What is accounts receivable

The work of any organization is associated with the occurrence of debt. It comes in two types:

Take our proprietary course on choosing stocks on the stock market → training course

- accounts receivable

- accounts payable

Usually there are no difficulties in understanding what accounts payable is. If we explain it in terms familiar to the average person, then accounts payable are all the amounts that a company owes to its counterparties, the budget (in the form of taxes) or other creditors.

The opposite situation occurs when accounts receivable are formed. All amounts that the company expects to receive will be the amount of accounts receivable.

For example, a company overpaid VAT to the budget. The amount of tax that is transferred in excess of the accrued amount will be a receivable. The same situation arises if an organization transfers money to a counterparty on account of a future delivery. With regard to funds paid to employees: the “accounts receivable” includes wage debts to employees, as well as funds issued on account.

The amount of such debt is formed throughout the year and is reflected in the balance sheet in line 1230, in accordance with Order of the Ministry of Finance No. 66n dated July 2, 2010.

| IMPORTANT! In the vast majority of cases, the debt of counterparties to the organization is reflected in the balance sheet asset in the section reflecting the value of current assets |

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

How to adjust accounts receivable?

The amount resulting from adding the debit balances of the above accounts must be adjusted before it is reflected on line 1230 of the balance sheet.

How to do it? Firstly, it is necessary to subtract from it the credit balance of account 63 “Provisions for doubtful debts”, because the balance is compiled in a net assessment (clause 35 of PBU 4/99).

Secondly, the amount received must be reduced by the debit balance of subaccount 73-1 in terms of interest-bearing loans. After all, such loans should be reflected as part of financial investments on the same lines 1170 (if long-term) or 1240 (if short-term). However, interest accrued on such loans on line 1230 must be taken into account.

Thirdly, it is advisable to exclude the debit balance of account 60 in terms of advances and prepayments for work and services related to the construction of fixed assets from line 1230 and show it in line 1190 “Other non-current assets” of Section I of the balance sheet.

Fourthly, from line 1230 of the balance sheet it is necessary to remove the VAT that was presented by suppliers when transferring advances to them and which was reflected by the buyer on the credit of accounts 60 or 76 (Letter of the Ministry of Finance dated 01/09/2013 No. 07-02-18/01).

So, for example, when transferring an advance payment to the supplier, the following entry was made:

Debit account 60 – Credit account 51 “Current accounts” - 118,000 rubles

VAT on the transferred advance will be reflected, for example, like this:

Debit account 19 “VAT on purchased valuables” - Credit account 60 - 18,000 rubles

On line 1230, the transferred advance will be shown in the amount of 100,000 rubles (118,000 rubles – 18,000 rubles).

Fifthly, line 1230 does not show VAT accrued for payment on advances received from buyers and reflected in the debit of accounts 62 or 76.

So, for example, when receiving an advance from the buyer, the following entry was made:

Debit account 51 – Credit account 62 – 118,000 rubles

VAT accrued on the advance payment was reflected as follows:

Debit account 62 – Credit account 68 – 18,000 rubles

Despite the fact that VAT on the advance was shown in the debit of account 62, it will not be reflected in line 1230.

The forms of financial reports and instructions for filling them out were approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n. With regard to accounts receivable, the official recommendations provide explanations for entering data into line 1230 of the balance sheet: the decoding of the data is given in relation to the code designations of the cells.

Types of receivables in a company

All receivables are divided into two large groups:

- Long-term

- Short term

Both varieties fall into balance after a year.

All debts that are repaid within 12 months constitute short-term “receivables”. As a rule, such debt includes overpayment of taxes, shipments to counterparties “on credit,” or prepayment for goods or services.

Long-term debt appears when the debt is not paid off within a year. As for settlements with counterparties, the possibility of this type of debt arising should be specified in the agreement with the partner. However, if the counterparty simply does not pay its obligations for a long time, then such debt also belongs to the category of long-term.

Of course, it is in the interests of each organization to have a significant share of short-term debt out of the total amount of “receivables”.

It must be taken into account that no matter what type of debt, after missing the repayment deadline, it becomes overdue. It is not in the best interests of the company to have overdue accounts receivable .

There is often great doubt that the debt will ever be repaid. Often such overdue debts are never closed, that is, they become hopeless. A debt can be doubtful for three years, and then becomes uncollectible. Ultimately, such debt must be written off as a loss.

Interpretation of individual balance sheet liability indicators

Liability codes are also 4-digit: the 1st digit is the line’s belonging to the balance sheet, the 2nd is the number of the liability section (for example, 3 is capital and reserves). The next digit of the code reflects obligations in order of increasing urgency of their repayment. The last digit of the code is for detail purposes. Total liabilities in the balance sheet are line 1700 of the balance sheet. In other words, total liabilities in the balance sheet are the sum of lines 1300, 1400, 1500.

