Receipt of fixed assets to the enterprise

Fixed assets are assets that are directly used to produce products, provide services and perform other functions of the enterprise and have a service life of at least one year.

In addition to those in operation, part of the fixed assets may be kept in stock or leased. Read about OS rental here. Depreciation of fixed assets subject to wear and tear, for example, machine tools or vehicles, is taken into account in the cost of manufactured products (services provided). We examined the concept and classification of fixed assets in this article, here we will dwell in more detail on the features of accounting for their receipt by the enterprise, consider the entries made when accepting fixed assets for accounting in the case of construction, purchase, gratuitous receipt, as well as when receiving an object in the form of a contribution to the charter capital.

Basic Operations

1 Purchasing an OS

The purchase of non-current fixed assets is reflected by the following entries:

Dt 08 Kt 60 – the purchased fixed assets are taken into account (negotiated price excluding VAT), as well as the costs of transportation, setup, storage under contracts with third parties – a separate entry is made for each operation;

Dt 19 Kt 60 – VAT allocated;

Dt 68 Kt 19 – VAT refunded.

2 Creation of an asset using your own resources (in whole or in part)

Dt 08 Kt 23 – expenses of auxiliary shops are accepted as non-current assets;

Dt 08 Kt 10 (70, 69) – expenses for materials and salaries of employees involved in creating property are accepted as non-current fixed assets.

3 Free admission

There are 2 options possible:

Dt 08 Kt 76 – donation of property:

Dt 08 Kt 98/2 – acceptance of an asset for accounting as a result of the inventory.

Attention! Property received free of charge is taken into account at the price at which it is usually sold in a competitive market (market value).

4 Contribution by the founder as a contribution to the management company

Dt 08 Kt 75 – assets were accepted as the founder’s contribution to the management company.

5 Receipt of equipment requiring installation

Dt 08 Kt 07 - equipment ready for installation is accepted as an investment in non-current assets.

6 Transfer of animals to an adult herd

Dt 08/6 Kt 11 - the cost of grown animals has been taken into account;

Dt 07 Kt 08/6 – the cost of the main herd has been increased.

7 Putting the property into operation

Dt 01 (03, 04) Kt 08 – acceptance of the asset for accounting as fixed assets (income investment, intangible assets).

Attention! As a rule, property purchased from suppliers is completely ready for use and is written off from the account. 08 on account 01 (03, 04) immediately after the transaction is completed. If the construction (creation) is carried out by the organization independently, the cost of the object can accumulate on Dt 08 for a long time. As a rule, the account balance at the end of the period represents the balances of incompletely formed assets created on its own.

Rubleva Elena Alekseevna, 2016-10-30

Postings + documents 1C 8.2

Enter the specified wiring into the Wiring Trainer and be sure to recite the “information” - what the wiring reflects, what “information” (see the description - I give a description for each wiring), 100% memorability, be sure to say it “out loud”.

A capital investment item has been received from the supplier

Posting: D. 08 “Investments in non-current assets” - K. 60 “Settlements with suppliers.”

Description: by posting we recorded “information” about the costs of the capital investment project (account 08) and by posting we recorded “information” about the debt to the equipment supplier (account 60).

Amount: amount WITHOUT VAT, indicated in the invoice or acceptance certificate. Posting date: date of the invoice or delivery certificate.

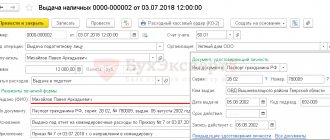

Document 1C 8.2 creating wiring D.08 - K.60:

doc.”Receipt of goods and fixed assets

- set the type of operation - "equipment" - tab.Equipment, set up an "accounting account" for each asset object = account 08.04 - tab. Settlement accounts, set up a "accounting account for settlements" with the counterparty = account 60.01/ 60.02

doc. “Receipt of goods and services” - receipt of “services” to bring the object to readiness

— set the type of operation - “equipment” — tab. and object = invoice 08.04 + object - issue a “account for settlements” with the counterparty = invoice 60.01 and invoice 60.02

The object of capital investment may be an expense of 100 rubles. (for example, we bought a bag of nails). In the version with a bag of nails, a part of the object was received, which still needs to be assembled into a single whole. If you don’t collect the expenses for this bag of nails on account 08 right away, then you can end up missing a million of these bags, and this is already an object worth 100 million rubles. The main thing is that you must highlight from the entire flow of expenses those expenses that need to be collected separately on account 08, expenses that are directly related to the creation of our future fixed asset.

