Accounting for accounts receivable on account 62

The rules that need to be kept in mind when working with account 62 “Settlements with buyers and customers” are indicated in the chart of accounts and instructions for it, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. Count 62 is used to reflect:

- accounts receivable (hereinafter referred to as receivables) of buyers and customers for goods, works, services sold (hereinafter referred to as GWS);

- accounts payable in the form of advances received.

Turnover in the debit of account 62 occurs when reflecting the debt of buyers when the sale of goods and services takes place. The second side of the posting will be income accounts 90.1, 91.1 or account 46 for the gradual reflection of income from long-term work. Thus, receivables are reflected simultaneously with revenue. In accordance with the accounting rules, revenue is shown in accounting if a number of conditions are met (clause 12 of PBU 9/99 “Organizational Income”, approved by order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n):

- existence of a legally valid right to receive proceeds;

- availability of total revenue value;

- having confidence in receiving payment;

- a transfer of ownership was carried out, i.e. the buyer accepted the GWS;

- the presence of the total value of the corresponding expenses incurred to obtain this revenue.

If at least one condition is not met, then the payment received by the organization should be reflected as accounts payable, and not repay accounts receivable.

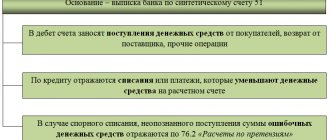

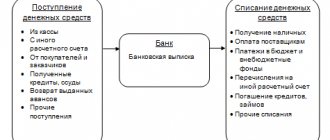

When payment is received from the buyer, account 62 is credited, and a debit entry is made in the cash accounts.

Analytics of 62 accounts should allow checking its balances for the presence of overdue debts, that is, carried out in the context of counterparties, issued invoices, and payment terms. To ensure transparency of reporting, overdue debt must be reserved by posting Dt 91.2 Kt 63 (clause 70 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n). In the balance sheet, receivables are shown minus reserves. Debts that cannot be repaid and debts with an expired statute of limitations must be written off (clause 77 of the PBU) at the expense of the reserve by posting Dt 63 Kt 62, and if they were not reserved, then they are written off to the financial results of Dt 91.2 Kt 62. When In this case, for another 5 years, the written off debt is reflected on the balance sheet (account 007) in order to track changes in the financial condition of the debtor and the possibility of repaying the debt.

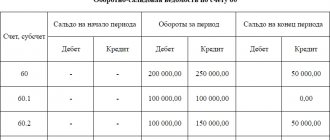

Turnover - balance sheet for settlements with suppliers and contractors

Its formation is one of the key elements that makes it possible to control the document flow at the enterprise for further reporting to the tax authorities

Statement structure

In general, it is represented by the following figure:

Balance sheet for account 60

The first column contains the names of all sellers. The opening balance allows you to see debts and advances transferred previously. The debit balance indicates the transfers of funds made, for which there was no delivery of materials or the documents were not submitted to the accounting department on time; for a loan - the sum of all received inventory items, the purchase of which was not paid for.

During the period, current mutual settlements arise. Similarly to the balance, all payments are included in the debit turnover, and receipts are included in the credit turnover. The length of time for analysis is arbitrarily selected (from operations on one specific day to any arbitrarily chosen interval). The ending balance indicates any unresolved issues with supplies and allows you to clearly track document flow and payments.

Advice! When maintaining accounting in specialized software products, you can consider not only the general type of calculations, but also statements separately for advances paid and purchases.

Filling example

The organization purchased a new computer for 20,000 rubles. Under the terms of the agreement, payment can be made in installments of 5,000 rubles per month. In accounting, these actions are reflected in the following entries:

- Dt10 Kt 60 - 20000 received a computer from the supplier

- D60 Kt51 – 5000 transferred the first payment on the computer

Based on the results of checking mutual settlements, we see that the organization’s debt to the counterparty is 15,000 rubles at the end of the period. It is necessary to track debt data so that selling companies are interested in working with the company.

Errors that occur

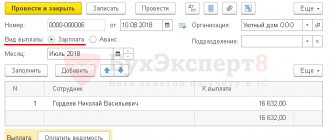

In the era of active development of technology, the manual method of drawing invoices is almost never used, but various software products are widely used, the leaders of which are 1C developments. Accounting registers can be created in them to better analyze the status of all payments and receipts.

