers

The driver responsible for the actual transportation signs in points 6 and 7 upon acceptance and delivery. In addition, the cargo carrier fills in the following fields.

- 8. “Conditions of transportation.” A list of factors that allow an object to be classified as lost, the cost of terminal storage services, sanctions for violating operational processes, etc. By default, the rules are regulated by the Motor Transport Charter.

- 9. “Information on acceptance for execution.” Date of receipt of the order for logistics services and details of the responsible employee. The law allocates three working days for the consideration of applications officially received from senders.

- 10. "Carrier". Details and information about the company carrying out transportation, full name. driver, telephone for operational communication.

- 11. "Vehicle". Car number, make, load capacity characteristics, as well as type of ownership - rent, leasing, or your own transport.

- 12. “Reservations and remarks.” Comments on the condition of the cargo, which is assessed during the acceptance process.

- 13. “Other conditions.” Date and number of the permit for the provision of logistics services, the planned route of movement (when transporting dangerous or large objects), etc.

- 14. “Forwarding.” The column is filled in by drivers if changes are made to the originally specified delivery address.

- 16. “Cost of services and calculation of fees.” An algorithm for determining the amount to be paid by the sender, including VAT, as well as bank details. If there is no information in this section, the TN must be accompanied by another primary document confirming the cost of logistics, for example, UPD.

For the consignee

The party acting as the recipient of the cargo fills out paragraph 7 in the presence of a representative of the carrier, indicating the timing of the delivery of the vehicle for unloading, the condition of the shipment, the weight and number of pieces. In cases where the goods are delivered in a serviceable closed transport, in a sealed and sealed container, a detailed check with the participation of the driver or forwarder is considered optional.

If there are complaints, the relevant information is entered into section 17 - “Marks”, which can also be filled out by other participants in the logistics operation. All facts of violations, damages or discrepancies must be documented, using acts that serve as evidence during the consideration of legal disputes.

How to fix an error in TN

A document drawn up incorrectly can be corrected in paper copies. An erroneous line is crossed out with one solid line, which makes it possible to identify the semantic content of what was written. Next, the correct data is entered, the o is entered, and the date, time, as well as the signature and details of the responsible person are indicated.

Packing list

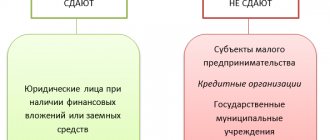

The list of generally accepted forms of initial accounting documents for recording commercial processes, which is approved by the State Statistics Committee of the Russian Federation, includes the initial accounting document, the waybill (TN), used for the purchase and sale of goods and materials by a third-party company, drawn up in 2 samples.

One sample remains at the enterprise that hands over the inventory, and is considered the basis for writing off the inventory. The second sample is transferred to a third-party company, and is considered the basis for the receipt of inventory data. In particular, in the situation of delivery of goods by sellers, TN is considered an acceptable basis for the arrival of products; issuing a waybill is not mandatory. There have been a large number of discussions between tax payers and fiscal structures regarding the rights to deduct value added tax, as well as taking into account the cost of inventory items in costs, whether the consumer has or does not have a TTN. Some court hearings consider this issue with a positive result for the mandatory presence of a consignment note, others provide the opportunity not to use this consignment note in a situation where the company has other documentation that confirms the purchase of inventory items.

Official clues of fiscal structures to the lack of a bill of lading from the customer were not so long ago the most popular reason for not accepting expenses made when calculating income tax, and not giving consent to the right of the tax payer to deduct input value added tax.

Today it is absolutely possible to state that when a company buys a product and is not a customer in contractual terms of transportation, this company can take into account the costs of purchasing inventory items in costs, and allow input value added tax on these products to be deducted, if absence of TTN.

The main thing in this situation is that it is imperative to have documentation that can confirm the transaction. It also confirms the reliability of this information contained in this documentation. If you want to get rid of controversial situations with fiscal structures, as well as your own counterparty, it is worth indicating in the contract that the receipt of products is based on technical specifications.

Consignment note by proxy

Despite the naturalness of the problem of the need for a printed imprint of the buyer on the invoice, in the case when the product is accepted by the customer’s employee by proxy, the problem remains open. There are two alternative opinions on this problem. On the one hand, based on the letter from the Russian Trade Committee, it is recommended to put a stamp on both the seller’s and the buyer’s side.

On the other hand, the stamp is already on the power of attorney, and you just need to attach the power of attorney to the invoice. It is possible to assume that a seal imprint is not needed in this situation, since the power of attorney contains all the data, and this is provided for by the Civil Code of the Russian Federation, Article 185. When receiving products on the basis of the technical specification, all data on the technical specification are written down in the power of attorney, and a seal is placed on it. For this reason, it is possible to combine this invoice and power of attorney, and then there will be no fiscal fines for the lack of printing on the TN.

To fill out the power of attorney data, a corresponding space is provided in the technical document. The employee who accepts the products signs an autograph in the “Accepted Products” position. At the same time, managers selling products need to take into account that in the case when the buyer of the product is a private person, there is no need to fill out the technical specification, since, according to the documentation of the State Committee on Statistics, this technical specification is used to post the shipment of goods and materials to a third-party enterprise.

Consignment note – documentation for inventory accounting

When the supplier has delivered the product and provided only a consignment note as accompanying documentation, and the “VAT Amount” space in the CTN is filled in, is it possible to take into account the products under this CTN and freely declare the deduction of input value added tax?

We can say that the availability of purchases of products and approval of the costs of their purchase for the purpose of calculating income tax, including approval for the deduction of incoming value added tax in the presence of a consignment note, is real.

And the reason is the following. Article 252 of the Tax Code of the Russian Federation states that in order for expenses to become legal, they must be supported by documents and justified. In order to accept input value added tax on purchased products as a deduction, it is enough to take inventory items into account, have an invoice for payment, and also justify that inventory items are used in a process that is subject to tax.

Both TN and TTN are considered primary documentation for recording the movement of products, and can be supplemented with the necessary details. Consequently, when an enterprise that buys products does not pay for the transportation of products, then it is possible to use a waybill or TN, the established form and filled out in accordance with all the rules, to arrive and display in accounting the cost of purchased inventory items.

New and old form: how cargo owners use transport companies

Some shippers have already implemented the new paperwork requirements, while others are still filling out the old form.

The main thing: what

must be filled out in the waybill in order to reduce tax risks:

- date of preparation of the waybill;

- names of the shipper, consignee (if necessary, the client - the customer of the transportation) and the carrier in sections 1, 2, 1a, 10 of the waybill;

- the amount of freight charge in section 1;

- names of positions, signatures and transcripts of signatures in sections 1a (if necessary), 6, 7, 15, 16.