Features of the annual DAM

The Calculation form for insurance premiums was approved by order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/751. DAM for 2022 will be the last report compiled on this form. Already from reporting for the first quarter of 2022, accountants will use a new form (approved by order of the Federal Tax Service dated October 6, 2021 No. ED-7-11/875).

Policyholders who received income from no more than ten insured persons can report on paper. If there are more recipients, the Federal Tax Service accepts the reporting of such companies only in electronic form.

The contribution calculation form consists of three sections with attachments. Not all sheets are required to be completed by employers. But without exception, all employers must provide:

- Title page;

- Section 1 with summary data on pension, medical and social contributions;

- subsections 1.1 and 1.2 of Appendix 1 to section 1 with calculations for pension and medical contributions;

- Appendix 2 to Section 1 with calculation of contributions to the Social Insurance Fund of the Russian Federation;

- Section 3 with individual information of employees.

The report should not contain negative values. Cells can contain only positive or zero indicators.

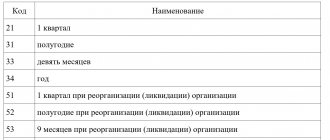

Before sending the report, check the registration data of the policyholder: name of the legal entity or full name of the entrepreneur, INN, KPP, type of activity and contact phone number. Indicate the required reporting period code from Appendix 3 to the order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/470 “On approval of the form for calculating insurance premiums”:

- 34 – DAM for 2022 is an ordinary legal entity;

- 90 – The DAM constitutes a legal entity in the process of reorganization or liquidation.

In the By location

Enter the appropriate code from Appendix 4 to the Federal Tax Service order No. ММВ-7-11/470. The most commonly used values are:

- 120 – at the place of residence of the entrepreneur;

- 214 – at the location of the legal entity;

- 222 – at the place of registration of the legal entity, at the location of the separate division.

In the DAM, it is necessary to indicate the average headcount indicator. Calculate it according to the instructions approved by Rosstat Order No. 711 dated November 27, 2019. If your company has not made payments to individuals, fill out the zero Calculation in the following order:

- Title page.

- In the first section, enter code “2” - this means that no payments were made to individuals.

- Fill out the third section for the head of the company and for each employee who was in the company in the reporting quarter. Enter your personal information and enter zeros in the total fields.

Responsibility for violations in reporting

If, when checking the report, the inspector finds an error, the company will be notified of its elimination in electronic or paper form. At the same time, the period established for eliminating the error is 5 working days when sending an electronic notification and 10 when sending by mail. If the company, for any reason, ignores the inspector’s requirement, the calculation receives the status of unrepresented. For this, the company will be fined in the amount of 5% of the calculated insurance premiums for each month of delay.

The amount of the fine cannot exceed 30% of contributions, but it cannot be less than 1000 rubles.

The legislative framework:

| Legislative act | Content |

| Article 22 of Law No. 125-FZ of July 24, 1998 | “Calculation and reporting periods for insurance premiums” |

| Chapter 34 of the Tax Code of the Russian Federation | "Insurance premiums" |

| Letter of the Federal Tax Service No. BS-4-11/12088 dated June 23, 2017 | “On filling out the calculation of insurance premiums for the last billing period of a reorganized legal entity” |

Reporting by separate divisions

Legal entities generally report at their location. If a legal entity has a separate division with its own bank account that pays salaries to employees, then a separate DAM must be submitted at the location of such a division.

Individual entrepreneurs submit the DAM at the place of their registration, regardless of the region in which their employees actually work. Entrepreneurs are required to report contributions if they hire workers under employment contracts or civil servants' agreements. If an individual entrepreneur does not have and did not have employees throughout 2022, the DAM does not need to be submitted, even the zero form.

