Average headcount is an indicator on which a company’s right to benefits depends. Here are some of them:

- the ability to apply a simplified taxation system (clause 15, clause 3, article 346.12 of the Tax Code of the Russian Federation);

- benefits for VAT (clause 2, clause 3, Article 149 of the Tax Code of the Russian Federation), property tax (Article 381 of the Tax Code of the Russian Federation), and land tax (clause 5 of Article 395 of the Tax Code of the Russian Federation);

- benefits for small enterprises (Law of July 24, 2007 No. 209-FZ).

In addition, the average number of employees must be calculated in the following cases:

- to know whether you need to submit reports to extra-budgetary funds electronically. The fact is that the average number of individuals in whose favor payments are made is equal to the average number of employees of the organization (Part 1 of Article 10, Part 10 of Article 15 of Law No. 212-FZ, paragraph 77 of the Instructions, approved by order of Rosstat dated October 28, 2013 No. 428);

- to determine whether the organization has lost the right to use the simplified tax system or UTII (clause 4 of article 346.13, clause 2.3 of article 346.26 of the Tax Code of the Russian Federation);

- to calculate the amount of UTII if the physical indicator for a specific type of activity is the number of employees (Article 346.27 of the Tax Code of the Russian Federation).

The rules for calculating the average number of employees are contained in Rosstat Order No. 428 dated October 28, 2013 “On approval of the Instructions for filling out federal statistical observation forms: ... No. P-4 “Information on the number, wages and movement of workers” ...”. This report must be submitted by all commercial organizations (except small ones), the average number of employees of which does not exceed 15 people (including part-time workers and civil contracts) based on the results of activities for the previous year.

The average number includes:

- average number of employees;

- average number of external part-time workers;

- the average number of employees performing work under civil contracts.

The average number of employees must be calculated in the following cases:

- in order to submit information on the average headcount for the past year to the Federal Tax Service at the location of the organization no later than January 20 of the current year.

This must be done annually, even if the organization does not have employees (clause 3 of Article 80 of the Tax Code of the Russian Federation). If you submit information about the average headcount late, the Federal Tax Service may impose two fines at the same time (clause 1 of article 126 of the Tax Code of the Russian Federation, part 1 of article 15.6 of the Code of Administrative Offenses of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated June 7, 2011 No. 03-02-07 /1-179):

- for the organization - in the amount of 200 rubles;

- per manager - in the amount of 300 rubles. up to 500 rub.;

- to know whether you need to submit tax reports to the Federal Tax Service in electronic form (clause 3 of Article 80 of the Tax Code of the Russian Federation);

- to fill out the field “Average headcount” in the calculation according to the RSV-1 Pension Fund form (clause 5.11 of the Procedure for filling out the RSV-1 Pension Fund form);

- to fill out the field “Number of employees” in the calculation according to Form 4 - Social Insurance Fund (clause 5.14 of the Procedure for filling out Form 4 - Social Insurance Fund);

- to calculate the amount of income tax (advance payment) paid at the location of a separate division, if the organization uses the average headcount indicator for the calculation (clause 2 of Article 288 of the Tax Code of the Russian Federation).

Headcount

To calculate the average number of employees, you must first determine the number of employees for each calendar day of the reporting period (for example, a month - from the 1st to the 30th or 31st, and for February - to the 28th or 29th) . The payroll takes into account:

- employees signed under an employment contract who perform permanent, temporary or seasonal work for one day or more;

- owners of the company who work and receive salaries in it.

Moreover, they take into account both those actually working and those absent from work for some reason:

- those who came to work, including those who did not work due to downtime;

- those on business trips, if the company maintains their salaries, as well as those on short-term business trips abroad;

- those who did not show up for work due to illness (during the entire sick leave and until retirement due to disability);

- those who did not show up for work due to performing state and public duties (for example, participated as a juror in court);

- those hired for part-time or part-time work, as well as those hired at half the rate (salary) in accordance with the employment contract or staffing table. In the payroll, these employees are counted for each calendar day as whole units, including non-working days of the week determined upon hiring. This group does not include workers who, in accordance with the law, have reduced working hours: under the age of 18; those employed in jobs with harmful and dangerous working conditions; women who are given additional breaks from work to feed their children; women working in rural areas; workers - disabled people of groups I and II;

- hired for a probationary period;

- homeworkers (they are counted for each calendar day as whole units);

- employees with special titles;

- sent away from work to educational institutions to improve their skills or acquire a new profession (specialty), if their salary is maintained;

- temporarily sent to work from other organizations, if their wages are not maintained at their main place of work;

- students and pupils of educational institutions working in organizations during practical training, if they are enrolled in workplaces (positions);