The advantage of using the balance sheet in 1C for control is the ability to analyze not only the general statement, but also to consider separately paid advances (60.02) and the resulting debt for received goods, works, services (60.01). In addition, from the statement you can go to account analysis specifically for transactions with a given counterparty and, if questions arise, immediately see the presence or absence of documents.

There are situations when the same amount falls into circulation at 60.01 and 60.02 and does not overlap. This may be due primarily to a violation of the sequence of documents. If re-execution does not change the situation, then you should pay attention to the possible linking of payments and receipts to various contracts or accounts.

How to create a balance sheet for account 60 in 1C can be seen in the video:

Accounting for advances received

Payment of goods and materials prior to their shipment or transfer is accounted for separately on account 62; subaccount 62.2 “Advances received” is usually used, while subaccount 62.1 “Settlements with buyers and customers” is used to account for receivables from buyers. In the balance sheet, advances received are included in accounts payable, that is, they are shown as a liability; it is impossible to show advances minimized from accounts payable. In addition, upon receipt of an advance payment, the supplier must charge VAT (clause 1 of Article 167 of the Tax Code of the Russian Federation).

Example:

In July, Pchelka LLC (buyer) and Vasilek LLC (seller) signed an agreement for the purchase of paving slabs worth RUB 944,590. In the same month, Pchelka LLC made a full prepayment. The following entries are made in the accounting of Vasilek LLC:

Dt 51 Kt 62.2 - 944,590 rub. — an advance payment from Pchelka LLC has been received into the bank account;

Dt 76 subaccount “VAT on advances received” Kt 68 subaccount “VAT” 157,431.67 rub. (944,590 × 20/120) - VAT is charged upon receipt of an advance payment.

In August, Vasilek LLC shipped all the paving slabs to the buyer and recorded the following entries:

Dt 62.1 Kt 90 — 1,944,590 rub. — revenue accrued;

Dt 90.3 Kt 68 subaccount “VAT” - 157,431.67 rubles. — VAT is charged on sales;

Dt 68 subaccount “VAT” Kt 76 subaccount “VAT on advances received” 157,431.67 rubles. — previously accrued VAT on the prepayment received is accepted for deduction;

Dt 62.2 Kt 62.1 - 944,590 rub. — the previously received prepayment has been offset.

For more information about the actions of the seller when receiving an advance payment, read the article “What is the general procedure for accounting for VAT on advances received?”

ConsultantPlus experts explained how to reflect advances received in the VAT return. Get trial access to the system and proceed to examples of filling out the report for free.

Formation of SALT according to account 62

Let's look at the process of generating a statement using an example.

Alfa Center LLC, on the basis of an agreement concluded with Polar Star LLC, must ship products worth 120,000 rubles to it. (including VAT 20,000 rubles) in March 20XX. In February 20XX, Polyarnaya Zvezda LLC transferred an advance payment for the full amount to Alpha Center LLC.

Read about how to fill out TORG-12 in this material.

For information about the features of the UTD, see the material “Universal transfer documents” .

Postings in the accounting of Alfa Center LLC:

| Dt accounts | CT account | Sum | Description | Primary document |

| February 20XX | ||||

| 51 | 62 "Advances" | 120 000 | Received advance payment reflected | Payment order, bank statement |

| 76 “VAT on advances received” | 68 “VAT payable” | 20 000 | VAT charged on advance payment | Invoice for advance payment, entry in the sales book |

| March 20XX | ||||

| 62 “Payments for products” | 90 | 120 000 | Sales reflected in accounting | TORG-12, invoice |

| 90 | 68 “VAT payable” | 20 000 | VAT reflected | Invoice |

| 62 "Advances" | 62 “Payments for products” | 120 000 | Prepayment under the contract has been credited | Accounting information |

| 68 “VAT payable” | 76 “VAT on advances received” | 20 000 | Accepted for deduction of VAT on advance payment | Entry in the purchase book |

For more information on how to reflect revenue, read the article “Controversial issues regarding the reflection of revenue with or without VAT (90 and 91 accounts)” .

IMPORTANT! The debit balance at the end of the period is formed according to the formula: debit balance at the beginning of the period plus the amount of debit transactions minus credit turnover. Credit balance at the end of the period: credit balance at the beginning of the period plus the amount of credit transactions minus debit turnover.