Tariffs of mandatory insurance contributions for employers

Insurance premium rates depend on the size of the taxable base. The larger the base, the lower the tariffs. This tariff scale is called regressive. Every year the Government approves the maximum base of insurance premiums - the amount upon reaching which tariffs are reduced. In 2022, the maximum base is 1 million 465 thousand rubles. for contributions to the Pension Fund or Pension Fund and 966 thousand rubles. - for contributions to the Social Insurance Fund or Social Insurance Fund (Resolution of the Government of the Russian Federation dated November 26, 2020 No. 1935. Once this amount of employee income is reached from the beginning of the year, reduced tariffs begin to be applied to subsequent income until the end of the year.

Until the maximum base is reached, the following tariffs apply (Article 425 of the Tax Code of the Russian Federation):

- compulsory pension insurance - 22% (after reaching the maximum base, tariffs are reduced to 10%);

- compulsory social insurance in case of temporary disability and in connection with maternity - 2.9%;

- compulsory health insurance - 5.1%.

What to check in Appendices 1 and 2 to Section 1

Please check Appendices 1 and 2 in the DAM for the year separately, after a control check of the database and insurance premiums according to special reports in 1C.

Check the calculation of the taxable base by type of accrual. Check whether your program has the correct division into taxable and non-taxable parts. It is possible that in the fourth quarter there were new types of payments to employees, and for them the base for contributions was formed incorrectly. This needs to be checked in the program.

The maximum value of the base for insurance premiums for 2021

| Type of compulsory insurance | Limit value |

| Pension | RUB 1,465,000 |

| Social | RUB 966,000 |

| Medical | — |

When checking the annual DAM, check the general base for calculating contributions and only after that – the DAM, which generates “1C: Salaries and Personnel Management 8” ed. 3. Check the database using the report Taxes and contributions – Reports on taxes and contributions (Section Insurance premiums) – Analysis of contributions to funds

(Fig. 1). The value for calculating contributions must be equal to the total amount of payments minus non-taxable amounts, taking into account the maximum values for calculating contributions for compulsory pension and social insurance.

Rice. 1. Analysis of contributions to funds

Report Analysis of Fund Contributions

can be configured in “1C: Salaries and HR Management 8” edition 3 specifically for your company and save several report options for specific legal entities in the program.

Report Analysis of Fund Contributions

additionally configure:

- by type of accrual;

- employee breakdown;

- in terms of employee status (selection for temporary residents, temporarily staying employees);

- by neighborhood.

To make additional settings in the Fund Contribution Analysis

Contact your company's service partner.

In “1C: Salaries and Personnel Management 8” edition 3 there is another additional calculation for monitoring contributions - Checking the calculation of contributions

, but it is formed with a breakdown for each employee and month.

Checking the calculation of contributions

is located in the same section with

the Analysis of contributions to funds: Taxes and contributions – Reports on taxes and contributions (Section Insurance contributions) – Checking the calculation of contributions

(Fig. 2).

Rice. 2. Checking the calculation of contributions

Appendix 1 to Section 1

In the first appendix, two subsections are required to be completed: subsection 1.1 reflects the amount of contributions for compulsory pension insurance, subsection 1.2 contains information about payments for compulsory health insurance.

Both subsections contain the same fields to fill out, but if in subsection 1.1 the contribution amounts are divided into deductions before and after exceeding the limit on contributions to compulsory health insurance, then in subsection 1.2 there is no such division, since there are no limits on contributions to compulsory medical insurance.

Next, check the completion of the payer tariff code. The full list is given in Appendix 5 to the order of the Federal Tax Service No. ММВ-7-11/470. A frequently used code is 01, when the policyholder pays premiums at the basic insurance premium rates.