Liability items of the balance sheet with codes and explanations are shown in the table:

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| TOTAL capital | The line contains information about the company's capital as of the reporting date | ||

| Authorized capital (share capital, authorized capital, contributions of partners) | Information on lines 1300–1370 is detailed in the statement of changes in equity and the statement of financial results (in terms of net profit for the reporting period). The company has the right to determine the additional amount of explanations about capital. | ||

| Revaluation of non-current assets | |||

| Additional capital (without revaluation) | |||

| Reserve capital | |||

| Retained earnings (uncovered loss) | |||

| Long-term borrowed funds | The information is deciphered in tabular (Form 5) or text form in the explanations to the balance sheet | ||

| Deferred tax liabilities | Indicate the credit balance of account 77 | ||

| Estimated liabilities | The credit balance of account 96 is reflected - estimated liabilities, the expected fulfillment period of which exceeds 12 months | ||

| Other long-term liabilities | Provides information about long-term liabilities not indicated in the previous lines of the section | ||

| TOTAL long-term liabilities | The final result of long-term liabilities is reflected | ||

| Short-term debt obligations | Account credit balance 66 | ||

| Short-term accounts payable | The total credit balance of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 is reflected. The information is deciphered in the notes to the balance sheet (for example, in Form 5) | ||

| Other current liabilities | Filled in if not all short-term liabilities are reflected in other lines of the section | ||

| Total current liabilities | The total total of short-term liabilities is indicated | ||

| Liabilities of everything | Summary of all liabilities | ||

Read about what characterizes simplified accounting in the article “Simplified reporting for small businesses.”

Which accounts make up the amount of accounts receivable?

When determining the amount of accounts receivable, it should be remembered that its amount is not formed on any one account, but consists of a set of values that are reflected in the debit balances of many accounts. This is enshrined in the order of the Ministry of Finance No. 94n dated October 31, 2000.

The calculation uses balances on the following accounts:

- If the company has a work in progress, then the turnover on account 46 will show the volume of work already completed

- Account 60. Shows the status of settlements with various suppliers

- Account 62 reflects the status of settlements for transactions with customers

- Accounts 68, 69. Show balances for settlements with the budget and extra-budgetary funds

- Accounts 70, 71, 73. They show the status of settlements with employees of the organization

- Account 75. This is the debt incurred in relation to the founders

- Account 76. Reflects settlements with other counterparties

Methods for adjusting accounts receivable

After summing the debit balances, the total must be adjusted before entering the data into the report. The fact is that cell 1230 is a balance sheet line intended to reflect the indicator of receivables in the net valuation (justification - clause 35 of PBU 4/99). Therefore, from the resulting value you need to subtract:

- credit balance of account 63 to minimize the error created by provisions for doubtful debts;

- debit balance formed on account 73.1 in the amount of loans taken at interest;

- the debit balance of account 60 must be reduced by the amount of advance transfers for construction work;

- VAT claimed by suppliers on prepayments is also subject to exclusion (justification - letter of the Ministry of Finance dated 01/09/2013 No. 07-02-18/01);

- should not be included in accounts receivable and VAT, which is accrued on advance transfers received.

Also see “Accounting for accounts receivable in accounting: to which account should it be attributed?”

The receivables of the enterprise are subject to constant monitoring; they are reflected in the accounting accounts and in the reporting of the enterprise. In the absence of overdue debts from debtors, this category of assets is considered liquid. If settlement is delayed, the amount goes into the category of doubtful debts.

Doubtful debts and receivables

Currently, it is established at the legislative level that each organization, subject to certain conditions, must create a reserve for doubtful debts.

Such a reserve is created when there is debt from counterparties. In this case, one of the following conditions must be met:

- The debt must be overdue

- The company has information about serious problems in the financial sector of the counterparty

However, even if there are accounts receivable, a reserve may not be created if the company knows for certain that the debt will be repaid by the counterparty.

Accounting for created reserves is kept on account 63. In order to create a reserve, it is necessary to make accounting entry D91.2 K63. The same posting is used if the reserve needs to be increased (added).

The restoration of the reserve is reflected by posting D63 K91.1. But if the debt is hopeless and needs to be written off, an entry is made D63 K62 (or another accounting account for the counterparty).

Instructions for creating a reserve are contained in paragraph 7 of PBU 1/2008.

It is very important to remember that the provision for such debt is directly related to accounts receivable and its reflection in the company’s annual reports. When drawing up a balance sheet, the amount of the reserve reduces the amount of accounts receivable, the net amount is reflected in line 1230 of the balance sheet asset .

Accounts receivable: invoice and movement reflection

The table provides a list of accounting accounts in which receivables can be accounted for (which account to use depends on who the debtor is).

| Number | Name |

| 60 | Settlements with suppliers and contractors |

| 62 | Settlements with buyers and customers |

| 68 | Calculations for taxes and fees |

| 69 | Social insurance calculations |

| 70 | Payments to personnel regarding wages |

| 71 | Accounting for imprest amounts |

| 73 | Accounting for other personnel transactions |

| 75 | Settlements with founders |

| 76 | Settlements with various debtors and creditors |

The amount of increase in the liability is reflected in the debit, and the decrease - in the credit. At the reporting date, the amount that the company's counterparties are obliged to pay to it is reflected as a debit balance.

