We are ready to send an employee on a business trip. How to calculate daily allowance correctly now?

Today, each commercial organization can set its own daily allowance.

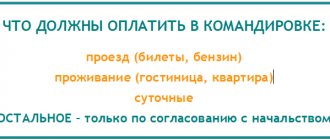

This amount must be approved in the collective agreement or in the travel regulations. Employees are paid daily allowances for all days of business travel, including weekends and holidays. Travel time to and from the business trip is also taken into account when calculating daily allowance. As for the fact of payments, they can be made either in cash through the company’s cash desk or through a bank by sending the appropriate amount to the employee’s card, and this method is now the most popular. Read also “Payment of daily allowances for business trips in 2022”

On which account are daily allowances displayed for business trips?

The amount of daily allowance is determined by the organization independently and is reflected in the collective labor agreement or is fixed by local regulations.

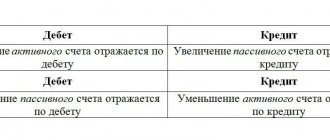

Accounting for settlements with employees regarding the payment of funds to them for reimbursement of travel expenses is carried out on 71 accounts:

- Debit displays amounts paid to the employee in correspondence with cash accounts (funds can be issued in cash or transferred to the employee’s current bank account).

- Account credit – return of excessively transferred funds based on the provided advance report (submitted within 3 days after the end of the work trip).

The account provides for the opening of a separate sub-account for recording payments in Russian rubles, as well as for accounting for payments in foreign currency. Analytical monitoring of the account is carried out separately for each employee.

Daily payments are calculated for each day of a work trip, including holidays and weekends, as well as days of temporary disability of an employee during a business trip.

Something to keep in mind! The company must approve a fixed daily allowance. The employee does not need confirmation of the directions for spending these funds from suppliers, unlike other amounts issued for a business trip, i.e. the employee can spend daily payments at his own discretion without approval.

It often happens that an employee leaves and returns from a business trip on the same day. What to do then?

A one-day business trip within the Russian Federation is not paid per diem. This is due to the fact that such a trip will be considered a regular working day, which means that the employee will not have any specific travel expenses and will not be entitled to daily allowances. An exception is made only for foreign one-day trips. Such a business trip is paid in the amount of 50% of the established limit per day for business trips abroad.

Read also: “Daily allowance for a one-day business trip”

In what currency should daily allowances be paid?

As for trips within the country, then, of course, the only payment currency can be the ruble. If we are talking about trips abroad, then in this case it is allowed to pay daily allowances both in rubles and in foreign currency. Most often, the US dollar or euro is used as a basis, but it is also acceptable to use local currencies depending on the country of destination. Although the use of “non-standard” banknotes will entail the problem of conversion and recalculation of exchange rate differences, unless the company has a special bank account opened for this purpose. As a rule, opening such an account is an additional expense for businesses. Only those companies whose employees regularly go on business trips abroad are ready for them.

Does the law stipulate cases when a company may not transfer daily allowances to an employee?

If sick leave is not a basis for refusing daily allowances, then the employee’s early return from a work trip will be a valid reason that will allow refusing to pay daily allowances. Please note that money is not transferred not only due to the employee’s unauthorized return from a business trip, but also if the trip was interrupted by the employer’s initiative. The situation is similar with going on vacation from a business trip. That is, if an employee returned early from a business trip and immediately went on vacation, such days are not included in the daily allowance calculation and the employer does not pay for them.

Business trips and reflection of daily allowances in 1C: ZUP

Content:

1. How to reflect a business trip 2. How to calculate daily allowances within the norm 3. How to calculate daily allowances in excess of the norm in 1C

1C: ZUP allows you to keep track of business trips in the system and reflect daily allowances in excess of the norm, for the purpose of assessing personal income tax and insurance contributions, as well as for reporting.

How to reflect a business trip

The first step is to make settings. If the settings have already been made, then skip this step and move on to the second. The following flags must be set in the accounting parameters:

· Business trip;

· Including intra-shift (when using intra-shift business trips).

Accounting parameters are located in the “Settings” - “Payroll calculation” - “Setting up accruals and deductions” - “Accounting for absences” section.

The second step is creating a business trip. The “Business Trip” document is used for this purpose. It can be found:

· On the desktop of the “Personnel”, “Salary” sections;

· In the “All Absences” workplace in the “Personnel” section;

· In the “All personnel documents” workplace in the “Personnel” section;

· In the “All accruals” workplace in the “Salary” section.

Go to one of the workspaces where this document is located and click on “Create”.

In the header we indicate the month of settlement, the date of creation of the document and the seconded employee.

On the “Main” tab, you need to set the travel period of the seconded employee. If a business trip is counted in part-time days, then you must check the “Part-time business trip (intra-shift)” flag and indicate the number of hours.

The “Vacate rate for the period of absence” flag is available only for full-day business trips and serves to ensure that a position in the staffing table is vacated during the period of absence of the posted employee and a temporary “replacement” can be appointed in his place.

The choice of payment option for a long business trip is available if the end date of the business trip is postponed to the next month. There are two options to choose from:

· Pay for the entire travel period. The full amount will be credited using this document and the current month. Payment will be made immediately for the entire period of the trip.

