Account 76 of accounting is an active-passive account “Settlements with various debtors and creditors”, accumulates information on settlements for transactions with debtors and creditors that are not related to accounts 60-75, for example, for amounts that the organization withholds from wages of employees on the basis of executive documents. Using standard postings and illustrative examples, we will consider the specifics of using account 76, its subaccounts 76.05, 76.09 and 76 AB, as well as the features of reflecting transactions on account 76: accounting for VAT on prepayments, housing and communal services and the sale of an apartment to an employee.

When to use count 76

In accordance with the chart of accounts (order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n), account 76 “Settlements with various debtors and creditors” is used to collect information related to:

- with insurance;

- claims under contracts;

- salary deposit;

- settlements based on executive documents of employees, etc.

Thus, it takes into account all settlement transactions that cannot be taken into account in other accounts.

This account is active-passive, the balance on it can be either debit or credit. In this case, the debit reflects the debt to the enterprise, and the credit reflects the debts of the enterprise itself.

For more information about accounting for receivables and payables, read the article “How are settlements with debtors and creditors reflected in accounting?” .

Find out what current debt is and how it differs from overdue debt from the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

When forming the balance, the expanded balance of account 76 is taken into account:

- Dt balances are shown on line 1230 “Accounts receivable”;

- credit balance - according to line 1520 “Accounts payable”.

Depending on the accounting policies applied by the enterprise, it is also possible to assign some groups of receivables (for example, undistributed insurance premiums) to other current assets (line 1260).

Analytics on account 76

Account 76 records many different transactions, so analytics depends on the subaccount. For example:

- when accounting for insurance calculations, analytics are built by insurance types and insurance companies;

- when accounting for claims, analytics are built on debtors and claims received;

- when accounting for dividends and income, analytics are built for each source of income;

- when accounting for deposited salaries, analytics are carried out for each employee who did not receive their salary on time;

- when accounting for settlements based on writs of execution, analytics are also carried out for each employee for whom there is a writ of execution;

- when accounting for leasing, analytics are carried out for leasing companies and contracts;

- when taking into account received bank guarantees, analytics are built for each bank and the issued guarantee;

- When accounting for contributed collateral, analytics is carried out by recipients, and so on.

Property insurance

To summarize data on operations on life and health insurance of employees, as well as company assets, subaccount 76/1 “Calculations for property and personal insurance” is opened.

NOTE! Account 76/1 does not take into account contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund - they are accounted for using account 69.

Accounting for insurance transactions includes 3 stages:

- accrual of payments;

- enumeration;

- operations upon the occurrence of an insured event.

The accrual of payments is shown according to Kt 76/1 in interaction with cost items. So, if production equipment is insured, account 76/1 corresponds with production accounts:

Dt 20 (23, 25) Kt 76/1 - the amount of the insurance payment was allocated to production expenses.

If assets not used directly in production are insured, payments are shown as other expenses:

Dt 91/2 Kt 76/1.

The transfer of amounts presented for payment is reflected by the posting:

Dt 76/1 Kt 51 (50, 52).

In relation to tax accounting, insurance is divided into compulsory and voluntary. Expenses for compulsory insurance are taken into account in full, for voluntary insurance - in the legally established amounts (Article 255 of the Tax Code of the Russian Federation).

You can get acquainted with the features of accounting for insurance premiums in the article “Entering insurance premiums in accounting.”

What subaccounts are used?

The following sub-accounts can be opened for account 76:

- 76.1 Personal and property insurance - accounting of insurance transactions here occurs only in relation to the listed types of insurance; other accounts are used for compulsory pension, medical, social insurance. This subaccount is used both to record insurance premiums and to collect information on insurance claims. Transactions on life and health insurance of company employees are also recorded here. Analytics is carried out by type of insurance and insurers.

- 76.02 Claims - this sub-account summarizes information about emerging claims regarding the quality of the goods supplied, claims for violation of the terms of concluded contracts in relation to timing, volume, etc. Accrued fines and penalties provided for in agreements are taken into account here. Analytics is carried out on debtors and submitted claims.