If there is a risk of non-repayment of the debt by the debtor, it is necessary to create a reserve in accordance with clause 70 of Order of the Ministry of Finance dated July 29, 1998 No. 34n.

The amount of the reserve is reflected in account 63. When created, the amount of doubtful debt is included in other expenses:

Debit 91 Credit 63.

More information about creating a reserve can be found in the article “Provisions for doubtful debts in accounting.”

The procedure for calculating the amount of receivables in the balance sheet

In order to calculate the amount of “receivables” to be reflected in the balance sheet, data from 10 accounting accounts is used.

To identify the correct debt balance for counterparties, it is necessary to generate settlement reconciliation acts and display the correct debt balance. This is necessary both for the organization itself and for the counterparty to correctly account for all obligations. After determining the amount of debt, its value can be transferred to the appropriate line of the balance sheet.

Let's give an example of filling out line 1230. At Romashka LLC, the account balances at the end of the year are as follows:

| Check | Debit balance | Credit balance |

| 60 | 10000 | 5000 |

| 62 | 25000 | 17000 |

| 63 | 8000 | |

| 76 | 3000 | 1000 |

Based on the given data, line 1230 will have the following meaning:

Page 1230 = 10000 + 25000 – 8000 + 3000 = 30000

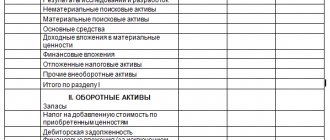

How to decipher balance sheet asset lines

Before deciphering an asset item, let’s consider its code - it carries certain information. So, the first digit shows that this line refers to the balance sheet (and not to another accounting report); 2nd - indicates the section of the asset (for example, 1 - non-current assets, etc.); The 3rd digit reflects assets in increasing order of their liquidity. The last digit of the code (initially it is 0) is intended to help in line-by-line detailing of indicators considered significant - this allows you to fulfill the requirement of PBU 4/99 (clause 11).

NOTE! The requirement for detail may not be fulfilled by small businesses (clause 6 of Order No. 66n).

Read about what distinguishes accounting carried out by small businesses in the material “Features of accounting in small enterprises.”

The asset lines of the balance sheet with codes and explanations are shown in the table:

| Line name | Code | Decoding the string | |

| By order No. 66n | By order No. 67n | ||

| Fixed assets | The total amount of non-current assets is reflected | ||

| Intangible assets | The information reflected in lines 1110–1170 is explained in the notes to the statements (information on the availability of assets at the reporting dates and changes for the period is disclosed) | ||

| Fixed assets | |||

| Profitable investments in material assets | |||

| Financial investments | |||

| Deferred tax assets | The debit balance of account 09 is indicated | ||

| Other noncurrent assets | Filled in if there is information about non-current assets that are not reflected in the previous lines | ||

| Current assets | The final result of current assets is determined | ||

| Reserves | The total balance of inventories is given (debit balance of accounts 10, 11, 15, 16, 20, 21, 23, 28, 29, 41, 43, 44, 45, 97 without taking into account the credit balance of accounts 14, 42) | ||

| Value added tax on purchased assets | Indicate account balance 19 | ||

| Accounts receivable | The result of adding the debit balances of accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 minus account 63 is reflected | ||

| Financial investments (excluding cash equivalents) | The debit balance of accounts 55, 58, 73 (minus account 59) is given - information on financial investments with a circulation period of no more than a year | ||

| Cash and cash equivalents | The line contains the balance of accounts 50, 51, 52, 55, 57, 58 and 76 (in terms of cash equivalents) | ||

| Other current assets | Filled in if data is available (for the amount of current assets not indicated in other lines of the section) | ||

| Total assets | Total of all assets | ||

Brief instructions for analyzing receivables

Analysis of debt in a company is important. During its implementation, many indicators are assessed, but even based on the dynamics of changes in debt indicators, some conclusions can already be drawn.

| Index | 2017 | 2018 | Height, % | Deviation, thousand rubles | ||

| Sum | Percent | Sum | Percent | |||

| Total | 233810 | 100 | 324306 | 100 | 138,7 | 90496 |

| Suppliers | 227 | 0,1 | 601 | 0,2 | 264,8 | 374 |

| Buyers | 233353 | 99,7 | 316614 | 97,5 | 2721,1 | 83261 |

| Taxes | 228 | 0,1 | 6204 | 1,9 | 44350 | 5976 |

| Other counterparties | 2 | 887 | 0,3 | 885 | ||

In accordance with the data presented in the table, we can conclude that the largest weight of debt falls on buyer debts. In addition, compared to 2022, in 2018 there was a general increase in receivables for all counterparties.