Check the taxable base: in subsection 1.1 of Appendix 1 to Section 1 the control ratio must be met:

Columns 1 (2,3,4) lines 050 = Columns 1 (2,3,4) lines 030 - Columns 1 (2,3,4) lines 040

All calculated contributions must be equal to the amount of contributions from payments within and above the limit. For reconciliation, use the ratio of indicators in subsection 1.1 of Appendix 1 to Section 1 (see below):

Columns 1 (2,3,4) lines 060 = Columns 1 (2,3,4) lines 061 + Columns 1 (2,3,4) lines 062

Also control the amounts payable by fund in section 1. Pension contributions payable must be equal to the total amount of contributions calculated for all tariffs. Apply the ratio:

Lines 030 (031,032,033) of section 1 = Amount of column 1 (2,3,4) of line 060 of subsection 1.1 of Appendix 1 for all tariffs

If equality is not met, check the indicators. There may be an error in the total amount of insurance premiums payable (lines 030–033 of section 1), or the amounts for individual tariffs have been calculated incorrectly.

The amount of contributions for health insurance must be equal to the amount of calculated contributions for all tariffs, that is:

Lines 050 (051,052,053) of section 1 = Amount of column 1 (2,3,4) of line 060 of subsection 1.2 of Appendix 1 for all tariffs

If equality is not met, check whether there may be errors in the total amount of insurance premiums payable (lines 050–053 of section 1) or in the indicators for individual tariffs.

Form structure

The report in KND form 1151111 consists of the following information blocks.

1. General information about the policyholder (organization, individual entrepreneur or individual who is not an individual entrepreneur).

2. Section 1.

Contains basic information for payment:

- KBK;

- amounts payable for the billing period (including for the last 3 months);

- the amount of excess expenses for VNiM contributions.

Subsection 1.1 includes information on OPS:

- total insured individuals since the beginning of the year, including over the last 3 months;

- the number of individuals to whom payments were made and contributions were accrued, including in amounts that exceed the maximum base value;

- the amount of all payments and other remuneration in favor of individuals;

- amounts of non-taxable payments;

- the basis for calculating insurance premiums, including in amounts exceeding the limit;

- the calculated amount, including from amounts that exceed and do not exceed the base limit.

Subsection 1.2 includes information on compulsory medical insurance similar to subsection 1.1.

Subsection 1.3 contains:

- OPS at an additional tariff (subsection 1.3.1);

- OPS at an additional tariff for certain categories of payers (“harmfulness”) specified in clause 3 of Art. 428 Tax Code (subsection 1.3.2).

Subsection 1.4 contains information on additional social security for members of flight crews of civil aviation aircraft, as well as certain categories of employees of a coal industry organization.

Appendix 2 (section 1) contains information on VNiM contributions:

- total insured individuals since the beginning of the year, including over the last 3 months;

- the amount of all payments and other remuneration in favor of individuals;

- amounts of non-taxable payments;

- amounts exceeding the base limit;

- basis for calculating insurance premiums, including other additional information;

- other additional information.

Calculation of insurance premiums 2022, Appendix 3 to Section 1 contains information on VNiM expenses for benefits paid:

- for temporary disability (cumulative total), taking into account restrictions and exceptions (taking into account external part-time workers), including for the last 3 months;

- for pregnancy and childbirth (cumulative), including for the last 3 months, taking into account external part-time workers;

- a one-time benefit for women who registered with medical organizations in the early stages of pregnancy, taking into account external part-time workers;

- lump sum benefit for the birth of a child;

- monthly child care allowance (up to 1.5 years), including for the first child and for the second and subsequent children;

- the number of additional days off to care for disabled children;

- insurance premiums calculated for additional days off to care for disabled children;

- social benefit for funeral or reimbursement of the cost of a guaranteed list of funeral services;

- for reference: accrued and unpaid benefits.

Appendix 4 contains information on expenses incurred using funds financed from the federal budget for section 1.

Appendix 5 - on the conditions for applying the reduced tariff of payers specified in paragraphs. 3 p. 1 art. 427 of the Tax Code of the Russian Federation (Russian organizations operating in the field of information technology).

Appendix 6 - on the conditions for applying the reduced tariff of payers specified in paragraphs. 5 p. 1 art. 427 of the Tax Code of the Russian Federation (organizations (IP) on the simplified tax system).