In my work, I immediately warn managers that they must inform me about the decision to create OS objects, and there were cases when I learned about an object under construction approximately halfway through its construction, and of course I did not correctly reflect the costs of this object, since my accountant wrote off the costs of creating the object simply as expenses for the period, which is NOT correct (distortion of accounting statements, income tax, property tax).

WE ACCEPT the object as part of fixed assets

Posting: D. 01 “Fixed assets” - K. 08 “Investments in non-current assets”.

Description: by posting we recorded “information” about the “initial cost” of the fixed asset (account 01) and by posting we recorded “information” about the completion of the formation of the “initial” cost of the fixed asset (account 08) and the write-off of all expenses to account 01.

Amount: the amount of accumulated expenses, which is listed on account 08 at the time of commissioning of the fixed asset. Posting date: The date the asset was put into operation, usually indicated in the commissioning report. Note: before generating the posting, we check the “attribution limit to the OS”.

Document 1C 8.2 creating wiring D.01 - K.08:

doc. "Acceptance for accounting of fixed assets"

- set the type of operation - "equipment" - bookmark.Fixed assets, set the "accounting account" for the capital investment object = account 08.04 - bookmark.Accounting, set the "accounting account" of the fixed assets object = account 01.01 - bookmark.Accounting , we issue a “depreciation account” for the fixed asset object = account 02.01

Accounting for receipt and disposal of fixed assets and the procedure for their inventory

D 08 - K 60 - reflects the costs of construction and installation work accepted from contractors;

D 19 - K 60 - VAT presented by the contractor for payment to the customer is reflected;

D 01 - K 08.3 - fixed assets put into operation.

When an organization carries out construction and installation work in an economic way, the following entries are made in accounting:

D 10 - K 60 - materials were purchased to carry out work on the construction of the facility;

D 19 - K 60 - VAT on purchased materials is reflected.

The costs for the construction of buildings, structures, installation and other capital construction costs minus VAT are reflected:

D 08 - K 07 - the costs of installing equipment are reflected;

D 08 - K 10 - costs of materials used are reflected;

D 08 - K 70 - wages to employees;

D 08 - K 69 - the amount of insurance contributions from employees' wages;

D 08 - K 19 - non-refundable VAT written off to increase the actual costs of construction and manufacturing;

D 08 - K 68 - VAT is charged on the volume of work performed;

D 60 - K 51 - funds were transferred;

D 68 - K 19 - VAT is reflected on materials purchased, work performed, services provided;

D 01 - K 08.3 - fixed assets were put into operation.

Acceptance of completed work on the completion and additional equipment of a facility, carried out in the order of capital investments, is formalized by an acceptance certificate for repaired, reconstructed and modernized facilities (form No. OS-3). The transfer of equipment for installation is formalized by an act of acceptance and transfer of equipment for installation (form No. OS-15). For equipment defects identified during installation, adjustment or testing, as well as based on inspection results, a report on identified equipment defects is drawn up (Form No. OS-16) [1, p. 128].

One of the ways to receive fixed assets is to receive objects as a contribution to the authorized capital of a newly formed or increasing the authorized capital of an organization. When making contributions to the authorized capital of the organization, the founders act on the basis of the constituent agreement, and when they are made in the accounting records of the organization, the initial value is recognized as their monetary value, agreed upon by the founders of the organization. When accepting for accounting fixed assets contributed by the founders as part of their contribution to the authorized capital of the organization, the following accounting entries are made:

D 75 - K 80 - for the amount of debt of the founders in monetary value for contributions to the authorized capital when creating the organization;

D 08 - K 60 - reflection of delivery costs;

D 08.4 - K 75.1 - receipt of deposits in the form of fixed assets from the founders;

D 19 - K 83 - VAT on contribution to the authorized capital;

D 01 - K 08.4 - acceptance of fixed assets into operation;

D 68 - K 19 - VAT on the contribution to the authorized capital is accepted for deduction.

According to the gift agreement, one party (the donor) gratuitously transfers or undertakes to transfer to the other party (the donee) an item of ownership or a property right (claim) to himself or to a third party, or releases or undertakes to release her from a property obligation to himself or to a third party [17 ]. Fixed assets received under a gift agreement are accepted for accounting at market value. The market value of property is established by documentary or expert means. The costs of establishing and confirming the market price are included in the initial cost of fixed assets. According to PBU 9/99 “Income of an organization,” assets received free of charge are included in other income of the organization [21].