- 76.3 Dividends - here is a generalization of information about accrued income due to the organization as a founder, as well as their payments. Analytics is carried out for each source of such income. See step-by-step instructions: how to pay dividends to the founder.

- 76.4 Deposited salary - is intended to account for wages not received on time, which are sent by the enterprise to the current account marked “Deposited”. Analytics is carried out on employees who did not receive their salaries on time.

- Calculations based on writs of execution - designed to summarize information on deductions made by an employee based on documents received from bailiffs - alimony, other deductions, etc. Analytics is carried out on debtor employees and received writs of execution.

- Settlements with other buyers and customers - this account records transactions that are not included in the main activities of the company. For example, payment of duties, settlements with a notary, etc. may be reflected here.

You might be interested in:

Account 20 in accounting “main production”: what is it used for, characteristics, subaccounts, postings

Depending on the specifics of conducting transactions, on account 76, in addition to the main sub-accounts recommended by the standard Chart of Accounts, similar ones can be opened, but for accounting for transactions in foreign currency.

For example, 76/6 - Settlements with other buyers and customers in rubles and 76/26 - Settlements with other buyers and customers in foreign currency.

Attention! If the list of subaccounts to be opened differs from the standard one, then it must be indicated in the adopted accounting policy of the organization.

Accounting for insurance compensation

If something happens to the insured property that is provided for by agreement of the parties as an insured event, the company has the right to demand compensation from the insurer.

On the date the insurance company makes a decision on payment, an entry is made (clauses 2, 7, 9, 10.2, 16 PBU 9/99):

Dt 76/1 Kt 91/1 - insurance compensation accrued.

The receipt of money into the account (cash) of companies is registered by the operation:

Dt 51 (50, 52) Kt 76/1 - the amount of compensation was credited to the current account.

Losses from insured events will be reflected in the debit of account 91.2 “Other expenses” (clauses 2, 11, 13 of PBU 10/99).

For more information about what an insurance premium is and how to calculate it, read the article “Insurance premium is...” .

Example

Gamma LLC insured the production premises against fire. According to the agreement, the company transferred 20,000 rubles to the insurance company. annually. The maximum amount of possible compensation was 400,000 rubles.

The following entries were made:

- Dt 20 Kt 76/1 - 20,000 rub. (the amount of the insurance payment has been calculated);

- Dt 76/1 Kt 51 - 20,000 rub. (insurance amount paid).

During the period of validity of the contract, a fire occurred in the insured premises. The insurer acknowledged the insured event and agreed to pay the full insurance premium.

The wiring is as follows:

Dt 76/1 Kt 91/1 - insurance compensation accrued;

Dt 51 Kt 76/1 - 400,000 rubles received. to the account as a refund.

The premises were renovated, which was carried out by a contractor and cost Gamma LLC 236,000 rubles. (including VAT RUB 39,333)

Postings:

- Dt 91/2 Kt 60 - 200,000 rub. (repair work was carried out by the contractor);

- Dt 19 Kt 60 - 39,333 rub. (VAT included);

- Dt 60 Kt 51 - 239,333 rub. (paid for work).

In addition, construction materials worth RUB 120,000 were purchased for the work. (including VAT RUB 20,000):

- Dt 10 Kt 60 - 100,000 rub. (building materials were purchased);

- Dt 19 Kt 60 - 20,000 rub. (VAT highlighted);

- Dt 60 Kt 51 - 120,000 rub. (money was transferred for building materials);

- Dt 91/2 Kt 10 - 100,000 rub. (purchased building materials were released into production).

As for VAT, if property is repaired, this tax can be reimbursed from the budget in the usual manner (letter of the Ministry of Finance of the Russian Federation dated June 17, 2015 No. GD-4-3 / [email protected] ). This operation will correspond to the wiring Dt 68 Kt 19.

Account 76: application by non-profit organizations (HOA)

An HOA is a typical example of a non-profit organization. They function due to:

- targeted financing - from the budget or from homeowners;

- permitted business activities.