SALT in the accounting of Alfa Center LLC in March 20XX.

SALT for account 62 “Advances”:

| Initial balance | Revolutions | Final balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | 120 000 | 120 000 | – | – | – |

SALT for account 62 “Payments for products”:

| Balance at the beginning | Revolutions | Closing balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | – | 120 000 | 120 000 | – | – |

SALT for count 62 (synthetic):

| Initial balance | Revolutions | Final balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | 120 000 | 240 000 | 120 000 | – | – |

If no postings were made between subaccounts, then the SALT will look like this:

SALT for account 62 “Advances”:

| Initial balance | Revolutions | Final balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | 120 000 | – | – | – | 120 000 |

SALT for account 62 “Payments for products”:

| Balance at the beginning | Revolutions | Closing balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | – | 120 000 | – | 120 000 | – |

SALT for count 62 (synthetic):

| Initial balance | Revolutions | Final balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| – | 120 000 | 120 000 | – | 120 000 | 120 000 |

The concept of accounts receivable is discussed in this publication.

Payments by bill of exchange

The instructions for the chart of accounts also pay attention to the peculiarities of settlements with bills of exchange. If the buyer issues his own bill of exchange to the supplier, then the debt is not repaid, but by this action a deferred payment is issued and a guarantee of payment is issued. To account for bills received, it is recommended to allocate a separate sub-account, for example, 62.3 “Bills received”. The following entries are made in the seller's accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 62.3 | 62.1 | Received own bill from buyer |

| 51 | 62.3 | Received funds upon presentation of a bill of exchange |

| 51 | 91.1 | Interest received on the bill |

Another situation arises if the debt is paid by a bill of exchange from third parties. Such a bill of exchange is recognized as a financial investment and is accounted for in account 58. The entries shown in the table are made in the supplier’s accounting:

| Dt | CT | Description |

| 62.1 | 90.1 | Revenue accrued |

| 90.3 | 68 subaccount “VAT” | VAT charged on sales |

| 58.2 | 62.1 | Received a third party promissory note as payment |

Analytical accounting on account 62 and its subaccounts

Under loan 62, the account receives funds from the sale of shipped products, as well as prepayment amounts for goods and services. In this case, payments for services rendered and advances are taken into account in different subaccounts:

- Invoice 62.01 – payment received in accordance with the general procedure;

- Account 62.02 – advances from buyers.

In addition, there is a sub-account for separate accounting of bills received (62.03). If the supplier receives a bill of exchange from the buyer providing for the payment of interest, the amount of interest is reflected in accounting account 91 “Other income and expenses.” Repayment of the principal amount of the debt is reflected by posting Dt account 51 (for foreign currency accounts DT) and Kt 62.

For the convenience of the accountant, analytics for account 62 are carried out in the context of each invoice sent to the buyer, as well as separately for each counterparty and agreement with him. In addition, operations can be classified according to the following criteria:

- payment method (availability of advance payment or payment upon shipment, provision of services);

- payment deadline (payment is overdue or not due);

- presence of a bill of exchange (the bill of exchange has been accounted for in the bank, its maturity has not yet come, or payment on the bill of exchange is overdue).

The accountant has the right to independently choose the criteria on which the analytical accounting of account 62 at the enterprise will be based.

Results

For different types of debt, the chart of accounts provides for special accounts. One of them is account 62, which can be either active or passive, since it is used to account for both debt from buyers and customers, and creditors in the form of advances and prepayments received.

Read about accounting for accounts receivable in the article “Keeping records of accounts receivable and accounts payable.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Description of account 62

Account 62 is active-passive, so it can have both a credit and a debit balance.

IMPORTANT! The balance at the beginning and end of the period must be reflected in subaccounts in detail. This is due to the fact that the debit balance is the debt of customers, and the credit balance is the prepayment received for future shipments and work.

For a breakdown of accounts payable and receivable, see the material.

It is convenient to conduct analytical accounting for this account both in the context of subaccounts and for each customer. Many accounting programs allow you to support such analytics. As a result, turnover for the account as a whole is formed, and if necessary, it is always possible to generate SALT for each customer. Such a report can also serve as the basis for drawing up a statement of reconciliation of settlements with the counterparty.

In what cases are receivables revalued, find out from the Ready-made solution from ConsultantPlus. Trial full access to the system can be obtained for free.