- students studying in educational institutions, postgraduate schools, who are on study leave with full or partial pay;

- students studying in educational institutions and who were on additional leave without pay, as well as workers entering educational institutions who were on leave without pay to take entrance exams in accordance with the law;

- those on annual and additional leave provided in accordance with the law, collective agreement and employment contract, including those on leave followed by dismissal;

- those who had a day off according to the organization’s work schedule, as well as for overtime during the summarized accounting of working hours;

- who received a day of rest for working on weekends or holidays (non-working days);

- those on maternity leave, on leave in connection with the adoption of a newborn child directly from a maternity hospital, as well as on parental leave;

- hired to replace absent employees (due to illness, maternity leave, parental leave);

- were on leave without pay, regardless of the duration of the leave;

- those who were in downtime at the initiative of the employer and for reasons beyond the control of the employer and employee, as well as on unpaid leave at the initiative of the employer;

- who took part in strikes;

- working on a rotational basis. If organizations do not have separate divisions on the territory of another constituent entity of the Russian Federation where rotational work is carried out, then employees who performed work on a rotational basis are taken into account in the report of the organization with which employment contracts and civil law contracts are concluded;

- foreign citizens who worked in organizations located in Russia;

- those who committed absenteeism;

- who were under investigation until the court's decision.

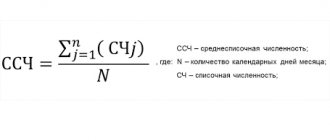

Calculation formula

To recount the population, various formulas are used. But sometimes the calculation is complicated by collecting data over several time intervals. If there is information at the beginning and end of the period, the average annual population (formula) has the following form:

CHNavg. = (CHNn.p. + CHNk.p.) / 2, where CHNav. – average population, CHn.p. – population number at the beginning of the period, ChNk.p. – number at the end of the period.

If statistics were collected for each month of the study period, the formula would be:

CHNavg. = (0.5 CN1 + CN2 … CNp-1 + 0.5 CNp)(n-1), where CN1, CN2 … CNp-1 is the number of the population at the beginning of the month, n is the number of months.

Who is not included in the payroll

The following are not included in the payroll:

- hired part-time from other companies (their records are kept separately);

- performing work under civil law contracts (contracts, services, etc.);

- recruited to work under special contracts with government agencies for the provision of labor (military personnel or those serving a sentence of imprisonment). Moreover, they are taken into account in the average number;

- those who wrote a letter of resignation and did not return to work before the notice period for dismissal expired (they are excluded from the workforce from the first day of absence from work);

- owners of the company who do not receive a salary from it;

- transferred to work in another company, if they do not retain their wages at their previous place of work, as well as those sent to work abroad;

- those sent for off-the-job training and receiving a stipend at the expense of the company that sent them;

- with whom a student agreement for training and additional professional education has been concluded (Article 197 of the Labor Code of the Russian Federation) and who receive a scholarship during their studies;

- lawyers;

- members of the cooperative who have not entered into employment contracts with the company;

- military personnel in the performance of military service duties.

The number of employees on the payroll is given not only for a specific date (for example, on the first or last day of the month), but also for the reporting period (for example, for a month, a quarter).

EXAMPLE In March of the reporting year, the payroll of JSC Spectr included: – from March 1 to March 12 – 88 people; – from March 13 to March 26 – 92 people; – from March 27 to March 31 – 90 people. Total: 270 people.

The payroll is clarified using the work time sheet, which records the employee’s attendance or absence from work, as well as on the basis of orders (instructions) on the hiring, transfer and dismissal of the employee.

Population

To be able to determine the average annual population of a city, region or country, it is necessary to understand the essence of the subject of the study. The demographic situation can be viewed from different angles.

Population refers to the entire number of people who live within the boundaries of a certain territory. To analyze the demographic situation, this indicator is considered in the context of natural reproduction (fertility and mortality) and migration. They also examine the structure of the population (by age, gender, economic and social level, etc.). Demographic data also shows how the settlement of people across the territory has changed.

The population is studied by statistics using general and special methods. This allows us to draw full, in-depth conclusions about the development of demographic indicators.

How is the average headcount calculated?

The average payroll number for a month is calculated as follows: sum up the payroll number for each calendar day of the month (according to the working time sheet) and divide by the number of calendar days of the month. In this case, for a weekend or holiday, the payroll number is equal to what it was on the previous working day.

