What is the inventory procedure?

Inventory is a procedure for checking the quantitative and qualitative characteristics of an institution’s property and the state of its financial obligations as of a specified date, ensuring control over the safety of fixed assets. This action is carried out by reconciling actual data with accounting registers: inventory in a budgetary institution in 2021 with new standards has been carried out since 2022, after the standard for the public sector “Fixed Assets” came into force (Order of the Ministry of Finance No. 257n dated December 31, 2016). For commercial organizations, the standards are changing in 2021-2022: from 01/01/2022, FSB 6/2020 “Fixed Assets” and 26/2020 “Capital Investments” will come into force, but companies are already using them in accounting and reporting for 2022 ( Order of the Ministry of Finance No. 204n dated September 17, 2020).

The inventory check is regulated by:

- 402-FZ “On Accounting” dated December 6, 2011;

- Order of the Ministry of Finance No. 49 of June 13, 1995, approving methodological instructions for this procedure and regulating the procedure for its implementation;

- local regulations of the organization on inventory.

The institution sets the timing of inventory control independently either in its accounting policies or by separate management orders. As a general rule, the inventory is carried out annually, before the preparation of annual financial statements, but not earlier than November 1 (regulations for fixed assets).

ConsultantPlus experts discussed how to prepare inventory documents. Use these instructions for free.

to read.

Inventory before annual reporting

Conducted in the 4th quarter. The start date is usually October 1st. The goal is to check the availability of the organization’s property and compare it with accounting data. All assets and liabilities are verified. To carry it out, the head issues an order.

If the annual procedure is not carried out, then inaccurate information will be reflected in the financial statements. For this, a fine is imposed on both the organization and its officials (Article 120 of the Tax Code of the Russian Federation, Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

Be sure to check:

- property;

- cash;

- obligations;

- settlements with debtors;

- reserves;

- loan balances;

- settlements with personnel.

IMPORTANT!

Conduct an inventory of fixed assets every 3 years, and library collections - once every 5 years.

The procedure for conducting an inventory of fixed assets

The procedure for conducting inventory is regulated by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49. Thus, according to the rules, fixed assets must be inventoried at least once every three years. But you can check them more often, for example, annually before drawing up the annual financial statements.

You can also distribute fixed assets into groups and annually, within a three-year period, inventory only part of the objects.

The exact timing of the audit is set by the company itself. However, there are cases in which a company is obliged to conduct an unscheduled inventory.

An inventory of fixed assets is required when:

- the lease, purchase or sale of an asset is expected;

- financially responsible persons are replaced;

- facts of theft, abuse or damage to property have been revealed;

- there was a fire, flood or other extreme circumstances;

- the organization is reorganized or liquidated;

- in other cases provided for by law and internal documents.

An inventory of fixed assets is carried out by a special commission by inspecting fixed assets. Before the inspection, you should check all available documents regarding the registration of these objects. These are inventory cards, inventory books, inventories and other analytical accounting registers, technical passports.

For buildings, structures and other real estate, the availability of documents that confirm the organization’s ownership of these objects is checked. For fixed assets leased and accepted for storage, the availability of lease agreements and acceptance certificates is checked.

If documents are missing or inaccuracies are identified in them, they must be reissued and the inaccuracies corrected.

The inventory process takes place in 4 stages.

- Approval by order of the head of the composition of the inventory commission, the deadline and grounds for conducting the inventory.

- Determining the availability of fixed assets, namely names of fixed assets, quantity, inventory numbers, cost, possibility of use for their intended purpose.

- Reconciliation of the received information with accounting data.

- Registration of audit results and reflection in accounting of data on deficiencies and surpluses identified during the inventory.

How it goes

The procedure for conducting a property inventory takes place in four stages:

- Preparation. During the preparatory stage, the manager issues an inspection order and forms an inventory commission, sets the deadlines for the process and determines the OS objects that will be inspected.

- Direct verification activities. Members of the commission study the quantitative and qualitative properties of OS objects, check their actual condition and availability, and draw up an inventory.

- The analytical stage, during which accounting data is compared with the results of the assessment process. If discrepancies are discovered by members of the commission, statements are drawn up and results are summed up.

- Registration of the results of checking the availability and current condition of property. Accounting brings accounting data into conformity with the commission's reports, those responsible for the errors are identified, and a measure of responsibility is established.

Please note that during the procedure, not only an order to conduct an inventory is issued, but also other orders. We will also talk about them in the article.

Order for inventory INV 22 (form)

Before proceeding with the reconciliation of the property present in the company or individual entrepreneur (fixed assets, inventory, intangible assets or inventories) and the data recorded in its accounting database, an appropriate order should be generated. It can have either a free form or be created on a unified form of the INV-22 form, approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. This is what we will consider further.

Important! If you use a self-developed form, it is recommended to reflect in it all the same indicators that the unified form contains, including: the personal composition of the inventory commission, the content, volume, procedure and timing of the inventory.