Account 76 is used by the HOA to reflect exactly those transactions that are related to targeted financing. Common postings (we will agree to use subaccount 76.6 for the purposes under consideration) include the following:

- Dt 76.6 Kt 86 - The HOA records the debt upon receipt of targeted funding (in practice, it makes an accrual for payments that citizens must pay);

- Dt 51 Kt 76.6 - the debt is repaid upon receipt of funds to the HOA account.

An alternative to cash financing may be for the HOA to obtain certain types of property—for example, materials. Their receipt is reflected by postings:

- Dt 76.6 Kt 86 - receivables accrued in the amount of contributed property;

- Dt 10 Kt 76.6 - property included.

The costs of the current period associated with the maintenance and management of the property of the HOA are reflected by posting Dt 20 Kt 76.6.

Employee insurance

Accounting for information related to life and health insurance of employees is similar to accounting for property insurance transactions. The difference is that when an employee pays the amount transferred to the company by the insurer as an insurance premium (if there was an insured event), account 76/1 interacts with account 73. Accounting account 73 is settlements with personnel for other transactions:

- Dt 76/1 Kt 73 - reflects the accrued amount of insurance compensation to be paid to the injured employee;

- Dt 51 Kt 76/1 - insurance compensation received, payable to the insured employee;

- Dt 73 Kt 50 (51) - the employee was paid the insurance amount.

What is account 76 used for?

76 accounting account is a register on which information about the organization’s relationships with other persons is reflected. At the same time, it reflects the debt of the enterprise itself, as well as existing debts to the business entity.

The peculiarity of the transactions reflected on this account is that they are of a secondary nature in the implementation of activities. That is, these operations do not occur on a regular basis and it makes no sense to allocate subaccounts for them in the accounts where the main debtors and creditors of the organization are reflected. It follows that this account includes those transactions that cannot be reflected on accounts 60 to 75.

First of all, it summarizes information on property and personal insurance when an organization receives claims, when making settlements related to enforcement proceedings against company employees (alimony, other deductions, etc.), as well as to reflect salary deposit transactions ( if it is not received on time).

Accounting for claims

To reflect information about claims against counterparties against account 76, a subaccount 76/2 “Claims” is opened. It is used in cases where the counterparty has violated any obligations, there are comments on the quality and quantity of the goods supplied, deadlines have not been met, errors have been found in documents, etc.

How to properly submit a claim, read the material “The procedure for filing a claim and the rules governing it.”

For a sample of writing a complaint, look in the materials:

- “How to write a claim for poor quality service - sample”;

- “Claim for payment of debt under a supply agreement”;

- “Sample claim under a lease agreement for non-residential premises.”

For example, if a shortfall is detected (before the values are accepted for accounting), the accountant makes the following entries:

Dt 76/2 Kt 60 - the amount of the claim is reflected.

If a shortfall is detected after acceptance, the claims account is debited with the accounts of inventories, goods and other valuables that are the subject of the transaction:

Dt 76/2 Kt 10 (41).

The agreement with the counterparty may provide for penalties (fines, penalties, penalties). Then the score is applied with a score of 91/1:

Dt 76/2 Kt 91/1 - the amount of the penalty is attributed to other income.

See also “Sample Claim for Penalty”.

The receipt of claims amounts is reflected by the following entries:

Dt 51 (50, 52) Kt 76/2 - money has been credited to the account.

If the demand is made by the organization itself, such calculations are also reflected in account 76/2. Accounting is carried out in a similar way, only in this case the company is no longer a debtor, but a creditor, and the amounts of claims recognized by it in relation to other parties to the transaction are credited to the accounts of the subject of the claim: Dt 10 (41) Kt 76/2.

For possible objections to a claim, see the article “Sample response to a claim under a work contract.”

Account 76.2 accounting for settlements of claims: use

Subaccount 76.2 reflects the amounts recorded in accordance with letters of claim received by suppliers and issued by customers. Letters of claim can be drawn up in connection with unsatisfied conditions of concluded contracts, namely:

- violation of delivery deadlines;

- non-compliance of the product with qualitative (quantitative) characteristics;

- violation of the completeness of the goods, lack of necessary packaging, etc.;

- the goods were not delivered (work, services were not performed).