As for buyers, each of them needs to be considered more carefully, in terms of contracts. It is necessary to determine the dynamics of debt and its change in accordance with the level of revenue. Only after conducting a full analysis can we say what condition the receivables are in and what risks exist for the company.

Analysis and valuation of receivables

Valuation of receivables means establishing its market value as of the current date. The resulting value may not match the amount in the accounting data. This is necessary for management accounting purposes, during transactions involving the assignment of claims and conducting a comprehensive assessment of the company. If assessment data is required for external users, then professional experts are involved in the procedure.

Analysis of receivables is carried out by clarifying the total volume of customer debts, dividing them into groups and tracking the dynamics of changes. The results are entered into the table. An important element of the procedure is to identify the share of long-term debts, since their growth can undermine the financial stability of the company.

Analysis of the company's receivables using the example:

| Criterion | End of 2014 | End of 2015 | End of 2016 | Growth rate, % | Absolute deviation | |||||

| thousand roubles | % | thousand roubles | % | thousand roubles | % | 2015/2014 | 2016/2015 | 2015/2014 | 2016/2015 | |

| Long-term debts | 0,00 | 0,00% | 0,00 | 0,00% | 0,00 | 0,00% | 0,00% | 0,00% | 0,00 | 0,00 |

| Short-term debts, including: | 170,70 | 100,00% | 162,70 | 100,00% | 191,40 | 100,00% | 95,00% | 118,00% | -8,00 | 28,70 |

| - settlements with customers | 152,00 | 89,00% | 144,00 | 89,00% | 188,00 | 98,00% | 95,00% | 131,00% | -8,00 | 44,00 |

| - settlements with suppliers | 10,00 | 6,00% | 10,00 | 6,00% | 0,00 | 0,00% | 100,00% | 0,00% | 0,00 | -10,00 |

| -settlements with the Federal Tax Service and Social Insurance Fund | 5,20 | 3,00% | 5,30 | 3,00% | 2,20 | 1,00% | 102,00% | 42,00% | 0,10 | -3,10 |

| -accountable amounts | 0,20 | 0,00% | 0,00 | 0,00% | 0,00 | 0,00% | 0,00% | 0,00% | -0,20 | 0,00 |

| -expenses deferred | 3,30 | 2,00% | 3,40 | 2,00% | 1,20 | 1,00% | 103,00% | 35,00% | 0,10 | -2,20 |

The table data shows that the largest volume of accounts receivable falls on buyers, and the amount of unpaid goods increases every year. For other positions, there has been a trend towards a stable reduction in debts. At the next stage, we need to consider in detail the state of settlements with customers (this is the largest group):

| Criterion | End of 2014 | End of 2015 | End of 2016 | Absolute deviation | ||||

| thousand roubles | % | thousand roubles | % | thousand roubles | % | 2015/2014 | 2016/2015 | |

| Settlements with buyers: | 152,00 | 100,00% | 144,00 | 100,00% | 188,00 | 100,00% | -8,00 | 44,00 |

| Company 1 | 10 | 7,00% | 0 | 0,00% | 5 | 3,00% | -10,00 | 5,00 |

| Company 2 | 25 | 16,00% | 22 | 15,00% | 20 | 11,00% | -3,00 | -2,00 |

| Company 3 | 70 | 46,00% | 100 | 69,00% | 125 | 66,00% | 30,00 | 25,00 |

| Company 4 | 2 | 1,00% | 0 | 0,00% | 2 | 1,00% | -2,00 | 2,00 |

| Company 5 | 45,00 | 30,00% | 22,00 | 15,00% | 36,00 | 19,00% | -23,00 | 14,00 |

The analysis showed that the main source of growth in receivables is Company 3. If receivables were not insured under an agreement with this buyer, then the risk of financial damage increases. At the next stage, settlements with the problematic counterparty and other companies are detailed, taking into account the deferments granted to them:

| Buyer name | End of 2016 | By duration of education, thousand rubles | Delay, days | ||||

| thousand roubles | % | 0-30 days | 30-60 days | 61-180 days | more than 181 days | ||

| Settlements with buyers: | 188,00 | 100,00% | 47,00 | 27,00 | 51,00 | 63,00 | |

| Company 1 | 5 | 3,00% | 5,00 | 0,00 | 0,00 | 0,00 | 30,00 |

| Company 2 | 20 | 11,00% | 18,00 | 2,00 | 0,00 | 0,00 | 60,00 |

| Company 3 | 125 | 66,00% | 2,00 | 10,00 | 50,00 | 63,00 | 60,00 |

| Company 4 | 2 | 1,00% | 2,00 | 0,00 | 0,00 | 0,00 | 30,00 |

| Company 5 | 36,00 | 19,00% | 20,00 | 15,00 | 1,00 | 0,00 | 60,00 |

Company 3 remains problematic. Only this company did not meet the debt repayment deadlines, even taking into account their extension. Further work consists of establishing a dialogue with this counterparty; if there is no response, you can go to court.