Appendix 7 - on the conditions for applying the reduced tariff of payers specified in paragraphs. 7 clause 1 art. 427 of the Tax Code of the Russian Federation (NPOs, with the exception of state (municipal) institutions on the simplified tax system).

Appendix 8 - on the conditions for applying the reduced tariff of payers specified in paragraphs. 9 clause 1 art. 427 of the Tax Code of the Russian Federation (individual entrepreneurs using patent SN).

Appendix 9 - about information for applying the tariff specified in paragraphs. 2 p. 2 art. 425 (paragraph 2, paragraph 2 of Article 426 of the Tax Code) of the Tax Code of the Russian Federation (general rates, reduced tariffs).

Appendix 10 - about the information that is necessary to apply the provisions of paragraphs. 1 clause 3 art. 422 of the Tax Code of the Russian Federation (payments and other remuneration under employment contracts, civil contracts, in favor of full-time students in professional and educational institutions of higher education, for activities carried out in a student group included in a special register).

3. Section 2 contains data on the obligations of the heads of peasant (farm) households:

- KBK;

- amounts payable for the billing period (including for the last 3 months) under compulsory pension insurance;

- amounts payable for the billing period (including for the last 3 months) under compulsory medical insurance.

Appendix 1 - other informative and clarifying information.

4. Section 3 - personalized information about the insured persons.

How to calculate the number of insured persons when calculating insurance premiums? To do this, take into account all the employees who are registered in your organization. Don’t forget to include specialists working under GPC contracts, as well as maternity workers and women on parental leave. Indicate this indicator in lines 010 of subsections 1.1-1.2 of Appendix 1 to Section. 1. Please note that line 020 may be less than line 010. For example, if during the reporting period the organization had employees on maternity leave or on parental leave, insurance premiums are not calculated for them.

To learn more, read the article about the procedure for filling out calculations for insurance premiums in 2020. It is also set out in the Order of the Federal Tax Service No. ММВ-7-11/551.

Key Points in Section 3

Complete the third section for each insured person. These include those working under employment contracts who received payments under the GPC, and the head of the company.

Do not fill in field 010 in the section header: this column is intended to cancel previously submitted information on an individual, as well as when adjusting data on lines 020–060 - to clarify the DAM.

Complete two subsections:

- 3.1 with personal data on the employee: last name, first name and patronymic, date of birth, citizenship information, passport data, SNILS and TIN numbers;

- 3.2 – data on income subject to insurance premiums at the basic and additional tariffs. Amounts reflect the fourth quarter of 2021. For cases where an employee quit in the 1st, 2nd or 3rd quarter and did not receive income after dismissal in the 4th quarter, take into account his payments and contributions only in the first section with applications. Do not include such an employee in the third section of the DAM for the fourth quarter.

In Section 3, also fill in information about the director of the legal entity. If the director is the sole founder and does not receive payments, personal information is filled in, and zeros are entered in the amount fields.

RSV 2022

Form 4-FSS Insurance premiums KBK

RSV calculation form

on insurance premiums

Zero RSV

RSV form

Organizations with more than 10 people must submit the DAM via the Internet.

Letter from the Federal Tax Service dated October 23, 2022 N BS-4-11/ [email protected]

Federal Tax Service Order No. ММВ-7-11/ [email protected] dated September 18, 2019 approved:

- Calculation form Appendix No. 1;

- procedure for filling out the form Appendix No. 2;

- format for submitting calculations in electronic form, Appendix No. 3.

Federal Tax Service Order No. ММВ-7-11/ [email protected] RSV form, sample, filling out

Zero RSV

Composition of the RSV form

- title page;

— sheet of information about the individual;

— Section 1 “Summary of the obligations of the payer of insurance premiums” and appendices thereto, including those containing:

calculation of insurance premiums for compulsory pension and health insurance;

calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity;

calculations of compliance with the conditions for the application of reduced tariffs by certain categories of payers;

— section 2 “Summary data on the obligations of insurance premium payers of heads of peasant (farm) farms”;

— Section 3 “Personalized information about insured persons.”

