The Labor Code requires the employer to pay the wages employees deserve at least twice a month. The first such payment is called an advance payment, since it is accrued before the month worked has expired.

- What proportion of the total salary should the advance be?

- When exactly does it need to be paid?

- What are the consequences for an employer of ignoring advance payments?

All questions regarding the advance are discussed below.

Question: Organizations are required to pay wages for the first half of the month, taking into account the time worked by the employee. Some companies apply a coefficient of 0.87 to the calculated advance payment. Does the employer underestimate the salary for the first half of the month in such a situation? View answer

What documents regulate the advance?

In no way, since the official term “advance” does not exist in labor legislation. This is a colloquial, established name for the first part of the salary, which must be paid at least twice a month (Article 136 of the Labor Code of the Russian Federation).

REFERENCE! The second part is traditionally called “pay” or “salary” itself, although in fact the salary is both payments together.

Question: Until recently, salaries in our organization were paid twice a month. Currently, they offered to write a statement refusing the advance payment and stated that the salary would be calculated once a month. Is this legal? View answer

Therefore, instead of the term “advance”, the legislation uses the expression “procedure for payment of wages”. And this procedure already has a strict documentary justification in the internal acts of the organization:

- collective agreement;

- internal rules of the company;

- individual employment contracts;

- Regulations on the enterprise.

Question: What type of income code should be indicated in the payment order when paying an advance (that is, from wage income for the first half of the month), if the employer withholds 70% of the salary from the salary once a month according to writs of execution, so that according to new writs the bank Didn't make the deduction yourself? View answer

Other questions regarding prepayment (advance payment) in a check

In what cases is it necessary to make one check for all advances?

Companies and individual entrepreneurs that accept a large number of advances may not be able to cope with the flow of cash advance receipts that they are required by law to issue. Imagine how much time it takes for the conductor to count all the advance checks at the end of the trip and issue a check for payment?

For some companies there are concessions - they can issue one general check for the advance payment for the billing period, in which all cash receipts for the advance payment can be combined. Unfortunately, the list does not include trade organizations.

It is allowed to generate one (final) check that covers the advance:

- organizers of cultural events;

- carriers of various types;

- companies providing communication services;

- organizations in the field of electronic services (from Article 174.2 of the Tax Code of the Russian Federation);

- management companies and utilities (housing and communal services);

- private security companies and organizations in the field of security systems;

- companies from the educational sector.

Organizations on this list have 10 days after the service is provided to generate a check for the advance payment.

What to put in the name of a product (service) if it is impossible to accurately determine the model (list of services)?

We recommend writing “advance payment” in the name of the product (service) on the cash register receipt. Similarly, indicate the attribute of the calculation method -.

In the receipt for the advance payment, write down the name of the product (service) specifically.

Buying a wardrobe in a furniture showroom. The package has been agreed upon, but at the buyer’s request, we will negotiate with the supplier for a discount on components. The price may be lower in the end. What payment indicator should be on the check - advance or prepayment?

Insure yourself against potential problems and indicate that you received an advance from the client. However, write in the contract that the client gives you money in advance and that the final cost may change.

Is it possible to cancel a knocked out advance check? The client changed his mind and took the money an hour after the check was generated. Didn't receive the goods.

You need to cancel an advance check (including an erroneous one) using a refund. It is necessary to punch the return check (a special command at the online cash register), and indicate in the payment attribute that this is a refund of the advance payment.

How to indicate the amount in a check for an advance payment if the company is paid by a foreign client (payment in dollars)?

According to 54-FZ, it is necessary to indicate the price of the goods in the receipt only in rubles, that is, at the time of payment you will have to convert dollars into rubles (the exchange rate of the Central Bank or the bank in which you hold an account).

You can indicate the cost of a product (service) in dollars only in the form of additional details (in a free field).

When is the advance paid?