Acceptance for accounting of fixed assets received from other legal entities and individuals under a gift agreement, as well as in other cases of their gratuitous receipt, is reflected in the following accounting entries:

D 08 - K 98 subaccount 2 “Gratuitous receipt” - receipt of fixed assets under a gift agreement;

D 08 - K 60 - reflection of expenses associated with the transportation of fixed assets;

Go to page: 2

Other articles

Feasibility study for the development of an innovative project that reduces the labor intensity of a product at an enterprise in the industry Currently, the world economy is largely a market economy, so it requires the constant presence of new types of industrial production, and given that modern technologies are regularly developing, competition is very noticeable . All companies are modernizing their...

Accounting for office furniture in accounting

If pieces of furniture, according to accounting rules and accounting policies, should be classified as inventories, then they must be received on account 10 in the following correspondence:

- D10 - K60 - the record shows the fact of receipt of furniture at the enterprise;

- D19 - K60 - this posting reflects the amount of VAT.

If, according to all standards, a furniture set should be taken into account as part of fixed assets, then its amount after installation and start of operation will be reflected in account 01. Depreciation will have to be charged on such objects every month. The arrival of new furniture is shown in the accounting records with the following entries:

- D08 – K60 – receipt of furniture items from the supplier and their shipment to the buyer’s territory;

- D19 – K60 – the amount of VAT is allocated;

- D01 - K08 - wiring is entered into accounting after the furniture is assembled and installed at the place of use.

The write-off process will be reflected through a set of correspondence:

- D91 - K01 posting is formed in the amount of the residual value of the object that was decided to be decommissioned;

- D02 – K01 – accrued depreciation amounts are written off;

- D10 - K99 - correspondence will be relevant in situations where furniture is liquidated by disassembly, and the remaining individual materials are registered and used in the activities of the enterprise;

- D91 - K99 - indicates the amount received by the organization as a result of the disposal of furniture;

- D99 - K91 - posting reflects the loss that was caused by the disposal of furniture.

Accounting for furniture in an organization is accompanied by the calculation of depreciation on those items that are recognized as fixed assets. To do this, it is necessary to determine which depreciation group these assets should belong to. Identification is carried out according to the criteria outlined in the government decree of January 1, 2002 under No. 1 and Art. 258 Tax Code of the Russian Federation. Furniture in the classification adopted by the legislator is not distinguished as a separate element. In such situations, it is allowed to focus on the service life. The value of this indicator should be taken from the technical documentation or recommendations of the furniture manufacturer.

To avoid conflicts between accounting and tax accounting data, it is recommended that in relation to furniture, the same time interval for operation is established in different types of accounting. Depreciation is charged to account 02 by posting D26 - K02.

In what cases is the posting Dt 08 Kt 60 drawn up?

Posting Dt 08 Kt 60 is used when creating (installing, modernizing) non-current assets by third-party organizations and reflects the attribution of the cost of objects (work, services) received from contractors to increase the initial cost of non-current assets.

Example (continued)

To decorate the store-warehouse, Stroy Market LLC turned to the contractor for services for the manufacture and installation of display cases, the cost of which was:

- production of display cases - RUB 127,810.16. (VAT included);

- installation of display cases - RUB 5,837.28. (VAT included).

In the same period, Stroy Market LLC ordered the development from a third-party IT company:

- accounting program for maintaining trade and warehouse accounting in the amount of 128,572.87 rubles. (including VAT) - without transfer of exclusive rights to the customer;

- applications to the online store website in the amount of RUB 4,413.56. (including VAT) - with the transfer of exclusive rights to the customer.

After receiving the final results for the above work, Stroy Market LLC reflected the transactions in accounting:

The initial cost of display cases reflects the costs of their production.

RUB 106,508.47 = 127,810.16 – 127,810.16 × 20 / 120

clause 1 art. 257 Tax Code of the Russian Federation

RUB 21,301.69 = 125,680 × 20 / 120

The initial cost of display cases reflects the costs of their installation.

RUB 4,864.40 = 5,837.28 – 5,837.28 × 20 / 120

RUB 972.88 = 5,837.28 × 20 / 120

The costs of developing an accounting program were written off as deferred expenses.

