The procedure for conducting unscheduled briefings on labor protection Conducting briefings on labor protection is mandatory

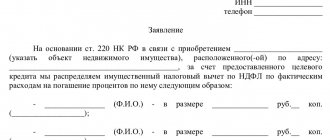

Types of property deductions Property deductions applied to income taxed at a rate of 13% are discussed

In 2022, the rules for filling out payment orders were updated. Some changes take effect immediately,

What is VAT? VAT is an indirect tax that is paid on the sale of goods, services and

What determines the minimum and maximum maternity payments? Receive a benefit determined by calculation

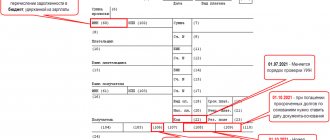

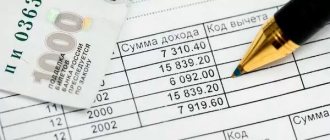

Certificate of income and tax amounts of an individual (previously it was called Certificate 2-NDFL)

Benefits for educational and medical institutions For organizations engaged in the field of education and/or medicine,

Accounting for accounts receivable on account 62 Rules to keep in mind when working

Account 76 of accounting is an active-passive account “Settlements with various debtors and creditors”, accumulates

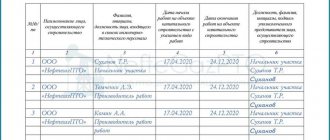

What is the KS-6 form (general work log) Form No. KS-6 was approved by resolution