You can download the INV-22 inventory order form on our website using the link below:

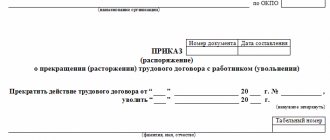

The order takes up one sheet of paper and has a structure that reflects:

- Details of this document: the name is indicated (order, instruction or resolution), and a specific number is assigned and the date of preparation is indicated.

- Information about the upcoming procedure: its reasons, elements of recalculation (fixed assets, intangible assets, inventories, cash or inventory), the time period that will be covered by the audit.

- The composition of the employees (indicating the position of each) who are part of the commission.

Test yourself: how to take an inventory. Completion time: about 5 minutes.

Pass the test The order is endorsed by the head of the company or individual entrepreneur, after which its details are entered in the journal intended for registering such documents (INV-23).

Read about the registration of INV-23 in the article “Unified form No. INV-23 - form and sample.”

In accordance with the order, upon completion of the inventory, all inspection materials are transferred to the accounting department: matching statements, inventory acts and inventories.

If you have access to ConsultantPlus, check whether you have correctly reflected the inventory results in your accounting and tax records. If you don't have access, get a free trial of online legal access.

How to draw up an order to conduct an inspection

The order is drawn up both in any form on the organization’s own letterhead, and using the unified form INV-22 (Resolution of the State Statistics Committee of the Russian Federation No. 88 of August 18, 1998). Be sure to indicate the number and date of the order, information about inventory activities, and the reason for the assessment of property assets. Indicate the values that the commission will check and set the time frame for this process. Determine the composition of the commission with the name and job description of each member.

IMPORTANT!

Let us give an example of the reason for the inventory in the order - “the need to prepare annual financial statements.” And for an unscheduled audit, write “control check”.

The order is signed by the head of the institution. Then information about the order is entered into the INV-23 registration log.

Each employee puts next to their full name. and a signature confirming the fact of familiarization with the assessment order. Maximum responsibility for the control activities carried out lies with the chairman of the inventory commission.

Current sample order for inventory of inventory items for 2022.

And this is a sample about conducting an annual inventory at a school before preparing financial statements.

Filling out the fields of the INV-22 form

Drawing up an order (resolution) for inventory is an extremely simple procedure. You will need to include OKPO and the name of the structural unit in the header if we are not talking about general inventory or revaluation, but about reporting on the property of a separate branch. If you plan to conduct inspections in several departments, then INV-22, as well as associated forms, will be compiled for each.

The inventory object can be fixed assets, inventories, liabilities, completed or unfinished construction objects, objects in safekeeping, etc.

We indicate “control check” or, more directly, “scheduled inventory” as the reason for the planned inventory. If personnel changes occur - “change of financially responsible persons” or “reorganization”. The resolution is also completed for cases of revaluation.

In the event of a change in responsible persons, storekeepers, cashiers and other specialists employed at the time of the inspection are indicated.

The timing of the assessment must be precise. The start date cannot be earlier than the document date.

After the INV-22 is completed, it should be entered into the journal using the INV-23 form. But the results of the inspection are entered into the journal using the INV-25 form. These documents can remain in the structural unit or be transferred (in the case we discussed above).

How to form a commission

The commission includes:

- representatives of the organization's management;

- accounting staff;

- financially responsible persons.

If for any reason one of the members of the commission is unable to perform duties (illness, business trip), then an order is issued to make changes to the composition of the inventory commission. All other employees participating in the procedure must put introductory signatures under the administrative document.

How to submit inspection results

Upon completion of verification activities, the IC analyzes the information received and draws up an inventory (inventory act) based on it. The financially responsible persons must sign the acts, thereby confirming their presence and agreement with the results of the reconciliation process.

If during the audit, surpluses or shortages were identified that lead to discrepancies with accounting data, a matching statement is generated. For fixed assets, unified forms of final documentation will be recorded in the INV-1 inventory and the INV-18 statement.

After completing the process of analyzing the final information, a meeting of the inventory commission is held, at which the results of the assessment are recorded and possible options for correcting the detected violations are determined. After the meeting, a protocol and statement are drawn up (many use the INV-26 form from GKS Resolution No. 26 of March 27, 2000), which records the absence (presence) of discrepancies and options for eliminating errors.

Documents prepared by the commission are sent to the head of the organization. The director reviews the initial materials of the assessment and makes decisions on the fact of control activities. The manager makes a decision based on the results of the inventory and issues a special order.

Comparison sheet for inventory of fixed assets

If during the inventory a surplus or shortage of fixed assets is identified, then to reflect the results of the audit, in addition to the inventories, a matching statement is drawn up. The document can be drawn up according to form No. INV-18, or you can develop it yourself.

The amounts of surpluses and shortages in this statement are indicated in accordance with their assessment in accounting.

The completed matching sheet is endorsed by the accountant and the employee who is responsible for the safety of the inventory property.

An example of preparing a comparison sheet based on the results of an inventory of fixed assets can be downloaded in the attachments to the article.