The amounts of claims submitted are taken into account according to Dt 76.2; to carry out operations with received claims, Kt 76.2 is used.

Let's look at the main wiring:

| Debit | Credit | Description | Document |

| 76.2 | 20 | A claim for downtime (defects) caused by the contractor was recognized. The amount of the claim is reflected at the expense of the main production costs | Letter of complaint |

| 76.2 | 23 (29) | A claim for downtime (defects) caused by the contractor was recognized. The amount of the claim is reflected in the expenses of auxiliary production (service facilities) | Letter of complaint |

| 76.2 | 28 | The amount of losses from defects that arose through the fault of the contractor and are subject to recovery is taken into account | Letter of complaint |

| 10 | 76.2 | The amount of the claim satisfied by the supplier of materials is taken into account | Letter of complaint |

| 41 | 76.2 | The amount of the claim satisfied by the supplier of goods (due to their shortage) is taken into account. | Letter of complaint |

What to do if it is impossible to collect a claim

In certain cases, it is impossible to obtain amounts of penalties and fines. Such situations include:

- lapse of time;

- the court's decision;

- liquidation of the debtor;

- reaching agreement through negotiations.

The amounts of claims are written off from account 76 to the account of the reserve for doubtful debts or to financial results (clause 77 of the Accounting Regulations, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n).

The procedure for writing off unrealistic debt is described in detail in the Ready-made solution from ConsultantPlus:

If you do not already have access to this legal system, a full access trial is available for free.

Example 2

Gamma LLC entered into a purchase and sale agreement for materials with Delta LLC for a total amount of 100,000 rubles. Delta LLC is not a VAT payer.

In accordance with the terms of the agreement, Gamma LLC transferred a 50% advance to:

Dt 60 Kt 51 - 50,000 rub. (advance paid).

After the materials were delivered to the buyer, it turned out that the goods were worth 10,000 rubles. defective. The seller received a claim for this amount:

Dt 76/2 Kt 60 - 10,000 rub. (a claim has been made).

The management of Delta LLC got acquainted with the buyer’s requirements and decided to satisfy them, but not in full, but only for the amount of 8,000 rubles, since the goods were worth 2,000 rubles. was not defective, the buyer’s comments to it were unfounded:

- Dt 51 Kt 76/2 — 8,000 rub. (received based on the submitted claim);

- Dt 60 Kt 76/2 — 2,000 rub. (a claim not satisfied by the seller has been written off).

Let's sum it up

- Account 76 of the accounting system collects information on settlements with counterparties that has not found a place on other settlement accounts.

- The list of transactions for account 76 discussed above is far from exhaustive. It can be used to reflect any transactions with debtors and creditors - if they methodologically cannot be reflected in accounting accounts 60-75.

- If necessary, it is possible to open any sub-accounts for account 76 in addition to those given in the general Chart of Accounts.

Accounting for dividends

If an organization owns shares or interests in other companies, it is entitled to receive dividends. To reflect such transactions, a subaccount 76/3 “Dividends” is opened.

Accrued amounts are shown on the invoice CT, received - on Dt:

- Dt 76/3 Kt 91/1 - dividends due are charged to other income;

- Dt 51 (50, 52) Kt 76/3 - the organization received dividend amounts.

For more information about accounting for dividends from recipients and payers, read the article “Accounting entries when paying dividends.”

You can learn more about the nuances of paying dividends in the article “The procedure for paying dividends to founders in an LLC in 2021.”

The article “How to correctly calculate the tax on dividends?” will tell you about the taxation of dividends.

Account 76: application by partnerships

The main purpose of creating partnerships is to make a profit as a result of joint business by several organizations. If there is profit, then it is distributed in proportion to the size of the contributions of each of the partners. Losses are distributed in a similar way. In both cases the score 76 is used.