Reflection of accounts receivable in the notes to the balance sheet

It is extremely rare that by the end of the year, based on the results of the analysis of the balance sheet, no debts are identified. Usually these indicators are present.

When preparing the annual report, debt amounts are reflected in the corresponding line of the balance sheet, and must also be reflected in Form No. 5, which is an appendix and is an integral part of the annual reporting. To reflect receivables and payables, there is a special table that details what type of debt is present in the company and what specific indicators it consists of. Moreover, in the explanations the amount of “receivables” is indicated regardless of whether a reserve for doubtful debts has been created or not.

When drawing up the application form, it is necessary to take into account that long-term receivables are reflected in the section with non-current assets.

Experienced accounting specialists do not recommend reflecting the presence of overdue accounts receivable in the explanations; accordingly, do not fill out the table in this part. Such advice is given so that there are no questions from regulatory authorities.

Accounting data is used to fill out information in Form No. 5. You need to know that when filling out the tabular lines, data on the balances and turnover of accounts 62, 60, 68, 69, 70, 71, 73, 75, 76 are used. Everything related to reserves for doubtful debts is reflected in account 63. Data is collected in the context analysts.

Accounts receivable. Line 1230

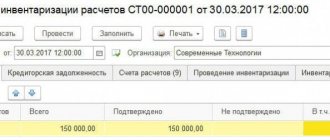

This line shows the total amount of accounts receivable as of the reporting date, as of December 31 of the previous year and as of December 31 of the year preceding the previous one.

According to paragraph 19 of PBU 4/99, in the balance sheet, assets and liabilities must be presented with a division depending on the maturity period into short-term and long-term. Disclosure of information about the nature of receivables can be carried out by introducing additional lines, for example “including long-term” and “including short-term”.

According to the clarifications of the Ministry of Finance of Russia, contained in Letter dated January 27, 2012 N 07-02-18/01, in the balance sheet, data on receivables for goods sold, products, work performed and services rendered are reflected, if significant, separately from the amounts of advances (prepayments). ) listed by the organization in accordance with the contracts.

What is included in accounts receivable?

The accounts receivable may include the debt of buyers, customers, suppliers, contractors, other debtors, the debt of the founders, as well as employees for wages and accountable amounts.

Accounts receivable in accounting are reflected in the accounts (Instructions for using the Chart of Accounts, paragraphs 73, 74 of the Regulations on Accounting and Financial Reporting, paragraph 2, paragraph 23 of PBU 18/02):

— 62 “Settlements with buyers and customers” in the amount of debt for goods sold, products (work performed, services rendered);

— 60 “Settlements with suppliers and contractors” in the amount of advance payment (advances) transferred by the organization for the supply of goods, products, performance of work, provision of overpaid (collected) taxes and fees;

— 69 “Calculations for social insurance and security” in the amount of overpaid contributions to compulsory social insurance, as well as in the amount of benefits paid;

— 70 “Settlements with personnel for wages” in the amount of overpaid wages and vacation pay to employees;

— 71 “Settlements with accountable persons” in terms of accountable amounts for which a report on their use has not been submitted, or advances paid in connection with a business trip that have not been spent and not returned on time;

— 73 “Settlements with personnel for other operations” in the amount of debt owed by employees on interest-free loans and compensation for material damage;

— 75 “Settlements with founders” in the amount of the contribution not made to the authorized capital;

— 76 “Settlements with various debtors and creditors” regarding other receivables not mentioned above (in particular, penalties, interest accrued on securities, credits and borrowings).

In addition, as a separate indicator detailing the group of items “Accounts receivable”, accrued revenue not presented for payment under construction contracts, the duration of which is more than one reporting year, or the start and end dates of which fall on different reporting years (in the amount of calculated on the basis of the contract value or the amount of expenses actually incurred, which during the reporting period are considered possible for reimbursement) (clauses 1, 2, 17, 23 of the Accounting Regulations “Accounting for Construction Contracts” (PBU 2/2008), approved by Order of the Ministry of Finance of Russia dated October 24, 2008 N 116n, Appendix to the Letter of the Ministry of Finance of Russia dated January 29, 2014 N 07-04-18/01).

If receivables are recognized as doubtful, the organization creates reserves for doubtful debts. The amount of the created reserve is taken into account in account 63 “Provisions for doubtful debts” and relates to the financial results of the organization (Instructions for using the Chart of Accounts, clause 70 of the Regulations on accounting and financial reporting). An organization's receivables are considered doubtful if they are not repaid or with a high degree of probability will not be repaid within the time limits established by the agreement and are not secured by appropriate guarantees.

Let us recall that the creation of estimated reserves is considered as a change in estimated values in accordance with paragraphs 2, 3 of PBU 21/2008.

Attention!