RUB 107,144.06 = 128,572.87 – 128,572.87 × 20 / 120

clause 5, clause 7, clause 18, clause 19 PBU 10/99

subp. 26 clause 1 art. 264 Tax Code of the Russian Federation

RUB 21,428.81 = 128,572.87 × 20 / 120

The initial cost of an online store website includes the costs of developing an application.

RUB 3,677.97 = 4,413.56 – 4,413.56 × 20 / 120

clause 9, clause 10 PBU 14/2007

clause 3 art. 257 Tax Code of the Russian Federation

RUB 735.59 = 4,413.56 × 20 / 120

Accounting for repairs of fixed assets

There are two options for repairing the OS, considered from an accounting point of view:

- Current repairs - such costs can be written off immediately after the fact;

- Major repairs (it can also be called modernization or reconstruction) - such costs must either be included in the cost of the object, or must be accounted for as a separate fixed asset (a new card is filled out for the amount of expenses);

The difference between major and current repairs is that in the second case, technical and other significant characteristics do not change, while the first type implies their improvement.

Possible wiring for current repairs:

- D20 K60 – reflects the price of repair of the operating system operated at the main production facility, the repair was carried out by the counterparty;

- D25 K60 - reflects the price of repair of an operating system operated for general production needs, the repair was performed by a counterparty;

- D26 K60 - reflects the price of repair of an operating system operated for general business needs, the repair was performed by a counterparty;

- D23 K10 – materials were released for OS repairs carried out by the organization independently;

Modernization in accounting:

- D08 K60 – major repairs were carried out by the counterparty, the price for services is reflected;

- D08 K10 – materials released during independent reconstruction;

- D01 K08 – the cost of upgrading the OS is included in the original cost.

Documentation of OS upgrades:

- OS-15 - transfer for installation;

- order;

- defective act.

Upgrading may result in an increase in the life of the OS.

Postings to account 08 - Investments in non-current assets

08 without VAT: the amount indicated in the invoice is divided into the actual price of the object (recorded in Dt 08) and the amount of VAT (in Dt 19).

Attention! The account records only property that is not ready for use in business activities. As soon as the object is ready for use, and the value of the property has been formed, it is necessary to write it off to the appropriate accounts (01, 03, 04). If this is not done on time, the tax service may have questions for the organization, as this entails incorrect calculation (underpayment) of property tax amounts.

OS accounting in postings

D 08 K 60 (02, 10, 70, 69)

Reflects the formation of construction and (or) assembly costs that form the initial cost

For equipment requiring installation:

Reflects the original cost, wiring

Input VAT is reflected on acquisition (construction) costs

VAT claimed for deduction

Documented OS are received on the basis of unified forms OS-1 and OS-6. The forms may be supplemented with other information required by the organization. Their disposal (upon sale, liquidation, other cases) is carried out at the residual value (for depreciable property). The residual value (posting) is determined as follows:

Types of Accounting Entries

Buh. records are divided into 2 types: simple and complex. Complex entries are entries in which more than two accounts correspond. They are divided into two types:

- Buh. transactions in which only one account is debited and several are credited at once. The sum of credit accounts must equal the sum of debit accounts.

- Buh. transactions in which only one account is credited and several are debited at once. The sum of debit accounts must equal the sum of credit accounts.

Simple accounting entries are entries in which only 2 accounts correspond. accounts. What type of wiring needs to be used will depend on the specific operation performed.

Based on the nature of the information displayed, accounting entries are divided into:

- real;

- conditional;

- clarifying.

The purpose of real postings is to record operations, phenomena and facts that were actually completed. For example, payment to the supplier.

Conditional entries arise as a result of the accounting methodology. In fact, the operation was not completed, but the wiring needs to be generated. They are used to clarify and transfer indicators. An example is the inclusion of management costs in production costs.

K buh. Clarifying type entries include corrective entries and entries for writing off the calculation difference in the production process accounts . They are divided into two types:

- additional - they are written in blue or black ink, their sum increases the turnover of the book. accounts;

- reversals - they are written in red ink; when calculating the totals, the red amount is subtracted.

Accounting on account 60

Thus, the credit of account 60 reflects the organization’s accounts payable to the supplier or contractor.

The debit of account 60 shows a decrease in this debt, that is, payment according to the supplier’s documents, debit 60 corresponds with the credit of cash accounting accounts, the posting for payment of debt to the supplier has the form D60 K50 (51, 52, 55).