Each of the partnership organizations that has the right to income records the following entries in the accounting registers:

- If there is profit: Dt 76.3 Kt 91.1 - profit from joint activities is reflected;

- Dt 51 Kt 76.3 - reflects the receipt of money on account of profit from joint activities.

- Dt 91.2 Kt 76.3 - loss from joint activities is reflected;

Salary deposit

Deposited amounts are funds that are the employee’s reserved wages, which for some reason he was unable to receive on time. Such money is accounted for in subaccount 76/4 “Deposited amounts”.

According to Kt they show the accrual of amounts in correspondence with account 70: Dt 70 Kt 76/4 - the salary amount is deposited.

Payments of deposited amounts are shown by the entries: Dt 76/4 Kt 50 (51) - deposited salary paid.

If for some reason a company employee never came for the money, and the statute of limitations for such payments has expired, the money is received as other income of the organization: Dt 76/4 Kt 91/1 - the amount of unclaimed deposited salary is included in other income.

Subaccount 76.01

In settlements based on enforcement documents, it is implied the withholding of funds from the amounts of remuneration for the labor of employees for the account of individuals and legal entities, based on court decisions and documents.

Let's consider possible types of correspondence of subaccount 76.01 with other accounts: Typical transactions using account 76.01

| Dt | CT | Characteristics of an accounting transaction |

| 70.01 | 76.01 | amount due due to court order withheld |

| 76.01 | 51 | the amount was paid according to the court decision from the current account |

| 76.01 | 50 | the amount of the court order was paid from the cash register |

| 50 or 51 | 76.01 | the previously transferred amount was returned to the cash register/account according to a court decision |

| 76.01 | 91.01 | writing off debts under court documents for enterprise income |

Subaccount 76.01 is debited with accounts 50 or 51 when the company makes the payment of the amounts required by executive documents. After the expiration of the limitation period for the documents, the debt amount is written off to the income of the enterprise and debited from 91.01 “Other income and expenses.”

The first entry in accounting for such a situation will be the correspondence of accounts 70 and 76.01, which reflects the process of withholding the amount payable. Subaccount 76.01 is credited with accounts 50, 51, 55 in the event that the organization returns amounts under executive documents.

Commission agreements

Calculations under commission agreements are also carried out in accounting using account 76. In this case, analytical accounting is carried out for each agreement separately. The principal, the seller of goods, makes the following entries:

- Dt 45 Kt 41 - goods transferred to the commission agent;

- Dt 76 Kt 68 - allocated VAT on the advance received by the commission agent from the buyer;

- Dt 76 Kt 90 - revenue received by the commission agent;

- Dt 90 Kt 45 - sold goods are written off;

- Dt 90 Kt 68 - VAT is charged on the amount of revenue;

- Dt 68 Kt 76 - VAT on advance to be deducted;

- Dt 44 Kt 76 - the intermediary's commission is included in sales expenses;

- Dt 19 Kt 76 - VAT is allocated from the commission amount;

- Dt 68 Kt 19 - VAT on commission to be deducted;

- Dt 51 Kt 76 - money received from the commission agent.

NOTE! Revenue under such contracts is recognized in full, that is, it is not reduced by commission and additional fees. intermediary income.

For information on how to correctly account for VAT and prepare documents during intermediary transactions, read the article “How to prepare invoices when selling goods through an intermediary?” .

When concluding agency agreements, accounting is also maintained using account 76. You can read more in the article “Features of an agency agreement in accounting.”

Examples of postings for subaccounts 76 accounts

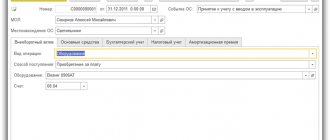

Example 1. Reflection of VAT on prepayment in invoice 76.AB

Let's say 02/06/2017. Vesna LLC received an advance payment from Leto LLC in the amount of RUB 47,200. On account of prepayment 02/08/2017. the goods have been shipped.