The date separating the payment terms is chosen by the enterprise arbitrarily. The law does not give strict instructions in this regard, however, there are recommendations from Rostrud, the Ministry of Social Development of the Russian Federation and the Federal Service for Labor and Employment, based on the logic of things.

When is the advance payment and the second part of the salary paid ?

Since remuneration for labor must be paid for the time actually worked and occurs twice a month, it is quite logical to divide the month approximately in half and choose the 15th-16th as the payment date.

FOR YOUR INFORMATION! With this choice of payment dates, it is recommended to divide the salary into approximately equal parts.

However, in the absence of strict legal requirements, the entrepreneur has some freedom in choosing dates for salary payments. You just need to take into account some nuances:

- it is allowed to divide payments not necessarily into 2 parts, you can split the salary into smaller shares, paying it three or four times a month, then the logic for setting dates will be different;

- if the gap between the advance and pay is more than 15 days, then according to the law, the employee theoretically has the right to complain about the delay in wages, suspend work and even go to court;

- the selected time periods must be recorded in the internal documents of the organization.

NOTE! The time for paying the advance must be a specific date, not a period. It is impossible to schedule advance payments, for example, from the 5th to the 10th, and paydays from the 25th to the 30th. Thus, the requirement to comply with the frequency of payments is violated.

If the appointed date coincides with a weekend or holiday, the employee will receive the required advance payment the day before.

Question: Is it necessary to calculate and transfer personal income tax to the budget from an advance payment of wages (clause 2 of Article 223, clause 6 of Article 226 of the Tax Code of the Russian Federation)? View answer

What is an advance?

Before figuring out the difference, you need to understand the concepts. Let's start with the advance. This is the name for a sum of money or other property that the debtor transfers to another party to fulfill obligations.

To put it simply, the advance payment is given so that the agreement can begin to be implemented. If the advance is not paid, then the other party has every right not to begin performing duties.

If the contractor, for any reason, refuses to fulfill his obligations, the advance must be returned in full. The transferred amount of money or property must not remain with the party who does not fulfill the obligation.

The advance performs two functions at once. On the one hand, it guarantees the execution of the contract. On the other hand, it confirms the fact that the customer’s side agrees with the terms of the agreement and will be obliged to pay the remaining amount.

Knowing what an advance and prepayment are, what the difference between these two legal concepts is, it will not be difficult to understand.

Advance share of salary

What amount or share will the first payment of part of the salary be? The law does not answer clearly here either. Of the documents, this issue is indirectly addressed only by the somewhat outdated, but not yet repealed, Resolution of the USSR Council of Ministers No. 566, which states that the amount is established by the organization and should not be lower than the tariff rate.

Is it necessary to withhold alimony from advance wages ?

In modern entrepreneurship, various methods of calculating the advance interest are used, all of them are legal, the choice is up to the employer.

- Payment for actual working hours. The advance is paid on a set date in an amount corresponding to remuneration for the number of days or hours worked. However, it may vary monthly. This method is recommended in the letter of the Ministry of Labor No. 14-1/10/B-660; it must be mentioned in internal documents.

- Fixed percentage of the salary amount. It is more convenient for calculations, since it will be the same at constant wages. It is attractive for employees because they always know how much they can count on by a certain date. If the monthly payments are divided in half, it is convenient to pay half of the due remuneration. A level of 40% is also acceptable; a smaller share is not accepted.

- Fixed amount. An entrepreneur has the right to pay not a share of the salary, but a part of it in the form of the same amount, and recalculate the rest in accordance with the time worked. With this method, the advance payment will remain unchanged, and subsequent payments may differ under different remuneration systems (they will be the same for a fixed salary, but may change for hourly or piecework wages).

Are there any differences?

What is the difference between an advance and a prepayment? What is the difference? And does it even exist? So, you must understand that if the transaction is successful, there is no difference.

Advance, deposit, prepayment. What is the difference between these concepts? So, now you know that advance and prepayment are identical. However, the deposit carries a slightly different meaning. The difference becomes obvious and will matter in the event of default or sudden termination of obligations.