EXAMPLE In March of the reporting year, the payroll of Spectr JSC consisted of: – from March 1 to 12 – 88 people (7 working days, 4 days off, 1 holiday); – from March 13 to 26 – 92 people (10 working days, 4 days off); – from March 27 to March 31 – 90 people (5 working days). Total payroll number – 270 people. The number of days in a month is 31. The average number of employees of Spectr JSC for March is: ((7 days + 4 days + 1 day) × 88 people + (10 days + 4 days) × 92 people. + 5 days × 90 people) : 31 days = (1056 person-days + 1288 person-days + 450 person-days) : 31 days = 90.1 people The average number is shown in whole units. This means that in March it is 90 people.

To calculate the average number of employees for a quarter, you need to add up the average number of employees for all months of the quarter and divide by 3.

EXAMPLEThe average headcount of a company in April was 100 people, in May – 105 people, in June – 102 people. The average headcount of the company for the second quarter is equal to: (100 people + 105 people + 102 people): 3 months. = 102.3 people/month. The average number is shown in whole units, so it is 102 people.

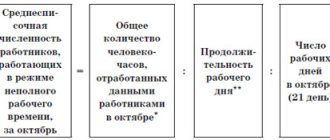

If some of the company's employees work part-time, the average number of employees is calculated differently. In this case, the number of part-time workers is taken into account in proportion to the time worked.

EXAMPLETwo employees of Legat LLC, Voronin and Somov, work 5 hours a day (with a five-day work week of 40 hours). Therefore, they are taken into account daily as follows: 5 man-hours: 8 hours = 0.6 people. The number of working days in June is 21. Voronin worked 21 days, Somov - 16 days. The average number of these employees per month will be equal to: (0.6 people × 21 work days + 0.6 people × 16 work days): 21 work days days = 1 person

Keep in mind: not all employees on the payroll are included in the average payroll. For example:

- women who are on maternity leave;

- those who are on additional parental leave;

- those who are on leave in connection with the adoption of a newborn child from the maternity hospital;

- workers who study in educational institutions and are on additional leave at their own expense;

- employees who enter educational institutions and are on leave at their own expense while taking entrance exams.

However, workers recruited to work under special contracts with government agencies for the provision of labor (military personnel or those serving a prison sentence), who are not included in the payroll, must be counted in the average payroll as whole units for the days when they were at work .

The average number of external part-time workers (that is, working at different enterprises) is calculated in the same way as the average number of part-time workers.

Workers registered under civil contracts (contracts, services, copyrights) are counted for each calendar day as whole units throughout the entire term of the contract. Moreover, the time of payment of remuneration is not taken into account.

When calculating the average number of employees for a weekend or holiday, take the number of employees for the previous working day.

The same applies to individual entrepreneurs who entered into civil contracts with the company and received remuneration under them, as well as to employees who were not included in the payroll and with whom such contracts were not concluded.

Professional press for accountants

For those who cannot deny themselves the pleasure of leafing through the latest magazine and reading well-written articles verified by experts. Select a magazine >>

Results

The calculation of the average number of employees is carried out by all employers and submitted annually to the Federal Tax Service.

In 2020-2021, when calculating the average number of employees, you must be guided by the rules approved by Rosstat Order No. 711. From 2022 - by the rules according to the new order No. 832 dated November 24, 2021. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Migration

The number of inhabitants can change not only due to natural processes. People leave to work or, conversely, come for the purpose of employment. If such migrants are present or absent from the study site for more than 6 months, this must be taken into account in the analysis.

Significant migration flows affect the economy. The labor market changes both with a decrease and an increase in the number of able-bodied residents.

The average annual population will help to find both the growth rate and the decrease in labor supply in the region. If too many emigrants enter the country, the unemployment rate will rise. A decrease in the number of working-age population leads to a budget deficit, reduction in pensions, salaries of doctors, teachers, etc. Therefore, the presented indicator is also extremely necessary to control the migration movement.

Population census

The average annual resident population is calculated based on census data. But this process requires a significant investment of time, effort and money. Therefore, it is not possible to conduct a census every month or even year.

Therefore, in the intervals between recalculating the number of people in a certain territory, a system of logical calculations is used. Collect statistics on births and deaths, migration movements. But over time, a certain error in the indicators accumulates.

Therefore, to correctly determine the average annual population, it is still necessary to conduct a periodic census.

Natural population movement

The average annual population, the calculation formula for which was discussed above, is involved in the assessment of various demographic indicators. One of them is the natural movement of the population. It is caused by the natural processes of fertility and mortality.

Over the course of a year, the average population increases by the number of newborn children and decreases by the number of deaths. This is the natural course of life. The coefficients of natural movement are found relative to the average population. If the birth rate exceeds the death rate, there is an increase (and vice versa).

Also, when conducting such an analysis, a breakdown of the population by age categories is performed. This determines which group had the highest mortality rate. This allows us to draw a conclusion about the standard of living in the study area and the social security of citizens.