Who is the Beneficial Owner?

A beneficiary is an individual who participates in a legal entity. The size of this dominant participation is more than 25%. The same person has the authority to control the actions of the legal entity. The meaning of the concept under consideration depends on the specific area.

The following persons may be the beneficial owner:

- Landlords.

- Account holders.

- Clients of trust firms who have given away their property on a trust basis.

- Holders of documentary letters of credit.

- Real owners of companies.

Often information about the beneficial owner is hidden. This is done to ensure the safety of the company’s activities, as well as to prevent claims from government agencies.

How do companies record and disclose information about beneficiaries ?

Who is the beneficiary?

Federal laws 115-FZ and 215-FZ define the term “beneficial owner” in this way: this is an individual who directly or indirectly owns a legal entity, or has the ability to exercise direct control over its actions. In this case, “ownership of a legal entity” means the predominant participation of an individual in it in an amount exceeding 25% in the capital.

Federal Law No. 134-FZ of June 28, 2013 obligated banks to identify beneficial owners, not only legal entities, but also individuals. Thus, in the process of carrying out their functions, credit institutions face a number of problems. One of them is to identify clients' beneficiaries.

The concept of a beneficiary and the features of its identification will differ somewhat depending on whether it acts for the benefit of a legal entity or an individual.

Who is the final beneficiary of a legal entity?

The chain of beneficiaries ends with a specific person or group of people who receive a certain profit. This person is the final beneficiary. In simple words, this concept can be explained as follows: the final beneficiary of a legal entity is an individual who receives profit from the activities of the organization or property management.

Beneficiary and beneficiary: what is the difference?

If everything is clear with the final beneficiary, then the concepts of “beneficiary” and “beneficial owner” are often substituted. Indeed, both of these entities receive income from the client's actions. Thus, some sources generally consider them to be equivalent.

However, Russian legislation gives different definitions to these terms. This can be seen in 115-FZ. Thus, a beneficial owner means an entity that owns a client - a legal entity, or has the ability to exercise control over its actions. To do this, he must own more than 25% of the company's shares.

And the beneficiary, according to the same law, is defined as the entity for whose benefit the client carries out its activities.

Thus, the concept of “beneficial owner” appears to be more specific and narrow, which specifically states that the beneficiary must own more than 25% of the shares in the capital of the organization in order to be considered its beneficiary. He must also have access to manage and control it. The beneficiary cannot do this because he does not have his own share in the company.

Based on this, when regulatory authorities identify illegal actions, they are interested, first of all, in the beneficial owners of organizations. This is explained by the fact that it is the latter who make decisions about illegal actions.

The legislative framework

The term “beneficiary” is given in Federal Law No. 115 (paragraph 13, article 3). This law regulates the area of combating money laundering. Federal Law No. 115 obliges financial institutions to identify beneficial owners. The criteria for identifying them are also given there. The amendment to the Federal Law is given in Law No. 215. The regulation contains nuances for the publication of relevant information of legal entities. The Federal Law obliges legal entities to enter information about beneficiaries into databases. Information must be updated once a year.

Does the non-profit organization have a beneficial owner ?

Determining beneficiaries allows you to increase the “transparency” of the work of companies and prevent the laundering of proceeds from crime. Relations with these persons are regulated by Central Bank Regulation No. 499. This Regulation contains the following information:

- Criteria for identifying beneficiaries.

- List of documents for identifying hidden owners.

- Rules for maintaining dossiers.

- Other items.

Additional information is disclosed in letters from the Central Bank. These letters contain various explanations and analysis of exceptional cases.

Legislative regulation

Legal norms came into national law from international agreements. For the first time, the term in relation to corporate law appeared in the country’s regulations in 2013. Previously, concepts such as:

- controlling person

- affiliate

- interested party

None of these terms fully defined the concept. The requirement to disclose the ultimate beneficiary was previously often made by the FAS of the Russian Federation when approving transactions, but this was based on internal regulations.

In 2012, public procurement legislation began requiring suppliers to disclose their ultimate beneficiaries. The situation became the basis for introducing clear language into the legislation. Amendments adopted in 2013 to Article 3 115-FZ, dedicated to the fight against legalization of illegal income, gave a clear description of the concept. The principles for how banks work with this information are established by Central Bank Resolution No. 499-P. The normative act defines:

- criteria by which the true owners are determined

- documents submitted by clients or requested by credit institutions

- how to maintain a client file and reflect the necessary data in it

How to determine a beneficiary

Beneficiaries can be either one or several actual owners of the company. A distinctive feature of such owners is the possibility of varying degrees of influence on the company’s activities. Beneficiaries are usually difficult to identify. The fact is that information about such owners may not appear in the company’s documents at all. Also, information about the owners may be contained in official documents, but the degree of their participation may be underestimated. The lack of information about beneficiaries may be due to these reasons:

- Availability of offshore companies.