· Pay for business trips at the end of each month. This document will contain the amount for the first month. In the future, on the basis of this document, accruals for business trips will be made using the document “Accrual of salaries and contributions.”

The program will calculate the required accruals automatically, relying on the earnings of the posted employee. The data for calculating the “average” can be viewed in a special workplace (see figure below).

We also indicate how this amount will be paid and the date of payment.

The “Accrued” tab displays a detailed calculation of the trip.

If the territorial conditions of the posted employee change during the business trip, this must be reflected on the “PFR Experience” tab.

The “Additional” tab is intended for entering information for generating orders of printed forms.

After entering all the information, click on “conduct and close”. The third step is to reflect the daily allowance in the ZUP.

In accordance with the Tax Code of the Russian Federation, business trip expenses are subject to personal income tax and insurance contributions if they exceed established standards.

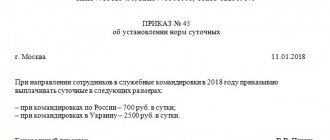

Let us remind you that the norm for a business trip within the Russian Federation is 700 rubles, and outside the Russian Federation 2500 rubles. for each day of the business trip. If the employer sets the daily allowance in excess of the norm, then he is obliged to impose personal income tax and insurance contributions on the excess amount.

To reflect daily allowances for a business trip in 1C: ZUP, you need to create two new accruals:

· Daily allowance is within normal limits;

· Daily allowance in excess of the norm in 1C.

Accrual “Daily allowance within normal limits”

To reflect the daily allowance in 1C: ZUP, do the following: go to the “Settings” - “Accruals” section.

We create a new accrual and make the following settings:

· type of assignment is set to “Income in kind 1C”;

· the result is entered as a fixed amount;

· assignments are made “According to a separate document”;

· Personal income tax is not assessed;

· Type of income for insurance premiums: “Income that is not subject to taxation of insurance premiums”

Accrual of daily allowances above the norm in 1C

We create a new accrual and make the following settings:

· type of assignment is set to “Income in kind in 1C”;

· the result is entered as a fixed amount;

· assignments are made “According to a separate document”;

· Personal income tax is assessed with income code 4800 and income category “Income in kind”;

· Type of income for insurance premiums: “Income entirely subject to insurance premiums”

The accrual is made by the document “Income in kind in 1C”.

During the final calculation in the document “Calculation of salaries and contributions”, insurance premiums are calculated from daily allowances in excess of the norm.

Specialist

Zhivolupova Yulia.

What documents must be completed when sending an employee on a business trip?

In order to transfer daily allowance, the employee needs a reason, namely being sent on a business trip. Otherwise, such transfers of money from the employer will be recognized as income with subsequent calculation of personal income tax. Let's look at how to pay for time on business trips and what documents you need to prepare for this. Thus, when traveling around Russia, the document confirming the date of the business trip is usually a business trip order. In this case, the amount of daily payments must comply with the organization’s standards approved in the collective agreement or in the regulations on business trips. For foreign trips to the CIS countries and the Customs Union, as in Russia, a business trip order is issued. And when moving to other countries, a mark from the border guards in the passport and a corresponding order from the director of the enterprise are sufficient. As for the amount of payments, days of travel in Russia are paid according to domestic standards. Traveling on a business trip on the days of crossing the border - according to foreign ones. And, accordingly, the days of travel through a foreign country are according to foreign standards, and the dates of crossing the border on the way back are according to Russian standards.

Daily allowance for business trips abroad

For example, let’s agree that the company’s daily allowance for a business trip abroad is 50 euros per day.

The employee was sent on a business trip to Germany for a period of 4 days. He purchased the plane ticket himself. The euro exchange rate on the date of payment of daily allowance was 70.00 rubles. Let's look at daily allowance transactions.

Dt 71 Kt 50.01.02 – 2000.00 euros or 14,000.00 rubles. – daily allowance was paid before the start of the business trip from the foreign exchange office (50.00 euros × 4 days or at the Central Bank exchange rate on the date of payment 2000.00 euros × 70.00 rubles).

Dt 50.03 Kt 71 – 40,000.00 rub. – airline tickets have been capitalized (to simplify the example, let’s assume that the tickets were purchased without VAT).

Dt 26 Kt 71 – 14,000.00 rub. – daily allowances are expensed based on the advance report.

Dt 70 Kt 68 – 520.00 rub. – personal income tax is withheld from excess daily allowance ((50 euros × 70 rubles – 2500.00 rubles) × 4 days × 13%).

Dt 26 Kt 69 - this is how accruals for insurance premiums for compulsory health insurance, compulsory medical insurance and VNiM should be reflected from the excess amount of 4000.00 rubles.

How to determine the date of receipt of such income from excess payments for personal income tax?

An organization may pay daily allowances in an amount exceeding the standards for personal income tax. Then the employee has income from which tax must be withheld. The date of receipt of income from January 1, 2016 is the last day of the month when the advance report is approved by the head of the company. For payments in foreign currency, the date of income is also considered the last day of the month of approval of the advance report. And the exchange rate for conversion into rubles is taken exactly on this date. Tax must be withheld on the day of the employee's next income payment, for example, on the day they receive their salary. And this money must be transferred to the budget no later than the next working day in accordance with paragraphs 4 and 6 of Article 226 of the Tax Code of the Russian Federation.