The appendices to the Procedure for filling out the calculation contain tables providing:

- category codes of the insured person;

- codes of constituent entities of the Russian Federation and other territories;

- codes of types of identification documents;

- payer tariff codes;

- codes of the place of submission of the calculation to the tax authority.

Sample of filling out RSV.xlsx

Contribution rate codes.docx

Insured person category code.docx

Filling out RSV.docx

Application for Refund of Insurance Amounts.docx Application for Refund of Additional. Contributions.docx

Reflection of sick leave in the RSV

Temporary disability benefits were accrued in one reporting period and paid in another. In what period should this benefit be included in the DAM?

Benefits for temporary disability and in connection with maternity are reflected in line 070 of Appendix No. 2 to Section 1 in the reporting period in which it was accrued.

Therefore, if the benefit was accrued to the employee in September and paid in October, the costs of paying this benefit should be reflected in the calculation of insurance premiums for 9 months.

Letter from the Federal Tax Service for Moscow dated 10.10.19 No. 27-15/ [email protected]

Reflection of sick leave in the RSV

Grounds for recognizing the DAM as unrepresented

In para. 2 clause 7 art. 431 of the Tax Code of the Russian Federation, new provisions have been added to recognize the payment of contributions as unpaid.

Errors should not be made in the following indicators of Section 3 for each individual:

210 - the amount of payments and other remuneration for each of the last three months of the reporting or billing period;

220 - the base for calculating pension contributions within the limit for the same months;

240 - the amount of calculated pension contributions within the limit for the same months;

250 - totals for columns 210, 220 and 240;

280 - the base for calculating pension contributions at the additional tariff for each of the last three months of the reporting or billing period;

290 - the amount of calculated pension contributions at the additional tariff for the same months;

300 - totals for columns 280, 290.

The summary data in the listed lines for all individuals must correspond to the summary data in subsections 1.1 and 1.3.

The changes are provided for by Federal Law dated November 27, 2017 N 335-FZ

Clarification of calculations in the DAM and 2-NDFL

If information about the employee has changed after submitting the DAM or 2-NDFL, then there is no need to update the reporting.

Personal data in the calculation of insurance premiums must be current as of the date of its submission to the inspectorate.

Therefore, if an employee, for example, changed his last name the next day, there is no need to retake the RSV or 2-NDFL certificate.

There is also no need to clarify 2-NDFL certificates.

Letter of the Federal Tax Service of the Russian Federation N ГД-4-11/ [email protected]

REIMBURSEMENT PERIOD IN DAM

For what period should reimbursement of expenses for sick leave be shown in the RSV?

Funds must be included in the calculation for the reporting period in which the Social Insurance Fund department reimbursed expenses.

It does not matter that the organization paid sick leave to the employee in the previous reporting period.

Letter from the Federal Tax Service No. BS-4-11/ [email protected]

Clarifications in the RSV

The inspectorate may not accept the calculation of contributions, or may request clarification or clarification.

If it is necessary to clarify personal data, then section 3 of the calculation is corrected for each “physicist” with incorrect information.

To do this, in subsection 3.1 indicate personal data from the initial calculation.

In this case, in lines 190-300 of subsection 3.2, “0” is put in all familiar places.

At the same time, fill out subsection 3.1 with current data and lines 190-300 of subsection 3.2 of the calculation.

If they forgot to include someone in the initial calculation, then section 3 with this data is included in the updated calculation and at the same time the indicators of section 1 are adjusted.

If information about the insured was shown by mistake, then section 3 for him is filled out in the updated calculation.

At the same time, in lines 190-300 of subsection 3.2, put “0” in all familiar places and correct the indicators of section 1.

If section 3.2 needs to be corrected, then section 3 with the correct data is included in the updated calculation.

If the amount of contributions has changed, the indicators in section 1 are also adjusted.