- Tax evasion.

- Legalization of money obtained from crime (laundering).

Various schemes are used to hide beneficiaries. To identify hidden owners, you need to know all these schemes. As a rule, to conceal information, a special method of registering property and title documents is used. For example, a person gains access to the company’s accounts by proxy. The power of attorney is provided by the “front” manager. As a result, the beneficiary is effectively given ownership of the bearer shares. Instead of a “dummy” director, nominee owners of securities may appear.

IMPORTANT! There is also the term "ultimate beneficiary". What does it mean? In the process of identifying the actual owners, a chain of beneficiaries is identified. This chain ends with the main recipient of the benefit - the final beneficiary. This is the person who receives income from the work of the company.

Difference between beneficiary and beneficiary

The term beneficiary is often found in civil legal relations such as insurance or trust management. But this definition also appears in relationships related to the study of the direction of cash flows. In this case, for the bank, the beneficiary will be the person for whose benefit the client conducts his work. He may not be a participant or shareholder, but, for example, receive all income from the activities of the organization on the basis of some agreement between him and the shareholders.

Who needs information about beneficial owners

Information is requested to combat the following offences:

- Legalization of money acquired illegally.

- Financing of terrorist structures and criminal groups.

- Illegal withdrawal of money to foreign accounts.

Information may also be requested by private legal entities. For example, these could be financial institutions that provide loans. To issue a loan, the institution requests information about the beneficiaries. This information allows you to assess the company’s reputation and also analyze lending risks. Financial companies, in turn, provide relevant information to Rosfinmonitoring. Financial companies mean the following entities:

- Representatives of the securities market.

- Insurance organizations.

- Pawnshops.

- Leasing companies.

- Credit institutions.

Information about beneficiaries should be transferred to the following structures:

- Authorized bodies.

- Tax structures.

- Federal divisions of the executive branch.

- Various state and municipal structures.

- Commercial firms associated with government agencies.

If firms refuse to provide the required information, they are subject to a fine. Beneficial owner information is requested when concluding contracts related to public procurement. In response to the request, the company must send a document that includes information about the owners, including individuals who are considered founders.

Beneficiaries: what does this mean for regulatory authorities?

Information about the recipients of profits is needed to combat crimes in the field of money laundering and other assets acquired through criminal means. Information is necessary not only to combat corruption, but also as part of anti-terrorist activities.

Identification of beneficiaries in international practice

Abroad, there is no clear list of rights and powers that would separate the nominal and actual managers of the company.

In Canada, for example, there is no definition of beneficial owner. And in the EU, a beneficiary is considered to be an individual or someone who carries out actions on his behalf, who directly makes transactions and manages the company. In this case, this person must have 25 percent of shares + 1 in relation to corporate entities or 25 percent of property from trusts and foundations.

In the USA, the first mention of beneficiary appeared in the mid-20th century (1966). Now in the United States there is no specific definition of who a beneficial owner is, but the owner himself can classify himself in this category. He can directly and indirectly manage the company, vote at shareholders' meetings, and also disclose information about himself if he has more than 5 percent of the shares.

In Denmark, a beneficiary is a person who can dispose of the funds received independently (not an intermediate element).

In China, there is the concept of an actual manager who exercises control over the company through connections, contracts, agreements, but does not have shares and is not a shareholder.

The FATF considers the beneficiary to be the owner of the company (an individual), who makes decisions, conducts the activities of the organization and controls everything in it.

How does the system work to identify the true owners of companies in Russia?

Thus, a person formally does not have the right to manage capital. However, it is still possible to prove that a citizen is a beneficiary using:

- general power of attorney in the name of the beneficiary;

- declaration of trust, which states that the founders and shareholders undertake to act in the interests of the beneficiary;

- other data that confirms the status.

By these methods, the Russian authorities are trying to find out the owners of undeclared income, who are thus trying to hide from paying taxes.

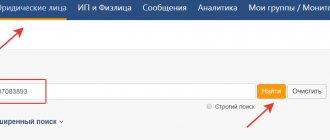

Quite often situations arise when large deposits are opened not by real owners, but by title ones. In this case, the owners of the documents are provided only with the signature rule; they do not have the ability to dispose and manage property. Such leaders attract attention from government agencies. They establish control over suspicious accounts, identifying the entire chain of connections through comparison of data from the Unified State Register of Legal Entities, which ultimately leads to the beneficial owner of the legal entity. This process, which may require time, but with modern account holder monitoring systems, is often effective.

It is worth noting that the Russian register contains information about tax residents of the Russian Federation, and for those who do not have such status, a chain of true owners is not built. To cease being a tax resident, it is enough not to stay in the Russian Federation for more than 183 days over the past year.

Beneficiary Rights

The beneficial owner receives rights only if the relationship with them is formalized. Let's consider the rights of beneficiaries:

- Disposal of your share in the company. For example, a person can sell his share.