What happens to the advance if the agreement is not fulfilled? They just return it. The party through whose fault the transaction did not take place does not suffer any financial losses. Except for those situations where a previously signed agreement includes a clause regarding the presence of fines.

If the transaction does not take place due to the fault of the customer or buyer, then the entire amount of the previously transferred deposit remains with the contractor or seller. A similar rule is true in the opposite direction. If the agreement did not take place due to the fault of the contractor, he will have to return the entire amount of the deposit in double amount. This is a significant difference from an advance payment.

The deposit performs a security function. That is, it obliges both parties to fulfill the contract and provides each of them with guarantees in case of violation of agreements. This is why it is important to clearly understand the difference between an advance payment, an advance payment, and a deposit. For some, legal illiteracy results in unpleasant financial losses.

How to calculate the advance amount

The salary mass includes not only the tariff rate, but also compensation, social charges, allowances, bonuses, etc. They are taken into account when dividing the payment amount.

For an advance payment, you need to take into account part of the tariff rate (salary), bonuses for experience and qualifications, compensation charges, and social subsidies.

The bonus share, if it is due, may well not be included in the advance payment, since in most cases the bonus is accrued or not accrued depending on the results of the month, which has not yet expired at the time of payment of the advance payment.

Profit tax is required to be withheld from wages. How does it affect the amount of the advance? 13% of personal income tax is deducted at the end of the month, so the first payment occurs without this deduction. The same applies to contributions to social funds. They are deducted from the salary, and the advance is only part of it.

The employer does not pay an advance

If an employer neglects his obligation to pay remuneration for work at least twice a month, this is a direct violation of the law. Such an administrative offense is subject to punishment, according to Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

- officials who established an unlawful procedure for calculating salaries will have to pay a fine in the amount of 1-5 thousand rubles, and in the event of a relapse of such a violation - 10-20 thousand rubles, and possibly receive disqualification for 1-3 years;

- Individual entrepreneurs are required to provide at least two-time payments, otherwise they face a fine of 1-5 thousand or 10-20 thousand in case of repetition;

- a legal entity is liable to its employees for a fine of 30-50 thousand rubles, and repeated involvement is fraught with amounts of 50-70 thousand rubles.

IMPORTANT! The amount of fines is paid to the budget. Additionally, an employee who has suffered from late payment of salary has the right to demand compensation for its delay (Article 235 of the Labor Code of the Russian Federation).

Also read: where to go if you don’t get paid

Accounting entries for advance payment

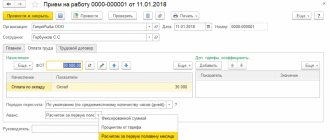

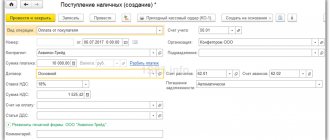

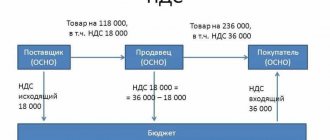

Accounting arrangements depend on the method of payment of the advance. Most often, it is transferred, like the rest of the salary, to a bank card . In this case, you must correctly indicate the purpose of the payment, mentioning the month of calculation, for example, “salary for half of August 2016.” Two entries are required: for the transfer of advance funds - debit 70, credit 50, and for the bank commission - debit 91-2, credit 51.

The law allows advance payment in other ways:

- in cash: you need to fill out a statement of the T-53 form provided for this or a KO-2 cash order;

- in non-monetary equivalent: part of the salary can be in kind, Art. 131 of the Labor Code of the Russian Federation allows this, regulating that its share should not exceed 20%; Thus, according to accounting, “transfer of finished products to payroll” occurs, and postings take place in 5 stages: revenue from finished products (debit 70, credit 50-1), writing off the cost of production (debit 90-2, credit 43), accrual VAT (debit 90-3, credit 68), profit or loss from transfer to salary account (debit 90-9 or 99, credit 99 or 90-9, respectively).