Federal Tax Service Letter No. BS-4-11/ [email protected]

WHO RENTS DAM

All employers submit a single calculation instead of the old RSV-1 - but not to the funds, but to the tax office. For each employee, personal data on contributions is entered into the document, which ultimately must agree on 316 indicators.

If individual lines do not match, the calculation is considered not submitted, and the Federal Tax Service will block the employer’s current accounts.

The Federal Tax Service Inspectorate compares the calculation of contributions with 6-NDFL and 2-NDFL.

Frequent Errors in RSV

— contributions in section 1 and the amount of contributions for all employees in section 3 do not match;

— incorrect information about employees is indicated in section 3.

The Federal Tax Service pays special attention to three details: full name, SNILS and INN.

Presentation of the DAM in the absence of payments

What sheets is the organization required to submit as part of the zero calculation of contributions?

Regardless of the type of activity, organizations and individual entrepreneurs include the following sheets in the calculation:

- title;

— section 1 “Summary data on the obligations of the payer of insurance premiums”;

— subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance” of Appendix 1 to Section 1;

— subsection 1.2 “Calculation of the amounts of insurance premiums for compulsory health insurance” of Appendix 1 to Section 1;

— Appendix 2 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity” to section 1;

— Section 3 “Personalized information about insured persons.”

The sheets are handed in even if no funds were paid to individuals and the DAM turned out to be zero.

Letter from the Federal Tax Service dated April 12, 2017 N BS-4-11/ [email protected]

Reporting to the Pension Fund Reporting to the Social Insurance Fund

Due date RSV

The DAM is due no later than the 30th day of the month following the end of each

from periods - 1st quarter, half-year, 9 months and full year.

These dates do not coincide with the deadlines for transferring payments.

The DAM is rented quarterly, and payments must be made to organizations and individual entrepreneurs

every month until the 15th.

From 2022, organizations with more than 10 people will have to submit the DAM via the Internet.

Letter from the Federal Tax Service dated October 23, 2022 N BS-4-11/ [email protected]

Accountant calendar

Penalties and Zero RSV

Failure to submit a calculation of insurance premiums with zero indicators will result in a fine. Its minimum amount is 1000 rubles.

The Code does not provide for an exemption from the obligation to submit calculations for insurance premiums if the organization does not conduct financial and economic activities during the reporting period.

By submitting a zero settlement, the payer declares that he did not make payments or other remuneration in favor of individuals.

Zero RSV

A zero calculation allows the inspectorate to distinguish organizations that do not pay remuneration to individuals and do not conduct financial and economic activities from those that have violated the deadline for submitting calculations.

Fines have been established for a single calculation of contributions (clause 1 of Article 119 of the Tax Code of the Russian Federation).

The fine is 5% of the amount of contributions for each month of delay.

EXAMPLE.

The RSV was not submitted or accepted by the tax authorities.

The amount of contributions is 1 million rubles.

For each full or partial month, the company will give 50,000 rubles. (1 million x 5%).

Letter of the Ministry of Finance N 03-15-07/17273

Federal Tax Service fines

RSV Form.pdf

Filling out RSV.docx

Insurance payments KBK Insurance Insurance Premiums Insurance Premiums from individual entrepreneurs

If clarification is needed on the RSV

When checking the DAM for the year, you can find problems that arose in the last quarter. For example, an employee took maternity leave at the end of September, but reported this and provided sick leave later, and the accountant had to recalculate her salary. If there is no income in the month of sick leave and the employee’s base for the fourth quarter is negative, in this case it is first necessary to generate an updated calculation for the third quarter, reduce the base for the previous period, and only then - the annual DAM. If this procedure is ignored, then without a refined calculation the annual DAM in “1C: Salaries and Personnel Management 8” edition 3 will not pass the control ratios and such a report will not be accepted by the Federal Tax Service.