- Control over the performance of duties by the head of the company.

- Appointment and dismissal of the general director.

- Participation in various meetings: joint-stock, constituent.

- Receiving profit from the company's work in the amount of dividends.

The exact list of rights depends on the specific area in which the beneficial owner operates.

Who should keep records of beneficiaries?

Records of information about persons who own companies or control their work are maintained by the companies themselves. This responsibility is assigned to them by amendments to 115-FZ of 2016. The internal register is maintained by an official authorized by internal documents. Most often, for joint-stock companies, this person is the corporate secretary or the secretary of the board of directors; in an LLC, the register of owners can be kept by the secretary, the records department, or one of the deputy directors.

It is better to formalize the obligation to maintain and update records in an order and job description.

Failure to comply with legal requirements to collect, update and provide information upon requests may result in fines, so the person maintaining the registry should be aware of their personal and disciplinary liability.

Protection of beneficiary rights

The rights of the beneficial owner are often violated. Let's look at the most common offenses:

- Failure to comply with previously reached agreements.

- Reducing the possibility of control over the activities of the company.

- Restriction of access to information about the actual state of affairs.

- Limitation of the ability to earn income.

IMPORTANT! To prevent violation of rights, it is recommended to formalize agreements in writing. The contract must contain provisions establishing control over the organization. They can include clauses on the need for non-disclosure of information, compensation for damage from unlawful or unprofessional actions.

Who requests information about beneficiaries

According to the logic of the law, information about beneficiaries is requested by banks and the Federal Tax Service. But often this information is also required by other organizations, including:

- FAS RF will request this information if a request for approval of merger or accession transactions is sent to it

- the state company will ask you to provide this data in the package of documents required to participate in the tender

- law enforcement agencies will take an interest in this issue when investigating crimes

- financial monitoring services - to resolve your issues

Providing data is necessary to solve the problems of the country's financial security. Requesting information is intended to solve such important issues for the state as countering:

- legalization of proceeds from crime

- financing of terrorism, cyber terrorism, and other criminal activities

- deliberate concealment of the tax base, tax evasion, aggressive methods of tax planning

- withdrawal of funds outside the Russian Federation

Information provided to the competent authorities cannot be disclosed to third parties. If this happens, it may be grounds for legal action.

State-owned companies often include all their contracts with requirements for counterparties to indicate owners and promptly update information when changes occur. Violation of this condition may become grounds for termination of the contract.

Can a company exist without beneficiaries?

Companies that do not include beneficial owners are generally non-profit entities. That is, the purpose of their activities is not to make a profit. If it is a commercial entity, there will always be individuals who are the ultimate beneficiaries of the income. However, it is often almost impossible to determine the ultimate beneficiary.

FOR YOUR INFORMATION! Although government agencies attempt to identify the beneficial owner, it is rarely possible to obtain all the necessary information. This is due to the fact that there is an unlimited number of schemes that serve to hide the identity of the beneficiary.

How to become a beneficiary of an individual

The legislator in Art. 3 of Law No. 115-FZ, it is this individual who is recognized as the beneficiary of an individual bank client. The only proof on his part will be his passport. The requirement to identify such a person is provided for by the FATF convention, signed by Russia, therefore this column must be filled out in the dossier of clients of credit institutions.

Thus, in relation to an individual, no one other than himself can be recognized as a beneficiary, with a small number of exceptions.

If a person does not have full legal capacity, that is, he is a child or a court has made a decision regarding him to recognize him as partially incompetent, the legal representative may be recognized as a beneficiary of the citizen:

- it could be a parent

- guardian

From the point of view of law enforcement agencies, in credit and other fraud schemes where students or the unemployed are recruited to receive funds, the organizer of a criminal group is recognized as the beneficiary of these schemes.

In this case, no formal employment relationship arises, and the existence of a relationship is proven by means available to investigators.

Ultimate beneficiary of a legal entity

The owners of an enterprise can include not only individuals, but also legal entities that have one or more owners. In particularly complex cases, the number of links in such a chain can reach several dozen. To establish who actually is the owner of an enterprise that has the powers to control and regulate its activities, it is necessary to find the ultimate beneficiary. The ultimate beneficiary is a person (or group of persons) who exercises its right to exercise control over the activities of an enterprise indirectly, with the involvement of third parties, nominally giving them the authority to make strategically important decisions.

In the event that the final beneficiary deliberately hides information about himself, creates the appearance of transferring management rights to a third party, registering large bank accounts in his name and concluding serious transactions on his behalf, law enforcement agencies come into play. Their main task is to study the accounts owned by the company and form a chain of their owners, which should ultimately lead to the true owner of the legal entity. This approach makes it possible to reduce the volume of money laundering obtained by criminal means, as well as to ensure transparency of other transactions, including those carried out with the involvement of large public and private companies.