To reflect VAT on prepayment in subaccount 76.AV, the accountant of Vesna LLC generated the following entries:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 62.02 | 47 200 | Advance received from Leto LLC | Bank statement |

| 76.AB | 68.02 | 7 200 | VAT charged (advance) | Invoice, sales book, payment order |

| 62.01 | 90.01 | 47 200 | Vesna LLC shipped the goods | Sales Invoice |

| 90.03 | 68.02 | 7 200 | VAT charged (sales) | Invoice, invoice |

| 62.02 | 62.01 | 47 200 | Advance payment credited | Accounting certificate-calculation |

| 68.02 | 76.AB | 7 200 | VAT accepted for deduction (sales) paid in advance) | Invoice, sales book |

Example 2. Postings for housing and communal services on account 76.05

Let's look at the postings for housing and communal services between the management company and residents under subaccount 76.05 in the table:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 76.06.01 | 76.05.01 | 4 000 | Utility bills accrued | Check |

| 76.06.01 | 86 | 1 500 | Contributions for maintenance and repairs and other targeted | |

| 76.06.01 | 60 | 5 500 | Reflection of debt to service provider | Contract, certificate of completion of work |

| 51 | 76.06.01 | 5 500 | Receipt of payment from the tenant | Bank statement |

| 60 | 51 | 5 500 | Paid to supplier | Payment order |

Example 3. Postings for the sale of an apartment to an employee on account 76.09

Suppose A.I. Khlebtsov is a very valuable employee of Osen LLC. The additional agreement to the employment contract states that Khlebtsov can buy an apartment from Osen LLC for less than the purchase price, provided that he works for the company for at least 5 years and 4 years after purchasing the apartment.

The accountant of Osen LLC generated the following entries for the sale of an apartment to an employee under subaccount 76.09:

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 76.09 | 51 | 3 000 000 | Khlebtsov A.I. paid the cost of the apartment to Osen LLC | Payment order |

| 41 | 76.09 | 3 500 000 | The apartment has been registered | Acceptance certificate |

| 51 | 73 | 3 000 000 | Funds were received from A.I. Khlebtsov. | Bank statement |

| 73 | 91.01 | 3 000 000 | The transfer of the apartment to the owner has been completed | The acceptance certificate has been signed |

| 91.02 | 41 | 500 000 | Osen LLC wrote off the cost of the sold apartment | Acceptance certificate |

Leasing agreements

The procedure for accounting for transactions under leasing agreements depends on where the subject of the financial lease is listed: on the balance sheet of the recipient company or the lessor.

From January 1, 2022, rental (leasing) transactions are accounted for in accordance with FAS 25/2018 “Lease Accounting”. You can start applying the Standard earlier. A ready-made solution from ConsultantPlus will help you switch to the new rules for leasing accounting. Trial access to the system can be obtained for free.

If the object is on the balance sheet of the lessor, the lessee organization shows such property as leased on off-balance sheet accounts. Records are generated:

- Dt 76 Kt 51 - advance payment paid;

- Dt 001 - the object is accepted for accounting;

- Dt 20 (26, 44) Kt 76 - lease payment due;

- Dt 19 Kt 76 - VAT on payment;

- Dt 68 Kt 19 - VAT deductible;

- Kt 001 - the subject of a financial lease is written off at the end of the contract.

Read more about accounting entries for the lessor and lessee in the material “Leasing under the simplified tax system, income minus expenses - entries.”

If, in accordance with the agreement, the property is placed on the balance sheet of the lessee, the organization accounts for the subject of the financial lease as fixed assets. In this case, the initial cost will be the sum of all transfers reflected in the contract, including advance payments, regular current payments, as well as the redemption fee, if provided.

Application of account 76: non-tax payments

There are types of budget payments that do not relate to taxes (customs duties and fees, recycling fees, etc.), and therefore it is not practical to reflect them on account 68 “Calculations for taxes and fees”.

To account for such non-tax amounts, you can use account 76. For example, when registering an imported car, the postings look like this:

- Dt 76 Kt 51 - fees and duties are transferred to the budget;

- Dt 08 Kt 76 - fees and duties are included in the initial cost of the imported car.

In the case under consideration, subaccounts corresponding to the type of fee or duty paid can be opened to account 76.