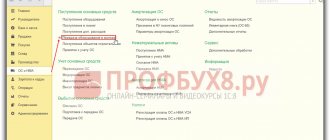

Today we will look at the assembly and commissioning of a fixed asset that requires installation and consists of

Sign in the 2-NDFL certificate The sign in the 2-NDFL certificate shows who (the tax agent or his

The patent system (remember the abbreviation PSN) is one of the special regimes for entrepreneurs. In contrast

Who is a Beneficial Owner? A beneficiary is an individual who participates in a legal entity.

Features of the calculation work It is necessary to pay a fee if the enterprise has negative impacts on the surrounding air

Form 1-IP for 2022: , sample 2022 Rosstat has approved several types of 1-IP reporting.

Why are fee payer tariff codes needed? The codes in question are recorded in

Leasing today is a very popular form of business relationships, as it allows you to obtain the necessary fixed assets

Closing an individual entrepreneur is a fairly simple procedure. First, the entrepreneur must submit to the tax office

Tax authorities require full reporting from all business entities, including individual