Introductory information From July 2022, the Tax Code will contain a list of grounds for which

In detail The authorized capital of a legal entity is the initial support for the organization’s activities by depositing funds

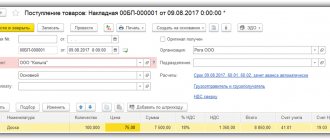

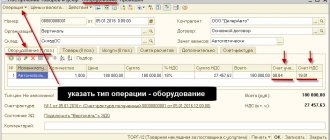

Receipt of fixed assets to the enterprise Fixed assets are assets directly used for production,

Social tax deduction for treatment - procedure for obtaining Russians can request a state tax deduction from the Federal Tax Service

Standard working hours for 2022 An important task of a HR specialist is to correctly determine

Accounting for containers Vasilyev Yu.A., General Director of CG “Ayudar”, Ph.D. in Economics, author of the book “Annual Report 2004” Tara

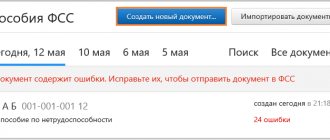

According to the new rules, benefits are paid to employees not by the employer, but directly by the Social Insurance Fund (see Government resolutions

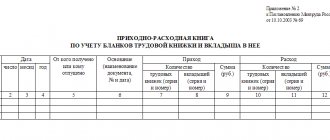

Is accounting of work books required at an enterprise? From 01.09.2021 new rules apply

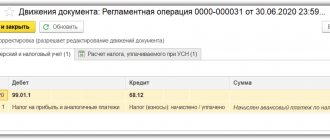

Accounting under the simplified tax system Accounting in organizations using the simplified tax system is mandatory. Most often they

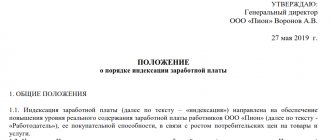

The economic crisis has a negative impact on the well-being of the population. Wage indexation in 2022 will allow