The DAM update in “1C: Salaries and Personnel Management 8” edition 3 for the selected period is generated automatically. Data for all sections is adjusted; the third section includes only those employees for whom adjustments were made.

Tariffs of mandatory insurance premiums for individual entrepreneurs “for themselves”

For individual entrepreneurs, if they are not on staff, their own tariffs apply (Article 430 of the Tax Code of the Russian Federation). They apply only to the individual entrepreneur himself - for employees he applies the tariffs that I described above.

- For contributions to the Pension Fund in 2022, this is a fixed amount of RUB 32,448. until the income reaches 300 thousand rubles. Then 1% of income is paid. The total amount of contributions for the year cannot exceed RUB 259,584.

- Individual entrepreneurs transfer 8,426 rubles for compulsory health insurance. in year.

- But he may not transfer anything to social insurance. True, he won’t get any paid sick leave or maternity leave. To receive them you need to pay contributions to the Social Insurance Fund on a voluntary basis.

Federal Law No. 322-FZ established fixed contributions to pension insurance for the coming years:

- 2022 - RUB 34,445;

- 2023 - RUB 36,723

With income over 300,000 rubles. as now, you will need to pay 1% of contributions.

Fixed deductions for compulsory health insurance in 2022 are 8,426 rubles, and will further increase in accordance with the same law No. 322-FZ:

- in 2022 - 8,766 rubles;

- in 2023 - 9,119 rubles.

Responsibility for failure to submit and errors in the DAM

You can receive fines from the tax authorities both for late submission of reports and for errors in calculating contributions. The minimum fine for late payment is 1000 rubles. The tax authorities will issue it even if you transferred the contributions to the budget on time (clause 1 of Article 119 of the Tax Code). If the contributions indicated in the DAM are not paid in full, the sanctions will be higher - in this case it all depends on the amount of the underpayment. So, each full and partial month of delay will cost 5% of the unpaid amount. The maximum fine is 30% (see letter of the Federal Tax Service dated December 30, 2016 No. PA-4-11/25567).

On the last day for submitting annual reports on the DAM – January 31, 2022 – the Federal Tax Service accounting system will work in emergency mode. This often leads to failures in document acceptance. To ensure that your company’s report is accepted without problems or penalties from tax authorities, we recommend sending it a few days before the deadline.

Deadlines for submitting reports on insurance premiums

At the end of each reporting period, organizations are required to submit reports on insurance premiums to the tax authority. It is submitted no later than the 30th day of the month following the reporting period. That is, the report for the 1st quarter must be submitted no later than April 30. In the event that the last day of delivery falls on a weekend, the deadline is moved to the first next working day. So, in 2022, April 30 is a day off, and May 1 is a holiday, then the deadline for delivery is postponed to May 2.

The report is provided electronically or in paper form, it depends on the average headcount of the organization for the previous year. For example, if in 2016 it was more than 25 people, then the report will need to be submitted only in electronic form. Otherwise, the company will face penalties of 200 rubles. If the average headcount is less than 25 people, the company itself chooses the method of reporting. There will be no penalty for providing the report in non-electronic form.

An example of calculating mandatory insurance premiums

As you can see, the principle of calculating insurance premiums for individual entrepreneurs without employees and for an employer is similar. I will give an example of a calculation for an individual entrepreneur, since insurance premiums for employees are usually calculated by an accountant.

Let’s say that an individual entrepreneur without employees received an income of 1 million rubles in 2022. The amount of insurance premiums will consist of three components.

1. Compulsory pension insurance for incomes up to 300 thousand rubles: 32,448 rubles.

2. Compulsory pension insurance for incomes over 300 thousand rubles: (1,000,000 rubles - 300,000 rubles) * 1% = 7,000 rubles.

Together, these amounts give 39,448 rubles, which is less than the maximum contributions to the Pension Fund (259,584 rubles). This means you will have to pay the full amount.

3. Contributions for compulsory health insurance: RUB 8,426.

Total: 47,874 rub.