Provisions for doubtful debts are created for any receivables recognized by the organization as doubtful (not only for debts of buyers and customers for products, goods, works and services). At the same time, not only debt with a due date for repayment can be considered doubtful, but also debt whose repayment period has not yet come, if there is a high degree of probability that when this period occurs, the debt will not be repaid (paragraph 2, clause 70 of the Regulations on the management of accounting and financial reporting as amended by Order No. 186n). At the same time, if there is confidence in repayment regarding overdue receivables as of the reporting date, then a reserve for this debt is not created (Letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01).

What accounting data is used when filling out line 1230 “Accounts receivable”?

When filling out this line of the Balance Sheet, data on debit balances on accounts 46, 62, 60, 68, 69, 70, 71, 73, 75, 76 minus the credit balance on account 63 (the reserve created for this debt) is used (clause. clauses 73, 74 of the Regulations on accounting and financial reporting, clause 35 of PBU 4/99).

According to the clarifications of the Ministry of Finance of Russia, in the case of an organization transferring payment, partial payment for upcoming deliveries of goods (performance of work, provision of services, transfer of property rights), accounts receivable are reflected in the Balance Sheet in the assessment minus the amount of VAT subject to deduction (accepted for deduction) (Letter Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01).

In addition, the amounts of transferred advances and prepayments for work and services related to the construction of fixed assets are reflected in section. I “Non-current assets” of the Balance Sheet, and, for example, the amount of advances paid (prepayment) in connection with the acquisition of inventories for the purpose of production are reflected in section. II “Current assets” (Letters of the Ministry of Finance of Russia dated 01/24/2011 N 07-02-18/01, dated 04/11/2011 N 07-02-06/42, dated 04/20/2012 N 07-02-06/113).

Attention!

When reflected in reporting, offsetting between items of assets and liabilities (debit and credit balances on accounts 62, 60, 68, 69, 70, 71, 73, 75, 76) is not allowed (clause 34 of PBU 4/99).

Attention!

Accounts receivable expressed in foreign currency (including those payable in rubles), for reflection in the financial statements, are recalculated into rubles at the rate in effect at the reporting date (clauses 1, 5, 7, 8 of PBU 3/2006).

The exception is accounts receivable that arise as a result of the transfer to counterparties of an advance, prepayment or deposit. Such debt is shown in the financial statements at the exchange rate valid on the date of transfer of funds (clauses 9, 10 of PBU 3/2006).

Accrued revenue expressed in foreign currency that is not presented for payment, recorded in the accounting records as of the reporting date in accordance with PBU 2/2008, is subject to recalculation into rubles on the date of the transaction in foreign currency and on the reporting date in the part in which it exceeds the amount the received advance payment (advance payment), expressed in foreign currency (Letter of the Ministry of Finance of Russia dated January 28, 2010 N 07-02-18/01).

Line 1230 “Accounts receivable” = Debit balance on accounts 46,62,60 Except for the amounts of advances and prepayments transferred to suppliers (contractors) in connection with the acquisition (creation) of non-current assets and If the organization has accounts receivable in accounts 60, 76 the amount of the transferred prepayment, taking into account VAT, then when determining the indicator of line 1230, it is necessary to reduce the debit balances on these accounts by the corresponding VAT amounts (Letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01), 68,69,70,71, 73 <***> If an organization has account 73, subaccount 73-1 “Settlements on loans provided”, takes into account interest-bearing loans provided to employees that meet the criteria for recognizing them as financial investments, then the amount of these loans should be shown in the Balance Sheet on line 1170 or 1240, and not on line 1230 “Accounts receivable”, 75.76 - Credit balance on account 63

In general, the indicators in line 1230 “Accounts receivable” as of December 31 of the previous year and as of December 31 of the year preceding the previous year are transferred from the Balance Sheet for the previous year. If the indicator of line 1230 as of the reporting date is formed according to other rules, then the indicators as of December 31 of the previous year and as of December 31 of the year preceding the previous one must be adjusted as if they were determined according to the same rules as the indicator for reporting date. In other words, the comparability of comparative indicators must be ensured (paragraph 2, clause 10 of PBU 4/99).

The “Explanations” column provides an indication of the disclosure of the indicator in line 1230 “Accounts receivable”. If an organization draws up Explanations to the Balance Sheet and the Statement of Financial Results according to the forms contained in the Example of Explaining Explanations given in Appendix No. 3 to Order of the Ministry of Finance of Russia No. 66n, then in the column “Explanations” on line 1230 “Accounts receivable” tables 5.1 and 5.2.