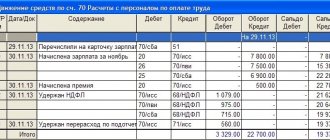

Accounting entries for account 60:

Accounting for settlements on advances issued

Separately, I would like to say about the features of accounting for 60 advances issued on the account. If an organization transfers an advance payment to a supplier for the future supply of assets, for work or services, that is, it issues an advance, then a separate sub-account 60.2 “Advance issued” is opened to account for them. In this case, subaccount 60.1 will take into account settlements with suppliers in the general case.

When transferring the advance payment, posting D60.2 K51 (50, 52) is performed. In this case, a receivable from the supplier to the organization is formed.

When the supplier offsets the advance received and delivers assets (work, services), then posting D60.1 K60.2 is performed.

Postings for accounting of advances issued:

Very often the question arises: is 60 count active or passive? As you can see, a debit can take into account the organization’s receivables, and a credit can take into account accounts payable, that is, accounting account 60 can simultaneously take into account assets and liabilities, which means it is active-passive. This was discussed in detail here.

Chart of accounts. Account 07 “Equipment for installation”

Accounting ~ chart of accounts >>

Account 07 “Equipment for installation” is intended to summarize information on the availability and movement of technological, energy and production equipment (including equipment for workshops, pilot plants and laboratories) that require installation and are intended for installation in facilities under construction (reconstruction). This account is used by property developers.

Equipment that requires installation also includes equipment that is put into operation only after its parts have been assembled and attached to the foundation or supports, to the floor, interfloor ceilings and other load-bearing structures of buildings and structures, as well as sets of spare parts for such equipment. This equipment includes control and measuring equipment or other devices intended for installation as part of the installed equipment.

Account 07 “Equipment for installation” does not take into account equipment that does not require installation: vehicles, free-standing machines, construction mechanisms, agricultural machines, production tools, measuring and other instruments, production equipment, etc. Costs of purchasing equipment that does not require installation , are reflected directly on account 08 “Investments in non-current assets” as they are received at the warehouse or other storage location.

Equipment for installation is accepted for accounting as a debit to account 07 “Equipment for installation” at the actual cost of acquisition, which consists of the cost at acquisition prices and expenses for the acquisition and delivery of these assets to the organization’s warehouses.

The purchase of equipment for a fee from other organizations and persons is reflected in the debit of account 07 “Equipment for installation” in correspondence with account 60 “Settlements with suppliers and contractors” or others.

Acceptance for accounting of equipment contributed by the founders on account of their contributions to the authorized (share) capital of the organization is reflected in the debit of account 07 “Equipment for installation” and the credit of account 75 “Settlements with founders”.

The receipt of equipment for installation can be reflected using account 15 “Procurement and acquisition of material assets” or without using it in a manner similar to the procedure for accounting for relevant operations with materials.

The cost of equipment handed over for installation is written off from account 07 “Equipment for installation” to the debit of account 08 “Investments in non-current assets”. At the same time, the contractor accepts equipment delivered to the construction site that requires installation for off-balance sheet accounting under account 005 “Equipment accepted for installation.” The contractor removes the cost of this equipment or its parts handed over for installation from off-balance sheet accounting in account 005 “Equipment accepted for installation.” The cost of equipment transferred to a contractor, the installation and installation of which at a permanent place of operation has not actually begun, is not deregistered from the developer’s register.

When selling, writing off, transferring free of charge or other equipment for installation, its cost is written off as a debit to account 91 “Other income and expenses.”

Analytical accounting for account 07 “Equipment for installation” is carried out by equipment storage locations and individual items (types, brands, etc.).

Account 07 “Equipment for installation” corresponds with the accounts

| by debit | on loan |

| 15 Procurement and acquisition of material assets 23 Ancillary production 60 Settlements with suppliers and contractors 66 Settlements for short-term loans and borrowings 67 Settlements for long-term loans and borrowings 71 Settlements with accountable persons 75 Settlements with founders 76 Settlements with various 79 On-company 80 Authorized capital 86 Targeted financing 91 Other income and expenses | 08 Investments in non-current assets 23 Ancillary production 76 Settlements with various debtors and creditors 79 On-farm settlements 80 Authorized capital 91 Other income and expenses 94 Shortages and losses from damage to valuables 99 Profits and losses by debtors and creditors settlements |

Accounting ~ chart of accounts >>