Example of filling out line 1230 “Accounts receivable”

Indicators for accounts 46, 62, 60, 70, 71, 73, 76 and 63 (there are no debit balances for accounts 68, 69 and 75): rub.

| Index | As of the reporting date (December 31, 2014) | |

| With a maturity less than 12 months after the reporting date | With a maturity of more than 12 months after the reporting date | |

| 1 | 2 | 3 |

| 1. By debit of account 62 | 4 456 000 | 500 000 |

| 2. By debit of account 60 (less VAT) | 236 000 | — |

| 3. By debit of account 70 | 28 200 | — |

| 4. By debit of account 71 | 14 000 | — |

| 5. By debit of account 73 | 101 000 | — |

| 6. By debit of account 76 (less VAT) | 1 180 000 | — |

| 7. By debit of account 46 (accrued revenue not presented for payment) | 3 900 000 | — |

| 8. On the credit of account 63 (analytical account for accounting for reserves for doubtful debts of buyers and customers) | 250 000 | — |

| 9. On the credit of account 63 (analytical account for accounting for provisions for doubtful debts of other debtors) | 50 000 | — |

Fragment of the Balance Sheet for 2013 (When forming the indicators of line 1230, the amounts of advance payment transferred by the organization are reduced by VAT accepted for deduction. There is no accrued revenue presented for payment as of 12/31/2013 and as of 12/31/2012.)

| Explanations | Indicator name | Code | As of December 31, 2013 | As of December 31, 2012 | As of December 31, 2011 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 5.1, 5.2 | Accounts receivable | 1230 | 7059 | 5357 | 5614 |

| including: | |||||

| long-term | 1231 | 1800 | 800 | 260 | |

| from it the debt of buyers and customers | 1232 | 1000 | 350 | 260 | |

| short-term | 1233 | 5259 | 4557 | 5354 | |

| from it the debt of buyers and customers | 1234 | 1100 | 855 | 4198 |

Solution

The amount of accounts receivable minus the created reserve is:

as of December 31, 2014 - RUB 10,115,200. (RUB 4,456,000 + RUB 500,000 + RUB 236,000 + RUB 28,200 + RUB 14,000 + RUB 101,000 + RUB 1,180,000 + RUB 3,900,000 — RUB 250,000 — 50 000 rub.),

including:

long-term - 500,000 rubles;

of which the debt of buyers and customers is 500,000 rubles;

short-term — RUB 9,615,200. (RUB 10,115,200 - RUB 500,000);

of which the debt of buyers and customers is RUB 4,206,000. (RUB 4,456,000 - RUB 250,000);

accrued revenue not presented for payment - RUB 3,900,000;

as of December 31, 2013 - 7059 thousand rubles,

including:

long-term - 1800 thousand rubles;

of which the debt of buyers and customers is 1000 thousand rubles;

short-term - 5259 thousand rubles;

of which the debt of buyers and customers is 1100 thousand rubles;

as of December 31, 2012 - 5357 thousand rubles,

including:

long-term - 800 thousand rubles;

of which the debt of buyers and customers is 350 thousand rubles;

short-term - 4557 thousand rubles;

of which the debt of buyers and customers is 855 thousand rubles.

A fragment of the Balance Sheet in Example 2.3 will look like this.

| Explanations | Indicator name | Code | As of December 31, 2014 | As of December 31, 2013 | As of December 31, 2012 |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 5.1, 5.2 | Accounts receivable | 1230 | 10 115 | 7059 | 5357 |

| including: | |||||

| long-term | 1231 | 500 | 1800 | 800 | |

| from it the debt of buyers and customers | 1232 | 500 | 1000 | 350 | |

| short-term | 1233 | 9615 | 5259 | 4557 | |

| from it the debt of buyers and customers | 1234 | 4206 | 1100 | 855 | |

| accrued revenue not presented for payment | 1235 | 3900 | — | — |

How to reflect overdue receivables on the balance sheet?

The balance sheet reflects the company's assets and liabilities. A separate line of the same name (1230) of the second section is allocated for accounts receivable. It is taken into account among the company's current assets.

If a receivable is past due, can it be considered an asset?

Based on the definition, the company's resources are recognized as current assets:

- designed to ensure the continuous process of its activities;

- consumed (repaid) during the operating cycle.

From the IFRS perspective, an asset is considered a resource:

- controlled by the firm;

- from which economic benefits are expected to flow in the future.

How international standards classify receivables, see the material “Accounting for receivables according to IFRS.”

Thus, a debtor's overdue debt may remain an asset if the debtor:

- asked for a deferred payment due to temporary financial difficulties and plans to fully repay the debt in the near future;

- has a good business reputation and the company is interested in continuing partnerships.

In this case, it is necessary to take into account additional evaluation criteria:

- the company values the accounts receivable as debt with a high probability of repayment;

- the debt is not overdue due to the expiration of the limitation period.

If the debt is overdue under the terms of the agreement, but the company does not consider such debt doubtful (evaluating it according to internal company criteria), such a receivable in the balance sheet as of the reporting date will be recognized as an asset and legally reflected in line 1230.

How to disclose information about accounts receivable, incl. overdue, in the explanations to the balance sheet, the experts of Consultant Plus explained in detail. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

We will talk about overdue receivables from the group of “doubtful” and “bad” debts, where and how they are reflected in the following sections.

Options for reflection in the balance sheet

The required detail is shown in lines 12301 to 12305 of the transcript for Form-1.

In these lines you must indicate the debit balance of the following accounting accounts:

- account No. 60 “Settlements with suppliers and contractors” in connection with prepayments made for the upcoming execution of work, provision of services, delivery of goods or materials;

- account No. 62 “Settlements with buyers and customers” in connection with the shipment of goods, performance of services and work overdue for payment by customers and customers;

- account No. 68 “Calculations for taxes and fees”, where there is a surplus of the amount transferred to the tax authority from the calculation of taxes and fees;

- account No. 69 “Calculations for social insurance and security” in connection with the surplus paid to the Social Insurance Fund;

- account No. 70 “Settlements with personnel for wages” in terms of overpaid wages;

- account No. 71 “Settlements with accountable persons” in connection with funds paid to employees of the organization;

- account No. 73 “Settlements with personnel for other transactions” in connection with credits, borrowings and advances issued to the organization’s personnel, or for compensation of material damage to the company;

- account No. 75 “Settlements with founders” in connection with the debt of the founders for contributions to the authorized capital of the organization;

- account No. 76 “Settlements with various debtors and creditors” in connection with accrued income from joint activities, sanctions recognized by debtors for failure to fulfill contractual terms, debts of other persons on transactions, dividends that must be paid by other companies.

It is necessary to make a reserve for outstanding overdue payments in terms of accounts receivable - it is best to make it on account 63

It is necessary to provide for a reserve for outstanding payments in terms of accounts receivable for services, work, goods or materials provided, which most likely will not meet the deadlines specified in the contract, or do not have guarantees that payment will be made on time.

It is most reasonable to make a reserve on account No. 63 “Provisions for doubtful debts”, in correspondence with account No. 91 “Other income and expenses”, subaccount 2 “Other expenses”.

Accounts receivable are entered into the balance sheet minus this reserve, if one has been created.

The reserve is reflected by posting:

D 91-2 K 63 – a provision was made for doubtful debt.

How to find the accounts receivable turnover ratio? What is the capital intensity of production, its calculation. A sample of filling out an invoice can be found here: https://buhguru.com/buhgalteria/schet-faktura-obrazec-zapolneniya.html

The write-off of a debt that is impossible to repay, for which a provision has been made, is recorded as follows:

D 63 K 62 - uncollectible debt for which a reserve was created has been written off.

The amount written off under this posting must be reflected in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss”:

D 007 – doubtful debts are taken into account.

The amount of such a reserve is calculated for each specific debtor depending on its solvency and the share of risk for full and partial repayment.

String structure

The balance sheet is filled out as of the reporting date. Information is entered into it based on the balances shown in the accounting cards. When calculating the balance of accounts receivable, which should be shown on the balance sheet, you need to focus on the debit balances of the set of accounts.

As a result, this is what line 1230 of the balance sheet consists of:

- in the final amount of debt, it is necessary to take into account the size of completed tasks for unfinished work reflected in account 46;

- balance of settlements with suppliers on account 60;

- the status of the debt of debtors, whose roles are buyers or customers of works/services - account 62;

- the final total for the debit of account 68, if there are overpayments of taxes and fees;

- to designate the receivable for insurance premiums, take account balance 69;

- also, line 1230 may contain information about overpaid funds to personnel (salaries overpayments are reflected in account 70, accountable funds to be returned are recorded in account 71, other transactions - account 73);

- if the debtor of the company is the founder, it is necessary to sum up the debit balance of account 75;

- The calculation must take into account the balance of account 76, which accumulates information on all groups of debtors not included in the previous categories.

Also see “Accounts receivable on the balance sheet: analysis and examples.”

The concept of long-term accounts receivable

Accounts receivable is the total amount of debts to the organization.

This includes the debt of buyers and suppliers, debts of the founders, employees of the enterprise and other counterparties. To determine the amount of receivables, you need to collect the debit balances listed for all counterparties in the settlement accounts (60, 62, 68, etc.).

Accounts receivable are conventionally divided into current and long-term. Current includes debts of all counterparties, repayment of which is expected within a period not exceeding 12 months from the reporting date. Accordingly, a long-term receivable is a debt that is expected to be repaid within a period of more than a year.

Find out how to reflect the transfer of long-term debt to short-term debt in accounting and reporting in ConsultantPlus. Trial access to the system can be obtained for free.

The starting point for the specified 12-month period is determined by the date of the transaction for which the debt to the organization arose. The date of occurrence of the buyer's receivables is the date of shipment of goods or performance of work, unless otherwise provided by the terms of the contract.

Assessment of long-term receivables is an important stage in characterizing the solvency of an enterprise.

You can find out why this stage is needed, how the amount of receivables and the possible timing of their repayment affect the financial position of the company, and you can familiarize yourself with the stages and methods of conducting this kind of assessment in the article “Basic methods for valuing receivables.”